Outlook of Mergers & Acquisitions, Investments, and Patents in the 3D Printing Market (2010–2016)

The M&A activity in the 3D printing industry has picked up pace in terms of the value as well as the number of deals. The analysis of many M&A deals reveals that 3D printing companies look for small- and mid-sized players that have lower operating expenses compared to their growth potential in the 3D printing industry value chain. Small-to mid-sized companies lacking the scale to grow have become attractive takeover targets for major players. There were maximum M&A deal announcements in 2014; it was a record year since 2010; this was followed by the number of announcements between 2013 and 2015.The information related to mergers and acquisitions in the market was sourced from company websites, press releases, annual reports, and public media. This analysis comprises all individual mergers or acquisitions, their disclosed or undisclosed values, minority stake purchases, and acquisitions of remaining stakes announced between Jauary 2010 and March 2016. The report, based on geography, is segmented into North America, Europe, Asia-Pacific, and Rest of the World (the Middle East & Africa, and South America). Cross-border deals considered in this report are the deals signed between two companies headquartered in different regions. Domestic deals include the deals between two companies headquartered in the same region.

The 3D printing market reached USD 4.98 Billion in 2015, reflecting a year-over-year (Y-o-Y) growth rate of 27.98% over the previous year. The market is expected to grow at a CAGR of 28.46% between 2016 and 2022. The market is expected to be driven by factors, such as ease of developing customized products, benefits of 3D printing, and government investments in 3D printing projects.

3D printing has opportunities in almost all sectors due to its potential benefits over the existing manufacturing technologies. Some of the opportunities for the growth of the 3D printing technology market include applications in manufacturing and supply chain management, and exploring the untapped market in end-user industries such as printed electronics, education, jewelry, energy, and food among others. However, it also faces challenges such as ensuring product quality and limited design tools.

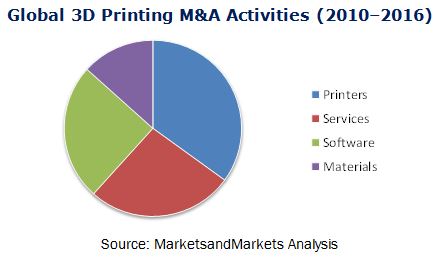

With the increasing adoption of 3D printing technologies, the market also witnessed a great deal of activities in terms of mergers and acquisitions (M&A), investments, and published patents. The printer segment led the market with the highest number of M&A deals, followed by services and software segments. The 3D printing market has been consolidated with established players acquiring small players because of potential technological benefits, and to further increase their market share & explore potential opportunities.

The increasing advancement in technology, improvement in material science, and software development resulted in several companies entering the 3D printing space. Several companies raised funds to develop new technologies to materialize this potential revolution. Investments were flown into companies across various segments of 3D printing, such as 3D printer manufacturers, materials manufacturers, software developers, and service bureaus. The number of funding transactions and the aggregate amount of funds raised increased significantly from 2010 to 2015 and are expected to further increase in 2016. Several start-up companies have pooled a significant amount of investment through crowd funding activities and private investors.

The industry is witnessing rapid developments in the 3D printing technology and material science. Several companies and universities are focused on R&D and have successfully launched new printing materials in the market. Several individuals have filed patents and the number of patent publications by both individuals and companies & universities has increased considerably over the past five years and is expected to further increase over the next five years.

