Wireline Logging Services Market by Hole Type (Cased Hole, Open Hole), by Wireline Type (Electricline, Slickline) & Geography (Asia-Pacific, Europe, Middle East, Africa, North America, South America) - Global Trends & Forecast to 2019

The growing demand of energy with increasing investments in offshore and unconventional exploration and production activities is expected to drive the global wireline logging services market. It is estimated to reach $25.46 Billion by 2019, at a CAGR of 10.3% from 2014 to 2019. The countries in Asia-Pacific and Africa have demand for the latest and highly advanced open hole and closed hole wireline logging services. Thus these regions are expected to experience highest growth in the next five years.

Wireline logging services employ an electrical cable to lower tools into the borehole to perform continuous recording of the reservoir characteristics. Wireline logging is a widely used technique for mapping the reservoir and its associated hydrocarbons, since it can provide crucial information that helps in efficient and optimized drilling practices. The tools and equipment are lowered into the wells either through an open-hole or cased-hole.

Wireline logging services are provided by oilfield service companies such as Halliburton (U.S.) to oil and gas companies such as Royal Dutch Shell (The Netherlands). These are frequently used during all the lifecycle stages of a well including exploration, drilling, completion, production, intervention, and others.

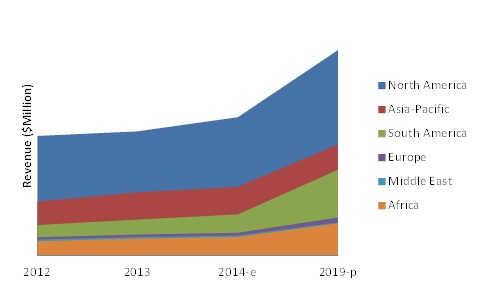

The wireline logging services market is highest in North America, where many leading oil field service companies operate including Schlumberger (U.S.), Halliburton (U.S.), Baker Hughes (U.S.), and other medium and small players. While the North American wireline services market is reaching its maturity, the other geographic regions are exhibiting a decent growth rate, owing to the new development of hydrocarbon reserves.

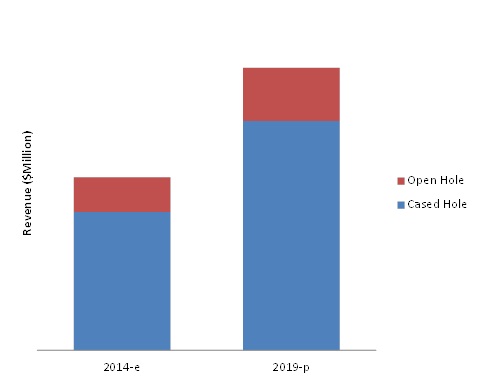

Wireline Logging Services Market Value, By Hole Type 2014-2019 ($Million)

Source: MarketsandMarkets Analysis

For this report, the major players in the wireline logging services market are identified through secondary and primary research, based on which their market shares are evaluated. This includes a study of the annual reports of top market players and interviews with key opinion leaders such as the CEOs, Directors, and marketing people.

The size of the overall market is determined by forecasting techniques based on its demand in different regions, which is validated through primary sources. The market data is available from 2012 to 2019 with a CAGR from 2014 to 2019.

Wireline logging services market report analyzes various marketing trends and establishes the most effective growth strategy. It identifies market dynamics such as drivers, opportunities, burning issues, and winning imperatives.

Scope of the report:

On the basis of Hole Types:

- Cased Hole

- Open Hole

- Electricline

- Slickline

- Asia-Pacific

- Europe

- Middle East

- Africa

- North America

- South America

Please click here to get the relevant report of

Wireline Services Market by Type (Logging, Well Intervention, Completion), & Geography (Asia-Pacific, Europe, Middle East, Africa, North America, South America) - Global Trends & Forecast to 2019

Wireline logging services market worth $25.46 Billion market by 2019 signifies a firm annualized growth rate of 10.3% from 2014 to 2019.

