Aerospace Interior Adhesive Market by Resin Type (Epoxy, Cyanoacrylate, Acrylic, PU), Product Type (IFE, Seating, Stowage Bins, Galley, Panels), Aircraft Type (Single Aisle, Regional Jets, Small, Medium, Large Wide Body) - Global Forecast to 2021

[147 Pages Report] The Aerospace Interior Adhesive Market is projected to reach USD 1,101.7 Million by 2021, at a CAGR of 5.35% from 2016 to 2021.

The years considered for the study include:

Base Year: 2015

Forecast Period: 20162021

Objectives of the study:

- To define, describe, and forecast the aeropsace interior adhesives market on the basis of resin type, product type, aircraft type, and region

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the market, and estimate the sizes of various other dependent submarkets in the overall aeropsace interior adhesives market. The research study involved the extensive use of secondary sources, directories, and databases such as, Hoovers, Bloomberg, Chemical Weekly, Factiva, ICIS, Securities and Exchange Commission (SEC), among other government and private websites, to identify and collect information useful for the technical, market-oriented, and commercial study of the global aeropsace interior adhesives market.

To know about the assumptions considered for the study, download the pdf brochure

Polyurethane is manufactured from various raw materials, such as, solvents, pigments, additives, and resins. The major manufacturers of aeropsace interior adhesive are Henkel AG & Co. KGaA (Germany), Huntsman Corporation (U.S), Avery Dennison (U.S.), Arkema S.A. (France), Solvay S.A. (Belgium), Hexcel Corporation (U.S.), 3M Company (U.S.), Delo Industrial Adhesives (Germany), Master Bond Inc.(U.S.), and Permabond LLC (U.K.).

Key Target Audience:

- Manufacturers of Aerospace Interior Adhesives

- Traders, Distributors, and Suppliers of Aerospace Interior Adhesives

- Government and Regional Agencies and Research Organizations

- Investment Research Firms

- Aircarft Manufacturers

Scope of the report:

This research report categorizes the global aeropsace interior adhesives market on the basis of raw material resin type, product type, aircraft type, and region

On the basis of Resin Type:

- Epoxy

- Polyurethane

- Acrylic

- Cyanoacrylate

- Others

On the basis of Product Type:

- Seating

- Inflight Entertainment

- Lavatory

- Panels

- Galley

- Stowage Bins

- Others

On the basis of Aircraft Type:

- Single Aisle

- Small Wide Body

- Medium Wide Body

- Large Wide Body

- Regional Jets

On the basis of Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

The market is further analyzed on the basis of key countries in each of these regions.

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of the company. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the global aeropsace interior adhesives market, by resin type, product type, and aircraft type.

Company Information:

- Detailed analysis and profiles of additional market players

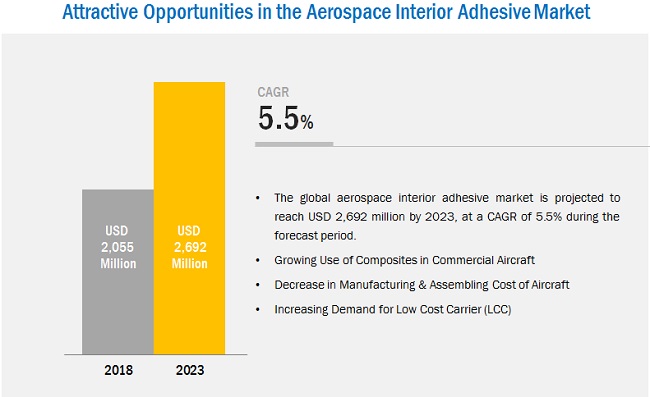

The aerospace interior adhesive market is projected to reach USD 1,101.7 Million by 2021, at a CAGR of 5.35% from 2016 to 2021. Decline in aviation fuel prices, growing air traffic in low cost carriers, and procurement of new aircraft by airline operators for modernization of fleet are the key factors expected to drive the growth of the aerospace interior adhesive market.