Some of the major companies, operating in the 3D printing market, included in the report are 3D Systems Corporation (U.S.), Stratasys Ltd. (U.S.), ExOne (U.S.), Voxeljet AG (Germany), Arcam AB (Sweden), SLM Solutions GmbH (Germany), EOS GmbH (Germany), EnvisionTEC GmbH (Germany), Materialise NV (Belgium), Concept Laser GmbH (Germany), Autodesk, Inc. (U.S.), and Koninklijke DSM N.V. (Netherlands) among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Study Scope

1.3 Currency

1.4 Stakeholders

2 Research Methodology (Page No. - 15)

3 Executive Summary (Page No. - 16)

4 M&A Analysis of 3D Printing Industry (Page No. - 19)

4.1 Introduction

4.2 3D Printing M&A Analysis, By Region (2010–2016)

4.2.1 North America

4.2.2 Europe

5 Investment Analysis of 3D Printing Industry (Page No. - 27)

5.1 Introduction

5.2 3D Printing: Investment Analysis

5.3 3D Printing Investment Analysis, By Region (2010–2016)

5.4 List of Investments in the 3D Printing Industry (2010—2016)

6 Patent Analysis of 3D Printing Industry (Page No. - 41)

6.1 Introduction

6.2 Top Five Assignees of Published Patents of 3D Printing

7 Company Profiles (Page No. - 47)

(Overview, Products and Services, Financials, Strategy & Development)*

7.1 Introduction

7.2 Stratasys Ltd.

7.3 3D Systems Corporation

7.4 Materialise NV

7.5 EOS GmbH

7.6 The Exone Company

7.7 Voxeljet AG

7.8 Arcam Group

7.9 SLM Solutions Group AG.

7.10 Envisiontec GmbH

7.11 Sciaky Inc

7.12 Proto Labs

7.13 Mcor Technologies Ltd

7.14 Microtec Gesellschaft Für Mikrotechnologie Mbh

7.15 Optomec Inc.

7.16 Organovo Holdings Inc.

7.17 Reprap

7.18 Ultimaker Bv

7.19 Oxford Performance Materials Inc.

7.20 3D Ceram

7.21 3Dponics Inc.

7.22 Renishaw PLC.

7.23 Xyzprinting

7.24 ARC Group Worldwide, Inc.

7.25 Autodesk, Inc.

7.26 Koninklijke DSM N.V.

7.27 Concept Laser GmbH

7.28 Luxexcel Group Bv

7.29 Printrbot Inc

7.30 Leapfrog 3D Printers

7.31 Afinia 3D

7.32 Solidoodle LLC

7.33 Arevo Labs

7.34 TLC Korea Co., Ltd.

7.35 Evonik Industries AG

7.36 Beijing Tiertime Technology Co., Ltd.

7.37 Taulman3D, LLC

7.38 the Argen Corporation

7.39 Arkema S.A.

7.40 Shapeways, Inc.

7.41 Höganäs AB

7.42 Formlabs Inc.

7.43 Scuplteo

7.44 Natural Machines

7.45 Wiivv Wearables Inc.

7.46 Dassault Systemes Sa

7.47 Groupe Gorgé

7.48 Zhejiang Flashforge 3D Technology Co., Ltd.

7.49 Neotech Amt GmbH

7.50 Nano Dimension

7.51 Graphene 3D Lab Inc.

7.52 Sols Systems

7.53 Alcoa Inc.

7.54 Cookson Precious Metals Ltd.

7.55 Canon Inc.

7.56 HP Inc

7.57 General Electric Company

7.58 Shenzhen Hueway Technology Co., Ltd.

7.59 Amazon.Com, Inc.

7.60 Shining 3D

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

List of Tables (16 Tables)

Table 1 Investments in the 3D Printing Market: 2010–2016

Table 2 List of Companies Which Have Raised Funds, 2010–2016

Table 3 Stratasys Limited: Financial Statement, 2012–2015

Table 4 3D Systems Corporation: Financial Statement, 2012–2015

Table 5 Materialize NV: Financial Statement, 2012–2014

Table 6 Exone Company : Financial Statement, 2012–2015

Table 7 Voxeljet AG: Financial Statement, 2012–2015

Table 8 Arcam Group: Financial Statement, 2012–2015

Table 9 SLM Solutions Group AG: Financial Statement, 2013–2015

Table 10 Proto Labs : Financial Statement, 2011–2014 (USD Million)

