Adhesion Promoter Market by Type (Silane, Maleic Anhydride, Chlorinated Polyolefins, Titanate & Zirconate, Others), Application (Plastics & Composites, Paints & Coatings, Rubber, Adhesives, Metals, Others), Region - Global Forecast to 2021

[178 Pages Report] The global adhesion promoter market was valued at USD 2.51 Billion in 2015, and is projected to reach USD 3.64 Billion by 2021, at a CAGR of 6.4% between 2016 and 2021.

The global adhesion promoters market has been categorized on the basis of type, application, and region. In terms of value, the silane segment led the global adhesion promoter market in 2015. The market is categorized on the basis of application into plastics & composites, paints & coatings, rubber, adhesives, metals, and others. Innovations in advanced composites and multilayer packaging have increased the demand of adhesion promoter in the plastics & composites application. The adhesion promoter market in the Asia-Pacific region is projected to grow at the highest CAGR during the forecast period, owing to the rising demand of paints & coatings in the automotive and construction sectors. The report on the adhesion promoter market considered 2015 as the base year, and the forecast period from 2016 to 2021.

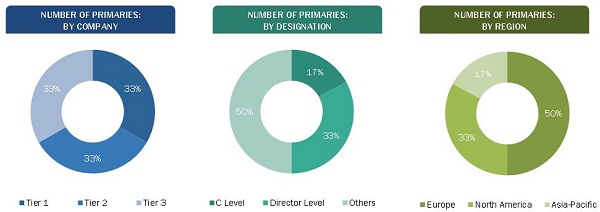

The research methodology used to estimate and forecast the global adhesion promoter market begins with capturing data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were later verified through primary research by conducting extensive interviews with key personnel, such as CEOs, VPs, directors, and executives. This data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The breakdown of profiles of primaries is depicted in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

The adhesion promoter market has a diversified ecosystem of upstream players, including raw material suppliers, along with downstream stakeholders, vendors, end users, and government organizations. Key players in this market include Momentive Performance Materials Inc. (U.S.), Eastman Chemical Company (U.S.), Dow Corning Corporation (U.S.), BASF SE (Germany), Arkema SA (France), Evonik Industries AG (Germany), ALTANA AG (Germany), Air Products and Chemicals, Inc. (U.S.), E. I. du Pont de Nemours and Company (U.S.), and AkzoNobel NV (Netherlands), among others. The government and research organizations, raw material suppliers and distributors, construction companies, and industry associations are considered as critical stakeholders in this study.

Target Audience

- Adhesion Promoter Producers

- Adhesion Promoter Traders, Distributors, and Suppliers

- Manufacturers in End-Use Industries

- Associations and Industry Bodies

Scope of the Report: This research report categorizes the global adhesion promoter market on the basis of type, application, and region; forecasting volumes and revenues as well as analyzing trends in each of these submarkets.

On the basis of Type, the adhesion promoter market is segmented into:

- Silane

- Maleic Anhydride

- Chlorinated Polyolefins

- Titanate & Zirconate

- Others

On the basis of Application, the adhesion promoter market is segmented into:

- Plastics & Composites

- Paints & Coatings

- Rubber

- Adhesives

- Metals

- Others

On the basis of Region: The geographic analysis of the global adhesion promoter market include regions, such as

- Asia-Pacific

- Europe

- North America

- Latin America

- RoW

The following customization options are available for the report:

- Further breakdown of Asia-Pacific & European adhesion promoter markets

- Company information

- Detailed analysis and profiling of additional market players (Up to 3)

The global adhesion promoter market was valued at USD 2.51 Billion in 2015 and is projected to reach USD 3.64 Billion by 2021, at a CAGR of 6.4% from 2016 to 2021. This growth is mainly attributed to the growing automotive sector in the Asia-Pacific region, use of adhesion promoters in composites, application of adhesion promoters in printed circuit boards, innovation of silane-based green tires, requirement of halogen-free wires, and development of multilayer packaging.

Among all applications, the plastics & composites segment is the fastest-growing application segment in the adhesion promoter market. Adhesion promoters are used to produce silica-reinforced tires. They are also used to develop high-molecular-weight rubbers and highly weatherable paints. In chemical applications such as paints & coatings and adhesives, adhesion promoters are used to increase adhesion with inorganic substrates. They assist in increasing transparency and reducing viscosity of coatings during mixing of paints & coatings. In electrical application, adhesion promoters are used to improve the reliability of semiconductors and flat panel displays. They also help in improving the adhesion and dispersibility of inorganic materials. Moreover, in the construction sector, adhesion promoters help in improving the durability of exterior walls of buildings, bridges, and other infrastructures.

