Activated Carbon Fiber Market by Type (PAN-based, Pitch-based, Cellulosic Fiber, Phenolic Resin), Application (Solvent Recovery, Air Purification, Water Treatment, Catalyst Carrier), & Region (North America, Europe, APAC, RoW) - Global Forecast to 2027

The Activated Carbon Fiber Market is projected to reach USD 350 million by 2027, at a cagr 8.5%.

The market's growth is attributed to the expanding chemical industry, water treatment plants in developing nations, and the demand for air purification due to high pollution loads emitted into the atmosphere.

The market is anticipated to increase over the forecast period because to factors like the high need for longer performance and less maintenance, growing demand from applications for water treatment and pollution control, and growing demand for efficient processes.

The same precursors that are used to create carbon fibres, including synthetic polymers [1-3], petroleum-based pitch [1,4], and natural cellulose [1,5], are also used to create activated carbon fibres. In particular, precursor fibres are stabilised, carbonised, and activated to create activated carbon fibres.

However, high production costs and obstacles to environment-friendly production of ACF are some of the challenges that restrict the market's growth.

Global Activated Carbon Fiber Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Activated Carbon Fiber Market Dynamics

Driver: Increasing demand for drinking water purification and treatment of wastewater

The demand for activated carbon fiber is expected to increase due to the growing need for water purification and wastewater treatment applications. In the coming years, several production facilities in the US and Europe, Asia, including production industries, which are discharging their effluent wastewater into water sources will be required to meet stringent new water pollution control standards for wastewater and other hazardous water pollutants overseen by the US Environmental Protection Agency (EPA).

Industrial and domestic effluent discharge into the water sources is contaminating the available water resources. To confirm that the water supply is pure and fit for use, it must be purified, toxins from wastewater must be removed, and essential bacterial development must be inhibited. Major manufacturing processes require water as a basic requirement although, after the production process, a major portion of water becomes contaminated and ends up as wastewater. The produced wastewater in this way will then require to be treated before it can be disposed of in a sewer, surface water, or even recycled. The aerated bioreactor is a new and emerging technology, which is used for wastewater and effluent treatment. The high modulus polyacrylonitrile (PAN)-based ACF was successfully used as a bio membrane carrier for industrial organic wastewater disposal, which is difficult to biodegrade. ACF is used as a bio membrane carrier in the wastewater disposal process thereby leading to the growth of the activated carbon fiber market.

Restraint: High production cost and fluctuating raw material availability

Activated carbon fibers are costly, and their cost of manufacturing is also growing with the increase in the price of raw materials. Fluctuating raw material prices and changing foreign currency fluctuations have resulted in higher raw material prices and increased cost of overall production.

ACF powder product is the costliest among ACF-related other products. In addition to the raw material prices, manufacturers are also burdened with the additional cost incurred due to the increased taxes on energy, which results in higher operating costs and lower profit margins restrain the growth of the activated carbon fiber market.

Opportunity: Rising atmospheric pollution and pollution abatement policy adoption by governing authorities worldwide

The rising level of pollutants in the atmosphere from vehicular emissions and industrial pollution is causing the biggest threat to the environment. To deal with this problem, governing authorities have prepared strict action-based policy norms. Governing authorities across the world have implemented BS VI vehicular norms to curb the emission of greenhouse gases, the BS VI also complies with the manufacturer to enhance catalytic converter technology in vehicles. Under Glasgow summit on climate change has urged countries to control carbon and GHG emissions and strengthen their targets by 2030. These recent advancements have created an opportunity for the activated carbon fiber to play a huge role. The market for activated carbon fiber is projected to grow at a significant pace in the European and North American markets.

Challenge: Requirement for cost-effective production and regeneration process

The cost-effective production of ACF depends on the availability of raw materials and the minimum cost of production by adopting new processes and technologies. ACF still has a lot of room to grow in terms of cutting-edge technology to build future living spaces that are energy self-sufficient, trouble-free, and of the highest quality. The regeneration process is cost-consuming, which is the biggest challenge for the ACF market. Also, the activation process of carbon fiber has two stages, which are chemical and physical activation. The use of chemical activation agents in the treatment increases the cost of processing.

Activated Carbon Fiber Market Ecosystem

High Demand in Commercial Applications for Pitch-Based Activated Carbon Fibers

Pitch is a viscoelastic polymer material that can be natural or manufactured, derived from petroleum, coal tar, or plants. Pitch-based activated carbon fibers are prepared from raw material consisting of mesophase pitch and are capable of adsorbing ammonia gas and basic gases and water vapours due to the high oxygen content. The pitch-based activated carbon fiber is expected to grow in commercial applications such as water treatment and air purification. The market for pitch-based ACFs, with a good supply base, is expected to grow in sync with the growth of the new technology. The stable prices for pitch-based materials are expected to show growth in the forecast period with an increase in the number of suppliers. Pitch-based activated carbon has such high heat resistance that it can be heat treated even under conditions under which conventional cellulosic-based activated carbon fiber would likely burn away with deterioration in its properties.

