Water Hardness Test Strip Market by Type (Calcium concentration measurement, magnesium concentration measurement), Application (Industrial, Laboratory, Others), Sales Channel (Retail & Non-retail), and Region - Global Forecast To 2025

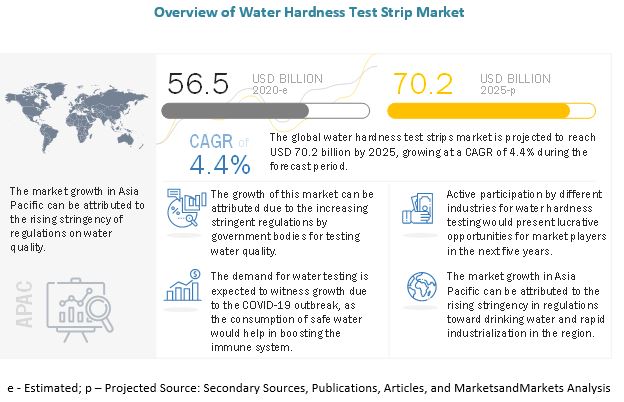

[163 Pages Report] According to MarketsandMarkets, the water hardness test strip market is estimated to be valued at USD 56.5 billion in 2020 and is projected to reach USD 70.2 billion by 2025, recording a CAGR of 4.4 %, in terms of value. The rise in number of industrial establishments, surge in rate of urbanization have been key factors that drive the overall value sales growth of water hardness test strip market. Asia Pacific segment is going to dominate the market, due to its high production of processed food, whereas the South American region is growing fastest owing to new technologies and increase in the export of food and beverages.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Growing demand for laboratory testing of water in civil bodies

With the growing stringency of regulations pertaining to the hardness of water, the water hardness test strips market is growing at a significant rate. Municipal bodies and civic societies are usually slow acceptors of new technologies, but test strips being economical and cost-effective products for water hardness testing, are highly accepted by the civic bodies in different regions. In addition to this, stringent regulations by governments have played a major role in the adoption of water hardness test strips by civil and municipal bodies for quality testing of water.

In the past 20 years, there has been a notable increase in the allocation of government expenditures on water testing development in many countries. Organisation for Economic Co-operation and Development (OECD) listed countries spend over USD 200 billion in investments necessary to rehabilitate existing infrastructure, comply with environmental and health regulations, and maintain the required water quality and supply. However, the growing demand from consumers for good quality water with enriched vitamins and minerals enables civil and municipal bodies to adopt the growing technology for laboratory testing of water. To meet regulatory standards, civic bodies are investing significantly to upgrade their testing technology to meet water quality norms. This, in turn, is projected to drive the growth of the water hardness test strips market across the globe.

Restraints: Lack of water quality control systems

In several developing regions, water quality control systems lack organization, sophistication, and technology for water hardness testing. The infrastructure of water quality control laboratories in many developing countries is likely to be scarce due to limited resources, limited technology, and poor management. There are numerous issues related to water safety, such as lack of institutional coordination, outdated technology, less expertise for the execution of regulations at low levels, and lack of updated standards; all these have been constraining the market for water hardness test strips. Water quality control laboratories are poorly equipped and lack suitable trained analytical staff, especially in African countries.

Countries such as India, China, and Southeast Asian countries are getting government assistance for finance and developing technologies. The concerned regulatory bodies of these developing countries need to apply their resources for the development of infrastructure, water control capacities, and technology enhancement. These developing countries also lack support from international agencies, such as the FAO, WHO, and the World Bank. Thus, the lack of water quality control infrastructure and resources in developing countries inhibits the growth of water hardness test strips.

Opportunities: Increasing stringent regulations for drinking water

Due to growing concerns among consumers demanding fresh and pure-quality water enriched with minerals and vitamins, water hardness test strips will grow significantly in the coming years. The Environmental Protection Agency (EPA) has developed the National Primary Drinking Water Regulations with enforceable standards on the quantity of contaminants allowed in drinking water. These standards protect consumers from contaminants that may pose a risk to human health. All public water providers (municipal and civil bodies) must comply with these requirements while supplying water to their consumers. In addition, the EPA has a set of standards known as the National Secondary Drinking Water Regulations. These standards are recommended guidelines by the government to the water providers, which have to be strictly followed.

For instance, the International Bottled Water Association (IBWA) has provided the code of practice to guide bottled water industry stakeholders with technical and federal regulations. All bottlers are required to comply with state or local agency regulatory requirements in areas where their bottles are sold or distributed. FDA regulations mandate that every bottled water be processed to undergo physical, chemical, and hardness tests.

