4D Printing in Healthcare Market by Component (Equipment, 3D printer SMM, Hydrogels, Software, Service, Cells), Technology (FDM, SLS, Stereolithography), Application (Research Model, Implant), End user (Hospital, Dental Lab, ASC) & Region - Global Forecasts to 2026

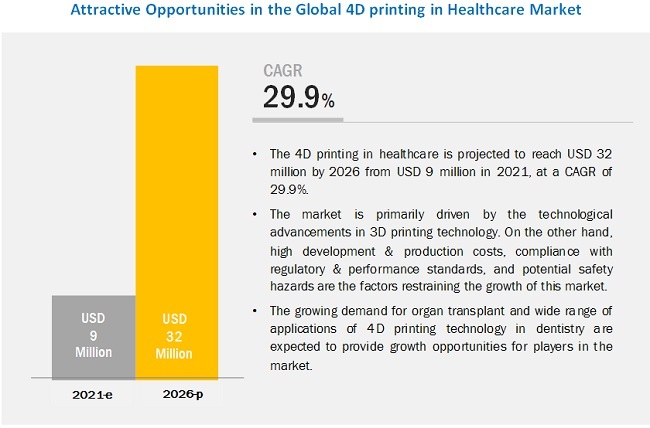

The 4D printing in healthcare market size is projected to reach USD 32 million by 2026, at a CAGR of 29.9%. Growth in this market is driven mainly by technological advancements in 3D printing technology, such as the development of smart, programmable materials. On the other hand, high development & production costs, need for compliance with regulatory & performance standards that will slow product launches, and potential safety hazards are expected to restrain the growth of the 4D printing in medical market to a certain extent

In 2021, the software & services segment accounted for the largest share of the 4D printing in healthcare market

Based on component, the market is segmented into equipment, programmable materials, and software & services. The software & services segment is expected to dominate the market in 2021 and register the highest growth during the forecast period.

Software has a diverse range of applications in additive manufacturing. 3D printing software is used for creating, designing, and assembling models required in the healthcare space. This software also inspects prototypes to ensure that the required specifications have been met. The file preparation software prepares STL and SLC files to develop the product design. Software needed for 4D printing should fully support the 4D printing process. However, research on 4D printing software is limited as the 4D printing technology is still in the nascent stage.

The PolyJet segment is expected to grow at the highest CAGR during the forecast period.

Based on technology, the FDM segment is expected to account for the largest share of the 4D printing in healthcare market in 2021. However, the PolyJet segment is expected to register the highest growth during the forecast period. This technology enables the development of complex shapes with intricate details and delicate features. It offers products with a variety of colors and materials into a single model. The reduced material wastage due to the higher accuracy of deposition and the ability to use multiple materials and colors are the major advantages of this process, thus, driving its demand.

The medical & research models segment accounted for the largest share of the 4D printing in healthcare market in 2021

Based on application, the 4D printing in medical market is segmented into medical & research models, surgical guides, and patient-specific implants. In 2021, the medical & research models segment is expected to account for the largest share of the market. These models can be customized as per the patient’s pathology, which will further help in delivering efficient patient care. The ability of the 4D printing technology to manufacture smart medical models will bring significant transformation in the medical field and will support the growth of this segment in the forecast period.

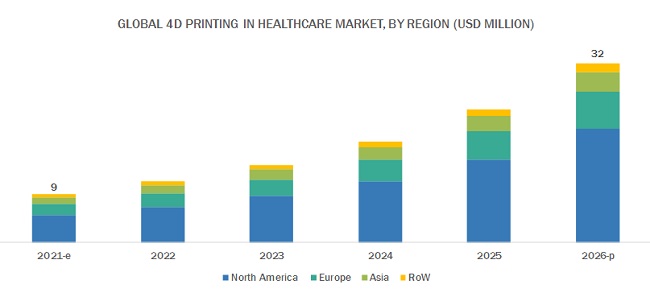

North America accounted for the largest share of the 4D printing in healthcare market during the forecast period

Geographically, the 4D printing in medical market is segmented into North America, Europe, Asia, and the Rest of the World (RoW). In 2021, North America is estimated to be the largest regional market for 4D printing in healthcare. This can majorly be attributed to the continuous technological advancements, growing demand for organ transplantation, efforts taken in the research & development of the 4D printing technology in the healthcare sector, and the presence of highly developed healthcare infrastructure in the region.

