Volumetric Video Market by Volumetric Capture (Hardware, Software, Service), Content Delivery, Application (Sports, Events & Entertainment, Medical, Education & Training, Signage & Advertisement) and Region - Global Forecast to 2028

Updated on : October 22, 2024

Volumetric Video Market Size & Growth

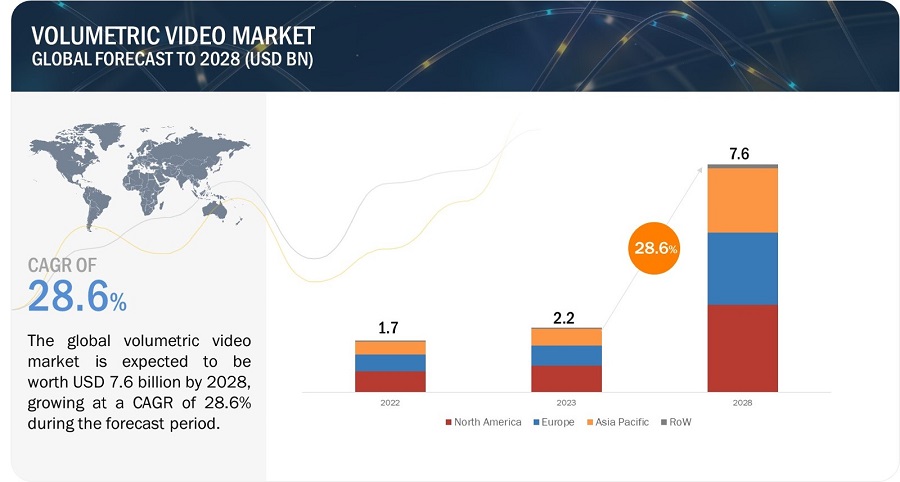

The global volumetric video market size is expected to be valued at USD 2.2 billion in 2023 and is projected to reach USD 7.6 billion by 2028; growing at a CAGR of 28.6% from 2023 to 2028.

The volumetric video market holds immense untapped potential, particularly in teleconferencing and the commercialization of 5G technology. The advent of 5G brings forth the advantages of low latency and high bandwidth speed, facilitating the seamless delivery of volumetric video content.

Furthermore, the expanding range of applications for volumetric videos, such as advanced medical imaging and image-guided surgery, presents promising growth opportunities for the market. However, the volumetric video market also needs help, including complex software solutions for image processing and the absence of standardization in 3D content creation. To navigate these challenges, partnerships, product developments, technological advancements, and prototyping have emerged as widely adopted strategies within the market. Both startups and established industry leaders are actively engaged in research and development efforts related to volumetric video technology, contributing to the market's growth prospects in the forecast period. Additionally, expansions and acquisitions are prominent strategies market players employ to enhance their market presence and offerings further.

Volumetric Video Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Volumetric Video Market Trends and Dynamics:

Driver: Increasing use of volumetric video in the entertainment industry

Volumetric video is an advanced technology that captures objects or individuals in three dimensions, resulting in an immersive and interactive viewing experience. Its adoption has been swift within the entertainment industry, as it finds applications in films, gaming, and live events. The growing demand for 3D/360° content in the entertainment sector and the desire for enhanced viewing experiences drive the expansion of the volumetric video market.

Diego Prilusky, the former head of Intel Studios, is a prominent advocate for incorporating volumetric video in filmmaking. Prilusky believes this technology can expedite production schedules and redefine various entertainment forms. Notably, volumetric video has already been utilized in notable projects, including HBO's "Watchmen" and "Westworld," as well as in the creation of digital doubles for "Star Wars: The Rise of Skywalker." Companies operating in the volumetric video domain, such as Avatar Dimension and Holo-Light, continually push the boundaries of what can be achieved with this technology. For instance, volumetric video enables the creation of immersive experiences for live events like concerts and sports games, enabling viewers to feel fully engaged in the heart of the action.

Restraint: High maintenance cost of equipment and software

Volumetric video technology is a cutting-edge technology used in various fields, including entertainment, education, and healthcare. However, it comes with certain restraints, such as high maintenance, equipment, and software costs. Regarding maintenance costs, software maintenance for volumetric video can cost up to two-thirds of the entire software process cycle or more than 50% of the SDLC processes. Additionally, software maintenance costs can be as high as $5,000 per month or $60,000 per year. It's essential to remember that the prices involved in software maintenance can vary depending on multiple factors.

Opportunity: Growing applications of volumetric video for progressive medical imaging and image-guided surgery

Volumetric video is a technology that captures images in three dimensions (3D) and creates a fully immersive experience for the viewer. Advanced medical imaging involves using cutting-edge technology to generate ideas of the human body that are more detailed and precise than traditional imaging techniques. On the other hand, image-guided surgery uses real-time imaging to guide surgical procedures and enhance their accuracy. The volumetric video has the potential to revolutionize both of these fields by creating 3D models of patients' organs or body parts that can be manipulated and viewed from any angle. This could enable surgeons to plan and carry out procedures more effectively, improving patient outcomes and reducing recovery times.

Challenge: Lack of standardization for 3D content creation

The lack of standardization in 3D content creation is a significant issue because it can lead to compatibility issues between different systems, which can cause errors and additional costs for content creators. For example, a content creator may create a 3D model in one software package that cannot be imported into another, requiring them to recreate the model from scratch. This can be time-consuming and expensive, leading to delays in the production process.

