4D Printing Market by Material (Programmable Carbon Fiber, Programmable Wood - Custom Printed Wood Grain, Programmable Textiles), End User (Aerospace, Automotive, Clothing, Construction, Defense, Healthcare & Utility) & Geography - Global Trends & Forecasts to 2019 - 2025

The 4D printing market is defined for this market study as the technology in which the fourth dimension entails a change in form or function after the 3D printing of Programmable Material (PM). In other words, 4D printing allows objects to be 3D printed and then to self-transform in shape and material property when exposed to a pre-determined stimulus such as submersion in water, or exposure to heat, pressure, current, ultraviolet light, or some other source of energy.

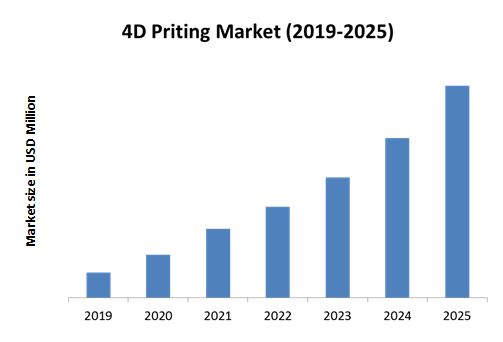

4D printing technology is expected to be commercialized in 2019. The global 4D printing market is expected to grow at a CAGR of 42.95% between 2019 and 2025. The market is segmented on the basis of material segments into programmable carbon fiber, programmable wood grain, and programmable textiles. The programmable carbon fiber segment is expected to be the largest contributor to the overall market, with a share of ~62% of the market, in 2019.

This report describes the value chain for the 4D printing market, taking into consideration all the major stakeholders in the market and their role analysis. The report also provides a detailed study based on the Porters’ five forces framework for the market. All the five major factors in these markets have been quantified using the internal key parameters governing each of them. The report also includes the company profiles of the leading players in the 3D printing industry along with their recent developments and other strategic business activities. The competitive landscape section of the report outlines the potential of the key companies in the 3D printing industry.

Some of the key players in this 4D printing market include 3D Systems Corporation (U.S.), Autodesk, Inc. (U.S.), Hewlett Packard Corp. (U.S.), Stratasys Ltd. (U.S), ExOne Co. (U.S.), Organovo Holdings, Inc. (U.S.), Materialise NV (Belgium), and Dassault Systèmes SA (France).

Scope of the report:

This report categorizes the global market on the basis of programmable material, end-user industry, and geography. It forecasts the revenue for the period between 2019 and 2025 and analyzes the trends in the 4D printing market.

On the basis of programmable material:

Global 4D printing market is segmented on the basis of programmable material into programmable carbon fiber, programmable wood - custom printed wood grain, and programmable textiles market.

On the basis of end-user industry:

In this section, the market is segmented on the basis of the end-user industries for which the 4D printing technology is used. These include aerospace, automotive, clothing, construction, defense & military, healthcare, and utility.

On the basis of geography:

In this section, the market is segmented on the basis of different regions, namely, North America, Europe, Asia-Pacific, and RoW.

4D printing is expected to play a very important role in the manufacturing process. The printing technology enables programmed material to be 1D or 2D printed and to self-transform into a 3D object according to the embedded program. The global 4D printing market is expected to be commercialized in 2019, and to grow at a CAGR of 42.95% to reach $537.8 million by 2025. This growth would be driven by the growing need to reduce the costs of manufacturing and processing and to ensure a sustainable environment.

The key material segments of the 4D printing market included in the report are programmable carbon fiber, programmable wood grain, and programmable fabric. Of the material segments, the programmable carbon fiber segment is expected to be the largest contributor to the overall market, accounting for a share of ~62% of the market in 2019.

The 4D printing market is also segmented on the basis of end-user industry into aerospace, automotive, clothing, construction, defense & military, healthcare, and utility. The report covers the market for geographic regions comprising North America, Europe, Asia-Pacific, and the Rest of the World (RoW). In 2019, North America is expected to have the largest market size in terms of value for market. The North American market is expected to grow at the highest CAGR of 44.01% between 2019 and2025.

The key players in this industry include Stratasys Ltd. (U.S.), 3D Systems Corporation (U.S.), Autodesk, Inc. (U.S.), Hewlett Packard Corp. (U.S.), ExOne Co. (U.S.), Organovo Holdings, Inc. (U.S.), Materialise NV (Belgium), and Dassault Systèmes SA (France).

