Waterproof Adhesives & Sealants Market by Chemistry (Silicones, PU, Acrylics, Epoxy, Polysulfide), End-use Industry (Building & Construction, Transportation, Electrical & Electronics) and Region - Global Forecasts to 2027

Updated on : September 02, 2025

Waterproof Adhesives and Sealants Market

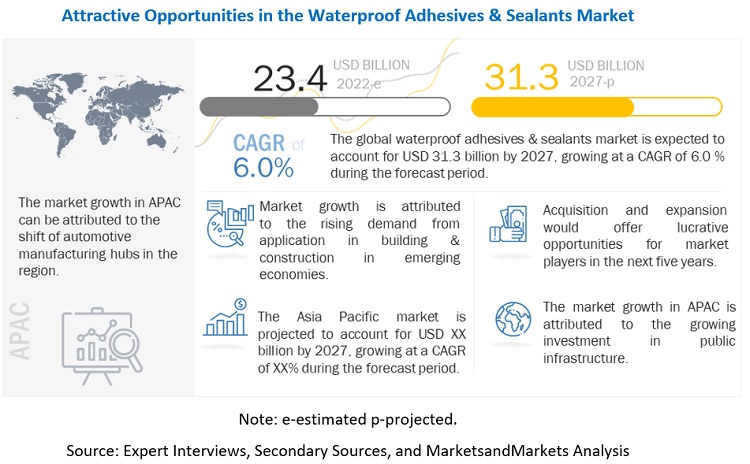

The Waterproof Adhesives & Sealants Market was valued at USD 23.4 billion in 2022 and is projected to reach USD 31.3 billion by 2027, growing at 6.0% cagr from 2022 to 2027. Increasing demand for waterproof adhesives & sealants from emerging markets and growth in building & construction and packaging industry are driving the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on Waterproof Adhesives & Sealants Market

According to first estimates from Eurostat, the European Union's (EU) statistical office, seasonally adjusted production in the EU construction industry fell by 11.7% MoM (Month on Month) in April 2020. At a global level, the supply chain was disrupted in various ways in different parts of the world. The supply of construction material was halted due to the travel restriction and disruption in the supply chain. In order to recover from the impact caused due to COVID-19, the majority of companies limited their budget in the R&D department to re-align them for maintaining their core function in the end-use industries.

Waterproof Adhesives & Sealants Market Dynamics

Driver: Growing investment in public infrastructure

Governments in developing countries are taking initiatives to develop their public infrastructures like power grids, roads, bridges, railways, water treatment plants, airports, and telecommunication. Most of these developing countries are located in Asia, which has a humid climate. Waterproof adhesives are needed to maintain the integrity and increase the lifespan of these structures. The Asian Infrastructure Bank, based in Beijing, China, actively participates in financing infrastructure pipelines across the Asian region. According to Asia Development Bank (ADB), the region demands financing of USD 1.7 trillion annually. Owing to various infrastructure projects like the Cross Island line project in Singapore, India’s development of a waterway freight corridor, and investment of about USD 738 million in the development of Singapore waterway tunnel systems, are set to increase the demand for waterproof adhesives. European countries, such as Spain, and Italy, focus on tourism as a part of their economy. The public infrastructure in these countries also acts as a public attraction. However, the tourism industry was highly impacted due to the COVID-19 pandemic; the industry in Spain is set to reach 88% of its pre-pandemic level in 2022.

In a developed economy like North America, the development of infrastructure acts as a multiplier effect in the country's industrial and manufacturing growth. The US economy relies on its vast network of the infrastructure of roads & bridges, freight rails & ports, and electrical grids. The GlobalData statistics assign construction project index between -5 and 5. The infrastructure construction project momentum index in North America, in January 2022 was 1. In US Transportation Infrastructure Finance and Innovation Act (TIFIA) provides cost-effective- long-term financing for infrastructure projects. According to Congressional Research Service (CRS), nearly USD 25 billion of financing has been done through this act. In March 2022, The US government unveiled a USD 2 trillion infrastructure plan.

Restraint: Volatility in raw material prices

Price and availability of raw materials is a key factor for adhesive manufacturers for determining the cost structure of their products. Raw materials used by the waterproof adhesive industry include plastic resins, synthetic rubber, industrial inorganic chemicals, and refined petroleum products. Most of these raw materials are petroleum-based derivatives vulnerable to fluctuations in commodity prices. Recently, oil prices witnessed highly volatile fluctuations on either side. The prices of different resins are at an all-time high. According to Plastics Today, in North America, there is a strong export demand for resins from the US, but freight constraints have limited the sale. This has left Mexico as the most viable option for export. This situation also causes fluctuation in pricing. Amid the outbreak of the COVID-19 pandemic, there is a rise in the prices of synthetic and bio-based chemicals due to short supply and restricted imports, which is expected to increase the cost of chemicals.

Opportunity: Growing demand for non-hazardous and sustainable adhesives

The stringent regulations by the United States Environmental Protection Agency (USEPA), Europe’s Registration, Evaluation, Authorisation and Restrictions of Chemicals (REACH), Leadership in Energy and Environmental Design (LEED), and other regional regulatory authorities have compelled waterproof adhesives & sealants manufacturers to make eco-friendly products with no- or low-VOC levels. The shift toward more sustainable products has provided significant growth opportunities for manufacturers.