Water treatment holds the second highest share in the activated carbon fiber market both in terms of value and volume.

Based on application, the activated carbon fiber market has been segmented into air purification, water treatment, Solvent Recovery, Catalyst Carrier, and others. Water treatment segment is expected to grow with the highest CAGR during the forecast period both in terms of value and volume. With the rapid development of the economy, various industrial enterprises have been increasing, and the pollution of water source areas has been becoming more and more serious. Activated carbon fibers (ACF) have been widely used in the field of water purification. It is difficult to effectively remove the pollutants in the water source through the traditional purification process for drinking water, and so the safety of drinking water has drawn increasing concerns. Water purification equipment using ACF as the adsorption material exhibits excellent application potential since it has a high purification efficiency and huge treatment capacity and does not produce any black powder. Thus, the new technological advancement in the water treatment industry using ACF will boost its growth.

To know about the assumptions considered for the study, download the pdf brochure

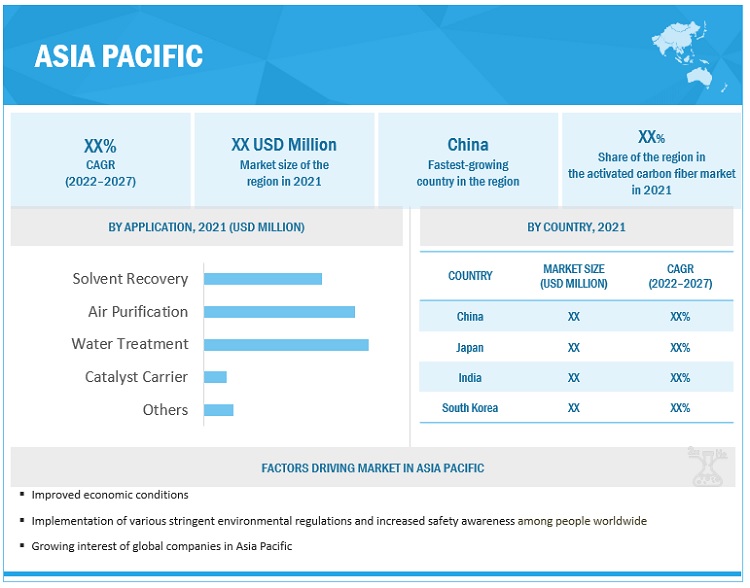

Asia Pacific held the largest market share in the activated carbon fiber market

Asia Pacific is the largest market for activated carbon fiber in 2021. It has a significant number of manufacturers that are actively participating in development activities, especially in expansions and new product launches. The region has the presence of major activated carbon fiber manufacturers, such as Toyobo Co., Ltd (Japan), Kuraray Co., Ltd. (Japan), and Unitika Ltd. (Japan). Europe is an attractive market for the cosmetic product manufacturers. The expanding manufacturing facilities in Asia Pacific promise a high potential for market growth in the coming years. This constraint-free availability of raw materials will also help the region emerge as a global supplier of activated carbon fibers.

Activated Carbon Fiber Market Players

Some of the key players in the global activated carbon fiber market are Toyobo Co., Ltd. (Japan); Kuraray Co., Ltd. (Japan); Unitika Ltd. (Japan); Taiwan Carbon Technology Co., Ltd. (Taiwan); Daigas Group (Japan); Auro Carbon & Chemicals (India); Hangzhou Nature Technology Co., Ltd. (China); Eurocarb Products Ltd. (UK); China Beihai Fiberglass Co., Ltd. (China); Bio-Medical Carbon Technology Co., Ltd. (Taiwan); CeraMaterials (US); and HPMS Graphite (US).).

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the activated carbon fiber industry. The study includes an in-depth competitive analysis of these key players in the activated carbon fiber market, with their company profiles, recent developments, and key market strategies.

Activated Carbon Fiber Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 232 Million |

|

Revenue Forecast in 2027 |

USD 350 Million |

|

CAGR |

8.5% |

|

Years considered for the study |

2018–2021 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD million), Volume (Tons) |

|

Segments |

Type, Application, and Region |

|

Regions |

Europe, North America, Asia Pacific, South America, Middle East and Africa, Rest of the world |

|

Companies |

Toyobo Co., Ltd. (Japan), Kuraray Co., Ltd. (Japan), Unitika Ltd. (Japan), Gun Ei Chemical Industry Co., Ltd. (Japan), Evertech Envisafe Ecology Co., Ltd. (Taiwan), AWA Paper & Technology Company, Inc. (Japan), Taiwan Carbon Technology Co., Ltd. (Taiwan), Daigas Group (Japan), Auro Carbon & Chemicals (India), Hangzhou Nature Technology Co., Ltd. (China), Eurocarb Products Ltd. (UK), China Beihai Fiberglass Co., Ltd. (China), Bio-Medical Carbon Technology Co., Ltd. (Taiwan), CeraMaterials (US), and HPMS Graphite (US). |

This research report categorizes the activated carbon fiber market based on type, application, and region.

