Acupuncture Needles Market by Type (Disposable, Non-disposable), Handle Material (Stainless-steel, Gold), End User (Clinics, Hospitals), Distribution Channel (Online Pharmacies, Hospital Pharmacies, Retail Pharmacies) & Region - Global Forecast to 2027

Market Growth Outlook Summary

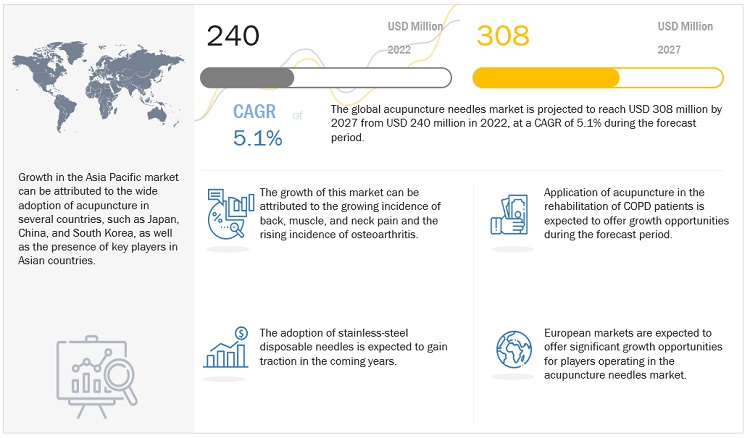

The global acupuncture needles market, stood at US$240 million in 2022 and is projected to advance at a resilient CAGR of 5.1% from 2023 to 2027, culminating in a forecasted valuation of US$308 million by the end of the period. The surge in geriatric population, and the rising prevalence of injuries and surgeries are the major factors driving the acupuncture needles market’s growth.

Acupuncture Needles Market Trends

e- estimated, p-projected

To know about the assumptions considered for the study, Request for Free Sample Report

Acupuncture Needles Market Dynamics

Driver: Increasing prevalence of back, muscle, and neck pain

The research suggests that acupuncture may be an effective way for the treatment of chronic low back pain. According to western practitioners the acupuncture points are the places to stimulate nerves, muscles, and connective tissue. It is believed that this stimulation boosts the body's natural painkillers. According to Practical Pain Management, it is estimated that up to 80% of the US population will experience back pain at some point in their lives. The treatment of low back pain (LBP), in particular, runs at least USD 50 billion in US healthcare costs each year. According to the WHO (July 2022), approximately 1.71 million people have musculoskeletal conditions worldwide.

Restraint: Alternative methods and medicines

In several cases, instead of needles, alternative methods for stimulation are used over the acupuncture points. These include heat (moxibustion), pressure (acupressure), friction, suction (cupping), and impulses of electromagnetic energy, among others. Non-steroidal anti-inflammatory drugs (NSAIDs) are among the most commonly used drugs and have a wide range of uses in muscle and back pain. The use of alternative methods and medications (such as NSAIDs) to reduce or relieve headaches, sore muscles, arthritis, and other aches and pains is a key factor restraining the growth of the market.

Opportunity: Use of acupuncture in rehabilitation of COPD patients

Acupuncture is potential in preventing, treating, and rehabilitation of COPD patients. The acupuncture may help relieve COPD by reducing bronchial immune-mediated inflammation and by promoting the release of vascular and immunomodulatory factors. Acupuncture is a component of Traditional Chinese Medicine (TCM), which is commonly used to treat respiratory illnesses. Findings such as the potential of acupuncture in the rehabilitation of COPD patients are resulting in the potential for profit for businesses in the acupuncture needles sector.

Challenge: Issues related to acupuncture standardization

Due to the unique features of acupuncture treatment based on syndrome differentiation, there are various disagreements or even problems that are misunderstood in the acupuncture and moxibustion sector. These factors are slowing down the development of standardization in these fields. A survey showed that 36.1% of participants thought that standardizing acupuncture and moxibustion would restrict the characteristics of treatments based on syndrome distinction and customized care.

The market is moderately consolidated. The top players—Seirin Corporation (Japan), Suzhou Hualun Medical Appliance Co., Ltd. (China), Boen Healthcare Co., Ltd. (China), Wuxi Jiajian Medical Instruments Co., Ltd. (China)-in the market accounted for a combined majority market share in 2021.

