WTTx Market by Component (Hardware, Platforms and Solutions, and Services), Operating Frequency (1.8 GHz - SUB 6 GHz, 6 GHz - 24 GHz, above 24 GHz), Organization Size (Large and Small-Medium Enterprises), and Region- Global Forecast to 2027

WTTx Market Analysis & Report Summary, Global Size

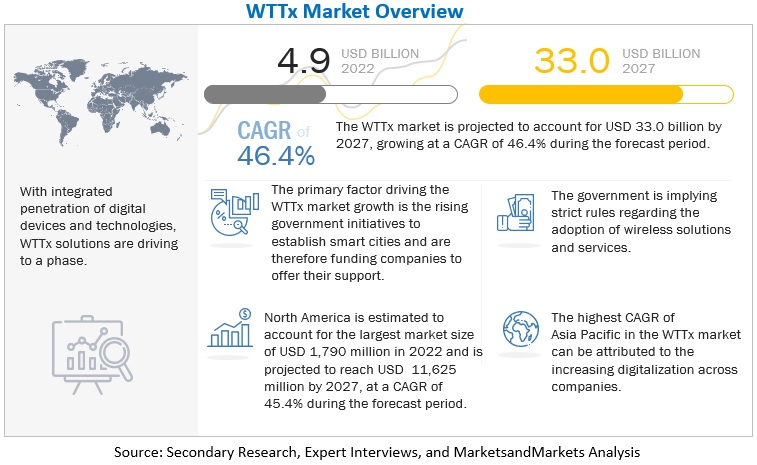

The global WTTx Market size size was worth approximately $4.9 billion in 2022 and is expected to generate revenue around $33.0 billion by the end of 2027, growing at a CAGR of around 46.4% from 2022 to 2027.

WTTx Market Growth is driven bythe primary factors such as increasing government spending and initiatives to establish smart cities. Recognizing the significance of high-speed internet to economic development, governments worldwide are pursuing large-scale projects to fund or subsidize the construction of broadband networks in underserved areas.

To know about the assumptions considered for the study, Request for Free Sample Report

WTTx Market Growth Dynamics:

Driver: Surge in 5G deployment coverage in untapped rural and urban regions

Wireless broadband networks could be deployed rapidly and easily. They can be used in conventional urban and suburban regions and in unique settings such as the Middle East’s deserts, the Philippines islands, rural areas in China, hilly areas such as in China and any historic and cultural locations where cable routing is inconvenient or even prohibited. According to FCC, more than 18 million Americans, 14 million of whom live in rural regions, lack broadband access, including wireless and fixed wireless connections. 5G operators offering WTTx-based services can provide various advantages to the rural and urban consumer segments.

Restraint: Adverse impact of millimeter-wave frequency circuitries on environment

The millimeter wave bands between 30GHz and 300 GHz provide enormous raw bandwidth, allowing multiple GBPS wireless transmission rates. However, it comes with substantial adverse effects on the environment and ecosystem. mmWave radiation, unlike much higher frequency X-ray, ultraviolet, and gamma radiation, is non-ionizing. Thus, the primary safety risk is heating of the eyes and skin induced by mmWave energy absorption in the human body. The full roll-out of 5G has the potential to destroy ecosystems. According to Punjab University, sparrows exposed to cell tower radiation for five to thirty minutes produced deformed eggs. Microwave radiation from cell towers disrupted bird nesting, breeding, and roosting in Spain. Wireless frequencies have also been discovered to interfere with birds’ navigational systems and circadian cycles causing migration to be disrupted. The signal range of the mmWave spectrum can be extended by increasing the transmitting power. This increase in the transmitting power has the potential to increase the usage of fuel and deforestation, particularly in rural regions. The impact of this restraint is substantial on the 5G WTTx market, which is expected to grow further in the next years due to the significant increase in the use of millimeter-wave technology.

Opportunity: Surgen cross-selling trends into 5G mobile and lower-cost routers

The target audience for 5G WTTx comes from a variety of sources. Countries with a high rate of home broadband adoption comprise fiber/existing cable/DSL households with price-conscious tendencies, as well as the mobile-only category, whether by choice or due to the lack of access. WTTx should profit from a surge of lower-cost routers and 5G mobile cross-sell. It is anticipated that 5G customers will increase by 1.6 billion over the next five years, reaching 20% of the worldwide total. As the 5G spectrum grows into lower-income countries such as Thailand, India, and parts of Africa, WTTx will become more appealing due to the lack of fixed-line infrastructure.

Challenge: Handling millimeter waves to maintain radio link performance

Wireless broadband to home and enterprises with 5G have made excitement around consumers because of the speed and range of coverage it offers. The earlier rollouts, however, are on sub-6-GHz channels. During the propagation of millimeter waves that are extremely sensitive to the transmission conditions and interferences. Any obstacle between the 5G antenna (transmitter) and the 5G receiver (receiver), supposing a new building, glass, tree, rain, wind, snow, or even a flock of birds swooping through, can cause a performance decline. Since mmWave employs a large spectrum range, it allows for significantly higher capacity and is eventually becoming the choice of technology for delivering last-mile broadband connectivity in highly populated urban areas.

