Welding Materials Market

Welding Materials Market by Type (Electrodes & Filler Materials, Fluxes & Wires, Gases), Technology (Arc, Resistance, Oxy-Fuel Welding), End-use Industry (Transportation, Building & Construction, Heavy Industries), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

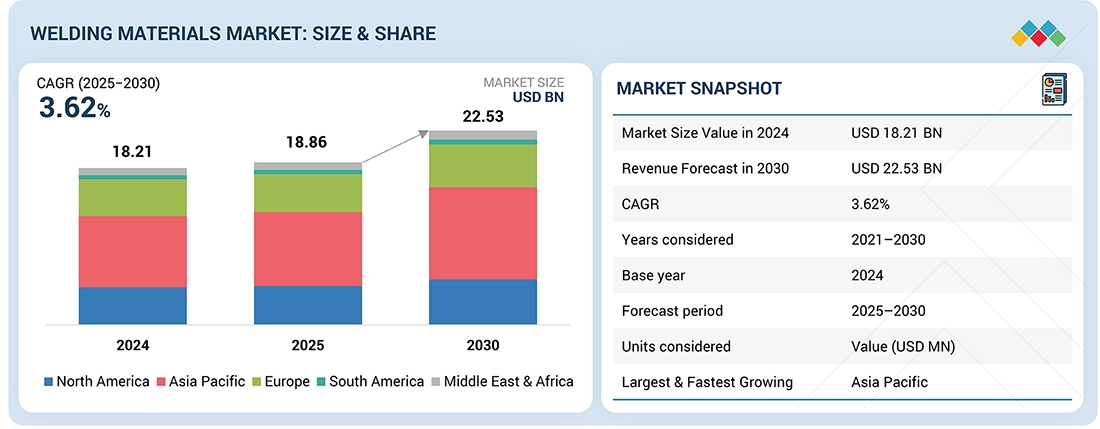

The welding materials market is projected to be USD 18.86 billion in 2025, and it is projected to reach USD 22.53 billion by 2030 at a CAGR of 3.62%. Welding is the process in which two metal parts are bonded together by melting various types of materials at their surfaces. It is an important process in metal fabrication industries. Any material used in the process of welding is known as welding material. Welding materials mainly include electrodes, fluxes, wires, and shielding gases. Its use is growing in sectors such as transportation, building & construction, and heavy industries.

KEY TAKEAWAYS

-

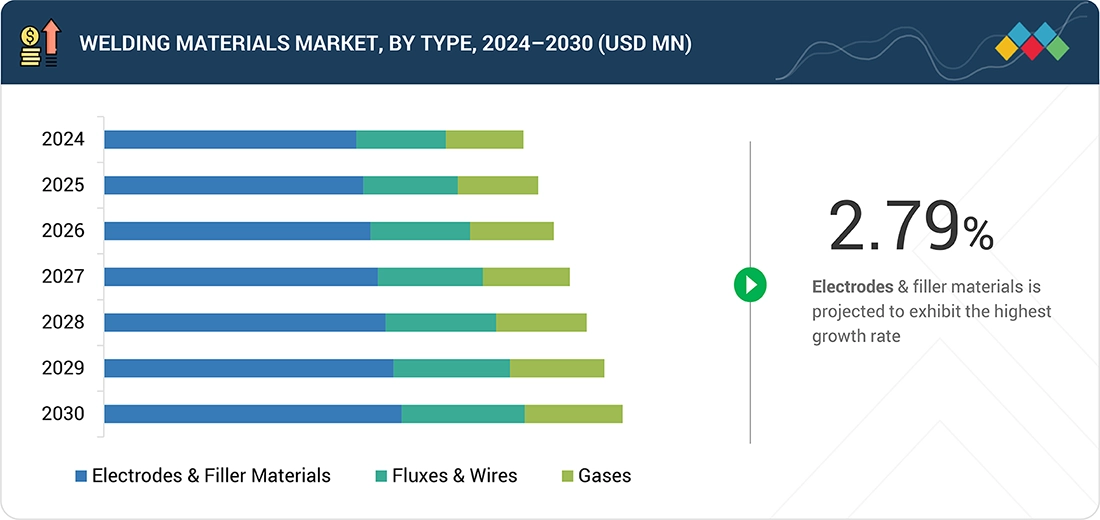

BY TYPEThe welding materials market includes electrodes & filler materials, fluxes & wires, and gases. The electrodes & filler materials are mainly used as welding materials as these elements are essential in the production of strong, durable, and superior welded joints, which makes them essential in construction, industrial manufacturing, and repair processes.

