Global Wireless and Mobile Backhaul Equipment Market (2009–2014)

The market for wireless and mobile backhaul technology is getting oriented towards providing high data bandwidth and more cost-effective solutions. Besides, the overall growth is also being boosted by the growing popularity of WiMAX-based wireless broadband services with speeds higher than cable internet broadband. WiMAX and other evolving wireless and mobile technologies such as evolution data optimized (EVDO), high speed packet access (HSPA), and long term evolution (LTE) are bandwidth-intensive services that need backhaul technologies to support huge data transmission requirements.

The market, on the whole, is segmented into following sub categories: microwave, TDM & ATM, pseudowire, All-IP RAN, free space optics, satellite. Backhaul technologies play a vital role in enabling wireless and mobile services providers to offer subscribers high quality service while simultaneously increasing average revenue per user (ARPU). Backhaul technology is influenced by various factors such as bandwidth requirements, geographical location of cell site, and local regulations. Remote cell sites that are difficult to connect through physical links use a microwave backhaul to connect to mobile core network. Backhaul architecture consists of either one or a combination of more than one transport mechanisms.

An ideal backhaul technology should: have high capacity and flexibility to support the existing network infrastructure, be able to deliver extensive service provisioning, reduce CAPEX and ongoing OPEX associated with backhauling, and provide a future-proof architecture to address evolving 4G wireless needs. Wireless backhaul technology enables a variety of applications, including cellular backhaul, building-to-building connectivity, and video surveillance backhaul. Cellular backhaul reduces network operation costs by wirelessly connecting cellular towers and transferring data from cell sites to the core network. Building-to-building backhaul connects buildings on campuses and across long distances without trenching fiber. Video surveillance backhaul offers the high throughput required for video applications such as close circuit camera. Broadband connectivity backhaul expands broadband links to remote areas.

Market players are focusing on providing high capacity, scalability, and reliable backhaul solutions to gain a competitive edge in the market. In the next few years, backhaul is expected to play a vital role in gaining new subscribers and retaining existing ones. First mover advantage in providing next generation network services

such as 4G will help operators gain a competitive edge.

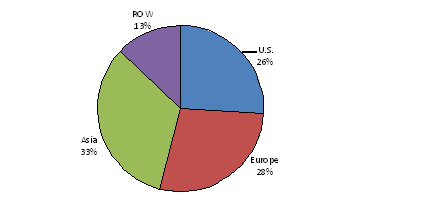

The global wireless and mobile backhaul equipment market is segmented into four geographies: The U.S., Europe, Asia, and ROW. The U.S. formed the largest wireless and mobile equipment market in 2007. However, Asia is expected to be the largest market for backhaul equipments by 2014, mainly as Asia is expected to have the highest number of new cell sites deployment in next few years.

Scope of the report

This research report categorizes the global wireless and mobile backhaul equipment market on the basis of different sub-types and countries; forecasting revenues, and analyzing trends in each of the sub segments.

On the basis of sub-types:

- Microwave

- TDM & ATM

- Pseudowire

- All-IP RAN

- Free space optics

- Satellite

On the basis of applications:

- Cellular backhaul

- Building-to-building connectivity

- Video surveillance backhaul

On the basis of network topologies:

- Point-to-point network configuration

- Point-to-multipoint configuration

Wave properties

- Multiplexing

- Modulation

On the basis of geography:

- U.S.

- Europe

- Asia

- ROW

Each section will provide market data, market drivers, trends and opportunities, top-selling products, key players, and competitive outlook. This report will also provide market tables for covering the sub-segments and micro-markets. In addition, the report also provides more than 45 company profiles covering all the sub-segments.

Customer Interested in this report also can view

-

Mobile and Wireless Backhaul Market by Equipment (Microwave, Millimeter Wave, Sub 6 GHZ, Test and Measurement), by Services (Network, System Integration, Professional) - Worldwide Market Forecasts and Analysis to 2015 - 2020

Global Wireless and Mobile Backhaul Equipment Market (2009-2014)

The growing trend of globalization is playing a critical role in the market growth of telecommunications; and hence acts as a market driver for the wireless backhaul market. The economic growth of developing nations and the spread of internet and mobile communication technologies have opened up new markets for wireless backhauling. The wireless backhaul market is, thus, set for huge growth and wireless backhaul is expected to become a mainstream data transfer technology within the next five years. The two major drivers of the backhaul equipment market include the increasing number of high-end mobile phone applications (such as mobile video conferencing, and mobile internet) and the increasing number of 3G subscribers.

