White Oil Market by Application (Adhesives, Pharmaceuticals, Personal Care, Food, Agriculture, Textile, Polymer) and Region (North America, Europe, Asia Pacific, South America, Middle East & Africa) - Global Forecast to 2030

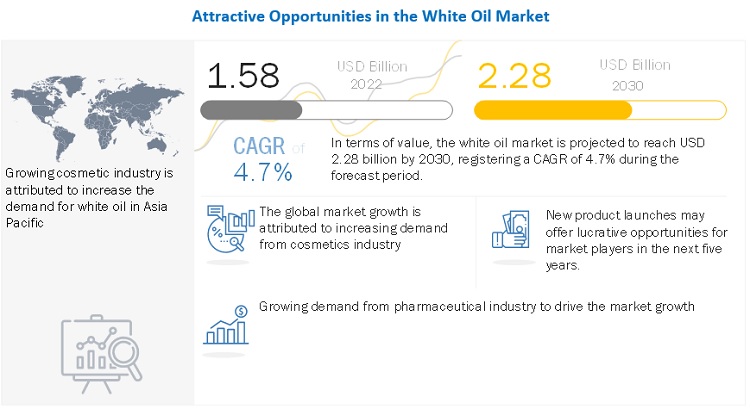

The white oil market is projected to reach USD 2.28 billion by 2030, at a CAGR of 4.7% from USD 1.58 billion in 2022. The growing need for the product in the pharmaceutical and personal care sectors is projected to be the main driver of market demand. Rising demand from cosmetics and medical applications is anticipated to be a key market driver globally. Mineral oils that have been refined to make them pure, stable, colorless, odorless, and non-toxic are known as white oils.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Developing pharmaceutical industry

A prominent market for white oil is the pharmaceutical industry. Laxative jellies, pomades, balms, creams, capsule lubricants, pelletizing aids, ointment bases, vaccinations, etc. are all prepared using white oil.

As it has the greatest level of purity, pharmaceutical-grade white oil is employed in this application area. White oil has light to medium viscosities, which are used in medicinal applications.

Restraints: Allergic reactions to white oil

Although white oil is safe in cosmetics and pharmaceutical when taken orally, it may cause few allergic reactions in some instances. Because mineral oil is fully safe, the U.S. Food and Drug Administration (FDA) has permitted its usage in cosmetics. But it may cause allergic reactions, such as hives, chest pain, breathing trouble, or swelling of the face, lips, or tongue, severe diarrhea, vomiting and other.

Opportunities: Rising demand from plastic industry

Low-volatility white oils are used in the manufacture of plastics and a variety of other polymers to enhance and regulate the melt flow rate of the final polymer to give release qualities or modify the physical properties. White oils are essential in the production of thermoplastic elastomers, as well. When light colour or food approval are required, elastomeric materials that can be manufactured without vulcanization use white oil as an extender to make fabrication easier.

Challenges: Volatile raw material prices

Volatile raw material prices, coupled with geophysical and political conflicts among key oil trading regions, are expected to affect the overall supply-demand scenario in the future. In addition, the tight supply of raw materials, coupled with a drop in their prices, might hinder the market growth.

“Personal care was the largest application for white oil market in 2021, in terms of value”

The personal care application segment led the white oil market in 2021. This owes to the rise in demand for personal care goods brought on by people's increased awareness of their health. While creating various personal care products, white oil is used as a basic component and as an emollient. It is widely used in the production of a variety of personal care goods, including cosmetics, skincare products, moisturizers, baby items, body lotions, hair oils, shampoos, scents, and creams that are water-resistant.

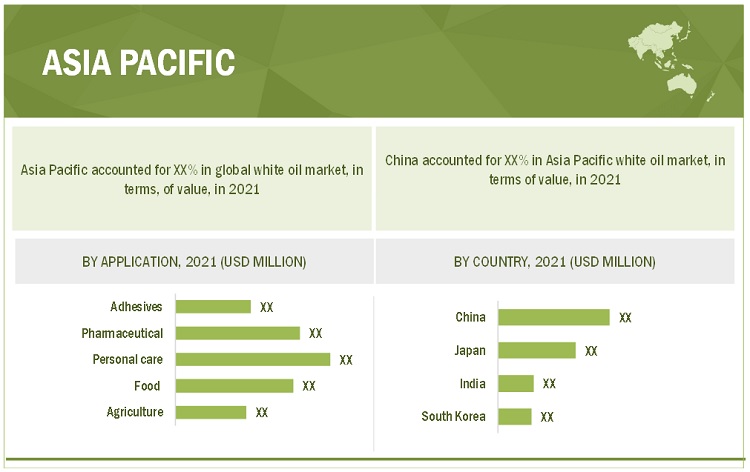

“Asia Pacific was the largest market for white oil in 2021, in terms of value.”

In 2021, the Asia Pacific region held a prominent share, dominating the white oil market. The growth is attributed to the region's expanding pharmaceutical industry's need for the product. The pharmaceutical sector has been primarily propelled by increased customer knowledge, affordability, and purchasing power. Industry participants continually invest in R&D, develop new goods, and set their prices to appeal to customers with various degrees of purchasing power.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market Royal Dutch Shell (Netherlands), ExxonMobil Corporation (US), Petro-Canada (Canada), Sasol (South Africa) and Renkert Oil, Inc. (US). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of white oil market have opted for new product launches to sustain their market position.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2017-2030 |

|

Base Year |

2021 |

|

Forecast period |

2022–2030 |

|

Units considered |

Volume (Kilotons); Value (USD Million) |

|

Segments |

Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

The key players in this market are Royal Dutch Shell (Netherlands), ExxonMobil Corporation (US), Petro-Canada (Canada), Sasol (South Africa) and Renkert Oil, Inc. (US)

|

This report categorizes the global white oil market based on application, and region.

