Managed Pressure Drilling Services Market by Technology (Constant Bottom Hole Pressure, Dual Gradient Drilling, Mud Cap Drilling, Return Flow Control Drilling), Application (Onshore & Offshore), and Region - Global Trends and Forecasts to 2021

[138 Pages Report] The size of the global managed pressure drilling services market is projected to reach USD 4.60 Billion by 2021, at a CAGR of 3.8% during the forecast period. North America was the largest market in 2015, owing to extensive offshore activities in the Gulf of Mexico region; this trend is projected to continue till 2021. The market has been segmented on the basis of technology, application, and region. The years considered for the study are:

- Historical Year 2014

- Base Year 2015

- Estimated Year 2016

- Projected Year 2021

- Forecast Period From 2016 to 2021

For company profiles, 2015 has been considered as the base year for calculating market share and the competitive landscape. Where information is unavailable for the base year, the prior year has been considered.

Research Methodology:

- Major regions have been identified along with countries contributing the maximum share, based on the prevalence of relevant applications

- Secondary research has been conducted to find the market size for different regions, calculated by taking into account the regional break-up of demand and consumption, further validating it with region-wise presence of managed pressure drilling service companies in those regions and their corresponding revenues

- Primary interviews from manufacturers and suppliers helped to obtain and verify critical qualitative & quantitative information as well as assess future market prospects. Information obtained has been used to estimate the share of different segments of managed pressure drilling services in regional markets

- The revenue of the top companies (regional/global), product pricing, and industry trends along with top-down, bottom-up, and MnM KNOW have been used to estimate the market size

The figure below shows the breakdown of the primaries on the basis of company type, designation, and region, conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

The managed pressure drilling services market ecosystem includes raw material suppliers, comprising electronic/electrical components, metals, and sensors among others. In the later stage, manufacturing of managed pressure drilling service takes place where all raw materials are assembled. These devices are then distributed to distribution utilities, industries, and T&D companies.

Target Audience:

The report caters to following audiences:

- Managed pressure drilling services equipment manufacturers, dealers, and suppliers

- Manufacturing, oil & gas, mining, and process industries

- Consulting companies in the energy and power sector

- State and national regulatory authorities

Study answers several questions for the stakeholders, primarily which market segments to focus on in the next 25 years for prioritizing efforts and investments.

Scope of the Report:

- By Application:

- Onshore

- Offshore

- By Technology

- Constant Bottom Hole Pressure (CBHP)

- Mud Cap Drilling (MCD)

- Dual Gradient Drilling (DGD)

- Return Flow Control Drilling (RFCD)

- By Region

- North America

- Europe

- Asia-Pacific

- Middle East

- Latin America

- Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for the report:

- Further segmentation and analysis of managed pressure drilling service based on end-use industry

- Detailed analysis and profiling of additional market players (Up to 5)

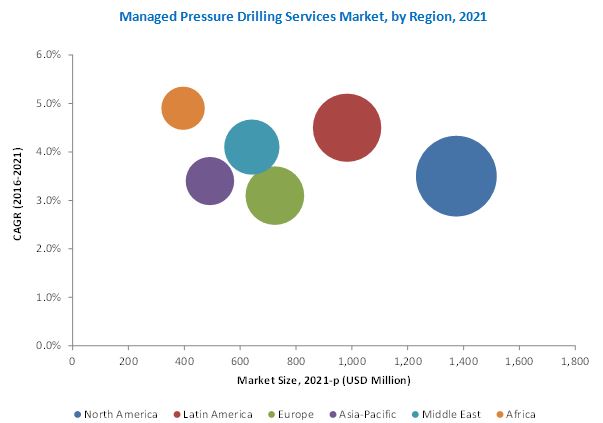

The global managed pressure drilling services market is projected to witness high growth on account of growing need for optimized drilling processes and safe & effective operational aspects of managed pressure drilling. The global market is estimated to be USD 3.81 Billion in 2016, and is projected to reach USD 4.60 Billion by 2021, at a CAGR of 3.8% from 2016 to 2021. Deepwater drilling in Africa and Latin America is expected to boost the demand for managed pressure drilling services during the forecast period. The North American market is also projected to grow at a moderate pace, aided by large-scale spending for the development of unconventional resources, such as shale plays, where managed pressure drilling is used to access difficult formation and drill wells in the most economical way.