Table 11 Organovo Holdings Inc.: Financial Statement, 2011–2014 (USD Million)

Table 12 Renishaw PLC.: Financial Statement, 2012–2015

Table 13 ARC Group Worldwide, Inc.: Financial Statement, 2011–2014

Table 14 Koninklijke DSM N.V.: Financial Statement, 2012–2015

Table 15 Evonik Industries AG: Financial Statement, 2012–2015 (USD Million)

Table 16 Amazon.Com, Inc.: Financial Statement, 2011–2014 (USD Million)

List of Figures (66 Figures)

Figure 1 Global 3D Printing M&A Activities (2010–2016)

Figure 2 Global 3D Printing Investment Activities (2010–2016)

Figure 3 Global 3D Printing Published Patents (2010–2016)

Figure 4 M&A Deals in the 3D Printing Industry (2010–2016)

Figure 5 Cross-Border vs. Domestic M&A Deals in the 3D Printing Industry (2010–2016)

Figure 6 M&A Deals in the 3D Printing Industry, By Segment (2010–2016)

Figure 7 M&A Deals in the 3D Printing Industry, By Segment (2010–2016)

Figure 8 M&A Deals in the 3D Printing Industry, By Region (2010–2016)

Figure 9 M&A Deals in the 3D Printing Industry in North America

Figure 10 M&A Deals in the 3D Printing Industry in North America, By Segment (2010–2016)

Figure 11 M&A Deals in the 3D Printing Industry in Europe (2010–2015)

Figure 12 M&A Deals in the 3D Printing Industry in Europe, By Segment (2010–2016)

Figure 13 Investments in the 3D Printing Industry, By Value and Volume

Figure 14 Aggregate Capital Raised Through Private Equity Funds, By Primary Geographic Focus (2010–2016)

Figure 15 Early-Stage Funding Accelerated With the Increase in the Number of Start-Ups Since 2010

Figure 16 3D Printing Investments, By Fund Size (2010–2016)

Figure 17 Year-Wise Funding, By Fund Size (2010–2016)

Figure 18 3D Printing Investment, By Region (2010–2016)

Figure 19 Year-Wise Investments, By Funding Stage (2010–2016)

Figure 20 Region-Wise Investments, By Value and Volume (2010–2016)

Figure 21 3D Printing Investments in North America, By Fund Size (2010–2016)

Figure 22 3D Printing Investments in Europe, By Fund Size (2010–2016)

Figure 23 3D Printing Investments in Asia-Pacific, By Fund Size (2010–2016)

Figure 24 Funds Raised By 3D Printing Companies, By Their Year of Establishment

Figure 25 3D Printing Patent Publications (2010–2016)

Figure 26 3D Printing Patents Publications, By Company & University and Individual

Figure 27 Top Assignees of 3D Printing Patent Publications (2010–2016)

Figure 28 3D Printing Patents By Top Assignees (2010–2016)