Large wide body aircraft type was the largest segment of the aerospace interior adhesive market. Large wide body aircraft are four-engine jets with seating capacity up to 850 passengers. The demand for large wide body aircraft is higher for routes with high traffic, often connecting international destinations. They are passengers first choice, due to factors such as comfort, flexibility, and efficiency. Large interior space, wide range of cabin interior, and suitability for long-haul flights are the major factors anticipated to drive the growth of the segment.

On the basis of resin type, the aerospace interior adhesive market has been segmented into epoxy, polyurethane, acrylic, cyanoacrylate, and others. Epoxy is projected to be the fastest-growing segment in the aerospace interior adhesive market between 2016 and 2021.

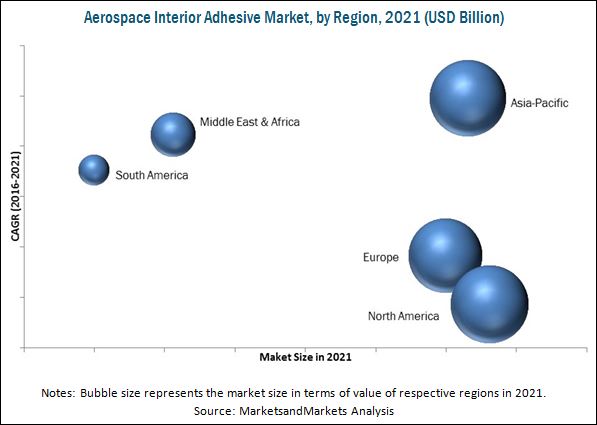

North America, Europe, Asia-Pacific, South America, and Middle East & Africa are considered the key regions for the aerospace interior adhesive market. North America led the aerospace interior adhesive market, in terms of value & volume, due to the presence of major aircraft manufacturers in the region. The major players in the aerospace industry are involved in several business activities. Bombardier Inc. (Canada), The Boeing Co. (U.S.), and Honeywell Aerospace (U.S.) have opened assembly plants in Mexico to increase their market share and cater to the increase in demand for aerospace interior adhesives from the aerospace industry.

Environmental regulations is a major factor that may restrain the growth of the aerospace interior adhesive market. Stringent regulations govern the use of materials in aircraft interiors, which includes the type of adhesives used in forming the components and structure of an aircraft cabin. The three major factors considered in the aerospace industry are passenger safety, weight management, and aesthetics. From safety point of view, there are various regulations which impact the selection of materials for aircraft interiors to ensure passenger safety. The Federal Aviation Administration (FAA) and the European Aviation Safety Agency (EASA) are responsible for regulations that cover fire testing requirements for flame retardancy and fire, smoke, and toxicity. Any materials which are used in aircraft have to pass all the safety standards.

The key players operational in the aerospace interior adhesive market include Henkel AG & Co.KGaA (Germany), Huntsman Corporation (U.S), Avery Dennison (U.S.), Arkema S.A. (France), Solvay S.A. (Belgium), Hexcel Corporation (U.S.), 3M Company (U.S.), Delo Industrial Adhesives (Germany), Master Bond Inc.(U.S.), and Permabond LLC (U.K.). Diverse product portfolios, strategically positioned R&D centers, adoption of development strategies, and technological advancements help strengthen the market positions of these companies in the aerospace interior adhesive market. These companies are adopting various organic and inorganic growth strategies, such as agreements, partnerships, mergers & acquisitions, and new product launches to enhance their current market shares.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Markets Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Pacakge Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