Among various technologies of managed pressure drilling service, the Constant Bottom Hole Pressure (CBHP) segment is expected to have the largest market share during the forecast period; it is also expected to grow at the highest CAGR during the same period. This growth is attributed to extensive utilization of the technology for drilling offshore wells across the U.S. Gulf of Mexico as well as in other regions of the world. The market for Dual Gradient Drilling (DGD) technology is also projected to grow at a fast pace, owing to its utility in mitigating formation damage in deepwater drilling.

In terms of application, the offshore segment held the largest share in the market in 2015; this segment is expected to continue its dominance in the market during the forecast period. This can be attributed to the frequent use of managed pressure drilling in High Pressure High Temperature (HPHT) wells and deepwater resources. This segment is expected to account for nearly two-third of the total market in 2016.

North America is expected to dominate the market throughout the forecast period, due to technological capabilities and the ability to invest huge capital. There has been a 15% increase in U.S. crude oil production levels between 2013 and 2014. The U.S. accounts for a major portion of the drilling activities in the region. On the other hand, the African market is likely to have the fastest growth during the forecast period as increased production in West Africa is expected to counter the production decline from the North African region.

Managed pressure drilling service are used to maintain accurate control of wellbore pressure. The sudden downturn in crude oil prices since July, 2014 has negatively impacted the oil & gas industry, leading to a reduction in capital expenditure and cancelled contracts.

Leading players in the market such as Weatherford International (U.S.), Schlumberger (U.S.), Baker Hughes (U.S.), Halliburton (U.S.), and Aker Solutions (Norway) have used different strategies to gain market share and cope with difficult market conditions. The recent consolidation in the industry led by the proposed Halliburton-Baker merger is expected to alter the competitive dynamics of the market in favor of large organizations. All the leading players in the managed pressure drilling services market have been profiled in the report with detailed analyses of their strategies, strengths, weaknesses, opportunities, and threats.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.4.1 Package Size

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Factor Analysis for Managed Pressure Drilling Services

2.2.1 Increasing Number of High-Pressure/High-Temperature Projects Worldwide

2.3 Secondary Data

2.3.1 Key Data From Secondary Sources

2.4 Primary Data

2.4.1 Key Data From Primary Sources

2.4.2 Key Industry Insights

2.4.3 Breakdown of Primaries

2.5 Market Size Estimation

2.5.1 Bottom-Up Approach

2.5.2 Top-Down Approach

2.6 Market Breakdown & Data Triangulation

2.7 Research Assumptions & Limitations

2.7.1 Assumptions

2.7.2 Limitations

3 Executive Summary (Page No. - 27)

3.1 Introduction

3.1.1 Current Scenario

3.1.2 Future Outlook

3.1.3 Conclusion

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Managed Pressure Drilling Services Market, 20162021