Challenge: Stringent, time-consuming, and ever-changing regulatory policies

The adhesives & sealants market is governed by stringent regulatory requirements. Therefore, waterproof adhesives & sealants manufacturers have to comply with local, state, country, and international VOC standards. In doing so, many adhesive suppliers have to make substantial investments to revamp their operations and comply with new regulations. In addition, the adhesives & sealants market have to face regulatory changes frequently. New regulations, such as regulation (EU) No 305/2011 was implemented by The Construction Products Regulation (CPR), for construction products marketing in the EU. For commercialization of their products, the adhesives & sealants manufacturers have to abide by these rules and standards. Such stringent and changing regulations are posing as barriers to the growth of the market.

Waterproof Adhesives & Sealants Market Ecosystem

In terms of value, the building & construction segment is projected to account for the largest share of the waterproof adhesives & sealants market, by end-use industry, during the forecast period.

The building & construction segment dominated the waterproof adhesives & sealants market, with a share of 42.8% in terms of value, of the overall market in 2021. Waterproof adhesives & sealants are extremely durable and can resist rough weather conditions, moisture, or sunlight. They are also widely used in interiors in floor joints, bathtubs, sinks, and showers to prevent water leakage and subsequent damage. Waterproof adhesives & sealants enable construction materials to provide better performance and last longer.

In terms of value, the polyurethanes segment is projected to account for the second fastest growth of the waterproof adhesives & sealants market, by chemistry, during the forecast period.

Based on chemistry, the polyurethanes segment accounted for the second fastest growth at a CAGR of 6.1% in terms of value, during the forecast period. Polyurethanes are widely used in the manufacturing of high-performance waterproof adhesives & sealants for applications, such as isolation joints, roofing, foundation, gutters, expansion, and control joints in the building & construction industry. They are often termed potting compounds and are used in the electronics & electrical industry to encapsulate, seal, and insulate fragile, pressure-sensitive, underwater cables, and printed circuit boards.

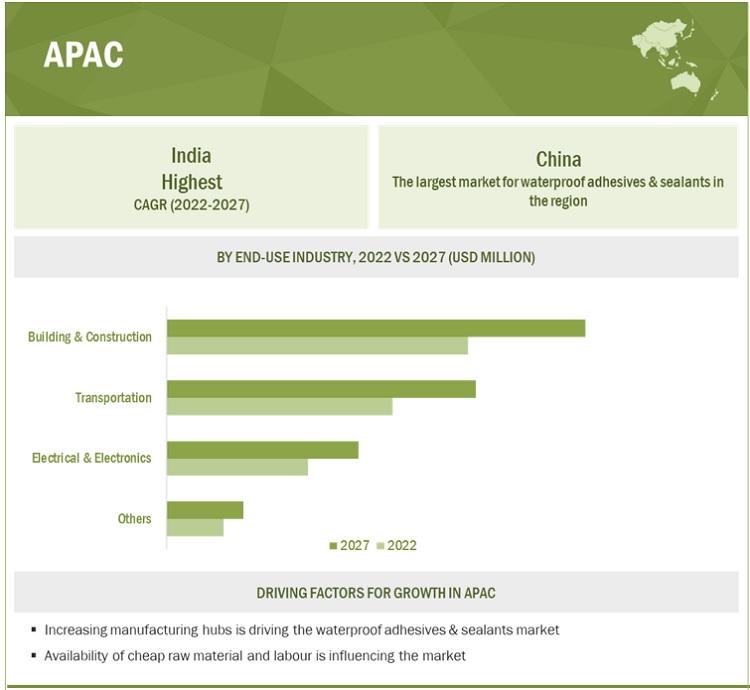

APAC is expected to be the fastest-growing market during the forecast period.

Based on region, Asia Pacific is a key market for the production of waterproof adhesives & sealants and is projected to grow at a CAGR of 6.5% in terms of value during the forecasted period. The demand for waterproof adhesives and sealants from the residential industry in Asia Pacific is expected to grow due to the influence of macroeconomic stimuli, such as population growth, rise in disposable income, and, most importantly, increasing investments in the Southeast Asian countries. Thus, the growth of the residential end-use industry will augment the demand for waterproof adhesives & sealants in the Asia Pacific region.

To know about the assumptions considered for the study, download the pdf brochure

Waterproof Adhesives and Sealants Market Players

Major players operating in the global waterproof adhesives & sealants market include 3M (US), Henkel AG (Germany), Avery Dennison Corporation (US), H.B. Fuller (US), Dow (US), Huntsman Corporation (US), Sika AG (Switzerland), MAPEI Spa (Italy), RPM International (US), and Bostik SA (France).

Waterproof Adhesives and Sealants Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2016–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Million/Billion), Volume (Kiloton) |

|

Segments |

Chemistry, End-Use Industry, and Region |

|

Regions |

North America, Europe, Asia Pacific, South America and Middle East & Africa |

|

Companies |

3M (US), Henkel AG (Germany), Avery Dennison Corporation (US), H.B. Fuller (US), Dow (US), Huntsman Corporation (US), Sika AG (Switzerland), MAPEI Spa (Italy), RPM International (US), and Bostik SA (France). |

This research report categorizes the waterproof adhesives & sealants market based on chemistry, application and region.

