World Defense Budget Analysis Market by Allocation Type (Military Expense, Admin Expense), Departmental Allocation, Platform Allocation, System Allocation, Domain Allocation, Technology Allocation, Sales Allocation and Region - Global Forecast to 2028

Update: 11/22/2024

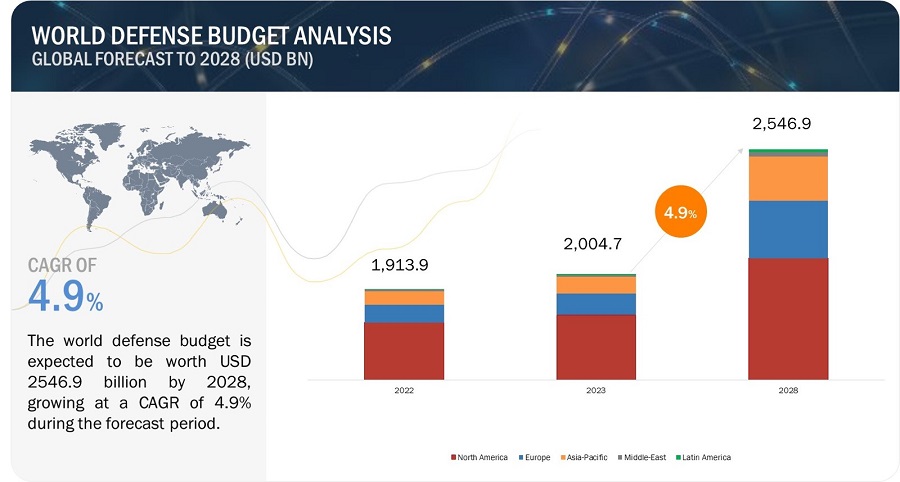

The World Defense Budget Analysis Market size is estimated to be USD 2,004.7 billion in 2023 and is expected to reach USD 2,546.9 billion by 2028 at a CAGR of 4.90% from 2023 to 2028. The world defense budget has experienced substantial growth over the years, reflecting the global focus on national security, military modernization, and the evolving nature of security threats. Factors driving the growth of the defense budget include geopolitical tensions, regional conflicts, and the need to address emerging challenges such as cyber warfare and terrorism. Technological advancements and the race for military superiority have also fueled increased defense spending.

Governments across the globe are investing in advanced weaponry, modernizing their armed forces, and adopting cutting-edge technologies like artificial intelligence, unmanned systems, and cyber capabilities. Furthermore, economic growth in certain regions has given governments the financial capacity to allocate more resources to defense. Rising defense budgets are also attributed to the desire to maintain military readiness, support global military operations, and safeguard national interests. However, challenges such as budget constraints, competing domestic priorities, and public scrutiny over defense spending remain. Nevertheless, the growth of the World Defense Budget Analysis Industry is expected to continue as nations navigate the evolving security landscape and strive to ensure their defense capabilities are robust, agile, and well-equipped to address both conventional and unconventional threats.

World Defense Budget Analysis Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

World Defense Budget Analysis Dynamics

Driver: Geopolitical tensions and security threats

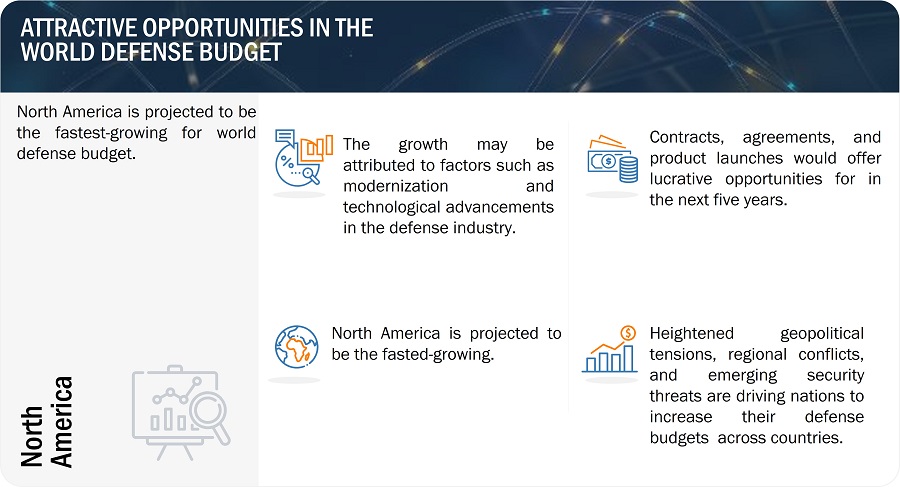

Heightened geopolitical tensions, regional conflicts, and emerging security threats drive nations to increase their defense budgets and allocate significant resources toward national security measures. The aim is to protect national interests, maintain deterrence capabilities, and ensure the safety and sovereignty of the country. Over the past few years, there has been a rise in instances of armed conflicts and disputes across the globe at both, intrastate and interstate levels. Some of the ongoing conflicts, such as the Russia-Ukraine war, the war against the Islamic State in Iraq, the civil war in Syria, the North Korean crisis, and the war against the Taliban in Afghanistan, have also had a significant impact on the global economy. These conflicts mobilized military and law enforcement agencies of major economies, including the US, the UK, and France.

Restraints: Budget constraints and fiscal limitations

Governments often need to work on budget constraints and fiscal limitations, which can pose challenges in allocating sufficient funds to defense. Competing demands for limited resources, economic downturns, or financial crises may lead to constraints in defense budget growth, requiring careful prioritization and optimization of available funds.

The various political and economic constraints related to the country’s overall defense budget to meet NATO mandate spending at least 2% of the country’s GDP on defense is a growing concern majorly for European countries and NATO Plus countries, which are expected to join NATO in coming years.

Opportunities: Technological advancements

The rapid advancement of technology presents an opportunity for nations to leverage innovative solutions and gain a competitive edge in defense capabilities. Investing in research and development, adopting emerging technologies, and integrating them into defense systems can enhance operational effectiveness, efficiency, and strategic advantage.

Military forces of different countries across the globe are carrying out modernization programs to enhance the capabilities of their existing platforms. These programs aim to increase the platform’s endurance, flexibility, and strength. Defense platform manufacturers focus on incorporating main guns, remote weapons, ballistic armor, and composite technologies in them. For instance, advancements in weapon technologies have led to the increased range and accuracy of self-propelled artillery systems. These technological advancements will drive the budget analysis for the forecast period.

Challenges: Complexity of defense procurement

The complexity of defense procurement processes poses a challenge in effectively allocating defense budgets. Acquiring advanced military equipment, ensuring transparency, addressing corruption risks, and managing contracts and supply chains require meticulous planning, coordination, and oversight to maximize the value and effectiveness of defense spending.

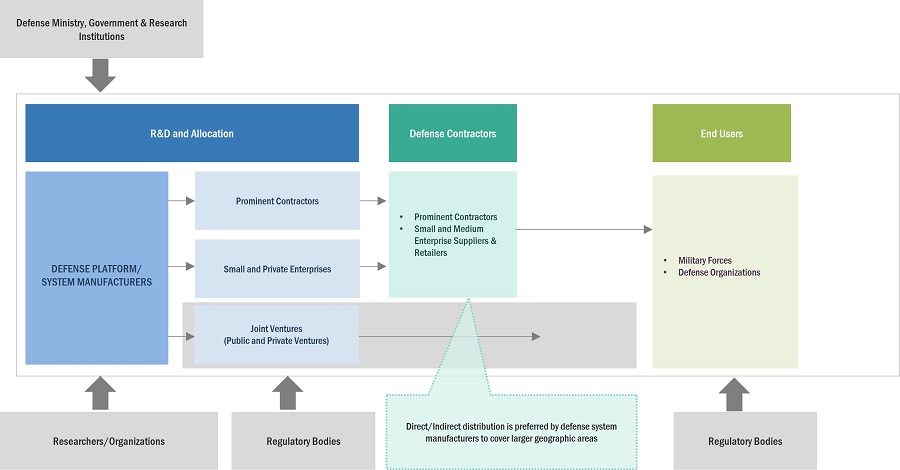

World Defense Budget Analysis Ecosystem

The world defense budget ecosystem encompasses a complex network of stakeholders, processes, and factors that influence the allocation and utilization of defense budgets globally. It involves governments, defense ministries, armed forces, defense contractors, research institutions, and other entities working together to ensure national security and maintain military capabilities. At the core of the ecosystem are the governments and defense ministries responsible for formulating defense policies, setting strategic priorities, and allocating resources. These decisions are based on assessments of national security threats, geopolitical dynamics, and the evolving nature of warfare. Governments work closely with defense ministries to determine the budgetary requirements and distribution across various defense sectors.

International collaborations and alliances also play a significant role in the defense budget ecosystem. Partnerships between nations facilitate joint defense programs, information sharing, interoperability, and cost-sharing initiatives. These collaborations enable countries to pool resources, optimize defense spending, and enhance collective defense capabilities. Governments and defense ministries are responsible for ensuring that defense spending is efficient, effective, and aligned with national security objectives. Oversight bodies, audit institutions, and legislative bodies monitor defense budgets, review expenditures, and ensure compliance with regulations and procedures. The world defense budget ecosystem is a dynamic and evolving landscape influenced by geopolitical shifts, emerging threats, technological advancements, and economic factors. It requires continuous assessment, strategic planning, and coordination among various stakeholders to optimize defense spending, enhance capabilities, and adapt to the ever-changing security environment.

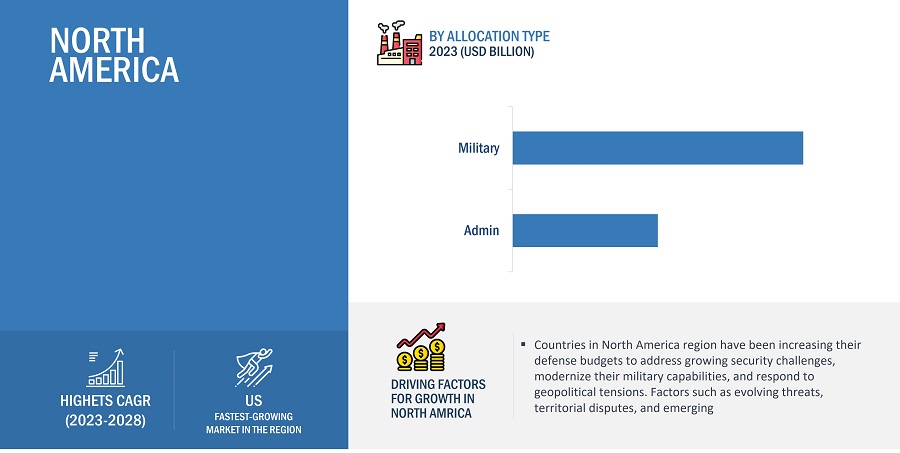

Based on allocation type, the Military expense segment is estimated to account for the largest share of the world defense budget analysis.

