3D Concrete Printing Market by Offering (Printing Services, Materials), Technique (Extrusion-based, Powder-based), End-use sector (Building, Infrastructure) and Region (Americas, Asia Pacific, Europe, Middle East) - Global Forecast to 2023

Updated on : February 16, 2023

3D concrete printing market was valued at USD 1.2 million in 2018 and is projected to reach USD 1,480.5 million by 2023, growing at a cagr 317.3% from 2018 to 2023. The base year considered for the study is 2017 and the forecast period is from 2018 to 2023.

The report aims at estimating the market size and future growth potential of the 3D concrete printing market across different segments on the basis of offering, technique, end-use sector, and region. It also provides detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges). The report further aims to study individual growth trends, future prospects, and contribution of various segments to the overall market. The study also analyzes the opportunities in the market for stakeholders and provides details of the competitive landscape for market leaders. It strategically profiles key players and comprehensively analyzes their core competencies.

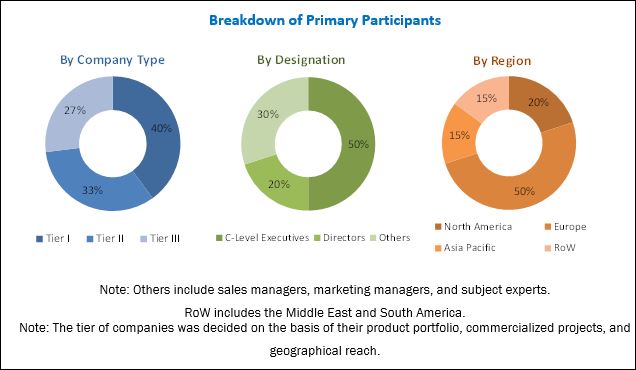

The research methodology used to estimate and forecast the size of the market started with capturing data on 3D concrete printed projects, value of each commercialized 3D concrete printed project through secondary research from sources such as companies’ websites, articles on 3D concrete printing, and partnership reports on 3D printed construction. Vendor offerings were taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall size of the market by estimating the value of each 3D concrete printed project. After arriving at the overall market size, the total market was split into the offerings segment, which was then verified through primary research by conducting extensive interviews with key personnel, such as CEOs, VPs, directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The market ecosystem includes various stakeholders involved in the supply chain of the 3D concrete printing market—starting from the procurement of raw materials to final product manufacturing. Post this, the marketing and sales of products take place, which is possible if an efficient distribution channel is developed. Finally, end products are made available to potential end users. The market for 3D concrete printing is led by major players such as Winsun (China), XtreeE (France), Monolite UK (UK), Apis Cor (Russia), CSP s.r.l. (Italy), CyBe Construction (Netherlands), and Sika (Switzerland).

Target Audience

- Raw material suppliers

- 3D concrete printer manufacturers

- 3D concrete printing service providers

- End users

- Associations and industry bodies

- Government & regulatory bodies

Scope of the Report:

The 3D concrete printing market has been segmented into the following submarkets:

By Offering:

- Printing services

- Materials

By Technique:

- Extrusion-based

- Powder-based

By End-use Sector:

- Building

- Infrastructure

By Region:

- Americas

- Europe

- Asia Pacific

- Middle East

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the 3D concrete printing report:

Product Analysis

- Product Matrix which offers a detailed comparison of product portfolio of each company

Geographic Analysis

- Analysis of the potential upcoming 3D concrete printed projects

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets projects that the 3D concrete printing market will grow from USD 1.2 million in 2018 to USD 1,480.5 million by 2023, at a CAGR of 317.3%. Rapid urbanization and the demand for affordable housing and architectural flexibility drive the growth of the 3D concrete printing market. The building sector is projected to account for a larger share through 2023. The cost-effectiveness and time-saving characteristics of this technology have contributed toward its usage for developing buildings. Furthermore, its capability to develop complex building geometries, better safety, more precision, and generate less waste has resulted in the construction of complex building structures at an affordable rate.

The segmentation for this report is based on offering, by technique, end-use sector, and region. The building sector is projected to be the fastest-growing segment in the 3D concrete printing market. In this sector, the demand for 3D concrete printing is expected to be driven by the demand for complex building structures and affordable housing. This technology helps in creating lightweight components such as walls and panels, while maintaining the structural integrity and results in lower handling & transportation costs.