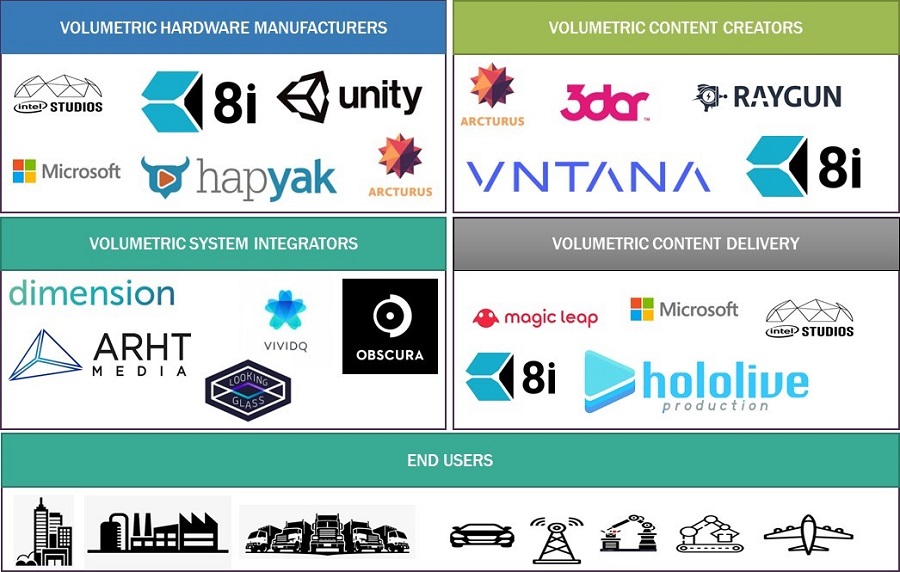

Volumetric Video Market Ecosystem

The volumetric video market is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. The volumetric video market comprises hardware manufacturers, content creators, system integrators, and content delivery. Volumetric video end users include sports, events and entertainment, consumer electronics, defense, military, healthcare, education and training, signage, and advertisement.

Volumetric Video Market Segmentation

Based on volumetric capture, the volumetric video market for service to hold the highest CAGR during the forecast period

Various vendors offer a range of services encompassing cloud services, streaming, and sharing. Companies utilize cloud servers to deliver enormous amounts of data to content delivery devices. This involves storing or processing volumetric video on the cloud, which is then compared with a relevant database to extract necessary information and subsequently sent back to mobile devices. The content delivery device then undertakes image processing tasks such as detection, resizing, and generating 3D volumetric images. The market for volumetric video services is expanding within the video production industry, providing businesses and individuals with access to advanced technologies for capturing and rendering immersive 3D video content. These services typically entail the usage of specialized cameras, software, and processing units dedicated to capturing and creating immersive 3D video content.

Signage & advertisement application to hold the highest CAGR during the forecast period.

The volumetric video has emerged as a groundbreaking technology that is revolutionizing the market for signage and advertisement. This technology enables advertisers to create compelling and interactive visuals seamlessly integrated into various signage and advertising platforms. With volumetric video, brands can now showcase their products and services more engagingly and dynamically, effectively grabbing the attention of potential customers. Whether it's a life-sized holographic display or an interactive augmented reality experience, volumetric video enables advertisers to bring their campaigns to life in ways that were previously unimaginable. As a result, the market for signage and advertisement is experiencing a significant boost as businesses recognize the immense potential of this technology in driving customer engagement, brand recognition, and, ultimately, sales. The demand for volumetric video solutions is rapidly growing, and it is poised to become a dominant force in the future of signage and advertising.

Volumetric Video Industry Regional Analysis

Volumetric video market in Asia Pacific to hold the highest CAGR during the forecast period

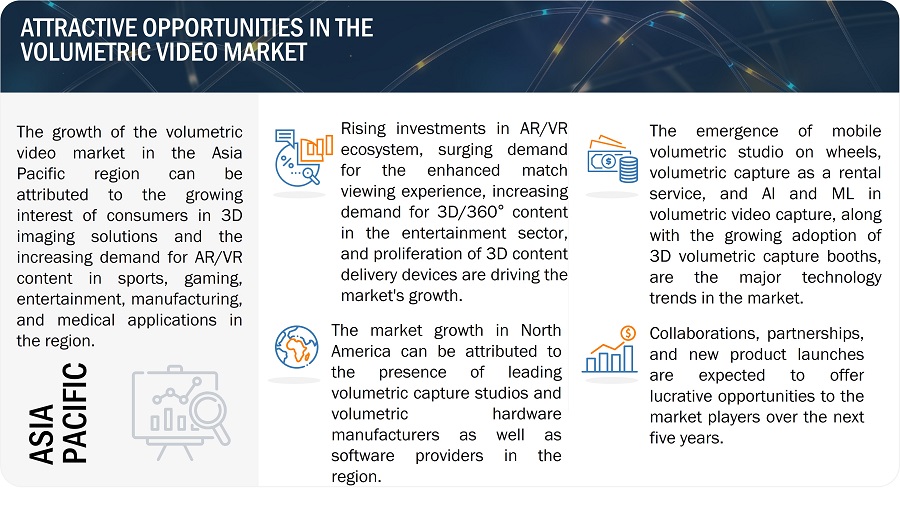

The Asia Pacific region is experiencing substantial gains in adopting and utilizing volumetric video technology, resulting in a significant boost to various industries. With its vast population and rapidly growing economies, the region has become a hotbed for technological innovation, and volumetric video is no exception. Asia Pacific countries leverage this advanced technology to enhance their signage and advertising sectors. By incorporating volumetric video, businesses in the region can create captivating and immersive experiences that resonate with their target audience. Whether in shopping malls, airports, or even on digital billboards, volumetric video offers a unique and attention-grabbing approach to signage and advertisement. Additionally, Asia Pacific has a thriving entertainment industry, including film, gaming, and virtual reality experiences, where volumetric video has found extensive applications. The region's solid creative talent and growing immersive content demand further contribute to volumetric video technology adoption.

