Waste Disposal Regulations for Drilling Mud & Cuttings Technology – Cost Trends, Environmental Impact and Regional Regulatory Bodies by Mud Type (Water-Based, Oil-Based, Synthetic Based), by Region and Markets Analysis with Forecast

[104 Pages Report] Drilling activity plays a crucial role in oil & gas exploration and production (E&P). It is essential to have a suitable waste management solution that safeguards the environment for drilling processes. The increase in E&P activities is creating promising opportunities for the drilling waste management market.

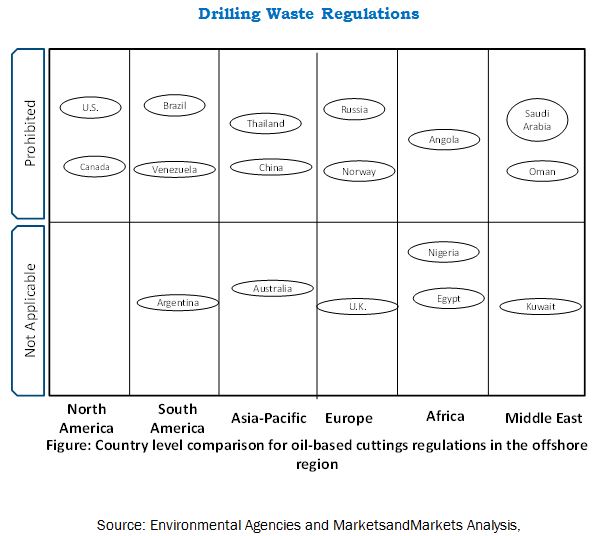

The oil & gas drilling process generates two basic types of drilling waste: drilling cuttings and used drilling fluids. Drilling cuttings are rock fragments that are returned to the surface with the drilling fluid. The drilling fluid can be categorized primarily into aqueous and non-aqueous fluids. Non-aqueous fluids comprise primary fluid such as synthetic oil or refined oil. Various countries have different regulatory measures to tackle environmental challenges arising from the disposal of waste, thereby ensuring the growth of the drilling waste management market. Oil & gas operators across the globe follow a three-tiered waste management hierarchy to control and manage drilling wastes in the most eco-friendly manner possible. These three stages (from most preferred to least preferred) are waste minimization, recycling/reuse, and treatment & disposal.

Countries considered for the study:

- The U.S.

- Canada

- Brazil

- Venezuela

- Argentina

- Russia

- Norway

- The U.K.

- China

- Thailand

- Australia

- Egypt

- Nigeria

- Angola

- Oman

- Saudi Arabia

- Kuwait

Research Methodology:

- Major countries in the drilling waste management services market have been identified in each region

- Secondary research has been conducted to determine the various regulatory bodies responsible for formulating the legislation and laws for human and environmental safety in each country

- Various regulations imposed by regulatory bodies have been studied according to the discharge limits for various chemicals, grease, oil, and discharge boundaries

- Top equipment and service providers for each country have been identified and their product portfolio has been studied to discover the common technologies used in the region

- Data for the various available technologies has also been studied and included in the report

This study answers several questions for stakeholders, including OEMs, engineering, procurement, and construction (EPC) companies, oil & gas service providers, distributers & suppliers, consulting firms, private equity groups, investment houses, and equity research firms. It provides information regarding the stringency of the regulations and the ease of market penetration, along with the market potential for drilling waste management services.

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report:

- This study details the disposal regulations for drilling waste management laid down by various associations and ministries in different regions

- It offers detailed insights into qualitative and quantitative legislation

- It provides a comprehensive review of major technologies used for the treatment of drilling waste currently available in the market, and the average cost of the technologies

- The study maps the major equipment and service providers in each region

- It provides detailed profiling of the associations, ministries, and agencies responsible for the formulation of these regulations

The report has been segmented as follows:

- By drilling mud type:

- Water-based

- Oil-based

- Synthetic-based

- By Region:

- North America

- South America

- Europe

- Asia-Pacific

- The Middle East

- Africa

Available Customizations

With the regulatory data provided above, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

- Detailed disposal regulations of additional countries (Up to 3)

The growing global energy demand has resulted in a rise in oil & gas production in regions such as North America and the Middle East, leading to an increase in exploration & production (E&P) activities in these regions. Drilling activity plays a crucial role in oil & gas E&P. The rise in drilling activities has resulted in an increasing amount of waste produced while drilling. This waste primarily comprises drilling mud and cuttings. It is essential to have a suitable waste management solution that safeguards the environment for drilling processes.