On the basis of technique, the market has been segmented into extrusion-based and powder-based. Each printing technique differs from each other on the basis of its advantages and limitations. In 2017, the extrusion-based technique accounted for the largest share of the 3D concrete printing market. Due to their capability to produce large-scale building components with complex geometrical structures and the usage of conventional construction materials, the extrusion-based technique has become the most widely employed 3D concrete printing technique for buildings and infrastructure.

The building sector dominated the market in 2017, in terms of both value and volume, as a result of the rising need for affordable houses, coupled with the trend toward the development of complex building structures. This sector is also projected to grow at the highest CAGR during the forecast period.

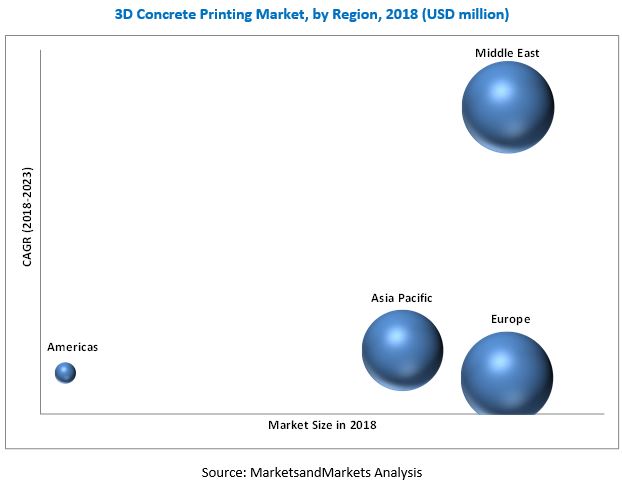

Europe dominated the 3D concrete printing market in 2017, in terms of value. Russia contributes a major share to the European market. The rise in new residential construction activities and increase in demand for complex building structures at affordable costs are driving the demand for 3D concrete printing in the region. The presence of key market players such as XtreeE (France), Monolite UK (UK), Apis Cor (Russia), CyBe Construction (Netherlands), and Sika (Switzerland) further contributes to the leading share of Europe in the global market.

The Middle East is projected to be the fastest-growing market for 3D concrete printing from 2018 to 2023. The supportive government initiatives such as “Dubai 3D Printing Strategy,” high labor costs, and demand for affordable homes from middle and low-income groups drive the growth of the 3D concrete printing market here. In 2017, the UAE was the largest country-level market in the region.

Lack of awareness about automation techniques in the construction industry acts as the major challenge in the growth of the market. The global 3D concrete printing market is dominated by players such as Winsun (China), XtreeE (France), Monolite UK (UK), Apis Cor (Russia), CSP s.r.l. (Italy), CyBe Construction (Netherlands), and Sika (Switzerland).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Periodization Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the 3D Concrete Printing Market

4.2 Market: By End-Use Sector

4.3 Market: By Technique

4.4 Market: By Country & End-Use Sector

4.5 Market: Geographic Snapshot

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Potential for Mass Customization and Enhanced Architectural Flexibility

5.2.1.2 Reduction in Health & Safety Risks and Rate of Accidents

5.2.1.3 Inherently Green Technology

5.2.2 Restraints

5.2.2.1 High Capital Investment

5.2.3 Opportunities

5.2.3.1 Rise in Demand for New Construction Projects Across Regions

5.2.3.2 Rapid Urbanization

5.2.4 Challenges

5.2.4.1 Lack of Awareness About Automation Techniques in the Construction Industry

5.2.4.2 Proper Material Development

5.2.4.3 Poor Surface Finish

5.2.4.4 Limited Size of the Printers

6 Industry Trends (Page No. - 37)

6.1 Introduction

6.2 Porter’s Five Forces Analysis

6.2.1 Threat of New Entrants

6.2.2 Threat of Substitutes

6.2.3 Bargaining Power of Suppliers

6.2.4 Bargaining Power of Buyers

6.2.5 Intensity of Competitive Rivalry

6.3 Macroeconomic Indicators

6.3.1 Introduction

6.3.2 Rising Population

6.3.3 Increase in Middle-Class Population, 2009–2030

6.3.4 Trends and Forecast of GDP

6.3.5 Contribution of the Construction Industry to the GDP, By Country

7 3D Concrete Printing Market, By Offering (Page No. - 43)