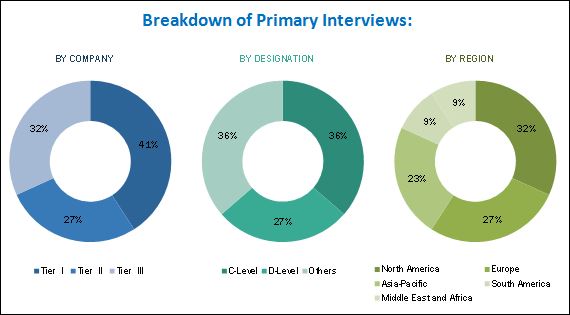

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Market Opportunities

4.2 Aerospace Interior Adhesives Market, By Resin Type

4.3 Aeropsace Interior Adhesives Market: Developed vs Developing Nations

4.4 Aeropsace Interior Adhesives Market, By Resin Type and Country

4.5 U.S. is the Largest Market for Aerospace Interior Adhesives

5 Market Overview (Page No. - 36)

5.1 Introduction

5.1.1 Market Segmentation

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Use of Composites in Commercial Aircraft

5.2.1.2 Replacement of Old Aircraft With New Ones

5.2.1.3 Increasing Demand for Low Cost Carrier (LCC)

5.2.1.4 Decline in Fuel Prices

5.2.2 Restraints

5.2.2.1 Stagnant Growth in North America and Europe

5.2.2.2 Stringent Government Regulations and High Safety Standards

5.2.3 Opportunities

5.2.3.1 Decrease in Manufacturing & Assembling Cost of Aircraft

5.2.3.2 Focus on Development of Fuel Efficient Aircraft

5.2.3.3 Global Increase in Number of Aircraft Deliveries

5.2.4 Challenges

5.2.4.1 Complying With International Safety and Quality Standards Without Increasing Cost

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Rivalry

7 Macro Economic Overview and Key Trends (Page No. - 48)

7.1 Introduction

7.2 Trends and Forecast of GDP

8 Patent Details (Page No. - 50)

8.1 Introduction

8.2 Patent Details

9 Aerospace Interior Adhesives Market, By Resin Type (Page No. - 52)

9.1 Introduction

9.2 Epoxy Resin

9.2.1 Cyanoacrylate

9.2.2 Polyurethane

9.2.3 Acrylic

9.2.4 Others

10 Aerospace Interior Adhesives Market, By Aircraft Type (Page No. - 60)

10.1 Introduction

10.1.1 Single Aisle

10.1.2 Small Wide Body

10.1.3 Medium Wide Body

10.1.4 Large Wide Body

10.1.5 Regional Jets

11 Aerospace Interior Adhesives Market, By Product Type (Page No. - 67)

11.1 Introduction

11.1.1 Seating

11.1.2 Inflight Entertainment

11.1.3 Galley

11.1.4 Stowage Bins

11.1.5 Lavatory

11.1.6 Panels

11.1.7 Others

12 Aerospace Interior Adhesives Market, By Region (Page No. - 76)

12.1 Introduction

12.2 Asia-Pacific

12.2.1 China

12.2.2 Japan

12.2.3 India

12.2.4 South Korea

12.2.5 Singapore

12.2.6 Thailand

12.2.7 Australia & New Zealand

12.2.8 Rest of Asia-Pacific

12.3 Europe

12.3.1 Germany

12.3.2 France

12.3.3 U.K.

12.3.4 Italy

12.3.5 Turkey

12.3.6 Rest of Europe

12.4 North America

12.4.1 U.S.

12.4.2 Canada

12.4.3 Mexico

12.5 Middle East & Africa

12.5.1 Iran

12.5.2 Israel

12.5.3 Africa

12.5.4 Rest of Middle East & Africa

12.6 South America

12.6.1 Brazil

12.6.2 Argentina

12.6.3 Chile

12.6.4 Rest of South America

13 Competitive Landscape (Page No. - 115)

13.1 Overview

13.2 Market Share Analysis: Aerospace Interior Adhesives (2015)

13.3 New Product Launch

13.4 Partnership, Agreement, & Joint Venture

13.5 Acquisition

14 Company Profiles (Page No. - 120)

(Overview, Financial*, Products & Services, Strategy, and Developments)