-

BY TECHNOLOGYBy technology, the market covers arc welding, resistance welding, oxy-fuel welding, and other technologies. Advanced technologies improve precision, strength, and efficiency, making them vital for aerospace, automotive, and infrastructure.

-

BY END-USE INDUSTRYEnd-use industries include transportation, building & construction, heavy industries, and other end-use industries. Welding materials are critical in these industries as they ensure strong, durable joints that maintain structural integrity under extreme conditions.

-

BY REGIONAsia Pacific is expected to grow fastest, driven by rapid urban growth and large infrastructure projects.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic acquisitions and product launches from leading players such as ESAB, voestalpine AG, and The Lincoln Electric Company. These companies are constantly innovating products with technology integration, and conducting acquisitions that help them increase regional presence.

The market of welding materials market is expected to grow due to various factors. Increasing demand from end-use industries an long-term growth in emerging markets and global energy infrastructural investments is expected to drive the market.

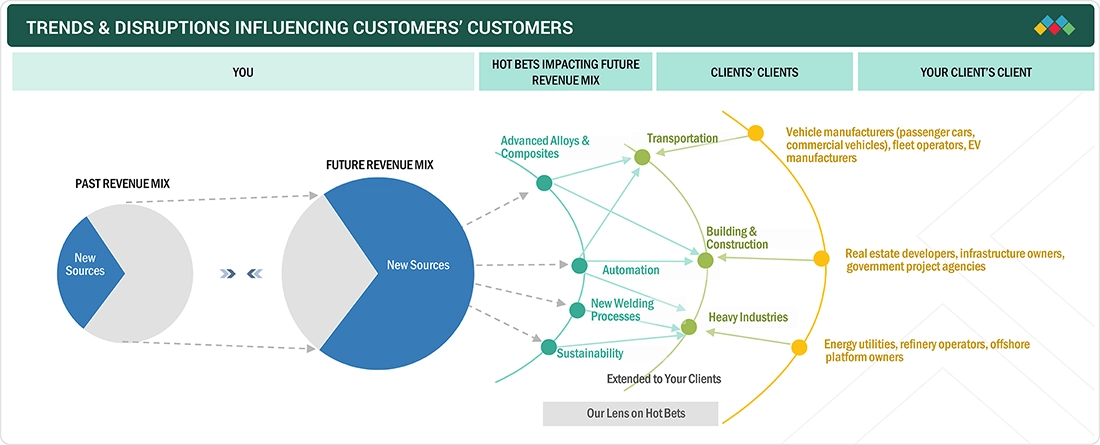

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of welding material suppliers, which, in turn, impacts the revenues of welding material manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

§Growing construction and automotive industries

-

§Rising demand for energy and growing investments in renewable energy in emerging markets

Level

-

§Environmental impact of welding materials

Level

-

•Growth prospects in emerging economies

-

•New and advanced applications

Level

-

•Shortage of skilled labor and high labor cost

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing construction and automotive industries

The use of welding materials is growing in different end-use industries like the automotive and construction industries. In the automotive industry, production is increasing, especially for electric vehicles (EVs), which need high-quality welding materials for lightweight metals like aluminum and advanced high-strength steel. In construction, global investments in infrastructure such as urban housing, transport systems, and industrial buildings are driving the need for steel structures, pipelines, bridges, and building frameworks, all of which rely on welding.

Restraint: Environmental impact of welding materials

Fumes from welding contain gases and microscopic particles that can contaminate the air we breathe. These contaminants can stay in the atmosphere, causing air pollution and contributing to issues like smog. In addition to contributing to climate change, certain hazardous gases emitted during welding can produce ground-level ozone.

Opportunity: New and advanced applications

Advanced welding techniques are enhancing precision, efficiency, and sustainability across industries, driving demand for innovative equipment and eco-friendly processes. This technological advancement, coupled with the increasing complexity of end-use applications, is expected to sustain demand for advanced welding materials well into the next decade

Challenge: Shortage of skilled labor and high labor cost

Welding is a precise process that requires trained professionals to conduct the welding process carefully and maintain quality, safety, and technical standards. However, the industry is currently facing a shortage of skilled workers and rising labor costs. While this change can increase the use of certain high-performance materials suitable for automation, it may decrease the need for traditional materials used in manual welding.