By organization size, large enterprises segment holds largest market size during forecast period

The adoption of wireless broadband solutions in large enterprises is higher than in small and medium-sized enterprises. Most mobile network operators are deploying to the 28 GHz spectrum for 5G to offer WTTx solutions to their consumers. It has been approved for usage in the US and South Korea. The spectrum has emerged as a recommended band for the first 5G-based WTTx network deployments. Other frequencies, such as 26 GHz and 39 GHz, are being researched in Europe and the US, respectively. Technologies such as AR/VR are used in homes and industries, including healthcare, education, retail, automotive, and Location-Based VR (LBVR) that require fast and reliable 5G connection to deliver an enhanced experience to the consumer. Hence, these organizations are extensively adopting WTTx solutions.

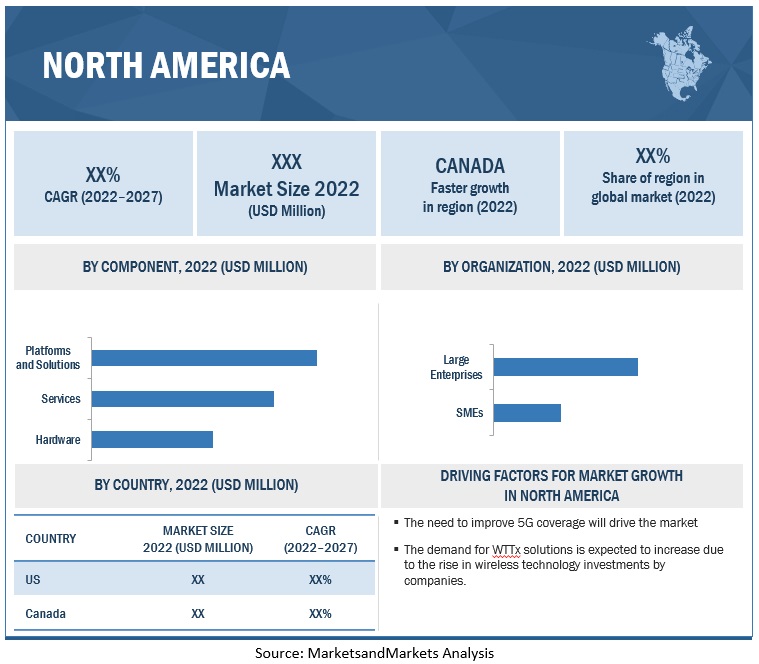

North America to hold largest market size during forecast period

The top IT and telecommunication companies and wireless solutions providers have headquarters in North American countries. The demand for WTTX solutions is expected to increase due to the rise in wireless technology investments by companies and the company’s efforts to offer reliable, cost-effective solutions in the US and Canada. In this region, investments in technological developments and advancements are higher than in other regions. Various vendors involved in the WTTx ecosystem, such as Qualcomm, UScellular, and Inseego, partner with the major market players in this region. The rising need for high-speed internet and to expand network connectivity in urban and rural areas of the country to surge the demand for WTTx solutions in this region.

To know about the assumptions considered for the study, download the pdf brochure

Market Players:

The major players in the WTTx market are Huawei (China), Nokia (Finland), Ericsson (Sweden), Qualcomm (US), CommScope (US), Samsung (South Korea), Eltel Group (Sweden), Airspan (US), Inseego (US), Gemtek (Taiwan), Fibocom (China), Anritsu (Japan), Keysight Technologies (US), Technicolor (France), Lumine (Canada), Remcom (US), Cohere Technologies (US), EDX (US), Kelly (Canada), Digi International (US), BLiNQ Networks (Canada), AVSystem (Poland), Tarana Wireless (US), Telrad Networks (Israel), and Jaton Technology Ltd (China). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions, to expand their footprint in the WTTx market.

Scope of the Report

|

Report Metrics |

Details |

|

Revenue Forecast Size in 2027 |

$33 billion |

|

Market size value in 2022 |

$4.9 billion |

|

Estimated Growth Rate |

46.4% |

|

Key Market Growth Drivers |

Surge in 5G deployment coverage in untapped rural and urban regions |

|

Key Market Opportunities |

Surgen cross-selling trends into 5G mobile and lower-cost routers |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments covered |

Component, Organization size, Operating frequency, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Top Players |

Major Vendors - Huawei (China), Nokia (Finland), Ericsson (Sweden), Qualcomm (US), CommScope (US), Samsung (South Korea), Eltel Group (Sweden), Airspan (US), Inseego (US), Gemtek (Taiwan), Fibocom (China), Anritsu (Japan), Keysight Technologies (US), and Technicolor (France).