Well logging is defined as the performing of a detailed recording (a well log) of the geologic rock formations that are a part of the reservoir and is penetrated during a drilling operation. The log may be based either on visual inspection of samples brought to the surface (geological logs) or on physical measurements made by instruments brought down into the hole (geophysical logs). In this report, the market is analyzed on the basis of revenue generated by the wireline services supplied by oilfield service companies to the oilfield services market. One of the major service provided in wireline is wireline logging service. Major value generation activities of the market are recorded in North America and the remaining regions are growing at a higher rate with the exploration of new reserves, creating growth prospects for the wireline logging services market. The North American market is reaching towards a stage of maturity and the movement in the market will mainly be subjected to competition.

Potential increase in recoverable resources and increased exploration and production are the most important drivers for the market. Increasing focus towards natural gas production also require wireline logging services. Currently, natural gas is referred as transitional fuel for being the chain between conventional resources and renewable energy. This proves to be an advantage for the international natural gas market and hence, for the wireline logging services market. As the energy demand in developing countries such as India and Brazil is increasing, fulfilling this demand will enhance the growth prospects for market.

The wireline logging services market has great opportunities outside North America; however, its growth depends upon many reasons that include environmental objections and a subsequent ban on certain logging techniques in few countries, which are key hurdles for the growth of this market.

Wireline Logging Services Market Value, By Geography, 2012-2019

Source: MarketsandMarkets Analysis

Currently, North America dominates the wireline logging services market. This dominance is seen mainly due to continuous and large increment in the U.S. exploration and production activities. The new and unconventional hydrocarbon recovery and its growth are important reasons for the growth of the market. North America has the highest market share because of favorable regulations in the region.