Welding Materials Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

On-site rebuild of Hanson Cement's Purfleet VRM grinding table & rollers using Integra mill wire hardfacing kits. | Restored original profiles, improved mill productivity, minimized downtime, successful completion within 3 days, full COVID-19 compliance, innovative work zoning and automation for safety. |

|

Used NSARC Copper-Glide 115 welding wire for producing material handling equipment and rack systems requiring smooth, consistent wire feedability and high-quality welds in robotic and semi-automatic MIG stations. | Achieved exceptional wire consistency, superior bead performance, enhanced production efficiency, cost effectiveness, and responsive support ensuring high-quality, reliable manufacturing of over 2 million pounds of welded steel weekly. |

|

Received on-site hands-on technical support from NSARC for setting up new stainless-steel welding wire manufacturing line, optimizing welding parameters, and process improvements. | Improved welding line efficiency, operator confidence, reduced setup time, optimized welding processes, and competitive market readiness through tailored expert assistance and advanced technology introduction. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

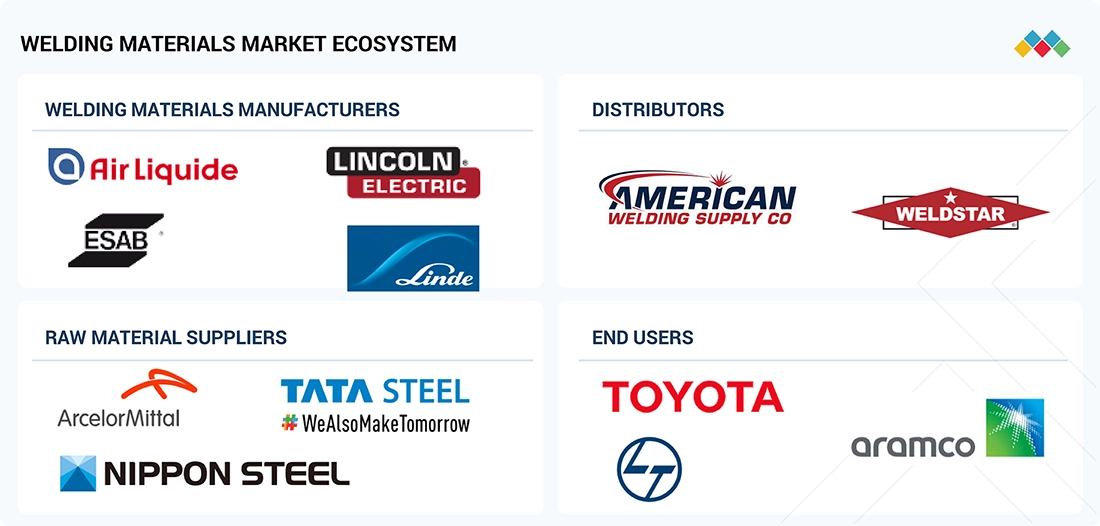

MARKET ECOSYSTEM

The welding materials ecosystem analysis involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, and end users. The process involves various activities such as raw material handling, synchronizing with the manufacturer, channelizing the communication sources & technologies, and finally delivering the finished product. The distributors and suppliers establish contact between the manufacturing companies and end users to streamline the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Welding Materials Market, By Type

Because of their important role in a variety of welding applications, electrodes and filler materials have dominated the market and taken the largest share during the forecast period. These elements are important to the production of strong, durable, and superior welded joints, which makes them essential in construction, industrial manufacturing, and repair processes. Together, electrodes and filler materials form a critical unity which are important in modern welding practices, serving to a diverse range of applications across multiple industries.

