Aerospace Tapes Market by Resin Type (Acrylic, Rubber, Silicone), Backing Material (Paper/Tissue, Film, Foam), End-use Industry (Commercial Aviation, Military Aviation, General Aviation), and Region - Global Forecast to 2024

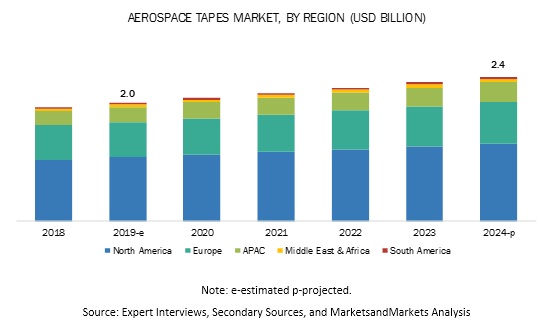

Aerospace Tapes Market size is projected to grow USD 2.4 billion by 2024, at a CAGR of 4.0%. The initiatives undertaken by governments of China and India, increasing demand for lightweight and more fuel-efficient aircraft, growing demand for passenger aircraft in emerging regions, and replacement of old/aging aircraft and modernization of existing aircraft are driving the aerospace tapes market.

The acrylic segment is estimated to account for the largest share of the aerospace tapes market during the forecast period.

Acrylic-based aerospace tapes are more firm and durable than rubber-based adhesive tapes. These resins have high shear strength. The properties of acrylics are fast-curing time; excellent resistance to oxidation, temperature, and UV radiation; color stability; exceptional anti-aging properties; good balance of adhesion and cohesion; excellent water resistance; and high peel, tack, and shear strength. Acrylic aerospace tapes are widely used in the aerospace industry, owing to its excellent adhesion properties in the bonding of carpet, floorings and galley mats in aircraft, overlay film for instructions, leaflets, surface and paint protection, and erosion protection of aircraft leading edges, propellers, de-icer systems, and helicopter rotors.

Paper/tissue to be the largest backing material of the aerospace tapes market during the forecast period.

Paper/tissue backing material accounted for the largest share of the aerospace tapes market in 2018. These tapes are made from crepe paper, and rubber adhesive coating and have a wide range of applications. These tapes are environmentally-friendly and are available in a wide range of colors. Paper tapes have good holding power, heat insulation, and temperature resistance properties. They are relatively thin, flexible, and also smooth, which makes them suitable for aircraft manufacturing.

Commercial aviation is estimated to be the fastest-growing end-use industry of the aerospace tapes during the forecast period.

Typically, aerospace tapes are in high demand from the commercial aviation industry compared to military and general aviation industries. Thus, the commercial aviation end-use industry segment is leading the aerospace tapes market. As the standard of living is improving in developing countries, the demand for air travel will continue to grow. Wide and narrow-body aircraft deliveries are expected to drive most of the market growth, with regional jet demand lagging. As per Boeing’s report on World Air Cargo Forecast, the global air cargo traffic has grown on an average by 5.2% every year since 1983, adding to the growth of the aerospace tapes market in commercial aviation. These factors are responsible for the growth of aerospace tapes in the commercial aviation segment.

North America is expected to account for the largest aerospace tapes market share during the forecast period

Despite the maturity of the market, there is a demand for aerospace tapes in both the US and Canada due to the presence of manufacturing facilities and distribution networks of the major market players. The aerospace industry in North America is highly regulated, which plays a crucial role in monitoring the performance and commercialization of aerospace tapes. The aerospace tapes market in Mexico is comparatively smaller than that in the US and Canada, but it is a rapidly growing market as aerospace is one of the largest industries of the country’s manufacturing sector. According to Boeing, there will be a demand for 7,290 airplanes in the next 15 years in North America. According to Bombardier, North America will require 3,650 aircraft in the next 15 years. This is expected to boost the demand for aerospace tapes in the region.