By Type:

- PAN-based

- Pitch-based

- Cellulosic Fiber

- Phenolic Resin

- Others

By Application:

- Solvent Recovery

- Air Purification

- Water Treatment

- Catalyst Carrier

- Others

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

- ROW

Recent Developments

- In March 2022, Toyobo Co., Ltd. and Mitsubishi Corporation (MC) signed a joint venture agreement to plan, develop, manufacture, and sell functional materials. The new company will operationalize from 2023 onward.

- In April 2022, Japan-based Kobe university and Toyobo Co., Ltd. sealed a comprehensive partnership agreement for research and development. Kobe University and Toyobo plan to advance their joint research, especially in environmental fields, including membrane technologies that contribute to the goal of achieving carbon neutrality and, in life sciences, improving people’s quality of life.

- In September 2017, Kuraray Co., Ltd. completed the acquisition of Calgon Carbon. Under the acquisition, the Functional Material Company division of Kuraray and Calgon Carbon was focused on providing activated carbon services and filtration media.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the activated carbon fiber market?

Increasing demand for drinking water purification and treatment of wastewater.

Which is the largest country-level market for activated carbon fiber?

Asia Pacific is the largest activated carbon fiber market due to presence of large number of manufacturers.

What are the factors contributing to the final price of activated carbon fiber?

Raw material plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of activated carbon fiber.

What are the challenges in the activated carbon fiber market?

Requirement for cost-effective production and regeneration process is the major challenge in the activated carbon fiber market. .

Which type of activated carbon fiber holds the largest market share?

Pan-based activated carbon fiber holds the largest share in terms of value, in the activated carbon fiber market.

How is the activated carbon fiber market aligned?

The market is growing at a moderate pace. It is a potential market, and many manufacturers are undertaking business strategies to expand their business.

Who are the major manufacturers?

Toyobo Co., Ltd. (Japan); Kuraray Co., Ltd. (Japan); Unitika Ltd. (Japan); Taiwan Carbon Technology Co., Ltd. (Taiwan); Daigas Group (Japan); Auro Carbon & Chemicals (India); Hangzhou Nature Technology Co., Ltd. (China); Eurocarb Products Ltd. (UK); China Beihai Fiberglass Co., Ltd. (China); Bio-Medical Carbon Technology Co., Ltd. (Taiwan); CeraMaterials (US); and HPMS Graphite (US).).

What is the biggest restraint in the activated carbon fiber market?

High Production cost and fluctuating raw material availability is one of the biggest restraining factors for the market growth .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 ACTIVATED CARBON FIBER MARKET SEGMENTATION

1.4.2 GEOGRAPHIC SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH APPROACH

FIGURE 1 ACTIVATED CARBON FIBER MARKET: RESEARCH DESIGN

2.2 BASE NUMBER CALCULATION

2.2.1 SUPPLY-SIDE APPROACH

2.2.2 DEMAND-SIDE APPROACH

2.3 FORECAST NUMBER CALCULATION

2.3.1 SECONDARY DATA

2.3.1.1 Key data from secondary sources

2.3.2 PRIMARY DATA

2.3.2.1 Key data from primary sources

2.3.2.2 Primary interviews – demand- and supply-sides

2.3.2.3 Breakdown of primary interviews

2.3.2.4 Key industry insights

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 3 MARKET: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 4 MARKET: DATA TRIANGULATION

2.6 RESEARCH ASSUMPTIONS

2.7 MARKET GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.8 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 5 PAN-BASED ACTIVATED CARBON FIBER DOMINATED MARKET IN 2021

FIGURE 6 AIR PURIFICATION LED MARKET IN 2021

FIGURE 7 US PROJECTED TO LEAD GLOBAL MARKET DURING FORECAST PERIOD

FIGURE 8 ASIA PACIFIC LED GLOBAL MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN ACTIVATED CARBON FIBER MARKET

FIGURE 9 INCREASING DEMAND FROM END-USE APPLICATIONS ATTRACTING INVESTMENTS

4.2 MARKET, BY TYPE

FIGURE 10 PAN-BASED ACTIVATED CARBON FIBER SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4.3 MARKET, BY APPLICATION

FIGURE 11 AIR PURIFICATION WAS LARGEST APPLICATION SEGMENT IN 2021

4.4 MARKET, BY KEY COUNTRIES

FIGURE 12 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ACTIVATED CARBON FIBER MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for drinking water purification and wastewater treatment

TABLE 1 STRINGENT REGULATIONS REGARDING WATER POLLUTION

5.2.1.2 Growing industrial demand for chemical separation agents, chemical recovery agents, and efficient catalyst carriers

