Video Measuring System Market Size, Share by Product Type (Manual, Semi-Automated, Automated), Application (Automotive, Aerospace & Defense, Heavy Machinery, Energy & Power, Electronics, Medical), Offering, And Geography - Global Forecast to 2025-2035

Video Measuring System Market 2025 to 2035 Overview

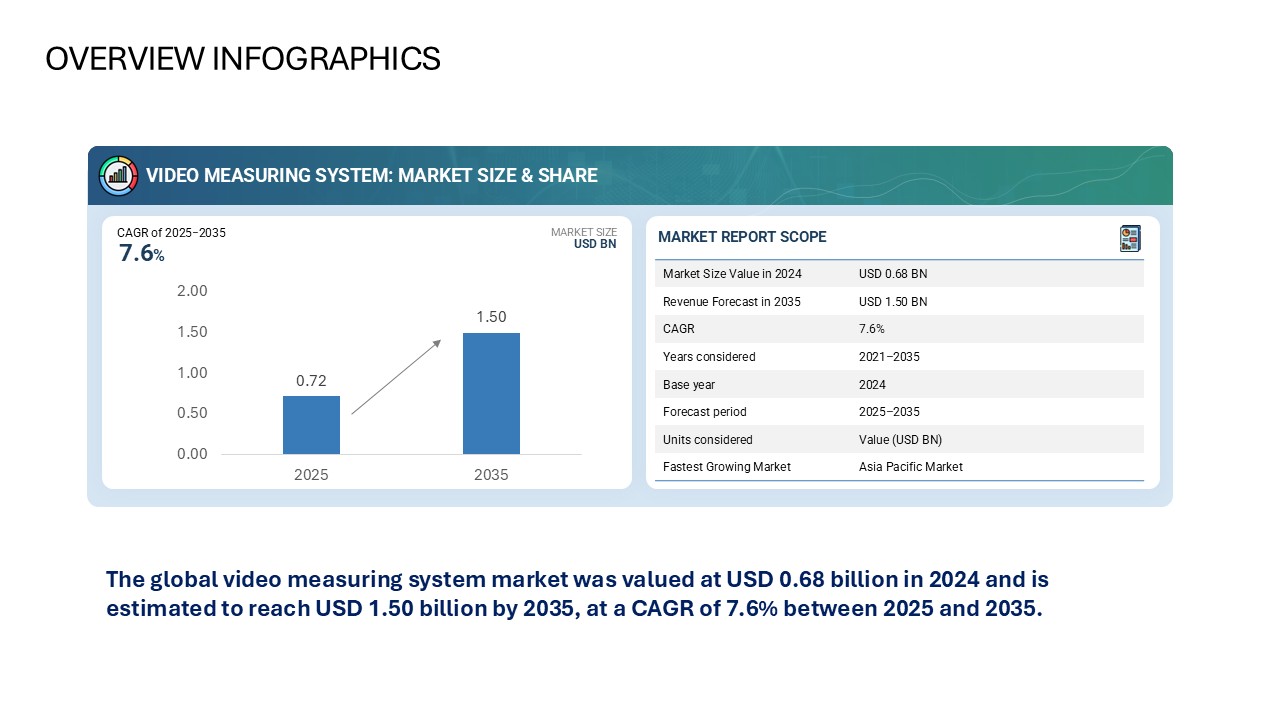

The global video measuring system market was valued at USD 0.68 billion in 2024 and is estimated to reach USD 1.50 billion by 2035, at a CAGR of 7.6% between 2025 and 2035.

The video measuring system market plays a critical role in modern manufacturing and quality assurance by providing accurate optical measurement solutions that support non contact dimensional analysis. These systems combine high resolution imaging, precision optics, motion control, and specialized software to measure complex parts and assemblies with speed and repeatability. Demand for video measuring systems is increasing across sectors that require strict tolerances and traceability including automotive aerospace electronics and medical device manufacturing.

Market Outlook 2025 to 2035

Market forecasts for video measuring systems vary by source but they consistently indicate sustained growth through the next decade as manufacturers pursue higher throughput and better quality control. Several market research reports project expansion driven by automation trends adoption of advanced materials and increasing requirements for precise dimensional inspection. The market is expected to expand significantly between 2025 and 2035 as the adoption of automated inspection solutions accelerates in high precision industries.