Key Aerospace Tapes Market Players

3M Company (US), Nitto Denko Corporation (Japan), Avery Dennison Corporation (US), tesa SE (Germany), Scapa Group plc (UK), Intertape Polymer Group (Canada), Compagnie de Saint-Gobain S.A. (France), Berry Global, Inc. (US), Advance Tapes International (UK), Stokvis Tapes BV (Netherlands), Shurtape Technologies, LLC (US), DeWAL Industries (US), MBK Tape Solutions (US), GERGONNE - The Adhesive Solution (France), Adhesives Research, Inc. (US), American Biltrite Inc. (US), Can-Do National Tape, Inc. (US), Av-DEC, Inc. (US), JTAPE Limited (UK), Fralock Innovative Materials Manufacturing & Automation (US), UltraTape (US), and Mask-Off Company, Inc. (US) are some of the players operating in the global market.

Scope of the Aerospace Tapes Market Report

|

Report Metric |

Details |

|

Years considered for the study |

2017–2024 |

|

Base year |

2018 |

|

Forecast period |

2019–2024 |

|

Units considered |

Value (USD Million) and Volume (Million Square Meter) |

|

Segments |

Resin Type, Backing Material, and End-use Industry |

|

Regions |

North America, Europe, APAC, the Middle East & Africa, and South America |

|

Companies |

3M Company (US), Nitto Denko Corporation (Japan), Avery Dennison Corporation (US), tesa SE (Germany), Scapa Group plc (UK), Intertape Polymer Group (Canada), Compagnie de Saint-Gobain S.A. (France), Berry Global, Inc. (US), Advance Tapes International (UK), Stokvis Tapes BV (Netherlands), Shurtape Technologies, LLC (US), DeWAL Industries (US), MBK Tape Solutions (US), GERGONNE - The Adhesive Solution (France), Adhesives Research, Inc. (US), American Biltrite Inc. (US), Can-Do National Tape, Inc. (US), Av-DEC, Inc. (US), JTAPE Limited (UK), Fralock Innovative Materials Manufacturing & Automation (US), UltraTape (US), and Mask-Off Company, Inc. (US). |

This research report categorizes the aerospace tapes market based on resin type, backing material, end-use industry, and region.

Based on resin type, the aerospace tapes market has been segmented as follows:

- Acrylic

- Rubber

- Silicone

- Others (EVA, butyl)

Based on backing material, the aerospace tapes market has been segmented as follows:

- Paper/tissue

- Film

- Foam

- Others (foil, glass cloth, and cloth)

Based on end-use industries, the aerospace tapes market has been segmented as follows:

- Commercial aviation

- Military aviation

- General aviation

Based on the region, the aerospace tapes market has been segmented as follows:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Recent Developments

- In July 2017, Intertape Polymer Group Inc. acquired Canadian Technical Tape Ltd., a North American supplier of industrial and specialty tapes based in Montreal. This acquisition has extended the company’s product offering and provided additional distribution channels for IPG products in Canada, the US, and Europe.

- In July 2017, Berry Global Group Inc. acquired Adchem Corp., a manufacturer of high-performance adhesive tape systems in the US. This expanded Berry Global's ability to service a consumer’s specialty tape requirements with expanded technologies.

Key Questions Addressed by the Report

- What is the mid-to-long term impact of the developments undertaken in the industry?

- What are the upcoming trends that will affect the overall aerospace industry?

- Which segment has the potential to register the highest market share?

- What is the current competitive landscape in the aerospace tapes market in terms of new resin type, backing material, end-use industry, production, and sales?

- What will be the growth prospects of the aerospace tapes market?

Frequently Asked Questions (FAQ):

What are the factors Influencing the growth of aerospace tapes?

What are the major drivers of the aerospace tapes market?

Which resins are used to manufacture aerospace tapes?

Which resin is estimated to account for the largest share of the overall aerospace tapes? Why?

Which backing materials are used to manufacture aerospace tapes?

Which is the major backing material used in adhesive tapes?

Which end-use industry is estimated to register the highest CAGR?

Who are the major manufacturers?