5.2.1.3 Rising pollution demanding air purification and pollutant-free air

5.2.1.4 Surging demand for activated carbon fibers in medical & healthcare sector

5.2.2 RESTRAINTS

5.2.2.1 High production cost and fluctuating raw material availability

5.2.2.2 Adverse environmental impact of ACF production

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for natural gas storage

5.2.3.2 Rising atmospheric pollution and pollution abatement policy adoption by governing authorities worldwide

5.2.3.3 Growing demand from personal protective equipment and protective clothing industry

5.2.4 CHALLENGES

5.2.4.1 Requirement for cost-effective production and regeneration process

5.2.4.2 Need for environment-favorable production processes

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 14 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 2 MARKET: PORTER’S FIVE FORCES ANALYSIS

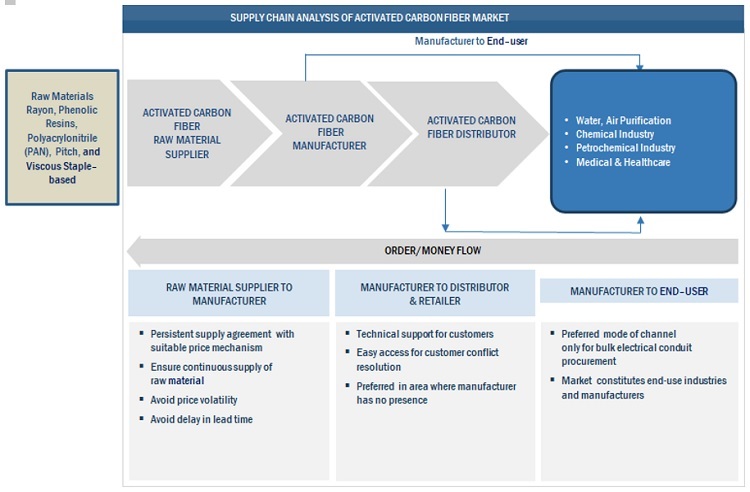

5.4 SUPPLY CHAIN ANALYSIS

TABLE 3 MARKET: SUPPLY CHAIN

5.5 PRICING ANALYSIS

5.5.1 AVERAGE SELLING PRICES OF ACTIVATED CARBON FIBER OFFERED BY KEY PLAYERS, BY APPLICATION

FIGURE 15 AVERAGE SELLING PRICES OF ACTIVATED CARBON FIBER OFFERED BY KEY PLAYERS FOR TOP THREE APPLICATIONS (USD/TON)

5.6 AVERAGE SELLING PRICES

TABLE 4 AVERAGE SELLING PRICES OF ACTIVATED CARBON FIBER, BY REGION

5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

5.7.2 BUYING CRITERIA

FIGURE 17 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 6 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.8 TECHNOLOGY ANALYSIS

