Warehouse Robotics Market Size, Share , Industry Report, Statistics & Growth by Type (AMR, AGV, Articulated, Cylindrical, SCARA, COBOT, Parallel, Cartesian), Payload Kg (<20, 20-100, 100-200, >200), Function (Transportation, Pick & Place, Palettizing, Packaging), Industry, Region - Global Forecast to 2028

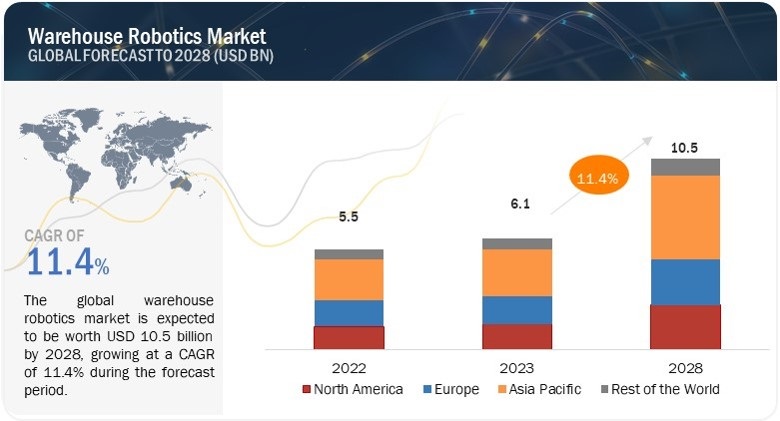

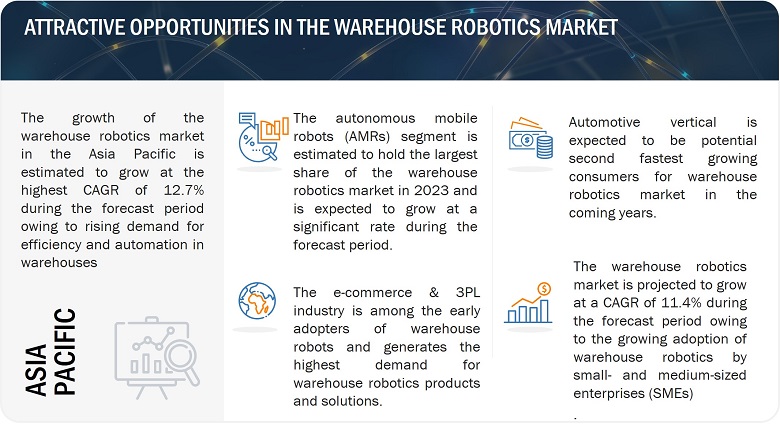

The warehouse robotics market is estimated to be worth USD 6.1 billion in 2023 and is projected to reach USD 10.5 billion by 2028, at a CAGR of 11.4% during the forecast period. The increasing need for improving the quality and reliability of operations in warehouses is one of the major drivers that fuel the market growth.

Warehouse Robotics Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Warehouse Robotics Market Trends & Dynamics

Driver: Rise in funding from venture capitalists in warehouse robotics

The warehouse robotics market has witnessed a substantial increase in funding from venture capitalists. This influx of capital is driven by the growing demand for automation and robotics solutions in the logistics and warehousing industry. Venture capitalists recognize the market's potential for high returns on investment due to factors like increased efficiency, cost reduction, and improved operational processes. The funding enables robotics companies to innovate and develop cutting-edge technologies, expand their market presence, and drive industry growth. Overall, the surge in venture capital funding indicates strong investor confidence in the warehouse robotics industry.

Restraint: High setup costs and infrastructure requirements

Warehouse robotics often entail high setup costs due to the sophisticated technology involved and the need for specialized equipment and infrastructure. These costs include the purchase or lease of autonomous mobile robots, installation of supporting hardware such as sensors and conveyors, and implementation of advanced software systems for navigation and coordination. Additionally, training personnel to operate and maintain these robotic systems also adds to the initial investment.

Opportunity: Transformation of warehouses through the integration of industry 4.0 and warehouse robotics

The evolution of traditional warehouses into smart and connected automated warehouses is underway, driven by the integration of Industry 4.0 with warehouse robots. While the automotive industry has been a major user of robotics, other sectors such as pharmaceutical manufacturing, food processing, metal fabrication, and packaging are recognizing the effectiveness of warehouse robots and increasing their deployment. Industry 4.0 aims to create an operational environment where humans and robots can collaborate, allowing robots to receive instructions and respond to their surroundings.

Challenge: Concerns regarding cybersecurity of Connected Robotics in the Industry 4.0

The advent of Industry 4.0 has brought connectivity to production processes, including the integration of collaborative robots. However, this connectivity exposes these processes to heightened cybersecurity risks. Robots can become vulnerable if they are not equipped with up-to-date software and proper network administration. Inadequate security measures can lead to industrial espionage, malware installations, and automated attacks.