A wide range of adhesion promoters are available in the market. Silane is the major type of adhesion promoters used in paints & coatings, rubber, and tire applications. It is also utilized in the automotive and construction industries. Maleic anhydride is the second-largest type of adhesion promoters. Its major application is in plastics & composites. It is also used in packaging, automotive, wire & cable, and recycling industries.

Asia-Pacific held the largest share in the global adhesion promoter market in 2015. The market in this region is projected to grow at the highest CAGR during the forecast period, in terms of value. This growth is mainly attributed to the increasing demand of adhesion promoters in the paints & coatings application. Several global players in the adhesion promoters market are establishing their manufacturing base in the Asia-Pacific region, owing to the easy availability of raw materials and labor.

Factors inhibiting the growth of the global adhesion promoter market include negative environmental impact of some adhesion promoters and the underdeveloped recycling industry in the Asia-Pacific region. Momentive Performance Materials Inc. (U.S.), Eastman Chemical Company (U.S.), Dow Corning Corporation (U.S.), BASF SE (Germany), Arkema SA (France), Evonik Industries AG (Germany), and ALTANA AG (Germany) are key players operating in the adhesion promoter market. Momentive Performance Materials Inc. (U.S.) is engaged in the production of new products in the field of adhesion promoters market. The company has also undertaken collaboration activities to improve growth opportunities in emerging markets.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of The Study

1.2 Market Definition

1.3 Scope of The Study

1.3.1 Markets Covered

1.3.2 Years Considered for The Study

1.4 Currency

1.5 Package Size

1.6 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in The Adhesion Promoter Market

4.2 Adhesion Promoters Market, By Type

4.3 Adhesion Promoter Market in Asia-Pacific

4.4 Adhesion Promoters Market Share, By Region

4.5 Adhesion Promoter Market: Developed vs Emerging Nations

4.6 Adhesion Promoter Market, By Application

4.7 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Difference Between Adhesion Promoters and Adhesives

5.3 Evolution of Adhesion Promoter

5.3.1 Silane-Based Adhesion Promoters

5.3.2 Polymeric Adhesion Promoter

5.4 Market Segmentation

5.4.1 By Type

5.4.2 By Application

5.5 Market Dynamics

5.5.1 Drivers

5.5.1.1 Growing Automotive Sector in the Asia-Pacific Region

5.5.1.2 Use of Adhesion Promoters in Composites

5.5.1.3 Application of Adhesion Promoters in Printed Circuit Boards

5.5.2 Restraints

5.5.2.1 Negative Environmental Impact of Some Adhesion Promoters

5.5.3 Opportunities

5.5.3.1 Innovation of Silane-Based Green Tires

5.5.3.2 Requirement of Halogen-Free Wires

5.5.3.3 Development of Multilayer Packaging

5.5.3.4 Use of Adhesion Promoters in Asphalt Applications

5.5.4 Challenges

5.5.4.1 Future Legislations Against Chemical-Based Adhesion Promoters

5.5.4.2 Underdeveloped Recycling Industry in the Asia-Pacific Region

5.6 Burning Issues

5.6.1 Shift of Demand From Chemical Adhesion Promoters to Polymeric Adhesion Promoters

6 Industry Trends (Page No. - 41)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Adhesion Promoter Market, By Type (Page No. - 47)