14.1 Henkel AG & Co. KGaA

14.2 Arkema S.A.

14.3 3M Company

14.4 Huntsman Corporation

14.5 Solvay S.A.

14.6 Avery Dennison Corporation

14.7 Hexcel Corporation

14.8 Delo Industrie Klebstoffe GmbH & Co KGaA

14.9 Master Bond Inc.

14.10 Perma Bond LLC

*Details Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 138)

15.1 Insights From Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

15.7 Author Details

List of Tables (112 Tables)

Table 1 Aerospace Interior Adhesive Market Snapshot (2016 vs 2021)

Table 2 Aerospace Interior Adhesive Market Segmentation, By Resin Type

Table 3 Aerospace Interior Adhesive Market Segmentation, By Product Type

Table 4 Aerospace Interior Adhesive Market Segmentation, By Aircraft Type

Table 5 Trends and Forecast of GDP, USD Billion (20152021)

Table 6 Market, By Resin Type, 20142021 (Ton)

Table 7 Market, By Resin Type, 20142021 (USD Million)

Table 8 Aerospace Interior Epoxy Adhesives Market Size, By Region, 20142021 (Ton)

Table 9 Aerospace Interior Epoxy Adhesives Market Size, By Region, 20142021 (USD Million)

Table 10 Aerospace Interior Cyanoacrylate Adhesives Market Size, By Region, 20142021 (Ton)

Table 11 Aerospace Interior Cyanoacrylate Adhesives Market Size, By Region, 20142021 (USD Million)

Table 12 Aerospace Interior Polyurethane Adhesives Market Size, By Region, 20142021 (Ton)

Table 13 Aerospace Interior Polyurethane Adhesives Market Size, By Region, 20142021 (USD Million)

Table 14 Aerospace Interior Acrylic Adhesives Market Size, By Region, 20142021 (Ton)

Table 15 Aerospace Interior Acrylic Adhesives Market Size, By Region, 20142021 (USD Million)

Table 16 Other Aerospace Interior Adhesive Aerospace Interior Adhesive Market Size, By Region, 20142021 (Ton)

Table 17 Other Aerospace Interior Adhesive Market Size, By Region, 20142021 (USD Million)

Table 18 Aerospace Interior Adhesive Market Size, By Aircraft Type, 20142021 (Ton)

Table 19 Aerospace Interior Adhesive Market Size, By Aircraft Type, 20142021 (USD Million)

Table 20 Single Aisle: Market Size, By Region, 20142021 (Ton)

Table 21 Single Aisle: Market Size, By Region, 20142021 (USD Million)

Table 22 Small Wide Body: Market Size, By Region, 20142021 (Ton)

Table 23 Small Wide Body: Market Size, By Region, 20142021 (USD Million)

Table 24 Medium Wide Body: Market Size, By Region, 20142021 (Ton)

Table 25 Medium Wide Body: Market Size, By Region, 20142021 (USD Million)

Table 26 Large Wide Body: Market Size, By Region, 20142021 (Ton)

Table 27 Large Wide Body: Market Size, By Region, 20142021 (USD Million)

Table 28 Regional Jets: Market Size, By Region, 20142021 (Ton)

Table 29 Regional Jets: Market Size, By Region, 20142021 (USD Million)

Table 30 Aerospace Interior Adhesive Market Size, By Product Type, 20142021 (Ton)

Table 31 Aerospace Interior Adhesive Market Size, By Product Type, 20142021 (USD Million)

Table 32 Seating: Market Size, By Region, 20142021 (Ton)

Table 33 Seating: Market Size, By Region, 20142021 (USD Million)

Table 34 Inflight Entertainment: Market Size By Region, 20142021 (Ton)

Table 35 Inflight Entertainment: Market Size, By Region, 20142021 (USD Million)

Table 36 Galley: Market Size, By Region, 20142021 (Ton)

Table 37 Galley: Market Size, By Region, 20142021 (USD Million)

Table 38 Stowage Bins: Market Size, By Region, 20142021 (Ton)

Table 39 Stowage Bins: Market Size, By Region, 20142021 (USD Million)

Table 40 Lavatory: Market Size, By Region, 20142021 (Ton)