Waterproof Adhesives & Sealants Market based on Chemistry:

- Silicones

- Polyurethanes

- Acrylics

- Epoxy

- Polysulfide

- Others

Waterproof Adhesives & Sealants Market based on End-Use Industry:

- Building & Construction

- Transportation

- Electrical & Electronics

- Others

Waterproof Adhesives & Sealants Market based on Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In December 2020, H.B. Fuller announced readily available adhesive grades with hot melt advanced technology for extreme cold storage of vaccines and medication packaging. Advantra adhesives provide a secure bond at -94°F with tamper evident fiber tear).

- In February 2022, H.B. Fuller acquired Fourny nv, a Belgium-based company, Fourny operates within H.B. Fuller’s existing Construction Adhesives global business unit. The acquisition includes one factory and an R&D center based in Willebroek, Antwerp, in Belgium. This acquisition strengthens the position of H.B. Fuller in the country and enhances its product offering.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the waterproof adhesives & sealants market?

The growth of this market can be attributed to growing requirement in APAC and increasing infrastructure growth.

Which are the key applications driving the waterproof adhesives & sealants market?

The application in building & construction, transportation and electrical & electronics industry are driving the demand for waterproof adhesives & sealants market.

Who are the major manufacturers?

Major manufacturers include 3M (US), Henkel AG (Germany), Avery Dennison Corporation (US), H.B. Fuller (US), Dow (US), Huntsman Corporation (US), Sika AG (Switzerland), MAPEI Spa (Italy), RPM International (US), and Bostik SA (France), among others.

What is the biggest restraint for waterproof adhesives & sealants?

The biggest restraint can be volatility in raw material prices.

How is COVID-19 affecting the overall waterproof adhesives & sealants market?

The waterproof adhesives & sealants market saw a disruption in supply chain for supply of raw materials.

What will be the growth prospects of the waterproof adhesives & sealants market?

Growth in developing countries and technological advancements in end-use industries are driving the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 WATERPROOF ADHESIVES & SEALANTS MARKET: INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 WATERPROOF ADHESIVES & SEALANTS: MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 WATERPROOF ADHESIVES & SEALANTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Primary interviews – demand and supply side

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 WATERPROOF ADHESIVES & SEALANTS MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 WATERPROOF ADHESIVES & SEALANTS MARKET: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: WATERPROOF ADHESIVES & SEALANTS MARKET

2.3 FORECAST NUMBER CALCULATION

FIGURE 6 DEMAND-SIDE FORECAST PROJECTIONS

2.4 DATA TRIANGULATION

FIGURE 7 WATERPROOF ADHESIVES & SEALANTS MARKET: DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS & RISKS ASSOCIATED WITH WATERPROOF ADHESIVES & SEALANTS MARKET

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 8 SILICONES TO LEAD WATERPROOF ADHESIVES & SEALANTS MARKET, BY CHEMISTRY

FIGURE 9 BUILDING & CONSTRUCTION INDUSTRY TO LEAD WATERPROOF ADHESIVES & SEALANTS MARKET

FIGURE 10 ASIA PACIFIC LED WATERPROOF ADHESIVES & SEALANTS MARKET

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN WATERPROOF ADHESIVES & SEALANTS MARKET

FIGURE 11 HIGH GROWTH POTENTIAL IN ASIA PACIFIC REGION

4.2 ASIA PACIFIC: WATERPROOF ADHESIVES & SEALANTS MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 12 CHINA LED THE WATERPROOF ADHESIVES & SEALANTS MARKET IN ASIA PACIFIC

4.3 WATERPROOF ADHESIVES & SEALANTS MARKET, BY CHEMISTRY

FIGURE 13 SILICONES TO LEAD WATERPROOF ADHESIVES & SEALANTS MARKET, BY CHEMISTRY

4.4 WATERPROOF ADHESIVES & SEALANTS MARKET, BY END-USE INDUSTRY

FIGURE 14 BUILDING & CONSTRUCTION INDUSTRY TO LEAD WATERPROOF ADHESIVES & SEALANTS MARKET

4.5 WATERPROOF ADHESIVES & SEALANTS MARKET, BY COUNTRY

FIGURE 15 CHINA AND INDIA TO BE FASTEST-GROWING WATERPROOF ADHESIVES & SEALANTS MARKETS DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN WATERPROOF ADHESIVES & SEALANTS MARKET

5.2.1 DRIVERS

5.2.1.1 Expanding building & construction and packaging industries

TABLE 1 GROWTH OF BUILDING & CONSTRUCTION MARKET IN VARIOUS REGIONS

TABLE 2 GROWTH OF TRANSPORTATION & AUTOMOTIVE MARKET IN VARIOUS REGIONS

5.2.1.2 Growing investment in public infrastructure

5.2.1.3 High demand for waterproof adhesives & sealants in Asia Pacific

5.2.1.4 Technological advancements in end-use industries

TABLE 3 KEY TECHNOLOGICAL ADVANCEMENTS IN VARIOUS PRODUCTS

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

TABLE 4 KEY RAW MATERIAL PRICES PERCENTAGE CHANGE (2017–2021)