What is the biggest restraint for aerospace tapes?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Aerospace Tapes: Market Segmentation

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Aerospace Tapes Market

4.2 Aerospace Tapes Market, By Resin Type

4.3 Aerospace Tapes Market, By Backing Material

4.4 Aerospace Tapes Market, By End-Use Industry and Key Countries

4.5 Aerospace Tapes Market, Developed vs. Developing Countries

4.6 APAC: Aerospace Tapes Market

4.7 Aerospace Tapes Market: Major Countries

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Initiatives Taken By Governments of China and India

5.2.1.2 Increasing Demand for Lightweight and More Fuel-Efficient Aircraft

5.2.1.3 Increasing Demand for Passenger Aircraft in Emerging Regions

5.2.1.4 Replacement of Old/Aging Aircraft and Modernization of Existing Aircraft

5.2.2 Restraints

5.2.2.1 Shortage of Profitable Airlines in Emerging Economies

5.2.2.2 Reduced Defense Spending in Developed Economies

5.2.3 Opportunities

5.2.3.1 Rising Influence of Low-Cost Airlines

5.2.3.2 Emergence of Aircraft Manufacturers in APAC and South America

5.2.4 Challenges

5.2.4.1 Delay in Aircraft Deliveries

5.2.4.2 Costly Mro Services

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Bargaining Power of Buyers

5.3.3 Threat of New Entrants

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Overview & Industry Trends

5.4.1 Introduction

5.4.2 Trends and Forecast of GDP

5.4.3 Growth Trends in Aerospace Industry

5.5 Impact on Aerospace Division on Future Revenue Pockets of the Manufacturers

5.5.1 Mega Industry Trends

5.5.1.1 Continued Technological Advancement

5.5.1.2 Unmanned Aircraft Systems (UAS)

5.5.1.3 In-Flight Entertainment & Connectivity

5.5.1.4 Strong Replacement Demand

5.5.1.5 Decline in Fuel Prices

5.5.1.6 Increasing Focus on Enhancing Safety and Efficiency

6 Aerospace Tapes Market, By Category (Page No. - 49)

6.1 Introduction

6.1.1 Specialty

6.1.2 Masking

7 Aerospace Tapes Market, By Application (Page No. - 51)

7.1 Introduction

7.1.1 Interior

7.1.2 Exterior

8 Aerospace Tapes Market, By Resin Type (Page No. - 52)

8.1 Introduction

8.2 Acrylic

8.2.1 Demand for Acrylic Resins in Aerospace Interiors Application is Boosting their Demand

8.3 Rubber

8.3.1 Rubber-Based Aerospace Tapes Possess High Tack and Peel Strength and are More Economical Than Most of the Acrylic Tapes

8.4 Silicone

8.4.1 Silicone Resins Consist of Silicone Polymers and are Widely Used in the Aerospace Industry as Aircraft are Exposed to Extreme Environments

8.5 Others

9 Aerospace Tapes Market, By Backing Material (Page No. - 59)

9.1 Introduction

9.2 Paper/Tissue

9.2.1 Repulpable Nature of Paper to Drive the Use of Paper/Tissue Backing Material in Aerospace Tapes Market

9.3 Film

9.3.1 Excellent Properties of Pp, Ptfe, and Pet Films are Expected to Drive the Aerospace Tapes Market

9.4 Foam

9.4.1 Growing Awareness About Foam Tapes in Military Aviation has Increased the Number of Foam-Backed Aerospace Tape Manufacturers

9.5 Others

10 Aerospace Tapes Market, By End-Use Industry (Page No. - 66)

10.1 Introduction

10.2 Commercial Aviation

10.2.1 Increasing Demand for Air Travel Owing to the Improving Standard of Living in Developing Regions to Boost Commercial Aviation Segment

10.3 Military Aviation

10.3.1 Fifth-Generation Technology Aircraft, Advanced Composite Materials, and Stealth Technology are Emerging Trends for Military Aircraft

10.4 General Aviation

10.4.1 Business Jets to Witness Fast Growth Owing to Rising Demand From Brics Countries

11 Aerospace Tapes Market, By Region (Page No. - 72)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Presence of Manufacturing Facilities of the Key Market Players, Strong Commercial Aviation Sector, and Increasing Air Passenger Traffic are the Market Drivers