Volumetric Video Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Volumetric Video Companies - Key Market Players

The volumetric video Companies is dominated by players such as

- Microsoft Corporation(US),

- Intel Corporation (US),

- Unity Technologies (US),

- Alphabet Inc. (US),

- Sony Corporation (Japan) and others.

Volumetric Video Market Report Scope

|

Report Metric |

Details |

|

Estimated Value |

USD 2.2 billion in 2023 |

|

Expected Value |

USD 7.6 billion by 2028 |

|

Growth Rate |

CAGR of 28.6% |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

By Volumetric Capture, Application |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major market players include Microsoft Corporation(US), Intel Corporation (US), Unity Technologies (US), Alphabet Inc. (US), Sony Corporation (Japan), and others. (Total of 34 players are profiled) |

Volumetric Video Market Highlights

The study categorizes the volumetric video market based on the following segments:

|

Segment |

Subsegment |

|

By Volumetric Capture |

|

|

By Content Delivery |

|

|

By Application |

|

|

By Region |

|

Recent Developments in Volumetric Video Industry

- In January 2023, Unity and Google expanded their partnership across their ecosystems to support studios in accelerating live game growth and development. Together, Unity, a global platform for creating and growing real-time 3D (RT3D) content, and Google are simplifying ways for developers to create multiplayer experiences by offering two solutions from Unity Gaming Services (UGS), Game Server Hosting (Multiplay) and Voice and Text Chat (Vivox), on Google Cloud Marketplace.

- In November 2022, Intel deployed 20 Intel RealSense depth-sensing cameras to capture 360-degree action for “volumetric capture.” The footage from each camera is sent to a computer powered by an Intel Xeon processor that runs Evercoast’s cutting-edge software to convert billions of pixels into a 3D immersive virtual environment that the viewer can manipulate to see from nearly any angle.

- In November 2022, Intel announced the launch of its streamlined artificial intelligence (AI) benefits within Intel Partner Alliance. With the debut of these benefits, Intel will better serve ecosystem partners by helping independent software vendors (ISV), original equipment and device manufacturer, and system integration (SI) partners connect with new opportunities, drive innovation, and accelerate business growth.

- In August 2022, Unity announced a new partnership with Mercedes-Benz. The Unity engine will power the infotainment domain of the Mercedes-Benz operating system. It will be rolled out to the first vehicles in 2024. Mercedes uses Unity Industrial Collection to create the UI for the in-car cockpit. Unity’s tech will power everything from 3D navigation software to virtual avatars and augmented reality experiences. This would include local weather and traffic data, streamed entertainment, or mixed-reality experiences using the car’s smart glass.

Frequently Asked Questions (FAQ):

What are the major driving factors and opportunities in the volumetric video market?

Some of the major driving factors for the growth of this market include increasing demand for virtual reality (VR) and augmented reality (AR) applications, increasing use of volumetric video in the entertainment industry, advancements in camera and display technologies, and rising investments in the AR/VR ecosystem. Moreover, the growing use of volumetric video in e-commerce, increasing use of volumetric video in education and training, and growing applications of volumetric video for advanced medical imaging and image-guided surgery are some of the critical opportunities for the volumetric video market.

Which region is expected to hold the highest market size?

The market in Asia Pacific will dominate the market share in 2023, showcasing strong demand for volumetric video in the region. Creative agencies and media companies have used extended reality technology for branding and marketing campaigns. This, in turn, drives the growth of the volumetric video market in China. The country is projected to witness the highest adoption of mobile-based AR and VR devices during the forecast period, thereby fueling the growth of the volumetric video market in the Asia Pacific. The massive base of mobile users, high mobile Internet penetration, and the vast population are expected to be the key growth drivers for the market in China.

Who are the leading players in the global volumetric video market share?

Companies such as Microsoft Corporation(US), Intel Corporation (US), Unity Technologies (US), Alphabet Inc. (US), and Sony Corporation (Japan) are the leading players in the market. Moreover, these companies rely on strategies that include new product launches and developments, partnerships and collaborations, and acquisitions. Such advantages give these companies an edge over other companies in the market.

What are some of the technological advancements in the volumetric video market?

One notable advancement in volumetric video is the improvement in capturing and processing techniques. Earlier methods required complex setups, such as using an array of cameras and depth sensors, to capture volumetric data. However, advancements in computer vision and depth-sensing technology have enabled capturing high-quality volumetric video with fewer cameras and sensors.

What is the impact of the global recession on the market?