5.8.1 ACTIVATED CARBON FIBER PRODUCTION

5.8.1.1 Carbonization

5.8.1.2 Activation

5.8.1.3 Activated carbon fiber regeneration

5.8.2 REGENERATION OF ACTIVATED CARBON FIBER USING CLEAN ELECTRO-PEROXYMONOSULFATE PROCESS

5.8.3 REGENERATION OF ACTIVATED CARBON FIBERS FROM AIR AND CARBON DIOXIDE USING THERMAL TREATMENT

5.9 REGULATIONS IN ACTIVATED CARBON FIBER MARKET

5.9.1 MERCURY AND AIR TOXICS STANDARDS

TABLE 7 WIDELY AVAILABLE CONTROL TECHNOLOGIES THAT REDUCE MERCURY AND OTHER AIR TOXICS

5.9.2 SETTING EMISSION LIMITS FOR TOXIC AIR POLLUTANTS

5.9.3 AIR QUALITY LAWS IN DIFFERENT SYSTEMS OF GOVERNMENTS

5.10 ECOSYSTEM: MARKET

5.11 VALUE CHAIN ANALYSIS: MARKET

FIGURE 18 VALUE CHAIN ANALYSIS

5.12 KEY MARKETS FOR IMPORT/EXPORT

5.12.1 CHINA

5.12.2 JAPAN

5.12.3 INDIA

5.12.4 US

5.12.5 UK

5.12.6 GERMANY

5.13 CASE STUDY ANALYSIS

5.14 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.15 PATENT ANALYSIS

5.15.1 INTRODUCTION

5.15.2 METHODOLOGY

5.15.3 DOCUMENT TYPE

TABLE 8 MARKET: GLOBAL PATENTS

FIGURE 19 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

FIGURE 20 GLOBAL PATENT PUBLICATION TREND ANALYSIS: LAST TEN YEARS

5.15.4 INSIGHTS

5.15.5 LEGAL STATUS OF PATENTS

FIGURE 21 MARKET: LEGAL STATUS OF PATENTS

5.15.6 JURISDICTION ANALYSIS

FIGURE 22 GLOBAL JURISDICTION ANALYSIS

5.15.7 ANALYSIS OF TOP APPLICANTS

FIGURE 23 CHONGQING ZAISHENG TECHNOLOGY CO., LTD. HAS HIGHEST NUMBER OF PATENTS

5.15.8 LIST OF PATENTS BY CHONGQING ZAISHENG TECHNOLOGY CO., LTD.

5.15.9 LIST OF PATENTS BY TOYOBO CO., LTD.

5.15.10 LIST OF PATENTS BY JIANGSU TONGKANG SPECIAL ACTIVATED CARBON FIBER & GARMENTS CO., LTD.

5.15.11 TOP TEN PATENT OWNERS (US) IN LAST TEN YEARS

6 ACTIVATED CARBON FIBER MARKET, BY TYPE (Page No. - 72)

6.1 INTRODUCTION

FIGURE 24 PAN-BASED ACTIVATED CARBON FIBER TO LEAD ACTIVATED CARBON FIBER MARKET

TABLE 9 ACTIVATED CARBON FIBER MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 10 MARKET, BY TYPE, 2020–2027 (KILOTON)

6.2 PAN-BASED

6.2.1 POLYACRYLONITRILE LEADING RAW MATERIAL FOR MANUFACTURING ACTIVATED CARBON FIBERS

FIGURE 25 ASIA PACIFIC TO BE LEADING MARKET FOR PAN MATERIAL OF MARKET

TABLE 11 PAN-BASED: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 12 PAN-BASED: MARKET, BY REGION, 2020–2027 (KILOTON)

6.3 PITCH-BASED

6.3.1 HIGH DEMAND IN COMMERCIAL APPLICATIONS FOR PITCH-BASED ACTIVATED CARBON FIBERS

FIGURE 26 ASIA PACIFIC TO BE LEADING MARKET FOR PITCH-BASED ACTIVATED CARBON FIBERS

TABLE 13 PITCH-BASED: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 14 PITCH-BASED: MARKET, BY REGION, 2020–2027 (KILOTON)

6.4 CELLULOSIC FIBER

6.4.1 ENVIRONMENT REGULATIONS LED TO SIGNIFICANT DEMAND FOR CELLULOSIC FIBER

FIGURE 27 ASIA PACIFIC TO BE LARGEST MARKET FOR CELLULOSIC FIBER-BASED ACTIVATED CARBON FIBER

TABLE 15 CELLULOSIC FIBER: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 16 CELLULOSIC FIBER: MARKET, BY REGION, 2020–2027 (KILOTON)

6.5 PHENOLIC RESIN

6.5.1 EXPANDING ROLE OF PHENOLIC RESIN IN INDUSTRIAL APPLICATIONS

FIGURE 28 ASIA PACIFIC TO BE LARGEST MARKET FOR PHENOLIC RESIN-BASED ACTIVATED CARBON FIBERS

TABLE 17 PHENOLIC RESIN: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 18 PHENOLIC RESIN: MARKET, BY REGION, 2020–2027 (KILOTON)

6.6 OTHERS

TABLE 19 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 20 OTHERS: MARKET, BY REGION, 2020–2027 (KILOTON)

7 ACTIVATED CARBON FIBER MARKET, BY APPLICATION (Page No. - 82)

7.1 INTRODUCTION

FIGURE 29 AIR PURIFICATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 21 ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 22 MARKET, BY APPLICATION, 2020–2027 (KILOTON)

7.2 SOLVENT RECOVERY

7.2.1 INCREASING SOLVENT RECOVERY APPLICATIONS TO BOOST MARKET GROWTH

FIGURE 30 ASIA PACIFIC TO LEAD MARKET FOR SOLVENT RECOVERY DURING FORECAST PERIOD

7.2.2 SOLVENT RECOVERY MARKET, BY REGION

TABLE 23 SOLVENT RECOVERY: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 24 SOLVENT RECOVERY: MARKET, BY REGION, 2020–2027 (KILOTON)

7.3 AIR PURIFICATION

7.3.1 GROWING APPLICATIONS IN AIR PURIFICATION INDUSTRY TO PROPEL MARKET GROWTH

FIGURE 31 ASIA PACIFIC TO LEAD MARKET FOR AIR PURIFICATION

7.3.2 AIR PURIFICATION MARKET, BY REGION

TABLE 25 AIR PURIFICATION: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 26 AIR PURIFICATION: MARKET, BY REGION, 2020–2027 (KILOTON)

7.4 WATER TREATMENT

7.4.1 HIGH DEMAND FOR WATER TREATMENT DUE TO INCREASING WATER POLLUTION LOAD WILL DRIVE MARKET

FIGURE 32 ASIA PACIFIC TO LEAD MARKET FOR WATER TREATMENT DURING FORECAST PERIOD

7.4.2 WATER TREATMENT MARKET, BY REGION

TABLE 27 WATER TREATMENT: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 28 WATER TREATMENT: MARKET, BY REGION, 2020–2027 (KILOTON)