11.2.2 Canada

11.2.2.1 The Market is Expected to Grow, Owing to A Full Range of Manufacturing Capabilities for the Aerospace Industry

11.2.3 Mexico

11.2.3.1 Aerospace is One of the Largest Industries in the Manufacturing Sector in the Country

11.3 Europe

11.3.1 Russia

11.3.1.1 The Aircraft Manufacturing Sector is A Key Contributor to the Economy of the Country

11.3.2 France

11.3.2.1 The Country’s Aerospace Industry is Heavily Reliant on the Export Market

11.3.3 UK

11.3.3.1 The Presence of Top Aircraft Design Companies in London is Helping the Market Growth

11.3.4 Germany

11.3.4.1 The Growing Domestic and International Air Travel in the Country is Expected to Aid the Market to Grow in the Near Future

11.3.5 Italy

11.3.5.1 The Increasing Demand for New Airplanes for Fleet Expansion and Replacement is Fueling the Market

11.3.6 Spain

11.3.6.1 Spain is A Promising Market, Owing to the Shifting Manufacturing Base to the Country

11.3.7 Rest of Europe

11.4 APAC

11.4.1 China

11.4.1.1 The Growth of the Aircraft Manufacturing and Maintenance Sector is Favorable for the Market

11.4.2 Japan

11.4.2.1 The Demand for New Airplanes to Replace the Older Ones is Likely to Influence the Market, Positively

11.4.3 India

11.4.3.1 Government’s Initiative to Make Air Travel More Affordable and Growth in Air Passenger Traffic are Contributing to the Market Growth

11.4.4 South Korea

11.4.4.1 The Demand is Expected to Grow in Both the Commercial and General Aviation Segments

11.4.5 Singapore

11.4.5.1 Growth in Demand for Aircraft Parts Manufacturing and Low-Cost Carriers are Likely to Impact the Market

11.4.6 Rest of APAC

11.5 Middle East & Africa

11.5.1 Israel

11.5.1.1 The Presence of Oems is Boosting the Market

11.5.2 Turkey

11.5.2.1 Major Companies are Spending on Branding By Creating Awareness About Aerospace Tapes in the Country

11.5.3 Rest of Middle East & Africa

11.6 South America

11.6.1 Brazil

11.6.1.1 The Country is One of the Only Five Commercial Jet Manufacturers, Globally

11.6.2 Rest of South America

12 Competitive Landscape (Page No. - 99)

12.1 Introduction

12.2 Competitive Leadership Mapping

12.2.1 Visionary Leaders

12.2.2 Innovators

12.2.3 Dynamic Differentiators

12.2.4 Emerging Companies

12.3 Strength of Product Portfolio

12.4 Business Strategy Excellence

12.5 Market Ranking Analysis

12.6 Competitive Scenario

12.6.1 Merger & Acquisition

12.6.2 Investment & Expansion

13 Company Profiles (Page No. - 107)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 3M Company

13.2 Nitto Denko Corporation

13.3 Avery Dennison Corporation

13.4 Tesa SE

13.5 Scapa Group Plc

13.6 Intertape Polymer Group

13.7 Compagnie De Saint-Gobain

13.8 Berry Global Group, Inc.

13.9 Advance Tapes International

13.10 DeWAL Industries, Inc.

13.11 Other Key Companies

13.11.1 Shurtape Technologies, LLC

13.11.2 Stokvis Tape Bv

13.11.3 MBK Tape Solutions

13.11.4 GERGONNE - the Adhesive Solution

13.11.5 Adhesives Research, Inc.

13.11.6 American Biltrite Inc.

13.11.7 Can-Do National Tape, Inc.

13.11.8 Av-DEC, Inc.

13.11.9 JTAPE Limited

13.11.10 Fralock Innovative Materials Manufacturing & Automation

13.11.11 Ultratape

13.11.12 Mask-Off Company, Inc.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 136)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (79 Tables)

Table 1 Aerospace Tapes Market Snapshot, 2019 vs. 2024

Table 2 GDP Trends and Forecast, By Key Country, 2017–2024 (Annual Percent Change)

Table 3 Growth Indicators of Aerospace Industry, 2015–2033

Table 4 Growth Indicators of Aerospace Industry, By Region, 2015–2033

Table 5 Number of Required Aircraft, By Region

Table 6 Number of Required Freighters

Table 7 Indicators Encouraging the Aerospace Industry

Table 8 Aerospace Tapes Market Size, By Resin Type, 2017–2024 (USD Million)