The global wireless and mobile backhaul equipment market is estimated to reach $33.9 billion in 2014, at a CAGR of 17.5% from 2009 to 2014. The wireless and mobile backhaul equipment market is analyzed for technologies, applications, and topologies. The U.S. was the leading market for wireless and mobile equipment market in 2007. However, by 2014, Asia is expected to be the largest market for backhaul equipments, as indicated in the figure below.

GLOBAL BACKHAUL MARKET, BY GEOGRAPHY (2009)

Source: MarketsandMarkets

TABLES OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 REPORT DESCRIPTION

1.3 SCOPE OF THE REPORT

1.4 RESEARCH METHODOLOGY

1.5 STAKEHOLDERS

2 SUMMARY

3 MARKET OVERVIEW

3.1 INCREASING NUMBER OF HIGH-END MOBILE PHONE APPLICATIONS

3.2 HIGH UP-FRONT INSTALLATION COSTS

3.3 MICROWAVE IS THE LARGEST MARKET

3.4 WIRELESS AND MOBILE BACKHAUL EQUIPMENT MARKET

3.5 BACKHAUL TECHNOLOGIES & NETWORK SERVICES

3.6 INCREASING NUMBER OF WIRELESS SUBSCRIBERS

3.7 VOICE DATA TRAFFIC VS. PACKET DATA TRAFFIC

3.8 BACKHAUL TECHNOLOGIES IN GROWTH PHASE

3.9 POSITIVE IMPACTS OF NEXT GENERATION BACKHAUL

3.10 ALL-IP-RAN SCORES OVER OTHER TECHNOLOGIES

3.11 WIRELESS BACKHAUL MARKET DYNAMICS

3.11.1 DEMAND-SIDE DRIVERS

3.11.2 SUPPLY-SIDE DRIVERS

3.11.3 ESTRAINTS

3.11.4 OPPORTUNITIES

3.11.5 KEY COMPETITIVE POINTS

3.12 DOMINANT BACKHAUL MARKETS IN 2009

3.13 ASIA EXPECTED TO HAVE LARGEST MARKET SHARE

4 WIRELESS BACKHAUL TECHNOLOGIES

4.1 ATTRIBUTES OF AN IDEAL BACKHAUL TECHNOLOGY

4.2 DRIVERS & RESTRAINTS

4.2.1 OPEX REDUCTION BOOSTING MARKET GROWTH

4.2.2 GLOBAL INCREASE IN NUMBER OF CELL SITES

4.2.3 HIGH DEMAND FOR BANDWIDTH

4.2.4 ISSUES CONCERNING RANGE & RELIABILITY

4.3 OPPORTUNITIES

4.3.1 COST-EFFICIENT & SCALABLE TECHNOLOGIES

4.3.2 LARGER RANGE AT VERY HIGH BANDWIDTH

4.4 MICROWAVE

4.4.1 DRIVERS

4.4.1.1 Lucrative option for new cell site installation

4.4.1.2 Suitable for use in adverse conditions

4.4.2 RESTRAINTS & OPPORTUNITIES

4.4.2.1 High cost of equipment & availability of other alternatives

4.4.2.2 Wireless broadband & backhaul upgrades

4.5 PSEUDOWIRE

4.5.1 DRIVERS AND OPPORTUNITIES

4.6 ALL-IP RAN

4.6.1 DRIVERS AND OPPORTUNITIES

4.6.1.1 IP RAN simplifies the network

4.6.1.2 Caters to increasing subscriber traffic

4.6.1.3 Cost-efficient technology

4.7 FREE SPACE OPTICS

4.7.1 DRIVERS AND OPPORTUNITIES

4.7.1.1 License-free operation

4.7.1.2 Secure transmission

4.8 SATELLITE

4.9 TDM & ATM

4.10 APPLICATIONS OF BACKHAUL TECHNOLOGIES

4.10.1 CELLULAR BACKHAUL

4.10.2 BROADBAND CONNECTIVITY BACKHAUL

