Virtual Retinal Display Market by End-User Industry (Aviation & Tactical, Engineering, Medical, Gaming & Entertainment, Sports, Training & Development, and Others) and Geography - Trends and Forecast to 2016 - 2025

The virtual retina display market is expected to be commercialized in 2016. The total market is expected reach USD 66.60 Million by 2025, at a CAGR of 45.28% between 2016 and 2025. The market is segmented based on end-user industries and geography. The demand in the gaming & entertainment industry is expected to drive the market growth in all regions– North America, Europe, APAC, and RoW. The market in the sports industry is expected to grow at the highest CAGR between 2016 and 2025 because of the initiatives undertaken for using VRD technology with augmented reality and virtual reality to increase popularity and interest of viewers, and provide real-time data to players and coaches. The North American market is expected to hold the largest share and grow at a high CAGR between 2016 and 2025. The market growth would be driven by the early adoption of VRD technology in the gaming & entertainment industry, fueled by delivering high resolution picture quality to applications based on augmented reality and virtual reality. The market in APAC is expected to grow at the highest CAGR between 2016 and 2025 because of the fast penetration of VRD technology in gaming & entertainment and engineering industries.

The virtual retinal display (VRD) technology is expected to commercialize in 2016 and expected to be worth USD 2.30 million in 2016. The VRD market is expected to grow at a CAGR of 45.28% between 2016 and 2025. The growth in the market is expected to be driven by the need for lightweight, portable wearable devices that can provide the required data to users in real-time.

Out of the major end-user industries that would adopt this technology, markets in sports and engineering are expected to grow at a high CAGR, from the year of adoption to 2025. The fast growth of virtual retinal display technology in sports can be attributed to the focus of suppliers on growing interest of users to watch matches with close-ups and detailing; it is also useful for coaches and referees/umpires to make quick decisions in real-time. The growth in the engineering industry will be driven by the need for optimizing resource utilization by providing field staff with essential data related to specific operations such as circuit schematics and operational procedures in real-time.

In terms of geography, APAC, followed by North America are expected to witness high growth of this market between 2016 and 2025. The high growth in APAC can be attributed to the applications of virtual reality and augmented reality across industries such as engineering and medical in the region, while the North American market growth will be driven by the presence of virtual retinal display technology providers in the region and initiatives taken by them to provide feature-rich products to sustain in the increased competitive environment.

Among end-user industries, the application in gaming & entertainment is expected to hold the largest share of the market for virtual reality and augmented reality. In regions, North America is estimated to hold the largest market share of the virtual retinal display technology because of the presence of local providers and value-driven market in gaming & entertainment.

The virtual retinal display market is expected to commercialize in 2016 and grow at a moderate CAGR. This low penetration rate would be the result of certain restraints in usage as current devices once mounted on a user’s head cover the eyes; therefore, these would be difficult to use in public places. Also, it could divert the attention of a user in end-user industries such as medical and engineering. However, with gradual acceptance and realization of benefits of wearable electronics in IoT applications, the virtual retinal display technology would find applications in various end-user industries and achieve significant growth by 2020.

Microvision Inc. (U.S.) and Avengant Corp. (U.S.) are expected to be forerunners in commercialization of VRDs. Microvision is jointly working with HIT laboratories (U.S.) i to develop commercial applications and Avegant (U.S.) is set to commercialize its Glyph, a wearable headset with a capability to deliver content in audio and video formats by 2016. The company is using its own website to pre-book orders from across the globe.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.3.3 Currency

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Introduction

2.2 Virtual Retinal Display Market Size Estimation

2.3 Virtual Retinal Display Market Breakdown & Data Triangulation

2.4 Virtual Retinal Display Market Share Estimation

2.4.1 Key Data Points Taken From Secondary Sources

2.4.2 Key Data Points From Primary Sources

2.4.3 Key Industry Insights

2.5 Market Breakdown & Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Growth Drivers for the Virtual Retinal Display Market

4.2 VRD Market – Comparison of Four Geogrpahic Regions

4.3 North American VRD Market

4.4 Gaming & Entertainment Industry Expected to Be the Largest End-User Industry in the VRD Market Between 2016 and 2025

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Virtual Retinal Display Market, By End-User Industry