Key Market Drivers

Primary drivers of growth include the rising need for improved inspection accuracy and throughput the trend toward automated manufacturing and the requirement to reduce scrap and rework. Increasing complexity of components in sectors such as automotive aerospace and electronics has pushed manufacturers to deploy optical measurement systems that deliver consistent results while minimizing contact based measurement errors. In addition regulatory and certification requirements in medical and aerospace industries continue to drive investment in validated measurement equipment.

Technological Trends

Video measuring systems are evolving with improvements in sensor resolution optics and software algorithms. Advancements in image processing and machine learning support faster and more reliable feature recognition and edge detection. Integration of multi sensor inspection workflows that combine optical, laser and coordinate measurement technologies is becoming more common to handle complex measurement tasks. Connectivity enhancements enable data capture and analytics for statistical process control and predictive maintenance.

Product Type Segmentation

From a product perspective the market is segmented into manual semi automated and automated video measuring systems. Manual units remain relevant for bench top inspection tasks and small scale operations where flexibility and lower capital cost matter. Semi automated systems provide a middle ground offering programmable routines combined with some manual control which suits batch production environments. Fully automated systems are increasingly demanded in high volume production lines where integration with manufacturing execution systems and robot based handling yields continuous inspection and reduced human intervention.

Manual Systems Market Dynamics

Manual video measuring systems are valued for their cost effectiveness and simple operation in low volume and prototype environments. They are widely used by small and medium sized enterprises and research institutions where versatility and quick setup are priorities. Manual systems typically include optics lighting and user friendly software that supports point to point measurement and basic reporting. Because they do not require extensive integration they are easier to deploy but they do not scale well for continuous automated production.

Semi Automated Systems Market Dynamics

Semi automated systems bridge the gap between manual and full automation by offering programmable measurement routines automated stage motion and optional vision based guidance. They are commonly deployed in medium throughput production lines and in quality laboratories where a balance of flexibility and repeatable performance is required. The semi automated segment benefits from modular upgrades that let customers add automated stages higher resolution optics or software packages as needs evolve.

Automated Systems Market Dynamics

Automated video measuring systems represent the fastest moving segment as industries aim to eliminate bottlenecks and achieve zero defect production. These systems integrate robotic part handling programmable measurement sequences and networked software to operate with minimal human oversight. They are designed for high throughput environments such as automotive component manufacturing and electronic assembly. Automated systems often feature enhanced traceability security and compliance functions to meet industry standards.

Application Landscape

Video measuring systems serve a wide range of applications including automotive aerospace and defense heavy machinery energy and power electronics and medical devices. Each application imposes unique performance requirements such as high accuracy and traceability in aerospace extreme environment resilience in heavy machinery and micro scale measurement capability in electronics. The convergence of these needs is expanding the role of video based measurement across the factory floor.

Automotive Application

In the automotive sector video measuring systems are used for inspection of engine components transmissions safety related parts and exterior trim. As vehicles incorporate more sensors and electric power trains the complexity and precision requirements of components continue to rise. Video based inspection supports inline verification of features and rapid feedback for process control enabling reduced cycle times and improved first pass yield. Integration with automated assembly and robotic handling systems is a strong adoption driver.

Aerospace and Defense Application

Aerospace and defense demand the highest standards of accuracy and documentation. Video measuring systems support inspection of air craft structural parts turbine components and precision machined elements by offering non contact measurement and comprehensive reporting. Traceability and compliance to quality management standards are essential in this vertical and video measurement technologies are increasingly used to meet ruggedness and certification requirements.

Heavy Machinery and Energy Application

Heavy machinery and energy equipment components often require large format measurement capability and rugged systems that can handle heavy parts. Video measuring systems deployed in these segments offer extended travel stages robust fixturing and software that supports large part alignment. These solutions help manufacturers ensure dimensional integrity of key components that impact performance and safety in energy generation and heavy construction equipment.

Electronics Application

The electronics sector is a rapidly growing market for video measuring systems due to miniaturization and the need for micrometer level accuracy. Printed circuit boards semiconductor packages and connector assemblies benefit from high resolution imaging and automated feature recognition. Video measurement supports inspection of surface mount components solder joints and tiny mechanical parts that are critical for performance and reliability. The trend toward miniaturization and higher density assemblies is a long term growth driver for this application.