The volumetric video market will likely experience several impacts during the ongoing recession. Reduced investment becomes a common occurrence as caution prevails among companies and investors. The uncertainty and financial constraints associated with a downturn may lead to a slowdown in funding for research and development in the volumetric video field, potentially hindering innovation. Moreover, businesses facing budget constraints during an economic downturn may delay their adoption of volumetric video solutions, as the necessary investments in infrastructure and equipment could be perceived as non-essential. Instead, organizations may prioritize more essential areas for cost-saving measures and efficiency improvements. Consequently, the market demand for volumetric video might decrease as businesses adjust their priorities during the recession.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for virtual reality (VR) and augmented reality (AR) applications- Rising use of volumetric video in entertainment industry- Rapid advancements in camera and display technologies- Increasing investments in AR/VR ecosystemRESTRAINTS- High costs associated with volumetric video technology- Lack of standardization and limited contentOPPORTUNITIES- Rising adoption of volumetric video technology in e-commerce- Increasing use of volumetric video content in education and training- Growing applications of volumetric video technology in progressive medical imaging and image-guided surgeriesCHALLENGES- Lack of standardization for 3D content creation- Regulatory and ethical concerns

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.6 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.8 AVERAGE SELLING PRICE ANALYSISAVERAGE SELLING PRICE TRENDS

-

5.9 CASE STUDY ANALYSISUSE OF VOLUMETRIC VIDEO TO OFFER STAR WARS UNIVERSE EXPERIENCE TO PARTICIPANTSADOPTION OF VOLUMETRIC VIDEO IN HEALTHCARE SECTOR TO DEVELOP TREATMENT PLANSDEPLOYMENT OF VOLUMETRIC VIDEO IN VIRTUAL REALITY TRAININGUTILIZATION OF VOLUMETRIC VIDEO IN PERFORMING ARTSDEPLOYMENT OF V-SENSE VOLUMETRIC VIDEO DATASET IN R&D OF AR AND VR

-

5.10 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- 3D capture- Computer vision- Graphics processingCOMPLEMENTARY TECHNOLOGIES- Virtual reality (VR)- Augmented reality (AR)ADJACENT TECHNOLOGIES- Light-field displays- Holographic displays

-

5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.13 TARIFF ANALYSIS

-

5.14 STANDARDS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America: list of regulatory bodies, government agencies, and other organizations- Europe: list of regulatory bodies, government agencies, and other organizations- Asia Pacific: list of regulatory bodies, government agencies, and other organizations- RoW: list of regulatory bodies, government agencies, and other organizationsSTANDARDS AND REGULATIONS RELATED TO VOLUMETRIC VIDEO MARKET

- 5.15 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 PROJECTORSGROWING PRODUCTION OF 3D MOVIES TO DRIVE MARKET FOR INNOVATIVE AND ADVANCED 3D PROJECTORS

-

6.3 AR/VR HMDSVR HMD- Gaming & entertainment, healthcare, retail, and e-commerce applications to fuel segmental growthAR HMDS- Ability to blend virtual and real-world environments to increase demand for AR HMDs

-

6.4 SMARTPHONESUSE OF SMARTPHONES TO STREAM 3D HOLOGRAMS IN REAL TIME TO PROPEL MARKET

-

6.5 VOLUMETRIC DISPLAYSSWEPT VOLUME DISPLAYS- High adoption of swept volume displays in gaming and entertainment applications to boost market- Oscillating swept volume displays- Rotating swept volume displaysSTATIC VOLUME DISPLAYS- Deployment of static volume displays to create 3D volumetric images in space without moving supporting partsMULTI-PLANAR VOLUMETRIC DISPLAYS- Use of multi-planar displays to create static viewing zones for multiple perspectives and users

- 7.1 INTRODUCTION

-

7.2 HARDWAREHARDWARE SEGMENT TO CAPTURE MAJORITY OF MARKET SHARE IN COMING YEARS- Camera unit- Processing unit

-

7.3 SOFTWAREGROWING DEMAND FROM SPORTS, EVENTS, & ENTERTAINMENT AND MEDICAL APPLICATIONS TO SUPPORT SEGMENTAL GROWTH

-

7.4 SERVICESSERVICES SEGMENT TO RECORD FASTEST GROWTH RATE DURING FORECAST PERIOD

- 8.1 INTRODUCTION

-

8.2 SPORTS, EVENTS, & ENTERTAINMENTRISING USE OF VOLUMETRIC VIDEOS TO ENHANCE EXPERIENCE OF EVENT PARTICIPANTS TO SUPPORT MARKET GROWTH

-

8.3 MEDICALRAPID TECHNOLOGICAL ADVANCEMENTS IN MEDICAL FIELD TO BOOST DEMAND FOR VOLUMETRIC VIDEO TECHNOLOGY

-

8.4 SIGNAGE & ADVERTISEMENTINCREASING USE OF VOLUMETRIC VIDEOS TO SHOWCASE PRODUCTS AND SERVICES TO CONTRIBUTE TO MARKET GROWTH

-

8.5 EDUCATION & TRAININGNEED FOR INTERACTIVE LEARNING TO DRIVE DEMAND FOR VOLUMETRIC VIDEOS IN EDUCATION & TRAINING

- 8.6 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICARECESSION IMPACT ON MARKET IN NORTH AMERICAUS- Increasing focus on delivering immersive media experience to potential customers to drive marketCANADA- Rising consumer spending on sports, events, & entertainment programs to boost marketMEXICO- Recent structural reforms to drive market