Challenges: Demand for innovative testing strips/technology

The technological focus from conventional water hardness testing methods has been shifting toward rapid testing methods, as they are efficient and time-saving and generate results within a few hours. Rapid testing methods ensure the analysis of a larger sample size and thereby reduce the time required for sample testing. Advanced technologies ensure the detection of microbial as well as chemical contaminants present in the samples. Furthermore, simultaneous detection of all contaminants present in the samples can reduce the number of tests required, thus saving time and cost of each test conducted. Sensitive and accurate time-efficient results obtained through rapid testing create several opportunities for the water hardness test strips market.

By type, the calcium concentration measurement is projected to account for the largest share in the water hardness test strip market during the forecast period

The quantitative or semi-quantitative determination of calcium by means of rapid methods is of interest to different fields, including medical diagnostics, environmental control, and other related industries. Of the different types of rapid methods on the market, dry chemical methods, also known as test strips, are probably those that make up the most active market. In majority of the industrial sectors, rise in calcium content in the water have been a major concern when it comes to its usage. Hence the manufacturers have been coming up with water hardness test strip products specifically designed to determine calcium concentration in water.

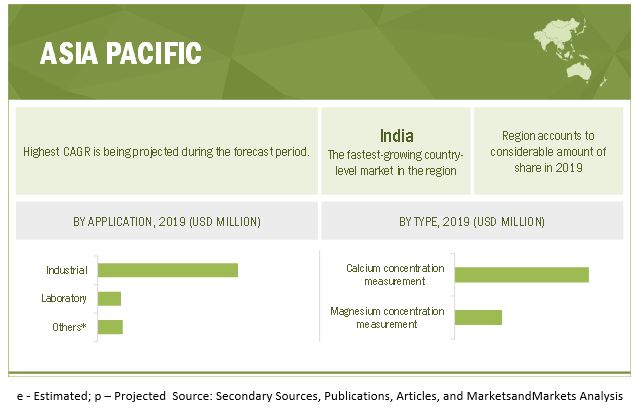

By application, industrial segment is projected to account for the largest share in the water hardness test strip market during the forecast period

Industrial water use includes water used for purposes such as fabricating, processing, washing, diluting, cooling, or transporting a product; incorporating water into a product; or for sanitation needs within the manufacturing facility. The use of water hardness test strips in industries is preferred as it is the quickest and cost-effective method to determine the quality of water being used. Through these results, the user can also determine the level of water treatment to be done, which helps save costs for the industry. Water is used in direct contact with the food or food contact surfaces or indirectly as a processing aid. The significance of using quality water in food production has also been recognized by requiring the application of HACCP principles in water usage. Thus, the use of strips for determining the level of water hardness is expected to grow commercially through sectors such as food, chemicals, and petroleum refineries.

Asia Pacific is projected to account for the largest market share during the forecast period

- India, China and countries of Southeast Asia are witnessing strong demand for water hardness testing strips thereby propelling the region to exhibit growth rates faster than global average.

- Key players in the market are eying on the promising growth scenario of emerging economies in Asia Pacific and this trend is expected to provide strong growth impetus.

Key Market Players:

Thermo Fisher Scientific, Inc. (US), Merck KGaA (Germany), Danaher Corporation (US),LaMotte Company (US), Johnson Test Paper Ltd (UK), Serim Research Corporation (US), Avantor, Inc. (US), Isolab Laborgerate GmbH (Switzerland), Aqua Cure Ltd. (England), Cole-Parmer Instrument Company, LLC (US), Spectris (UK), Industrial Test Systems, Inc. (US), US Water Systems, Inc (US) Bartovation LLC (US), Colorkim Kimya (Turkey), Simplex Health (UK), Amity International (UK), Instruments Direct Services Limited (UK), Hangzhou Lohand Biological Co., Ltd (China), and Changchun Wancheng Bio- Electron Co., Ltd. (China).

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period considered |

2020–2025 |

|

Units considered |

Value (USD) |

|

Segments covered |

Application, Type, Sales Channel, and region |

|

Regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies studied |

|

This research report categorizes the water hardness test strip market based on type, application, sales channel, and region.

Target Audience:

- Chief Information officers

- Research Officers

- Purchase managers from laboratories

- Business development officers

- Marketing and sales manager

- CEOs

- Directors

- Vice presidents and other opinion leaders

By Type

- Calcium Concentration Measurement

- Magnesium Concentration Measurement.