Key players in the global 4D printing in healthcare market

The market is a highly diversified and competitive market, with a large number of players, including mid-tier companies and startup firms. 3D Systems (US), Organovo Holdings Inc. (US), Stratasys Ltd. (US & Israel), Dassault Systèmes (France), Materialise (Belgium), EOS GmbH Electro Optical Systems (Germany), EnvisionTEC (Germany), and Poietis (France) are some of the key players in the market.

3D Systems Inc. (US) is one of the leading players in the 3D printing market. With a wide distribution network across the globe, 3D Systems has established itself as one of the leading players in the 3D printing market. The company’s strong focus on providing unique and highly specialized products to meet its customer needs with optimal cost and performance has helped establish itself in the market. 3D printing solutions offered by the company enable its customers to design and manufacture complex and exclusive parts and also helps them to eliminate expensive tooling. To remain competitive in the global market, the company focuses on various inorganic growth strategies such as acquisitions, collaborations, and agreements to expand & enhance its portfolio of products, geographic reach, and client relationships. The company also focuses on organic growth strategies like product launches to strengthen its presence in this highly competitive market.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2021–2026 |

|

Base year considered |

2018 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component, technology, application, end user, and region. |

|

Geographies covered |

North America (US and Canada), Asia, Europe (Germany, UK, and RoE), and the Rest of the World |

|

Companies covered |

3D Systems (US), Organovo Holdings Inc. (US), Stratasys Ltd. (US & Israel), Dassault Systèmes (France), Materialise (Belgium), EOS GmbH Electro Optical Systems (Germany), EnvisionTEC (Germany), and Poietis (France) |

The research report categorizes the global 4D printing in medical market into the following segments and subsegments:

4D printing in healthcare market, by Component

- Equipment

- 3D Printers

- 3D Bioprinters

- Programmable Materials

- Shape-memory Materials

- Hydrogels

- Living cells

- Software & Services

4D printing in healthcare market, by Technology

- FDM

- PolyJet

- Stereolithography

- SLS

4D printing in healthcare market, by Application

- Medical Models

- Surgical Guides

- Patient-specific Implants

4D printing in healthcare market, by End-User

- Hospitals & Clinics

- Dental Laboratories

- Other End-Users

4D printing in healthcare market, by Region

- North America

-

Europe

- Germany

- UK

- Rest of Europe (RoE)

- Asia

- Rest of the World (RoW)

Recent Developments

- In May 2018, 3D Systems launched Simbionix ANGIO Tab Pro endovascular simulator.

- In January 2017, 3D Systems’ acquired with Vertex-Global Holding B.V. (Netherlands) to enhance 3D Systems’ dental product offerings with the Vertex and NextDent brands. This also helped the company to establish a foothold in the dental industry by accelerating the adoption of 3D-printed products for advanced solutions.

- In May 2018, Organovo Holdings, Inc. (US) & Samsara Sciences, Inc. (US) signed a partnership with Advanced Regenerative Manufacturing Institute (‘ARMI’) (US) to develop next-generation manufacturing processes and technologies for cells, tissues, and organs.

Key Questions Addressed by the Report

- Where will all these developments take the industry in the mid to long term?

- What types of annual and multi-year partnerships are 3D printing in Healthcare companies exploring?

- Which are the key players in the 4D printing in medical market and how intense is the competition?

- Which are the recent contracts and agreements key players have signed?

- What are the recent trends affecting 3D printing in Healthcare software vendors?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 4D Printing in Medical Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Sources

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Sources

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 4D Printing in Medical Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 4D Printing in Healthcare: Market Overview

4.2 4D Printing in Healthcare, By Component

4.3 4D Printing in Healthcare, By Technology and Region, 2021

4.4 Geographic Snapshot: 4D Printing in Healthcare

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 4D Printing in Medical Market Drivers

5.2.1.1 Technological Advancements in 3D Printing

5.2.2 Market Restraints and Challenges

5.2.2.1 High Development and Production Costs

5.2.2.2 Potential Safety Hazards

5.2.2.3 Compliance With Regulatory and Performance Standards

5.2.3 4D Printing in Medical Market Opportunities

5.2.3.1 Growing Demand for Organ Transplants

5.2.3.2 4D-Printed Medical Implants

5.2.3.3 Applications of 4D Printing Technology in Dentistry

6 4D Printing in Healthcare Market, By Component (Page No. - 35)