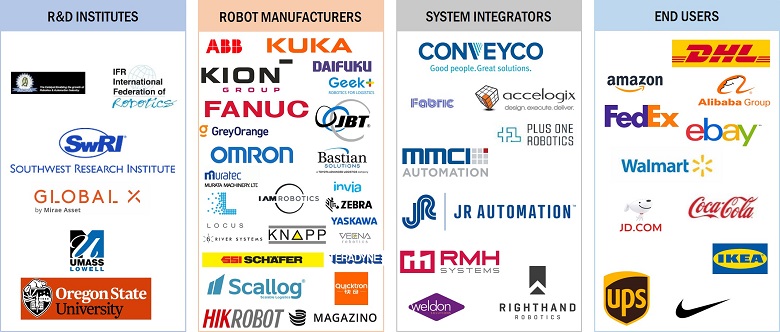

Warehouse Robotics Market Ecosystem

The section describes the warehouse robotics ecosystem and the adoption of security solutions in different end-use products and solutions, along with the impact of emerging technologies on them. The market mapping explains a network of R&D institutes, robot manufacturers, system integrators, and end users involved in the complete ecosystem of warehouse robotics market.

The market for AGVs by type to hold second-largest market share during the forecast period

The growth of the AGV segment can be attributed to the increased use of these vehicles in numerous industries, such as automotive, manufacturing, aerospace, and 3PL, to carry heavy loads in less time. The selection of the type of AGV depends on the industry’s requirements and where it is to be used. Customized and hybrid AGVs are being manufactured to cater to the varied requirements of end users and are expected to contribute to the growth of this segment during the forecast period.

Sorting & Packaging by function held the second-largest CAGR during the forecast period

The rise of robotics in warehouses has revolutionized packaging and sorting processes, enhancing efficiency and productivity. These automated systems streamline operations, enabling faster order fulfillment and accurate product categorization, leading to improved customer satisfaction.

E-commerce and 3PL by industry to witness highest CAGR during forecast period

Warehouse robotics have become increasingly popular in the logistics industry, especially for third-party logistics (3PL) providers and e-commerce companies. These advanced robotic systems are revolutionizing the way warehouses operate, offering increased efficiency, accuracy, and productivity.

Asia Pacific held to register highest CAGR in the warehouse robotics market during forecast period

The Asia Pacific region is one of the key markets for warehouse robotics market. The increasing adoption of warehouse robots by SMEs in the region is a major driver for the market in region. Several companies in the region are actively involved in the development, production, and distribution of warehouse robotics. The technology continues to advance, and its applications are expanding to new areas, promoting safety, efficiency, and innovation in the region.

Warehouse Robotics Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Warehouse Robotics Companies

The overall warehouse robotics companies is dominated by Daifuku Co., Ltd. (Japan), KION GROUP AG (Germany), KUKA AG (Germany), ABB (Switzerland), FANUC CORPORATION (Japan), Geekplus Technology Co., Ltd. (China), GreyOrange (US), TOYOTA INDUSTRIES CORPORATION (Japan), Omron Corporation (Japan), JBT (US), Honeywell International Inc. (US), Murata Machinery, Ltd. (Japan), Yaskawa Electric (Japan), Knapp (Austria), SSI Schaefer (Germany), Teradyne (US), Hikrobot (China), Shopify (Canada) ,Scallog (France), Locus Robotics (US), Zebra Technologies (US), Vecna Robotics (US), IAM Robotics (US), inVia Robotics (US) and Magazino (Germany). These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the market.

Scope of the Report

|

Report Metric |

Details |

| Estimated Value | USD 6.1 billion in 2023 |

| Projected Value | USD 10.5 billion by 2028 |

| Growth Rate | CAGR of 11.4% |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Type, By Function, Payload Capacity, Industry, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of World |

|

Companies covered |

The major players in the warehouse robotics market are Daifuku Co., Ltd. (Japan), KION GROUP AG (Germany), KUKA AG (Germany), ABB (Switzerland), FANUC CORPORATION (Japan), Geekplus Technology Co., Ltd. (China), GreyOrange (US), TOYOTA INDUSTRIES CORPORATION (Japan), Omron Corporation (Japan), JBT (US), Honeywell International Inc. (US), Murata Machinery, Ltd. (Japan), Yaskawa Electric (Japan), Knapp (Austria), SSI Schaefer (Germany), Teradyne (US), Hikrobot (China), Shopify (Canada) ,Scallog (France), Locus Robotics (US), Zebra Technologies (US), Vecna Robotics (US), IAM Robotics (US), inVia Robotics (US) and Magazino (Germany). |

Warehouse Robotics Market Highlights

The study segments the warehouse robotics market By Type, By Function, Payload Capacity, Industry, and Region

|

Segment |

Subsegment |

|

By Type |

|

|

By Function |

|

|

By Payload Capacity |

|

|

By Industry |

|

|

By Region |

|

Recent Developments

- In May 2023, KUKA (Germany) launched the KR CYBERTECH series Edition robot makes the perfect choice for cost-effective automation of handling and basic machining tasks. The multi-talented KR CYBERTECH feeds components into assembly processes, checks workpiece quality, and grinds and polishes metal parts. Its flexibility makes it particularly popular in a wide range of industries, including the dynamic metal and electronics industries.

- In May 2023, FANUC Corp. (Japan), the world leader in CNCs, robotics, and ROBOMACHINEs introduced two new high-payload capacity collaborative robots, and demonstrate a wide range of automation solutions at Automate 2023. The CRX-25iA cobot will demonstrate its enhanced 30kg payload capacity by easily handling a 30kg kettlebell with full wrist articulation.