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.3.4 Currency

1.4 Package Size

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Description of the Market Demand Model

2.1.1 Reduction in Manufacturing & Process Cost

2.1.2 Drive for Sustainable Envoirnment to Conserve Limited Resources on Earth

2.1.3 Development of New and Improved Technologies and Materials

2.2 Market Size Estimation

2.3 Market Crackdown & Data Triangulation

2.4 Market Share Estimation

2.4.1 Key Data Points Taken From Secondary Sources

2.4.2 Key Data Points From Primary Sources

2.4.2.1 Key Industry Insights

2.5 Market Breakdown & Data Triangulation

2.5.1 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Growth Drivers for Market

4.2 Market – Comparison of Growth Pattern of Top Three Material Segments

4.3 North American Market

4.4 Geographical Snapshot of the Market

4.5 Aerospace and Military & Defense Industries Will Dominate the North American Market From 2019 to 2025

4.6 Aerospace and Military & Defense Industy: Largest End-User Industry for Market

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Programmable Material

5.2.2 By End-User Industry

5.23 Market Dynamics

5.3.1 Drivers

5.3.1.1 Need for Reduction in Manufacturing & Process Cost

5.3.1.2 Drive for Sustainable Environment

5.3.2 Restraints

5.3.2.1 Entry Opportunity is Restricted to Major Companies Due to High Initial Investments

5.3.2.2 Complexity in Intellectual Property Rights

5.3.2.3 High Initial Costs of Development

5.3.3 Opportunities

5.3.3.1 Early Adoption in Aerospace, Military & Defense, Healthcare and Automotive Industries

5.3.3.2 Potential for Innovation and Product Developments

5.3.4 Challenges

5.3.4.1 Compliance With Regulatory and Performance Standards

5.3.4.2 Insecurity for Policy Makers

5.3.4.3 Potential Safety Hazard

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Value Chain Analysis: Market

6.3 Supply Chain Analysis

6.4 Industry Trends

6.5 Porter’s Five Forces Analysis

6.5.1 Threat From New Entrants

6.5.2 Threat From Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Degree of Competition

7 Global Market, By Material (Page No. - 57)

7.1 Introduction

7.2 Programmable Carbon Fibre

7.3 Programmable Wood-Custom Printed Wood Grain

7.4 Programmable Textile

8 Global Market, By End-User Industry (Page No. - 63)

8.1 Introduction

8.1.1 Aerospace Industry

8.1.2 Automotive Industry

8.1.3 Clothing

8.1.4 Construction

8.1.5 Military and Defense

8.1.6 Healthcare Industry

8.1.6.1 Dental

8.1.6.2 Medical

8.1.7 Utility

9 Global Market, By Geography (Page No. - 90)

9.1 Introduction

9.2 North America

9.3 Europe

9.4 Asia-Pacific

9.5 RoW

10 Competitive Landscape (Page No. - 105)

11 Company Profiles (Page No. - 109)

11.1 3D Systems Corporation

11.1.1 Business Overview

11.1.2 Product Portfolio

11.1.3 Recent Developments

11.1.4 MnM View

11.1.4.1 Key Strategies

11.1.4.2 SWOT Analysis

11.2 Autodesk Inc.

11.2.1 Business Overview

11.2.2 Product Portfolio

11.2.3 Recent Developments

11.2.4 MnM View

11.2.4.1 1.3.4.1 Key Strategies

11.2.4.2 1.3.4.2 SWOT Analysis

11.3 Hewlett Packard Corp.

11.3.1 Business Overview

11.3.2 Product/Service Portfolio

11.3.3 Recent Developments

11.3.4 MnM View

11.3.4.1 Key Strategies

11.3.4.2 SWOT Analysis

11.4 Stratasys Ltd.

11.4.1 Business Overview

11.4.2 Product/Service Portfolio

11.4.3 Recent Developments

11.4.4 MnM View

11.5 Exone Co.

11.5.1 Business Overview

11.5.2 Product/Service Portfolio

11.5.3 Recent Developments

11.5.4 MnM View

1.10.4.1 Key Strategies

11.6 Organovo Holdings Inc.

11.6.1 Business Overview

11.6.2 Product/Service Portfolio

11.6.3 Recent Developments

11.6.4 MnM View

11.7 ARC Centre of Excellence for Electromaterials Science (ACES)

11.7.1 Business Overview

11.7.2 Product/Service Portfolio

11.7.3 Recent Developments

11.7.4 Key Strategies

11.8 Massachusetts Institute of Technology

11.8.1 Business Overview

11.8.2 Service Portfolio

11.8.3 Recent Developments

11.8.4 Key Strategies

11.9 Materialise NV

11.9.1 Business Overview

11.9.2 Products/Services Portfolio

11.9.3 Recent Developments

11.9.4 Key Strategies

11.1 Dassault Systemes SA

11.10.1 Business Overview

11.10.2 Products/Services Portfolio

11.10.3 Recent Developments

11.10.4 Key Strategies

12 Appendix (Page No. - 141)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (36 Tables)

Table 1 Demand for Reduction in Manufacturing & Process Costs and Drive for Sustainable Environment are Expected to Propel the Growth