In the report, waste regulations for drilling muds and cuttings have been segmented on the basis of muds used for drilling purposes into non-aqueous muds and aqueous muds. Non-aqueous muds are further divided according to primary base fluids into oil-based and synthetic-based. The report outlines the drilling waste management hierarchy, whereby fluids produced are treated using various processes such as waste minimization, recycling/reuse, and treatment & disposal. Numerous technologies, including thermal incineration, thermal desorption, bioremediation, vermiculture solvent extraction using supercritical CO2, onsite burial, land spray, and land filling, have also been analyzed, along with their advantages and disadvantages. Treatment & disposal services, which include services such as onsite burial (pits, landfills), land farming, land spreading, bioremediation, thermal treatment, and slurry injection, account for nearly two-fifth of the drilling waste management market. North America is estimated to occupy the largest market share in the global drilling waste management services market. The recent slump in crude oil prices has had no effect on the disposal regulations of the country.

The report also provides a detailed description of various technologies used in different countries, and lists the key players for the technology. Major players in each region have also been profiled. Additionally, companies such as Schlumberger Ltd. (U.S.), Halliburton (U.S.), Baker Hughes (U.S.), Weatherford International (U.S.), National Oilwell Varco (U.S.), SAR AS (Norway), Egyptian Mud Engineering and Chemicals Company (EMEC) (Egypt), and Step Oil Tools (The Netherlands) have been analyzed. The vendor selection matrix included in the report mentions the equipment provider, the service provider, and players providing both, equipment and services. In addition to the key players, important organizations regulating the various disposal & discharge regulations in countries have been profiled.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Segments Covered