-

9.3 EUROPERECESSION IMPACT ON MARKET IN EUROPEUK- Surging demand for AR/VR devices to drive marketGERMANY- Technological advancements in volumetric videos to offer major growth opportunitiesFRANCE- Intensive industrial infrastructure to boost demand for volumetric video technologyREST OF EUROPE

-

9.4 ASIA PACIFICRECESSION IMPACT ON MARKET IN ASIA PACIFICCHINA- Growing demand for extended reality technology to fuel marketJAPAN- Collaborations between volumetric capture providers and telecom companies to boost marketSOUTH KOREA- Developments in extended reality market in South Korea to drive demand for volumetric videosAUSTRALIA & NEW ZEALAND- Sports, events, & entertainment, and healthcare applications to dominate volumetric video market in Australia and New ZealandREST OF ASIA PACIFIC

-

9.5 ROWRECESSION IMPACT ON MARKET IN ROWSOUTH AMERICA- Growing adoption of holography in medical and biomedical research to boost marketMIDDLE EAST & AFRICA- Growing demand for volumetric video solutions in gaming and entertainment applications to drive market

- 10.1 OVERVIEW

-

10.2 STRATEGIES ADOPTED BY KEY PLAYERSOVERVIEW OF STRATEGIES FOLLOWED BY VOLUMETRIC VIDEO OEMS

- 10.3 REVENUE ANALYSIS OF TOP 5 COMPANIES IN VOLUMETRIC VIDEO MARKET, 2020–2022

- 10.4 MARKET SHARE ANALYSIS, 2022

-

10.5 COMPANY EVALUATION QUADRANTSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

10.6 STARTUPS/SMES EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.7 MARKET: COMPANY PRODUCT FOOTPRINT

-

10.8 STARTUPS/SMES EVALUATION MATRIXVOLUMETRIC VIDEO MARKET: LIST OF STARTUPS/SMESSTARTUPS/SMES MATRIX: DETAILED LIST OF KEY STARTUPS/SMES

-

10.9 COMPETITIVE SCENARIOS AND TRENDSDEALS

-

11.1 KEY PLAYERSMICROSOFT CORPORATION- Business overview- Products offered- Recent developments- MnM viewINTEL CORPORATION- Business overview- Products offered- Recent developments- MnM view4DVIEWS- Business overview- Products offered- Recent developments- MnM view8I- Business overview- Products offered- Recent developments- MnM viewUNITY TECHNOLOGIES- Business overview- Products offered- Recent developments- MnM viewALPHABET, INC.- Business overview- Products offered- Recent developmentsSCATTER (DEPTHKIT)- Business overview- Products offeredSTEREOLABS INC.- Business overview- Products offered- Recent developmentsMARK ROBERTS MOTION CONTROL (MRMC)- Business overview- Products offered- Recent developmentsMETASTAGE- Business overview- Products offered- Recent developments

-

11.2 OTHER KEY PLAYERSMETA PLATFORMS, INC.MOD TECH LABS, INC.SONY CORPORATIONCANON INC.DIMENSION STUDIOEVERCOASTVIVIDQCORETEC GROUPVOXON PHOTONICSHOLOXICAVOLUCAPVOLOGRAMS LTD.HUMENSE PTY LTDDOUBLEMEMANTIS VISION LTD.ATOMONTAGESCANDY CO.DGENETETAVIARCTURUS STUDIOS HOLDINGS, INC.RAYTRIX GMBHMAGIC LEAP, INC.

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 RISK FACTOR ANALYSIS

- TABLE 2 RECESSION IMPACT ANALYSIS PARAMETERS

- TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM/VALUE CHAIN

- TABLE 4 VOLUMETRIC VIDEO MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 7 AVERAGE SELLING PRICE OF VOLUMETRIC VIDEO CAMERAS, BY APPLICATION (USD)

- TABLE 8 ASP TRENDS OF VOLUMETRIC CAMERA SYSTEMS

- TABLE 9 LIST OF KEY PATENTS IN MARKET, 2021–2023

- TABLE 10 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 11 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 12 MFN TARIFF FOR PRODUCTS EXPORTED BY US UNDER HS CODE 852580

- TABLE 13 MFN TARIFF FOR PRODUCTS EXPORTED BY CHINA UNDER HS CODE 852580

- TABLE 14 MFN TARIFF FOR PRODUCTS EXPORTED BY INDIA UNDER HS CODE 852580

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, A ND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 VOLUMETRIC VIDEO SYSTEMS MARKET: LIST OF MAJOR CONFERENCES AND EVENTS

- TABLE 20 VOLUMETRIC VIDEO MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 21 MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 22 VOLUMETRIC CAPTURE: MARKET, BY HARDWARE COMPONENT, 2019–2022 (USD MILLION)

- TABLE 23 VOLUMETRIC CAPTURE: MARKET, BY HARDWARE COMPONENT, 2023–2028 (USD MILLION)

- TABLE 24 VOLUMETRIC CAPTURE: MARKET, BY HARDWARE COMPONENT, 2019–2022 (THOUSAND UNITS)

- TABLE 25 VOLUMETRIC CAPTURE: MARKET, BY HARDWARE COMPONENT, 2023–2028 (THOUSAND UNITS)