TABLE 5 KEY PRICE FLUCTUATIONS IDENTIFIED AT SUPPLIER END DUE TO RAW MATERIAL PRICE CHANGE

5.2.2.2 Stringent environmental regulations in North America and Europe

TABLE 6 KEY VOC REGULATIONS IN VARIOUS US STATES

TABLE 7 VOC CONTENT LIMITS FOR ADHESIVES & SEALANTS

TABLE 8 KEY DEVELOPMENTS AT SUPPLIER END FOR COMPLIANCE TO LOW VOC AND SUSTAINABLE SOLUTIONS

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for non-hazardous and sustainable adhesives

TABLE 9 KEY DEVELOPMENTS AT SUPPLIER END TO INTRODUCE GREEN AND SUSTAINABLE WATERPROOF ADHESIVES & SEALANTS

5.2.3.2 Greater opportunities in Asia Pacific and Middle East

5.2.3.3 Condominium safety bill to boost consumption of waterproof adhesives & sealants in North America

TABLE 10 FLORIDA CONDOMINIUM STATISTICS

TABLE 11 OPINION OF VARIOUS SUPPLIERS ON LIKELY IMPACT OF BUILDING RECERTIFICATION ON DEMAND FOR WATERPROOF ADHESIVES & SEALANTS

5.2.4 CHALLENGES

5.2.4.1 Stringent, time-consuming, and ever-changing regulatory policies

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 17 WATERPROOF ADHESIVES & SEALANTS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 12 WATERPROOF ADHESIVES & SEALANTS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.4 VALUE CHAIN ANALYSIS

5.4.1 RAW MATERIAL SUPPLIERS

5.4.2 MANUFACTURERS

5.4.3 DISTRIBUTORS

5.4.4 END CONSUMERS

FIGURE 18 WATERPROOF ADHESIVES & SEALANTS MARKET: VALUE CHAIN

5.5 ECOSYSTEM MAPPING

FIGURE 19 ECOSYSTEM OF WATERPROOF ADHESIVES & SEALANTS MARKET

TABLE 13 WATERPROOF ADHESIVES & SEALANTS: ECOSYSTEM

5.6 AVERAGE SELLING PRICE ANALYSIS

5.6.1 AVERAGE SELLING PRICE BASED ON REGION

FIGURE 20 AVERAGE SELLING PRICE BASED ON REGION (USD/KG)

5.6.2 AVERAGE SELLING PRICE BASED ON CHEMISTRY

TABLE 14 AVERAGE SELLING PRICES BASED ON CHEMISTRY (USD/KG)

FIGURE 21 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE END-USE INDUSTRIES

5.6.3 AVERAGE SELLING PRICES FOR KEY PLAYERS

TABLE 15 KEY PLAYERS: AVERAGE SELLING PRICES (USD/KG)

5.7 TRADE ANALYSIS

TABLE 16 IMPORT TRADE DATA FOR ADHESIVES BASED ON POLYMERS FOR TOP TEN COUNTRIES, 2017–2021 (USD THOUSAND)

TABLE 17 EXPORT TRADE DATA FOR ADHESIVES BASED ON POLYMERS FOR TOP TEN COUNTRIES, 2017–2021 (USD THOUSAND)

5.8 COVID-19 IMPACT ANALYSIS

5.8.1 COVID-19 ECONOMIC ASSESSMENT

5.8.2 EFFECTS ON GDPS OF COUNTRIES

5.8.3 IMPACT ON END-USE INDUSTRIES

5.8.3.1 Economic slowdown and impact of COVID-19 on manufacturing sector

TABLE 18 COVID-19-RELATED IMPACT ON CAPITAL EXPENDITURE IMPACTING CONSTRUCTION INDUSTRY

5.9 TECHNOLOGY ANALYSIS

5.9.1 MODIFIED SILANE (MS) POLYMER

5.9.2 CT1 SEALANT

5.9.3 SILANE TERMINATED POLY-ETHER (STPE)

5.9.4 SILANE-TERMINATED POLYURETHANE (STPU)

5.10 MACROECONOMIC DATA

5.10.1 US BUILDING AND CONSTRUCTION INVESTMENT

TABLE 19 ANNUAL VALUE OF CONSTRUCTION, 2011-2020 (USD BILLION)

5.10.2 AUTOMOTIVE PRODUCTION

TABLE 20 AUTOMOTIVE PRODUCTION, BY COUNTRY (MILLION UNIT)

5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

FIGURE 22 GREEN BUILDINGS AND SUSTAINABLE CONSTRUCTION TO INFLUENCE WATERPROOF ADHESIVES & SEALANTS MARKET

5.12 PATENT ANALYSIS

5.12.1 METHODOLOGY

5.12.2 DOCUMENT TYPE

TABLE 21 TOTAL NUMBER OF PATENTS

FIGURE 23 TOTAL NUMBER OF PATENTS

5.12.3 PUBLICATION TRENDS

FIGURE 24 NUMBER OF PATENTS YEAR-WISE FROM 2011 TO 2021

5.12.4 INSIGHTS

5.12.5 LEGAL STATUS OF PATENTS

FIGURE 25 PATENT ANALYSIS, BY LEGAL STATUS

5.12.6 JURISDICTION ANALYSIS

FIGURE 26 TOP JURISDICTION, BY DOCUMENT

5.12.7 TOP COMPANIES/APPLICANTS

FIGURE 27 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

5.12.7.1 Patents by Jiangsu Canlon Building Materials Co. Ltd.

TABLE 22 PATENTS BY JIANGSU CANLON BUILDING MATERIALS CO. LTD.