Welding Materials Market, By Technology

During the forecast period, the arc welding industry is expected to hold the largest segment of the welding materials market. The production of an electric arc between the electrode and the workpiece, which produces a concentrated and intense heat, is what distinguishes this welding technique. Because it effectively melts the metal surfaces and promotes a strong fusion between them, this high temperature is essential. Arc welding's capacity to guarantee uniform and regulated metal deposition is one of its most notable benefits

Welding Materials Market, By End-use Industry

By end-use industry, the transportation segment is projected to experience the fastest growth and hold the largest market share during the forecast period. The welding materials market is thriving mainly because the automotive industry relies heavily on welding. Welding is an important process in the production of modern vehicles, carefully joining structural and body parts like sturdy chassis frames, complex exhaust systems, vital engine parts, intricate transmission assemblies, durable suspensions, and streamlined body panels

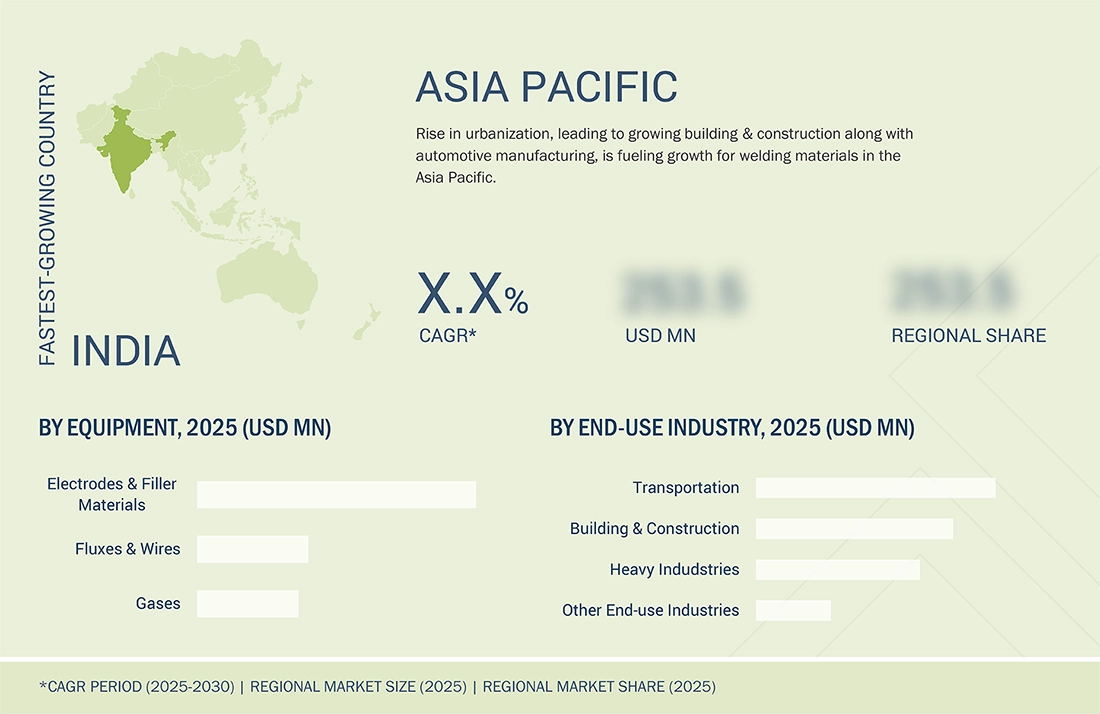

REGION

Asia Pacific to be fastest-growing region in global welding materials market during forecast period

Countries like China, India, Japan, and South Korea are experiencing rapid urban growth and large infrastructure projects. This includes building highways, bridges, railways, and smart cities. For example, India’s National Infrastructure Pipeline involves large investments, which directly increases the demand for welding materials. The Asia-Pacific (APAC) region has also become a major manufacturing center, with growth in the automotive, shipbuilding, and heavy industries