1.3.2 Stakeholders

2 Executive Summary (Page No. - 16)

2.1 Introduction

2.2 Regulatory Scenario

2.2.1 Best Management Practices

2.2.2 Comparative Regulatory Scenario

3 Industry & Technological Overview (Page No. - 22)

3.1 Introduction

3.2 Environmental Impact

3.3 Drilling Waste Management Hierarchy

3.3.1 Waste Minimization

3.3.2 Reuse Or Recycling

3.3.3 Treatment & Disposal

3.3.4 Vendor Selection Matrix

3.4 Drilling Waste Management Costs

3.4.1 Drilling Waste Management Cost, By Technology

3.4.1.1 Cuttings Reinjection

3.4.1.2 Onsite Burial/Waste Pits/Landfill

3.4.1.3 Thermal Treatment

3.4.1.4 Land Farming/Land Spreading

3.4.1.5 Other Bioremediation (Composting/Vermiculture)

3.4.2 Drilling Waste Management Cost, By Region

3.4.3 Drilling Waste Management: Key Companies & Solutions Offered

4 Drilling Waste Regulations, By Region (Page No. - 36)

4.1 Introduction

4.2 North America

4.2.1 North America: Drilling Waste Management Market Size, By Country

4.2.2 U.S.

4.2.2.1 Drilling Waste Industry Regulations, By Region

4.2.2.1.1 California: Discharge Practices & Standards

4.2.2.1.2 GOM: Discharge Practices & Standards

4.2.2.1.3 Louisiana: Discharge Practices & Standards

4.2.2.1.4 Texas: Discharge Practices & Standards

4.2.2.1.5 Rest of the U.S.: Discharge Practices & Standards

4.2.2.1.6 Regulatory Bodies

4.2.2.2 Environmental Protection Agency—U.S.

4.2.2.2.1 Overview

4.2.2.2.2 Organizational Chart

4.2.2.2.3 Administrating Activities

4.2.2.3 U.S. Department of the Interior

4.2.2.3.1 Overview

4.2.2.3.2 Administrating Activities

4.2.2.4 U.S. Department of Commerce National Oceanic and Atmospheric Administration (Noaa)

4.2.2.4.1 Overview

4.2.2.4.2 Organizational Structure

4.2.2.4.3 Administrating Activities

4.2.2.5 U.S. Fish & Wildlife Services

4.2.2.5.1 Overview

4.2.2.5.2 Organizational Structure

4.2.2.5.3 Administrating Activities

4.2.3 Canada

4.2.3.1 Drilling Waste Industry Regulations

4.2.3.2 Regulatory Bodies

4.2.3.3 Environment Canada

4.2.3.3.1 Overview

4.2.3.3.2 Organizational Chart

4.2.3.3.3 Administrating Activities

4.2.3.3.4 Recent Announcements

4.2.3.4 Fisheries and Ocean Canada

4.2.3.4.1 Overview

4.2.3.4.2 Organizational Chart

4.2.3.4.3 Administrating Activities

4.2.3.5 National Energy Board

4.2.3.5.1 Overview

4.2.3.5.2 Organizational Chart

4.2.3.5.3 Administrating Activities

4.2.3.6 Canada-Newfoundland & Labrador Offshore Petroleum Board

4.2.3.6.1 Overview

4.2.3.6.2 Organizational Chart

4.2.3.6.3 Administrating Activities

4.2.3.7 Canada-Nova Scotia Offshore Petroleum Board

4.2.3.7.1 Overview

4.2.3.7.2 Organizational Chart

4.2.3.7.3 Administrating Activities

4.3 Europe

4.3.1 Europe: Drilling Waste Management Market, By Country

4.3.2 Russia

4.3.2.1 Drilling Waste Industry Regulations

4.3.2.2 Ministry of Natural Resources & Environment of the Russian Federation

4.3.2.2.1 Overview

4.3.2.2.2 Organizational Structure

4.3.2.2.3 Administrating Activities

4.3.3 Norway

4.3.3.1 Drilling Waste Industry Regulations

4.3.3.2 Norwegian Environment Agency

4.3.3.2.1 Overview

4.3.3.2.2 Organizational Structure

4.3.3.2.3 Administrating Activities

4.3.4 U.K.

4.3.4.1 Drilling Waste Industry Regulations

4.3.4.2 Environment Agency—U.K.

4.3.4.2.1 Overview

4.3.4.2.2 Organizational Structure

4.3.4.2.3 Administrating Activities

4.4 Asia-Pacific

4.4.1 Asia-Pacific: Drilling Waste Management Market Size, By Country

4.4.2 China

4.4.2.1 Drilling Waste Industry Regulations

4.4.2.2 Ministry of Environmental Protection of the People’s Republic of China

4.4.2.2.1 Overview

4.4.2.2.2 Organizational Structure

4.4.2.2.3 Administrating Activities

4.4.3 Thailand

4.4.3.1 Drilling Waste Industry Regulations

4.4.3.2 Ministry of Natural Resources and Environment—Thailand

4.4.3.2.1 Overview

4.4.3.2.2 Organizational Structure

4.4.3.2.3 Administrating Activities

4.4.4 Australia

4.4.4.1 Drilling Waste Industry Regulations

4.4.4.2 National Offshore Petroleum Safety and Environmental Management Authority

4.4.4.2.1 Overview

4.4.4.2.2 Organizational Structure

4.4.4.2.3 Administrating Activities

4.5 South America

4.5.1 South America: Drilling Waste Management Market Size, By Country

4.5.2 Venezuela

4.5.2.1 Drilling Waste Industry Regulations

4.5.3 Argentina

4.5.3.1 Drilling Waste Industry Regulations

4.5.4 Brazil

4.5.4.1 Drilling Waste Industry Regulations

4.6 Africa

4.6.1 Africa: Drilling Waste Management Market Size, By Country

4.6.2 Egypt

4.6.2.1 Drilling Waste Industry Regulations

4.6.2.2 Ministry of State for Environmental Affairs

4.6.2.2.1 Overview

4.6.2.2.2 Organizational Structure

4.6.2.2.3 Administrating Activities