5.12.7.2 Patents by The State Grid Corporation of China

TABLE 23 PATENTS BY THE STATE GRID CORPORATION OF CHINA

5.12.7.3 Patents by DIC Corporation

TABLE 24 PATENTS BY DIC CORPORATION

5.12.8 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

TABLE 25 TOP TEN PATENT OWNERS

5.13 CASE STUDY ANALYSIS

5.13.1 BOSTIK’S SIMSON ISR 7003 ADHESIVE AND SEALANT FOR MEDICAL VEHICLES

5.13.2 MAINTAINING FOOD-SAFE PLANT, BY HENKEL AG

5.13.3 REPEATED CASES OF LEAKAGES FROM GEARBOX FLANGES, BY HENKEL AG

5.14 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 26 WATERPROOF ADHESIVES & SEALANTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.15 KEY FACTORS AFFECTING BUYING DECISION

5.15.1 QUALITY

5.15.2 SERVICE

FIGURE 28 KEY BUYING CRITERIA

5.16 TARIFFS & REGULATIONS

5.16.1 ASIA PACIFIC

5.16.2 EUROPE

5.16.3 NORTH AMERICA

5.16.3.1 US

5.16.3.2 Canada

TABLE 27 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 WATERPROOF ADHESIVES & SEALANTS MARKET, BY CHEMISTRY (Page No. - 92)

6.1 INTRODUCTION

FIGURE 29 SILICONES SEGMENT TO LEAD WATERPROOF ADHESIVES & SEALANTS MARKET, BY CHEMISTRY

TABLE 28 WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2016–2021 (KILOTON)

TABLE 29 WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2022–2027 (KILOTON)

TABLE 30 WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2016–2021 (USD MILLION)

TABLE 31 WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2022–2027 (USD MILLION)

6.2 SILICONES

6.2.1 MOST PREFERRED CHEMISTRY OWING TO BETTER FLEXIBILITY AND LONGER LIFESPAN

6.3 POLYURETHANES (PU)

6.3.1 INCREASING USE IN BUILDING & CONSTRUCTION AND ELECTRONICS INDUSTRIES

6.4 ACRYLICS

6.4.1 HIGH FLEXIBILITY AND EFFICIENT BONDING PROPELLING DEMAND IN BUILDING & CONSTRUCTION

6.5 EPOXY

6.5.1 INCREASING USE IN TRANSPORTATION AND ELECTRONICS INDUSTRIES DRIVING GROWTH

6.6 POLYSULFIDE

6.6.1 EXCELLENT UNDERWATER CURING CAPABILITY AND CHEMICAL RESISTANCE

6.7 OTHERS

7 WATERPROOF ADHESIVES & SEALANTS MARKET, BY END-USE INDUSTRY (Page No. - 98)

7.1 INTRODUCTION

FIGURE 30 BUILDING & CONSTRUCTION END-USE INDUSTRY TO LEAD WATERPROOF ADHESIVES & SEALANTS MARKET

TABLE 32 WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 33 WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 34 WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 35 WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

7.2 BUILDING & CONSTRUCTION

7.2.1 EXTENSIVE USE IN INTERIORS, WINDOW & DOOR SYSTEMS, AND SHOWERS

7.2.2 RESIDENTIAL

7.2.3 COMMERCIAL

7.2.4 INDUSTRIAL

7.3 TRANSPORTATION

7.3.1 DEMAND FOR WATERPROOF ADHESIVES & SEALANTS IN AEROSPACE AND PASSENGER VEHICLE SEGMENTS GAINING TRACTION

7.4 ELECTRICAL & ELECTRONICS

7.4.1 DEMAND FOR LONGEVITY AND WATER RESISTANCE IN ELECTRONIC & ELECTRICAL DEVICES

7.5 OTHERS

8 REGIONAL ANALYSIS (Page No. - 105)

8.1 INTRODUCTION

FIGURE 31 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

TABLE 36 WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY REGION, 2016–2021 (KILOTON)

TABLE 37 WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

TABLE 38 WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 39 WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.2 ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: WATERPROOF ADHESIVES & SEALANTS MARKET SNAPSHOT

TABLE 40 ASIA PACIFIC: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2016–2021 (KILOTON)

TABLE 41 ASIA PACIFIC: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 42 ASIA PACIFIC: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 43 ASIA PACIFIC: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 44 ASIA PACIFIC: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 45 ASIA PACIFIC: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 46 ASIA PACIFIC: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 47 ASIA PACIFIC: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 48 ASIA PACIFIC: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2016–2021 (KILOTON)

TABLE 49 ASIA PACIFIC: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2022–2027 (KILOTON)

TABLE 50 ASIA PACIFIC: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2016–2021 (USD MILLION)

TABLE 51 ASIA PACIFIC: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2022–2027 (USD MILLION)

8.2.1 CHINA

8.2.1.1 Rising urbanization and industrialization in country

TABLE 52 CHINA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 53 CHINA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 54 CHINA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 55 CHINA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.2.2 JAPAN

8.2.2.1 Large electronics industry to maintain demand in waterproof adhesives & sealants market

TABLE 56 JAPAN: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 57 JAPAN: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 58 JAPAN: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 59 JAPAN: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.2.3 INDIA