By Application

- Industrial

- Laboratory

- Other (civil and municipal bodies, residential societies, and academia)

By Sales Channel

- Retail

- Non-retail

By Region

- North America

- Europe

- Asia Pacific

-

Rest of the World (RoW)

- South Africa

- Middle East

- Africa

Frequently Asked Questions (FAQ):

How many segments are being covered for the market study ?

For market study, there are three segment including the regional segment being covered for the study.

What is the estimated value sales for water hardness test strip market in2020?

In 2020, water hardness test strip market is being estimated to be valued at USD 56.57 million.

What are the regions being covered for the market study?

Regions namely North America, Europe, Asia Pacific, South America, Africa and Middle East are being covered for the market study

What all are the other contents covered in the report in terms of qualitative factor?

Key trends at country level, in-depth research methodology, competitive landscape and analysis as well as COVID impact analysis are being covered in the report for water hardness test strip market.

What all are the segment covered in the report for market study?

The segments that are covered for market study are: by application, by type, by sales channel and by region. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SEGMENTATION

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED FOR THE STUDY

1.6 CURRENCY CONSIDERED

TABLE 1 US DOLLAR EXCHANGE RATES CONSIDERED, 2015–2019

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 1 WATER HARDNESS TEST STRIPS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

2.6 MARKET SCENARIOS CONSIDERED FOR ASCERTAINING THE IMPACT OF COVID-19

2.6.1 SCENARIO-BASED MODELLING

2.7 COVID-19: HEALTH ASSESSMENT

FIGURE 3 COVID-19: THE GLOBAL PROPAGATION

FIGURE 4 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19: ECONOMIC ASSESSMENT

FIGURE 5 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 IMPACT ON THE ECONOMY—SCENARIO ASSESSMENT

FIGURE 6 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 7 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 43)

TABLE 2 WATER HARDNESS TEST STRIPS MARKET SNAPSHOT, 2020 VS. 2025

FIGURE 8 WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)L

FIGURE 9 WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 10 WATER HARDNESS TEST STRIPS MARKET SIZE, BY SALES CHANNEL, 2020 VS. 2025 (USD MILLION)

FIGURE 11 WATER HARDNESS TEST STRIPS MARKET SHARE AND GROWTH RATE, BY REGION

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 BRIEF OVERVIEW OF THE WATER HARDNESS TEST STRIPS MARKET

FIGURE 12 GROWING STRINGENCY IN REGULATIONS BY GOVERNMENT BODIES IS PROJECTED TO DRIVE THE GROWTH OF THE WATER HARDNESS TEST STRIPS MARKET

4.2 WATER HARDNESS TEST STRIPS MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 13 THE US WAS THE LARGEST MARKET GLOBALLY IN 2019

4.3 NORTH AMERICA: WATER HARDNESS TEST STRIPS MARKET, BY APPLICATION AND KEY COUNTRY

FIGURE 14 INDUSTRIAL APPLICATION ACCOUNTED FOR THE LARGEST SHARE IN THE NORTH AMERICAN MARKET IN 2019

4.4 WATER HARDNESS TEST STRIPS MARKET, BY TYPE AND REGION

FIGURE 15 CALCIUM CONCENTRATION MEASUREMENT DOMINATED THE MARKET FOR WATER HARDNESS TEST STRIPS IN 2019

4.5 WATER HARDNESS TEST STRIPS MARKET, BY SALES CHANNEL

FIGURE 16 NON-RETAIL CHANNEL TO DOMINATE DURING THE FORECAST PERIOD, 2020 VS. 2025

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 WATER HARDNESS TEST STRIPS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Active participation of government and regulatory bodies to monitor water quality

5.2.1.2 Growing demand for laboratory testing of water by civil bodies

5.2.1.3 Health hazards associated with hard water

5.2.1.4 Increase in R&D and technological advancements by manufacturers

5.2.1.5 Rise in different end-use applications to bolster the market demand for water hardness strip testing

5.2.1.6 Growing usage of accurate water testing in non-industrial applications

5.2.2 RESTRAINTS

5.2.2.1 Lack of water quality control systems, technology, and infrastructure in developing economies

5.2.3 OPPORTUNITIES

5.2.3.1 Rapid industrialization and urbanization to fuel the demand for water hardness testing

FIGURE 18 GLOBAL ANNUAL GROWTH RATE OF INDUSTRIES, 2012–2017

TABLE 3 GROWING POPULATION ACROSS DIFFERENT REGIONS

5.2.3.2 Increasing stringent regulations for drinking water

5.2.3.3 Awareness among consumers regarding the consumption of better quality of water

5.2.4 CHALLENGES

5.2.4.1 Demand for innovative testing strips/technology

5.3 IMPACT OF COVID-19 ON THE MARKET DYNAMICS OF THE WATER HARDNESS TEST STRIPS MARKET

6 INDUSTRY TRENDS (Page No. - 57)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 19 WATER HARDNESS TEST STRIPS MARKET: SUPPLY CHAIN