On the basis of application, the white oil market has been segmented as follows:

- Adhesives

- Pharmaceutical

- Personal Care

- Food

- Agriculture

- Textile Polymers

- Others

On the basis of region, the white oil market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Frequently Asked Questions (FAQ):

What is the expected growth rate of white oil market?

The forecast period for white oil market in this study is 2022-2030. The white oil market is projected to grow at CAGR of 4.7%, in terms of value, during the forecast period.

Who are the major key players in white oil market?

Royal Dutch Shell (Netherlands), ExxonMobil Corporation (US), Petro-Canada (Canada), Sasol (South Africa) and Renkert Oil, Inc. (US

What is the average selling price trend for white oil market?

Prices are low in Asian countries (primarily China and India) compared to those in Europe and North America due to the low prices of raw materials and the availability of low-cost workforces in Asia Pacific. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of content

1 Introduction

1.1 Objective of the study

1.2 Market definition

1.3 Market Scope

1.3.1 Years considered for the study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.2 Secondary Data

2.2.1 Key data from secondary sources

2.3 Primary Data

2.3.1 Key data from primary sources

2.3.2 Breakdown of Primary Interviews

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Data Triangulation

2.6 Assumptions

2.7 Limitations

3 Executive Summary

4 Premium Insights

4.1 Opportunities in White Oil Market

4.2 White Oil Market, By Application

4.3 White Oil Market, By Region

5 Market Overview and Industry Trends

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

5.3 Supply Chain Analysis

5.3.1 Raw Material

5.3.2 Manufacturers

5.3.3 Distribution

5.3.4 End-Use Industry

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Buyers

5.4.4 Bargaining Power of Suppliers

5.4.5 Intensity of Competitive Rivalry

5.5 Average Selling Price

5.6 Regulatory Landscape

5.7 Industry Outlook

6 White Oil Market, By Application

6.1 Introduction

6.2 Adhesives

6.3 Pharmaceutical

6.4 Personal Care

6.5 Food

6.6 Agriculture

6.7 Textile

6.8 Polymers

6.9 Others

7 White Oil Market, By Region

7.1 Introduction

7.2 Asia Pacific

7.2.1 China

7.2.2 India

7.2.3 Japan

7.2.4 South Korea

7.2.5 Rest of Asia Pacific

7.3 North America

7.3.1 U.S.

7.3.2 Canada

7.3.3 Mexico

7.4 Europe

7.4.1 Germany

7.4.2 France

7.4.3 Italy

7.4.4 U.K.

7.4.5 Rest of Europe

7.5 Middle East & Africa

7.5.1 Egypt

7.5.2 Saudi Arabia

7.5.3 South Africa

7.5.4 Rest of Middle East & Africa

7.6 South America

7.6.1 Brazil

7.6.2 Argentina

7.6.3 Rest of South America

8 Competitive Landscape

8.1 Introduction

8.2 Market Share Analysis

8.3 Company Evaluation Quadrant

8.4 Competitive Situation & Trends

8.4.1 New Product Launches

8.4.2 Contracts & Agreements

8.4.3 Partnerships & Collaborations

8.4.4 Joint Ventures

8.4.5 Expansions

9 Company Profile

9.1 British Petroleum

9.1.1 Business Overview

9.1.2 Products Offered

9.1.3 Recent Development

9.1.4 MnM View

9.1.4.1 Key Strengths

9.1.4.2 Strategic choices made

9.1.4.3 Threat from competition

9.2 Renkert Oil, Inc.

9.3 ExxonMobil Corporation

9.4 JX Nippon Oil & Energy Corporation

9.5 Royal Dutch Shell NV

9.6 Petro-Canada

9.7 Sinopec Corporation

9.8 Sasol

9.9 Seojin Chemical Co., Ltd

9.10 Nynas AB

9.11 List of other key players

10 Appendix

10.1 Insights from Industry Experts

10.2 Discussion Guide

10.3 Related Reports

The study involved four major activities to estimate the size of white oil market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

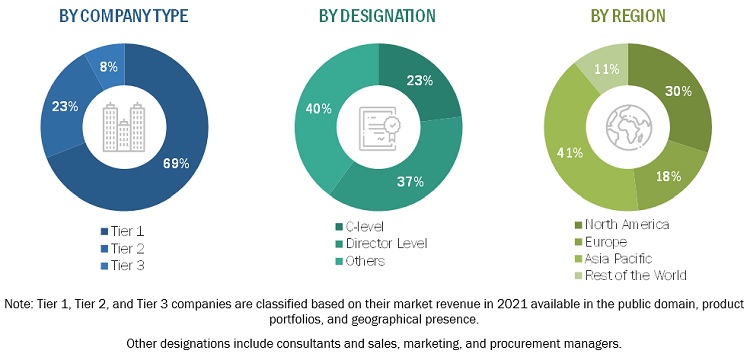

The white oil market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, distributors, and end users. Various primary sources from the supply and demand sides of the white oil market have been interviewed to obtain qualitative and quantitative information.

The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the white oil industry.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the white oil market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

White Oil Market: Bottum-Up Approach 1

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Report Objectives

- To define, describe, and forecast the size of the white oil market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on application, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, and Middle East & Africa, and South America along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies2

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Regional Analysis

Further breakdown of a region with respect to a particular country or additional application

- Company Information

Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in White Oil Market