Table of Contents

1 Introduction (Page No. - 15)

1.1 Key Take Aways

1.2 Analyst Insights

1.3 Market Investment Analysis

1.4 Report Description

1.5 Market Definitions

1.6 Market Segmentation & Markets Aspects Covered

1.7 Stakeholders

1.8 Research Methodology

1.8.1 Approach

1.8.2 Market Size Estimation

1.8.3 Market Crackdown and Data Triangulation

1.8.4 Key Data Points Taken From Secondary Sources

1.8.5 Key Secondary Sources Used

1.8.6 Key Data Points Taken From Secondary Sources

1.8.7 Assumptions Made For This Report

2 Executive Summary (Page No. - 26)

3 Premium Insights (Page No. - 28)

3.1 Introduction

3.2 Market Statistics

3.2.1 Global Wireline Logging Services Market

3.2.2 Sub Markets

3.2.2.1 Growth Trend for Different Types of Services

3.2.2.1.1 Wireline Type Trend Analysis

3.2.2.1.2 Wireline Type Trend Analysis, By Hole Type

3.2.2.1.3 Hole Type Trend Analysis

3.2.2.1.4 Hole Type Trend Analysis, By Wireline Type

3.2.2.2 Present Vs Forecast Market Size for Different Services

3.2.2.3 Growth Trend for Different Geographies

3.2.2.3.1 Regional Analysis of Wireline Service Market

3.2.3 Related Market

3.2.3.1 Global Wireline Services Market

4 Market Analysis Key Findings (Page No. - 38)

4.1 Introduction

4.2 Market Dynamics

4.2.1 Market Drivers

4.2.1.1 Investments in Exploration and Production Activities and Increased Oil Production

4.2.1.1.1 Growth in Drilling & Completion Activities

4.2.1.1.2 Discoveries of New Oil & Gas Field

4.2.1.1.3 High Oil & Gas Demand Globally

4.2.1.2 New Technologies Drive the Activities for Shale Gas, CBM

4.2.1.3 Technological Developments and Well Integrity Concerns

4.2.1.3.1 Rise in Number of Horizontal Wells

4.2.1.3.2 Prevention of Deepwater Geo-Hazards

4.2.1.3.3 Well Integrity Concerns

4.2.1.3.4 High Demand for Real Time Logging

4.2.2 Market Restraint

4.2.2.1 Environmental Concerns Hampering the Growth for Wireline Logging Services

4.2.2.2 Regulatory Issues a Major Hurdle for Wireline Logging Services Growth

4.2.3 Market Opportunities

4.2.3.1 Increased Investment for Exploration and Production

4.2.3.2 Growing E&P Spending Due To High Demand in Emerging Markets

4.3 Burning Issue

4.3.1 High Hazard Business

4.3.2 Absence of Specialized Proficient

4.4 Winning Imperative

4.4.1 Well Integrity and Enhanced Oil Recovery from Maturing Wells

4.5 Value Chain Analysis

4.5.1 Equipment Manufacturers

4.5.2 Service Providers

4.5.3 Oil Field Operators

4.6 Porter’s Analysis

4.6.1 Threat of New Entrants

4.6.2 Threat of Substitutes

4.6.3 Suppliers’ Power

4.6.4 Buyers’ Power

4.6.5 Degree of Competition

5 Wireline Logging Services Market, By Hole Type (Page No. - 56)

5.1 Introduction

5.2 Market Analysis, By Hole Type

5.2.1 Market, By Cased Hole Type

5.2.1.1 Definition and Description

5.2.1.2 Market Size and Forecast

5.2.2 Market, By Open Hole Type

5.2.2.1 Definition and Description

5.2.2.2 Market Size and Forecast

6 Wireline Logging Services Market, By Wireline Type (Page No. - 64)

6.1 Introduction

6.1.1 E-Line

6.1.2 Slickline

6.2 Market Analysis, By Service Type

6.2.1 Market, By E-Line Service Type

6.2.1.1 Definition and Description

6.2.1.2 Market Size and Forecast

6.2.2 Market, By Slick Line Service Type

6.2.2.1 Definition and Description

6.2.2.2 Market Size and Forecast

7 Wireline Logging Services Market, By Geography (Page No. - 74)

7.1 Introduction

7.2 Geographic Analysis of the Wireline Logging Services Market

7.3 Market Analysis, By Geography

7.3.1 North America

7.3.1.1 Industry Trend

7.3.1.2 Market Size and Forecast

7.3.1.3 Country-Wise Analysis

7.3.1.3.1 U.S. Land

7.3.1.3.2 GOM

7.3.1.3.3 Canada

7.3.1.3.4 Mexico

7.3.2 South America

7.3.2.1 Industry Trend

7.3.2.2 Market Size and Forecast

7.3.2.3 Country-Wise Analysis

7.3.2.3.1 Brazil

7.3.2.3.2 Argentina

7.3.2.3.3 Venezuela

7.3.2.3.4 Colombia

7.3.2.3.5 Other

7.3.3 Middle East

7.3.3.1 Industry Trend

7.3.3.2 Market Size and Forecast

7.3.3.3 Country-Wise Analysis

7.3.3.3.1 Saudi Arabia

7.3.3.3.2 Qatar

7.3.3.3.3 Abu Dhabi

7.3.3.3.4 Other

7.3.4 Europe

7.3.4.1 Industry Trend

7.3.4.2 Market Size and Forecast

7.3.4.3 Country-Wise Analysis

7.3.4.3.1 Norway

7.3.4.3.2 U.K.

7.3.4.3.3 Russia

7.3.4.3.4 Other

7.3.5 Asia-Pacific

7.3.5.1 Industry Trend

7.3.5.2 Market Size and Forecast

7.3.5.3 Country-Wise Analysis

7.3.5.3.1 China

7.3.5.3.2 Thailand

7.3.5.3.3 Indonesia

7.3.5.3.4 India

7.3.5.3.5 Australia

7.3.5.3.6 Other

7.3.6 Africa

7.3.6.1 Industry Trend

7.3.6.2 Market Size and Forecast