6.1 Introduction

6.1.1 Software & Services

6.1.1.1 Software & Services Segment to Witness the Highest Growth During the Forecast Period

6.2 Equipment

6.2.1 3D Bioprinters

6.2.1.1 3D Bioprinters Aid in the Production of Complex Living and Non-Living Biological Products

6.2.2 3D Printers

6.2.2.1 Continuous Technological Advancements in Existing 3D Printers to Support Market Growth

6.3 Programmable Materials

6.3.1 Living Cells

6.3.1.1 Living Cells have the Ability to Fabricate Human-Scale Tissues in A Defined and Stable Method

6.3.2 Hydrogels

6.3.2.1 Smart Hydrogels are Current Areas of Focus for Researchers in the Market

6.3.3 Shape-Memory Materials

6.3.3.1 Shape-Memory Materials have the Ability to Get Back to Their Original Shape in Response to an Appropriate Stimulus

7 4D Printing in Healthcare Market, By Technology (Page No. - 44)

7.1 Introduction

7.2 Fused Deposition Modelling

7.2.1 Ability of FDM to Provide Biocompatible, Durable and Stable Products is Responsible for the Growth of This Market

7.3 Polyjet

7.3.1 Advantages of Polyjet Printing Will Drive Its Use in the Coming Years

7.4 Stereolithography

7.4.1 Increasing Demand for Stereolithography in Manufacturing of Medical Devices is A Major Market Driver

7.5 Selective Laser Sintering

7.5.1 Manufacturing Benefits of Sls Technologies Form the Major Growth Driver

8 4D Printing in Healthcare Market, By Application (Page No. - 50)

8.1 Introduction

8.2 Medical and Research Models

8.2.1 Medical & Research Models is the Largest & Fastest-Growing Application Segment of the Market

8.3 Surgical Guides

8.3.1 Effective Role of Surgical Guides in Complex Surgical Procedures to Drive the Growth of This Application Segment

8.4 Patient-Specific Implants

8.4.1 Advantages Offered By Patient-Specific Implants Over Standard Implants to Drive Market Growth

9 4D Printing in Healthcare Market, By End User (Page No. - 55)

9.1 Introduction

9.2 Dental Laboratories

9.2.1 Applications of 4D Printing in Production of Restorative Materials and Prosthetics Will Drive Demand

9.3 Hospitals & Clinics

9.3.1 Growing Demand for Organ Transplantation to Drive the Demand for 4D Printing in Hospitals and Clinics

9.4 Other End Users

10 4D Printing in Healthcare Market, By Region (Page No. - 59)

10.1 Introduction

10.2 North America

10.2.1 North America to Dominate the Market During the Forecast Period

10.3 Europe

10.3.1 Favorable Developments in the 3D Printing Space in Europe are Creating A Favorable Environment for Market Growth

10.4 Asia

10.4.1 Japan is Expected to Be A Potential Growth Market in the Asian Region

10.5 RoW

11 Competitive Landscape (Page No. - 76)

11.1 Overview

11.2 Competitive Situation and Trends

11.2.1 Product/Service Launches and Upgrades (2016–2019)

11.2.2 Partnerships, Agreements, and Collaborations (2016–2019)

11.2.3 Acquisitions (2016–2019)

11.2.4 Expansions (2016–2019)

12 Company Profiles (Page No. - 79)

(Business Overview, Products and Services Offered, Recent Developments, MnM View)*

12.1 3D Systems, Inc.