5.2.2 Virtual Retinal Display Market, By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Fast Growing Virtual Reality and Augmented Reality Applications in Gaming, Entertainment, and Other End-User Industries

5.3.1.2 Potential of VRDs to Address Constraints Related to Portability- and Space Requirement of Screen-Based Displays

5.3.1.3 Features Such as Greater Clarity, Low Manufacturing Cost, and Reduced Power Consumption Could Help VRDs Reduce Screen-Based Displays Used By an Individual

5.3.1.4 Complete Privacy Can Be Achieved By Using VRD

5.3.2 Restraints

5.3.2.1 Potential Hazards of Scanning the Laser Light Directly Onto A Human Eye

5.3.2.2 Difficulties in Interpersonal Communication Due to Covered Eyes

5.3.3 Opportunities

5.3.3.1 Demand for Products That Consume Less Power

5.3.3.2 Growing Need of Online Personal Assistance Amongst Smartphone Users

5.3.3.3 Reducing the Number of Screens Used By an Individual

5.3.4 Challenges

5.3.4.1 Development of A Virtual Retinal Display That is Suitable for All Weather Conditions

6 Industry Trends (Page No. - 41)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Emerging Trends

7 Global Virtual Retinal Display Market, By End-User Industry (Page No. - 44)

7.1 Introduction

7.2 Aviation & Tactical

7.3 Engineering

7.4 Medical

7.5 Gaming & Entertainment

7.6 Sports

7.7 Training & Simulation

7.8 Others

8 Global Virtual Retianl Display Market, By Geography (Page No. - 73)

8.1 Introduction

8.2 North America

8.3 Europe

8.4 Asia-Pacific

8.5 RoW

9 Competitive Landscape (Page No. - 87)

9.1 Overview

9.2 Ranking Analysis, Virtual Retinal Displays Market in 2016

9.3 Significant Developments in Visual Retinal Displays Market

10 Company Profiles (Page No. - 92)

10.1 Introduction

10.2 Avegant Corporation

10.2.1 Business Overview

10.2.2 Products

10.2.3 Recent Developments

10.2.4 MnM View

10.2.4.1 Key Strategies

10.3 Microvision Inc.

10.3.1 Business Overview

10.3.2 Products

10.3.3 Recent Developments

10.3.4 MnM View

10.3.4.1 Key Strategies

10.3.4.2 SWOT Analysis

10.4 Texas Instruments

10.4.1 Business Overview

10.4.2 Products

10.4.3 Recent Developments

10.4.4 MnM View

10.4.4.1 Key Strategies

10.4.4.2 SWOT Analysis

10.5 Human Interface Technology Laboratory

10.5.1 Business Overview

10.5.2 Research Projects

10.5.3 Recent Developments

10.5.4 MnM View

10.5.4.1 Key Strategies

10.6 Google Inc.

10.6.1 Business Overview

10.6.2 Products

10.6.3 Recent Developments

10.6.4 MnM View

10.6.4.1 Key Strategies

10.6.4.2 SWOT Analysis

11 Appendix (Page No. - 109)

11.2 Discussion Guide

11.3 Introducing RT: Real Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

List of Tables (41 Tables)

Table 1 Fast-Growing Virtual Reality and Augmented Realty Applications in Gaming & Entertainment and Other End User Industriesexpected to Propel the Growth of the Virtual Retinal Display Market

Table 2 Potential Hazards of Scanning the Laser Light Directly Onto Human Eye Would Be A Restraint for Virtual Retinal Display Market

Table 3 Growing Need of Online Personal Assistance Amongst Smartphone Users is A Huge Opportunity for the Virtual Retinal Display Market

Table 4 Development of A Virtual Retinal Display Suitable for All Weather Conditions

Table 5 Increasing Application Areas are Driving the Virtual Retinal Display Market

Table 6 Virtual Retinal Display Market Size, By End-User Industry, 2016–2025 (USD Thousand)

Table 7 Aviation & Tactical Industry Market Size for VRD, By Region, 2022–2025 (USD Thousand)

Table 8 North American Aviation & Tactical Industry Market Size for VRD, By Country, 2022–2025 (USD Thousand)

Table 9 European Aviation & Tactical Industry Market Size for VRD, By Country, 2022–2025 (USD Thousand)

Table 10 APAC Aviation & Tactical Industry Market Size for VRD, By Country, 2022–2025 (USD Thousand)