Startup/SME Vendors - Lumine (Canada), Remcom (US), Cohere Technologies (US), EDX (US), Kelly (Canada), Digi International (US), BLiNQ Networks (Canada), AVSystem (Poland), Tarana Wireless (US), Telrad Networks (Israel), and Jaton Technology Ltd (China). |

This research report categorizes the WTTx Market to forecast revenues and analyze trends in each of the following submarkets:

Based on Components:

-

Hardware

- Access Units

- Customer Premises Equipment (CPE)

- Others

- Platforms and Solutions

- Services

Based on Operating Frequencies:

- 1.8 GHz – sub-6 GHz

- 6 GHz – 24 GHz

- 24 GHz and above

Based on Organization Size:

- SMEs

- Large Enterprises

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- India

- South Korea

- Rest of Asia Pacific

-

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In July 2022, Nokia announced a five-year agreement with Ice to provide high-capacity equipment such as 5G Massive MIMO to support all spectrum bands. The company will modernize approximately 3,200 base stations in this agreement and deploy 3,900 new base stations.

- In May 2022, Qualcomm and Viettel announced plans to collaborate to develop a next-generation 5G radio unit with massive Distributed Units (DUs) and MIMO capabilities.

- In May 2022, Nokia added a 5G wearable and video camera to improve video surveillance in its existing private wireless solution. These new wearable devices and digital twinning will enable manufacturers, public safety agencies, mine owners, and other enterprises to connect with their employees, workers, and machines securely.

- In February 2022, Qualcomm announced a collaboration with Fujitsu to commercialize 5G open and virtualized Distributed Unit (DU) and Radio Unit (RU) solutions. This collaboration addresses the demand for streamlined deployments, modern networks, and deliver high-performance 5G solutions with a lower total cost of ownership.

- In October 2021, Ericsson partnered with Nex-Tech Wireless to support the deployment of wireless 5G capabilities in Kansas. Nex-Tech Wireless will use Ericsson Radio System products and solutions with Ericsson Spectrum Sharing.

- In October 2021, Samsung added new capabilities, C-Band and CBRS, in Massive MIMO to support two mid-band spectrums and deliver connectivity to billions of users worldwide.

- In January 2020, Samsung Electronics announced the completion of an agreement to acquire TeleWorld Solutions (TWS), a US-based network services provider. TWS provides network designing, testing, and optimizing services to mobile service and cable operators, OEMs, and other companies across the US. This agreement is expected to offer required end-to-end support in delivering network solutions in the US.

Frequently Asked Questions (FAQ):

What is the projected market value of WTTx Market?

What is the estimated growth rate (CAGR) of the global WTTx Market?

What are the major revenue pockets in the global WTTx Market currently?

Which are Leading Companies in WTTx Market?

What are the major growth drivers in the WTTx Market?

What are the key opportunities in the WTTx Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 WTTX MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

FIGURE 2 MARKET: GEOGRAPHIC SCOPE

1.3.3 INCLUSIONS AND EXCLUSIONS

1.3.4 YEARS CONSIDERED

1.4 CURRENCY

TABLE 1 USD EXCHANGE RATES, 2019–2021

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 3 WTTX MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Breakdown of primary profiles

2.1.2.4 Primary sources

2.1.2.5 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF WTTX MARKET

2.2.2 TOP-DOWN APPROACH

FIGURE 6 TOP-DOWN APPROACH

2.2.3 MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

2.2.4 MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

2.2.5 GROWTH FORECAST ASSUMPTIONS

TABLE 2 MARKET GROWTH ASSUMPTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.4.1 FACTOR ASSESSMENT

TABLE 3 FACTOR ASSESSMENT: MARKET

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 10 WTTX MARKET, 2020–2027 (USD MILLION)

FIGURE 11 MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET, BY ORGANIZATION SIZE, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET, BY OPERATING FREQUENCY, 2022 VS. 2027 (USD MILLION)

FIGURE 14 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 WTTX MARKET OVERVIEW

FIGURE 15 INCREASING USE OF ECOMMERCE AND MCOMMERCE PLATFORMS TO DRIVE MARKET GROWTH

4.2 NORTH AMERICA: MARKET, BY OPERATING FREQUENCY AND ORGANIZATION SIZE (2022)

FIGURE 16 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

4.3 ASIA PACIFIC: MARKET, BY OPERATING FREQUENCY AND ORGANIZATION SIZE (2022)

FIGURE 17 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

4.4 EUROPE: MARKET, BY OPERATING FREQUENCY AND ORGANIZATION SIZE (2022)

FIGURE 18 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

4.5 GEOGRAPHICAL SNAPSHOT OF MARKET

FIGURE 19 ASIA PACIFIC TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: WTTX MARKET