Based on allocation type, Military expense is poised to lead the budget allocation type as governments prioritize strengthening their defense capabilities and allocating substantial resources toward military spending. The increasing global security threats, geopolitical tensions, and the need to modernize armed forces are driving the growth of the military expense segment. This includes investments in advanced weaponry, equipment procurement, training programs, and personnel recruitment to maintain military readiness and combat capabilities.

Regarding domain allocation, the army segment is anticipated to dominate the defense budget analysis.

Regarding domain allocation, the army segment is expected to take the lead in the defense budget analysis. Governments recognize the significance of a robust military force to ensure national security and protect strategic interests. The army across the globe is heavily modernizing and upgrading its capabilities. Investments in defense personnel, training, equipment modernization, and infrastructure development contribute to the dominance of the army segment in the defense budget landscape.

The cyber segment of the world defense budget analysis by the platform is projected to rise at the highest CAGR in the market.

When considering platform allocation, the cyber segment is projected to lead with the highest compound annual growth rate (CAGR). The increasing reliance on digital infrastructure and the rising threats in the cyber domain has elevated the significance of cybersecurity in the defense sector. Governments are investing in advanced cyber defense capabilities, including secure networks, robust encryption systems, threat intelligence, and cyber response mechanisms. The growing adoption of cloud computing, artificial intelligence, and the Internet of Things (IoT) in defense systems further accentuates the need for robust cyber defenses, driving the growth of the cyber segment in defense budget allocation.

The advanced technology segment of the world defense budget analysis by technology allocation is projected to dominate the market with the highest CAGR.

Based on technology allocation, the advanced segment is expected to lead the market with the highest CAGR. The digitization of defense systems, including digital communication networks, data analytics, and command and control systems, offers enhanced situational awareness, operational efficiency, and decision-making capabilities. Governments are increasingly investing in digital technologies to optimize defense operations, streamline logistics, improve information sharing, and enable interoperability. The adoption of emerging technologies such as artificial intelligence, machine learning, and big data analytics within the defense sector further propels the growth of the digital segment in defense budget allocation. The digital segment’s dominance reflects the transformative impact of technology on defense capabilities and the growing recognition of the importance of digitalization in modern warfare.

North America is expected to lead the defense budget analysis in 2023.

The defense budget for countries in the North American region is experiencing significant growth due to several key factors. Firstly, the region is home to a major military power, the US. The US and Canada form the internal part of North American countries. The US, has the highest military budget and has been modernizing its military capabilities, and has invested heavily to advance its defense capabilities. Secondly, the rapid technological advancements and investments in defense platforms, systems, and technology drive the analysis in this region.

North America will continue to hold the largest share in world defense budget analysis for the forecast period.

World Defense Budget Analysis by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Countries

The world defense budget analysis is dominated by a few countries, such as the US, China, India, Russia, the UK, and Saudi Arabia, are some of the leading countries in the world defense budget analysis countries.

Scope of the Report

|

Report Metric |

Details |

|

Growth Rate |

4.90% |

|

Estimated Market Size in 2023 |

USD 2,004.7 Billion |

|

Projected Market Size in 2028 |

USD 2,546.9 Billion |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

By Allocation Type, Departmental Allocation, Platform Allocation, System Allocation, Domain Allocation, Technology Allocation, and By Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Countries covered |

US, China, India, Russia, France, UK, Canada, Japan, Saudi Arabia, etc. |

World Defense Budget Analysis Highlights

The study categorizes the world defense budget analysis based on allocation type, departmental allocation, platform allocation, system allocation, domain allocation, technology allocation, and by region.

|

Segment |

Subsegment |

|

By Allocation Type |

|

|

By Departmental Allocation |

|

|

By Platform Allocation |

|

|

By System Allocation |

|

|

By Domain Allocation |

|

|

By Technology Allocation |

|

|

By Region |

|

Recent Developments

- The US is working to strengthen its military alliances with countries like Japan, South Korea, and NATO. This is important because it allows the US to share the burden of defending its interests worldwide.

- The US is increasing its military presence in Asia-Pacific in response to China’s growing power. This includes sending more ships and aircraft to the region and conducting joint exercises with allies.

Frequently Asked Questions (FAQ):

What will be the world defense budget in 2023?

The world defense budget is estimated to be USD 2004.7 billion in 2023 and is projected to reach USD 2,546.9 billion by 2028, at a CAGR of 4.9% from 2023 to 2028.

Which are the key countries in the world defense budget analysis? What are their major strategies to strengthen their market presence?

Some of the key countries in the world defense budget analysis are the US, India, Russia, Saudi Arabia, UK China, among others, are the key countries.

What are the drivers and opportunities for the world defense budget analysis?

Heightened geopolitical tensions, evolving security threats, and the need to safeguard national interests drive the allocation of significant resources to defense budgets. Governments worldwide prioritize modernizing their armed forces, enhancing military capabilities, and strengthening national security. The rapid advancements in technology present immense opportunities within the defense budget landscape. Innovations like artificial intelligence, unmanned systems, cyber capabilities, and advanced weaponry offer new possibilities for defense applications. Governments recognize the importance of leveraging these technologies to gain a competitive edge, enhance operational effectiveness, and adapt to the evolving nature of warfare.

Which region is expected to grow at the highest rate in the next five years?

The North American region is projected to experience the highest CAGR in defense budget allocation. This growth can be attributed to several key factors. Firstly, the region is witnessing significant economic growth, increasing overall government spending, including defense budgets. Countries like China, India, and Japan are expanding their defense capabilities to meet evolving security challenges and protect their strategic interests. Secondly, the Asia-Pacific region is characterized by geopolitical tensions and territorial disputes, driving the need for enhanced defense capabilities. Rising military expenditures in countries such as China and India reflect their ambitions to assert regional dominance and ensure national security.

Which country is expected to lead significantly in the coming years?

The US is expected to exhibit the largest share of the world defense budget over the forecasted period from 2023 to 2028. As the world’s largest military spender, the US plays a crucial role in shaping the global defense budget landscape. With a strong emphasis on defense capabilities and military modernization, the country allocates significant resources to defense expenditure. Its defense budget supports advanced research and development programs, procurement of cutting-edge weaponry, and the maintenance of a technologically superior military force.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 TRENDS/DISRUPTIONS IMPACTING CONTRACTOR BUSINESS

- 5.3 REGULATORY AND POLICY LANDSCAPE

- 5.4 IMPACT OF MEGATRENDS

-

5.5 TECHNOLOGY TRENDSQUANTUM COMPUTING

-

5.6 TREND INDICATORSMACRO- GDP and defense budget share (%) of GDP- Geopolitical intensity/external disputes- Development index- Terrorism index- Recession impact analysisMICRO- Military strength/recruitment- Military modernization- Soldier welfare

- 5.7 EXPORT AND IMPORT/TRADE ANALYSIS

-

5.8 DEFENSE BUDGET ANALYSIS, BY DEPARTMENTAL ALLOCATIONMILITARY- Department of National Defense- Canadian Armed Forces- Defense Research and Development Canada- Communications Security Establishment- Canadian Security Intelligence Service- Canadian Border Services Agency- Canadian Security and Intelligence Review CommitteeHOMELAND SECURITY- Public Safety Canada- Royal Canadian Mounted Police- Integrated Terrorism Assessment Centre- Canadian Centre for Cyber Security- Joint Task Force 2- Provincial and Municipal Police Forces

-

5.9 DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATIONLANDAIRBORNENAVALSPACECYBER

-

5.10 DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATIONELECTRONICS- Intelligence, surveillance, and reconnaissance- Communication, navigation, and surveillance- Global navigation satellite system- Electronic warfare- Digital battlefieldARMAMENTS- Weapons and munitions- Firearms and ammunition

-

5.11 DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATIONADVANCED- Use casesCONVENTIONAL- Use cases

-

5.12 DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATIONMILITARY FORCES- Canadian Army- Royal Canadian Navy- Royal Canadian Air ForceSPECIAL FORCES

-

5.13 DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPEMILITARY EXPENSEADMIN EXPENSE

-

5.14 DEFENSE BUDGET ANALYSIS, BY SALES OVERHEADFOREIGN MILITARY SALESINDIGENOUS SALES

-

5.15 DEFENSE BUDGET ANALYSIS, COMPETITIVE SCENARIOSCOMPETITIVE LANDSCAPE- Company ranking analysis- Competitive benchmarkingPRIME CONTRACTORS- Lockheed Martin Corporation- CAE Inc.- General Dynamics Land Systems Inc.

- 6.1 INTRODUCTION

-

6.2 TRENDS/DISRUPTIONS IMPACTING CONTRACTOR BUSINESS

- 6.3 REGULATORY AND POLICY LANDSCAPE

- 6.4 IMPACT OF MEGATRENDS

-

6.5 TECHNOLOGY TRENDSFUTURE COMBAT AIR SYSTEM

-

6.6 TREND INDICATORSMACRO- GDP and defense budget share (%) of GDP- Geopolitical intensity/external disputes- Development index- Terrorism index- Recession impact analysisMICRO- Military strength/recruitment- Military modernization- Soldier welfare

- 6.7 EXPORT AND IMPORT/TRADE ANALYSIS

-

6.8 DEFENSE BUDGET ANALYSIS, BY DEPARTMENTAL ALLOCATIONMILITARY- Ministry of Defence- British Army- Royal Navy- Royal Air Force- Defense Equipment and Support- Joint Forces CommandHOMELAND SECURITY

-

6.9 DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATIONLANDAIRBORNENAVALSPACECYBER

-

6.10 DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATIONELECTRONICS- Intelligence, surveillance, and reconnaissance- Communication, navigation, and surveillance- Global navigation satellite system- Electronic warfare- Digital battlefieldARMAMENTS- Weapons and munitions- Firearms and ammunition

-

6.11 DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATIONADVANCED- Use casesCONVENTIONAL- Use cases

-

6.12 DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATIONMILITARY FORCES- British Army- Royal Navy- Royal Air ForceSPECIAL FORCES- Special Air Service- Special Boat Service

-

6.13 DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPEMILITARY EXPENSEADMIN EXPENSE

-

6.14 DEFENSE BUDGET ANALYSIS, BY SALES OVERHEADFOREIGN MILITARY SALESINDIGENOUS SALES

-

6.15 DEFENSE BUDGET ANALYSIS, COMPETITIVE SCENARIOSCOMPETITIVE LANDSCAPE- Company ranking analysis- Competitive benchmarkingPRIME CONTRACTORS- Babcock International Group PLC- BAE Systems plc- Lockheed Martin Corporation