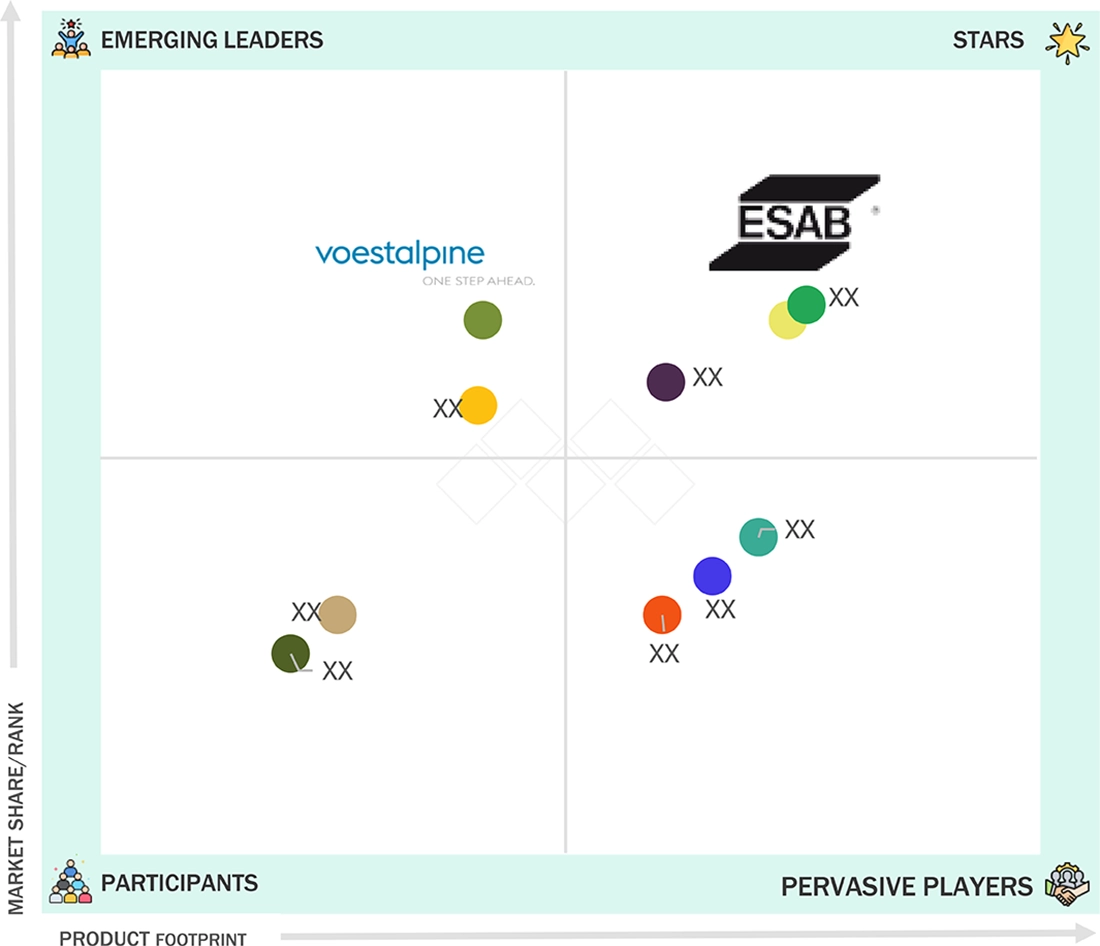

Welding Materials Market: COMPANY EVALUATION MATRIX

In the welding materials market matrix, ESAB (Star), global leader in welding and cutting technologies, offering a wide range of equipment, consumables, and digital solutions for industries such as construction, automotive, shipbuilding, and energy. The company emphasizes innovation in automation and sustainable welding solutions. vostalpine AG (Emerging Leader) emphasizes high-performance filler materials and customer-focused application support. While ESAB dominates with scale, vostalpine AG shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 18.21 Billion |

| Market Forecast in 2030 (value) | USD 22.53 Billion |

| Growth Rate | CAGR of 3.62% from 2025-2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | • By Type: Electrodes & Filler Materials, Fluxes & Wires, And Gases • By Technology: Arc Welding, Resistance Welding, Oxy-Fuel Welding, and Other Technologies • By End-Use Industry: Transportation, Building & Construction, Heavy Industries, And Other End-Use Industries |

| Regions Covered | Europe, North America, Asia Pacific, the Middle East & Africa, and South America |