5.2.1 DRIVERS

5.2.1.1 Government initiatives to establish smart cities

5.2.1.2 WTTx-5G deployment coverage in untapped rural and urban regions

5.2.2 RESTRAINTS

5.2.2.1 Adverse impact of millimeter-wave frequency circuitries on environment

5.2.3 OPPORTUNITIES

5.2.3.1 WTTx offering economic benefits to mobile network operators

5.2.3.2 Surge in cross-selling trends of 5G mobiles and lower cost routers

FIGURE 21 PROJECTED NET ADDITIONS WORLDWIDE (MILLION) 2021–2025

5.2.3.3 Generation of new revenue streams for mobile operators

5.2.3.4 Increased work from home activities give rise to household broadband penetration

FIGURE 22 GLOBE TELECOM FIXED BROADBAND SUBSCRIBERS (THOUSANDS)

5.2.4 CHALLENGES

5.2.4.1 Maintaining QoS and integration of technologies

5.2.4.2 Handling millimeter waves to maintain radio link performance

5.3 WTTX MARKET: SUPPLY CHAIN ANALYSIS

FIGURE 23 MARKET: SUPPLY CHAIN

5.4 ECOSYSTEM

FIGURE 24 MARKET: ECOSYSTEM

TABLE 4 MARKET: ECOSYSTEM

5.5 AVERAGE SELLING PRICE MODEL OF MARKET PLAYERS

TABLE 5 PRICING MODELS AND INDICATIVE PRICE POINTS, 2021–2022

5.6 TECHNOLOGY ANALYSIS

5.6.1 INTRODUCTION

5.6.2 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.6.3 AUGMENTED REALITY/VIRTUAL REALITY

5.6.4 INTERNET OF THINGS

5.7 CASE STUDY ANALYSIS

5.7.1 CASE STUDY 1: OPTUS USED ERICSSON’S SOLUTION TO PROVIDE WIRELESS BROADBAND 5G SERVICES

5.7.2 CASE STUDY 2: KDDI DELIVERS NETWORK TO YAKUSUGI BY USING COMMSCOPE’S SOLUTION

5.7.3 CASE STUDY 3: ZAIN KSA DEPLOYED NOKIA’S SOLUTIONS FOR 5G-WTTX

5.7.4 CASE STUDY 4: CHUNGHWA TELECOM REAPED ECONOMIC BENEFITS BY DEPLOYING ERICSSON’S SOLUTION

5.7.5 CASE STUDY 5: DIALOG DEPLOYED HUAWEI’S SOLUTIONS TO INCREASE HOME BROADBAND PENETRATION

5.7.6 CASE STUDY 6: TELENOR GROUP DEPLOYS ELTEL SOLUTIONS

5.8 PATENT ANALYSIS

5.8.1 METHODOLOGY

5.8.2 DOCUMENT TYPES OF PATENTS

TABLE 6 PATENTS FILED, 2019–2022

5.8.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 25 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2019–2022

5.8.3.1 Top applicants

FIGURE 26 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2019–2022

TABLE 7 US: TOP TEN PATENT OWNERS IN WTTX MARKET, 2019–2022

TABLE 8 LIST OF A FEW PATENTS IN MARKET, 2020–2022

5.9 REVENUE SHIFT FOR MARKET

FIGURE 27 REVENUE IMPACT ON MARKET

5.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 MARKET: PORTER’S FIVE FORCES MODEL

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF BUYERS

5.10.4 BARGAINING POWER OF SUPPLIERS

5.10.5 DEGREE OF COMPETITION

5.11 REGULATORY LANDSCAPE

5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11.1.1 North America

5.11.1.1.1 US

5.11.1.1.2 Canada

5.11.1.2 Europe

5.11.1.3 Asia Pacific

5.11.1.3.1 China

5.11.1.3.2 Australia

5.11.1.3.3 Japan

5.11.1.4 Middle East and Africa

5.11.1.4.1 Saudi Arabia

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

5.12.2 BUYING CRITERIA

FIGURE 29 KEY BUYING CRITERIA

TABLE 16 KEY BUYING CRITERIA

5.13 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 17 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 WTTX MARKET, BY COMPONENT (Page No. - 83)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

FIGURE 30 PLATFORMS AND SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

TABLE 18 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 19 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 HARDWARE

6.2.1 SHIFT TOWARD WTTX HARDWARE INSTALLATION BECAUSE OF ENHANCED SIGNAL QUALITY

TABLE 20 HARDWARE: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 21 HARDWARE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 22 HARDWARE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 23 HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 CUSTOMER PREMISE EQUIPMENT

6.2.2.1 WTTx deployment leads to growing demand for customer premise equipment

TABLE 24 CUSTOMER PREMISE EQUIPMENT: WTTX MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 25 CUSTOMER PREMISE EQUIPMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3 ACCESS UNITS

6.2.3.1 Short-range and large-range applications coverage with two kinds of access unit

TABLE 26 ACCESS UNITS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 27 ACCESS UNITS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.4 OTHER HARDWARE

6.2.4.1 Telecoms adopting WTTx devices to reduce operational costs and enhance customer experience

TABLE 28 OTHER HARDWARE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 29 OTHER HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 PLATFORMS AND SOLUTIONS