- TABLE 26 VOLUMETRIC CAPTURE: MARKET FOR HARDWARE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 27 VOLUMETRIC CAPTURE: MARKET FOR HARDWARE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 VOLUMETRIC CAPTURE: MARKET FOR HARDWARE, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 29 VOLUMETRIC CAPTURE: MARKET FOR HARDWARE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 30 VOLUMETRIC CAPTURE: MARKET FOR HARDWARE IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 31 VOLUMETRIC CAPTURE: VOLUMETRIC VIDEO MARKET FOR HARDWARE IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 32 VOLUMETRIC CAPTURE: MARKET FOR HARDWARE IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 33 VOLUMETRIC CAPTURE: MARKET FOR HARDWARE IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 34 VOLUMETRIC CAPTURE: MARKET FOR HARDWARE IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 35 VOLUMETRIC CAPTURE: MARKET FOR HARDWARE IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 36 VOLUMETRIC CAPTURE: MARKET FOR HARDWARE IN ROW, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 VOLUMETRIC CAPTURE: MARKET FOR HARDWARE IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 VOLUMETRIC CAPTURE: MARKET FOR SOFTWARE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 VOLUMETRIC CAPTURE: MARKET FOR SOFTWARE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 VOLUMETRIC CAPTURE: MARKET FOR SOFTWARE, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 41 VOLUMETRIC CAPTURE: MARKET FOR SOFTWARE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 42 VOLUMETRIC CAPTURE: VOLUMETRIC VIDEO MARKET FOR SOFTWARE IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 43 VOLUMETRIC CAPTURE: MARKET FOR SOFTWARE IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 44 VOLUMETRIC CAPTURE: MARKET FOR SOFTWARE IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 45 VOLUMETRIC CAPTURE: MARKET FOR SOFTWARE IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 46 VOLUMETRIC CAPTURE: MARKET FOR SOFTWARE IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 47 VOLUMETRIC CAPTURE: MARKET FOR SOFTWARE IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 48 VOLUMETRIC CAPTURE: MARKET FOR SOFTWARE IN ROW, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 VOLUMETRIC CAPTURE: MARKET FOR SOFTWARE IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 VOLUMETRIC CAPTURE: MARKET FOR SERVICES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 51 VOLUMETRIC CAPTURE: VOLUMETRIC VIDEO MARKET FOR SERVICES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 VOLUMETRIC CAPTURE: MARKET FOR SERVICES, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 53 VOLUMETRIC CAPTURE: MARKET FOR SERVICES, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 54 VOLUMETRIC CAPTURE: MARKET FOR SERVICES IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 55 VOLUMETRIC CAPTURE: MARKET FOR SERVICES IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 56 VOLUMETRIC CAPTURE: MARKET FOR SERVICES IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 57 VOLUMETRIC CAPTURE: MARKET FOR SERVICES IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 58 VOLUMETRIC CAPTURE: MARKET FOR SERVICES IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 59 VOLUMETRIC CAPTURE: MARKET FOR SERVICES IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 60 VOLUMETRIC CAPTURE: MARKET FOR SERVICES IN ROW, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 VOLUMETRIC CAPTURE: MARKET FOR SERVICES IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 VOLUMETRIC VIDEO MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 63 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 64 SPORTS, EVENTS, & ENTERTAINMENT: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 65 SPORTS, EVENTS, & ENTERTAINMENT: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 66 MEDICAL: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 67 MEDICAL: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 68 SIGNAGE & ADVERTISEMENT: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 69 SIGNAGE & ADVERTISEMENT: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 70 EDUCATION & TRAINING: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 71 EDUCATION & TRAINING: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 72 OTHER APPLICATIONS: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 73 OTHER APPLICATIONS: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 74 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 75 VOLUMETRIC VIDEO MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 80 US: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 81 US: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 82 CANADA: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 83 CANADA: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 84 MEXICO: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 85 MEXICO: VOLUMETRIC VIDEO MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 87 EUROPE: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 89 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 90 UK: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 91 UK: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 92 GERMANY: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 93 GERMANY: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 94 FRANCE: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 95 FRANCE: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 96 REST OF EUROPE: VOLUMETRIC VIDEO MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 97 REST OF EUROPE: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 102 CHINA: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 103 CHINA: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 104 JAPAN: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 105 JAPAN: VOLUMETRIC VIDEO MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 106 SOUTH KOREA: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 107 SOUTH KOREA: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 108 AUSTRALIA & NEW ZEALAND: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 109 AUSTRALIA & NEW ZEALAND: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 111 REST OF ASIA PACIFIC: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 112 ROW: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 113 ROW: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 114 ROW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 115 ROW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 116 SOUTH AMERICA: VOLUMETRIC VIDEO MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 117 SOUTH AMERICA: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: MARKET, BY VOLUMETRIC CAPTURE, 2019–2022 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: MARKET, BY VOLUMETRIC CAPTURE, 2023–2028 (USD MILLION)

- TABLE 120 MARKET: DEGREE OF COMPETITION

- TABLE 121 PRODUCT FOOTPRINT OF COMPANIES

- TABLE 122 APPLICATION FOOTPRINT OF COMPANIES

- TABLE 123 REGION FOOTPRINT OF COMPANIES

- TABLE 124 VOLUMETRIC CAPTURE FOOTPRINT OF COMPANIES

- TABLE 125 VOLUMETRIC VIDEO MARKET: LIST OF STARTUPS/SMES

- TABLE 126 STARTUPS/SMES MATRIX: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 127 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY APPLICATION