Disposable segment accounted for the largest share of the acupuncture needles industry, by type

Based on type, the acupuncture needles market is segmented into disposable and non-disposable needles. Disposable needles accounted for a larger share of the market. The use of disposable needles will decrease the risk of transmission of diseases.

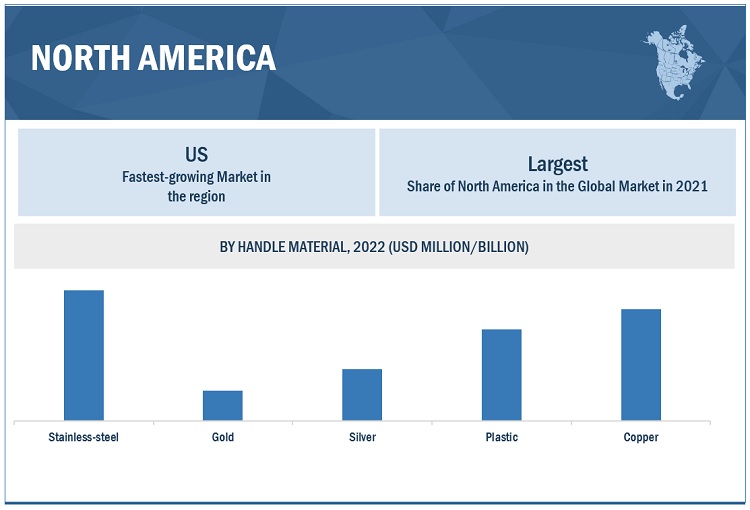

Stainless-steel segment accounted for the largest share in the acupuncture needles industry, by portability

Based on handle material, the acupuncture needles market is segmented into stainless steel, gold, silver, plastic, and copper. The stainless-steel handle needles segment is accounted for the largest share during the forecast period owing to the lesser price of stainless steel and these are easily available.

Clinics segment accounted for the largest share in the acupuncture needles industry, by end user

Based on end user, the acupuncture needles market is segmented into hospitals and clinics. The clinics segment dominated the market. The rising number of private acupuncture clinics worldwide is the key factor driving the growth of this market segment.

Online pharmacies segment accounted for the largest share in the acupuncture needles industry, by distribution channel

Based on distribution channel, the acupuncture needles market has been segmented into hospital, retail, and online pharmacies. The online pharmacies segment accounted for the largest share of 49.0% of the market. This can be attributed to factors such as the easy accessibility to a wide range of products in online pharmacies.

Asia Pacific is the largest region for acupuncture needles industry.

The global acupuncture needles market is segmented into North America, Europe, the Asia Pacific, and the Rest of the World. The Asia Pacific accounted for the largest share of the market, followed by Europe. The active number of local and global companies has grown in the Asia Pacific in recent years is the major the factor that will drive the market.

To know about the assumptions considered for the study, download the pdf brochure

The key players of this market are:

- Seirin Corporation (Japan)

- Suzhou Hualun Medical Appliance Co., Ltd. (China)

- Boen Healthcare Co., Ltd. (China)

- Wuxi Jiajian Medical Instruments Co., Ltd. (China)

- Suzhou Zhongjing Life & Science Technology Co., Ltd. (China)

Scope of the Acupuncture Needles Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$240 million |

|

Projected Revenue Size by 2027 |

$308 million |

|

Industry Growth Rate |

Poised to grow at a CAGR of 5.1% |

|

Market Driver |

Increasing prevalence of back, muscle, and neck pain |

|

Market Opportunity |

Use of acupuncture in rehabilitation of COPD patients |

This report categorizes the acupuncture needles market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Disposable

- Non-disposable

By Handle Material

- Stainless-steel

- Gold

- Silver

- Plastic

- Copper

By End User

- Hospitals

- Clinics

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global acupuncture needles market?

The global acupuncture needles market boasts a total revenue value of $308 million by 2027.

What is the estimated growth rate (CAGR) of the global acupuncture needles market?