6.3.1 WTTX SOLUTIONS PROVIDE ENHANCED OVERALL SIGNAL STRENGTH AND BROADBAND SPEEDS

TABLE 30 PLATFORMS AND SOLUTIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 31 PLATFORMS AND SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 SERVICES

6.4.1 INCREASED B2B COMMUNICATION AND IMPROVED SPECTRAL EFFICIENCY LED TO RISE IN MARKET SERVICES ADOPTION

TABLE 32 SERVICES: WTTX MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 33 SERVICES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 34 SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 35 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.2 MANAGED SERVICES

6.4.2.1 Managing in-house services forced organizations to outsource certain processes

TABLE 36 MANAGED SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 37 MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.3 PROFESSIONAL SERVICES

TABLE 38 PROFESSIONAL SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 39 PROFESSIONAL SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 WTTX MARKET, BY ORGANIZATION SIZE (Page No. - 95)

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: MARKET DRIVERS

FIGURE 31 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 40 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 41 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

7.2 SMALL AND MEDIUM-SIZED ENTERPRISES

7.2.1 ADOPTION OF DIGITAL SOLUTIONS TO REDUCE COSTS AND PROVIDE USERS ENHANCED EXPERIENCE

TABLE 42 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 43 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 LARGE ENTERPRISES

7.3.1 WTTX SOLUTIONS MEET REQUIREMENTS OF HOME, ENTERPRISE, AND DIFFERENT INDUSTRIES

TABLE 44 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 45 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 WTTX MARKET, BY OPERATING FREQUENCY (Page No. - 100)

8.1 INTRODUCTION

8.1.1 OPERATING FREQUENCY: MARKET DRIVERS

FIGURE 32 6 GHZ - 24 GHZ SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE BY 2027

TABLE 46 MARKET, BY OPERATING FREQUENCY, 2016–2021 (USD MILLION)

TABLE 47 MARKET, BY OPERATING FREQUENCY, 2022–2027 (USD MILLION)

8.2 1.8 GHZ – SUB 6GHZ

8.2.1 LOWER FREQUENCY SIGNALS HELP ENHANCE GEOGRAPHIC COVERAGE

TABLE 48 1.8 GHZ – SUB 6 GHZ: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 49 1.8 GHZ – SUB 6 GHZ: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 6 GHZ – 24 GHZ

8.3.1 24 GHZ OFFERS LOWER PROPAGATION LOSS COMPARED TO OTHER MMWAVE BANDS

TABLE 50 6 GHZ – 24 GHZ: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 51 6 GHZ – 24 GHZ: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 ABOVE 24 GHZ

8.4.1 HIGHER BANDWIDTHS TO KEEP EVERYONE CONNECTED IN BUSY ENVIRONMENTS

TABLE 52 ABOVE 24 GHZ: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 53 ABOVE 24 GHZ: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 WTTX MARKET, BY REGION (Page No. - 106)

9.1 INTRODUCTION

FIGURE 33 MARKET: REGIONAL SNAPSHOT (2022)

FIGURE 34 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 54 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 55 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

TABLE 56 NORTH AMERICA: WTTX MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY HARDWARE, 2016–2021 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY OPERATING FREQUENCY, 2016–2021 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY OPERATING FREQUENCY, 2022–2027 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.2.2 US

9.2.2.1 Remarkable growth of smart infrastructure

TABLE 68 US: WTTX MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 69 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 70 US: MARKET, BY HARDWARE, 2016–2021 (USD MILLION)

TABLE 71 US: MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 72 US: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 73 US: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 74 US: MARKET, BY OPERATING FREQUENCY, 2016–2021 (USD MILLION)

TABLE 75 US: MARKET, BY OPERATING FREQUENCY, 2022–2027 (USD MILLION)

TABLE 76 US: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 77 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.2.3 CANADA

9.2.3.1 Improve network connectivity to automate work process

9.3 EUROPE

9.3.1 PESTLE ANALYSIS: EUROPE

TABLE 78 EUROPE: WTTX MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY HARDWARE, 2016–2021 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY OPERATING FREQUENCY, 2016–2021 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY OPERATING FREQUENCY, 2022–2027 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.2 UK

9.3.2.1 Need to connect premises with fixed wireless technology

TABLE 90 UK: WTTX MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 91 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 92 UK: MARKET, BY HARDWARE, 2016–2021 (USD MILLION)

TABLE 93 UK: MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 94 UK: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 95 UK: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 96 UK: MARKET, BY OPERATING FREQUENCY, 2016–2021 (USD MILLION)

TABLE 97 UK: MARKET, BY OPERATING FREQUENCY, 2022–2027 (USD MILLION)

TABLE 98 UK: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 99 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.3.3 GERMANY

9.3.3.1 Need to support Industry 4.0 and digitalization

9.3.4 FRANCE

9.3.4.1 Rising need to provide high-speed internet

9.3.5 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 PESTLE ANALYSIS: ASIA PACIFIC