- 7.1 INTRODUCTION

-

7.2 TRENDS/DISRUPTIONS IMPACTING CONTRACTOR BUSINESS

- 7.3 REGULATORY AND POLICY LANDSCAPE

- 7.4 IMPACT OF MEGATRENDS

-

7.5 TECHNOLOGY TRENDSFUTURE COMBAT AIR SYSTEMCYBERSECURITY AND INFORMATION WARFARE

-

7.6 TREND INDICATORSMACRO- GDP and defense budget share (%) of GDP- Geopolitical intensity/external disputes- Development index- Terrorism index- Recession impact analysisMICRO- Military strength/recruitment- Military modernization- Soldier welfare

- 7.7 EXPORT AND IMPORT/TRADE ANALYSIS

-

7.8 DEFENSE BUDGET ANALYSIS, BY DEPARTMENTAL ALLOCATIONMILITARY- French Army- French Navy- French Air and Space ForceHOMELAND SECURITY- Ministry of the Interior- National Police- Gendarmerie Nationale- General Directorate for Internal Security- General Directorate of Foreign Security- Directorate-General for Civil Protection and Crisis Management

-

7.9 DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATIONLANDAIRBORNENAVALSPACECYBER

-

7.10 DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATIONELECTRONICS- Intelligence, surveillance, and reconnaissance- Communication, navigation, and surveillance- Global navigation satellite system- Electronic warfare- Digital battlefieldARMAMENTS- Weapons and munitions- Firearms and ammunition

-

7.11 DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATIONADVANCED- Use casesCONVENTIONAL- Use cases

-

7.12 DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATIONMILITARY FORCES- Army- Navy- Air and Space Force- GendarmerieSPECIAL FORCES

-

7.13 DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPEMILITARY EXPENSEADMIN EXPENSE

-

7.14 DEFENSE BUDGET ANALYSIS, BY SALES OVERHEADFOREIGN MILITARY SALESINDIGENOUS SALES

-

7.15 DEFENSE BUDGET ANALYSIS, COMPETITIVE SCENARIOSCOMPETITIVE LANDSCAPE- Company ranking analysis- Competitive benchmarkingPRIME CONTRACTORS- Airbus SE- Safran SA- Thales SA

- 8.1 INTRODUCTION

-

8.2 TRENDS/DISRUPTIONS IMPACTING CONTRACTOR BUSINESS

- 8.3 REGULATORY AND POLICY LANDSCAPE

- 8.4 IMPACT OF MEGATRENDS

-

8.5 TECHNOLOGY TRENDSNETWORK-CENTRIC WARFAREADVANCED SENSORS AND SURVEILLANCE

-

8.6 TREND INDICATORSMACRO- GDP and defense budget share (%) of GDP- Geopolitical intensity/external disputes- Development index- Terrorism index- Recession impact analysisMICRO- Military strength/recruitment- Military modernization- Soldier welfare

- 8.7 EXPORT AND IMPORT/TRADE ANALYSIS

-

8.8 DEFENSE BUDGET ANALYSIS, BY DEPARTMENTAL ALLOCATIONMILITARY- Army- Navy- Air Force- Joint Support Service- Cyber and Information Domain Service- Medical Service- Military PoliceHOMELAND SECURITY- Federal Police- Federal Criminal Police Office- State Police- Federal Office for the Protection of the Constitution- Federal Agency for Technical Relief- Customs Administration

-

8.9 DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATIONLANDAIRBORNENAVALSPACECYBER

-

8.10 DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATIONELECTRONICS- Intelligence, surveillance, and reconnaissance- Communication, navigation, and surveillance- Global navigation satellite system- Electronic warfare- Digital battlefieldARMAMENTS- Weapons and munitions- Firearms and ammunition

-

8.11 DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATIONADVANCED- Use casesCONVENTIONAL- Use cases

-

8.12 DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATIONMILITARY FORCES- German Army- German Navy- German Air Force- Joint Support Service- Cyber and Information Domain ServiceSPECIAL FORCES

-

8.13 DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPEMILITARY EXPENSEADMIN EXPENSE

-

8.14 DEFENSE BUDGET ANALYSIS, BY SALES OVERHEADFOREIGN MILITARY SALESINDIGENOUS SALES

-

8.15 DEFENSE BUDGET ANALYSIS, COMPETITIVE SCENARIOSCOMPETITIVE LANDSCAPE- Company ranking analysis- Competitive benchmarkingPRIME CONTRACTORS- Rheinmetall AG- Leonardo SpA- Thales SA

- 9.1 INTRODUCTION

-

9.2 TRENDS/DISRUPTIONS IMPACTING CONTRACTOR BUSINESS

- 9.3 REGULATORY AND POLICY LANDSCAPE

- 9.4 IMPACT OF MEGATRENDS

-

9.5 TECHNOLOGY TRENDSASYMMETRIC FORCE-MULTIPLIER TECHNOLOGIESHYPERSONIC MISSILES

-

9.6 TREND INDICATORSMACRO- GDP and defense budget share (%) of GDP- Geopolitical intensity/external disputes- Development index- Terrorism index- Recession impact analysisMICRO- Military strength/recruitment- Military modernization- Soldier welfare

- 9.7 EXPORT AND IMPORT/TRADE ANALYSIS

-

9.8 DEFENSE BUDGET ANALYSIS, BY DEPARTMENTAL ALLOCATIONMILITARY- Ministry of Defense- Ground Forces- Navy- Aerospace Forces- Strategic Missile Troops- Airborne Troops- Space ForcesHOMELAND SECURITY- Federal Security Service- Ministry of Internal Affairs- National Guard of Russia- Ministry of Emergency Situations- Border Guard Service- Federal Protective Service

-

9.9 DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATIONLANDAIRBORNENAVALSPACECYBER

-

9.10 DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATIONELECTRONICS- Intelligence, surveillance, and reconnaissance- Communication, navigation, and surveillance- Global navigation satellite system- Electronic warfare- Digital battlefieldARMAMENTS- Weapons and munitions- Firearms and ammunition

-

9.11 DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATIONADVANCED- Use casesCONVENTIONAL- Use cases

-

9.12 DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATIONMILITARY FORCES- Russian Armed Forces- Russian Ground Forces- Russian Navy- Russian Aerospace Forces- Strategic Missile Troops- Russian Airborne TroopsSPECIAL FORCES

-

9.13 DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPEMILITARY EXPENSEADMIN EXPENSE

-

9.14 DEFENSE BUDGET ANALYSIS, BY SALES OVERHEADFOREIGN MILITARY SALESINDIGENOUS SALES

-

9.15 DEFENSE BUDGET ANALYSIS, COMPETITIVE SCENARIOSCOMPETITIVE LANDSCAPE- Company ranking analysis- Competitive benchmarkingPRIME CONTRACTORS- UralVagonZavod (UVZ)- United Aircraft Corporation (UAC)- United Shipbuilding Corporation (USC)

- 10.1 INTRODUCTION

-

10.2 TRENDS/DISRUPTIONS IMPACTING CONTRACTOR BUSINESS

- 10.3 REGULATORY AND POLICY LANDSCAPE

- 10.4 IMPACT OF MEGATRENDS

-

10.5 TECHNOLOGY TRENDSCYBER DEFENSEDIRECTED ENERGY WEAPONS

-

10.6 TREND INDICATORSMACRO- GDP and defense budget share (%) of GDP- Geopolitical intensity/external disputes- Development index- Terrorism index- Recession impact analysisMICRO- Military strength/recruitment- Military modernization- Soldier welfare

- 10.7 EXPORT AND IMPORT/TRADE ANALYSIS

-

10.8 DEFENSE BUDGET ANALYSIS, BY DEPARTMENTAL ALLOCATIONMILITARY- Italian Army (Esercito Italiano)- Italian Navy (Marina Militare)- Italian Air Force (Aeronautica Militare)- CarabinieriHOMELAND SECURITY- Ministry of Interior (Ministero dell'Interno)- State Police (Polizia di Stato)- Guardia di Finanza- Customs and Border Protection (Agenzia delle Dogane e dei Monopoli)- Civil Protection Department (Dipartimento della Protezione Civile)- Intelligence and Security Services

-

10.9 DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATIONLANDAIRBORNENAVALSPACECYBER

-

10.10 DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATIONELECTRONICS- Intelligence, surveillance, and reconnaissance- Communication, navigation, and surveillance- Global navigation satellite system- Electronic warfare- Digital battlefieldARMAMENTS- Weapons and munitions- Firearms and ammunition

-

10.11 DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATIONADVANCED- Use casesCONVENTIONAL- Use cases

-

10.12 DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATIONMILITARY FORCESSPECIAL FORCES

-

10.13 DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPEMILITARY EXPENSEADMIN EXPENSE

-

10.14 DEFENSE BUDGET ANALYSIS, BY SALES OVERHEADFOREIGN MILITARY SALESINDIGENOUS SALES

-

10.15 DEFENSE BUDGET ANALYSIS, COMPETITIVE SCENARIOSCOMPETITIVE LANDSCAPE- Company ranking analysis- Competitive benchmarkingPRIME CONTRACTORS- Northrop Grumman Corporation- Leonardo SpA- Thales SA

- 11.1 INTRODUCTION

-

11.2 TRENDS/DISRUPTIONS IMPACTING CONTRACTOR BUSINESS

- 11.3 REGULATORY AND POLICY LANDSCAPE

- 11.4 IMPACT OF MEGATRENDS

-

11.5 TECHNOLOGY TRENDSARTIFICIAL INTELLIGENCESWARMING MUNITIONS

-

11.6 TREND INDICATORSMACRO- GDP and defense budget share (%) of GDP- Geopolitical intensity/external disputes- Development index- Terrorism index- Recession impact analysisMICRO- Military strength/recruitment- Military modernization- Soldier welfare

- 11.7 EXPORT AND IMPORT/TRADE ANALYSIS

-

11.8 DEFENSE BUDGET ANALYSIS, BY DEPARTMENTAL ALLOCATIONMILITARY- Central Military Commission- People's Liberation Army- Ground Force- Navy- Air Force- Rocket Force- Strategic Support ForceHOMELAND SECURITY- Ministry of Public Security- People's Armed Police- State Administration for Market Regulation- State Administration of Work Safety- National Administration of State Secrets Protection- Ministry of State Security

-

11.9 DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATIONLANDAIRBORNENAVALSPACECYBER

-

11.10 DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATIONELECTRONICS- Intelligence, surveillance, and reconnaissance- Communication, navigation, and surveillance- Global navigation satellite system- Electronic warfare- Digital battlefieldARMAMENTS- Weapons and munitions- Firearms and ammunition

-

11.11 DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATIONADVANCED- Use casesCONVENTIONAL- Use cases

-

11.12 DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATIONMILITARY FORCES- PLA Army- PLA Navy- PLA Air Force- Rocket Force- Strategic Support Force- People's Armed PoliceSPECIAL FORCES- Special Operations Forces- Navy Marine Corps- Air Force Special Operations Forces- Reconnaissance Units- Snow Leopard Commando Unit- Night Tiger Commando Unit

-

11.13 DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPEMILITARY EXPENSEADMIN EXPENSE

-

11.14 DEFENSE BUDGET ANALYSIS, BY SALES OVERHEADFOREIGN MILITARY SALESINDIGENOUS SALES

-

11.15 DEFENSE BUDGET ANALYSIS, COMPETITIVE SCENARIOSCOMPETITIVE LANDSCAPE- Company ranking analysis- Competitive benchmarkingPRIME CONTRACTORS- AVIC Shenyang Aircraft Co., Ltd.- AECC Aviation Power Co. Ltd.- China CSSC Holdings Ltd.