Table 41 Lavatory: Market Size, By Region, 20142021 (USD Million)

Table 42 Panels: Market Size, By Region, 20142021 (Ton)

Table 43 Panels: Market Size, By Region, 20142021 (USD Million)

Table 44 Others: Aerospace Interior Adhesive Market Size, By Region, 20142021 (Ton)

Table 45 Others: Aerospace Interior Adhesive Market Size By Region, 20142021 (USD Million)

Table 46 Aerospace Interior Adhesive Market Size, By Region, 20142021 (Ton)

Table 47 Aerospace Interior Adhesive Market Size, By Region, 20142021 (USD Million)

Table 48 Asia-Pacific: Aerospace Interior Adhesive Market Size, By Country, 20142021 (Ton)

Table 49 Asia-Pacific: Market Size, By Country, 20142021 (USD Million)

Table 50 China: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 51 China: Market Size, By Resin Type, 20142021 (USD Million)

Table 52 Japan: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 53 Japan: Market Size, By Resin Type, 20142021 (USD Million)

Table 54 India: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 55 India: Market Size, By Resin Type, 20142021 (USD Million)

Table 56 South Korea: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 57 South Korea: Market Size, By Resin Type, 20142021 (USD Million)

Table 58 Singapore: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 59 Singapore: Market Size, By Resin Type, 20142021 (USD Million)

Table 60 Thailand: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 61 Thailand: Market Size, By Resin Type, 20142021 (USD Million)

Table 62 Australia & New Zealand: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 63 Australia & New Zealand: Market Size, By Resin Type, 20142021 (USD Million)

Table 64 Rest of Asia-Pacific: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 65 Rest of Asia-Pacific: Market Size, By Resin Type, 20142021 (USD Million)

Table 66 Europe: Aerospace Interior Adhesive Market Size, By Country, 20142021 (Ton)

Table 67 Europe: Market Size, By Country, 20142021 (USD Million)

Table 68 Germany: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 69 Germany: Market Size, By Resin Type, 20142021 (USD Million)

Table 70 Russia: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 71 Russia: Market Size, By Resin Type, 20142021 (USD Million)

Table 72 France: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 73 France: Market Size, By Resin Type, 20142021 (USD Million)

Table 74 U.K.: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 75 U.K.: Market Size, By Resin Type, 20142021 (USD Million)

Table 76 Italy: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 77 Italy: Market Size, By Resin Type, 20142021 (USD Million)

Table 78 Turkey: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 79 Turkey: Market Size, By Resin Type, 20142021 (USD Million)

Table 80 Rest of Europe: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 81 Rest of Europe: Market Size, By Resin Type, 20142021 (USD Million)

Table 82 North America: Aerospace Interior Adhesive Market Size, By Country, 20142021 (Ton)

Table 83 North America: Market Size, By Country, 20142021 (USD Million)

Table 84 U.S.: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 85 U.S.: Market Size, By Resin Type, 20142021 (USD Million)

Table 86 Canada: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 87 Canada: Market Size, By Resin Type, 20142021 (USD Million)

Table 88 Mexico: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 89 Mexico: Market Size, By Resin Type, 20142021 (USD Million)

Table 90 Middle East & Africa: Aerospace Interior Adhesive Market Size, By Country, 20142021 (Ton)

Table 91 Middle East and Africa: Market Size, By Country, 20142021 (USD Million)

Table 92 Iran: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 93 Iran: Market Size, By Resin Type, 20142021 (USD Million)

Table 94 Israel: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 95 Israel: Market Size, By Resin Type, 20142021 (USD Million)

Table 96 Africa: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 97 Africa: Market Size, By Resin Type, 20142021 (USD Million)

Table 98 Rest of Middle East & Africa: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 99 Rest of Middle East & Africa: Market Size, By Resin Type, 20142021 (USD Million)

Table 100 South America: Aerospace Interior Adhesive Market Size, By Country, 20142021 (Ton)