TABLE 100 ASIA PACIFIC: WTTX MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET, BY HARDWARE, 2016–2021 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET, BY OPERATING FREQUENCY, 2016–2021 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET, BY OPERATING FREQUENCY, 2022–2027 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Accelerating 5G network deployment

9.4.3 INDIA

9.4.3.1 Increasing investments to boost 5G deployment

TABLE 112 INDIA: WTTX MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 113 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 114 INDIA: MARKET, BY HARDWARE, 2016–2021 (USD MILLION)

TABLE 115 INDIA: MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 116 INDIA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 117 INDIA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 118 INDIA: MARKET, BY OPERATING FREQUENCY, 2016–2021 (USD MILLION)

TABLE 119 INDIA: MARKET, BY OPERATING FREQUENCY, 2022–2027 (USD MILLION)

TABLE 120 INDIA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 121 INDIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.4.4 SOUTH KOREA

9.4.4.1 Increasing demand for 5G and 6G wireless technology

9.4.5 REST OF ASIA PACIFIC

9.5 MIDDLE EAST AND AFRICA

9.5.1 PESTLE ANALYSIS: MIDDLE EAST AND AFRICA

TABLE 122 MIDDLE EAST AND AFRICA: WTTX MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 123 MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 124 MIDDLE EAST AND AFRICA: MARKET, BY HARDWARE, 2016–2021 (USD MILLION)

TABLE 125 MIDDLE EAST AND AFRICA: MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 126 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 127 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 128 MIDDLE EAST AND AFRICA: MARKET, BY OPERATING FREQUENCY, 2016–2021 (USD MILLION)

TABLE 129 MIDDLE EAST AND AFRICA: WTTX MARKET, BY OPERATING FREQUENCY, 2022–2027 (USD MILLION)

TABLE 130 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 131 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 132 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 133 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.5.2 SAUDI ARABIA

9.5.2.1 Government initiatives to enhance wireless coverage to surge demand for WTTx solutions

9.5.3 UAE

9.5.3.1 To achieve digital vision 2030 and develop to most connected country

TABLE 134 UAE: WTTX MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 135 UAE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 136 UAE: MARKET, BY HARDWARE, 2016–2021 (USD MILLION)

TABLE 137 UAE: MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 138 UAE: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 139 UAE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 140 UAE: MARKET, BY OPERATING FREQUENCY, 2016–2021 (USD MILLION)

TABLE 141 UAE: MARKET, BY OPERATING FREQUENCY, 2022–2027 (USD MILLION)

TABLE 142 UAE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 143 UAE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.5.4 SOUTH AFRICA

9.5.4.1 Infrastructure development to drive market

9.5.5 REST OF MIDDLE EAST AND AFRICA

9.6 LATIN AMERICA

9.6.1 PESTLE ANALYSIS: LATIN AMERICA

TABLE 144 LATIN AMERICA: WTTX MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 145 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 146 LATIN AMERICA: MARKET, BY HARDWARE, 2016–2021 (USD MILLION)

TABLE 147 LATIN AMERICA: MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 148 LATIN AMERICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 149 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 150 LATIN AMERICA: MARKET, BY OPERATING FREQUENCY, 2016–2021 (USD MILLION)

TABLE 151 LATIN AMERICA: MARKET, BY OPERATING FREQUENCY, 2022–2027 (USD MILLION)

TABLE 152 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 153 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 154 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 155 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.6.2 BRAZIL

9.6.2.1 Increased investments in digital infrastructure to surge demand for WTTx solutions

TABLE 156 BRAZIL: WTTX MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 157 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 158 BRAZIL: MARKET, BY HARDWARE, 2016–2021 (USD MILLION)

TABLE 159 BRAZIL: MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 160 BRAZIL: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 161 BRAZIL: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 162 BRAZIL: MARKET, BY OPERATING FREQUENCY, 2016–2021 (USD MILLION)

TABLE 163 BRAZIL: MARKET, BY OPERATING FREQUENCY, 2022–2027 (USD MILLION)

TABLE 164 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 165 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.6.3 MEXICO

9.6.3.1 Increasing number of internet users to drive market growth

9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 149)

10.1 OVERVIEW

10.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 166 STRATEGIES ADOPTED BY KEY PLAYERS IN WTTX MARKET

10.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 167 MARKET: DEGREE OF COMPETITION

10.4 HISTORICAL REVENUE ANALYSIS

FIGURE 36 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2019–2021 (USD MILLION)

10.5 COMPETITIVE BENCHMARKING

TABLE 168 PRODUCT FOOTPRINT WEIGHTAGE

TABLE 169 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 170 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 171 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