6.3 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS OF THE WATER HARDNESS TEST STRIPS MARKET

6.4 GLOBAL AVERAGE SELLING PRICE (ASP)

FIGURE 21 AVERAGE SELLING PRICE (ASP) OF ONE TEST STRIP ACROSS DIFFERENT REGIONS, 2019 (USD/STRIP)

6.5 YC-YCC SHIFT

FIGURE 22 WATER HARDNESS TEST STRIPS MARKET: YC-YCC SHIFT

6.6 REGULATIONS

6.6.1 US

6.6.1.1 EPA regulations on drinking water

TABLE 4 EPA REGULATIONS ON DRINKING WATER

6.6.2 EU-28

6.6.2.1 Regulations for calcium, magnesium, or hardness in drinking water

6.6.2.2 France (regulations on water)

6.6.3 BRAZIL

6.6.3.1 Regulation on water

6.6.4 ASIA PACIFIC

6.6.4.1 India (Indian standard specifications for drinking water)

6.7 CASE STUDIES

6.7.1 CASE STUDY 1

6.7.1.1 Title

6.7.1.2 Problem statement

6.7.1.3 MnM Approach

6.7.1.4 Revenue Impact (RI)

6.7.2 CASE STUDY 2

6.7.2.1 Title

6.7.2.2 Problem Statement

6.7.2.3 MnM Approach

6.7.2.4 Revenue Impact (RI)

6.8 ECOSYSTEM MAP

6.8.1 WATER HARDNESS TEST STRIPS: ECOSYSTEM VIEW

6.8.2 WATER HARDNESS TEST STRIPS: MARKET MAP

7 WATER HARDNESS TEST STRIPS MARKET, BY APPLICATION (Page No. - 66)

7.1 INTRODUCTION

TABLE 5 MEASURES OF WATER HARDNESS

FIGURE 23 WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

TABLE 6 WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

7.2 COVID-19 IMPACT ON THE WATER HARDNESS TEST STRIPS MARKET

7.2.1 REALISTIC SCENARIO

TABLE 7 REALISTIC SCENARIO: COVID-19 IMPACT ON THE WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

7.2.2 OPTIMISTIC SCENARIO

TABLE 8 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

7.2.3 PESSIMISTIC SCENARIO

TABLE 9 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

7.3 INDUSTRIAL

7.3.1 COST-EFFECTIVE METHOD FOR TESTING IF WATER HARDNESS HELPS IN GAINING MARKET TRACTION

TABLE 10 INDUSTRIAL: WATER HARDNESS TEST STRIPS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

7.4 LABORATORY

7.4.1 OFFERS ACCURATE RESULTS, THEREBY INCREASING CREDIBILITY, WHICH HELPS IN THE WATER HARDNESS TEST STRIPS MARKET GROWTH

TABLE 11 LABORATORY: WATER HARDNESS TEST STRIPS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

7.5 OTHERS

7.5.1 GROWING USAGE BY MUNICIPAL AND CIVIL BODIES DUE TO STRINGENT REGULATIONS FORMED BY GOVERNMENTS TO DRIVE THE MARKET GROWTH

TABLE 12 OTHERS: WATER HARDNESS TEST STRIPS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

8 WATER HARDNESS TEST STRIPS MARKET, BY TYPE (Page No. - 72)

8.1 INTRODUCTION

FIGURE 24 WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE,2018–2025 (USD MILLION)

TABLE 13 WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

8.2 COVID-19 IMPACT ON THE WATER HARDNESS TEST STRIPS MARKET, BY TYPE

8.2.1 OPTIMISTIC SCENARIO

TABLE 14 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

8.2.2 REALISTIC SCENARIO

TABLE 15 REALISTIC SCENARIO: COVID-19 IMPACT ON THE WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

8.2.3 PESSIMISTIC SCENARIO

TABLE 16 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE WATER HARDNESS TEST STRIP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