12.2 Organovo Holdings, Inc.

12.3 Stratasys, Ltd.

12.4 Dassault Systèmes

12.5 Materialise NV

12.6 EOS GmbH Electro Optical System

12.7 Envisiontec

12.8 Poietis

*Business Overview, Products and Services Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 100)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (60 Tables)

Table 1 4D Printing in Medical Market, By Component, 2020–2026 (USD Million)

Table 2 4D Printing Software & Services Market, By Region, 2020–2026 (USD Million)

Table 3 4D Printing Equipment Market, By Type, 2020–2026 (USD Million)

Table 4 4D Printing Equipment Market, By Region, 2020–2026 (USD Million)

Table 5 3D Bioprinters Market, By Region, 2020–2026 (USD Million)

Table 6 3D Printers Market, By Region, 2020–2026 (USD Thousand)

Table 7 4D Printing Programmable Materials Market, By Type , 2020–2026 (USD Million)

Table 8 4D Printing Programmable Materials Market, By Region, 2020–2026 (USD Million)

Table 9 Living Cells Market, By Region, 2020–2026 (USD Million)

Table 10 Hydrogels Market, By Region, 2020–2026 (USD Thousand)

Table 11 Shape-Memory Materials Market, By Region, 2020–2026 (USD Thousand)

Table 12 Market, By Technology, 2020–2026 (USD Million)

Table 13 Fused Deposition Modelling 4D Printing Market, By Region, 2020–2026 (USD Million)

Table 14 Polyjet 4D Printing Market, By Region, 2020–2026 (USD Million)

Table 15 Stereolithography 4D Printing Market, By Region, 2020–2026 (USD Million)

Table 16 Selective Laser Sintering 4D Printing Market, By Region, 2020–2026 (USD Million)

Table 17 4D Printing in Healthcare Market, By Application, 2020–2026 (USD Million)

Table 18 Market for Medical and Research Models, By Region, 2020–2026 (USD Million)

Table 19 Market for Surgical Guides, By Region, 2020–2021 (USD Million)

Table 20 4D Printing in Medical Market for Patient-Specific Implants, By Region, 2020–2026 (USD Million)

Table 21 4D Printing in Healthcare Market, By End User, 2020–2026 (USD Million)

Table 22 Market for Dental Laboratories, By Region, 2020–2026 (USD Million)

Table 23 Market for Hospitals & Clinics, By Region, 2020–2026 (USD Thousand)

Table 24 4D Printing in Medical Market for Other End Users, By Region, 2021–2026 (USD Million)

Table 25 Market, By Region, 2020–2026 (USD Million)

Table 26 North America: Market, By Component, 2020–2026 (USD Million)

Table 27 North America: 4D Printing Equipment Market, By Type, 2020–2026 (USD Million)

Table 28 North America: 4D Printing Programmable Materials Market, By Type, 2020–2026 (USD Million)

Table 29 North America: Market, By Technology, 2020–2026 (USD Million)

Table 30 North America: Market, By Application, 2020–2026 (USD Million)

Table 31 North America: Market, By End User, 2020–2026 (USD Million)

Table 32 Europe: 4D Printing in Medical Market, By Component, 2020–2026 (USD Million)

Table 33 Europe: 4D Printing Equipment Market, By Type, 2020–2026 (USD Million)

Table 34 Europe: 4D Printing Programmable Materials Market, By Type, 2020–2026 (USD Million)

Table 35 Europe: Market, By Technology, 2020–2026 (USD Million)

Table 36 Europe: Market, By Application, 2020–2026 (USD Million)

Table 37 Europe: 4D Printing in Medical Market, By End User, 2020–2026 (USD Million)

Table 38 Germany: 4D Printing in Healthcare Market, By Technology, 2020–2026 (USD Million)

Table 39 Germany: Market, By Application, 2020–2026 (USD Million)

Table 40 Germany: Market, By End User, 2020–2026 (USD Million)

Table 41 UK: Market, By Technology, 2020–2026 (USD Million)

Table 42 UK: 4D Printing in Healthcare Market, By Application, 2020–2026 (USD Million)

Table 43 UK: Market, By End User, 2020–2026 (USD Million)

Table 44 RoE: Market, By Technology, 2020–2026 (USD Million)

Table 45 RoE: 4D Printing in Medical Market, By Application, 2020–2026 (USD Million)

Table 46 RoE: lthcare Market, By End User, 2020–2026 (USD Million)

Table 47 Asia: lthcare Market, By Component, 2020–2026 (USD Million)

Table 48 Asia: 4D Printing Equipment Market, By Type, 2020–2026 (USD Million)

Table 49 Asia: 4D Printing Programmable Materials Market, By Type, 2020–2026 (USD Million)

Table 50 Asia: 4D Printing in Healthcare Market, By Technology, 2020–2026 (USD Million)

Table 51 Asia: Market, By Application, 2020–2026 (USD Million)