- 12.1 INTRODUCTION

-

12.2 TRENDS/DISRUPTIONS IMPACTING CONTRACTOR BUSINESS

- 12.3 REGULATORY AND POLICY LANDSCAPE

- 12.4 IMPACT OF MEGATRENDS

-

12.5 TECHNOLOGY TRENDSHYPERSONIC WEAPONSANTI-SATELLITE MISSILES

-

12.6 TREND INDICATORSMACRO- GDP and defense budget share (%) of GDP- Geopolitical intensity/external disputes- Development index- Terrorism index- Recession impact analysisMICRO- Military strength/recruitment- Military modernization- Soldier welfare

- 12.7 EXPORT AND IMPORT/TRADE ANALYSIS

-

12.8 DEFENSE BUDGET ANALYSIS, BY DEPARTMENTAL ALLOCATIONMILITARY- Ministry of Defence (MOD)- Indian Army- Indian Navy- Indian Air Force- Defence Research and Development Organization (DRDO)- Defence Acquisition Council (DAC)- Integrated Defence Staff (IDS)HOMELAND SECURITY- Ministry of Home Affairs- Central Reserve Police Force- Border Security Force- Central Industrial Security Force- National Security Guard- Intelligence Bureau- National Investigation Agency- State Police Departments

-

12.9 DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATIONLANDAIRBORNENAVALSPACECYBER

-

12.10 DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATIONELECTRONICS- Intelligence, surveillance, and reconnaissance- Communication, navigation, and surveillance- Global navigation satellite system- Electronic warfare- Digital battlefieldARMAMENTS- Weapons and munitions- Firearms and ammunition

-

12.11 DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATIONADVANCED- Use casesCONVENTIONAL- Use cases

-

12.12 DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATIONMILITARY FORCES- Indian Army- Indian Navy- Indian Air Force- Indian Coast GuardSPECIAL FORCES- Para- MARCOS- Garud Commando Force- National Security Guard

-

12.13 DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPEMILITARY EXPENSEADMIN EXPENSE

-

12.14 DEFENSE BUDGET ANALYSIS, BY SALES OVERHEADFOREIGN MILITARY SALESINDIGENOUS SALES

-

12.15 DEFENSE BUDGET ANALYSIS, COMPETITIVE SCENARIOSCOMPETITIVE LANDSCAPE- Company ranking analysis- Competitive benchmarkingPRIME CONTRACTORS- Bharat Dynamics Ltd.- Bharat Electronics Ltd.- Hindustan Aeronautics Ltd.

- 13.1 INTRODUCTION

-

13.2 TRENDS/DISRUPTIONS IMPACTING CONTRACTOR BUSINESS

- 13.3 REGULATORY AND POLICY LANDSCAPE

- 13.4 IMPACT OF MEGATRENDS

-

13.5 TECHNOLOGY TRENDSLONG-RANGE MISSILESHIGH-POWER MICROWAVE

-

13.6 TREND INDICATORSMACRO- GDP and defense budget share (%) of GDP- Geopolitical intensity/external disputes- Development index- Terrorism index- Recession impact analysisMICRO- Military strength/recruitment- Military modernization- Soldier welfare

- 13.7 EXPORT AND IMPORT/TRADE ANALYSIS

-

13.8 DEFENSE BUDGET ANALYSIS, BY DEPARTMENTAL ALLOCATIONMILITARY- Ministry of Defense- Defense Agency- Self-Defense Forces- National Security Council- National Defense CouncilHOMELAND SECURITY- Ground Self-Defense Force- Maritime Self-Defense Force- Air Self-Defense Force

-

13.9 DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATIONLANDAIRBORNENAVALSPACECYBER

-

13.10 DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATIONELECTRONICS- Intelligence, surveillance, and reconnaissance- Communication, navigation, and surveillance- Global navigation satellite system- Electronic warfare- Digital battlefieldARMAMENTS- Weapons and munitions- Firearms and ammunition

-

13.11 DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATIONADVANCED- Use casesCONVENTIONAL- Use cases

-

13.12 DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATIONMILITARY FORCESSPECIAL FORCES

-

13.13 DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPEMILITARY EXPENSESADMIN EXPENSES

-

13.14 DEFENSE BUDGET ANALYSIS, BY SALES OVERHEADFOREIGN MILITARY SALESINDIGENOUS SALES

-

13.15 DEFENSE BUDGET ANALYSIS, COMPETITIVE SCENARIOSCOMPETITIVE LANDSCAPE- Company ranking analysis- Competitive benchmarkingPRIME CONTRACTORS- Kawasaki Heavy Industries, Ltd.- Mitsubishi Heavy Industries, Ltd.- NEC Corporation

- 14.1 INTRODUCTION

-

14.2 TRENDS/DISRUPTIONS IMPACTING CONTRACTOR BUSINESS

- 14.3 REGULATORY AND POLICY LANDSCAPE

- 14.4 IMPACT OF MEGATRENDS

-

14.5 TECHNOLOGY TRENDSHYPERSONIC PROPULSION PLATFORMSINTERMEDIATE-RANGE BALLISTIC MISSILES

-

14.6 TREND INDICATORSMACRO- GDP and defense budget share (%) of GDP- Geopolitical intensity/external disputes- Development index- Terrorism index- Recession impact analysisMICRO- Military strength/recruitment- Military modernization- Soldier welfare

- 14.7 EXPORT AND IMPORT/TRADE ANALYSIS

-

14.8 DEFENSE BUDGET ANALYSIS, BY DEPARTMENTAL ALLOCATIONMILITARY- Republic of Korea Army- Republic of Korea Navy- Republic of Korea Air Force- Republic of Korea Marine Corps- Defense Acquisition Program Administration- Joint Chiefs of StaffHOMELAND SECURITY- Ministry of Interior and Safety- National Police Agency- Korea Coast Guard (KCG)- National Intelligence Service- Ministry of National Defense

-

14.9 DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATIONLANDAIRBORNENAVALSPACECYBER

-

14.10 DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATIONELECTRONICS- Intelligence, surveillance, and reconnaissance- Communication, navigation, and surveillance- Global navigation satellite system- Electronic warfare- Digital battlefieldARMAMENTS- Weapons and munitions- Firearms and ammunition

-

14.11 DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATIONADVANCED- Use casesCONVENTIONAL- Use cases

-

14.12 DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATIONMILITARY FORCESSPECIAL FORCES

-

14.13 DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPEMILITARY EXPENSEADMIN EXPENSE

-

14.14 DEFENSE BUDGET ANALYSIS, BY SALES OVERHEADFOREIGN MILITARY SALESINDIGENOUS SALES

-

14.15 DEFENSE BUDGET ANALYSIS, COMPETITIVE SCENARIOSCOMPETITIVE LANDSCAPE- Company ranking analysis- Competitive benchmarkingPRIME CONTRACTORS- Hyundai Rotem Co- Hanwha Corporation- Korea Aerospace Industries Ltd. (KAI)

- 15.1 INTRODUCTION

-

15.2 TRENDS/DISRUPTIONS IMPACTING CONTRACTOR BUSINESS

- 15.3 REGULATORY AND POLICY LANDSCAPE

- 15.4 IMPACT OF MEGATRENDS

-

15.5 TECHNOLOGY TRENDSSENSORS AND ANALYTICSAUGMENTED REALITY AND VIRTUAL REALITY

-

15.6 TREND INDICATORSMACRO- GDP and defense budget share (%) of GDP- Geopolitical intensity/external disputes- Development index- Terrorism index- Recession impact analysisMICRO- Military strength/recruitment- Military modernization- Soldier welfare

- 15.7 EXPORT AND IMPORT/TRADE ANALYSIS

-

15.8 DEFENSE BUDGET ANALYSIS, BY DEPARTMENTAL ALLOCATIONMILITARY- Department of Defense- Australian Defense Force- Australian Army- Royal Australian Navy- Royal Australian Air Force- Defense Science and Technology Group- Defense Materiel OrganizationHOMELAND SECURITY- Department of Home Affairs- Australian Federal Police- Australian Security Intelligence Organization- Australian Border Force- Australian Security and Intelligence Review Agency- State and Territory Police Forces

-

15.9 DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATIONLANDAIRBORNENAVALSPACECYBER

-

15.10 DEFENSE BUDGET ANALYSIS, SYSTEM ALLOCATIONELECTRONICS- Intelligence, surveillance, and reconnaissance- Communication, navigation, and surveillance- Global navigation satellite system- Electronic warfare- Digital battlefieldARMAMENTS- Weapons and munitions- Firearms and ammunition

-

15.11 DEFENSE BUDGET ANALYSIS, TECHNOLOGY ALLOCATIONADVANCED- Use casesCONVENTIONAL- Use cases

-

15.12 DEFENSE BUDGET ANALYSIS, DOMAIN ALLOCATIONMILITARY FORCES- Australian Army- Royal Australian Navy- Royal Australian Air ForceSPECIAL FORCES- Special Air Service Regiment- 2nd Commando Regiment- Incident Response Regiment- Tactical Assault Group (East and West)

-

15.13 DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPEMILITARY EXPENSEADMIN EXPENSE

-

15.14 DEFENSE BUDGET ANALYSIS, BY SALES OVERHEADFOREIGN MILITARY SALINDIGENOUS SALES

-

15.15 DEFENSE BUDGET ANALYSIS, COMPETITIVE SCENARIOSCOMPETITIVE LANDSCAPE- Company ranking analysis- Competitive benchmarkingPRIME CONTRACTORS- BAE Systems Australia Ltd.- Lockheed Martin Corporation- Thales SA