8.3 CALCIUM CONCENTRATION MEASUREMENT

8.3.1 EXCESSIVE PRESENCE OF CALCIUM IN WATER DRIVES THE DEMAND FOR CALCIUM CONCENTRATION MEASUREMENT

TABLE 17 CALCIUM CONCENTRATION MEASUREMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.4 MAGNESIUM CONCENTRATION MEASUREMENT

8.4.1 MAGNESIUM-RICH WATER DEGRADES THE LIFE OF EQUIPMENT OWING TO WHICH MAGNESIUM CONCENTRATION MEASUREMENT IS GAINING TRACTION

TABLE 18 MAGNESIUM CONCENTRATION MEASUREMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9 WATER HARDNESS TEST STRIPS MARKET, BY SALES CHANNEL (Page No. - 77)

9.1 INTRODUCTION

FIGURE 25 WATER HARDNESS TEST STRIP MARKET SIZE, BY SALES CHANNEL, 2020 VS. 2025 (USD MILLION)

TABLE 19 WATER HARDNESS TEST STRIPS MARKET SIZE, BY SALES CHANNEL, 2018–2025 (USD MILLION)

9.2 COVID-19 IMPACT ON THE WATER HARDNESS TEST STRIP MARKET, BY SALES CHANNEL

9.2.1 OPTIMISTIC SCENARIO

TABLE 20 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE WATER HARDNESS TEST STRIP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

9.2.2 REALISTIC SCENARIO

TABLE 21 REALISTIC SCENARIO: COVID-19 IMPACT ON THE WATER HARDNESS TEST STRIP MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

9.2.3 PESSIMISTIC SCENARIO

TABLE 22 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

9.3 RETAIL

9.3.1 USE OF WATER HARDNESS TEST STRIPS FOR HOUSEHOLDS AND SWIMMING POOLS DRIVES THE MARKET FOR RETAIL SALES CHANNELS

TABLE 23 RETAIL: WATER HARDNESS TEST STRIP MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.4 NON-RETAIL

9.4.1 INDUSTRIAL AND LABORATORY APPLICATIONS ARE THE FOREFRONT USERS OF WATER HARDNESS TEST STRIPS

TABLE 24 NON-RETAIL: WATER HARDNESS TEST STRIPS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10 WATER HARDNESS TEST STRIP MARKET, BY REGION (Page No. - 82)

10.1 INTRODUCTION

FIGURE 26 INDIA IS PROJECTED TO RECORD THE HIGHEST CAGR IN THE WATER HARDNESS TEST STRIP MARKET FROM 2020 TO 2025

TABLE 25 WATER HARDNESS TEST STRIP MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.1.1 COVID-19 IMPACT ON THE WATER HARDNESS TEST STRIP MARKET, BY REGION (2018–2021)

10.1.1.1 Realistic Scenario

TABLE 26 REALISTIC SCENARIO: COVID-19 IMPACT ON THE WATER HARDNESS TEST STRIP MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.1.1.2 Optimistic Scenario

TABLE 27 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE WATER HARDNESS TEST STRIP MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.1.1.3 Pessimistic Scenario

TABLE 28 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE WATER HARDNESS TEST STRIP MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 27 NORTH AMERICA: MARKET SNAPSHOT

TABLE 29 NORTH AMERICA: WATER HARDNESS TEST STRIPS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 30 NORTH AMERICA: WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 31 NORTH AMERICA: WATER HARDNESS TEST STRIP MARKET SIZE FOR INDUSTRIAL, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 32 NORTH AMERICA: WATER HARDNESS TEST STRIP MARKET SIZE FOR LABORATORY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 33 NORTH AMERICA: WATER HARDNESS TEST STRIP MARKET SIZE FOR OTHER APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 34 NORTH AMERICA: WATER HARDNESS TEST STRIP MARKET SIZE, BY TYPE, 2018 -2025 (USD MILLION)

TABLE 35 NORTH AMERICA: WATER HARDNESS TEST STRIP MARKET SIZE FOR CALCIUM CONCENTRATION MEASUREMENT, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 36 NORTH AMERICA: WATER HARDNESS TEST STRIP MARKET SIZE FOR MAGNESIUM CONCENTRATION MEASUREMENT, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 37 NORTH AMERICA: WATER HARDNESS TEST STRIP MARKET SIZE, BY SALES CHANNEL, 2018–2025 (USD MILLION)

10.2.1 US

10.2.1.1 Laboratory sector considered to be the potential end user in the country

TABLE 38 US: WATER HARDNESS TEST STRIP MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 39 US: WATER HARDNESS TEST STRIP MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Rise in industrialization driving the demand for water hardness test strips in the country