Table 9 Aerospace Tapes Market Size, By Resin Type, 2017–2024 (Million Square Meter)

Table 10 Acrylic-Based Aerospace Tapes Market Size, By Region, 2017–2024 (USD Million)

Table 11 Acrylic-Based Aerospace Tapes Market Size, By Region, 2017–2024 (Million Square Meter)

Table 12 Rubber-Based Aerospace Tapes Market Size, By Region, 2017–2024 (USD Million)

Table 13 Rubber-Based Aerospace Tapes Market Size, By Region, 2017–2024 (Million Square Meter)

Table 14 Silicone-Based Aerospace Tapes Market Size, By Region, 2017–2024 (USD Million)

Table 15 Silicone-Based Aerospace Tapes Market Size, By Region, 2017–2024 (Million Square Meter)

Table 16 Other Resin-Based Aerospace Tapes Market Size, By Region, 2017–2024 (USD Million)

Table 17 Other Resin-Based Aerospace Tapes Market Size, By Region, 2017–2024 (Million Square Meter)

Table 18 Aerospace Tapes Market Size, By Backing Material, 2017–2024 (USD Million)

Table 19 Aerospace Tapes Market Size, By Backing Material, 2017–2024 (Million Square Meter)

Table 20 Paper/Tissue-Backed Aerospace Tapes Market Size, By Region, 2017–2024 (USD Million)

Table 21 Paper/Tissue-Backed Aerospace Tapes Market Size, By Region, 2017–2024 (Million Square Meter)

Table 22 Film-Backed Aerospace Tapes Market Size, By Region, 2017–2024 (USD Million)

Table 23 Film-Backed Aerospace Tapes Market Size, By Region, 2017–2024 (Million Square Meter)

Table 24 Foam-Backed Aerospace Tapes Market Size, By Region, 2017–2024 (USD Million)

Table 25 Foam-Backed Aerospace Tapes Market Size, By Region, 2017–2024 (Million Square Meter)

Table 26 Other Backing Materials for Aerospace Tapes Market Size, By Region, 2017–2024 (USD Million)

Table 27 Other Backing Materials for Aerospace Tapes Market Size, By Region, 2017–2024 (Million Square Meter)

Table 28 Aerospace Tapes Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 29 Aerospace Tapes Market Size, By End-Use Industry, 2017–2024 (Million Square Meter)

Table 30 Aerospace Tapes Market Size in Commercial Aviation, By Region, 2017–2024 (USD Million)

Table 31 Aerospace Tapes Market Size in Commercial Aviation, By Region, 2017–2024 (Million Square Meter)

Table 32 Aerospace Tapes Market Size in Military Aviation, By Region, 2017–2024 (USD Million)

Table 33 Aerospace Tapes Market Size in Military Aviation, By Region, 2017–2024 (Million Square Meter)

Table 34 Aerospace Tapes Market Size in General Aviation, By Region, 2017–2024 (USD Million)

Table 35 Aerospace Tapes Market Size in General Aviation, By Region, 2017–2024 (Million Square Meter)

Table 36 Aerospace Tapes Market Size, By Region, 2017–2024 (USD Million)

Table 37 Aerospace Tapes Market Size, By Region, 2017–2024 (Million Square Meter)

Table 38 North America: Aerospace Tapes Market Size, By Country, 2017–2024 (USD Million)

Table 39 North America: Aerospace Tapes Market Size, By Country, 2017–2024 (Million Square Meter)

Table 40 North America: Aerospace Tapes Market Size, By Resin Type, 2017–2024 (USD Million)

Table 41 North America: Aerospace Tapes Market Size, By Resin Type, 2017–2024 (Million Square Meter)

Table 42 North America: Aerospace Tapes Market Size, By Backing Material, 2017–2024 (USD Million)

Table 43 North America: Aerospace Tapes Market Size, By Backing Material, 2017–2024 (Million Square Meter)

Table 44 North America: Aerospace Tapes Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 45 North America: Aerospace Tapes Market Size, By End-Use Industry, 2017–2024 (Million Square Meter)