7.1 Introduction

7.2 Silane

7.3 Maleic Anhydride

7.4 Chlorinated Polyolefins

7.5 Titanate & Zirconate

7.6 Others

8 Adhesion Promoter Market, By Application (Page No. - 59)

8.1 Introduction

8.2 Plastics & Composites

8.3 Paints & Coatings

8.4 Rubber

8.5 Adhesives

8.6 Metals

8.7 Others

9 Adhesion Promoter Market, By Region (Page No. - 74)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 India

9.2.3 Japan

9.2.4 South Korea

9.2.5 Rest of Asia-Pacific

9.3 Europe

9.3.1 Germany

9.3.2 U.K.

9.3.3 France

9.3.4 Italy

9.3.5 Rest of Europe

9.4 North America

9.4.1 U.S.

9.4.2 Canada

9.4.3 Mexico

9.5 Latin America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of Latin America

9.6 RoW

9.6.1 Middle East

9.6.2 Others

10 Competitive Landscape (Page No. - 136)

10.1 Introduction

10.2 New Product Launches: the Most Popular Growth Strategy

10.3 Momentive Performance Materials Inc.: the Most Active Player Between 2010 & 2015

10.4 Maximum Developments Recorded in 2011

10.5 Competitive Situations & Trends

10.5.1 New Product Developments/New Product Launches

10.5.2 Patents

10.5.3 Expansions

10.5.4 Collaborations

10.5.5 Acquisitions

11 Company Profiles (Page No. - 145)

11.1 Introduction

11.2 Momentive Performance Materials Inc.

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments

11.2.4 MnM View

11.2.4.1 SWOT Analysis

11.3 Eastman Chemical Company

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 MnM View

11.3.4.1 SWOT Analysis

11.4 DOW Corning Corporation

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Recent Developments

11.4.4 MnM View

11.4.4.1 SWOT Analysis

11.5 BASF SE

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Developments

11.5.4 MnM View

11.5.4.1 SWOT Analysis

11.6 Arkema SA

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments

11.6.4 MnM View

11.6.4.1 SWOT Analysis

11.7 Evonik Industries AG

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Recent Developments

11.7.4 MnM View

11.8 Altana AG

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Recent Developments

11.8.4 MnM View

11.9 Air Products and Chemicals, Inc.

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Recent Developments

11.9.4 MnM View

11.10 E. I. Du Pont De Nemours and Company

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 Recent Developments

11.10.4 MnM View

11.11 Akzonobel NV

11.11.1 Business Overview

11.11.2 Products Offered

11.11.3 Recent Developments

11.11.4 MnM View

11.12 Other Companies

12 Appendix (Page No. - 173)

12.1 Insights From Industrial Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (136 Tables)

Table 1 Adhesion Promoters Market to Register High Growth in the Asia-Pacific Region Between 2016 and 2021

Table 2 Adhesion Promoter Market, By Type, 20142021 (USD Million)

Table 3 Adhesion Promoters Market, By Type, 20142021 (Kilotons)

Table 4 Silane Adhesion Promoter Market, By Region, 20142021 (USD Million)

Table 5 Silane Adhesion Promoters Market, By Region, 20142021 (Kilotons)

Table 6 Maleic Anhydride Adhesion Promoters Market, By Region, 20142021 (USD Million)

Table 7 Maleic Anhydride Adhesion Promoter Market, By Region, 20142021 (Kilotons)

Table 8 Chlorinated Polyolefins Adhesion Promoters Market, By Region, 20142021 (USD Million)

Table 9 Chlorinated Polyolefins Adhesion Promoter Market, By Region, 20142021 (Kilotons)

Table 10 Titanate & Zirconate Adhesion Promoters Market, By Region, 20142021 (USD Million)

Table 11 Titanate & Zirconate Adhesion Promoter Market, By Region, 20142021 (Kilotons)

Table 12 Other Adhesion Promoters Type Market, By Region, 20142021 (USD Million)

Table 13 Other Adhesion Promoter Type Market, By Region, 20142021 (Kilotons)

Table 14 Adhesion Promoters Market, By Application, 20142021 (USD Million)

Table 15 Adhesion Promoter Market, By Application, 20142021 (Kilotons)

Table 16 Adhesion Promoters Market in Plastics & Composites Application, By Region, 20142021 (USD Million)

Table 17 Adhesion Promoter Market in Plastics & Composites Application, By Region, 20142021 (Kilotons)

Table 18 Adhesion Promoters Market in Paints & Coatings Application, By Region, 20142021 (USD Million)

Table 19 Adhesion Promoter Market in Paints & Coatings Application, By Region, 20142021 (Kilotons)

Table 20 Adhesion Promoters Market in Rubber Application, By Region, 20142021 (USD Million)

Table 21 Adhesion Promoter Market in Rubber Application, By Region, 20142021 (Kilotons)

Table 22 Adhesion Promoters Market in Adhesives Application, By Region, 20142021 (USD Million)

Table 23 Adhesion Promoter Market in Adhesives Application, By Region, 20132021 (Kilotons)

Table 24 Adhesion Promoters Market in Metals Application, By Region, 20142021 (USD Million)

Table 25 Adhesion Promoter Market in Metals Application, By Region, 20142021 (Kilotons)

Table 26 Adhesion Promoters Market in Other Applications, By Region, 20142021 (USD Million)

Table 27 Adhesion Promoter Market in Other Applications, By Region, 20142021 (Kilotons)