- 16.1 INTRODUCTION

-

16.2 TRENDS/DISRUPTIONS IMPACTING CONTRACTOR BUSINESS

- 16.3 REGULATORY AND POLICY LANDSCAPE

- 16.4 IMPACT OF MEGATRENDS

-

16.5 TECHNOLOGY TRENDSDIRECTED ENERGY WEAPONS

-

16.6 TREND INDICATORSMACRO- GDP and defense budget share (%) of GDP- Geopolitical intensity/external disputes- Development index- Terrorism index- Recession impact analysisMICRO- Military strength/recruitment- Military modernization- Soldier welfare

- 16.7 EXPORT AND IMPORT/TRADE ANALYSIS

-

16.8 DEFENSE BUDGET ANALYSIS, BY DEPARTMENTAL ALLOCATIONMILITARY- Royal Saudi Land Forces- Royal Saudi Naval Forces- Royal Saudi Air Defense Forces- Royal Saudi Air Force- Royal Saudi Strategic Missile Force- Saudi Arabian National GuardHOMELAND SECURITY- Ministry of Interior- General Directorate of Public Security- General Directorate of Border Guards- General Directorate of Civil Defense- General Directorate of Prisons

-

16.9 DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATIONLANDAIRBORNENAVALSPACECYBER

-

16.10 DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATIONELECTRONICS- Intelligence, surveillance, and reconnaissance- Communication, navigation, and surveillance- Global navigation satellite system- Electronic warfare- Digital battlefieldARMAMENTS- Weapons and munitions- Firearms and ammunition

-

16.11 DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATIONADVANCED- Use casesCONVENTIONAL- Use cases

-

16.12 DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATIONMILITARY FORCESSPECIAL FORCES

-

16.13 DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPEMILITARY EXPENSEADMIN EXPENSE

-

16.14 DEFENSE BUDGET ANALYSIS, BY SALES OVERHEADFOREIGN MILITARY SALESINDIGENOUS SALES

-

16.15 DEFENSE BUDGET ANALYSIS, COMPETITIVE SCENARIOSCOMPETITIVE LANDSCAPE- Company ranking analysis- Competitive benchmarkingPRIME CONTRACTORS- Lockheed Martin Corporation- The Boeing Company- BAE Systems plc

- 17.1 INTRODUCTION

-

17.2 TRENDS/DISRUPTIONS IMPACTING CONTRACTOR BUSINESS

- 17.3 REGULATORY AND POLICY LANDSCAPE

- 17.4 IMPACT OF MEGATRENDS

-

17.5 TECHNOLOGY TRENDSMICRO-SUICIDE DRONE SWARMSROCKET ARTILLERY SYSTEMS

-

17.6 TREND INDICATORSMACRO- GDP and defense budget share (%) of GDP- Geopolitical intensity/external disputes- Development index- Terrorism index- Recession impact analysisMICRO- Military strength/recruitment- Military modernization- Soldier welfare

- 17.7 EXPORT AND IMPORT/TRADE ANALYSIS

-

17.8 DEFENSE BUDGET ANALYSIS, BY DEPARTMENTAL ALLOCATIONMILITARY- Israeli Army- Israeli Air Force- Israeli Navy- Intelligence Directorate (Aman)- C4I Directorate- Cyber Defense DirectorateHOMELAND SECURITY- Israel Security Agency (Shin Bet)- Israel National Police- Border Police- Home Front Command- Fire and Rescue Services- Ministry of Public Security

-

17.9 DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATIONLANDAIRBORNENAVALSPACECYBER

-

17.10 DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATIONELECTRONICS- Intelligence, surveillance, and reconnaissance- Communication, navigation, and surveillance- Global navigation satellite system- Electronic warfare- Digital battlefieldARMAMENTS- Weapons and munitions- Firearms and ammunition

-

17.11 DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATIONADVANCED- Use casesCONVENTIONAL- Use cases

-

17.12 DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATIONMILITARY FORCESSPECIAL FORCES

-

17.13 DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPEMILITARY EXPENSEADMIN EXPENSE

-

17.14 DEFENSE BUDGET ANALYSIS, BY SALES OVERHEADFOREIGN MILITARY SALESINDIGENOUS SALES

-

17.15 DEFENSE BUDGET ANALYSIS, COMPETITIVE SCENARIOSCOMPETITIVE LANDSCAPE- Company ranking analysis- Competitive benchmarkingPRIME CONTRACTORS- Israel Aerospace Industries- Rafael Advanced Defense Systems Ltd.- Elbit Systems

- 18.1 INTRODUCTION

-

18.2 TRENDS/DISRUPTIONS IMPACTING CONTRACTOR BUSINESS

- 18.3 REGULATORY AND POLICY LANDSCAPE

- 18.4 IMPACT OF MEGATRENDS

- 18.5 TECHNOLOGY TRENDS

-

18.6 TREND INDICATORSMACRO- GDP and defense budget share (%) of GDP- Geopolitical intensity/external disputes- Development index- Terrorism index- Recession impact analysisMICRO- Military strength/recruitment- Military modernization- Soldier welfare

- 18.7 EXPORT AND IMPORT/TRADE ANALYSIS

-

18.8 DEFENSE BUDGET ANALYSIS, BY DEPARTMENTAL ALLOCATIONMILITARYHOMELAND SECURITY

-

18.9 DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATIONLANDAIRBORNENAVALSPACECYBER

-

18.10 DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATIONELECTRONICS- Intelligence, surveillance, and reconnaissance- Communication, navigation, and surveillance- Global navigation satellite system- Electronic warfare- Digital battlefieldARMAMENTS- Weapons and munitions- Firearms and ammunition

-

18.11 DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATIONADVANCED- Use casesCONVENTIONAL- Use cases

-

18.12 DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATIONMILITARY FORCESSPECIAL FORCES

-

18.13 DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPEMILITARY EXPENSEADMIN EXPENSE

-

18.14 DEFENSE BUDGET ANALYSIS, BY SALES OVERHEADFOREIGN MILITARY SALESINDIGENOUS SALES

-

18.15 DEFENSE BUDGET ANALYSIS, COMPETITIVE SCENARIOSCOMPETITIVE LANDSCAPE- Company ranking analysis- Competitive benchmarkingPRIME CONTRACTORS- Thales SA- Airbus SE- The Boeing Company

- 19.1 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 19.2 AUTHOR DETAILS

- TABLE 1 WORLD DEFENSE BUDGET ANALYSIS, 2019–2022 (USD BILLION)

- TABLE 2 WORLD DEFENSE BUDGET ANALYSIS, 2023–2028 (USD BILLION)

- TABLE 3 USD EXCHANGE RATES

- TABLE 4 INCLUSIONS AND EXCLUSIONS IN WORLD DEFENSE BUDGET ANALYSIS

- TABLE 5 MARKET ESTIMATION PROCEDURE

- TABLE 6 US: DEFENSE BUDGET ANALYSIS, 2019–2022 (USD BILLION)

- TABLE 7 US: DEFENSE BUDGET ANALYSIS, 2023–2028 (USD BILLION)

- TABLE 8 US: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2019–2022 (USD BILLION)

- TABLE 9 US: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2023–2028 (USD BILLION)

- TABLE 10 US: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 11 US: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 12 US: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 13 US: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 14 US: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 15 US: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 16 US: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 17 US: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 18 US: EXPORT DATA (USD THOUSAND)

- TABLE 19 US: IMPORT DATA (USD THOUSAND)

- TABLE 20 KEY FIREARMS USED BY US ARMED FORCES

- TABLE 21 KEY CALIBERS USED BY US ARMED FORCES

- TABLE 22 US DEFENSE BUDGET ANALYSIS: COMPETITIVE BENCHMARKING

- TABLE 23 NORTHROP GRUMMAN CORPORATION: COMPANY OVERVIEW

- TABLE 24 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 25 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 26 CANADA: DEFENSE BUDGET ANALYSIS, 2019–2022 (USD BILLION)

- TABLE 27 CANADA: DEFENSE BUDGET ANALYSIS, 2023–2028 (USD BILLION)

- TABLE 28 CANADA: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2019–2022 (USD BILLION)

- TABLE 29 CANADA: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2023–2028 (USD BILLION)

- TABLE 30 CANADA: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 31 CANADA: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 32 CANADA: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 33 CANADA: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 34 CANADA: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 35 CANADA: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 36 CANADA: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 37 CANADA: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 38 CANADA: EXPORT DATA (USD THOUSAND)

- TABLE 39 CANADA: IMPORT DATA (USD THOUSAND)

- TABLE 40 KEY FIREARMS USED BY CANADIAN ARMED FORCES

- TABLE 41 KEY CALIBERS USED BY CANADIAN ARMED FORCES

- TABLE 42 CANADA DEFENSE BUDGET ANALYSIS MARKET: COMPETITIVE BENCHMARKING

- TABLE 43 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 44 CAE INC.: COMPANY OVERVIEW

- TABLE 45 GENERAL DYNAMICS LAND SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 46 UK: DEFENSE BUDGET ANALYSIS, 2019–2022 (USD BILLION)

- TABLE 47 UK: DEFENSE BUDGET ANALYSIS, 2023–2028 (USD BILLION)

- TABLE 48 UK: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2019–2022 (USD BILLION)

- TABLE 49 UK: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2023–2028 (USD BILLION)

- TABLE 50 UK: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 51 UK: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 52 UK: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 53 UK: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 54 UK: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 55 UK: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 56 UK: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 57 UK: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 58 UK: EXPORT DATA (USD THOUSAND)

- TABLE 59 UK: IMPORT DATA (USD THOUSAND)

- TABLE 60 KEY FIREARMS USED BY UK ARMED FORCES

- TABLE 61 KEY CALIBERS USED BY UK ARMED FORCES

- TABLE 62 UK DEFENSE BUDGET ANALYSIS: COMPETITIVE BENCHMARKING

- TABLE 63 BABCOCK INTERNATIONAL GROUP PLC: COMPANY OVERVIEW

- TABLE 64 BAE SYSTEMS PLC: COMPANY OVERVIEW

- TABLE 65 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 66 FRANCE: DEFENSE BUDGET ANALYSIS, 2019–2022 (USD BILLION)

- TABLE 67 FRANCE: DEFENSE BUDGET ANALYSIS, 2023–2028 (USD BILLION)

- TABLE 68 FRANCE: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2019–2022 (USD BILLION)

- TABLE 69 FRANCE: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2023–2028 (USD BILLION)