7.5 CATALYST CARRIER

7.5.1 HIGH DEMAND FOR LOW-COST CATALYST RECOVERY AND CATALYST CARRIER OPERATIONS TO AUGMENT MARKET GROWTH

FIGURE 33 ASIA PACIFIC TO LEAD ACTIVATED CARBON FIBER FOR CATALYST CARRIER SEGMENT

7.5.2 CATALYST CARRIER, BY REGION

TABLE 29 CATALYST CARRIER: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 30 CATALYST CARRIER: MARKET, BY REGION, 2020–2027 (KILOTON)

7.6 OTHERS

TABLE 31 OTHERS: ACTIVATED CARBON FIBER MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 32 OTHERS: ACTIVATED CARBON FIBER MARKET, BY REGION, 2020–2027 (KILOTON)

8 ACTIVATED CARBON FIBER MARKET, BY REGION (Page No. - 93)

8.1 INTRODUCTION

FIGURE 34 CHINA TO BE FASTEST-GROWING ACTIVATED CARBON FIBER MARKET DURING FORECAST PERIOD

TABLE 33 MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 34 MARKET, BY REGION, 2020–2027 (KILOTON)

8.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: ACTIVATED CARBON FIBER MARKET SNAPSHOT

8.2.1 NORTH AMERICA: MARKET, BY TYPE

TABLE 35 NORTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET, BY TYPE, 2020–2027 (KILOTON)

8.2.2 NORTH AMERICA: MARKET, BY APPLICATION

TABLE 37 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.2.3 NORTH AMERICA: MARKET, BY COUNTRY

TABLE 39 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (KILOTON)

8.2.4 US

8.2.4.1 Dominating market for activated carbon fibers in North America

TABLE 41 US: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 42 US: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.2.5 CANADA

8.2.5.1 Favorable government initiatives to be governing factor for market growth

TABLE 43 CANADA: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 44 CANADA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.2.6 MEXICO

8.2.6.1 Water treatment industry to provide lucrative opportunities for ACF

TABLE 45 MEXICO: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 46 MEXICO: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.3 EUROPE

FIGURE 36 EUROPE: ACTIVATED CARBON FIBER MARKET SNAPSHOT

8.3.1 EUROPE: MARKET, BY TYPE

TABLE 47 EUROPE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 48 EUROPE: MARKET, BY TYPE, 2020–2027 (KILOTON)

8.3.2 EUROPE: MARKET, BY APPLICATION

TABLE 49 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 50 EUROPE: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.3.3 EUROPE: MARKET, BY COUNTRY

TABLE 51 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 52 EUROPE: MARKET, BY COUNTRY, 2020–2027 (KILOTON)

8.3.4 GERMANY

8.3.4.1 Leading market for activated carbon fibers in Europe

TABLE 53 GERMANY: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 54 GERMANY: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.3.5 FRANCE

8.3.5.1 Rise in demand for activated carbon fibers for industrial applications

TABLE 55 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 56 FRANCE: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.3.6 UK

8.3.6.1 Increased spending on industrial sector to provide growth opportunities for activated carbon fibers

TABLE 57 UK: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 58 UK: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.3.7 ITALY

8.3.7.1 High demand for activated carbon fibers from air purification and defense clothing industries

TABLE 59 ITALY: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 60 ITALY: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.3.8 SPAIN

8.3.8.1 Growing industrial sector boosting demand for activated carbon fibers

TABLE 61 SPAIN: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 62 SPAIN: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.3.9 REST OF EUROPE

TABLE 63 REST OF EUROPE: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 64 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.4 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: ACTIVATED CARBON FIBER MARKET SNAPSHOT

8.4.1 ASIA PACIFIC: MARKET, BY TYPE

TABLE 65 ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (KILOTON)

8.4.2 ASIA PACIFIC: MARKET, BY APPLICATION

TABLE 67 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.4.3 ASIA PACIFIC: MARKET, BY COUNTRY

TABLE 69 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 70 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (KILOTON)

8.4.4 CHINA

8.4.4.1 China to be fastest-growing market for activated carbon fibers in Asia Pacific

TABLE 71 CHINA: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 72 CHINA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.4.5 JAPAN

8.4.5.1 Presence of major manufacturers to drive market

TABLE 73 JAPAN: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 74 JAPAN: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.4.6 INDIA

8.4.6.1 Increasing demand for activated carbon fibers from water treatment and air purification industries

TABLE 75 INDIA: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 76 INDIA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.4.7 SOUTH KOREA

8.4.7.1 High demand from water treatment industries

TABLE 77 SOUTH KOREA: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 78 SOUTH KOREA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.4.8 REST OF ASIA PACIFIC