Figure 29 Stratasys Ltd.: Published Patents

Figure 30 3D Systems Corporation: Published Patents

Figure 31 Voxeljet: Published Patents

Figure 32 EOS GmbH: Published Patents

Figure 33 Arcam AB: Published Patent

Figure 34 Industries Served By Top 3D Printing Companies

Figure 35 Stratasys Limited: Company Snapshot

Figure 36 Stratasys Limited: SWOT Analysis

Figure 37 3D Systems Corporation: Company Snapshot

Figure 38 3D Systems Corporation: SWOT Analysis

Figure 39 Materialise NV: Company Snapshot

Figure 40 Materialise NV: SWOT Analysis

Figure 41 EOS GmbH: SWOT Analysis

Figure 42 The Exone Company: Company Snapshot

Figure 43 The Exone Company: SWOT Analysis

Figure 44 Voxeljet AG: Company Snapshot

Figure 45 Voxeljet AG: SWOT Analysis

Figure 46 Arcam Group: Company Snapshot

Figure 47 Arcam Group: SWOT Analysis

Figure 48 SLM Solutions Group AG: Company Snapshot

Figure 49 SLM Solutions Group AG: SWOT Analysis

Figure 50 Envisiontec GmbH: SWOT Analysis

Figure 51 Sciaky Inc: SWOT Analysis

Figure 52 Proto Labs: Company Snapshot

Figure 53 Organovo Holdings Inc.: Company Snapshot

Figure 54 Renishaw PLC.: Company Snapshot

Figure 55 ARC Group Worldwide, Inc.: Company Snapshot

Figure 56 Autodesk, Inc.: Company Snapshot

Figure 57 Koninklijke DSM N.V.: Company Snapshot

Figure 58 Evonik Industries AG: Company Snapshot

Figure 59 Arkema S.A.: Company Snapshot

Figure 60 Dassault Systèmes: Company Snapshot

Figure 61 Groupe Gorgé: Company Snapshot

Figure 62 Alcoa Inc.: Company Snapshot

Figure 63 Canon Inc.: Company Snapshot

Figure 64 HP Inc.: Company Snapshot

Figure 65 General Electric Company: Company Snapshot

Figure 66 Amazon: Company Snapshot

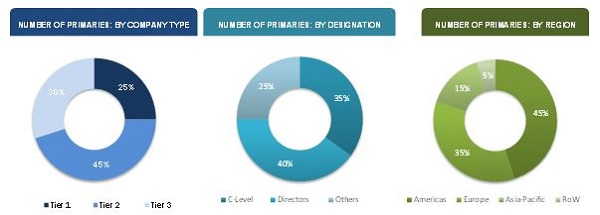

This research study involves the extensive usage of secondary sources to identify and collect information useful for this technical, market-oriented, and commercial study of the 3D printing market. The primary sources are mainly several experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, reimbursement providers, technology developers, alliances, and standard & certification organizations related to all the segments of this industry’s value chain. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key players, and consultants among other experts to obtain and verify critical qualitative and quantitative information as well as assess future prospects.

The term deal value (either in M&A deals or investment deals), when referenced herein, refers to deals with a disclosed value in USD million. While estimating global transactional activities, mostly, the data on completed deals has been considered rather than announced deal values as it reflects the actual outcome.

The breakdown of profiles of primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The Target Audience for the report includes:

- 3D printing products and solutions providers

- 3D printing-related service providers

- 3D printing materials and accessories providers

- 3D printing consulting companies

- Private and institutional investors

- 3D printing assembly companies

- 3D printing software providers

- 3D printing-related associations, organizations, forums, and alliances

- Governments and corporate offices

- Venture capitalists, private equity firms, and startup companies

- Distributors and traders

- End users who want to know more about M&A and investment trends in the 3D printing market

Scope of the Report:

This research report segments mergers and acquisitions, investments, and patent publications in the 3D printing market during the period between 2010 and the first quarter of 2016 into following categories:

Merger and Acquisition in the 3D Printing Market

- By Segment

- By Cross-Border and Domestic deals

- By Region

- By Deal Volume

Investments in the 3D Printing Market

- By Fund Size

- By Funding Stage

- By Region

- By Deal Value and Volume

Patents in the 3D Printing Market

- By Patent Published

- By Top Companies

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Analysis of the patents of the next major five companies in the 3D printing market.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Outlook of Mergers & Acquisitions, Investments, and Patents in the 3D Printing Market

Dear Representative, Could you clarify which private equity firms are interested in acquiring 3D printing players?

Currently we are very interested in finding information about the 3D industry in Mexico, therefore if your report have some information about it we will be really driven to purchase it.

We are a 3D printing start up looking for the most valid information on the M&A trends in the market.

We are trying to enter into the 3D printing market and would like to identify best fit for acquisition. What were the parameters considered for analyzing the listed companies? Would like a detailed description on that. Further, can we have analysis of few more companies of our choice?