- In February 2023, KION Group has entered into a strategic partnership with Li-Cycle Holdings Corp. (“Li-Cycle”), an industry leader in lithium-ion battery resource recovery. KION Group and Li-Cycle held a signing ceremony at KION GROUP AG’s Frankfurt headquarters to finalize the definitive agreement for the partnership. It will initially remain in place until 2030. According to the agreement, the environmentally friendly recycling of lithium-ion batteries will begin in the second half of this year. KION Group brands sell such batteries worldwide with their electric industrial trucks and automated warehouse logistics solutions.

Frequently Asked Questions (FAQ):

What is the current size of the global warehouse robotics market?

The warehouse robotics market is estimated to be worth USD 6.1 billion in 2023 and is projected to reach USD 10.5 billion by 2028, growing at a CAGR of 11.4% during the forecast period.

Who are the winners in the global warehouse robotics market?

Daifuku Co., Ltd. (Japan), KION GROUP AG (Germany), KUKA AG (Germany), ABB (Switzerland), are some of the global winners in warehouse robotics market.

Which region is expected to hold the highest market share?

Asia Pacific is expected to dominate the warehouse robotics market during forecast period due to rising adoption of warehouse automation from SMEs; increasing demand for e-commerce, expanding manufacturing sector, and rising labor costs are driving businesses and high economic growth and adoption of automation in region.

What are the major opportunities related to the warehouse robotics market?

Rising demand for last-mile delivery with autonomous mobile robots and potential growth in customization and application of autonomous mobile robots are major opportunities related to warehouse robotics market.

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, and partnerships to strengthen their position in the warehouse robotics market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing popularity of e-commerce shopping platforms- Increasing investments by venture capitalists in warehouse automation- Pressing need to improve warehouse operations to ensure fast product delivery- Growing focus of SMEs on improving logistics management efficiency- Rapid advancements in robotics, AI, and ML technologiesRESTRAINTS- High costs associated with warehouse setup and infrastructure development- Shortage of skilled workforce- Complexities in designing and integrating autonomous systemsOPPORTUNITIES- Transformation of warehouses due to industrial revolution- Availability of alternatives- Rising use of AMRs to offer quick last-mile delivery and ensure customer satisfaction- Increasing demand for customized AMRs across several verticalsCHALLENGES- Security risks associated with connected autonomous robots- Lack of awareness regarding warehouse robotics in developing countries- Interoperability issues due to lack of standardized protocols and regulatory frameworks

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 WAREHOUSE ROBOTICS ECOSYSTEM

- 5.5 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN WAREHOUSE ROBOTICS MARKET

-

5.6 AVERAGE SELLING PRICE ANALYSISPRICING ANALYSIS- Average selling prices of warehouse robots- Average selling price trend, by payload capacity

-

5.7 TECHNOLOGY ANALYSISSIMULTANEOUS LOCALIZATION AND MAPPING (SLAM)LIDAR AND 3D MAPPINGPREDICTIVE ANALYTICSVOICE RECOGNITION TECHNOLOGYMACHINE LEARNING PLATFORMARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML)5GINTERNET OF THINGS (IOT)INDUSTRY 4.0ROBOTIC PROCESS AUTOMATIONDIGITAL TWIN MODEL BUILDER

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDY ANALYSISWALMART PARTNERS WITH AUTOMATION COMPANY TO ENHANCE OPERATIONAL EFFICIENCYCOCA-COLA COLLABORATES WITH SYSTEM LOGISTICS AND FKI LOGISTEX TO OPTIMIZE MATERIAL HANDLINGFEDEX JOINS HANDS WITH PLUS ONE ROBOTICS AND YASKAWA AMERICA TO ENHANCE PACKAGE SORTING EFFICIENCYIKEA COLLABORATES WITH SWISSLOG TO IMPLEMENT AUTOMATED PALLET WAREHOUSE SOLUTIONUPS AND SOFTEON PARTNER TO DEVELOP WAREHOUSE EXECUTION SYSTEMNIKE AND GEEK+ JOIN HANDS TO ENHANCE DISTRIBUTION CENTER OPERATIONS

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

- 5.14 TARIFF ANALYSIS

-

5.15 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY STANDARDSGOVERNMENT REGULATIONS- Global- North America- Europe- Asia Pacific

- 6.1 INTRODUCTION

- 6.2 SAFETY SYSTEMS

- 6.3 COMMUNICATION SYSTEMS

- 6.4 JOB CONTROL SYSTEMS

- 6.5 TRAFFIC MANAGEMENT SYSTEMS

- 6.6 BATTERY CHARGING SYSTEMS

- 6.7 SENSORS

- 6.8 CONTROLLERS

- 6.9 DRIVES

- 6.10 ROBOTIC ARMS

- 7.1 INTRODUCTION

-

7.2 WAREHOUSE MANAGEMENT SYSTEMS (WMS)BENEFITS OF WMS

-

7.3 WAREHOUSE CONTROL SYSTEMS (WCS)BENEFITS OF WCS

-

7.4 WAREHOUSE EXECUTION SYSTEMS (WES)BENEFITS OF WES

- 8.1 INTRODUCTION

-

8.2 SOFTWAREHIGH PREFERENCE FOR CLOUD-BASED SERVICES TO DRIVE MARKET

-

8.3 AUTOMATED LABORADOPTION OF DATA-DRIVEN APPROACHES TO FUEL MARKET DEMAND

-

8.4 AUTOMATED WAREHOUSENEED FOR EFFICIENT RESOURCE ALLOCATION TO SUPPORT MARKET GROWTH

- 9.1 INTRODUCTION

-

9.2 AUTONOMOUS MOBILE ROBOTSAUTONOMOUS MOBILE ROBOTS: WAREHOUSE ROBOTICS MARKET, BY TECHNOLOGY- Laser/LiDAR- Vision guidance- Other technologies