- TABLE 70 FRANCE: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 71 FRANCE: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 72 FRANCE: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 73 FRANCE: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 74 FRANCE: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 75 FRANCE: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 76 FRANCE: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 77 FRANCE: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 78 FRANCE: EXPORT DATA (USD THOUSAND)

- TABLE 79 FRANCE: IMPORT DATA (USD THOUSAND)

- TABLE 80 KEY FIREARMS USED BY FRENCH ARMED FORCES

- TABLE 81 KEY CALIBERS USED BY FRENCH ARMED FORCES

- TABLE 82 FRANCE DEFENSE BUDGET ANALYSIS MARKET: COMPETITIVE BENCHMARKING

- TABLE 83 AIRBUS SE: COMPANY OVERVIEW

- TABLE 84 SAFRAN SA: COMPANY OVERVIEW

- TABLE 85 THALES SA: COMPANY OVERVIEW

- TABLE 86 GERMANY: DEFENSE BUDGET ANALYSIS, 2019–2022 (USD BILLION)

- TABLE 87 GERMANY: DEFENSE BUDGET ANALYSIS, 2023–2028 (USD BILLION)

- TABLE 88 GERMANY: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2019–2022 (USD BILLION)

- TABLE 89 GERMANY: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2023–2028 (USD BILLION)

- TABLE 90 GERMANY: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 91 GERMANY: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 92 GERMANY: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 93 GERMANY: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 94 GERMANY: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 95 GERMANY: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 96 GERMANY: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 97 GERMANY: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 98 GERMANY: EXPORT DATA (USD THOUSAND)

- TABLE 99 GERMANY: IMPORT DATA (USD THOUSAND)

- TABLE 100 KEY FIREARMS USED BY GERMAN ARMED FORCES

- TABLE 101 KEY CALIBERS USED BY GERMAN ARMED FORCES

- TABLE 102 GERMANY DEFENSE BUDGET ANALYSIS: COMPETITIVE BENCHMARKING

- TABLE 103 RHEINMETALL AG: COMPANY OVERVIEW

- TABLE 104 LEONARDO SPA: COMPANY OVERVIEW

- TABLE 105 THALES SA: COMPANY OVERVIEW

- TABLE 106 RUSSIA: DEFENSE BUDGET ANALYSIS, 2019–2022 (USD BILLION)

- TABLE 107 RUSSIA: DEFENSE BUDGET ANALYSIS, 2023–2028 (USD BILLION)

- TABLE 108 RUSSIA: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2019–2022 (USD BILLION)

- TABLE 109 RUSSIA: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2023–2028 (USD BILLION)

- TABLE 110 RUSSIA: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 111 RUSSIA: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 112 RUSSIA: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 113 RUSSIA: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 114 RUSSIA: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 115 RUSSIA: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 116 RUSSIA: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 117 RUSSIA: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 118 KEY FIREARMS USED BY RUSSIAN ARMED FORCES

- TABLE 119 KEY CALIBERS USED BY RUSSIAN ARMED FORCES

- TABLE 120 RUSSIA DEFENSE BUDGET ANALYSIS: COMPETITIVE BENCHMARKING

- TABLE 121 URALVAGONZAVOD (UVZ): COMPANY OVERVIEW

- TABLE 122 UNITED AIRCRAFT CORPORATION (UAC): COMPANY OVERVIEW

- TABLE 123 UNITED SHIPBUILDING CORPORATION (USC): COMPANY OVERVIEW

- TABLE 124 ITALY: DEFENSE BUDGET ANALYSIS, 2019–2022 (USD BILLION)

- TABLE 125 ITALY: DEFENSE BUDGET ANALYSIS, 2023–2028 (USD BILLION)

- TABLE 126 ITALY: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2019–2022 (USD BILLION)

- TABLE 127 ITALY: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2023–2028 (USD BILLION)

- TABLE 128 ITALY: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 129 ITALY: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 130 ITALY: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 131 ITALY: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 132 ITALY: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 133 ITALY: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 134 ITALY: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 135 ITALY: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 136 ITALY: EXPORT DATA (USD THOUSAND)

- TABLE 137 ITALY: IMPORT DATA (USD THOUSAND)

- TABLE 138 KEY FIREARMS USED BY ITALIAN ARMED FORCES

- TABLE 139 KEY CALIBERS USED BY ITALIAN ARMED FORCES

- TABLE 140 ITALY DEFENSE BUDGET ANALYSIS: COMPETITIVE BENCHMARKING

- TABLE 141 NORTHROP GRUMMAN CORPORATION: COMPANY OVERVIEW

- TABLE 142 LEONARDO SPA: COMPANY OVERVIEW

- TABLE 143 THALES SA: COMPANY OVERVIEW

- TABLE 144 CHINA: DEFENSE BUDGET ANALYSIS, 2019–2022 (USD BILLION)

- TABLE 145 CHINA: DEFENSE BUDGET ANALYSIS, 2023–2028 (USD BILLION)

- TABLE 146 CHINA: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2019–2022 (USD BILLION)

- TABLE 147 CHINA: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2023–2028 (USD BILLION)

- TABLE 148 CHINA: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 149 CHINA: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 150 CHINA: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 151 CHINA: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 152 CHINA: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 153 CHINA: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 154 CHINA: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 155 CHINA: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 156 CHINA: EXPORT DATA (USD THOUSAND)

- TABLE 157 CHINA: IMPORT DATA (USD THOUSAND)

- TABLE 158 KEY FIREARMS USED BY CHINESE ARMED FORCES

- TABLE 159 KEY CALIBERS USED BY CHINESE ARMED FORCES

- TABLE 160 CHINA DEFENSE BUDGET ANALYSIS: COMPETITIVE BENCHMARKING

- TABLE 161 AVIC SHENYANG AIRCRAFT CO., LTD.: COMPANY OVERVIEW

- TABLE 162 AECC AVIATION POWER CO. LTD.: COMPANY OVERVIEW

- TABLE 163 CHINA CSSC HOLDINGS LTD.: COMPANY OVERVIEW

- TABLE 164 INDIA: DEFENSE BUDGET ANALYSIS, 2019–2022 (USD BILLION)

- TABLE 165 INDIA: DEFENSE BUDGET ANALYSIS, 2023–2028 (USD BILLION)

- TABLE 166 INDIA: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2019–2022 (USD BILLION)

- TABLE 167 INDIA: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2023–2028 (USD BILLION)

- TABLE 168 INDIA: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 169 INDIA: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 170 INDIA: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 171 INDIA: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 172 INDIA: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 173 INDIA: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 174 INDIA: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 175 INDIA: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 176 INDIA: EXPORT DATA (USD THOUSAND)

- TABLE 177 INDIA: IMPORT DATA (USD THOUSAND)

- TABLE 178 KEY FIREARMS USED BY INDIAN ARMED FORCES

- TABLE 179 KEY CALIBERS USED BY INDIAN ARMED FORCES

- TABLE 180 INDIA DEFENSE BUDGET ANALYSIS: COMPETITIVE BENCHMARKING

- TABLE 181 BHARAT DYNAMICS LTD.: COMPANY OVERVIEW

- TABLE 182 BHARAT ELECTRONICS LTD.: COMPANY OVERVIEW

- TABLE 183 HINDUSTAN AERONAUTICS LTD.: COMPANY OVERVIEW

- TABLE 184 JAPAN: DEFENSE BUDGET ANALYSIS, 2019–2022 (USD BILLION)

- TABLE 185 JAPAN: DEFENSE BUDGET ANALYSIS, 2023–2028 (USD BILLION)

- TABLE 186 JAPAN: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2019–2022 (USD BILLION)

- TABLE 187 JAPAN: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2023–2028 (USD BILLION)

- TABLE 188 JAPAN: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 189 JAPAN: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 190 JAPAN: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 191 JAPAN: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 192 JAPAN: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 193 JAPAN: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 194 JAPAN: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 195 JAPAN: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 196 JAPAN: EXPORT DATA (USD THOUSAND)

- TABLE 197 JAPAN: IMPORT DATA (USD THOUSAND)

- TABLE 198 KEY FIREARMS USED BY JAPANESE ARMED FORCES

- TABLE 199 KEY CALIBERS USED BY JAPANESE ARMED FORCES

- TABLE 200 JAPAN DEFENSE BUDGET ANALYSIS: COMPETITIVE BENCHMARKING

- TABLE 201 KAWASAKI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 202 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 203 NEC CORPORATION: COMPANY OVERVIEW

- TABLE 204 SOUTH KOREA: DEFENSE BUDGET ANALYSIS, 2019–2022 (USD BILLION)

- TABLE 205 SOUTH KOREA: DEFENSE BUDGET ANALYSIS, 2023–2028 (USD BILLION)

- TABLE 206 SOUTH KOREA: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2019–2022 (USD BILLION)

- TABLE 207 SOUTH KOREA: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2023–2028 (USD BILLION)

- TABLE 208 SOUTH KOREA: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 209 SOUTH KOREA: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 210 SOUTH KOREA: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 211 SOUTH KOREA: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 212 SOUTH KOREA: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 213 SOUTH KOREA: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 214 SOUTH KOREA: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 215 SOUTH KOREA: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 216 SOUTH KOREA: EXPORT DATA (USD THOUSAND)

- TABLE 217 SOUTH KOREA: IMPORT DATA (USD THOUSAND)

- TABLE 218 KEY FIREARMS USED BY SOUTH KOREAN ARMED FORCES

- TABLE 219 KEY CALIBERS USED BY SOUTH KOREAN ARMED FORCES

- TABLE 220 SOUTH KOREA DEFENSE BUDGET ANALYSIS: COMPETITIVE BENCHMARKING

- TABLE 221 HYUNDAI ROTEM CO: COMPANY OVERVIEW

- TABLE 222 HANWHA CORPORATION: COMPANY OVERVIEW

- TABLE 223 KOREA AEROSPACE INDUSTRIES LTD. (KAI): COMPANY OVERVIEW

- TABLE 224 AUSTRALIA: DEFENSE BUDGET ANALYSIS, 2019–2022 (USD BILLION)

- TABLE 225 AUSTRALIA: DEFENSE BUDGET ANALYSIS, 2023–2028 (USD BILLION)

- TABLE 226 AUSTRALIA: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2019–2022 (USD BILLION)

- TABLE 227 AUSTRALIA: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2023–2028 (USD BILLION)

- TABLE 228 AUSTRALIA: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 229 AUSTRALIA: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 230 AUSTRALIA: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 231 AUSTRALIA: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 232 AUSTRALIA: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 233 AUSTRALIA: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 234 AUSTRALIA: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 235 AUSTRALIA: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 236 AUSTRALIA: EXPORT DATA (USD THOUSAND)

- TABLE 237 AUSTRALIA: IMPORT DATA (USD THOUSAND)