The global acupuncture needles market has an estimated compound annual growth rate (CAGR) of 5.1% and a revenue size in the region of $240 million in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing prevalence of back, muscle, and neck pain- Growing incidence of chronic diseases- Growing geriatric population- Increasing incidence of injuries and surgeriesRESTRAINTS- Alternative methods and medicines- Use of acupuncture pens- Risk of injuries and infectionsOPPORTUNITIES- Use of acupuncture in rehabilitation of COPD patientsCHALLENGES- Issues related to acupuncture standardization

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSISROLE IN ECOSYSTEM

-

5.6 REGULATORY LANDSCAPENORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- Japan- China- India

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTES

-

5.8 PATENT ANALYSIS FOR ACUPUNCTURE NEEDLES

- 5.9 TRADE ANALYSIS FOR ACUPUNCTURE NEEDLES

- 5.10 TECHNOLOGY ANALYSIS

- 5.11 PRICING ANALYSIS

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 5.14 KEY CONFERENCES AND EVENTS IN 2023–2024

- 6.1 INTRODUCTION

-

6.2 DISPOSABLE NEEDLESINCREASED SAFETY AND EASY AVAILABILITY TO SUPPORT MARKET GROWTH

-

6.3 NON-DISPOSABLE NEEDLESHIGHER RISK OF INFECTION TO RESTRAIN MARKET GROWTH

- 7.1 INTRODUCTION

-

7.2 STAINLESS-STEEL HANDLE NEEDLESLOWER COST AND EASY AVAILABILITY TO DRIVE GROWTH

-

7.3 GOLD HANDLE NEEDLESBENEFITS OF GOLD IN ACUPUNCTURE TO DRIVE GROWTH

-

7.4 SILVER HANDLE NEEDLESADVANTAGES OF SILVER OVER OTHER METALS TO DRIVE GROWTH

-

7.5 PLASTIC HANDLE NEEDLESLIGHTER WEIGHT OF PLASTIC HANDLE NEEDLES TO PROPEL GROWTH

-

7.6 COPPER HANDLE NEEDLESFLEXIBILITY AND USABILITY TO DRIVE DEMAND

- 8.1 INTRODUCTION

-

8.2 HOSPITALSACUPUNCTURE THERAPY INTEGRATION IN AMBULATORY AND INPATIENT SERVICES IN HOSPITALS TO DRIVE GROWTH

-

8.3 CLINICSGROWING NUMBER OF ACUPUNCTURISTS TO DRIVE GROWTH

- 9.1 INTRODUCTION

-

9.2 ONLINE PHARMACIESONLINE PHARMACIES FORM LARGEST DISTRIBUTION CHANNEL FOR ACUPUNCTURE NEEDLES

-

9.3 RETAIL PHARMACIESRETAIL PHARMACIES SEGMENT TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

-

9.4 HOSPITAL PHARMACIESIMPROVING HEALTHCARE INFRASTRUCTURE TO DRIVE SEGMENT GROWTH

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- US to dominate North American market over forecast periodCANADA- Growing acceptance to drive market

-

10.3 EUROPEGERMANY- Germany to command largest share of European marketUK- Rising prevalence of osteoarthritis to drive marketFRANCE- Increasing acceptance to accelerate market growthITALY- Increasing healthcare expenditure to propel marketSPAIN- Unfavorable regulations to restrain growthREST OF EUROPE

-

10.4 ASIA PACIFICJAPAN- Increasing prevalence of osteoarthritis to propel market growthCHINA- Presence of major players to support market growthINDIA- Growing incidence of low back pain to drive market growthSOUTH KOREA- Increasing incidence of musculoskeletal diseases to drive growthREST OF ASIA PACIFIC

- 10.5 REST OF THE WORLD

- 11.1 OVERVIEW

- 11.2 MARKET RANKING ANALYSIS

-

11.3 COMPANY EVALUATION QUADRANT (2021)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.4 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2021)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 11.5 COMPETITIVE BENCHMARKING

-

12.1 KEY PLAYERSBOEN HEALTHCARE CO., LTD.- Business overview- Products offered- MnM view3B SCIENTIFIC GMBH- Business overview- Products offered- MnM viewSUZHOU ZHONGJING LIFE & SCIENCE TECHNOLOGY CO., LTD.- Business overview- Products offered- MnM viewWUXI JIAJIAN MEDICAL INSTRUMENT CO., LTD.- Business overview- Products offered- MnM viewACUMEDIC LTD.- Business overview- Products offered- MnM viewCHANGCHUN AIKANG MEDICAL DEVICES CO., LTD.- Business overview- Products offeredHEGU SVENSKA AB- Business overview- Products offeredSUZHOU HUALUN MEDICAL APPLIANCE CO., LTD.- Business overview- Products offeredASIA-MED GMBH- Business overview- Products offeredSEIRIN CORPORATION- Business overview- Products offeredDONGBANG MEDICAL CO., LTD.- Business overview- Products offeredHAENG LIM SEO WON MEDICAL COMPANY- Business overview- Products offeredSUZHOU MEDICAL APPLIANCE FACTORY (SUZHOU HWATO) CO., LTD.- Business overview- Products offered