8.2.3.1 Government policies and projects likely to impact market growth

TABLE 60 INDIA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 61 INDIA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 62 INDIA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 63 INDIA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.2.4 SOUTH KOREA

8.2.4.1 Transportation sector comprising automotive and shipbuilding to drive market

TABLE 64 SOUTH KOREA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 65 SOUTH KOREA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 66 SOUTH KOREA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 67 SOUTH KOREA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.2.5 MALAYSIA

8.2.5.1 Green initiatives and affordable housing to drive construction industry

TABLE 68 MALAYSIA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 69 MALAYSIA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 70 MALAYSIA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 71 MALAYSIA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.2.6 AUSTRALIA

8.2.6.1 Government investments to boost construction industry

TABLE 72 AUSTRALIA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 73 AUSTRALIA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 74 AUSTRALIA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 75 AUSTRALIA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.2.7 REST OF ASIA PACIFIC

TABLE 76 REST OF ASIA PACIFIC: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 77 REST OF ASIA PACIFIC: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 78 REST OF ASIA PACIFIC: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 79 REST OF ASIA PACIFIC: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.3 EUROPE

FIGURE 33 EUROPE: WATERPROOF ADHESIVES & SEALANTS MARKET SNAPSHOT

TABLE 80 EUROPE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2016–2021 (KILOTON)

TABLE 81 EUROPE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 82 EUROPE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 83 EUROPE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 84 EUROPE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 85 EUROPE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 86 EUROPE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 87 EUROPE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 88 EUROPE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2016–2021 (KILOTON)

TABLE 89 EUROPE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2022–2027 (KILOTON)

TABLE 90 EUROPE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2016–2021 (USD MILLION)

TABLE 91 EUROPE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2022–2027 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 Growth in medical device manufacturing industry

TABLE 92 GERMANY: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 93 GERMANY: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 94 GERMANY: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 95 GERMANY: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.3.2 UK

8.3.2.1 Government policy to boost construction industry

TABLE 96 UK: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 97 UK: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 98 UK: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 99 UK: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.3.3 FRANCE

8.3.3.1 Home to large aerospace and automotive industries

TABLE 100 FRANCE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 101 FRANCE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 102 FRANCE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 103 FRANCE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.3.4 ITALY

8.3.4.1 Evolving medical industry owing to government reforms

TABLE 104 ITALY: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 105 ITALY: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 106 ITALY: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 107 ITALY: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.3.5 SPAIN

8.3.5.1 Waterproof adhesives & sealants used in tourism infrastructure

TABLE 108 SPAIN: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 109 SPAIN: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 110 SPAIN: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 111 SPAIN: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.3.6 REST OF EUROPE

TABLE 112 REST OF EUROPE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 113 REST OF EUROPE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 114 REST OF EUROPE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 115 REST OF EUROPE: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.4 NORTH AMERICA

FIGURE 34 NORTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SNAPSHOT

TABLE 116 NORTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2016–2021 (KILOTON)

TABLE 117 NORTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 118 NORTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 119 NORTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 120 NORTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 121 NORTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 122 NORTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 123 NORTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 124 NORTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2016–2021 (KILOTON)

TABLE 125 NORTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2022–2027 (KILOTON)

TABLE 126 NORTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2016–2021 (USD MILLION)

TABLE 127 NORTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2022–2027 (USD MILLION)

8.4.1 US

8.4.1.1 Government laws to drive waterproof adhesives & sealants market

TABLE 128 US: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 129 US: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 130 US: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 131 US: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.4.2 CANADA

8.4.2.1 Government investment in construction sector to contribute toward market growth

TABLE 132 CANADA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 133 CANADA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 134 CANADA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 135 CANADA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.4.3 MEXICO

8.4.3.1 Rising foreign investment to drive various end-use industries

TABLE 136 MEXICO: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 137 MEXICO: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 138 MEXICO: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 139 MEXICO: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.5 SOUTH AMERICA

TABLE 140 SOUTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2016–2021 (KILOTON)

TABLE 141 SOUTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 142 SOUTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 143 SOUTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 144 SOUTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 145 SOUTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 146 SOUTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 147 SOUTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 148 SOUTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2016–2021 (KILOTON)

TABLE 149 SOUTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2022–2027 (KILOTON)

TABLE 150 SOUTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2016–2021 (USD MILLION)

TABLE 151 SOUTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2022–2027 (USD MILLION)

8.5.1 BRAZIL

8.5.1.1 Government program to directly impact construction industry

TABLE 152 BRAZIL: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 153 BRAZIL: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 154 BRAZIL: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 155 BRAZIL: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.5.2 ARGENTINA

8.5.2.1 Collaboration projects to boost demand

TABLE 156 ARGENTINA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 157 ARGENTINA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 158 ARGENTINA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 159 ARGENTINA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.5.3 REST OF SOUTH AMERICA

TABLE 160 REST OF SOUTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 161 REST OF SOUTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 162 REST OF SOUTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 163 REST OF SOUTH AMERICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.6 MIDDLE EAST & AFRICA

TABLE 164 MIDDLE EAST & AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2016–2021 (KILOTON)

TABLE 165 MIDDLE EAST & AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 166 MIDDLE EAST & AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 167 MIDDLE EAST & AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 169 MIDDLE EAST & AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 170 MIDDLE EAST & AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2016–2021 (KILOTON)