4.6.3.1 Drilling Waste Industry Regulations

4.6.3.2 National Environmental Standards & Regulations Enforcement Agency (Nesrea)-Nigeria

4.6.3.2.1 Overview

4.6.3.2.2 Organizational Chart

4.6.3.2.2.1 Administrating Activities

4.6.3.2.3 Angola

4.6.3.2.4 Drilling Waste Industry Regulations

4.6.3.3 Ministry of Petroleum—Angola

4.6.3.3.1 Overview

4.6.3.3.2 Organizational Structure

4.6.3.3.3 Administrating Activities

4.7 The Middle East

4.7.1 The Middle East: Drilling Waste Management Market Size, By Country

4.7.2 Oman

4.7.2.1 Drilling Waste Industry Regulations

4.7.2.2 Ministry of Environment and Climate Affairs

4.7.2.2.1 Overview

4.7.2.2.2 Administrating Activities

4.7.2.3 Ministry of Oil & Gas—Oman

4.7.2.3.1 Overview

4.7.2.3.2 Organization Structure

4.7.2.3.3 Administrating Activities

4.7.3 Saudi Arabia

4.7.3.1 Drilling Waste Industry Regulations

4.7.3.2 Ministry of Petroleum and Mineral Resources of Saudi Arabia

4.7.3.2.1 Overview

4.7.3.2.2 Organizational Structure

4.7.3.2.3 Administrating Activities

4.7.4 Kuwait

4.7.4.1 Drilling Waste Industry Regulations

4.7.4.2 Environment Public Authority—Kuwait

4.7.4.2.1 Overview

4.7.4.2.2 Organizational Structure

4.7.4.2.3 Administrating Activities

List of Tables (97 Tables)

Table 1 Constituents That Impact the Environment, By Waste Type

Table 2 Exposure Type

Table 3 Elemental Composition of Drilling Mud (Mg/Kg)

Table 4 Waste Minimization Technologies

Table 5 Drilling Cuttings Reuse & Recycling Management Options

Table 6 Drilling Cuttings & Drilling Fluid Disposal Technologies

Table 7 Cost Drivers for Drilling Waste Management

Table 8 Approximate Costs of Different Drilling Waste Management Technologies

Table 9 Drilling Waste Management, Regional Cost Variations

Table 10 Key Companies in the Drilling Waste Management Market & Their Solutions Portfolio

Table 11 North America: Drilling Waste Management Market Size, By Country, 2013–2020 (USD Million)

Table 12 California: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 13 California: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 14 California: Discharge Practices & Standards for Synthetic-Based Drilling Mud & Cuttings

Table 15 GOM: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 16 GOM: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 17 GOM: Discharge Practices & Standards for Synthetic-Based Drilling Mud & Cuttings

Table 18 Louisiana: Onshore Land Spreading Practices & Standards

Table 19 Texas: Onshore Land Spreading Practices & Standards

Table 20 Rest of the U.S.: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 21 Rest of the U.S.: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 22 U.S.: Active Players Among Drilling Waste Management Service Providers

Table 23 Canada: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 24 Canada: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 25 Canada: Discharge Practices & Standards for Synthetic-Based Drilling Mud & Cuttings

Table 26 Canada: Onshore Land-Spray Disposal Method, Discharge Practices, & Standards

Table 27 Canada: Onshore Land-Spray-While-Drilling Disposal Method, Discharge Practices & Standards

Table 28 Canada: Onshore Disposal Onto Forested Public Lands Method, Discharge Practices & Standards

Table 29 Canada: Onshore Pump-Off Disposal Method, Discharge Practices & Standards

Table 30 Canada: Onshore Mix-Bury-Cover Disposal Method, Discharge Practices & Standards

Table 31 Canada: Land-Spreading Disposal Method, Discharge Practices & Standards

Table 32 Canada: Active Players Among Drilling Waste Management Service Providers

Table 33 Europe: Drilling Waste Management Market Size, By Country, 2013–2020 (USD Million)

Table 34 Russia: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 35 Russia: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 36 Russia: Discharge Practices & Standards for Synthetic-Based Drilling Mud & Cuttings

Table 37 Russia: Active Players Among Drilling Waste Management Service Providers

Table 38 Norway: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 39 N0rway: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 40 Norway: Discharge Practices & Standards for Synthetic-Based Drilling Mud & Cuttings

Table 41 Norway: Active Players Among Drilling Waste Management Service Providers

Table 42 U.K.: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 43 U.K.: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 44 U.K.: Discharge Practices & Standards for Synthetic-Based Drilling Mud & Cuttings

Table 45 U.K.: Active Players Among Drilling Waste Management Service Providers

Table 46 Asia-Pacific: Drilling Waste Management Market Size, By Country, 2013–2020 (USD Million)