Table 28 Adhesion Promoters Market, By Region, 2014-2021 (USD Million)

Table 29 Adhesion Promoter Market, By Region, 2014-2021 (Kilotons)

Table 30 Asia-Pacific Adhesion Promoters Market, By Country, 2014-2021 (USD Million)

Table 31 Asia-Pacific Market, By Country, 2014-2021 (Kilotons)

Table 32 Asia-Pacific Market, By Type, 2014-2021 (USD Million)

Table 33 Asia-Pacific Market, By Type, 2014-2021 (Kilotons)

Table 34 Asia-Pacific Market, By Application, 2014-2021 (USD Million)

Table 35 Asia-Pacific Market Size, By Application, 2014-2021 (Kilotons)

Table 36 China Adhesion Promoters Market, By Type, 2014-2021(USD Million)

Table 37 China Market, By Type, 2014-2021 (Kilotons)

Table 38 China Market, By Application, 2014-2021 (USD Million)

Table 39 China Market, By Application, 2014-2021 (Kilotons)

Table 40 India Adhesion Promoters Market, By Type, 2014-2021 (USD Million)

Table 41 India Market Size, By Type, 2014-2021 (Kilotons)

Table 42 India Market, By Application, 2014-2021 (USD Million)

Table 43 India Market Size, By Application, 2014-2021 (Kilotons)

Table 44 Japan Adhesion Promoters Market, By Type, 2014-2021 (USD Million)

Table 45 Japan Market, By Type, 2014-2021 (Kilotons)

Table 46 Japan Market, By Application, 2014-2021 (USD Million)

Table 47 Japan Market, By Application, 2014-2021 (Kilotons)

Table 48 South Korea Adhesion Promoters Market, By Type, 2014-2021 (USD Million)

Table 49 South Korea Market, By Type, 2014-2021 (Kilotons)

Table 50 South Korea Market, By Application, 2014-2021 (USD Million)

Table 51 South Korea Market, By Application, 2014-2021 (Kilotons)

Table 52 Rest of Asia-Pacific Adhesion Promoters Market, By Type, 2014-2021 (USD Million)

Table 53 Rest of Asia-Pacific Market, By Type, 2014-2021 (Kilotons)

Table 54 Rest of Asia-Pacific Market, By Application, 2014-2021 (USD Million)

Table 55 Rest of Asia-Pacific Market, By Application, 2014-2021 (Kilotons)

Table 56 Europe Adhesion Promoters Market, By Country, 2014-2021 (USD Million)

Table 57 Europe Market, By Country, 2014-2021 (Kilotons)

Table 58 Europe Market, By Type, 2014-2021 (USD Million)

Table 59 Europe Market, By Type, 2014-2021 (Kilotons)

Table 60 Europe Market, By Application, 2014-2021 (USD Million)

Table 61 Europe Market, By Application, 2014-2021 (Kilotons)

Table 62 Germany Adhesion Promoters Market, By Type, 2014-2021 (USD Million)

Table 63 Germany Market, By Type, 2014-2021 (Kilotons)

Table 64 Germany Market, By Application, 2014-2021 (USD Million)

Table 65 Germany Market, By Application, 2014-2021 (Kilotons)

Table 66 U.K. Adhesion Promoters Market, By Type, 2014-2021 (USD Million)

Table 67 U.K. Market Size, By Type, 2014-2021 (Kilotons)

Table 68 U.K. Market, By Application, 2014-2021 (USD Million)

Table 69 U.K. Market, By Application, 2014-2021 (Kilotons)

Table 70 France Adhesion Promoters Market, By Type, 2014-2021 (USD Million)

Table 71 France Market, By Type, 2014-2021 (Kilotons)

Table 72 France Market, By Application, 2014-2021 (USD Million)

Table 73 France Market, By Application, 2014-2021 (Kilotons)

Table 74 Italy Adhesion Promoters Market, By Type, 2014-2021 (USD Million)

Table 75 Italy Market, By Type, 2014-2021(Kiloton)

Table 76 Italy Market, By Application, 2014-2021 (USD Million)

Table 77 Italy Market Size, By Application, 2014-2021 (Kilotons)

Table 78 Rest of Europe Adhesion Promoters Market, By Type, 2014-2021 (USD Million)

Table 79 Rest of Europe Market, By Type, 2014-2021 (Kilotons)

Table 80 Rest of Europe Market, By Application, 2014-2021 (USD Million)

Table 81 Rest of Europe Market, By Application, 2014-2021 (Kilotons)