7.1 Introduction

7.2 Materials

7.3 Printing Services

8 3D Concrete Printing Market, By Technique (Page No. - 46)

8.1 Introduction

8.2 Extrusion-Based Technique

8.3 Powder-Based Technique

9 3D Concrete Printing Market, By End-Use Sector (Page No. - 51)

9.1 Introduction

9.2 Building

9.3 Infrastructure

10 3D Concrete Printing Market, By Region (Page No. - 54)

10.1 Introduction

10.1.1 3D Concrete Printing Market Size, By Region

10.2 Commercialized Markets

10.2.1 Europe

10.2.1.1 Russia

10.2.1.2 France

10.2.1.3 Denmark

10.2.1.4 Spain

10.2.1.5 Netherlands

10.2.1.6 Italy

10.2.2 Middle East

10.2.2.1 UAE

10.2.2.2 Saudi Arabia

10.2.3 Asia Pacific

10.2.3.1 China

10.2.3.2 Thailand

10.2.3.3 Philippines

10.2.4 Americas

10.2.4.1 US

10.2.4.2 EL Salvador

10.3 Potential Markets

10.3.1 India

10.3.2 Japan

10.3.3 Brazil

10.3.4 Egypt

11 Competitive Landscape (Page No. - 85)

11.1 Overview

11.3 Market Ranking

11.4 Potential Projects

11.5 Competitive Scenario

11.5.1 New Projects

11.5.2 Agreements

11.5.3 Partnerships

11.5.4 Joint Ventures

11.5.5 Expansions

12 Company Profiles (Page No. - 92)

12.1 Yingchuang Building Technique (Winsun)

12.1.1 Business Overview

12.1.2 Projects Undertaken

12.1.3 Recent Developments

12.1.4 SWOT Analysis

12.1.5 MnM View

12.2 Xtreee

12.2.1 Business Overview

12.2.2 Projects Undertaken

12.2.3 Recent Developments

12.2.4 SWOT Analysis

12.2.5 MnM View

12.3 Monolite UK (D-Shape)

12.3.1 Business Overview

12.3.2 Projects Undertaken

12.3.3 Recent Developments

12.3.4 SWOT Analysis

12.3.5 MnM View

12.4 Apis Cor

12.4.1 Business Overview

12.4.2 Projects Undertaken

12.4.3 Recent Developments

12.4.4 SWOT Analysis

12.4.5 MnM View

12.5 CSP S.R.L. (Centro Sviluppo Progetti)

12.5.1 Business Overview

12.5.2 Projects Undertaken

12.5.3 Recent Developments

12.5.4 MnM View

12.6 Cybe Construction

12.6.1 Business Overview

12.6.2 Products Offeredand Projects Undertaken

12.6.3 Recent Developments

12.6.4 MnM View

12.7 Sika

12.7.1 Business Overview

12.7.2 Products Offered

12.7.3 Recent Developments

12.7.4 MnM View

12.8 Other Players

12.8.1 Betabram

12.8.2 Rohaco

12.8.3 Imprimere AG

12.8.4 Beijing Huashang Luhai Technology

12.8.5 Icon

12.8.6 Total Kustom

12.8.7 Spetsavia

12.8.8 Contour Crafting

12.8.9 Cazza Construction Technologies

12.8.10 Be More 3D

12.8.11 3D Printhuset

12.8.12 Acciona

13 Appendix (Page No. - 113)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (79 Tables)

Table 1 Conversion Rates, 2014–2017

Table 2 Regional Urbanization Prospects

Table 3 GDP (Current Prices), By Country, 2015–2022 (USD Billion)

Table 4 North America: Contribution of the Construction Industry to GDP, By Country, 2014–2021 (USD Billion)

Table 5 Europe: Contribution of Construction Industry to GDP, By Country, 2014–2021 (USD Billion)

Table 6 Asia Pacific: Contribution of Construction Industry to GDP, By Country, 2014–2021 (USD Billion)