4.2 North America is Projected to Hold the Largest Market Share in 2021

4.3 Managed Pressure Drilling Services, By Technology, 20162021

4.4 China & Australia Drive the Managed Pressure Drilling Services Industry in Asia-Pacific

4.5 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Technical Overview

5.2.1 Benefits of Managed Pressure Drilling

5.2.2 Categories of Managed Pressure Drilling

5.2.2.1 Proactive Managed Pressure Drilling System

5.2.2.2 Reactive Managed Pressure Drilling System

5.3 Market Segmentation

5.3.1 By Application

5.3.1.1 Onshore

5.3.1.2 Offshore

5.3.2 By Technology

5.3.2.1 Constant Bottom Hole Pressure

5.3.2.2 Mud Cap Drilling

5.3.2.3 Dual Gradient Drilling

5.3.2.4 Return Flow Control Drilling Or Hse Method

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Safe and Cost-Effective

5.4.1.2 Need for Optimized Drilling Operations

5.4.2 Restraints

5.4.2.1 Low Oil Prices

5.4.2.2 Reduced Capital Expenditure

5.4.2.3 High-Cost of Managed Pressure Drilling Equipment

5.4.2.4 Drilled But Uncompleted Wells

5.4.3 Opportunities

5.4.3.1 Increasing Number of Mature Wells

5.4.3.2 Drilling in Complex Formations

5.4.4 Challenges

5.4.4.1 Extended Reach Drilling Applications

5.4.4.2 Limited Planning & Executing Expertise for Managed Pressure Drilling

5.5 Supply Chain Analysis

5.6 Porters Five Forces Analysis

5.6.1 Threat of New Entrants

5.6.2 Threat of Substitutes

5.6.3 Bargaining Power of Suppliers

5.6.4 Bargaining Power of Buyers

5.6.5 Intensity of Competitive Rivalry

6 Managed Pressure Drilling Services, By Technology (Page No. - 46)

6.1 Introduction

6.2 Constant Bottom Hole Pressure

6.3 Dual Gradient Drilling

6.4 Mud Cap Drilling

6.5 Return Flow Control Drilling Or Hse Method

7 Managed Pressure Drilling Services Market, By Application (Page No. - 52)

7.1 Introduction

7.2 Offshore

7.3 Onshore

8 Managed Pressure Drilling Services, By Region (Page No. - 61)

8.1 Introduction

8.2 North America

8.2.1 U.S.

8.2.2 Canada

8.3 Latin America

8.3.1 Argentina

8.3.2 Brazil

8.3.3 Mexico

8.3.4 Rest of Latin America

8.4 Europe

8.4.1 Russia

8.4.2 Norway

8.4.3 U.K.

8.4.4 Rest of Europe

8.5 The Middle East

8.5.1 Saudi Arabia

8.5.2 UAE

8.5.3 Kuwait

8.5.4 Rest of the Middle East

8.6 Asia-Pacific

8.6.1 China

8.6.2 India

8.6.3 Australia

8.6.4 Rest of Asia-Pacific

8.7 Africa

8.7.1 Nigeria

8.7.2 Angola

8.7.3 Ghana

8.7.4 Rest of Africa

9 Competitive Landscape (Page No. - 91)

9.1 Overview

9.2 Competitive Situation & Trends

9.3 Contracts & Agreements

9.4 Expansions

9.5 Mergers & Acquisitions

9.6 New Product Launches

10 Company Profiles (Page No. - 97)

10.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

10.2 Weatherford International Limited

10.3 Halliburton Company

10.4 Baker Hughes Inc.

10.5 Schlumberger Limited

10.6 National Oilwell Varco

10.7 Archer Limited

10.8 Aker Solutions

10.9 Ensign Energy Services Inc.

10.10 Eds Group as (Enhanced Drilling)

10.11 Strata Energy Services Inc.

10.12 Blade Energy Partners

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 126)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Other Developments

11.3.1 Halliburton Company

11.3.2 Schlumberger Limited

11.3.3 Archer Well Services

11.3.4 Aker Solutions

11.4 Knowledge Store: Marketsandmarkets Subscription Portal

11.6 Available Customizations

11.7 Related Reports

List of Tables (65 Tables)

Table 1 Managed Pressure Drilling Services Market Size, By Technology, 20142021 (USD Million)

Table 2 Constant Bottom Hole Pressure: Market Size, By Region, 20142021 (USD Million)

Table 3 Dual Gradient Drilling: Market Size, By Region, 20142021 (USD Million)

Table 4 Mud Cap Drilling: Market Size, By Region, 20142021 (USD Million)

Table 5 Return Flow Control Drilling: Market Size, By Region, 20142021 (USD Million)

Table 6 Market Size, By Application, 20142021 (USD Million)

Table 7 Offshore: Market Size, By Region, 20142021 (USD Million)

Table 8 North America: Offshore Market Size, By Country, 20142021 (USD Million)

Table 9 Latin America: Offshore Market Size, By Country, 20142021 (USD Million)

Table 10 Europe: Offshore Market Size, By Country, 20142021 (USD Million)

Table 11 Asia-Pacific: Offshore Market Size, By Country, 20142021 (USD Million)

Table 12 Middle East: Offshore Market Size, By Country, 20142021 (USD Million)