Table 82 North America Adhesion Promoters Market, By Country, 2014-2021 (USD Million)

Table 83 North America Market, By Country, 2014-2021 (Kilotons)

Table 84 North America Market, By Type, 2014-2021 (USD Million)

Table 85 North America Market, By Type, 2014-2021 (Kilotons)

Table 86 North America Market, By Application, 2014-2021 (USD Million)

Table 87 North America Market, By Application, 2014-2021 (Kilotons)

Table 88 U.S. Adhesion Promoters Market, By Type, 2014-2021 (USD Million)

Table 89 U.S. Market, By Type, 2014-2021 (Kilotons)

Table 90 U.S. Market, By Application, 2014-2021 (USD Million)

Table 91 U.S. Market, By Application, 2014-2021 (Kilotons)

Table 92 Canada Adhesion Promoters Market, By Type, 2014-2021 (USD Million)

Table 93 Canada Market, By Type, 2014-2021 (Kilotons)

Table 94 Canada Market, By Application, 2014-2021 (USD Million)

Table 95 Canada Market, By Application, 2014-2021 (Kilotons)

Table 96 Mexico Adhesion Promoters Market, By Type, 2014-2021 (USD Million)

Table 97 Mexico Market, By Type, 2014-2021 (Kilotons)

Table 98 Mexico Market, By Application, 2014-2021 (USD Million)

Table 99 Mexico Market Size, By Application, 2014-2021 (Kilotons)

Table 100 Latin America Adhesion Promoters Market, By Country, 2014-2021 (USD Million)

Table 101 Latin America Market, By Country, 2014-2021 (Kilotons)

Table 102 Latin America Market, By Type, 2014-2021 (USD Million)

Table 103 Latin America Market, By Type, 2014-2021 (Kilotons)

Table 104 Latin America Market, By Application, 2014-2021 (USD Million)

Table 105 Latin America Market, By Application, 2014-2021 (Kilotons)

Table 106 Brazil Adhesion Promoters Market, By Type, 2014-2021 (USD Million)

Table 107 Brazil Market, By Type, 2014-2021 (Kilotons)

Table 108 Brazil Market, By Application, 2014-2021 (USD Million)

Table 109 Brazil Market, By Application, 2014-2021 (Kilotons)

Table 110 Argentina Adhesion Promoters Market, By Type, 2014-2021 (USD Million)

Table 111 Argentina Market, By Type, 2014-2021 (Kilotons)

Table 112 Argentina Market, By Application, 2014-2021 (USD Million)

Table 113 Argentina Market, By Application, 2014-2021 (Kilotons)

Table 114 Rest of Latin America Adhesion Promoters Market, By Type, 2014-2021 (USD Million)

Table 115 Rest of Latin America Market, By Type, 2014-2021 (Kilotons)

Table 116 Rest of Latin America Market, By Application, 2014-2021 (USD Million)

Table 117 Rest of Latin America Market, By Application, 2014-2021 (Kilotons)

Table 118 RoW Adhesion Promoters Market, By Region, 2014-2021 (USD Million)

Table 119 RoW Market, By Region, 2014-2021 (Kilotons)

Table 120 RoW Market, By Type, 2014-2021 (USD Million)

Table 121 RoW Market, By Type, 2014-2021 (Kilotons)

Table 122 RoW Market, By Application, 2014-2021 (USD Million)

Table 123 RoW Market, By Application, 2014-2021 (Kilotons)

Table 124 Middle East Adhesion Promoters Market, By Type, 2014-2021 (USD Million)

Table 125 Middle East Market, By Type, 2014-2021 (Kilotons)

Table 126 Middle East Market, By Application, 2014-2021 (USD Million)

Table 127 Middle East Market, By Application, 2014-2021 (Kilotons)

Table 128 Others Adhesion Promoters Market, By Type, 2014-2021 (USD Million)

Table 129 Others Market, By Type, 2014-2021 (Kilotons)

Table 130 Others Market, By Application, 2014-2021 (USD Million)

Table 131 Others Market, By Application, 2014-2021 (Kilotons)

Table 132 New Product Developments/New Product Launches, 2010-2015

Table 133 Patents, 2010-2015

Table 134 Expansions, 2010-2015

Table 135 Collaborations, 2010-2015

Table 136 Acquisitions, 2010-2015

List of Figures (54 Figures)

Figure 1 Adhesion Promoters Market: Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Research Methodology: Data Triangulation