-

9.3 AUTOMATED GUIDED VEHICLESAUTOMATED GUIDED VEHICLES: WAREHOUSE ROBOTICS MARKET, BY TYPE- Pallet trucks- Forklift trucks- Towing AGVs- Assembly line vehicles- Unit load carriers- Other AGV typesAUTOMATED GUIDED VEHICLES: WAREHOUSE ROBOTICS MARKET, BY NAVIGATION TECHNOLOGY- Magnetic guidance- Inductive guidance- Laser guidance- Vision guidance- Optical tape guidance- Other navigation technologies

-

9.4 ARTICULATED ROBOTSRISING DEMAND FOR ARTICULATED ROBOTS OWING TO THEIR HIGH LOAD-CARRYING CAPACITY, RELIABILITY, AND SPEED

-

9.5 CYLINDRICAL & SCARA ROBOTSCYLINDRICAL ROBOTS- Use of cylindrical robots in packaging, palletizing, and pick-and-place applications owing to their high accuracySELECTIVE COMPLIANCE ASSEMBLY ROBOT ARM (SCARA) ROBOTS- Adoption of SCARA robots to ensure high-speed warehouse operations

-

9.6 COLLABORATIVE ROBOTSDEPLOYMENT OF COLLABORATIVE ROBOTS TO SAVE TIME AND LABOR COSTS

-

9.7 OTHER TYPESPARALLEL ROBOTSCARTESIAN ROBOTS

- 10.1 INTRODUCTION

-

10.2 PICKING & PLACINGREQUIREMENT TO REDUCE WAREHOUSE OPERATION TIME TO DRIVE SEGMENTAL GROWTH

-

10.3 PALLETIZING & DE-PALLETIZINGUSE OF ROBOTIC SYSTEMS TO EFFICIENTLY LOAD AND UNLOAD GOODS TO SUPPORT SEGMENTAL GROWTH

-

10.4 TRANSPORTATIONDEPLOYMENT OF ROBOTICS TO MINIMIZE LOGISTICS AND IMPROVE WORKFLOW EFFICIENCY TO FUEL SEGMENTAL GROWTH

-

10.5 SORTING & PACKAGINGVERSATILITY AND CONSISTENCY OF AUTOMATED SYSTEMS TO CREATE SIGNIFICANT DEMAND IN SORTING & PACKAGING APPLICATIONS

- 11.1 INTRODUCTION

-

11.2 LESS THAN 20 KGEASY NAVIGATION AND WAREHOUSE OPTIMIZATION BENEFITS TO DRIVE SEGMENT

-

11.3 20–100 KGMODERATE PAYLOAD CAPACITY AND COMPACT SIZE OF ROBOTIC SYSTEMS TO CONTRIBUTE TO MARKET GROWTH

-

11.4 100–200 KGDEVELOPMENT OF MOBILE ROBOTS WITH HEAVY LOAD-CARRYING CAPACITY TO BOOST SEGMENTAL GROWTH

-

11.5 MORE THAN 200 KGHIGH ADOPTION IN AUTOMOTIVE SECTOR TO DRIVE SEGMENTAL GROWTH

- 12.1 INTRODUCTION

-

12.2 AUTOMOTIVERISING DEMAND FOR AUTOMOBILE SPARE PARTS TO DRIVE MARKET

-

12.3 CHEMICALDIGITAL TRANSFORMATION IN CHEMICAL INDUSTRY TO DRIVE SEGMENTAL GROWTH

-

12.4 SEMICONDUCTOR & ELECTRONICSINCLINATION TOWARD PORTABLE ELECTRONICS TO FUEL MARKET GROWTH

-

12.5 E-COMMERCERISING INVESTMENTS BY E-COMMERCE COMPANIES IN WAREHOUSE AUTOMATION TO DRIVE DEMAND FOR MOBILE ROBOTS

-

12.6 FOOD & BEVERAGERISING DEPLOYMENT OF ROBOTS IN COLD STORAGE WAREHOUSES TO BOOST SEGMENTAL GROWTH

-

12.7 HEALTHCAREINCREASING USE OF AUTOMATED TOOLS IN PHARMACEUTICAL MANUFACTURING TO SUPPORT SEGMENTAL GROWTH

-

12.8 METALS & HEAVY MACHINERYGROWING CONSTRUCTION, MINING, AND MANUFACTURING ACTIVITIES TO ACCELERATE SEGMENTAL GROWTH

-

12.9 OTHER INDUSTRIESPAPER & PRINTINGTEXTILE & CLOTHING

- 13.1 INTRODUCTION

-

13.2 NORTH AMERICAUS- Constant growth of e-commerce industry to drive marketCANADA- Pressing need to combat labor shortage and soaring wages to boost demand for warehouse roboticsMEXICO- Rising importance of industrial infrastructure development to create opportunities for providers of robotic solutionsRECESSION IMPACT ON MARKET IN NORTH AMERICA