- TABLE 128 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION

- TABLE 129 MARKET: DEALS, 2020–2023

- TABLE 130 MARKET: PRODUCT LAUNCHES, 2020–2022

- TABLE 131 VOLUMETRIC VIDEO MARKET: OTHERS, 2023

- TABLE 132 MICROSOFT CORPORATION: COMPANY OVERVIEW

- TABLE 133 MICROSOFT CORPORATION: PRODUCT OFFERINGS

- TABLE 134 MICROSOFT CORPORATION: DEALS

- TABLE 135 MICROSOFT CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 136 MICROSOFT CORPORATION: OTHERS

- TABLE 137 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 138 INTEL CORPORATION: PRODUCT OFFERINGS

- TABLE 139 INTEL CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 140 INTEL CORPORATION: DEALS

- TABLE 141 4DVIEWS: COMPANY OVERVIEW

- TABLE 142 4DVIEWS: PRODUCT OFFERINGS

- TABLE 143 4DVIEWS: DEALS

- TABLE 144 8I: COMPANY OVERVIEW

- TABLE 145 8I: PRODUCT OFFERINGS

- TABLE 146 8I: DEALS

- TABLE 147 8I: PRODUCT LAUNCHES

- TABLE 148 UNITY TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 149 UNITY TECHNOLOGIES: PRODUCT OFFERINGS

- TABLE 150 UNITY TECHNOLOGIES: DEALS

- TABLE 151 ALPHABET, INC.: COMPANY OVERVIEW

- TABLE 152 ALPHABET, INC.: PRODUCT OFFERINGS

- TABLE 153 ALPHABET, INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 154 SCATTER (DEPTHKIT): COMPANY OVERVIEW

- TABLE 155 SCATTER (DEPTHKIT): PRODUCT OFFERINGS

- TABLE 156 STEREOLABS INC.: COMPANY OVERVIEW

- TABLE 157 STEREOLABS INC.: PRODUCT OFFERINGS

- TABLE 158 STEREOLABS INC: PRODUCT LAUNCHES

- TABLE 159 MARK ROBERTS MOTION CONTROL (MRMC): COMPANY OVERVIEW

- TABLE 160 MARK ROBERTS MOTION CONTROL (MRMC): PRODUCT OFFERINGS

- TABLE 161 MARK ROBERTS MOTION CONTROL (MRMC): DEALS

- TABLE 162 MARK ROBERTS MOTION CONTROL (MRMC): PRODUCT LAUNCHES

- TABLE 163 METASTAGE: COMPANY OVERVIEW

- TABLE 164 METASTAGE: PRODUCT OFFERINGS

- TABLE 165 METASTAGE: DEALS

- TABLE 166 METASTAGE: PRODUCT LAUNCHES

- FIGURE 1 VOLUMETRIC VIDEO MARKET SEGMENTATION

- FIGURE 2 GDP GROWTH PROJECTION UNTIL 2023 FOR MAJOR ECONOMIES WORLDWIDE

- FIGURE 3 MARKET: RESEARCH DESIGN

- FIGURE 4 SECONDARY AND PRIMARY RESEARCH

- FIGURE 5 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE FROM SALES OF VOLUMETRIC VIDEO PRODUCTS AND SOLUTIONS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 HARDWARE SEGMENT TO DOMINATE MARKET, BY VOLUMETRIC CAPTURE, DURING FORECAST PERIOD

- FIGURE 11 SIGNAGE & ADVERTISEMENT SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 INCREASING DEMAND FOR 3D/360° CONTENT IN ENTERTAINMENT SECTOR TO DRIVE MARKET

- FIGURE 14 US AND HARDWARE SEGMENT TO HOLD LARGEST SHARE OF NORTH AMERICAN VOLUMETRIC VIDEO MARKET IN 2023

- FIGURE 15 SPORTS, EVENTS, & ENTERTAINMENT SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 MARKET DYNAMICS: VOLUMETRIC VIDEO MARKET

- FIGURE 18 MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 19 MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 20 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 21 MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 22 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 MARKET: KEY PLAYERS

- FIGURE 24 VOLUMETRIC VIDEO MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 26 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 27 REVENUE SHIFT FOR PLAYERS IN MARKET

- FIGURE 28 AVERAGE SELLING PRICE OF VOLUMETRIC VIDEO CAMERAS FOR TOP 3 APPLICATIONS

- FIGURE 29 NUMBER OF PATENTS GRANTED IN MARKET, 2012–2022

- FIGURE 30 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 31 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 32 SERVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 SPORTS, EVENTS, & ENTERTAINMENT APPLICATIONS TO HOLD MAJORITY OF MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 34 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: VOLUMETRIC VIDEO MARKET SNAPSHOT

- FIGURE 36 EUROPE: MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 38 THREE-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN MARKET

- FIGURE 39 MARKET SHARES OF LEADING PLAYERS IN MARKET, 2022

- FIGURE 40 MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 41 VOLUMETRIC VIDEO MARKET: STARTUPS/SMES EVALUATION QUADRANT, 2022