TABLE 79 REST OF ASIA PACIFIC: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 80 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.5 MIDDLE EAST & AFRICA

8.5.1 MIDDLE EAST & AFRICA: MARKET, BY TYPE

TABLE 81 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 82 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2020–2027 (KILOTON)

8.5.2 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION

TABLE 83 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 84 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.5.3 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY

TABLE 85 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 86 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (KILOTON)

8.5.4 SAUDI ARABIA

8.5.4.1 ACF demand boosted due to increasing need for wastewater treatment

TABLE 87 SAUDI ARABIA: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 88 SAUDI ARABIA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.5.5 UAE

8.5.5.1 Infrastructural growth of energy sector to enhance AFC market growth

TABLE 89 UAE: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 90 UAE: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.5.6 SOUTH AFRICA

8.5.6.1 Emerging market for activated carbon fibers in Middle East & Africa

TABLE 91 SOUTH AFRICA: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 92 SOUTH AFRICA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.5.6.2 Rest of Middle East & Africa

TABLE 93 REST OF MIDDLE EAST & AFRICA: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 94 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.6 SOUTH AMERICA

8.6.1 SOUTH AMERICA: ACTIVATED CARBON FIBER MARKET, BY TYPE

TABLE 95 SOUTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 SOUTH AMERICA: MARKET, BY TYPE, 2020–2027 (KILOTON)

8.6.2 SOUTH AMERICA: MARKET, BY APPLICATION

TABLE 97 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 98 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.6.3 SOUTH AMERICA: MARKET, BY COUNTRY

TABLE 99 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 100 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (KILOTON)

8.6.4 BRAZIL

8.6.4.1 Dominant market for activated carbon fibers in South America

TABLE 101 BRAZIL: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 102 BRAZIL: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

8.6.5 REST OF SOUTH AMERICA

TABLE 103 REST OF SOUTH AMERICA: ACTIVATED CARBON FIBER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 104 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (KILOTON)

9 COMPETITIVE LANDSCAPE (Page No. - 134)

9.1 INTRODUCTION

9.2 MARKET SHARE ANALYSIS

FIGURE 38 MARKET SHARE OF TOP COMPANIES IN MARKET

TABLE 105 DEGREE OF COMPETITION: MARKET

9.3 MARKET RANKING

FIGURE 39 RANKING OF TOP FIVE PLAYERS IN ACTIVATED CARBON FIBER

9.4 MARKET EVALUATION FRAMEWORK

TABLE 106 ACTIVATED CARBON FIBER MARKET: DEALS, 2017–2022

TABLE 107 ACTIVATED CARBON FIBER: OTHERS, 2017–2022

9.5 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

9.6 COMPANY EVALUATION MATRIX

TABLE 108 COMPANY PRODUCT FOOTPRINT

TABLE 109 COMPANY TYPE FOOTPRINT

TABLE 110 COMPANY APPLICATION FOOTPRINT

TABLE 111 COMPANY REGION FOOTPRINT

9.6.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 40 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN ACTIVATED CARBON FIBER MARKET

9.6.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 41 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN ACTIVATED CARBON FIBER MARKET

9.7 COMPANY EVALUATION QUADRANT (TIER 1)

9.7.1 STARS

9.7.2 PERVASIVE PLAYERS

9.7.3 PARTICIPANTS

9.7.4 EMERGING LEADERS

FIGURE 42 ACTIVATED CARBON FIBER: COMPETITIVE LEADERSHIP MAPPING, 2021

9.7.4.1 Competitive benchmarking of key start-ups/SMEs

TABLE 112 MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 113 MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

9.8 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

9.8.1 PROGRESSIVE COMPANIES

9.8.2 RESPONSIVE COMPANIES

9.8.3 DYNAMIC COMPANIES

9.8.4 STARTING BLOCKS

FIGURE 43 ACTIVATED CARBON FIBER: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2021