Table 2 High Capital Investment and Complexity in Intellectual Property Rights Would Restrict Major 3D Printing Technology Providers

Table 3 Adoption By Aerospace, Military, and Automobile Industries is Generating New Opportunities for Market

Table 4 Ensuring Human Safety is the Major Challenge for the Market

Table 5 High Demand for Programmable and Reusable 4D Printing Material

Table 6 Programmable Carbon Fiber: Market, By End User Industry, 2019–2025 ($Million)

Table 7 Programmable Carbon Fiber: Market, By Geography, 2019–2025 ($Million)

Table 8 Programmable Wood:Market, By End User Industry, 2019–2025 ($Million)

Table 9 Programmable Wood:Market, By Geography, 2019–2025 ($Million)

Table 10 Programmable Textile: Market, By End User Industry, 2019–2025 ($Million)

Table 11 Programmable Textile:Market, By Geography, 2019–2025 ($Million)

Table 12 Market, By End-User Industry, 2019-2025 ($ Million)

Table 13 4D Printing: Success Factors in Different Industries

Table 14 Aerospace Industry: Market Size, By Material, 2019-2025 ($ Million)

Table 15 Aerospace Industry : Market Size, By Geography, 2019-2025 ($ Million)

Table 16 Automotive Industry: Market Size, By Material, 2021-2025 ($ Million)

Table 17 Automotive Industry: Market Size, By Geography, 2021-2025 ($ Million)

Table 18 Clothing Industry: Market Size, By Material, 2021-2025 ( $ Million)

Table 19 Clothing Industry: Market Size, By Geography, 2021-2025 ($ Million)

Table 20 Construction Industry: Market Size, By Material, 2020-2025 ($ Million)

Table 21 Construction Industry: Market Size, By Geography, 2020-2025 ($ Million)

Table 22 Military & Defense: Market Size, By Material, 2019-2025 ($Million)

Table 23 Military & Defense: Market Size, By Geography, 2019-2025 ($ Million)

Table 24 Healthcare Industry: Market Size, By Material, 2020-2025 ($ Million)

Table 25 Healthcare: Market Size, By Geography, 2020-2025 ($ Million)

Table 26 Utility Industry: Market Size, By Material, 2019-2025 ($ Million)

Table 27 Utility Industry: Market Size, By Geography, 2019-2025 ($ Million)

Table 28 Global Market, By Geography, 2019–2025 ($ Million)

Table 29 North American Market, By End User Industry, 2019–2025 ($Million)

Table 30 North American Market, By Country, 2019–2025 ($ Million)

Table 31 European Market, By End User Industry, 2019–2025 ($Million)

Table 32 European Market, By Country, 2019–2025 ($Million)

Table 33 APAC Market, By End User Industry, 2019–2025 ($ Million)

Table 34 APAC Market, By Country, 2019–2025 ($ Million)

Table 35 RoW Market, By End User Industry, 2019–2025 ($ Million)

Table 36 RoW Market, By Country, 2019–2025 ($ Million)

List of Figures (73 Figures)

Figure 1 Markets Covered

Figure 2 Research Methodology

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 6 Market Breakdown and Data Triangulation

Figure 7 Market Snapshot, By End-User Industry Segment (Year of Adoption vs. 2020): Aerospace and Military & Defense Industries are Expected to Dominate the Overall Market

Figure 8 Global Market, By Region, 2021

Figure 9 Attractive Opportunities for Aerospace and Military & Defense Industries in Market

Figure 10 Carbon Fiber to Grow at A Faster Rate in the Forecast Period

Figure 11 U.S. Will Hold the Largest Share in European Calibration Service Market in 2021

Figure 12 APAC Market to Grow With Highest CAGR in the Period 2019-2025

Figure 13 Geography Wise Break Up of Industries Within Market in 2021

Figure 14 Carbon Fiber has A Promising Future

Figure 15 4D Printing : the New Dimension to 3D Printing

Figure 16 Segmentation: By Programmable Material

Figure 17 Segmentation: By End-User Industry

Figure 18 Drive for Reduction in Manufacturing and Process Costs Would Lead to New Growth Opportunities

Figure 19 Prototype : Morphable Car Wing

Figure 20 Value Chain Analysis (2019): Major Value is Added During the R&D and Design Phases

Figure 21 Supply Chain of Market

Figure 22 Porter’s Five Forces Analysis

Figure 23 Carbon Fiber is Expected to Grow at Highest CAGR Between 2019 and 2025 ($Million)