Table 46 Europe: Aerospace Tapes Market Size, By Country, 2017–2024 (USD Million)

Table 47 Europe: Aerospace Tapes Market Size, By Country, 2017–2024 (Million Square Meter)

Table 48 Europe: Aerospace Tapes Market Size, By Resin Type, 2017–2024 (USD Million)

Table 49 Europe: Aerospace Tapes Market Size, By Resin Type, 2017–2024 (Million Square Meter)

Table 50 Europe: Aerospace Tapes Market Size, By Backing Material, 2017–2024 (USD Million)

Table 51 Europe: Aerospace Tapes Market Size, By Backing Material, 2017–2024 (Million Square Meter)

Table 52 Europe: Aerospace Tapes Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 53 Europe: Aerospace Tapes Market Size, By End-Use Industry, 2017–2024 (Million Square Meter)

Table 54 APAC: Aerospace Tapes Market Size, By Country, 2017–2024 (USD Million)

Table 55 APAC: Aerospace Tapes Market Size, By Country, 2017–2024 (Million Square Meter)

Table 56 APAC: Aerospace Tapes Market Size, By Resin Type, 2017–2024 (USD Million)

Table 57 APAC: Aerospace Tapes Market Size, By Resin Type, 2017–2024 (Million Square Meter)

Table 58 APAC: Aerospace Tapes Market Size, By Backing Material, 2017–2024 (USD Million)

Table 59 APAC: Aerospace Tapes Market Size, By Backing Material, 2017–2024 (Million Square Meter)

Table 60 APAC: Aerospace Tapes Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 61 APAC: Aerospace Tapes Market Size, By End-Use Industry, 2017–2024 (Million Square Meter)

Table 62 Middle East & Africa: Aerospace Tapes Market Size, By Country, 2017–2024 (USD Million)

Table 63 Middle East & Africa: Aerospace Tapes Market Size, By Country, 2017–2024 (Million Square Meter)

Table 64 Middle East & Africa: Aerospace Tapes Market Size, By Resin Type, 2017–2024 (USD Million)

Table 65 Middle East & Africa: Aerospace Tapes Market Size, By Resin Type, 2017–2024 (Million Square Meter)

Table 66 Middle East & Africa: Aerospace Tapes Market Size, By Backing Material, 2017–2024 (USD Million)

Table 67 Middle East & Africa: Aerospace Tapes Market Size, By Backing Material, 2017–2024 (Million Square Meter)

Table 68 Middle East & Africa: Aerospace Tapes Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 69 Middle East & Africa: Aerospace Tapes Market Size, By End-Use Industry, 2017–2024 (Million Square Meter)

Table 70 South America: Aerospace Tapes Market Size, By Country, 2017–2024 (USD Million)

Table 71 South America: Aerospace Tapes Market Size, By Country, 2017–2024 (Million Square Meter)

Table 72 South America: Aerospace Tapes Market Size, By Resin Type, 2017–2024 (USD Million)

Table 73 South America: Aerospace Tapes Market Size, By Resin Type, 2017–2024 (Million Square Meter)

Table 74 South America: Aerospace Tapes Market Size, By Backing Material, 2017–2024 (USD Million)

Table 75 South America: Aerospace Tapes Market Size, By Backing Material, 2017–2024 (Million Square Meter)

Table 76 South America: Aerospace Tapes Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 77 South America: Aerospace Tapes Market Size, By End-Use Industry, 2017–2024 (Million Square Meter)

Table 78 Merger & Acquisition, 2016–2019

Table 79 Investment & Expansion, 2016–2019

List of Figures (46 Figures)

Figure 1 Aerospace Tapes Market: Research Design

Figure 2 Aerospace Tapes Market: Bottom-Up Approach

Figure 3 Aerospace Tapes Market: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Acrylic to Be the Largest Segment in the Aerospace Tapes Market

Figure 6 Paper/Tissue to Be the Largest Backing Material in the Aerospace Tapes Market

Figure 7 Commercial Aviation to Be the Fastest-Growing End-Use Industry of the Aerospace Tapes Market