Table 101 South America: Market Size, By Country, 20142021 (USD Million)

Table 102 Brazil: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 103 Brazil: Market Size, By Resin Type, 20142021 (USD Million)

Table 104 Argentina: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 105 Argentina: Market Size, By Resin Type, 20142021 (USD Million)

Table 106 Chile: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 107 Chile: Market Size, By Resin Type, 20142021 (USD Million)

Table 108 Rest of South America: Aerospace Interior Adhesive Market Size, By Resin Type, 20142021 (Ton)

Table 109 Rest of South America: Market Size, By Resin Type, 20142021 (USD Million)

Table 110 New Product Launches, 20142016

Table 111 Partnerships, Agreements, & Joint Ventures, 20142016

Table 112 Acquisitions, 20142016

List of Figures (41 Figures)

Figure 1 Aerospace Interior Adhesives: Market Segmentation

Figure 2 Aerospace Interior Adhesives Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Aerospace Interior Adhesives Market: Data Triangulation

Figure 6 Small Wide Body Segment to Witness the Highest CAGR Between 2016 and 2021

Figure 7 Seating to Be the Fastest-Growing Product Type Between 2016 and 2021

Figure 8 North America Was the Largest Market of Aerospace Interior Adhesives in 2015

Figure 9 Emerging Economies to Offer Lucrative Growth Potential for Market Players Between 2016 and 2021

Figure 10 Epoxy Resin to Witness the Highest CAGR Between 2016 and 2021

Figure 11 Market of Aerospace Interior Adhesives to Register Highest CAGR in Developing Nations Than Developed Nations

Figure 12 Epoxy Resin Segment Accounted for the Largest Market Share in Aerospace Interior Adhesives, in 2015

Figure 13 U.S. and China Accounted for the Largest Market Share of Aerospace Interior Adhesives, in 2015

Figure 14 Drivers, Restrains, Opportunities, and Challenges in the Aerospace Interior Adhesives Market

Figure 15 Aerospace Interior Adhesives: Value Chain Analysis

Figure 16 GDP of Major Countries in the World in 2015

Figure 17 Europe Filed the Highest Number of Patents Between 2010 and 2016

Figure 18 The Boeing Company Registered the Highest Number of Patents Between 2010 and 2016

Figure 19 Epoxy Resin Dominates the Market of Aerospace Interior Adhesives

Figure 20 India is Emerging as the Leading Market of Aerospace Interior Adhesives

Figure 21 Asia-Pacific Market Snapshot: China is the Largest Market

Figure 22 Europe Market Snapshot: Russia is the Largest Market

Figure 23 North America Market Snapshot: U.S. is the Largest Market

Figure 24 Companies Adopted New Product Launch as the Key Growth Strategy Between 2014 and 2016

Figure 25 Developmental Market Evaluation Framework

Figure 26 Henkel AG & Co. KGaA Company Lead Aerospace Interior Adhesives Market With the Highest Market Share in 2015

Figure 27 New Product Launches and Partnerships, Agreements, & Joint Ventures Were the Key Strategies Between 2014 and 2016

Figure 28 Henkel AG & Co. KGaA: Company Snapshot

Figure 29 Henkel AG & Co. KGaA: SWOT Analysis

Figure 30 Arkema S.A.: Company Snapshot

Figure 31 Arkema S.A.: SWOT Analysis

Figure 32 3M Company: Company Snapshot

Figure 33 3M Company: SWOT Analysis

Figure 34 Huntsman Corporation: Company Snapshot

Figure 35 Huntsman Corporation: SWOT Analysis

Figure 36 Solvay S.A.: Company Snapshot

Figure 37 Solvay S.A.: SWOT Analysis

Figure 38 Avery Dennison Corporation: Company Snapshot

Figure 39 Avery Dennison Corporation: SWOT Analysis

Figure 40 Hexcel Corporation: Company Snapshot

Figure 41 Hexcel Corporation: SWOT Analysis

Growth opportunities and latent adjacency in Aerospace Interior Adhesive Market