- TABLE 238 KEY FIREARMS USED BY AUSTRALIAN ARMED FORCES

- TABLE 239 KEY CALIBERS USED BY AUSTRALIAN ARMED FORCES

- TABLE 240 AUSTRALIA DEFENSE BUDGET ANALYSIS: COMPETITIVE BENCHMARKING

- TABLE 241 BAE SYSTEMS AUSTRALIA LTD.: COMPANY OVERVIEW

- TABLE 242 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 243 THALES SA: COMPANY OVERVIEW

- TABLE 244 SAUDI ARABIA: DEFENSE BUDGET ANALYSIS, 2019–2022 (USD BILLION)

- TABLE 245 SAUDI ARABIA: DEFENSE BUDGET ANALYSIS, 2023–2028 (USD BILLION)

- TABLE 246 SAUDI ARABIA: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2019–2022 (USD BILLION)

- TABLE 247 SAUDI ARABIA: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2023–2028 (USD BILLION)

- TABLE 248 SAUDI ARABIA: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 249 SAUDI ARABIA: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 250 SAUDI ARABIA: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 251 SAUDI ARABIA: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 252 SAUDI ARABIA: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 253 SAUDI ARABIA: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 254 SAUDI ARABIA: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 255 SAUDI ARABIA: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 256 KEY FIREARMS USED BY SAUDI ARABIAN ARMED FORCES

- TABLE 257 KEY CALIBERS USED BY SAUDI ARABIAN ARMED FORCES

- TABLE 258 SAUDI ARABIA DEFENSE BUDGET ANALYSIS: COMPETITIVE BENCHMARKING

- TABLE 259 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 260 THE BOEING COMPANY: COMPANY OVERVIEW

- TABLE 261 BAE SYSTEMS PLC: COMPANY OVERVIEW

- TABLE 262 ISRAEL: DEFENSE BUDGET ANALYSIS, 2019–2022 (USD BILLION)

- TABLE 263 ISRAEL: DEFENSE BUDGET ANALYSIS, 2023–2028 (USD BILLION)

- TABLE 264 ISRAEL: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2019–2022 (USD BILLION)

- TABLE 265 ISRAEL: DEFENSE BUDGET ANALYSIS, BY ALLOCATION TYPE, 2023–2028 (USD BILLION)

- TABLE 266 ISRAEL: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 267 ISRAEL: DEFENSE BUDGET ANALYSIS, BY DOMAIN ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 268 ISRAEL: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 269 ISRAEL: DEFENSE BUDGET ANALYSIS, BY PLATFORM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 270 ISRAEL: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 271 ISRAEL: DEFENSE BUDGET ANALYSIS, BY SYSTEM ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 272 ISRAEL: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2019–2022 (USD BILLION)

- TABLE 273 ISRAEL: DEFENSE BUDGET ANALYSIS, BY TECHNOLOGY ALLOCATION, 2023–2028 (USD BILLION)

- TABLE 274 KEY FIREARMS USED BY ISRAELI ARMED FORCES

- TABLE 275 KEY CALIBERS USED BY ISRAELI ARMED FORCES

- TABLE 276 ISRAEL DEFENSE BUDGET ANALYSIS: COMPETITIVE BENCHMARKING

- TABLE 277 ISRAEL AEROSPACE INDUSTRIES: COMPANY OVERVIEW

- TABLE 278 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 279 ELBIT SYSTEMS: COMPANY OVERVIEW

- TABLE 280 OTHER COUNTRIES: DEFENSE BUDGET ANALYSIS, 2019–2022 (USD BILLION)

- TABLE 281 OTHER COUNTRIES: DEFENSE BUDGET ANALYSIS, 2023–2028 (USD BILLION)

- TABLE 282 GDP AND DEFENSE BUDGET SHARE (%) OF GDP

- TABLE 283 HUMAN DEVELOPMENT INDEX

- TABLE 284 GLOBAL TERRORISM INDEX

- TABLE 285 OTHER COUNTRIES’ DEFENSE BUDGET ANALYSIS: COMPETITIVE BENCHMARKING

- TABLE 286 THALES SA: COMPANY OVERVIEW

- TABLE 287 AIRBUS SE: COMPANY OVERVIEW

- TABLE 288 THE BOEING COMPANY: COMPANY OVERVIEW

- FIGURE 1 WORLD DEFENSE BUDGET ANALYSIS SEGMENTATION

- FIGURE 2 RESEARCH FLOW

- FIGURE 3 WORLD DEFENSE BUDGET ANALYSIS: RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 US: DEFENSE BUDGET (2016–2022)

- FIGURE 9 US: TRENDS/DISRUPTIONS IMPACTING CONTRACTOR BUSINESS

- FIGURE 10 US: DEFENSE BUDGET AS % OF GDP (2016–2022)

- FIGURE 11 US: LAND FLEET (2018–2021)

- FIGURE 12 US: AIR FLEET (2018–2021)

- FIGURE 13 US: NAVAL FLEET (2019–2022)

- FIGURE 14 US: SATELLITES (2018–2021)

- FIGURE 15 RANKING ANALYSIS OF TOP 3 PLAYERS IN US DEFENSE BUDGET ANALYSIS, 2022

- FIGURE 16 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 17 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 18 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 19 CANADA: DEFENSE BUDGET (2016–2022)

- FIGURE 20 REVENUE SHIFT AND NEW REVENUE POCKETS

- FIGURE 21 CANADA: DEFENSE BUDGET AS % OF GDP (2016–2022)

- FIGURE 22 CANADA: LAND FLEET (2018–2022)

- FIGURE 23 CANADA: AIR FLEET (2018–2021)

- FIGURE 24 CANADA: NAVAL FLEET (2019–2022)

- FIGURE 25 CANADA: SATELLITES (2018–2021)

- FIGURE 26 RANKING ANALYSIS OF TOP 3 PLAYERS IN CANADA DEFENSE BUDGET ANALYSIS, 2022

- FIGURE 27 CAE INC.: COMPANY SNAPSHOT

- FIGURE 28 UK: DEFENSE BUDGET (2016–2022)

- FIGURE 29 REVENUE SHIFT AND NEW REVENUE POCKETS

- FIGURE 30 UK: DEFENSE BUDGET AS % OF GDP (2016–2022)

- FIGURE 31 UK: LAND FLEET (2018–2021)

- FIGURE 32 UK: AIR FLEET (2018–2021)

- FIGURE 33 UK: NAVAL FLEET (2019–2022)

- FIGURE 34 UK: SATELLITES (2018–2021)

- FIGURE 35 RANKING ANALYSIS OF TOP 3 PLAYERS IN UK DEFENSE BUDGET ANALYSIS, 2022

- FIGURE 36 BABCOCK INTERNATIONAL GROUP PLC: COMPANY SNAPSHOT

- FIGURE 37 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- FIGURE 38 FRANCE: DEFENSE BUDGET (2016–2022)

- FIGURE 39 REVENUE SHIFT AND NEW REVENUE POCKETS

- FIGURE 40 FRANCE: DEFENSE BUDGET AS % OF GDP (2016–2022)

- FIGURE 41 FRANCE: LAND FLEET (2018–2021)

- FIGURE 42 FRANCE: AIR FLEET (2018–2021)

- FIGURE 43 FRANCE: NAVAL FLEET (2019–2022)

- FIGURE 44 FRANCE: SATELLITES (2018–2021)

- FIGURE 45 RANKING ANALYSIS OF TOP 3 PLAYERS IN FRANCE DEFENSE BUDGET ANALYSIS, 2022

- FIGURE 46 AIRBUS SE: COMPANY SNAPSHOT

- FIGURE 47 SAFRAN SA: COMPANY SNAPSHOT

- FIGURE 48 THALES SA: COMPANY SNAPSHOT

- FIGURE 49 GERMANY: DEFENSE BUDGET (2016−2022)

- FIGURE 50 REVENUE SHIFT AND NEW REVENUE POCKETS

- FIGURE 51 GERMANY: DEFENSE BUDGET AS % OF GDP (2016−2022)

- FIGURE 52 GERMANY: LAND FLEET (2018−2021)

- FIGURE 53 GERMANY: AIR FLEET (2018−2021)

- FIGURE 54 GERMANY: NAVAL FLEET (2019–2022)

- FIGURE 55 GERMANY: SATELLITES (2018–2021)

- FIGURE 56 RANKING ANALYSIS OF TOP 3 PLAYERS IN GERMANY DEFENSE BUDGET ANALYSIS, 2022

- FIGURE 57 RHEINMETALL AG: COMPANY SNAPSHOT

- FIGURE 58 LEONARDO SPA: COMPANY SNAPSHOT

- FIGURE 59 RUSSIA: DEFENSE BUDGET (2016–2022)

- FIGURE 60 REVENUE SHIFT AND NEW REVENUE POCKETS

- FIGURE 61 RUSSIA: DEFENSE BUDGET AS % OF GDP (2016–2022)

- FIGURE 62 RUSSIA: LAND FLEET (2018–2021)

- FIGURE 63 RUSSIA: AIR FLEET (2018–2021)

- FIGURE 64 RUSSIA: NAVAL FLEET (2019–2022)

- FIGURE 65 RUSSIA: SATELLITES (2018–2021)

- FIGURE 66 RANKING ANALYSIS OF TOP 3 PLAYERS IN RUSSIA DEFENSE BUDGET ANALYSIS, 2022

- FIGURE 67 ITALY: DEFENSE BUDGET (2016–2022)

- FIGURE 68 REVENUE SHIFT AND NEW REVENUE POCKETS

- FIGURE 69 ITALY: DEFENSE BUDGET AS % OF GDP (2016–2022)

- FIGURE 70 ITALY: LAND FLEET (2018–2021)

- FIGURE 71 ITALY: AIR FLEET (2018–2021)

- FIGURE 72 ITALY: NAVAL FLEET (2019–2022)

- FIGURE 73 ITALY: SATELLITES (2018–2021)

- FIGURE 74 RANKING ANALYSIS OF TOP 3 PLAYERS IN ITALY DEFENSE BUDGET ANALYSIS, 2022

- FIGURE 75 LEONARDO SPA: COMPANY SNAPSHOT

- FIGURE 76 CHINA: DEFENSE BUDGET (2016–2022)

- FIGURE 77 REVENUE SHIFT AND NEW REVENUE POCKETS

- FIGURE 78 CHINA: DEFENSE BUDGET AS % OF GDP (2016–2022)

- FIGURE 79 CHINA: LAND FLEET (2018–2021)

- FIGURE 80 CHINA: AIR FLEET (2018–2021)

- FIGURE 81 CHINA: NAVAL FLEET (2019–2022)