- FIGURE 42 MICROSOFT CORPORATION: COMPANY SNAPSHOT

- FIGURE 43 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 UNITY TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 45 ALPHABET, INC.: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the volumetric video market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of Primary and Secondary Sources

|

SOURCE |

WEB LINK |

|

CIPA - Camera & Imaging Products Association |

|

|

Digital Advertising Alliance |

|

|

Volumetric Format Association |

|

|

IDEA - Information Display & Entertainment Association |

|

|

VR/AR Association |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the volumetric video market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the volumetric video market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

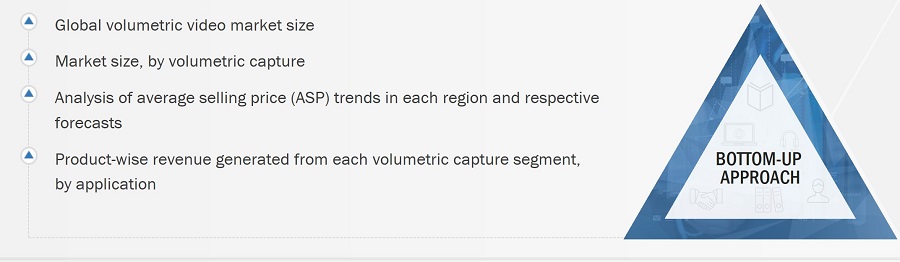

Bottom-Up Approach

The bottom-up approach was used to determine the overall size of the volumetric video market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the gains of the key players identified in the market.

- Identifying various applications using or expected to implement the volumetric video solutions

- Analyzing each application, along with the significantly related companies and volumetric video hardware and software providers, and identifying service providers for implementing 3D technologies.

- Estimating the volumetric video market for applications

- Understanding the demand generated by companies operating across different applications.

- Tracking projects' ongoing and upcoming implementation based on the volumetric video by applications and forecasting the market based on these developments and other critical parameters.

- Studying various paid and unpaid sources, such as annual reports, press releases, white papers, and databases

- Tracking ongoing and upcoming developments in the market, such as investments, R&D activities, product launches, collaborations, and partnerships, and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand the volumetric capture technologies, related raw materials, and products designed and developed, thereby analyzing the break-up of the scope of work carried out by major volumetric video device manufacturers and software solution providers.

- Verifying and cross-checking the estimates at every level via discussions with key opinion leaders, such as CXOs, directors, and operations managers, and finally with the domain experts at MarketsandMarkets

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

The most appropriate immediate parent market size has been used to implement the top-down approach to calculate the market size of specific segments. The top-down approach was implemented for the data extracted from the secondary research to validate the market size obtained.

Each company’s market share was estimated to verify the revenue shares used earlier in the top-down approach. The data triangulation method and data validation through primaries determined and confirmed the overall parent and individual market sizes in this study. The data triangulation method in this study is explained in the next section.

- Arriving at market estimates by analyzing the revenues generated by volumetric video hardware manufacturers in different countries

- Focusing on the top-line investments and expenditures in the ecosystem of the volumetric video market

- Calculating the market size considering the revenue generated by market players through the sale of volumetric video devices for the hardware market and through apps for the software market

- Identifying further splits considering R&D activities and prominent developments in key market areas

- Gathering and analyzing the information related to the revenue generated by players offering volumetric capture hardware equipment

- Conducting multiple on-field discussions with key opinion leaders across the major companies involved in the development of volumetric capture

- Estimating the geographic split using secondary sources—based on factors such as the number of players in a specific country as well as region and types of products used in application areas such as medical, sports, events, and entertainment; signage & advertisement; education & training; and others

Data Triangulation

After arriving at the overall size of the volumetric video market from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all parts and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using top-down and bottom-up approaches.

Market Definition

A volumetric video is a technique used to capture and display three-dimensional (3D) video content of real-world objects or people. It aims to provide a more immersive and realistic viewing experience by capturing not only the surface appearance of the subjects but also their depth and volumetric details. Traditionally, video is captured using cameras that record a two-dimensional scene representation. In contrast, volumetric video involves using an array of cameras or specialized sensors to capture multiple viewpoints simultaneously, covering an entire 360-degree field of view. These cameras capture the subject from different angles, allowing for the reconstruction of a 3D representation of the issue.

Key Stakeholders

- Developers/vendors of AR/VR devices

- Content creators

- Suppliers of raw materials and manufacturing equipment

- Semiconductor foundries

- Original equipment manufacturers (OEMs)

- Product manufacturers

- Solution providers of ODM and OEM technologies

- Research organizations

- Technology standards organizations, forums, alliances, and associations

- Technology investors

- Governments, financial institutions, and investor communities

- Analysts and strategic business planners

Report Objectives

- To describe and forecast the volumetric video market size, in terms of value, by volumetric capture, and application

- To define and forecast the market size, in terms of value, across four key regions: North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To describe and forecast the market for volumetric capture hardware in terms of volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges of the market

- To strategically analyze micro markets with respect to the individual growth trends, prospects, and their contributions to the overall market

- To strategically profile key market players and comprehensively analyze their market share and core competencies

- To provide a detailed overview of the market’s value chain and ecosystem

- To provide a detailed overview of technology trends, average selling price trends, regulations, and trade analysis about the market

- To analyze competitive developments such as contracts, acquisitions, product launches and developments, collaborations, partnerships, and research & development (R&D) activities in the market

- To analyze the impact of the recession on the volumetric video market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Further country-level analysis of the volumetric video market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the volumetric video market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Volumetric Video Market