Zone Controller Market - Global Forecast to 2030

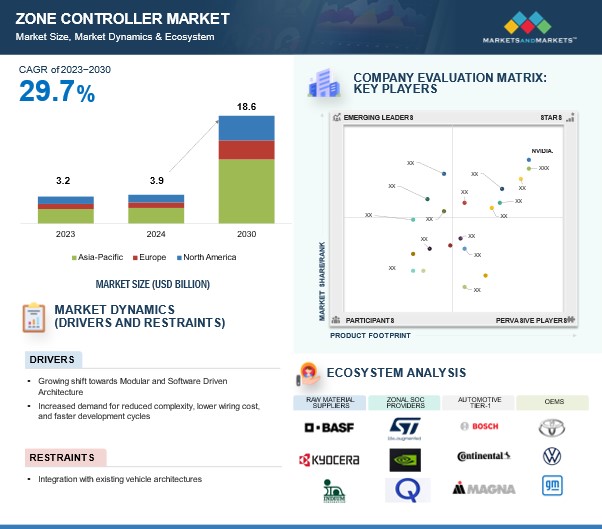

The global zone controller market size is expected to grow from USD 3.2 billion in 2023 to USD 18.6 billion in 2030, at a CAGR of 29.7%. As the automotive industry shifts toward software-defined and autonomous vehicles, zone controller units (ZCUs) are becoming increasingly important in advanced vehicle architectures. These units play a vital function in managing power distribution and data communication within specific vehicle zones, additionally simplifying the overall electrical and electronic (E/E) architecture. ZCUs optimize the functionality and design of vehicles, offering significant advantages. Due to their capacity to combine several Electronic Control Units (ECUs), wiring complexity is greatly reduced, lowering material costs and streamlining assembly procedures. This cost minimization along with optimized performance is a crucial benefit for OEMs attempting to strike a balance between cost and innovation.

In addition to lower production costs, lesser wiring requirement reduces vehicle weight and improves energy efficiency. Similarly, intelligent power management of zone controllers, including smart fusing, further help improving fault detection and safety. These features ensure robust electrical system performance, reducing the risks associated with power failures and supporting safer vehicle operations. ZCUs also provide reliable data transfer over high-speed protocols such as Ethernet, facilitating advanced capabilities in zonal architecture.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

DRIVER: Growing shift towards modular and software-defined architecture

The transition to zonal architectures allows for quicker integration of new technologies and features. This agility is essential as automotive manufacturers increasingly adopt software-defined vehicles (SDVs) that require regular updates and new functionalities post-manufacture. Consolidating functions into fewer hardware components facilitates rapid deployment and testing of software updates, enhancing the overall user experience.

The shift towards SDVs and zonal architectures is driving increased adoption of simulation tools, which are seen as vital for reducing engineering and prototyping costs amid financial pressures. By enabling software-driven features, scalable, modular designs, and zone controller units' future-proof automotive architectures, OEMs can incorporate new features and technologies without requiring major hardware modifications, keeping cars competitive and in line with evolving customer demands. OEMs such as BMW, General Motors, and Mercedes Benz are also exploring AI tools to leverage learnings from past designs, which is crucial for staying competitive.

Driver: Increased demand for reduced complexity, lower wiring costs, and faster development cycles.

The shift to zonal architectures simplifies vehicle wiring, enhances performance, and reduces costs. This presents a market need for advanced computing systems, for autonomous driving and ADAS. Some of the leading central control systems include NVIDIA Drive AGX, Intel Mobileye EyeQ5, and Qualcomm Snapdragon Ride. With computing capabilities above 10-15 TOPS, zone controller units can efficiently handle complex tasks such as data processing from numerous sensors and actuators - essential for ADAS and automated driving functionalities. Zone controller units facilitate a scalable architecture that can adapt to future technological advancements in vehicles. This flexibility allows manufacturers to implement software-defined features and updates without overhauling hardware, thus extending the vehicle's lifecycle and enhancing its value proposition.

Challenge: Integration with Existing Vehicle Architectures

Integrating with existing vehicle architectures is a major challenge in the zone controller market. The centralized architecture utilizing the zone controllers fundamentally differs from the centralized ECU system used in traditional vehicles. In addition to the resource requirement, transitioning from traditional vehicles to vehicles with zone controllers extends development cycles, adding substantial costs. Furthermore, the chances of communication breakdowns or system malfunctions and the systems raise concerns regarding stability and reliability, particularly in safety-critical activities like braking and engine control.

Key Market Players

NVIDIA Corporation (US), NXP Semiconductors (Netherlands), Valeo SE (France), Infineon Technologies AG (Germany), and Continental AG (Germany), among others, are the key companies operating in the zone controller market. These companies adopted new product launches and deals, such as partnerships and collaborations, to gain traction in the zone controller market.

Key Developments

- In April 2024, Marelli collaborated with Infineon to showcase its advanced Zone Control Unit, featuring AURIX™ TC4x microcontrollers, at the Beijing International Automotive Exhibition. The Zone Control Unit consolidates ECUs across domains, enabling reduced hardware complexity and cost and enhanced scalability for software-defined vehicles.

- In April 2024, Continental AG began a series of Zone Control Units (ZCUs) production for European and Asian automakers, enhancing server-based E/E architectures for software-defined vehicles. The ZCUs streamline vehicle wiring, reduce complexity, and enable over-the-air updates, receiving multiple orders globally.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Zone Controller Market