4.10.3 BUILDING-TO-BUILDING CONNECTIVITY

4.10.4 VIDEO SURVEILLANCE BACKHAUL

4.11 NETWORK TOPOLOGIES

4.11.1 POINT-TO-POINT (PTP) CONFIGURATIONS

4.11.2 POINT-TO-MULTIPOINT (PTM) CONFIGURATIONS

4.12 WAVE PROPERTIES

4.12.1 MODULATION

4.12.1.1 Phase-shift keying (PSK) modulation

4.12.1.2 Quadrature amplitude (QAM) modulation

4.12.2 MULTIPLEXING

4.12.2.1 Frequency division multiplexing (FDM)

4.12.2.2 Time division multiplexing (TDM)

4.12.2.3 Orthogonal frequency division multiplexing (OFDM)

5 WIRELESS BACKHAUL WILL BENEFIT CELLULAR OPERATORS

5.1 IMPACT OF INCREASE ON 3G/4G SERVICE

5.2 CHALLENGES IN MAINTAINING OPEX

5.2.1 FLEXIBILITY

5.2.2 SCALABILITY

5.2.3 COST-EFFECTIVENESS

5.3 REDUCTION IN PROFITABILITY

5.4 REDUCTION IN COST PER BIT

5.5 CELLULAR BACKHAUL ARCHITECTURE

5.6 NETWORK SERVICES FOR REMOTE AND RURAL AREAS

6 COMPETITIVE LANDSCAPE

6.1 CONSOLIDATED WIRELESS BACKHAUL EQUIPMENT MARKET

7 GEOGRAPHIC ANALYSIS

7.1 OVERVIEW

7.2 U.S. WIRELESS AND MOBILE BACKHAUL EQUIPMENT MARKET

7.3 EUROPEAN WIRELESS AND MOBILE BACKHAUL EQUIPMENT MARKET

7.4 ASIAN WIRELESS AND MOBILE BACKHAUL EQUIPMENT MARKET

8 COMPANY PROFILES

8.1 ADC TELECOMMUNICATIONS INC.

8.2 ALCATEL-LUCENT

8.3 ALVARION LTD.

8.4 AMCC

8.5 ANDA NETWORKS

8.6 AT&T MOBILITY LLC

8.7 AXERRA NETWORKS

8.8 BRIDGEWAVE COMMUNICATIONS, INC.

8.9 BROADCOM CORP.

8.10 CABLEFREE SOLUTIONS

8.11 CELTRO LTD.

8.12 CERAGON

8.13 CISCO SYSTEMS INC.

8.14 COMBA

8.15 COMCAST

8.16 COMMPROVE

8.17 COMMSCOPE

8.18 COX COMMUNICATIONS

8.19 DRAGONWAVE INC

8.20 E-BAND COMMUNICATIONS CORP

8.21 EION WIRELESS

8.22 ELVA-1

8.23 EMBARQ

8.24 ENDWAVE CORP.

8.25 ERICSSON

8.26 EXALT COMMUNICATIONS INC.

8.27 FIBER TOWER

8.28 HARMONIC INC.

8.29 HARRIS STRATEX NETWORKS

8.30 HUAWEI TECHNOLOGIES

8.31 LEAP WIRELESS INTERNATIONAL, INC.

8.32 LIGHTPOINTE

8.33 LOEA CORP.

8.34 NEC CORP.

8.35 NOKIA SIEMENS NETWORK

8.36 NORTEL

8.37 PMC-SIERRA INC

8.38 PROXIM WIRELESS CORP.

8.39 QWEST

8.40 SPRINT NEXTEL

8.41 T-MOBILE

8.42 TELECOM TRANSPORT MANAGEMENT INC.

8.43 TIME WARNER CABLE

8.44 VERIZON

8.45 XO COMMUNICATIONS

8.46 ZTE CORP.

9 PATENT ANALYSIS

APPENDIX

LIST OF TABLES

SUMMARY TABLE GLOBAL WIRELESS AND MOBILE BACKHAUL MARKET, BY PRODUCTS 2007 – 2014 ($MILLIONS)

TABLE 1 GLOBAL WIRELESS AND MOBILE BACKHAUL EQUIPMENT MARKET, BY TECHNOLOGIES 2007 – 2014 ($MILLIONS)

TABLE 2 GLOBAL WIRELESS AND MOBILE BACKHAUL TECHNOLOGY MARKET, BY GEOGRAPHY 2007 – 2014 ($MILLIONS)

TABLE 3 GLOBAL MICROWAVE BACKHAUL TECHNOLOGY MARKET, BY GEOGRAPHY 2007 – 2014 ($MILLIONS)