Table 7 Middle East & Africa: Contribution of Construction Industry to GDP, By Country, 2014–2021 (USD Billion)

Table 8 South America: Contribution of Construction Industry to GDP, By Country, 2014–2021 (USD Billion)

Table 9 3D Concrete Printing Market Size, By Offering, 2016–2023 (USD Thousand)

Table 10 By Market Size, By Technique, 2016–2023 (USD Thousand)

Table 11 By Market Size, By Technique, 2016–2023 (Square Meter)

Table 12 By Market Size, By End-Use, 2016–2023 (USD Thousand)

Table 13 By Market Size, By End-Use Sector, 2016–2023 (Square Meter)

Table 14 By Market Size, By Region, 2016–2023 (USD Thousand)

Table 15 By Market Size, By Region, 2016–2023 (Square Meter)

Table 16 Europe: By Market Size, By Country, 2016–2023 (USD Thousand)

Table 17 Europe: By Market Size, By Country, 2015–2022 (Square Meters)

Table 18 Europe: By Market Size, By Offering, 2016–2023 (USD Thousand)

Table 19 Europe: By Market Size, By End-Use Sector, 2016–2023 (USD Thousand)

Table 20 Europe: By Market Size, By End-Use Sector, 2016–2023 (Square Meters)

Table 21 3D Concrete Printed Projects in Russia

Table 22 Russia: 3D Concrete Printing Market Size, By End-Use Sector, 2016–2023 (USD Thousand)

Table 23 Russia: By Market Size, By End-Use Sector, 2016–2023 (Square Meter)

Table 24 3D Concrete Printed Projects in France

Table 25 France: By Market Size, By End-Use Sector, 2016–2023 (USD Thousand)

Table 26 France: By Market Size, By End-Use Sector, 2016–2023 (Square Meter)

Table 27 3D Concrete Printed Projects in Denmark

Table 28 Denmark: 3D Concrete Printing Market Size, By End-Use Sector, 2016–2023 (USD Thousand)

Table 29 Denmark: By Market Size, By End-Use Sector, 2016–2023 (Square Meter)

Table 30 3D Concrete Printed Projects in Spain

Table 31 Spain: By Market Size, By Technique, 2016–2023 (USD Thousand)

Table 32 Spain: By Market Size, By Technique, 2016–2023 (USD Thousand)

Table 33 Spain: By Market Size, By End-Use Sector, 2016–2023 (USD Thousand)

Table 34 Spain: By Market Size, By End-Use Sector, 2016–2023 (Square Meters)

Table 35 3D Concrete Printed Projects in the Netherlands

Table 36 Netherlands: By Market Size, By End-Use Sector, 2016–2023 (USD Thousand)

Table 37 Netherlands: By Market Size, By End-Use Sector, 2016–2023 (Square Meter)

Table 38 3D Concrete Printed Projects in Italy

Table 39 Italy: By Market Size, By End-Use Sector, 2016–2023 (USD Thousand)

Table 40 Italy: By Market Size, By End-Use Sector, 2016–2023 (Square Meter)

Table 41 Middle East: By Market Size, By Country, 2016–2023 (USD Thousand)

Table 42 Middle East: By Market Size, By Country, 2016–2023 (Square Meter)

Table 43 Middle East: By Market Size, By Offering, 2016–2023 (USD Thousand)

Table 44 Middle East: By Market Size, By End-Use Sector, 2016–2023 (USD Thousand)

Table 45 Middle East & Africa: 3D Concrete Printing Market Size, By End-Use Sector, 2016–2023 (Square Meters)

Table 46 UAE: 3D Concrete Printed Projects

Table 47 UAE: By Market Size, By End-Use Sector, 2016–2023 (USD Thousand)

Table 48 UAE: By Market Size, By End-Use Sector, 2016–2023 (Square Meters)

Table 49 Saudi Arabia: By Market Size, By End-Use Sector, 2016–2023 (USD Thousand)

Table 50 Saudi Arabia:By Market Size, By End-Use Sector, 2016–2023 (Square Meters)

Table 51 Asia Pacific: By Market Size, By Country, 2016–2023 (USD Thousand)

Table 52 Asia Pacific: By Market Size, By Country, 2016–2023 (Square Meter)