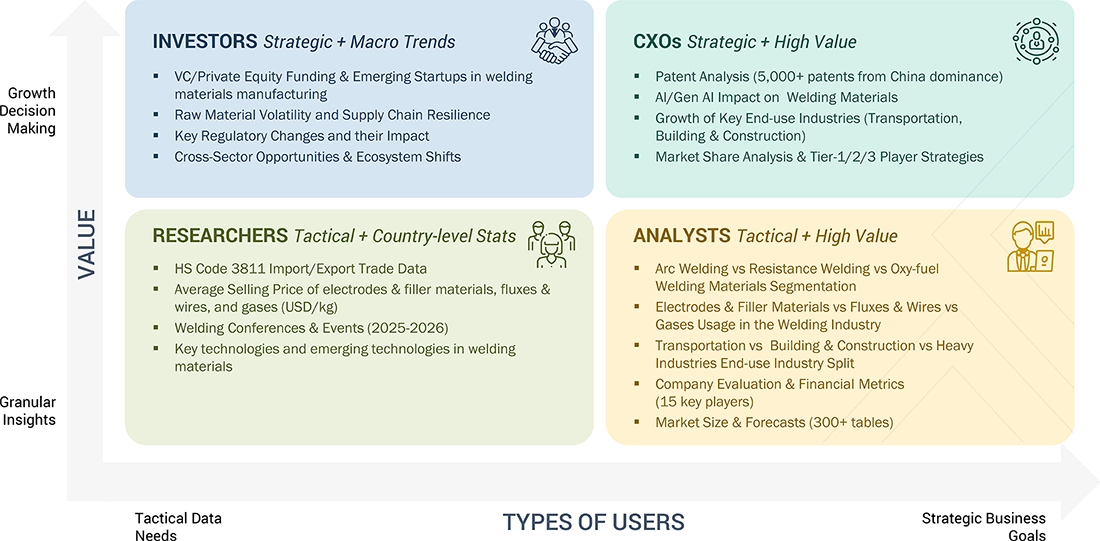

WHAT IS IN IT FOR YOU: Welding Materials Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Deep Dive into US Welding Materials Market | • • Detailed breakdown of US welding materials market into Midwest, Southwest, Southeast, West, and Northeast • Further breakdown of Fluxes & Wires segment into Solid Wire and Tubular Wire; and subsegments of each | • Insights into each region of the US and potential market for different welding materials • Identification of future growth opportunities and investments |

RECENT DEVELOPMENTS

- May 2025 : ESAB signed an agreement to acquire Germany-based EWM GmbH for approximately USD 317.06 million (€275 million), targeting completion in the second half of 2025. This deal addresses ESAB’s product gaps in heavy industrial welding equipment, enhances technological capabilities, and is expected to be accretive to earnings from year one, while expanding the global market reach.

- June 2025 : Air?Liquide announced that it will build, own, and operate a large-scale air separation unit (ASU) on Naoshima Island, Japan, expected to start operations in 2027, capable of producing up to 1,400?tons/day of oxygen, as well as nitrogen, to support increasing demand driven by the semiconductor manufacturing, transportation equipment manufacturing and construction work. Argon and neon will also be produced to meet the demand from semiconductor manufacturing and welding applications.

- February 2025 : Lincoln Electric acquired Vanair Manufacturing, a leading U.S. provider of mobile power solutions like vehicle-mounted compressors, generators, welders, and electrified equipment. This acquisition broadens Lincoln Electric’s capabilities in the fast-growing maintenance and repair service truck market and builds on prior joint development initiatives.

- August 2023 : Air Products South Africa, along with its subsidiary Weldamax, expanded its gas and welding portfolio by acquiring a controlling interest in EWN&S, a respected distributor of welding equipment and consumables. The acquisition enhances Air Products’ supply chain capabilities, product offerings, and after-sales support, leveraging EWN&S’s longstanding market reputation and technical expertise.

- January 2023 : Linde plc finalized the purchase of nexAir, LLC, a company specializing in gas distribution and welding supplies in the United States, to enhance the company’s geographical presence in various regions.