TABLE 173 MIDDLE EAST & AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2022–2027 (KILOTON)

TABLE 174 MIDDLE EAST & AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2016–2021 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY CHEMISTRY, 2022–2027 (USD MILLION)

8.6.1 SAUDI ARABIA

8.6.1.1 Transition from oil-based economy to influence market for waterproof adhesives & sealants

TABLE 176 SAUDI ARABIA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 177 SAUDI ARABIA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 178 SAUDI ARABIA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 179 SAUDI ARABIA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.6.2 SOUTH AFRICA

8.6.2.1 Increasing foreign investments to create market opportunities

TABLE 180 SOUTH AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 181 SOUTH AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 182 SOUTH AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 183 SOUTH AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

8.6.3 REST OF MIDDLE EAST & AFRICA

TABLE 184 REST OF MIDDLE EAST & AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (KILOTON)

TABLE 185 REST OF MIDDLE EAST & AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 186 REST OF MIDDLE EAST & AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2021 (USD MILLION)

TABLE 187 REST OF MIDDLE EAST & AFRICA: WATERPROOF ADHESIVES & SEALANTS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 172)

9.1 OVERVIEW

FIGURE 35 COMPANIES ADOPTED ACQUISITION AND EXPANSION AS KEY GROWTH STRATEGIES BETWEEN 2018 AND 2022

9.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

FIGURE 36 RANKING OF TOP SIX PLAYERS IN WATERPROOF ADHESIVES & SEALANTS MARKET, 2022

9.3 MARKET SHARE ANALYSIS

FIGURE 37 WATERPROOF ADHESIVES & SEALANTS MARKET SHARE, BY COMPANY (2022)

TABLE 188 WATERPROOF ADHESIVES & SEALANTS MARKET: DEGREE OF COMPETITION

9.4 REVENUE ANALYSIS OF TOP PLAYERS

TABLE 189 WATERPROOF ADHESIVES & SEALANTS MARKET: REVENUE ANALYSIS (USD)

9.5 MARKET EVALUATION MATRIX

TABLE 190 MARKET EVALUATION MATRIX

9.6 COMPANY EVALUATION MATRIX, 2022 (TIER 1)

9.6.1 STAR PLAYERS

9.6.2 EMERGING LEADERS

FIGURE 38 WATERPROOF ADHESIVES & SEALANTS MARKET: COMPANY EVALUATION MATRIX, 2022

9.7 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

9.7.1 PROGRESSIVE COMPANIES

9.7.2 RESPONSIVE COMPANIES

9.7.3 STARTING BLOCKS

FIGURE 39 WATERPROOF ADHESIVES & SEALANTS MARKET: START-UPS AND SMES MATRIX, 2022

9.8 COMPANY END-USE INDUSTRY FOOTPRINT

9.9 COMPANY REGION FOOTPRINT

9.10 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 40 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN WATERPROOF ADHESIVES & SEALANTS MARKET