TABLE 40 CANADA: WATER HARDNESS TEST STRIP MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 41 CANADA: WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Food & beverage sector is the forefront user of the product in the country

TABLE 42 MEXICO: WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 43 MEXICO: WATER HARDNESS TEST STRIP MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.3 EUROPE

FIGURE 28 EUROPE: MARKET SNAPSHOT

TABLE 44 EUROPE: WATER HARDNESS TEST STRIP MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 45 EUROPE: WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 46 EUROPE: WATER HARDNESS TEST STRIPS MARKET SIZE FOR INDUSTRIAL, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 47 EUROPE: WATER HARDNESS TEST STRIP MARKET SIZE FOR LABORATORY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 48 EUROPE: WATER HARDNESS TEST STRIPS MARKET SIZE FOR OTHER APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 49 EUROPE: WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 50 EUROPE: WATER HARDNESS TEST STRIPS MARKET SIZE FOR CALCIUM CONCENTRATION MEASUREMENT, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 51 EUROPE: WATER HARDNESS TEST STRIPS MARKET SIZE FOR MAGNESIUM CONCENTRATION MEASUREMENT, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 52 EUROPE: WATER HARDNESS TEST STRIPS MARKET SIZE, BY SALES CHANNEL, 2018–2025 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 The industrial sector is a major end user of the product

TABLE 53 GERMANY: WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 54 GERMANY: WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.3.2 UK

10.3.2.1 Stringent rules and regulations on water quality drive the demand for water hardness test strips in the country

TABLE 55 UK: WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 56 UK: WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Well-established industrial sector is a major user of water hardness test strip products

TABLE 57 FRANCE: WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 58 FRANCE: WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Rising consumption of water from industrial as well as household sectors triggering the demand for products

TABLE 59 ITALY: WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 60 ITALY: WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Food & beverage processing sector is a potential end user of water hardness test strips

TABLE 61 SPAIN: WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 62 SPAIN: WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.3.6 NETHERLANDS

10.3.6.1 Emphasis on the usage of high-quality water driving the demand for water hardness test strips

TABLE 63 NETHERLANDS: WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 64 NETHERLANDS: WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.3.7 REST OF EUROPE

10.3.7.1 The growing industrial as well as laboratory sectors expected to drive the demand for water testing equipment

TABLE 65 REST OF EUROPE: WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 66 REST OF EUROPE: WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 67 ASIA PACIFIC: WATER HARDNESS TEST STRIPS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 68 ASIA PACIFIC: WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 69 ASIA PACIFIC: WATER HARDNESS TEST STRIPS MARKET SIZE FOR INDUSTRIAL, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 70 ASIA PACIFIC: WATER HARDNESS TEST STRIPS MARKET SIZE FOR LABORATORY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 71 ASIA PACIFIC: WATER HARDNESS TEST STRIPS MARKET SIZE FOR OTHERS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 72 ASIA PACIFIC: WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 73 ASIA PACIFIC: WATER HARDNESS TEST STRIPS MARKET SIZE FOR CALCIUM CONCENTRATION MEASUREMENT, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 74 ASIA PACIFIC: WATER HARDNESS TEST STRIPS MARKET SIZE FOR MAGNESIUM CONCENTRATION MEASUREMENT, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 75 ASIA PACIFIC: WATER HARDNESS TEST STRIPS MARKET SIZE, BY SALES CHANNEL, 2018–2025 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Robust demand dynamics and promising growth rates of end-use sectors have propelled the market for water hardness test strips in China

TABLE 76 CHINA: WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 77 CHINA: WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.4.2 INDIA

10.4.2.1 Extensive public sector interventions and growing voluntary testing scenario in India to drive the market for water hardness test strips

TABLE 78 INDIA: WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 79 INDIA: WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 Comprehensive water quality management framework and a strong focus on end-use sectors in assessing pollution control strategies to drive the market for water hardness test strips in the country

TABLE 80 JAPAN: WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 81 JAPAN: WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.4.4 SOUTH KOREA

10.4.4.1 Growing focus on improving the potable water quality standards to drive the market for water hardness test strips in South Korea

TABLE 82 SOUTH KOREA: WATER HARDNESS TEST STRIP MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 83 SOUTH KOREA: WATER HARDNESS TEST STRIP MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.4.5 AUSTRALIA & NEW ZEALAND

10.4.5.1 Favorable regulatory environment and consumer awareness are key factors for market boost in Australia & New Zealand