Table 13 Africa: Offshore Market Size, By Country, 20142021 (USD Million)

Table 14 Onshore: Market Size, By Region, 20142021 (USD Million)

Table 15 North America: Onshore Market Size, By Country, 20142021 (USD Million)

Table 16 Latin America: Onshore Market Size, By Country, 20142021 (USD Million)

Table 17 Middle East: Onshore Market Size, By Country, 2014-2021 (USD Million)

Table 18 Europe: Onshore Market Size, By Country, 20142021 (USD Million)

Table 19 Asia-Pacific: Onshore Market Size, By Country, 20142021 (USD Million)

Table 20 Africa: Onshore Market Size, By Country, 20142021 (USD Million)

Table 21 Market, By Region, 20142021 (USD Million)

Table 22 North America: Market Size, By Country, 20142021 (USD Million)

Table 23 North America: Market Size, By Technology, 20142021 (USD Million)

Table 24 North America: Market Size, By Application, 20142021 (USD Million)

Table 25 U.S.: Market Size, By Application, 20142021 (USD Million)

Table 26 Canada: Market Size, By Application, 20142021 (USD Million)

Table 27 Latin America: Market Size, By Technology, 20142021 (USD Million)

Table 28 Latin America: Market Size, By Application, 20142021 (USD Million)

Table 29 Latin America: Market Size, By Country, 20142021 (USD Million)

Table 30 Argentina: Market Size, By Application, 20142021 (USD Million)

Table 31 Brazil: Market Size, By Application, 20142021 (USD Million)

Table 32 Mexico: Market Size, By Application, 20142021 (USD Million)

Table 33 Rest of Latin America: Market Size, By Application, 20142021 (USD Million)

Table 34 Europe: Market Size, By Technology, 20142021 (USD Million)

Table 35 Europe: Market Size, By Application, 20142021 (USD Million)

Table 36 Europe: Market Size, By Country, 20142021 (USD Million)

Table 37 Russia: Market Size, By Application, 20142021 (USD Million)

Table 38 Norway: Market Size, By Application, 20142021 (USD Million)

Table 39 U.K.: Market Size, By Application, 20142021 (USD Million)

Table 40 Rest of Europe: Market Size, By Application, 20142021 (USD Million)

Table 41 Middle East: Market Size, By Country, 20142021 (USD Million)

Table 42 Middle East: Market Size, By Technology, 20142021 (USD Million)

Table 43 Middle East: Market Size, By Application, 20142021 (USD Million)

Table 44 Saudi Arabia: Market Size, By Application, 20142021 (USD Million)

Table 45 UAE: Market Size, By Application, 20142021 (USD Million)

Table 46 Kuwait: Market Size, By Application, 20142021 (USD Million)

Table 47 Rest of the Middle East: Market Size, By Application, 20142021 (USD Million)

Table 48 Asia-Pacific: Market Size, By Country, 20142021 (USD Million)

Table 49 Asia-Pacific: Market Size, By Technology, 20142021 (USD Million)

Table 50 Asia-Pacific: Market Size, By Application, 20142021 (USD Million)

Table 51 China: Market Size, By Application, 20142021 (USD Million)

Table 52 India: Market Size, By Application, 20142021 (USD Million)

Table 53 Australia: Market Size, By Application, 20142021 (USD Million)

Table 54 Rest of Asia-Pacific: Market Size, By Application, 20142021 (USD Million)

Table 55 Africa: Market Size, By Country, 20142021 (USD Million)

Table 56 Africa: Market Size, By Technology, 20142021 (USD Million)

Table 57 Africa: Market Size, By Application, 20142021 (USD Million)

Table 58 Nigeria: Market Size, By Application, 20142021 (USD Million)

Table 59 Angola: Market Size, By Application, 20142021 (USD Million)

Table 60 Ghana: Market Size, By Application, 20142021 (USD Million)

Table 61 Rest of Africa: Market Size, By Application, 20162021 (USD Million)

Table 62 Contracts & Agreements, 20152016

Table 63 Expansions, 20142016

Table 64 Mergers & Acquisitions, 20152016

Table 65 New Product Launches, 20142015

List of Figures (53 Figures)