-

12.2 OTHER PLAYERSSHINYLINK (SHANGHAI) INDUSTRIAL INC.SCHWA-MEDICO GMBHPHOENIX MEDICAL LTD.EU PEAK INTERNATIONAL CO., LTD.MERIDIUS MEDICAL GMBHDANA MEDICAL

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 KEY DATA FROM PRIMARY SOURCES

- TABLE 3 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 4 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 5 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 6 PORTER’S FIVE FORCES ANALYSIS: ACUPUNCTURE NEEDLES MARKET

- TABLE 7 IMPORT DATA FOR HS CODE 901839, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 8 EXPORT DATA FOR HS CODE 901839, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 9 AVERAGE SELLING PRICE OF ACUPUNCTURE NEEDLES, BY COUNTRY

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO END USERS (%)

- TABLE 11 KEY BUYING CRITERIA FOR TOP TWO END USERS

- TABLE 12 LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 13 ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 14 DISPOSABLE ACUPUNCTURE NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 15 NON-DISPOSABLE ACUPUNCTURE NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 16 ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2020–2027 (USD MILLION)

- TABLE 17 STAINLESS-STEEL HANDLE ACUPUNCTURE NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 18 GOLD HANDLE ACUPUNCTURE NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 19 SILVER HANDLE ACUPUNCTURE NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 20 PLASTIC HANDLE ACUPUNCTURE NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 21 COPPER HANDLE ACUPUNCTURE NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 22 ACUPUNCTURE NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 23 ACUPUNCTURE NEEDLES MARKET FOR HOSPITALS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 24 ACUPUNCTURE NEEDLES MARKET FOR CLINICS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 25 ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 26 ACUPUNCTURE NEEDLES MARKET FOR ONLINE PHARMACIES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 27 ACUPUNCTURE NEEDLES MARKET FOR RETAIL PHARMACIES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 28 ACUPUNCTURE NEEDLES MARKET FOR HOSPITAL PHARMACIES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 29 ACUPUNCTURE NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 30 NORTH AMERICA: ACUPUNCTURE NEEDLES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 31 NORTH AMERICA: ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 32 NORTH AMERICA: ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2020–2027 (USD MILLION)

- TABLE 33 NORTH AMERICA: ACUPUNCTURE NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 34 NORTH AMERICA: ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 35 US: ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 36 US: ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2020–2027 (USD MILLION)

- TABLE 37 US: ACUPUNCTURE NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 38 US: ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 39 CANADA: ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 40 CANADA: ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2020–2027 (USD MILLION)

- TABLE 41 CANADA: ACUPUNCTURE NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 42 CANADA: ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 43 EUROPE: ACUPUNCTURE NEEDLES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 44 EUROPE: ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 45 EUROPE: ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2020–2027 (USD MILLION)

- TABLE 46 EUROPE: ACUPUNCTURE NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 47 EUROPE: ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 48 GERMANY: ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 49 GERMANY: ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2020–2027 (USD MILLION)

- TABLE 50 GERMANY: ACUPUNCTURE NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 51 GERMANY: ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 52 UK: ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 53 UK: ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2020–2027 (USD MILLION)

- TABLE 54 UK: ACUPUNCTURE NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 55 UK: ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 56 FRANCE: ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 57 FRANCE: ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2020–2027 (USD MILLION)

- TABLE 58 FRANCE: ACUPUNCTURE NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 59 FRANCE: ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 60 ITALY: ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 61 ITALY: ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2020–2027 (USD MILLION)

- TABLE 62 ITALY: ACUPUNCTURE NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 63 ITALY: ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 64 SPAIN: ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 65 SPAIN: ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2020–2027 (USD MILLION)

- TABLE 66 SPAIN: ACUPUNCTURE NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 67 SPAIN: ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 68 REST OF EUROPE: ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 69 REST OF EUROPE: ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2020–2027 (USD MILLION)

- TABLE 70 REST OF EUROPE: ACUPUNCTURE NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 71 REST OF EUROPE: ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 72 ASIA PACIFIC: ACUPUNCTURE NEEDLES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 73 ASIA PACIFIC: ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 74 ASIA PACIFIC: ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2020–2027 (USD MILLION)