Medical Application

Medical device manufacturing requires stringent inspection for implantable devices surgical instruments and diagnostic components. Video measuring systems are used to validate dimensions surface features and assembly conditions while providing documented evidence for regulatory submission. The medical segment places high value on measurement traceability and software that supports audit ready reporting which makes it a strategic area for system suppliers.

Offering Based Segmentation

The market offerings include hardware software and services. Hardware comprises cameras optics lighting and motion stages. Software includes measurement applications image processing and reporting modules. Services cover calibration training maintenance and integration. Bundled offerings that combine hardware software and services are increasingly popular as they reduce deployment complexity and help customers achieve faster return on investment.

Regional Market Overview

Geographically the market is segmented across North America Europe Asia Pacific and Rest of World. North America benefits from strong adoption in automotive aerospace and high precision industries along with a robust base of technology providers. Europe is driven by automotive manufacturing and industrial automation projects while Asia Pacific displays rapid growth fueled by electronics manufacturing expanding automotive production and increasing industrial automation investments. Emerging markets in Latin America the Middle East and Africa show gradually rising demand as manufacturing capabilities modernize.

Competitive Landscape

The competitive environment includes global instrumentation firms specialized optics manufacturers and software providers. Key market participants invest in research and development to enhance accuracy throughput and automation capabilities. Strategic partnerships and acquisitions are common as vendors expand solution portfolios to include automation integration and analytics. Reputation for service quality calibration and application specific expertise remains a differentiator in procurement decisions.

Pricing and Procurement Trends

Pricing is influenced by system accuracy stage travel range camera resolution and software sophistication. Many vendors offer tiered product lines to address entry level laboratory needs as well as fully integrated automated lines for industrial production. Procurement often includes service level agreements calibration schedules and training packages to ensure long term measurement reliability. Leasing and equipment as a service models are emerging as alternatives that lower upfront costs while providing access to advanced measurement technology.

Integration and Industry 4.0

Video measuring systems are increasingly integrated into Industry 4.0 architectures with connectivity to enterprise resource planning systems manufacturing execution systems and quality management platforms. Real time measurement data feeds enable closed loop process control and advanced analytics for continuous improvement. Edge computing and secure cloud services are also helping organizations scale inspection data processing while maintaining data integrity and audit trails.

Challenges and Restraints

Despite growth prospects the market faces challenges including the need for skilled operators variability in measurement standards across regions and the initial investment cost for fully automated solutions. Data management for high resolution imaging and the requirement for validated processes in regulated industries can also slow adoption. Vendors that provide easy to use interfaces flexible integration options and strong service support are better positioned to overcome these barriers.

Future Outlook and Opportunities

Looking toward 2035 the video measuring system market is expected to continue evolving with more autonomous inspection solutions augmented by artificial intelligence enhanced imaging and smarter analytics. Opportunities lie in collaborative robotics for automated part handling inline system integration for real time quality control and growth in sectors such as semiconductor electric vehicles and medical devices. Standardization of data formats and expanding remote service capabilities will further lower barriers to adoption.

Video measuring systems are central to modern quality assurance enabling manufacturers to meet higher standards for accuracy and traceability while improving production efficiency. The market will be shaped by continued automation adoption advances in imaging and software and the need for integrated inspection within digital manufacturing environments. Companies that invest in scalable easy to integrate and serviceable solutions will capture value as industry requirements become more demanding and competitive pressures increase.

The ecosystem of the video measuring system market comprises technology providers such as Hexagon (Sweden), Carl Zeiss (Germany), Faro Technologies (US), Mitutoyo Corporation) (Japan), Nikon Corporation (Japan), GOM Metrology (Germany), Perceptron (US), Renishaw (UK), Zygo Corporation (US), Advantest Corporation (Japan), Wenzel Prazision (Germany), Creaform (Canada), Keyence (Japan), Vision Engineering (UK), and Carmar Accuracy Co. (Taiwan).