Table 11 Engineering Industry Market Size for VRD, By Region, 2020–2025 (USD Thousand)

Table 12 North American Engineering Industry Market Size for VRD, By Country, 2022–2025 (USD Thousand)

Table 13 European Engineering Industry Market Size, By Country, 2022–2025 (USD Thousand)

Table 14 APAC Engineering Industry Market Size for VRD, By Country, 2022–2025 (USD Thousand)

Table 15 Medical Industry Market Size, By Region, 2021–2025 (USD Thousand)

Table 16 North American Medical Industry Market Size, By Country, 2021–2025 (USD Thousand)

Table 17 European Medical Industry Market Size, By Country, 2021–2025 (USD Thousand)

Table 18 APAC Medical Industry Market Size, By Country, 2021–2025 (USD Thousand)

Table 19 Gaming & Entertainment Industry Market Size, By Region, 2016–2025 (USD Thousand)

Table 20 North American Gaming & Entertainment Industry Market Size, By Country, 2016–2025 (USD Thousand)

Table 21 European Gaming & Entertainment Industry Market Size, By Country, 2016–2025 (USD Thousand)

Table 22 APAC Gaming & Entertainment Industry Market Size, By Country, 2016–2025 (USD Thousand)

Table 23 Sports Industry Market Size, By Region, 2019–2025 (USD Thousand)

Table 24 North American Sports Industry Market Size, By Country, 2019–2025 (USD Thousand)

Table 25 European Sports Industry Market Size, By Country, 2019–2025 (USD Thousand)

Table 26 APAC Sports Industry Market Size, By Country, 2019–2025 (USD Thousand)

Table 27 Training & Simulation Industry Market Size, By Region, 2018–2025 (USD Thousand)

Table 28 North American Training & Simulation Industry Market Size, By Country, 2018–2025 (USD Thousand)

Table 29 European Training & Simulation Industry Market Size, By Country, 2018–2025 (USD Thousand)

Table 30 APAC Training & Simulation Industry Market Size, By Country, 2018–2025 (USD Thousand)

Table 31 Other Industries Market Size, By Region, 2020–2025 (USD Thousand)

Table 32 North American Other Industries Market Size, By Country, 2020–2025 (USD Thousand)

Table 33 European Other Industries Market Size, By Country, 2020–2025 (USD Thousand)

Table 34 APAC Other Industries Market Size, By Country, 2020–2025 (USD Thousand)

Table 35 Global Virtual Retinal Display Market, By Region, 2016–2025 (USD Thousand)

Table 36 North America: Virtual Retinal Display Market, By End-User Industry, 2016–2025 (USD Thousand)

Table 37 Europe: Virtual Retinal Display Market, By End-User Industry, 2016–2025 (USD Thousand)

Table 38 Asia-Pacific: Virtual Retinal Display Market, By End-User Industry, 2016–2025 (USD Thousand)

Table 39 RoW: Virtual Retinal Display Market, By End-User Industry, 2016–2025 (USD Thousand)

Table 40 Avegant Technologies Expected to Lead the Visual Retinal Display Market in 2016

Table 41 Significant Developments

List of Figures (34 Figures)

Figure 1 Virtual Retinal Display Market Covered

Figure 2 Virtual Retinal Display Market: Research Design

Figure 3 Research Methodology

Figure 4 Virtual Retinal Display Market Size Estimation Methodology: Bottom-Up Approach

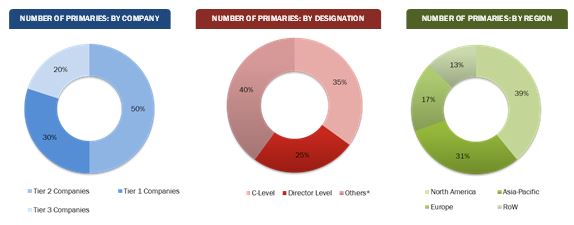

Figure 5 Breakdown of Primary Interviewsbreakdown of Primary Interviews

Figure 6 Virtual Retinal Display Market Breakdown & Data Triangulation

Figure 1 Gaming & Entertainment Industry Expected to Dominate the Overall Virtual Retinal Display Market During 2016–2025