TABLE 172 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES BY REGION

TABLE 173 MARKET: COMPETITIVE BENCHMARKING OF MAJOR PLAYERS

10.6 MARKET RANKING OF KEY PLAYERS IN WTTX MARKET, 2022

FIGURE 37 MARKET RANKING OF KEY PLAYERS, 2022

10.7 COMPANY EVALUATION QUADRANT

10.7.1 STARS

10.7.2 EMERGING LEADERS

10.7.3 PERVASIVE PLAYERS

10.7.4 PARTICIPANTS

FIGURE 38 MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2022

10.8 STARTUP/SME EVALUATION QUADRANT

10.8.1 PROGRESSIVE COMPANIES

10.8.2 RESPONSIVE COMPANIES

10.8.3 DYNAMIC COMPANIES

10.8.4 STARTING BLOCKS

FIGURE 39 WTTX MARKET (STARTUP): COMPANY EVALUATION MATRIX, 2022

10.9 COMPETITIVE SCENARIO

10.9.1 PRODUCT LAUNCHES

TABLE 174 PRODUCT LAUNCHES, JANUARY 2019–JULY 2022

10.9.2 DEALS

TABLE 175 DEALS, JANUARY 2019–JULY 2022

11 COMPANY PROFILES (Page No. - 166)

11.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)*

11.1.1 HUAWEI

TABLE 176 HUAWEI: BUSINESS OVERVIEW

FIGURE 40 HUAWEI: COMPANY SNAPSHOT

TABLE 177 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 178 HUAWEI: PRODUCT LAUNCHES

11.1.2 NOKIA

TABLE 179 NOKIA: BUSINESS OVERVIEW

FIGURE 41 NOKIA: COMPANY SNAPSHOT

TABLE 180 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 181 NOKIA: PRODUCT LAUNCHES

TABLE 182 NOKIA: DEALS

11.1.3 ERICSSON

TABLE 183 ERICSSON: BUSINESS OVERVIEW

FIGURE 42 ERICSSON: COMPANY SNAPSHOT

TABLE 184 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 185 ERICSSON: DEALS

11.1.4 QUALCOMM

TABLE 186 QUALCOMM: BUSINESS OVERVIEW

FIGURE 43 QUALCOMM: COMPANY SNAPSHOT

TABLE 187 QUALCOMM: PRODUCTS OFFERED

TABLE 188 QUALCOMM: PRODUCT LAUNCHES

TABLE 189 QUALCOMM: DEALS

11.1.5 SAMSUNG

TABLE 190 SAMSUNG: BUSINESS OVERVIEW

FIGURE 44 SAMSUNG: COMPANY SNAPSHOT

TABLE 191 SAMSUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 192 SAMSUNG: PRODUCT LAUNCHES

TABLE 193 SAMSUNG: DEALS

TABLE 194 SAMSUNG: OTHERS

11.1.6 COMMSCOPE

TABLE 195 COMMSCOPE: BUSINESS OVERVIEW

FIGURE 45 COMMSCOPE: COMPANY SNAPSHOT

TABLE 196 COMMSCOPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 197 COMMSCOPE: PRODUCT LAUNCHES

TABLE 198 COMMSCOPE: DEALS

11.1.7 ELTEL GROUP

TABLE 199 ELTEL GROUP: BUSINESS OVERVIEW

FIGURE 46 ELTEL: COMPANY SNAPSHOT

TABLE 200 ELTEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 201 ELTEL: DEALS

11.1.8 AIRSPAN

TABLE 202 AIRSPAN: BUSINESS OVERVIEW

FIGURE 47 AIRSPAN: COMPANY SNAPSHOT

TABLE 203 AIRSPAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 204 AIRSPAN: PRODUCT LAUNCHES

TABLE 205 AIRSPAN: DEALS

TABLE 206 AIRSPAN: OTHERS

11.1.9 INSEEGO

TABLE 207 INSEEGO: BUSINESS OVERVIEW

FIGURE 48 INSEEGO: COMPANY SNAPSHOT

TABLE 208 INSEEGO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 209 INSEEGO: PRODUCT LAUNCHES

TABLE 210 INSEEGO: DEALS

11.1.10 GEMTEK

TABLE 211 GEMTEK: BUSINESS OVERVIEW

FIGURE 49 GEMTEK: COMPANY SNAPSHOT

TABLE 212 GEMTEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

11.1.11 FIBOCOM

TABLE 213 FIBOCOM: BUSINESS OVERVIEW

FIGURE 50 FIBOCOM: COMPANY SNAPSHOT

TABLE 214 FIBOCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 215 FIBOCOM: PRODUCT LAUNCHES

TABLE 216 FIBOCOM: DEALS

11.1.12 ANRITSU

TABLE 217 ANRITSU: BUSINESS OVERVIEW

FIGURE 51 ANRITSU: COMPANY SNAPSHOT

TABLE 218 ANRITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 219 ANRITSU: PRODUCT LAUNCHES