-

13.3 EUROPEGERMANY- Rising demand for automated material handling solutions to drive marketUK- Strong focus of e-commerce companies on improving warehouse efficiency to accelerate demand for robotic solutionsFRANCE- Increased adoption of robots in logistics operations to support market growthITALY- Industrial revolution to boost demand for warehouse automation systemsSPAIN- Rise in vehicle production to fuel market growthREST OF EUROPERECESSION IMPACT ON MARKET IN EUROPE

-

13.4 ASIA PACIFICCHINA- Advancements in AI and ML technologies to increase demand for warehouse robotsJAPAN- Implementation of robots in logistics and e-commerce sectors to contribute to market growthSOUTH KOREA- Increasing focus on reshaping logistics sector to facilitate e-commerce activities to drive marketREST OF ASIA PACIFICRECESSION IMPACT ON MARKET IN ASIA PACIFIC

-

13.5 ROWSOUTH AMERICA- Expansion of retail industry to propel marketMIDDLE EAST & AFRICA- Establishment of state-of-the-art warehouses to drive marketRECESSION IMPACT ON MARKET IN ROW

- 14.1 OVERVIEW

-

14.2 STRATEGIES ADOPTED BY KEY PLAYERSPRODUCT PORTFOLIOREGIONAL FOCUSMANUFACTURING FOOTPRINTORGANIC/INORGANIC GROWTH STRATEGIES

- 14.3 REVENUE ANALYSIS OF KEY PLAYERS IN WAREHOUSE ROBOTICS MARKET

-

14.4 MARKET SHARE ANALYSIS, 2022KEY PLAYERS IN WAREHOUSE ROBOTICS MARKET, 2022

-

14.5 COMPANY EVALUATION MATRIX, 2022STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

- 14.6 COMPETITIVE BENCHMARKING

-

14.7 EVALUATION MATRIX OF STARTUPS/SMES, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

14.8 COMPETITIVE SCENARIOS AND TRENDSDEALS

-

15.1 KEY PLAYERSDAIFUKU CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKION GROUP AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKUKA AG- Business overview- Products/Solutions/Services offered- Recent developments- Recent developments- MnM viewABB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFANUC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGEEKPLUS TECHNOLOGY CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsGREYORANGE PTE. LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsMURATA MACHINERY, LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsOMRON CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsTOYOTA INDUSTRIES CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsHONEYWELL INTERNATIONAL INC.- Business overview- Products/Solutions/Services offered- Recent developments

-

15.2 OTHER KEY PLAYERSHIKROBOT CO., LTD.IAM ROBOTICSINVIA ROBOTICS, INC.JBTKNAPP AGLOCUS ROBOTICSMAGAZINO GMBHSCALLOGSHANGHAI QUICKTRON INTELLIGENT TECHNOLOGY CO., LTD.AMAZON ROBOTICSYASKAWA ELECTRIC CORPORATIONFETCH ROBOTICS, INCTERADYNE, INC.SHOPIFY INC.

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 AVAILABLE CUSTOMIZATIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 RESEARCH ASSUMPTIONS

- TABLE 2 AVERAGE SELLING PRICES OF INDUSTRIAL ROBOTS, BY PAYLOAD CAPACITY

- TABLE 3 AVERAGE SELLING PRICES OF PRODUCTS OFFERED BY KEY PLAYERS (USD)

- TABLE 4 PORTER’S FIVE FORCES: IMPACT ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- TABLE 7 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 8 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 9 LIST OF PATENTS GRANTED IN WAREHOUSE ROBOTICS MARKET, 2023

- TABLE 10 WAREHOUSE ROBOTICS MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 11 MFN TARIFF LEVIED ON COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 12 MFN TARIFF LEVIED ON COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 13 MFN TARIFF LEVIED ON COMPLIANT PRODUCTS EXPORTED BY JAPAN

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 WAREHOUSE ROBOTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 19 WAREHOUSE ROBOTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 20 AUTONOMOUS MOBILE ROBOTS: WAREHOUSE ROBOTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 21 AUTONOMOUS MOBILE ROBOTS: WAREHOUSE ROBOTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 AUTONOMOUS MOBILE ROBOTS: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 23 AUTONOMOUS MOBILE ROBOTS: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 24 AUTONOMOUS MOBILE ROBOTS: WAREHOUSE ROBOTICS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 25 AUTONOMOUS MOBILE ROBOTS: WAREHOUSE ROBOTICS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 26 AUTOMATED GUIDED VEHICLES: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 27 AUTOMATED GUIDED VEHICLES: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 28 AUTOMATED GUIDED VEHICLES: WAREHOUSE ROBOTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 AUTOMATED GUIDED VEHICLES: WAREHOUSE ROBOTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 AUTOMATED GUIDED VEHICLES: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 31 AUTOMATED GUIDED VEHICLES: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 32 AUTOMATED GUIDED VEHICLES: WAREHOUSE ROBOTICS MARKET, BY NAVIGATION TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 33 AUTOMATED GUIDED VEHICLES: WAREHOUSE ROBOTICS MARKET, BY NAVIGATION TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 34 ADVANTAGES AND APPLICATIONS OF ARTICULATED ROBOTS