Table 53 Asia Pacific: By Market Size, By Offering, 2016–2023 (USD Thousand)

Table 54 Asia Pacific: By Market Size, By End-Use Sector, 2016–2023 (USD Thousand)

Table 55 Asia Pacific: 3D Concrete Printing Market Size, By End-Use Sector, 2016–2023 (Square Meter)

Table 56 3D Concrete Printed Projects in China

Table 57 China: By Market Size, By End-Use Sector, 2016–2023 (USD Thousand)

Table 58 China: By Market Size, By End-Use Sector, 2016–2023 (Square Meter)

Table 59 Thailand: By Market Size, By Technique, 2016–2023 (USD Thousand)

Table 60 Thailand: By Market Size, By Technique, 2016–2023 (Square Meter)

Table 61 Thailand: By Market Size, By End-Use Sector, 2016–2023 (USD Thousand)

Table 62 Thailand: By Market Size, By End-Use Sector, 2016–2023 (Square Meter)

Table 63 Americas: By Market Size, By Country, 2016–2023 (USD Thousand)

Table 64 Americas: 3D Concrete Printing Market Size, By Country, 2016–2023 (Square Meter)

Table 65 Americas: By Market Size, By End-Use Sector, 2016–2023 (USD Thousand)

Table 66 Americas: By Market Size, By End-Use Sector, 2016–2023 (Square Meter)

Table 67 Americas: By Market Size, By Offering, 2016–2023 (USD Thousand)

Table 68 3D Concrete Printed Projects in the Us

Table 69 US: By Market Size, By End-Use Sector, 2016–2023 (USD Thousand)

Table 70 US: 3D Concrete Printing Market Size, By End-Use Sector, 2016–2023 (Square Meter)

Table 71 EL Salvador: By Market Size, By End-Use Sector, 2016–2023 (USD Thousand)

Table 72 EL Salvador: By Market Size, By End-Use Sector, 2016–2023 (Square Meter)

Table 73 Market Ranking of Key Players

Table 74 Potential Projects

Table 75 New Projects

Table 76 Agreements

Table 77 Partnerships

Table 78 Joint Ventures

Table 79 Expansions

List of Figures (27 Figures)

Figure 1 3D Concrete Printing Market Segmentation

Figure 2 Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 3D Concrete Printing Market: Data Triangulation

Figure 6 Building Construction Sector is Projected to Be the Largest in the Global Market, By 2023

Figure 7 3D Concrete Printing Market, By Technique, is Estimated to Be Dominated By the Extrusion-Based Segment in 2018

Figure 8 Printing Services in the Market is Projected to Grow at A Higher Rate During the Forecast Period

Figure 9 Europe Dominated the 3D Concrete Printing Market in 2017

Figure 10 Rise in Demand for Affordable Homes to Drive the Market

Figure 11 Building Sector to Record Robust Growth in the 3D Concrete Printing Market By 2023

Figure 12 Extrusion-Based Technique to Lead the Market Through 2023

Figure 13 Building Sector Held the Largest Share in Americas in 2017, in Terms of Volume

Figure 14 Market in Middle East is Projected to Grow at the Highest Rate From 2018 to 2023

Figure 15 3D Concrete Printing Market: Drivers, Restraints, Opportunities,And Challenges

Figure 16 Porter’s Five Forces Analysis

Figure 17 3D Concrete Printing Market Size, By Offering, 2018 vs 2023 (USD Thousand)

Figure 18 By Market Size, By Technique, 2018 vs 2023 (USD Thousand)

Figure 19 By Market Size, By End-Use Sector, 2018 vs 2023 (USD Thousand)

Figure 20 Regional Snapshot: UAE is Projected to Be the Fastest-Growing Country-Level Market, 2018–2023

Figure 21 Europe: 3D Concrete Printing Market Snapshot

Figure 22 Companies Adopted Various Growth Strategies From 2017 to 2018

Figure 23 Yingchuang Building Technique (Winsun): SWOT Analysis

Figure 24 Xtreee: SWOT Analysis

Figure 25 Monolite UK (D-Shape): SWOT Analysis

Figure 26 Apis Cor: SWOT Analysis

Figure 27 Sika: Company Snapshot

Growth opportunities and latent adjacency in 3D Concrete Printing Market