- TABLE 75 ASIA PACIFIC: ACUPUNCTURE NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 76 ASIA PACIFIC: ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 77 JAPAN: ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 78 JAPAN: ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2020–2027 (USD MILLION)

- TABLE 79 JAPAN: ACUPUNCTURE NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 80 JAPAN: ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 81 CHINA: ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 82 CHINA: ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2020–2027 (USD MILLION)

- TABLE 83 CHINA: ACUPUNCTURE NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 84 CHINA: ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 85 INDIA: ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 86 INDIA: ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2020–2027 (USD MILLION)

- TABLE 87 INDIA: ACUPUNCTURE NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 88 INDIA: ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 89 SOUTH KOREA: ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 90 SOUTH KOREA: ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2020–2027 (USD MILLION)

- TABLE 91 SOUTH KOREA: ACUPUNCTURE NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 92 SOUTH KOREA: ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2020–2027 (USD MILLION)

- TABLE 95 REST OF ASIA PACIFIC: ACUPUNCTURE NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 97 REST OF THE WORLD: ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 98 REST OF THE WORLD: ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2020–2027 (USD MILLION)

- TABLE 99 REST OF THE WORLD: ACUPUNCTURE NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 100 REST OF THE WORLD: ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

- TABLE 101 ACUPUNCTURE NEEDLES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 102 PRODUCT FOOTPRINT OF KEY PLAYERS

- TABLE 103 REGIONAL FOOTPRINT OF KEY PLAYERS

- TABLE 104 BOEN HEALTHCARE CO., LTD.: BUSINESS OVERVIEW

- TABLE 105 BOEN HEALTHCARE CO., LTD.: PRODUCTS OFFERED

- TABLE 106 3B SCIENTIFIC GMBH: BUSINESS OVERVIEW

- TABLE 107 3B SCIENTIFIC GMBH: PRODUCTS OFFERED

- TABLE 108 SUZHOU ZHONGJING LIFE & SCIENCE TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

- TABLE 109 SUZHOU ZHONGJING LIFE & SCIENCE TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 110 WUXI JIAJIAN MEDICAL INSTRUMENT CO., LTD.: BUSINESS OVERVIEW

- TABLE 111 WUXI JIAJIAN MEDICAL INSTRUMENT CO., LTD.: PRODUCTS OFFERED

- TABLE 112 ACUMEDIC LTD.: BUSINESS OVERVIEW

- TABLE 113 ACUMEDIC LTD.: PRODUCTS OFFERED

- TABLE 114 CHANGCHUN AIKANG MEDICAL DEVICES CO., LTD.: BUSINESS OVERVIEW

- TABLE 115 CHANGCHUN AIKANG MEDICAL DEVICES CO., LTD.: PRODUCTS OFFERED

- TABLE 116 HEGU SVENSKA AB: BUSINESS OVERVIEW

- TABLE 117 HEGU SVENSKA AB: PRODUCTS OFFERED

- TABLE 118 SUZHOU HUALUN MEDICAL APPLIANCE CO., LTD.: BUSINESS OVERVIEW

- TABLE 119 SUZHOU HUALUN MEDICAL APPLIANCE CO., LTD.: PRODUCTS OFFERED

- TABLE 120 ASIA-MED GMBH: BUSINESS OVERVIEW

- TABLE 121 ASIA-MED GMBH: PRODUCTS OFFERED

- TABLE 122 SEIRIN CORPORATION: BUSINESS OVERVIEW

- TABLE 123 SEIRIN CORPORATION: PRODUCTS OFFERED

- TABLE 124 DONGBANG MEDICAL CO., LTD.: BUSINESS OVERVIEW

- TABLE 125 DONGBANG MEDICAL CO., LTD.: PRODUCTS OFFERED

- TABLE 126 HAENG LIM SEO WON MEDICAL COMPANY: BUSINESS OVERVIEW

- TABLE 127 HAENG LIM SEO WON MEDICAL COMPANY: PRODUCTS OFFERED

- TABLE 128 SUZHOU MEDICAL APPLIANCE FACTORY (SUZHOU HWATO) CO., LTD.: BUSINESS OVERVIEW

- TABLE 129 SUZHOU MEDICAL APPLIANCE FACTORY (SUZHOU HWATO) CO., LTD.: PRODUCTS OFFERED

- FIGURE 1 ACUPUNCTURE NEEDLES MARKET: RESEARCH DESIGN METHODOLOGY

- FIGURE 2 KEY INDUSTRY INSIGHTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BOTTOM-UP APPROACH: PATIENT-BASED APPROACH

- FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 7 ACUPUNCTURE NEEDLES MARKET: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 ACUPUNCTURE NEEDLES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 ACUPUNCTURE NEEDLES MARKET, BY HANDLE MATERIAL, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 ACUPUNCTURE NEEDLES MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 ACUPUNCTURE NEEDLES MARKET, BY DISTRIBUTION CHANNEL, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 REGIONAL SNAPSHOT OF ACUPUNCTURE NEEDLES MARKET

- FIGURE 14 RISING INCIDENCE OF BACK, NECK, AND MUSCLE PAIN TO DRIVE MARKET GROWTH

- FIGURE 15 DISPOSABLE NEEDLES ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2021

- FIGURE 16 ITALY TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 17 EUROPE TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 18 ACUPUNCTURE NEEDLES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 US: INJURIES CAUSED BY VARIOUS SPORTS ACTIVITIES (2020)

- FIGURE 20 DIRECT DISTRIBUTION—PREFERRED STRATEGY OF PROMINENT COMPANIES

- FIGURE 21 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

- FIGURE 22 ECOSYSTEM ANALYSIS OF ACUPUNCTURE NEEDLES MARKET

- FIGURE 23 PATENT ANALYSIS FOR ACUPUNCTURE NEEDLES (JANUARY 2013 TO DECEMBER 2022)

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO END USERS

- FIGURE 25 KEY BUYING CRITERIA FOR TOP TWO END USERS

- FIGURE 26 NORTH AMERICA: ACUPUNCTURE NEEDLES MARKET SNAPSHOT

- FIGURE 27 ASIA PACIFIC: ACUPUNCTURE NEEDLES MARKET SNAPSHOT

- FIGURE 28 ACUPUNCTURE NEEDLES MARKET RANKING ANALYSIS, BY KEY PLAYER (2021)

- FIGURE 29 ACUPUNCTURE NEEDLES MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2021

- FIGURE 30 ACUPUNCTURE NEEDLES MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2021

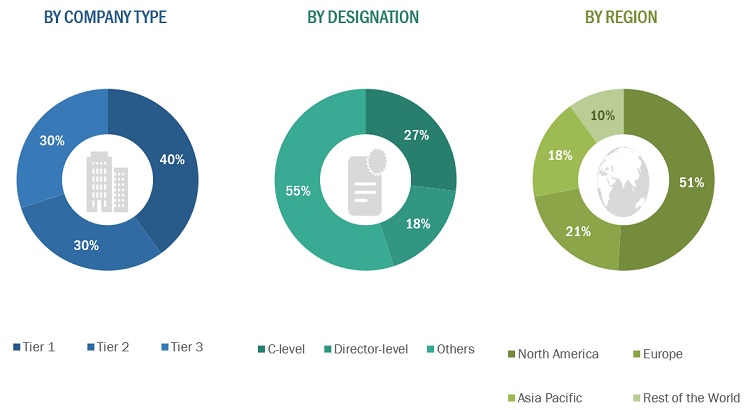

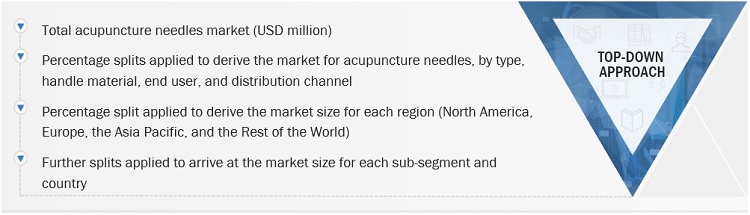

This study involved four major activities in estimating the current size of the acupuncture needles market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the acupuncture needles market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the acupuncture needles market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, segment, and forecast the global acupuncture needles market by type, handle material, end user, distribution channel, and region.

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall acupuncture needles market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, and Rest of the World.

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches, agreements, partnerships, and acquisitions in the acupuncture needles market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

- Acupuncture needles market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific, and Rest of the World.

Company profiles

- Additional five company profiles of players operating in the acupuncture needles market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Acupuncture Needles Market