- TABLE 35 ARTICULATED ROBOTS: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 36 ARTICULATED ROBOTS: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 37 ARTICULATED ROBOTS: WAREHOUSE ROBOTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 ARTICULATED ROBOTS: WAREHOUSE ROBOTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 ADVANTAGES AND APPLICATIONS OF SCARA ROBOTS

- TABLE 40 CYLINDRICAL & SCARA ROBOTS: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 41 CYLINDRICAL & SCARA ROBOTS: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 42 CYLINDRICAL & SCARA ROBOTS: WAREHOUSE ROBOTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 CYLINDRICAL & SCARA ROBOTS: WAREHOUSE ROBOTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 COLLABORATIVE ROBOTS: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 45 COLLABORATIVE ROBOTS: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 46 COLLABORATIVE ROBOTS: WAREHOUSE ROBOTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 47 COLLABORATIVE ROBOTS: WAREHOUSE ROBOTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 WAREHOUSE ROBOTICS MARKET, BY OTHER TYPES, 2019–2022 (USD MILLION)

- TABLE 49 WAREHOUSE ROBOTICS MARKET, BY OTHER TYPES, 2023–2028 (USD MILLION)

- TABLE 50 OTHER TYPES: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 51 OTHER TYPES: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 52 OTHER TYPES: WAREHOUSE ROBOTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 OTHER TYPES: WAREHOUSE ROBOTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 WAREHOUSE ROBOTICS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 55 WAREHOUSE ROBOTICS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 56 WAREHOUSE ROBOTICS MARKET, BY PAYLOAD CAPACITY, 2019–2022 (USD MILLION)

- TABLE 57 WAREHOUSE ROBOTICS MARKET, BY PAYLOAD CAPACITY, 2023–2028 (USD MILLION)

- TABLE 58 LESS THAN 20 KG: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 59 LESS THAN 20 KG: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 60 WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 61 WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 62 AUTOMOTIVE: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 63 AUTOMOTIVE: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 64 AUTOMOTIVE: WAREHOUSE ROBOTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 AUTOMOTIVE: WAREHOUSE ROBOTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 CHEMICAL: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 67 CHEMICAL: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 68 CHEMICAL: WAREHOUSE ROBOTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 CHEMICAL: WAREHOUSE ROBOTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 SEMICONDUCTOR & ELECTRONICS: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 71 SEMICONDUCTOR & ELECTRONICS: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 72 SEMICONDUCTOR & ELECTRONICS: WAREHOUSE ROBOTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 SEMICONDUCTOR & ELECTRONICS: WAREHOUSE ROBOTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 E-COMMERCE: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 75 E-COMMERCE: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 76 E-COMMERCE: WAREHOUSE ROBOTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 E-COMMERCE: WAREHOUSE ROBOTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 FOOD & BEVERAGE: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 79 FOOD & BEVERAGE: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 80 FOOD & BEVERAGE: WAREHOUSE ROBOTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 81 FOOD & BEVERAGE: WAREHOUSE ROBOTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 HEALTHCARE: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 83 HEALTHCARE: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 84 HEALTHCARE: WAREHOUSE ROBOTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 85 HEALTHCARE: WAREHOUSE ROBOTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 METALS & HEAVY MACHINERY: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 87 METALS & HEAVY MACHINERY: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 88 METALS & HEAVY MACHINERY: WAREHOUSE ROBOTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 METALS & HEAVY MACHINERY: WAREHOUSE ROBOTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 OTHER INDUSTRIES: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 91 OTHER INDUSTRIES: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 92 OTHER INDUSTRIES: WAREHOUSE ROBOTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 93 OTHER INDUSTRIES: WAREHOUSE ROBOTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 WAREHOUSE ROBOTICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 95 WAREHOUSE ROBOTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: WAREHOUSE ROBOTICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: WAREHOUSE ROBOTICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 99 NORTH AMERICA: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 100 NORTH AMERICA: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 102 EUROPE: WAREHOUSE ROBOTICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 103 EUROPE: WAREHOUSE ROBOTICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 104 EUROPE: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 105 EUROPE: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 106 EUROPE: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 107 EUROPE: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: WAREHOUSE ROBOTICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 109 ASIA PACIFIC: WAREHOUSE ROBOTICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 114 ROW: WAREHOUSE ROBOTICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 115 ROW: WAREHOUSE ROBOTICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 116 ROW: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 117 ROW: WAREHOUSE ROBOTICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 118 ROW: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 119 ROW: WAREHOUSE ROBOTICS MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 120 STRATEGIES ADOPTED BY MANUFACTURERS OF WAREHOUSE ROBOTS

- TABLE 121 MARKET SHARE ANALYSIS (2022)

- TABLE 122 COMPANY FOOTPRINT, BY INDUSTRY

- TABLE 123 COMPANY FOOTPRINT, BY REGION

- TABLE 124 OVERALL COMPANY FOOTPRINT

- TABLE 125 WAREHOUSE ROBOTICS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 126 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (INDUSTRY FOOTPRINT)

- TABLE 127 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (REGION FOOTPRINT)

- TABLE 128 WAREHOUSE ROBOTICS MARKET: DEALS, 2020–2023

- TABLE 129 WAREHOUSE ROBOTICS MARKET: PRODUCT LAUNCHES, 2020-2023

- TABLE 130 DAIFUKU CO., LTD.: COMPANY OVERVIEW

- TABLE 131 DAIFUKU CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 132 DAIFUKU CO., LTD.: DEALS