- FIGURE 82 CHINA: SATELLITES (2018–2021)

- FIGURE 83 RANKING ANALYSIS OF TOP 3 PLAYERS IN CHINA DEFENSE BUDGET ANALYSIS, 2022

- FIGURE 84 INDIA: DEFENSE BUDGET (2016–2022)

- FIGURE 85 REVENUE SHIFT AND NEW REVENUE POCKETS

- FIGURE 86 INDIA: DEFENSE BUDGET AS % OF GDP (2016–2022)

- FIGURE 87 INDIA: LAND FLEET (2018–2021)

- FIGURE 88 INDIA: AIR FLEET (2018–2021)

- FIGURE 89 INDIA: NAVAL FLEET (2019–2022)

- FIGURE 90 INDIA: SATELLITES (2018–2021)

- FIGURE 91 RANKING ANALYSIS OF TOP 3 PLAYERS IN INDIA DEFENSE BUDGET ANALYSIS, 2022

- FIGURE 92 BHARAT DYNAMICS LTD.: COMPANY SNAPSHOT

- FIGURE 93 BHARAT ELECTRONICS LTD.: COMPANY SNAPSHOT

- FIGURE 94 HINDUSTAN AERONAUTICS LTD.: COMPANY SNAPSHOT

- FIGURE 95 JAPAN: DEFENSE BUDGET (2016–2022)

- FIGURE 96 REVENUE SHIFT AND NEW REVENUE POCKETS

- FIGURE 97 JAPAN: DEFENSE BUDGET AS % OF GDP (2016–2022)

- FIGURE 98 JAPAN: LAND FLEET (2018–2021)

- FIGURE 99 JAPAN: AIR FLEET (2018–2021)

- FIGURE 100 JAPAN: NAVAL FLEET (2019–2022)

- FIGURE 101 JAPAN: SATELLITES (2018–2021)

- FIGURE 102 RANKING ANALYSIS OF TOP 3 PLAYERS IN JAPAN DEFENSE BUDGET ANALYSIS, 2022

- FIGURE 103 KAWASAKI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 104 SOUTH KOREA: DEFENSE BUDGET (2016–2022)

- FIGURE 105 REVENUE SHIFT AND NEW REVENUE POCKETS

- FIGURE 106 SOUTH KOREA: DEFENSE BUDGET AS % OF GDP (2016–2022)

- FIGURE 107 SOUTH KOREA: LAND FLEET (2018–2021)

- FIGURE 108 SOUTH KOREA: AIR FLEET (2018–2021)

- FIGURE 109 SOUTH KOREA: NAVAL FLEET (2019–2022)

- FIGURE 110 SOUTH KOREA: SATELLITES (2018–2021)

- FIGURE 111 RANKING ANALYSIS OF TOP 3 PLAYERS IN SOUTH KOREA DEFENSE BUDGET ANALYSIS, 2022

- FIGURE 112 AUSTRALIA: DEFENSE BUDGET (2016−2022)

- FIGURE 113 REVENUE SHIFT AND NEW REVENUE POCKETS

- FIGURE 114 AUSTRALIA: DEFENSE BUDGET AS % OF GDP (2016−2022)

- FIGURE 115 AUSTRALIA: LAND FLEET (2018−2021)

- FIGURE 116 AUSTRALIA: AIR FLEET (2018−2021)

- FIGURE 117 AUSTRALIA: NAVAL FLEET (2019–2022)

- FIGURE 118 AUSTRALIA: SATELLITES (2018−2021)

- FIGURE 119 RANKING ANALYSIS OF TOP THREE PLAYERS IN AUSTRALIA DEFENSE BUDGET ANALYSIS, 2022

- FIGURE 120 BAE SYSTEMS AUSTRALIA LTD.: COMPANY SNAPSHOT

- FIGURE 121 SAUDI ARABIA: DEFENSE BUDGET (2016−2022)

- FIGURE 122 REVENUE SHIFT AND NEW REVENUE POCKETS

- FIGURE 123 SAUDI ARABIA: DEFENSE BUDGET AS % OF GDP (2016−2022)

- FIGURE 124 SAUDI ARABIA: LAND FLEET (2018−2021)

- FIGURE 125 SAUDI ARABIA: AIR FLEET (2018−2021)

- FIGURE 126 SAUDI ARABIA: NAVAL FLEET (2019–2022)

- FIGURE 127 SAUDI ARABIA: SATELLITES (2018−2021)

- FIGURE 128 RANKING ANALYSIS OF TOP 3 PLAYERS IN SAUDI ARABIA DEFENSE BUDGET ANALYSIS, 2022

- FIGURE 129 THE BOEING COMPANY: COMPANY SNAPSHOT

- FIGURE 130 ISRAEL: DEFENSE BUDGET (2016–2022)

- FIGURE 131 REVENUE SHIFT AND NEW REVENUE POCKETS

- FIGURE 132 ISRAEL: DEFENSE BUDGET AS % OF GDP (2016–2022)

- FIGURE 133 ISRAEL: LAND FLEET (2018–2021)

- FIGURE 134 ISRAEL: AIR FLEET (2018–2021)

- FIGURE 135 ISRAEL: NAVAL FLEET (2019–2022)

- FIGURE 136 ISRAEL: SATELLITES (2018–2021)

- FIGURE 137 RANKING ANALYSIS OF TOP 3 PLAYERS IN ISRAEL DEFENSE BUDGET ANALYSIS, 2022

- FIGURE 138 ELBIT SYSTEMS: COMPANY SNAPSHOT

- FIGURE 139 RANKING ANALYSIS OF TOP 3 PLAYERS IN OTHER COUNTRIES’ DEFENSE BUDGET ANALYSIS, 2022

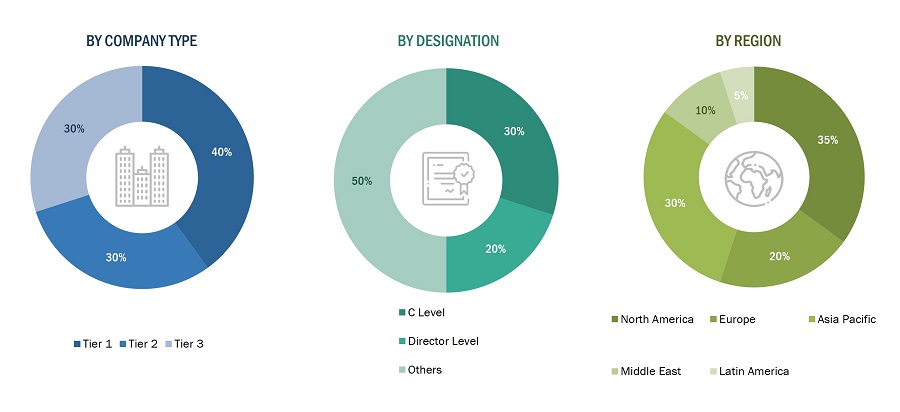

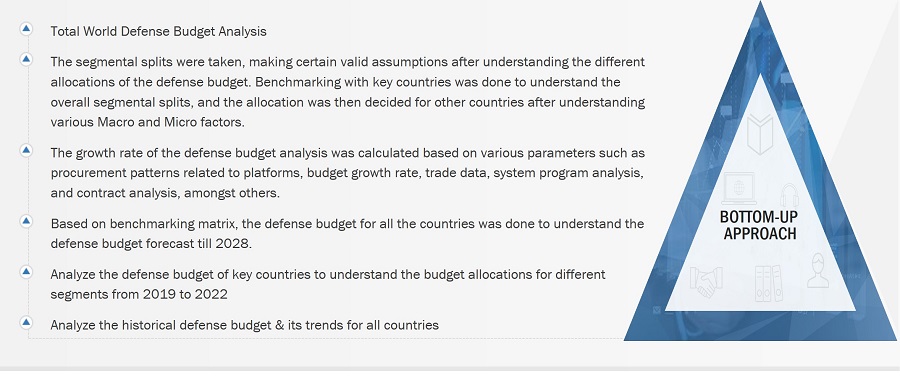

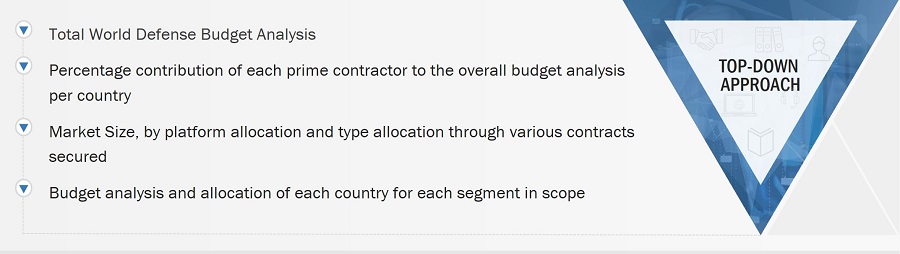

The study involved four major activities in estimating the current size of the world defense budget analysis. Exhaustive secondary research was done to collect information on the budget analysis and growth trends, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total defense budget size. After that, market breakdown and data triangulation were used to estimate the budget allocation of segments and subsegments.

Secondary Research

The ranking analysis of countries in the world defense budget analysis used secondary data from paid and unpaid sources. Primary sources further validated these data points.

In the secondary research phase, a systematic review and analysis of existing data and information were conducted. This involved examining government reports, academic studies, industry publications, and reputable databases. By synthesizing and interpreting these secondary sources, a solid knowledge base was established, providing historical context and supporting the identification of key trends and benchmarks in defense budget allocation.

Primary Research

In the primary research phase, data was collected directly from reliable sources such as government officials, defense experts, and industry professionals through surveys, interviews, and direct interactions. This allowed for the acquisition of specific and up-to-date insights into the defense budget allocation practices of various countries.

In addition to primary and secondary research methods, the world defense budget analysis incorporated primary interviews as a crucial component of the research process. Primary interviews involved one-on-one discussions with key stakeholders, including government officials, defense experts, and industry professionals. These interviews provided valuable firsthand insights and perspectives directly from those involved in defense budget allocation decision-making and implementation.

During the primary interviews, structured or semi-structured questionnaires were utilized to guide the discussions and ensure relevant topics were covered. The interviews focused on gathering in-depth information about defense budget allocation strategies, priorities, factors influencing decision-making, challenges faced, and future trends. The responses obtained during the interviews were carefully recorded, transcribed, and analyzed to extract meaningful insights.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the world defense budget analysis size includes the following details.

- The top-down and bottom-up approaches were used to estimate and validate the size of the world defense budget analysis. The research methodology used to estimate the market size includes the following details.

- The key countries were identified through secondary research, and their market ranking was determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Bottom-up Approach

Top-down Approach

Data Triangulation