Table of Contents

Methodology

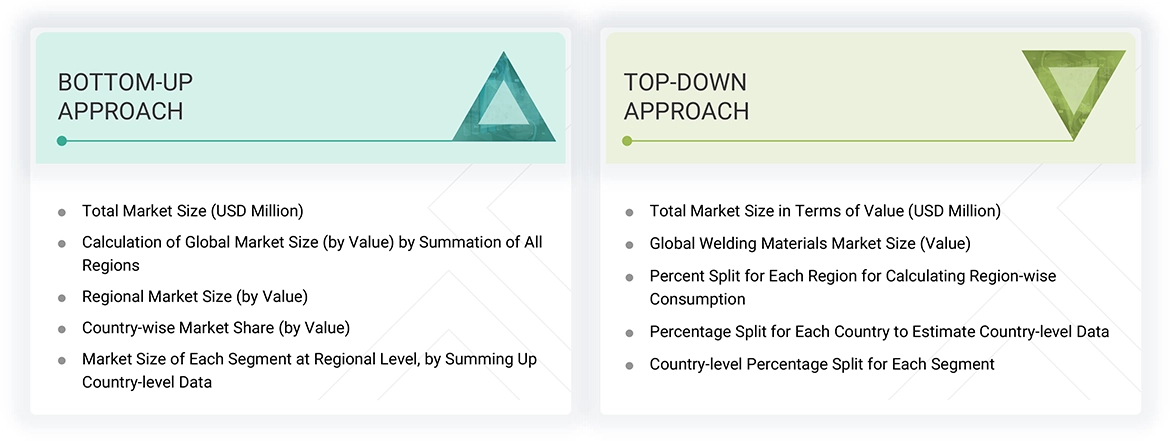

The study involved four main activities to estimate the current size of the global welding materials market. Comprehensive secondary research was conducted to gather information on the market, related product markets, and the broader product group markets. The next step was to validate these findings, assumptions, and estimates with industry experts across the entire welding materials value chain through primary research. Both top-down and bottom-up approaches were used to determine the overall market size. Subsequently, market segmentation and data triangulation were applied to identify the size of various segments and sub-segments within the market.

Secondary Research

The market size for companies offering welding materials is assessed using secondary data from paid and unpaid sources, analyzing the product portfolios of major companies in the industry, and rating these companies based on their performance and quality. Various secondary sources, such as Business Standard, Bloomberg, the World Bank, and Factiva, were consulted to gather information for this study on the welding materials market. Multiple sources were examined during the secondary research process to collect relevant data. These sources included annual reports, press releases, investor presentations from welding material manufacturers, forums, reputable publications, and whitepapers. The secondary research provided important insights into the industry’s value chain, the key players, as well as market classification and segmentation from both market and technology perspectives.

Primary Research

During the primary research process, various primary sources from both the supply and demand sides were interviewed to collect qualitative and quantitative information for this report. The supply-side sources included industry experts such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and other key executives from several leading companies and organizations within the Welding materials market. After completing the market engineering—covering calculations for market statistics, market breakdown, market size estimates, market forecasting, and data triangulation—extensive primary research was carried out to gather, verify, and validate the critical numbers used in the report. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of welding materials offered by various market players, and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to estimate and forecast the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed throughout the market engineering process to highlight key information and insights in the report.

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were employed to estimate and validate the size of the global welding materials market. These methods were also widely used to determine the size of various related market segments. The research methodology used to estimate the market size included the following:

Data Triangulation

After estimating the overall market size using the appropriate methods, the market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were applied, where applicable, to complete the overall market analysis and determine precise statistics for each segment and subsegment. The data was triangulated by examining various factors and trends from both demand and supply perspectives.

Market Definition

Welding is the process in which two metal parts are joined together by melting materials at their surfaces. It is a vital process in metal fabrication industries. The welding process is commonly used in many fields, such as transportation, shipbuilding, construction, and manufacturing. It is also utilized in the repair and maintenance industry to fasten different metal surfaces. Any material used in welding is known as welding material. Welding materials mainly consist of electrodes, fluxes, wires, and shielding gases.

Stakeholders

- Welding material manufacturers

- Raw material suppliers

- Traders and distributors

- Industry associations

- Research organizations, trade associations, and government agencies

- R&D institutes

- Regulatory bodies

- End-use industries

Report Objectives

- To define, describe, and forecast the size of the global welding materials market based on type, technology, end-use industry, and region in terms of value

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments and subsegments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as product launches, acquisitions, expansions, partnerships, and agreements in the welding materials market

- To provide the impact of AI/Gen AI on the market

Key Questions Addressed by the Report

What are the major drivers driving the growth of the welding materials market?

Increasing demand from end-use industries, long-term growth in emerging markets, and global energy infrastructure investments.

What are the major challenges in the welding materials market?

The major challenge is the shortage and high cost of skilled labor.

What are the restraining factors in the welding materials market?

The primary restraining factor is the environmental impact of welding materials.

What is the key opportunity in the welding materials market?

Growth prospects in developing economies and new, advanced applications provide new opportunities for the market.

What are the end-use industries of welding materials?

Welding materials are mainly used in transportation, heavy industries, building & construction, and other industrial sectors.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Welding Materials Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Welding Materials Market