- TABLE 133 DAIFUKU CO., LTD.: OTHERS

- TABLE 134 KION GROUP AG: COMPANY OVERVIEW

- TABLE 135 KION GROUP AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 KION GROUP AG: DEALS

- TABLE 137 KION GROUP AG: OTHERS

- TABLE 138 KUKA AG: COMPANY OVERVIEW

- TABLE 139 KUKA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 KUKA AG: PRODUCT LAUNCHES

- TABLE 141 KUKA AG: DEALS

- TABLE 142 KUKA AG: OTHERS

- TABLE 143 ABB: COMPANY OVERVIEW

- TABLE 144 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 ABB: PRODUCT LAUNCHES

- TABLE 146 ABB: DEALS

- TABLE 147 ABB: OTHERS

- TABLE 148 FANUC CORPORATION: COMPANY OVERVIEW

- TABLE 149 FANUC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 FANUC CORPORATION: PRODUCT LAUNCHES

- TABLE 151 FANUC CORPORATION: DEALS

- TABLE 152 GEEKPLUS TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 153 GEEKPLUS TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 GEEKPLUS TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 155 GEEKPLUS TECHNOLOGY CO., LTD.: DEALS

- TABLE 156 GEEKPLUS TECHNOLOGY CO., LTD.: OTHERS

- TABLE 157 GREYORANGE PTE. LTD.: COMPANY OVERVIEW

- TABLE 158 GREYORANGE PTE. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 GREYORANGE PTE. LTD.: DEALS

- TABLE 160 MURATA MACHINERY, LTD.: COMPANY OVERVIEW

- TABLE 161 MURATA MACHINERY, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 MURATA MACHINERY, LTD.: PRODUCT LAUNCHES

- TABLE 163 MURATA MACHINERY, LTD.: DEALS

- TABLE 164 MURATA MACHINERY, LTD.: OTHERS

- TABLE 165 OMRON CORPORATION: COMPANY OVERVIEW

- TABLE 166 OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 OMRON CORPORATION: PRODUCT LAUNCHES

- TABLE 168 OMRON CORPORATION: DEALS

- TABLE 169 TOYOTA INDUSTRIES CORPORATION: COMPANY OVERVIEW

- TABLE 170 TOYOTA INDUSTRIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 TOYOTA INDUSTRIES CORPORATION: PRODUCT LAUNCHES

- TABLE 172 TOYOTA INDUSTRIES CORPORATION: DEALS

- TABLE 173 TOYOTA INDUSTRIES CORPORATION: OTHERS

- TABLE 174 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 175 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 177 HONEYWELL INTERNATIONAL INC.: OTHERS

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PROCESS FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 WAREHOUSE ROBOTICS MARKET: TOP-DOWN APPROACH

- FIGURE 5 WAREHOUSE ROBOTICS MARKET: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 AUTONOMOUS MOBILE ROBOTS SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 9 TRANSPORTATION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 10 E-COMMERCE SEGMENT TO REGISTER HIGHEST CAGR IN WAREHOUSE ROBOTICS MARKET DURING FORECAST PERIOD

- FIGURE 11 >200 KG SEGMENT TO ACCOUNT FOR LARGEST SHARE OF WAREHOUSE ROBOTICS MARKET IN 2028

- FIGURE 12 ASIA PACIFIC TO GROW AT HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 13 RISING INVESTMENTS IN AUTOMATION SYSTEMS TO CREATE LUCRATIVE OPPORTUNITIES FOR PLAYERS IN WAREHOUSE ROBOTICS MARKET

- FIGURE 14 TRANSPORTATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 15 AUTONOMOUS MOBILE ROBOTS SEGMENT TO HOLD LARGEST SHARE OF WAREHOUSE ROBOTICS MARKET IN 2028

- FIGURE 16 E-COMMERCE SEGMENT AND CHINA HELD LARGEST SHARE OF WAREHOUSE ROBOTICS MARKET IN 2022

- FIGURE 17 WAREHOUSE ROBOTICS MARKET IN JAPAN TO DEPICT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 DRIVERS: IMPACT ANALYSIS

- FIGURE 20 RESTRAINTS: IMPACT ANALYSIS

- FIGURE 21 OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 22 CHALLENGES: IMPACT ANALYSIS

- FIGURE 23 VALUE CHAIN ANALYSIS

- FIGURE 24 KEY PARTICIPANTS IN WAREHOUSE ROBOTICS ECOSYSTEM

- FIGURE 25 REVENUE SHIFTS OF PLAYERS IN WAREHOUSE ROBOTICS MARKET

- FIGURE 26 AVERAGE SELLING PRICES OF PRODUCTS OFFERED BY KEY PLAYERS

- FIGURE 27 AVERAGE SELLING PRICE TREND, BY PAYLOAD CAPACITY

- FIGURE 28 PORTER’S FIVE FORCES: IMPACT ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES

- FIGURE 30 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- FIGURE 31 NUMBER OF PATENTS GRANTED FROM 2013–2022

- FIGURE 32 WES INTEGRATES KEY FUNCTIONALITIES OF WMS AND WCS

- FIGURE 33 AUTONOMOUS MOBILE ROBOTS SEGMENT TO EXHIBIT HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 34 LASER GUIDANCE NAVIGATION TECHNOLOGY SEGMENT TO DOMINATE MARKET FOR AUTOMATED GUIDED VEHICLES FROM 2023–2028