10 COMPANY PROFILES (Page No. - 147)

10.1 KEY COMPANIES

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

10.1.1 TOYOBO CO., LTD.

TABLE 114 TOYOBO CO., LTD.: COMPANY OVERVIEW

FIGURE 44 TOYOBO CO., LTD.: COMPANY SNAPSHOT

10.1.2 KURARAY CO., LTD.

TABLE 115 KURARAY CO., LTD.: COMPANY OVERVIEW

FIGURE 45 KURARAY CO., LTD.: COMPANY SNAPSHOT

10.1.3 UNITIKA LTD.

TABLE 116 UNITIKA LTD.: COMPANY OVERVIEW

FIGURE 46 UNITIKA LTD.: COMPANY SNAPSHOT

10.1.4 GUN EI CHEMICAL INDUSTRY CO., LTD.

TABLE 117 GUN EI CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

10.1.5 EVERTECH ENVISAFE ECOLOGY CO., LTD.

TABLE 118 EVERTECH ENVISAFE ECOLOGY CO., LTD.: COMPANY OVERVIEW

10.1.6 AWA PAPER & TECHNOLOGY COMPANY, INC.

TABLE 119 AWA PAPER & TECHNOLOGY COMPANY, INC.: COMPANY OVERVIEW

10.1.7 TAIWAN CARBON TECHNOLOGY CO., LTD

TABLE 120 TAIWAN CARBON TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

10.1.8 DAIGAS GROUP

TABLE 121 DAIGAS GROUP: COMPANY OVERVIEW

FIGURE 47 DAIGAS GROUP: COMPANY SNAPSHOT

10.1.9 AURO CARBON & CHEMICALS

TABLE 122 AURO CARBON & CHEMICALS: COMPANY OVERVIEW

10.1.10 HANGZHOU NATURE TECHNOLOGY CO., LTD.

TABLE 123 HANGZHOU NATURE TECHNOLOGY CO., LTD: COMPANY OVERVIEW

10.1.11 EUROCARB PRODUCTS LTD.

TABLE 124 EUROCARB PRODUCTS LTD.: BUSINESS OVERVIEW

10.1.12 CHINA BEIHAI FIBERGLASS CO., LTD.

TABLE 125 CHINA BEIHAI FIBERGLASS CO., LTD.: BUSINESS OVERVIEW

10.1.13 BIO-MEDICAL CARBON TECHNOLOGY CO., LTD.

TABLE 126 BIO-MEDICAL CARBON TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

10.1.14 CERAMATERIALS

TABLE 127 CERAMATERIALS: COMPANY OVERVIEW

10.1.15 HPMS GRAPHITE

TABLE 128 HPMS GRAPHITE: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

10.2 OTHER COMPANIES

10.2.1 JIANGSU TONGKANG ACTIVATED CARBON FIBER CO., LTD.

10.2.2 NANTONG SENYOU CARBON FIBER CO., LTD.

10.2.3 JIANGSU SUTONG CARBON FIBER CO., LTD.

10.2.4 NANTONG YONGTONG ENVIRONMENTAL TECHNOLOGY CO., LTD.

10.2.5 NANTONG HAILAN FILTRATION TECH CO., LTD.

10.2.6 ANSHAN SINOCARB CARBON FIBERS CO., LTD.

10.2.7 FLIPS INDIA ENGINEERING

10.2.8 NANTONG RUIBANG ACTIVATED CARBON FILTER MATERIAL CO., LTD.

10.2.9 FUYANG SENSI TRADING CO., LTD.

10.2.10 ANHUI JIALIQI ACF CO., LTD

11 APPENDIX (Page No. - 184)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

11.3 CUSTOMIZATION OPTIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

The study involves two major activities in estimating the current size of the activated carbon fiber market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases, and investor presentations of companies; certified publications; articles from recognized authors; gold & silver standard websites; and various databases were referred to for identifying and collecting information for this study.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the total pool of players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

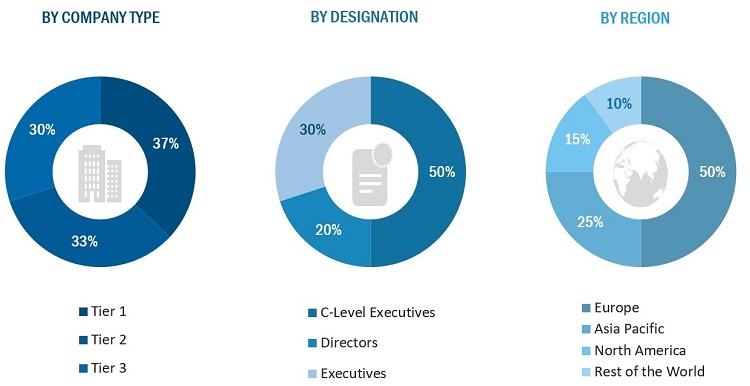

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and related key executives from various leading companies and organizations operating in the activated carbon fiber market. Primary sources from the demand side included procurement managers and experts from end-use industries.

Following is the breakdown of primary respondents:

Notes: Tiers of companies are selected based on their ownership and revenues in 2021.

Others include sales managers, marketing managers, and product managers.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total activated carbon fiber market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall activated carbon fiber market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the Solvent Recovery, Air Purification, Water Treatment, Catalyst Carrier, and other applications.

Report Objectives

- To analyze and forecast the global market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on type and application.

- To analyze and forecast the market size based on four main regions, namely, Asia Pacific (APAC), Europe, North America, South America, Middle East and Africa and Rest of the World.

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of Asia Pacific activated carbon fiber market

- Further breakdown of Rest of European activated carbon fiber market

- Further breakdown of Rest of Middle East & Africa activated carbon fiber market

- Further breakdown of Rest of Latin American activated carbon fiber market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Activated Carbon Fiber Market