7.3.6.3 Country-Wise Analysis

7.3.6.3.1 Angola

7.3.6.3.2 Egypt

7.3.6.3.3 Nigeria

7.3.6.3.4 Other

8 Competitive Landscape (Page No. - 111)

8.1 Introduction

8.2 Key Players of Wireline Services Market

8.2.1 List of Key Players

8.2.2 Key Companies Focus Area

8.2.2.1 Growth Strategies in The Global Wireline Logging Services Market

8.3 Key to Success Is New Product/Technology Launch

8.4 Market Share Analysis and Rankings

8.4.1 Market Share Scenario

8.4.2 Market Rankings of the Industry Players

8.5 Competitive Situation and Trends

8.5.1 New Product/Technology Launch

8.5.2 Mergers & Acquisitions

8.5.3 Expansions

8.5.4 Contracts & Agreements

9 Company Profiles (Page No. - 127)

9.1 Baker Hughes

9.1.1 Introduction

9.1.2 Products & Services

9.1.3 Baker Hughes: SWOT Analysis

9.1.4 Strategy & Insights

9.1.5 MNM View

9.1.6 Recent Developments

9.2 Casedhole Solutions

9.2.1 Introduction

9.2.2 Products & Services

9.2.3 Strategy & Insights

9.2.4 Recent Developments

9.3 Expro International Group Holdings Ltd.

9.3.1 Introduction

9.3.2 Products and Services

9.3.3 Strategy & Insights

9.3.4 Recent Developments

9.4 Halliburton

9.4.1 Introduction

9.4.2 Products & Services

9.4.3 SWOT Analysis: Halliburton

9.4.4 Strategy & Insights

9.4.5 MNM View

9.4.6 Recent Developments

9.5 Nabors Industries Ltd.

9.5.1 Introduction

9.5.2 Products and Services

9.5.3 Strategy & Insight

9.5.4 Recent Developments

9.6 Oilserv

9.6.1 Introduction

9.6.2 Product and Services

9.6.3 Strategy & Insights

9.6.4 Recent Developments

9.7 Pioneer Energy Services

9.7.1 Introduction

9.7.2 Products and Services

9.7.3 Strategy & Insights

9.7.4 Recent Developments

9.8 Superior Energy Services

9.8.1 Introduction

9.8.2 Products & Services

9.8.3 SWOT Analysis

9.8.4 Strategy & Insights

9.8.5 MNM View

9.8.6 Recent Developments

9.9 Schlumberger

9.9.1 Introduction

9.9.2 Products & Services

9.9.3 SWOT Analysis

9.9.4 Strategy & Insights

9.9.5 MNM View

9.9.6 Recent Developments

9.10 Weatherford International Inc.

9.10.1 Introduction

9.10.2 Products & Services

9.10.3 SWOT Analysis

9.10.4 STRATEGY & Insights

9.10.5 MNM View

9.10.6 Recent Developments

List of Tables (70 Tables)

Table 1 Wireline Service Market: By Geography, 2012-2019 ($Million)

Table 2 Wireline Logging Units: Manufacturers & Service Providers

Table 3 Wireline Logging: Types And Its Purpose

Table 4 Global New Discoveries, By Geography, 2013

Table 5 Technically Recoverable Shale Oil Reserves, By Major Countries, 2011 (Billion BBl)

Table 6 Technically Recoverable Shale Gas Reserves, By Major Countries, 2011 (TCF)

Table 7 Wireline Logging Services Market Size (Value), By Hole Type, 2012 – 2019 ($Million)

Table 8 Market Size (Value), By Cased Hole Type, 2012 – 2019 ($Million)

Table 9 Market Size (Value), By Open Hole Type, 2012 – 2019 ($Million)

Table 10 Electric Line Services: Applications & Processes

Table 11 E-Line Logging Services Market Value, By Geography, 2012-2019-P ($Million)

Table 12 Slickline Services: Applications & Processes

Table 13 Slickline Logging Services Market Value, By Geography, 2012-2019-P ($Million)

Table 14 Wireline Logging Services Market Size (Value), By Wireline Type, 2012 – 2019 ($Million)

Table 15 Market Size (Value), By E-Line Service Type, 2012 – 2019 ($Million)

Table 16 Market Size (Value), By Cased Hole Type, 2012 – 2019 ($Million)

Table 17 Market Size, By Geography, 2012-2019 ($Million)

Table 18 North America: Wireline Logging Services Market Size, By Service Type, 2012-2019 ($Million)

Table 19 North America: Wireline Services Market Size, By Country, 2012-2019 ($Million)

Table 20 U.S. Land: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 21 GOM: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 22 Canada: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 23 Mexico: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 24 South America: Wireline Logging Services Market Size, By Service Type, 2012-2019 (Million)

Table 25 South America: Wireline Services Market Size, By Country, 2012-2019 ($Million

Table 26 Brazil: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 27 Argentina: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 28 Venezuela: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 29 Colombia: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 30 Other South America: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 31 Middle East: Wireline Logging Services Market Size, By Service Type, 2012-2019 ($Million)