- FIGURE 35 TRANSPORTATION SEGMENT TO DOMINATE WAREHOUSE ROBOTICS MARKET DURING FORECAST PERIOD

- FIGURE 36 100–200 KG SEGMENT TO DEPICT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 E-COMMERCE SEGMENT TO DOMINATE WAREHOUSE ROBOTICS MARKET FROM 2023 TO 2028

- FIGURE 38 ASIA PACIFIC TO DOMINATE WAREHOUSE ROBOTICS MARKET BETWEEN 2023 AND 2028

- FIGURE 39 NORTH AMERICA: WAREHOUSE ROBOTICS MARKET SNAPSHOT

- FIGURE 40 EUROPE: WAREHOUSE ROBOTICS MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: WAREHOUSE ROBOTICS MARKET SNAPSHOT

- FIGURE 42 5-YEAR REVENUE ANALYSIS OF KEY PLAYERS IN WAREHOUSE ROBOTICS MARKET

- FIGURE 43 COMPANY EVALUATION MATRIX, 2022

- FIGURE 44 EVALUATION MATRIX OF STARTUPS/SMES, 2022

- FIGURE 45 DAIFUKU CO., LTD.: COMPANY SNAPSHOT

- FIGURE 46 KION GROUP AG: COMPANY SNAPSHOT

- FIGURE 47 KUKA AG: COMPANY SNAPSHOT

- FIGURE 48 ABB: COMPANY SNAPSHOT

- FIGURE 49 FANUC CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 OMRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 TOYOTA INDUSTRIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

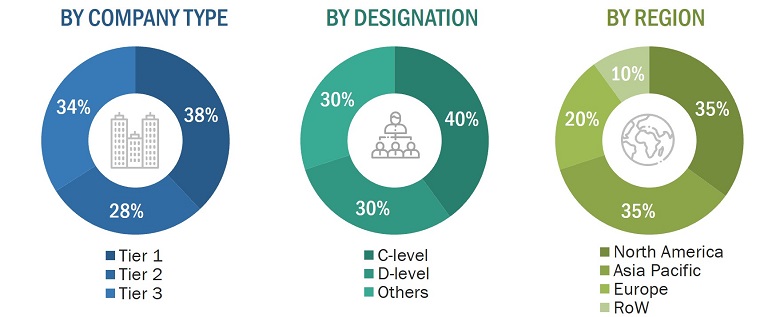

The research study involved 4 major activities in estimating the size of the warehouse robotics market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, and investor presentations of companies, white papers, and articles from recognized authors. Secondary research was mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, and regional outlook and developments from both market and technology perspectives.

Primary Research

In the primary research, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, equipment manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the warehouse robotics market ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used along with several data triangulation methods to estimate and forecast the overall market segments and subsegments listed in this report.

Estimating market size by bottom-up approach (demand side)

The bottom-up approach has been used to arrive at the overall size of the warehouse robotics market from the revenues of key players and their shares in the market. Key players have been identified on the basis of several parameters, such as product portfolio analysis, revenue, R&D expenditure, geographic presence, and recent activities. The overall market size has been calculated based on the revenues of the key players identified in the market.

Market Size Estimation Methodology-Bottom-up Approach

Data Triangulation

After arriving at the overall market size through the process explained earlier, the total market has been split into several segments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both the top-down and bottom-up approaches.

Market Definition

Warehouse robotics are used to automate different warehouse functions, such as transportation, picking and placing, packaging, and palletizing and de-palletizing. The use of warehouse robots reduces the need for human intervention and increases the efficiency of warehouse operations. They find applications in various industries, such as e-commerce, automotive, electrical & electronics, food & beverage, and pharmaceutical.

Stakeholders

- Robotics material and component providers

- Integrators and installers of warehouse robotics

- Warehouse robot and solution providers

- Consulting companies

- Warehouse robotic software providers

- Warehouse robotic-related associations, organizations, forums, and alliances

- Government and corporate bodies

- Research institutes and organizations

- Venture capitalists, private equity firms, and start-ups

- Distributors and traders

- Warehouse operators in various industries, such as e-commerce, automotive, chemical, food & beverage, metals & machinery, and electrical & electronics

The main objectives of this study are as follows:

- To define, describe, and forecast the warehouse robotics market, in terms of value, based on type, function, payload capacity, industry, and geography

- To define, describe, and forecast the warehouse robotics market, in terms of volume, based on type

- To forecast the market size, in terms of value, for various segments, with respect to 4 main regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

-

To provide detailed information regarding the major factors influencing the growth of

the warehouse robotics market (drivers, restraints, opportunities, and industry-specific challenges) - To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities for the market players by identifying high-growth segments of the warehouse robotics market

- To benchmark players operating in the market using the proprietary “Company Evaluation Matrix” framework, which analyzes market players on various parameters within the broad categories of market rank and product offering

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2 and provide a detailed competitive landscape for market leaders

- To track and analyze competitive developments such as partnerships, collaborations, agreements, and joint ventures; mergers and acquisitions; expansions; and product launches in the warehouse robotics market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Warehouse Robotics Market