Figure 24 Market, By Material, 2019-2025 ($Million)

Figure 25 Defense & Military is Expected to Witness Highest Growth in Programmable Carbon Fiber Market for 4D Printing Between 2019-2025 ($ Million)

Figure 26 Aerospace Drives the Programmable Wood- Custom Printed Wood Grain Market for 4D Printing Between 2019-2025 ($ Million)

Figure 27 Aerospace is Expected to Witness Highest Growth in Programmable Textile Market for 4D Printing Between 2019-2025 ($ Million)

Figure 28 Market: By Application

Figure 29 Aerospace to Witness Highest Growth in Market Between 2019-2025 ( $ Million)

Figure 30 Market: Future Application Areas

Figure 31 Programmable Textile to Witness Highest Growth in Aerospace Industry Market Between 2019-2025 ( $ Million)

Figure 32 Asia-Pacific to Witness Highest Growth in Aerospace Industry Market Between 2019-2025 ( $ Million)

Figure 33 Programmable Textile is Expected to Grow in Automotive Industry Market Between 2021-2025 ( $ Million)

Figure 34 Asia-Pacific to Witness Highest Growth in Automotive Industry Market Between 2021-2025 ( $ Million)

Figure 35 Programmable Textile to Witness Highest Growth in Clothing Industry Market Between 2021-2025 ( $ Million)

Figure 36 North America to Witness Highest Growth in Clothing Industry Market Between 2021-2025 ( $ Million)

Figure 37 Programmable Wood-Custom Printed Wood Grain to Witness Highest Growth in Construction Industry Market Between 2020-2025 ( $ Million)

Figure 38 North America Drives the Highest Growth in Construction Industry Market Between 2020-2025 ( $ Million)

Figure 39 Programmable Carbon Fiber Drives the Growth in Military & Defense Industry Market Between 2019-2025 ( $ Million)

Figure 40 North America to Witness Highest Growth in Military & Defense Industry Market Between 2019-2025 ( $ Million)

Figure 41 Importance of 4D Printing in Dental and Medical Segment

Figure 42 Programmable Textile Drives the Healthcare Industry in Market Between 2020-2025 ( $ Million)

Figure 43 North America to Witness Highest Growth in Healthcare Industry Market Between 2020-2025 ( $ Million)

Figure 44 Programmable Carbon Fiber to Witness Highest Growth in Utility Industry Market Between 2021-2025 ( $ Million)

Figure 45 North America Drives the Utility Industry Market Between 2021-2025 ( $ Million)

Figure 46 Benefits of 4D Printing

Figure 47 Geographic Snapshot (2021) – Rapid Growth Markets are Emerging as the New Hot Spots

Figure 48 APAC– an Attractive Destination for All Applications of 4D Printing

Figure 49 APAC to Witness Highest Growth Between 2019-2025 ($ Million)

Figure 50 North American Market With Respect to the Top Materials and End-User Industries

Figure 51 U.S. to Gain Major Market Share in North American Market Between 2019 and 2025

Figure 52 Aerospace and Defense & Military Industries are Expected to Grow With Highest CAGR in European Market Between 2019 and 2025

Figure 53 European Market, By End-User Industry, (2019-2025)

Figure 54 Germany is Expected to Gain Highest Share in European Market Between 2019 and 2025

Figure 55 Defense & Military to Grow With Highest Rate in APAC Market Between 2019 and 2025

Figure 56 China to Lead Market in APAC Region Between 2019 and 2025

Figure 57 Construction Industry to Grow at Highest Rate in RoW Market Between 2019 and 2025

Figure 58 Middle East to Drive Growth in RoW Region Between 2019 and 2025

Figure 59 Top 3D Printing Companies Presence in Various Services

Figure 60 3D Systems Corporation.: Business Overview

Figure 61 3D Systems Corporation :SWOT Analysis

Figure 62 Autodesk Inc.: Business Overview

Figure 63 Autodesk .: SWOT Analysis

Figure 64 Hewlett Packard: Business Overview

Figure 65 HP: SWOT Analysis

Figure 66 Stratasys Ltd. : Business Overview

Figure 67 Stratasys Ltd. SWOT Analysis

Figure 68 Exone Co.: Business Overview

Figure 69 Organovo Holdings Inc.: Business Overview

Figure 70 ACES: Business Overview

Figure 71 Massachusetts Institute of Technology: Business Overview

Figure 72 Materialise NV: Business Overview

Figure 73 Dassault Systems SA: Business Overview

Growth opportunities and latent adjacency in 4D Printing Market

4D printing is the greatest innovation in the manufacturing industry. There is such an application like a 4D printed valve, 4D printed shoes, 4D printed pipelines will play an important role.