Figure 5 Chlorinated Polyolefins to Register the Highest Growth

Figure 6 Plastics & Composites Segment to Register Highest Growth in the Adhesion Promoter Market

Figure 7 Asia-Pacific is Estimated to Lead the Adhesion Promoters Market in 2016

Figure 8 Adhesion Promoter Market to Register Moderate Growth Between 2016 and 2021

Figure 9 Chlorinated Polyolefins Segment to Grow at the Highest CAGR During the Forecast Period

Figure 10 Paints & Coatings Accounts for the Largest Share in the Asia-Pacific Adhesion Promoter Market

Figure 11 Asia-Pacific is Estimated to Account for the Largest Share in the Adhesion Promoter Market in 2016

Figure 12 Adhesion Promoters Market to Witness High Growth in China and India Between 2016 and 2021

Figure 13 China Led the Adhesion Promoter Market By Application Between 2016 and 2021

Figure 14 Asia-Pacific to Register the Highest Growth in the Global Adhesion Promoter Market

Figure 15 Drivers, Restraints, Opportunities, and Challenges in the Adhesion Promoter Market

Figure 16 Adhesion Promoters: Value Chain Analysis

Figure 17 Silane Adhesion Promoters are Expected to Dominate the Adhesion Promoters Market During the Forecast Period

Figure 18 Asia-Pacific to Remain the Market Leader in the Silane Adhesion Promoters Market By 2021

Figure 19 Asia-Pacific to Register the Highest Growth in the Maleic Anhydride Adhesion Promoter Market During the Forecast Period

Figure 20 North America to Remain the Market Leader in the Chlorinated Polyolefins Adhesion Promoter Market By 2021

Figure 21 Asia-Pacific to Register the Highest Growth in the Titanate & Zirconate Adhesion Promoter Market

Figure 22 Asia-Pacific is Expected to Drive the Adhesion Promoters Market in the Others Type Segment

Figure 23 Global Adhesion Promoters Market, By Application, 2016 & 2021 (Kilotons)

Figure 24 Asia-Pacific is Expected to Drive the Adhesion Promoter Market in the Plastics & Composites Application

Figure 25 Asia-Pacific Region to Lead the Adhesion Promoter Market in Paints & Coatings Application During the Forecast Period

Figure 26 Asia-Pacific to Remain the Market Leader in the Adhesion Promoters Market in Rubber Application

Figure 27 Adhesives Application Segment in the Asia-Pacific Region to Grow at the Highest CAGR in the Adhesion Promoter Market

Figure 28 North America to Remain the Market Leader in the Adhesion Promoters Market in Metals Application

Figure 29 North America to Lead the Other Applications Segment in the Adhesion Promoter Market During the Forecast Period

Figure 30 Regional Snapshot- China and India are Leading Countries in the Global Adhesion Promoters Market

Figure 31 Asia-Pacific Adhesion Promoter Market Snapshot

Figure 32 Europe Adhesion Promoter Market Snapshot

Figure 33 North America Adhesion Promoter Market Snapshot

Figure 34 Latin America Adhesion Promoter Market Snapshot

Figure 35 Companies Primarily Adopted Organic Growth Strategies (2010-2015)

Figure 36 New Product Launches Was the Most Popular Strategy Adopted Between 2010 and 2015

Figure 37 Growth Strategies Share, By Company, 20102015

Figure 38 Adhesion Promoter Market Developmental Share, 20102015

Figure 39 Regional Revenue Mix of Top Five Market Players

Figure 40 Momentive Performance Materials Inc.: Company Snapshot

Figure 41 Momentive Performance Materials Inc.: SWOT Analysis

Figure 42 Eastman Chemical Company: Company Snapshot

Figure 43 Eastman Chemical Company: SWOT Analysis

Figure 44 DOW Corning Corporation: Company Snapshot

Figure 45 DOW Corning Corporation: SWOT Analysis

Figure 46 BASF SE: Company Snapshot

Figure 47 BASF SE: SWOT Analysis

Figure 48 Arkema SA: Company Snapshot

Figure 49 Arkema SA: SWOT Analysis

Figure 50 Evonik Industries AG: Company Snapshot

Figure 51 Altana AG: Company Snapshot

Figure 52 Air Products and Chemicals, Inc.: Company Snapshot

Figure 53 E. I. Du Pont De Nemours and Company: Company Snapshot

Figure 54 Akzonobel NV: Company Snapshot

Growth opportunities and latent adjacency in Adhesion Promoter Market