TABLE 220 ANRITSU: DEALS

* Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

11.2 OTHER KEY PLAYERS

11.2.1 KEYSIGHT TECHNOLOGIES

11.2.2 TECHNICOLOR

11.2.3 LUMINE

11.2.4 REMCOM

11.2.5 COHERE TECHNOLOGIES

11.2.6 EDX

11.2.7 KELLY

11.2.8 DIGI INTERNATIONAL

11.2.9 BLINQ NETWORKS

11.2.10 AVSYSTEM

11.2.11 TARANA WIRELESS

11.2.12 TELRAD NETWORKS

11.2.13 JATON TECHNOLOGY LIMITED

12 ADJACENT/RELATED MARKETS (Page No. - 223)

12.1 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET

12.1.1 MARKET OVERVIEW

12.1.2 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET, BY TECHNOLOGY

TABLE 221 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET SIZE, BY TECHNOLOGY, 2020–2026 (USD MILLION)

12.1.2.1 Wi-Fi

TABLE 222 WI-FI: WIRELESS BROADBAND IN PUBLIC SAFETY MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.1.3 CELLULAR M2M

TABLE 223 CELLULAR M2M: WIRELESS BROADBAND IN PUBLIC SAFETY MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.1.4 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET, BY OFFERING

TABLE 224 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 225 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET SIZE, BY OFFERING, 2020–2026 (USD MILLION)

12.1.5 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET, BY APPLICATION

12.1.5.1 Introduction

TABLE 226 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 227 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

12.2 5G SERVICES MARKET

12.2.1 MARKET DEFINITION

12.2.2 MARKET OVERVIEW

12.2.3 5G SERVICES MARKET, BY END USER

TABLE 228 5G SERVICES MARKET, BY END USER, 2020–2026 (USD BILLION)

TABLE 229 CONSUMERS: 5G SERVICES MARKET, BY REGION, 2020–2026 (USD BILLION)

TABLE 230 ENTERPRISES: 5G SERVICES MARKET, BY REGION, 2020–2026 (USD BILLION)

12.2.4 5G SERVICES MARKET, BY COMMUNICATION TYPE

TABLE 231 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2020–2026 (USD BILLION)

TABLE 232 FIXED WIRELESS ACCESS: 5G SERVICES MARKET, BY REGION, 2020–2026 (USD BILLION)

TABLE 233 ENHANCED MOBILE BROADBAND: 5G SERVICES MARKET, BY REGION, 2020–2026 (USD BILLION)

TABLE 234 MASSIVE MACHINE-TYPE COMMUNICATIONS: 5G SERVICES MARKET, BY REGION, 2020–2026 (USD BILLION)

TABLE 235 ULTRA-RELIABLE, LOW-LATENCY: 5G SERVICES MARKET, BY REGION, 2020–2026 (USD BILLION)

12.2.5 5G SERVICES MARKET, BY ENTERPRISE

TABLE 236 5G SERVICES MARKET, BY ENTERPRISE, 2020–2026 (USD BILLION)

12.2.6 5G SERVICES MARKET, BY REGION

TABLE 237 5G SERVICES MARKET, BY REGION, 2020–2026 (USD BILLION)

13 APPENDIX (Page No. - 233)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun and Bradstreet (D&B), Hoovers, and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the WTTx market. The study involved four major activities in estimating the current size of the WTTx market. Exhaustive secondary research was done to collect information on the WTTx industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakup and data triangulation procedures were used to estimate the size of the segments and subsegments of the market.

Secondary Research

The market for the companies offering WTTx solutions and services is arrived at based on secondary data available through paid and unpaid sources and by analyzing the product portfolios of the major companies in the ecosystem and rating the companies based on performance and quality. In the secondary research process, various sources were referred to, for identifying and collecting information for this study. The secondary sources include annual reports, press releases and investor presentations of companies, white papers, journals, and certified publications and articles from recognized authors, directories, and databases. Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives, all of which were further validated by primary sources.

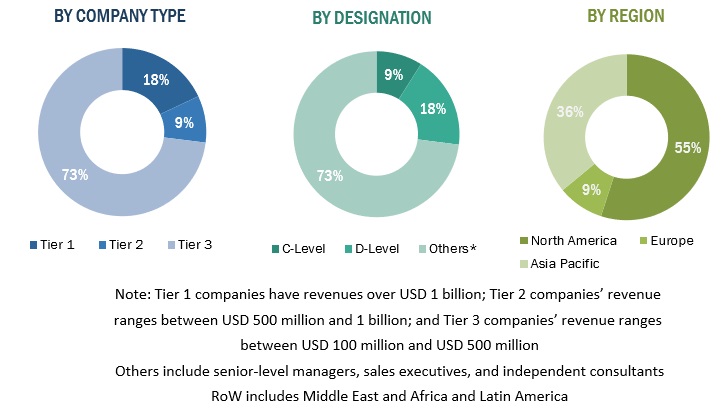

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the WTTx market. Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use WTTx, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current usage of WTTx, which is expected to affect the overall WTTx market growth. Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the WTTx market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the overall WTTx market was divided into several segments and subsegments. The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Report Objectives

- To determine, segment, and forecast the global WTTx market based on component, application, organization size, deployment type, vertical, and region

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA)

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze macro and micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze industry trends, pricing data, and patents and innovations related to the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the WTTx market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in WTTx Market