9.11 BUSINESS STRATEGY EXCELLENCE

FIGURE 41 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN WATERPROOF ADHESIVES & SEALANTS MARKET

9.12 COMPETITIVE SCENARIO

9.12.1 NEW PRODUCT LAUNCHES

TABLE 191 NEW PRODUCT LAUNCHES, 2018–2022

9.12.2 DEALS

TABLE 192 DEALS, 2018–2022

9.12.3 OTHER DEVELOPMENTS

TABLE 193 OTHER DEVELOPMENTS, 2018–2021

10 COMPANY PROFILES (Page No. - 193)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

10.1 KEY PLAYERS

10.1.1 HENKEL AG

TABLE 194 HENKEL AG: BUSINESS OVERVIEW

FIGURE 42 HENKEL AG: COMPANY SNAPSHOT

TABLE 195 HENKEL AG: PRODUCT OFFERINGS

TABLE 196 HENKEL AG: NEW PRODUCT LAUNCHES

TABLE 197 HENKEL AG: DEALS

TABLE 198 HENKEL AG: OTHER DEVELOPMENTS

10.1.2 H. B. FULLER

TABLE 199 H.B. FULLER: BUSINESS OVERVIEW

FIGURE 43 H.B. FULLER: COMPANY SNAPSHOT

TABLE 200 H.B. FULLER: PRODUCT OFFERINGS

TABLE 201 H.B. FULLER: NEW PRODUCT LAUNCH

TABLE 202 H.B. FULLER: DEALS

TABLE 203 H.B. FULLER: OTHER DEVELOPMENTS

10.1.3 BOSTIK SA

TABLE 204 BOSTIK SA: BUSINESS OVERVIEW

TABLE 205 BOSTIK SA: PRODUCT OFFERINGS

TABLE 206 BOSTIK SA: DEALS

TABLE 207 BOSTIK SA: OTHER DEVELOPMENTS

10.1.4 SIKA AG

TABLE 208 SIKA AG: BUSINESS OVERVIEW

FIGURE 44 SIKA AG: COMPANY SNAPSHOT

TABLE 209 SIKA AG: PRODUCT OFFERINGS

TABLE 210 SIKA AG: DEALS

TABLE 211 SIKA AG: OTHER DEVELOPMENTS

10.1.5 DOW

TABLE 212 DOW: BUSINESS OVERVIEW

FIGURE 45 DOW: COMPANY SNAPSHOT

TABLE 213 DOW: PRODUCT OFFERINGS

10.1.5.3 Recent developments

TABLE 214 DOW: OTHER DEVELOPMENTS

10.1.6 3M

TABLE 215 3M: BUSINESS OVERVIEW

FIGURE 46 3M: COMPANY SNAPSHOT

TABLE 216 3M: PRODUCT OFFERINGS

TABLE 217 3M: DEALS

10.1.7 AVERY DENNISON CORPORATION

TABLE 218 AVERY DENNISON CORPORATION: BUSINESS OVERVIEW

FIGURE 47 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

TABLE 219 AVERY DENNISON CORPORATION: PRODUCT OFFERINGS

TABLE 220 AVERY DENNISON CORPORATION: DEALS

TABLE 221 AVERY DENNISON CORPORATION: OTHER DEVELOPMENTS

10.1.8 HUNTSMAN CORPORATION

TABLE 222 HUNTSMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 48 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

TABLE 223 HUNTSMAN CORPORATION: PRODUCT OFFERINGS

TABLE 224 HUNTSMAN CORPORATION: NEW PRODUCT LAUNCHES

TABLE 225 HUNTSMAN CORPORATION: DEALS

TABLE 226 HUNTSMAN CORPORATION: OTHER DEVELOPMENTS

10.1.9 MAPEI SPA

TABLE 227 MAPEI SPA: BUSINESS OVERVIEW

TABLE 228 MAPEI SPA: PRODUCT OFFERINGS

TABLE 229 MAPEI SPA: DEALS

10.1.10 RPM INTERNATIONAL

TABLE 230 RPM INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 49 RPM INTERNATIONAL: COMPANY SNAPSHOT

TABLE 231 RPM INTERNATIONAL: PRODUCT OFFERINGS

TABLE 232 RPM INTERNATIONAL: DEALS

10.2 OTHER COMPANIES

10.2.1 BERRY GLOBAL INC.

10.2.2 DELO INDUSTRIAL ADHESIVES

10.2.3 DYMAX CORP.

10.2.4 FRANKLIN INTERNATIONAL

10.2.5 GENERAL SEALANTS

10.2.6 ILLINOIS TOOL WORKS INC.

10.2.7 JOWAT CORP.

10.2.8 KLEBCHEMIE M.G. BECKER

10.2.9 LORD CORPORATION (PARKER HANNIFIN)

10.2.10 MACTAC NORTH AMERICA

10.2.11 PIDILITE INDUSTRIES

10.2.12 SASHCO

10.2.13 SOUDAL GROUP

10.2.14 THE REYNOLDS CO.

10.2.15 UNISEAL INC.

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 232)

11.1 INSIGHTS OF INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 CUSTOMIZATION OPTIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

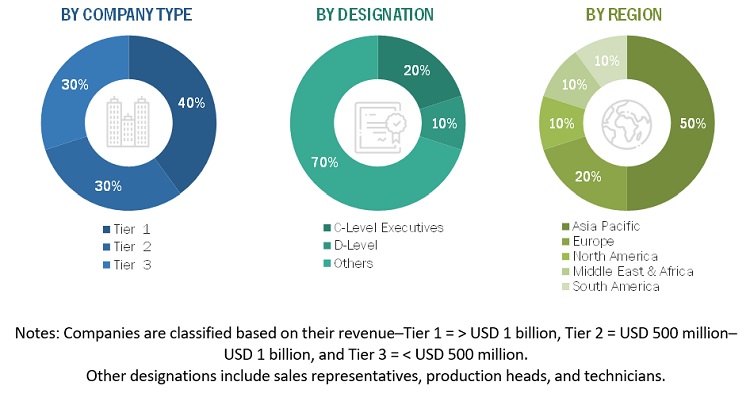

The study involved four major activities in estimating the current size of the waterproof adhesives & sealants market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, FEICA, OICA, and World Bank, to identify and collect information useful for the technical, market-oriented, and commercial study of the waterproof adhesives & sealants market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers and certified publications.

Primary Research

The waterproof adhesives & sealants market comprises several stakeholders, such as raw material suppliers, manufacturers, distributors, buyers, and regulatory organizations. The demand side of this market is characterized by automotive manufacturers. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of the various submarkets for waterproof adhesives & sealants for each region. The research methodology used to estimate the market size included the following steps:

- Global waterproof adhesives & sealants market was identified, and the share for waterproof adhesives & sealants was determined through primary and secondary research.

- The global market was then segmented into five major regions and validated through industry experts.

- All percentage shares, splits, and breakdowns based on chemistry, end-use industry, and country were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

Data Triangulation

After arriving at the overall market size—using the estimation processes explained above—the waterproof adhesives & sealants market was split into several segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the size of the waterproof adhesives & sealants market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing market growth

- To estimate and forecast the market size based on chemistry, end-use industry, and region

- To forecast the size of the market in the major regions, namely, Europe, North America, Asia Pacific (APAC), Middle East & Africa, and South America along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To identify the impact of the COVID-19 pandemic on the market

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the waterproof adhesives & sealants market report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the waterproof adhesives & sealants market, by segments

Company Information

- Detailed analysis and profiling of additional market players (up to ten)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Waterproof Adhesives & Sealants Market