Table 52 Asia: thcare Market, By End User, 2020–2026 (USD Million)

Table 53 RoW: Market, By Component, 2020–2026 (USD Million)

Table 54 RoW: 4D Printing Equipment Market, By Type, 2020–2026 (USD Thousand)

Table 55 RoW: 4D Printing Programmable Materials Market, By Type, 2020–2026 (USD Thousand)

Table 56 RoW: 4D Printing in Medical Market, By Technology, 2020–2026 (USD Million)

Table 57 RoW: Market, By Application, 2020–2026 (USD Million)

Table 58 RoW: 4D Printing in Healthcare Market, By End User, 2020–2026 (USD Million)

Table 59 Exchange Rate (Used for the Conversion of Eur to USD)

Table 60 Exchange Rate (Used for the Conversion of Eur to USD)

List of Figures (26 Figures)

Figure 1 4D Printing in Healthcare: Market Segmentation

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 4D Printing in Healthcare, By Component, 2021 vs 2026 (USD Million)

Figure 8 4D Printing in Healthcare, By Technology, 2021–2026 (USD Million)

Figure 9 4D Printing in Healthcare, By Application, 2021 vs 2026 (USD Million)

Figure 10 4D Printing in Healthcare, By End User, 2021 vs 2026 (USD Million)

Figure 11 Geographical Snapshot: 4D Printing in Healthcare Market

Figure 12 Technological Advancements in 3D Printing Technology is Driving Market Growth

Figure 13 Software & Services to Dominate the 4D Printing in Healthcare in 2021

Figure 14 North America to Hold the Largest Share of the Market in 2021

Figure 15 North America to Register the Highest Growth During the Forecast Period

Figure 16 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Software & Services Segment Will Continue to Dominate the 4D Printing in Healthcare Market in 2026

Figure 18 FDM to Dominate the the Highest Growth in the Market

Figure 20 North America: 4D Printing in Medical Market Snapshot

Figure 21 Key Developments in the 4D Printing Market Between 2016 and 2019

Figure 22 3D Systems, Inc.: Company Snapshot (2018)

Figure 23 Organovo Holdings, Inc.: Company Snapshot (2018)

Figure 24 Stratasys Ltd.: Company Snapshot (2018)

Figure 25 Dassault Systèmes: Company Snapshot (2018)

Figure 26 Materialise: Company Snapshot (2018)

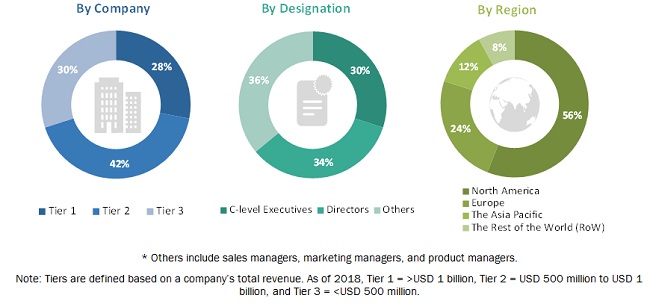

The study involved four major activities in estimating the current size of the global 4D printing in healthcare market. Exhaustive secondary research was done to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing values with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the 4D printing in medical market size of segments and subsegments.

Secondary Research

Secondary research was mainly used to identify and collect information for the extensive, technical, market-oriented, and commercial study of the global market. Secondary sources include directories; databases such as Bloomberg Business, Factiva, and Wall Street Journal; white papers; and annual reports were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects of the market. Various primary sources from both the supply and demand sides of the 4D printing in medical market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the global 4D printing in healthcare market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- 4D was not commercialized until 2018, thus the revenue generated from the sale of 3D printing in healthcare solutions and services by leading players has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall 4D printing in medical market size from the market size estimation process, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the market by component, technology, application, end user, and region

- To provide detailed information regarding the factors influencing the growth of the market (such as drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the 4D printing in the healthcare market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments in North America, Europe, Asia, and the Rest of the World (RoW)2

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies3

- To track and analyze competitive developments, such as product launches; expansions; partnerships, agreements & collaborations; and mergers & acquisitions in the 4D printing in the healthcare market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs.

The following customization options are available for this report.

Company Information

- Detailed analysis and profiling of additional 4D printing in medical market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 4D Printing in Healthcare Market