Table 32 Middle East: Wireline Services Market Size, By Country, 2012-2019 ($Million)

Table 33 Saudi Arabia: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 34 Qatar: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 35 Abu Dhabi: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 36 Other Middle East: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 37 Europe: Wireline Logging Services Market Size, By Service Type, 2012-2019 ($Million)

Table 38 Europe: Wireline Services Market Size, By Country, 2012-2019 ($Million)

Table 39 Norway: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 40 U.K.: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 41 Russia: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 42 Other Europe: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 43 Asia-Pacific: Wireline Logging Services Market Size, By Service Type, 2012-2019 ($Million)

Table 44 Asia-Pacific: Wireline Services Market Size, By Country, 2012-2019 ($Million)

Table 45 China: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 46 Thailand: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 47 Indonesia: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 48 India: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 49 Australia: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 50 Other Asia-Pacific: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 51 Africa: Wireline Logging Services Market Size, By Service Type, 2012-2019 ($Million)

Table 52 Africa: Wireline Services Market Size, By Country, 2012-2019 ($Million)

Table 53 Angola: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 54 Egypt: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 55 Nigeria: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 56 Other Africa: Wireline Services Market Size, By Service Type, 2012-2019 ($Million)

Table 57 New Product/Technology Launch, 2010-2014

Table 58 Mergers & Acquisitions, 2010-2014

Table 59 Expansions, 2010-2014

Table 60 Contracts & Agreements, 2010-2014

Table 61 Baker Hughes: Products/Services & Description/Application

Table 62 Casedhole Solutions: Products And Services

Table 63 Expro Group: Product/Services And Their Application & Description

Table 64 Halliburton: Products/Service & Their Description/Application

Table 65 Nabors Industries Ltd: Products/Service & Their Description/Application

Table 66 Oilserve: Products/Service & Their Description/Application

Table 67 Pioneer Energy Services: Products/Service & Their Description/Application

Table 68 Superior Energy Services Inc.: Products/Service & Their Description/Application

Table 69 Schlumberger: Products/Services & Description/Application

Table 70 Weatherford International: Products/Services & Description/Application

List Of Figures (29 Figures)

Figure 1 Research Methodology

Figure 2 Data Triangulation Methodology

Figure 3 Global Wireline Logging Services Market, By Geography, 2012-2019 ($Million)

Figure 4 Market Overview: Tree Structure

Figure 5 Global Wireline Logging Services Market Revenue, 2011 – 2019, ($Million)

Figure 6 Market Value, By Wireline Type, 2012-2019-P ($Million)

Figure 7 Market Scenario, By Line Type

Figure 8 Wireline Logging Services Growth Trend Analysis, 2012-2019

Figure 9 Market Scenario, By Hole Type

Figure 10 Market Share (Value) Analysis, 2014-2019

Figure 11 Global Wireline Logging Services Market Scenario Of Different Geographies, 2013

Figure 12 Global Market Revenue, By Major Countries Of Each Geography, 2013, ($Million)

Figure 13 Global Wireline Services Market, By Geography 2012 – 2019, ($Million)

Figure 14 Distribution In Various Segments Of Drilling Activities, 2012

Figure 15 E&P Spending Scenario, By Company Type, Region Analysis, 2013

Figure 16 Value Chain Analysis Of Wireline Services Market

Figure 17 Porter’s Five Force Analysis

Figure 18 Wireline Logging Services Market Share (Value), By Hole Type

Figure 19 Cased Hole Wireline Logging Services

Figure 20 Open Hole Wireline Logging Services

Figure 21 Wireline Logging Services Market Share (Value), By Wireline Type

Figure 22 Market Share (Value), By Geography

Figure 23 Market Growth Strategies, 2011-2013

Figure 24 Wireline Services Market Share: Top 5 Companies Vs Others, 2013

Figure 25 Market Share Analysis: By Company, 2013

Figure 26 New Product/Technology Launch, 2010-2014

Figure 27 Mergers & Acquisitions, 2010-2014

Figure 28 Expansion, 2011-2013

Figure 29 Contracts & Agreements, 2010-2014

Growth opportunities and latent adjacency in Wireline Logging Services Market