Figure 1 Managed Pressure Drilling Service Market: Research Design

Figure 2 Number of High-Pressure/High-Temperature Projects Worldwide

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 North America Held the Largest Market Share (Value) in 2015

Figure 8 Offshore Application Dominated the Managed Pressure Drilling Services in 2015

Figure 9 Constant Bottom Hole Pressure & Dual Gradient Drilling Segments are Projected to Be the Most Attractive Markets During the Forecast Period

Figure 10 North America is Estimated to Be the Largest Regional Market From 2016 to 2021

Figure 11 The Offshore Application Dominated the Managed Pressure Drilling Market Across All Regions in 2015

Figure 12 Growing Need for Drilling Optimization is Expected to Drive the Demand for Managed Pressure Drilling Services During the Forecast Period

Figure 13 Africa is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 14 The CBHP Segment is Expected to Hold the Largest Market Share (By Value) During the Forecast Period

Figure 15 China is Projected to Hold the Largest Market Share (By Value) in Asia-Pacific During the Forecast Period

Figure 16 The Latin America Market is Expected to Grow at the Highest Rate During the Forecast Period

Figure 17 Market Dynamics: Managed Pressure Drilling Service

Figure 18 Global Petroleum and Other Liquids: Supply & Demand Trends, 20112015

Figure 19 Brent Crude Oil Spot Prices in Comparison to the Global Oil & Gas Rig Count, 20122015

Figure 20 Number of Drilled But Uncompleted Wells in the U.S., 2015

Figure 21 U.K. Oil & Gas Production Levels, 19702014

Figure 22 Managed Pressure Drilling Services: Supply Chain Analysis

Figure 23 Porters Five Forces Analysis: Managed Pressure Drilling Services Industry

Figure 24 The CBHP Segment is Projected to Remain as the Largest Market During the Forecast Period

Figure 25 The Offshore Segment Accounted for the Largest Market Share(By Value) in 2015

Figure 26 Regional Snapshot (2015): Rapidly Growing Markets are Emerging as New Hot Spots

Figure 27 Declining Rig Count in U.S. (20142015)

Figure 28 Declining Oil & Gas Rig Count Following Oil Price Crash in Mid-2014

Figure 29 Declining Well Count in Canada Owing to Low Oil Price Environment, 20142016

Figure 30 Europe Managed Pressure Drilling Services: Regional Snapshot

Figure 31 Growing U.S. Production Overshadowed Saudi Arabias Crude Oil Production in 2014

Figure 32 Oil & Gas Rigs in Saudi Arabia Drilling to Maintain Production in 2015 & 2016

Figure 33 Asia-Pacific Managed Pressure Drilling Services: Regional Snapshot

Figure 34 Slowing Demand for Oil & Gas Rigs Due to the Current Low-Price Scenario, 20132016

Figure 35 Increasing Crude Oil Production in Angola, From 2000 to 2014

Figure 36 Companies Adopted Various Growth Strategies in the Past 5 Years

Figure 37 Battle for Market Share: Contracts & Agreements Was the Key Strategy Adopted By the Top Players, 20112016

Figure 38 Market Evolution Framework: Contracts & Agreements and Expansion Led to Market Growth, 20132016

Figure 39 Regional Mix of the Top Players

Figure 40 Weatherford International Limited: Company Snapshot

Figure 41 Weatherford International Limited: SWOT Analysis

Figure 42 Halliburton Company: Company Snapshot

Figure 43 SWOT Analysis: Halliburton Company

Figure 44 Baker Hughes Inc.: Company Snapshot

Figure 45 SWOT Analysis: Baker Hughes Inc.

Figure 46 Schlumberger Limited: Company Snapshot

Figure 47 SWOT Analysis: Schlumberger Limited

Figure 48 National Oilwell Varco: Company Snapshot

Figure 49 Archer Limited: Company Snapshot

Figure 50 Aker Solutions: Company Snapshot

Figure 51 SWOT Analysis: Aker Solutions

Figure 52 Ensign Energy Services Inc.: Company Snapshot

Figure 53 Enhanced Drilling: Company Snapshot

Growth opportunities and latent adjacency in Managed Pressure Drilling Services Market