Figure 2 Global Virtual Retinal Display Market, By Region, 2016

Figure 3 Gaming & Entertainment Industry Expected to Drive the Virtual Retinal Display Market Between 2016 and 2025

Figure 4 APAC to Grow at A Higher Rate Between 2016 and 2025

Figure 5 U.S. Would Hold the Largest Share of the North American VRD Market By 2022

Figure 6 North America Would Hold the Largest Share of Most of the End-User Industries

Figure 7 By Geography

Figure 8 Fast-Growing Virtual Reality (VR) and Augmented Reality (AR) Applications in Various End-User Industries Including Gaming and Entertainment Expected to Spur the Demand for Virtual Retinal Display

Figure 9 Value Chain Analysis (2015): Major Value is Added During R&D and Manufacturing Phases

Figure 10 Virtual Retinal Display Market By End-User Industry

Figure 11 Year of Adoption of VRD By End-User Industries and Potential Driving Factors

Figure 12 Sports to Witness the Highest Growth Rate in the VRD Market Between 2019 and 2025

Figure 13 APAC to Witness the Highest Growth Rate in the Aviation & Tactical Industry Between 2022 and 2025 (USD Thousand)

Figure 14 APAC Would Hold the Largest Market Share of the Engineering Industry Between 2022 and 2025 (USD Thousand)

Figure 15 North America to Hold the Largest Market Share in Medical Industry Between 2021 and 2025 (USD Thousand)

Figure 16 APAC to Grow at the Highest CAGR in Gaming & Entertainment Industry Between 2016 and 2025 (USD Thousand)

Figure 17 North America to Grow at the Highest CAGR in Sports Industry Between 2019 and 2025 (USD Thousand)

Figure 18 North America to Hold the Largest Share in Training & Simulation Industry Between 2018 and 2025 (USD Thousand)

Figure 19 North America to Grow at the Highest CAGR in Other Industries Between 2020 and 2025 (USD Thousand)

Figure 20 Geographic Snapshot (2016-2025) –Markets in North America and APAC Expected to Grow Rapidly

Figure 21 Asia-Pacific– an Attractive Destination for All End-User Industries of the Virtual Retinal Display Technology

Figure 22 Asia-Pacific to Witness Highest Growth Between 2016 and 2025

Figure 23 North America: Market With Respect to End User Industries

Figure 24 Virtual Retinal Display Market for Sports in Europe Expected to Grow at the Highest CAGR Between 2016 and 2025

Figure 25 Virtual Retinal Display Market in the Engineering Industry in Asia-Pacific to Grow at the Highest Rate in Between 2020 and 2025

Figure 26 Application in the Gaming & Entertainment Industry Expected to Hold the Largest Share in 2016

Figure 27 Avegant Corporation : Company Snapshot

Figure 28 Microvision Inc: Company Snapshot

Figure 29 Microvision Inc: SWOT Analysis

Figure 30 Texas Instruments: Company Snapshot

Figure 31 Texas Instruments: SWOT Analysis

Figure 32 Human Interface Technology Laboratory : Company Snapshot

Figure 33 Google Inc: Company Snapshot

Figure 34 Google Inc: SWOT Analysis

The research methodology used to estimate and forecast the virtual retinal display market began with gathering data related to the revenue of existing companies through the secondary research. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the global virtual retinal display market from the estimated revenue of e existing key players. After arriving at the overall market size, the total market has been split into several segments and sub-segments and then verified through the primary research by conducting extensive interviews with people holding key positions such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The breakdown of profiles of primaries is depicted in the below figure

To know about the assumptions considered for the study, download the pdf brochure

The virtual retinal display ecosystem comprises research & development laboratories, major display companies, start-up companies working on the technology, distributors and end-user industries that implement these systems.

Key Target Audience

- Display technology vendors

- Start-up companies in display technology

- Venture capitalists

- Investment houses

- Consulting firms

- End-user industry players

Scope of the Report:

The research report segments the virtual retinal display market to following submarkets

By end-user industry:

- Aviation & Tactical

- Engineering

- Medical

- Gaming & Entertainment

- Sports

- Training & simulation

- Others

By geography:

- North America

- Europe

- Asia-Pacific

- RoW.

Available customizations:

- Detailed analysis and profiling of additional market players (Upto Five)

Growth opportunities and latent adjacency in Virtual Retinal Display Market