Figure 8 North America to Lead the Aerospace Tapes Market

Figure 9 Emerging Economies to Offer Lucrative Growth Opportunities for Market Players

Figure 10 Acrylic Resin to Be the Largest Segment

Figure 11 Paper/Tissue-Backed Aerospace Tapes Accounted for the Largest Share in 2018

Figure 12 Commercial Aviation Segment to Account for the Largest Market Share

Figure 13 Aerospace Tapes Market to Grow at A Faster Rate in Developing Countries

Figure 14 China to Lead the Aerospace Tapes Market in the APAC Region

Figure 15 China to Register the Highest Cagr in the Market

Figure 16 Drivers, Restraints, Opportunities, and Challenges in the Aerospace Tapes Market

Figure 17 Jet Fuel Monthly Price—Us Dollars Per Gallon

Figure 18 Low Threat of Backward Integration From End-Users in the Aerospace Tapes Market

Figure 19 Number of Jets Added to the Global Aircraft Fleet, By Manufacturers, in 2018

Figure 20 World Fleet Production Forecast, 2018–2037

Figure 21 World Fleet Stats, 2018—2037

Figure 22 Acrylic to Be the Largest Resin Type in 2019

Figure 23 Paper/Tissue to Be the Largest Backing Material in 2019

Figure 24 High Growth in Major Industries to Drive the Aerospace Tapes Market

Figure 25 China to Be the Fastest-Growing Aerospace Tapes Market

Figure 26 North America: Aerospace Tapes Market Snapshot

Figure 27 Rise in Demand From the Commercial Aviation Segment to Drive the Aerospace Tapes Market in Europe

Figure 28 APAC: Aerospace Tapes Market Snapshot

Figure 29 Turkey to Be the Largest Aerospace Tapes Market in the Middle East

Figure 30 Increasing Demand From the Commercial Aviation Segment to Drive the Aerospace Tapes Market

Figure 31 Companies Adopted Merger & Acquisition as the Key Growth Strategy Between 2016 and 2019

Figure 32 Global Aerospace Tapes Market: Competitive Leadership Mapping, 2018

Figure 33 Ranking of Key Players

Figure 34 3M Company: Company Snapshot

Figure 35 3M Company: SWOT Analysis

Figure 36 Nitto Denko Corporation: Company Snapshot

Figure 37 Nitto Denko Corporation: SWOT Analysis

Figure 38 Avery Dennison Corporation: Company Snapshot

Figure 39 Avery Dennison Corporation: SWOT Analysis

Figure 40 Tesa Se: Company Snapshot

Figure 41 Tesa Se: SWOT Analysis

Figure 42 Scapa Group Plc: Company Snapshot

Figure 43 Scapa Group: SWOT Analysis

Figure 44 Intertape Polymer Group: Company Snapshot

Figure 45 Compagnie De Saint-Gobain: Company Snapshot

Figure 46 Berry Global Group: Company Snapshot

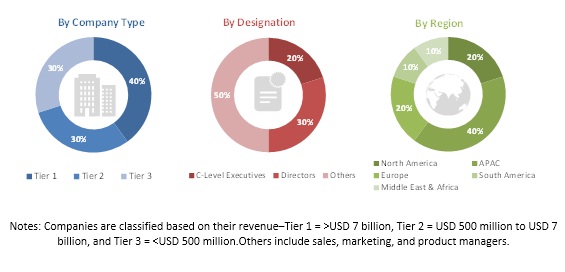

The study involved four major activities in estimating the current market size of aerospace tapes. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves the use of extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the aerospace tapes market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

The aerospace tapes market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. The demand side of this market is characterized by the development of the commercial aviation, military aviation, and general aviation industries. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the aerospace tapes market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the estimation processes explained above-the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the aerospace tapes market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the size of the market based on resin type, backing material, and end-use industry

- To estimate and forecast the market size based on five regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To analyze the market opportunities and competitive landscape of the market leaders and stakeholders

- To analyze the competitive developments, such as merger & acquisition and investment & expansion in the aerospace tapes market

- To strategically identify and profile the key market players and analyze their core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the aerospace tapes market, by segment

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Aerospace Tapes Market