TABLE 4 GLOBAL PSEUDOWIRE BACKHAUL TECHNOLOGY MARKET, BY GEOGRAPHY 2007 – 2014 ($MILLIONS)

TABLE 5 GLOBAL ALL-IP RAN BACKHAUL TECHNOLOGY MARKET, BY GEOGRAPHY 2007 – 2014 ($MILLIONS)

TABLE 6 GLOBAL FREE SPACE OPTICS BACKHAUL TECHNOLOGY MARKET, BY GEOGRAPHY 2007 – 2014 ($MILLIONS)

TABLE 7 GLOBAL SATELLITE BACKHAUL TECHNOLOGY MARKET, BY GEOGRAPHY 2007 – 2014 ($MILLIONS)

TABLE 8 GLOBAL TDM & ATM BACKHAUL TECHNOLOGY MARKET, BY GEOGRAPHY 2007 – 2014 ($MILLIONS)

TABLE 11 U.S. WIRELESS AND MOBILE BACKHAUL EQUIPMENT MARKET, BY TECHNOLOGIES 2007 - 2014 ($MILLIONS)

TABLE 12 EUROPEAN WIRELESS AND MOBILE BACKHAUL EQUIPMENT MARKET, BY TECHNOLOGIES 2007 - 2014 ($MILLIONS)

TABLE 13 ASIAN WIRELESS AND MOBILE BACKHAUL EQUIPMENT MARKET, BY TECHNOLOGIES 2007 - 2014 ($MILLIONS)

LIST OF FIGURES

FIGURE 1 BACKHAUL FOR DIFFERENT NETWORK SERVICES

FIGURE 2 GROWTH IN THE GLOBAL BACKHAUL MARKET

FIGURE 3 GROWTH TRENDS IN 3G SUBSCRIPTION

FIGURE 4 VOICE DATA TRAFFIC VS. PACKET DATA TRAFFIC

FIGURE 5 BACKHAUL TECHNOLOGY LIFECYCLE

FIGURE 6 POSITIVE IMPACTS OF NEXT GENERATION BACKHAUL

FIGURE 7 COMPARATIVE ANALYSIS OF BACKHAUL TECHNOLOGIES

FIGURE 8 FACTORS INFLUENCING WIRELESS AND MOBILE BACKHAUL MARKET

FIGURE 9 GLOBAL BACKHAUL MARKET, BY TECHNOLOGY (2009)

FIGURE 10 GLOBAL BACKHAUL MARKET, BY GEOGRAPHY (2009)

FIGURE 11 GLOBAL BACKHAUL MARKET, BY GEOGRAPHY (2009)

FIGURE 12 VIDEO SURVEILLANCE APPLICATIONS

FIGURE 13 GLOBAL CELL SITES BY REGION (2008)

FIGURE 14 GROWTH TRENDS IN CELL SITES (2009 VS 2012)

FIGURE 15 GROWTH TRENDS IN 3G/4G CELL SITES (2009 VS 2012)

FIGURE 16 AVERAGE CELLULAR NETWORK OPERATING COST (2008)

FIGURE 17 MARKET SHARES OF MAJOR PLAYERS (2008)

FIGURE 18 INDUSTRY GROWTH STRATEGIES

FIGURE 19 GLOBAL WIRELESS AND MOBILE BACKHAUL EQUIPMENT MARKET, BY GEOGRAPHY 2007 - 2014 ($MILLIONS)

FIGURE 20 GLOBAL WIRELESS AND MOBILE BACKHAUL PATENTS, BY TECHNOLOGIES (2004-SEPTEMBER 2009)

FIGURE 21 GLOBAL WIRELESS AND MOBILE BACKHAUL PATENTS, BY GEOGRAPHY (2004- SEPTEMBER 2009)

FIGURE 22 U.S. WIRELESS AND MOBILE BACKHAUL PATENTS (2004- SEPTEMBER 2009)

FIGURE 23 EUROPEAN WIRELESS AND MOBILE BACKHAUL PATENTS (2004- SEPTEMBER 2009)

FIGURE 24 ASIAN WIRELESS AND MOBILE BACKHAUL PATENTS (2004- SEPTEMBER 2009)

Growth opportunities and latent adjacency in Global Wireless and Mobile Backhaul Equipment Market

Interested in understanding the challenges in next generation Mobile Backhaul solutions.