TABLE 84 AUSTRALIA & NEW ZEALAND: WATER HARDNESS TEST STRIP MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 85 AUSTRALIA & NEW ZEALAND: WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

10.4.6.1 Expanding industrialization and increasing awareness of maintaining optimum water quality standards to fuel the growth of water hardness test strips

TABLE 86 REST OF ASIA PACIFIC: WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 87 REST OF ASIA PACIFIC: WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.5 ROW

FIGURE 30 ROW: MARKET SNAPSHOT

TABLE 88 ROW: WATER HARDNESS TEST STRIPS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 89 ROW: WATER HARDNESS TEST STRIP MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 90 ROW: WATER HARDNESS TEST STRIP MARKET SIZE FOR INDUSTRIAL, BY REGION, 2018–2025 (USD MILLION)

TABLE 91 ROW: WATER HARDNESS TEST STRIP MARKET SIZE FOR LABORATORY, BY REGION, 2018–2025 (USD MILLION)

TABLE 92 ROW: WATER HARDNESS TEST STRIPS MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

TABLE 93 ROW: WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018 -2025 (USD MILLION)

TABLE 94 ROW: WATER HARDNESS TEST STRIPS MARKET SIZE FOR CALCIUM CONCENTRATION MEASUREMENT, BY REGION, 2018–2025 (USD MILLION)

TABLE 95 ROW: WATER HARDNESS TEST STRIPS MARKET SIZE FOR MAGNESIUM CONCENTRATION MEASUREMENT, BY REGION, 2018–2025 (USD MILLION)

TABLE 96 ROW: WATER HARDNESS TEST STRIPS MARKET SIZE, BY SALES CHANNEL, 2018–2025 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Local governing bodies and industries demanding rapid, economical, and effective water quality management systems to fuel the market growth

TABLE 97 SOUTH AMERICA: WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 98 SOUTH AMERICA: WATER HARDNESS TEST STRIPS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.5.2 MIDDLE EAST

10.5.2.1 Strict controls and quality assessment systems for potable water along with proactive efforts from local bodies and private institutions to propel the market for water hardness test strips

TABLE 99 MIDDLE EAST: WATER HARDNESS TEST STRIP MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 100 MIDDLE EAST: WATER HARDNESS TEST STRIP MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.5.3 AFRICA

10.5.3.1 Africa is witnessing a strong surge in industrial activities coupled with a growing focus on water security and safety assessment – these developments would fuel the market growth

TABLE 101 AFRICA: WATER HARDNESS TEST STRIPS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 102 AFRICA: WATER HARDNESS TEST STRIP MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 124)

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS, 2019

TABLE 103 WATER HARDNESS TEST STRIPS MARKET: DEGREE OF COMPETITION

TABLE 104 WATER HARDNESS TEST STRIPS MARKET: COMPANY APPLICATION FOOTPRINT

11.3 COMPANY EVALUATION MATRIX: DEFINITIONS & METHODOLOGY

11.3.1 STARS

11.3.2 EMERGING LEADERS

11.3.3 PERVASIVE PLAYERS

11.3.4 PARTICIPANTS

11.4 COMPANY EVALUATION MATRIX, 2019 (OVERALL MARKET)

FIGURE 31 GLOBAL WATER HARDNESS TEST STRIPS MARKET: COMPANY EVALUATION MATRIX, 2019

12 COMPANY PROFILES (Page No. - 128)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.1.1 THERMO FISHER SCIENTIFIC INC.

FIGURE 32 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT

12.1.2 MERCK KGAA

FIGURE 33 MERCK KGAA: COMPANY SNAPSHOT

12.1.3 SERIM RESEARCH CORPORATION

12.1.4 LAMOTTE COMPANY

12.1.5 SPECTRIS

FIGURE 34 SPECTRIS: COMPANY SNAPSHOT

12.1.6 DANAHER CORPORATION

FIGURE 35 DANAHER CORPORATION: COMPANY SNAPSHOT

12.1.7 AVANTOR, INC.

FIGURE 36 AVANTOR, INC.: COMPANY SNAPSHOT

12.1.8 AQUA CURE LTD.

12.1.9 ISOLAB LABORGERATE GMBH

12.1.10 JOHNSON TEST PAPERS LTD

12.2 OTHER PLAYERS

12.2.1 INSTRUMENTS DIRECT SERVICES LIMITED

12.2.2 COLE-PARMER INSTRUMENT COMPANY, LLC

12.2.3 SIMPLEX HEALTH

12.2.4 BARTOVATION LLC

12.2.5 US WATER SYSTEMS INC

12.2.6 COLORKIM KIMYA

12.2.7 HANGZHOU LOHAND BIOLOGICAL CO., LTD

12.2.8 CHANGCHUN WANCHENG BIO-ELECTRON CO., LTD.

12.2.9 AMITY INTERNATIONAL

12.2.10 INDUSTRIAL TEST SYSTEMS, INC.

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 153)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATION

13.4 KEY PRIMARY INSIGHTS

13.5 RELATED REPORTS

13.6 ADJACENT MARKETS

13.6.1 ENVIRONMENTAL TESTING MARKET

13.6.1.1 Wastewater/Effluent

TABLE 105 ENVIRONMENTAL TESTING MARKET SIZE FOR WASTEWATER/EFFLUENT, BY REGION, 2018–2025 (USD MILLION)

TABLE 106 ENVIRONMENTAL TESTING MARKET SIZE FOR WASTEWATER/EFFLUENT, BY TARGETS TESTED, 2018–2025 (USD MILLION)

13.6.1.2 Water

TABLE 107 ENVIRONMENTAL TESTING MARKET SIZE FOR WATER, BY REGION, 2018–2025 (USD MILLION)

TABLE 108 ENVIRONMENTAL TESTING MARKET SIZE FOR WATER, BY TARGETS TESTED, 2018–2025 (USD MILLION)

13.7 AUTHOR DETAILS

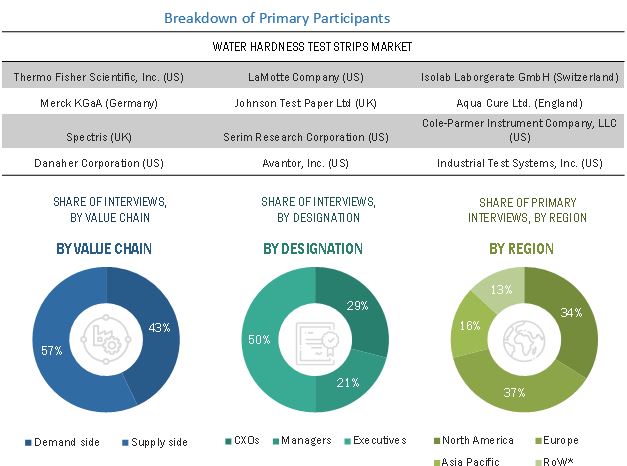

The study involved four major activities in estimating the water hardness test strip market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of enzyme manufacturing companies and government organizations, service providing company officials, government and research organizations, and research officers. The supply side is characterized by the presence of key CEOs and vice presidents, marketing directors, product innovation directors and related key executives from manufacturing companies and organizations operating in the market, and manufacturing and marketing companies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the water hardness test strips market. These approaches were also used extensively to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

Approach 1:

- The key players in the industry and the markets were identified through extensive secondary research.

- The revenues of major water hardness test strips players were determined through primary and secondary research such as paid databases, which were used as the basis for market estimation.

- Based on the market share analysis of key industry players from all regions, the final market size of water hardness test strips was arrived at.

Approach 2:

- The testing sample numbers of the water hardness test strips market, by region, and other factors, such as the prevalence of outbreaks, pricing trends, the adoption rate, patents registered, and organic & inorganic growth attempts, were derived from various secondary sources, such as publications by companies, industry publications, trade data providers, and paid databases.

- Demand analysis was conducted for each sample tested and region.

- Pricing analysis was conducted on the basis of the technology cost in regions.

- From this, we derived the market sizes for each region.

- Summing up the above, we arrived at the size of the global water hardness test strips market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

All macroeconomic and microeconomic factors affecting the growth of the water hardness test strips market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted-top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

Market Intelligence

- Determining and projecting the size of the water hardness test strips market, with respect to type, application, sales channel, and regional markets, from 2020 to 2025

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, future prospects, and their contribution to the total market

Competitive Intelligence

- Identifying and profiling the key market players in the water hardness test strips market

- Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain, products, and regulatory frameworks across key regions and their impact on the prominent market players

Providing insights into key product innovations and investments in the water hardness test strips market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Segmental Analysis

- Further criss-cross of type by application for water hardness test strips

Geographic analysis

- A further breakdown of the Rest of Asia Pacific water hardness test strips market, by key country

- A further breakdown of the Rest of European water hardness test strips market, by key country

- A further breakdown of the Rest of South American water hardness test strips market, by key country

Company information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Water Hardness Test Strip Market