Table 47 China: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 48 China: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 49 China: Discharge Practices & Standards for Synthetic-Based Drilling Mud & Cuttings

Table 50 China: Active Players Among Drilling Waste Management Service Providers

Table 51 Thailand: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 52 Thailand: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 53 Thailand: Discharge Practices & Standards for Synthetic-Based Drilling Mud & Cuttings

Table 54 Thailand: Active Players Among Drilling Waste Management Service Providers

Table 55 Australia: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 56 Australia: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 57 Australia: Discharge Practices & Standards for Synthetic-Based Drilling Mud & Cuttings

Table 58 Australia: Active Players Among Drilling Waste Management Service Providers

Table 59 South America: Drilling Waste Management Market Size, By Country, 2013–2020 (USD Million)

Table 60 Venezuela: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 61 Venezuela: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 62 Venezuela: Discharge Practices & Standards for Synthetic-Based Drilling Mud & Cuttings

Table 63 Venezuela: Active Players Among Drilling Waste Management Service Providers

Table 64 Argentina: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 65 Argentina: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 66 Argentina: Discharge Practices & Standards for Synthetic-Based Drilling Mud & Cuttings

Table 67 Argentina: Active Players Among Drilling Waste Management Service Providers

Table 68 Brazil: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 69 Brazil: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 70 Brazil: Discharge Practices & Standards for Synthetic-Based Drilling Mud & Cuttings

Table 71 Brazil: Active Players Among Drilling Waste Management Service Providers

Table 72 Africa: Drilling Waste Management Market Size, By Country, 2013–2020 (USD Million)

Table 73 Egypt: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 74 Egypt: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 75 Egypt: Discharge Practices & Standards for Synthetic-Based Drilling Mud & Cuttings

Table 76 Egypt: Active Players Among Drilling Waste Management Service Providers

Table 77 Nigeria: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 78 Nigeria: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 79 Nigeria: Discharge Practices & Standards for Synthetic-Based Drilling Mud & Cuttings

Table 80 Nigeria: Active Players Among Drilling Waste Management Service Providers

Table 81 Angola: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 82 Angola: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 83 Angola: Discharge Practices & Standards for Synthetic-Based Drilling Mud & Cuttings

Table 84 Angola: Active Players Among Drilling Waste Management Service Providers

Table 85 The Middle East: Drilling Waste Management Market Size, By Country, 2013–2020 (USD Million)

Table 86 Oman: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 87 Oman: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 88 Oman: Discharge Practices & Standards for Synthetic-Based Drilling Mud & Cuttings

Table 89 Oman: Active Players Among Drilling Waste Management Service Providers

Table 90 Saudi Arabia: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 91 Saudi Arabia: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 92 Saudi Arabia: Discharge Practices & Standards for Synthetic-Based Drilling Mud & Cuttings

Table 93 Saudi Arabia: Active Players Among Drilling Waste Management Service Providers

Table 94 Kuwait: Discharge Practices & Standards for Water-Based Drilling Mud & Cuttings

Table 95 Kuwait: Discharge Practices & Standards for Oil-Based Drilling Mud & Cuttings

Table 96 Kuwait: Discharge Practices & Standards for Synthetic-Based Drilling Mud & Cuttings

Table 97 Kuwait: Active Players Among Drilling Waste Management Service Providers

List of Figures (10 Figures)

Figure 1 Countries Covered: Drilling Waste Management Market

Figure 2 North America has the Most Stringent Criteria to Be Met for Discharge of Oil-Based Cuttings

Figure 3 Ospar Countries Have High Growth Potential for Drilling Waste Management Services With Limited Norms to Be Followed for the Disposal of Water-Based Muds

Figure 4 Nigeria & Kuwait: APT Locations for Oil-Based Management Services

Figure 5 Australia, Nigeria, & Brazil: Medium Potential Markets With Limited-Risk Regulation Levels for Disposal of Synthetic-Based Mud Services

Figure 6 Top Technology Providers in Each Region

Figure 7 Drilling Waste Management Hierarchy

Figure 8 Vendor Selection Matrix

Figure 9 North America & Europe Impose Stricter Regulations

Figure 10 Organizational Chart

Growth opportunities and latent adjacency in Waste Disposal Regulations for Drilling Mud & Cuttings Technology