The report also describes drivers, restraints, opportunities, and challenges impacting the growth of the video measuring system market. Apart from the in-depth view on the market segmentation, the report also includes the critical market data and qualitative information for each type, along with the qualitative analyses such as value chain analysis, market ranking analysis, competitive situations and trends, and competitive leadership mapping. The report targets the technology providers, software providers, system integrators, and end-user industries of the video measuring system market.

Scope of the Report

The market covered in this report has been segmented as follows:

Video Measuring System Market, by Application:

-

Automotive

-

Aerospace & Defense

-

Heavy Machinery Industry

-

Energy & Power

-

Electronics

-

Medical

-

Others

Video Measuring System Market, by Product Type

-

Manual

-

Semi-automated

-

Automated/CNC

Video Measuring System Market, by Offering:

-

Hardware

-

Software

-

Services

Video Measuring System Market, by Region:

-

North America

-

Europe

-

Asia Pacific (APAC)

-

RoW

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.4 Years Considered for Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Video Measuring System Market

4.2 Market in Asia Pacific, By Application and Country

4.3 Market, By Offering

4.4 Market, By Product Type

4.5 Market, By Geography

5 Market Overview (Page No. - 36)

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Increasing Adoption of Noncontact Measurement Techniques Based on Computer Numerical Control (CNC) Technology

5.1.1.2 Increasing Focus on Quality Control

5.1.1.3 Advantages of Video Measurement Technology Over Conventional Measurement Methods

5.1.1.4 Increasing Need for Efficient, Reliable, and Precise Measurement Technology

5.1.2 Restraints

5.1.2.1 High Cost Associated With Video Measuring Technology

5.1.2.2 Lack of Expertise to Handle Video Measuring Systems Efficiently

5.1.3 Opportunities

5.1.3.1 Smart Factory/Industry 4.0 has Created Multiple Opportunities

5.1.3.2 Rise in Wages Would Create Investment Opportunities for Video Measuring Systems in Developing Countries

5.1.4 Challenges

5.1.4.1 Lack of Simplified Software Solutions

5.1.4.2 Less Efficiency in Measuring 3D Images

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Research and Development

6.2.2 Component Manufacturers

6.2.3 Original Equipment Manufacturers (OEMs)

6.2.4 System Integrators

6.2.5 Resellers & Distributors

6.2.6 End Users

6.3 Technological Trends

7 Video Measuring System Market, By Offering (Page No. - 43)

7.1 Introduction

7.2 Hardware

7.2.1 Cameras

7.2.2 Processors

7.2.3 Sensors

7.2.4 Lighting System

7.2.5 Others

7.3 Software

7.4 Services

7.4.1 Measurement Service

7.4.2 After-Sales Service

8 Video Measuring System Market, By Product Type (Page No. - 56)

8.1 Introduction

8.2 Manual Video Measuring System

8.3 Semi-Automated Video Measuring System

8.4 Automated Video Measuring System

9 Video Measuring System Market, By Application (Page No. - 65)

9.1 Introduction

9.2 Automotive

9.3 Aerospace & Defence

9.4 Heavy Machinery Industry

9.5 Energy & Power

9.6 Electronics

9.7 Medical

9.8 Others

10 Video Measuring System Market, By Region (Page No. - 83)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 UK

10.3.2 Germany

10.3.3 France

10.3.4 Italy

10.3.5 Spain

10.3.6 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 South Korea

10.4.4 India

10.4.5 Rest of Asia Pacific

10.5 Rest of the World

10.5.1 Middle East & Africa

10.5.2 South America

11 Competitive Landscape (Page No. - 101)

11.1 Overview

11.2 Ranking of Players, 2017

11.3 Competitive Scenario

11.3.1 Product Launches

11.3.2 Partnerships, Contracts, Joint Ventures, Agreements, & Expansions

11.3.3 Mergers & Acquisitions

12 Company Profiles (Page No. - 105)

(Business Overview, Products and Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.1 Key Players

12.1.1 Hexagon

12.1.2 Carl Zeiss

12.1.3 Faro Technologies

12.1.4 Mitutoyo

12.1.5 Nikon

12.1.6 Perceptron

12.1.7 Renishaw

12.1.8 Keyence

12.1.9 Advantest

12.1.10 GOM

12.1.11 Wenzel Prazision

12.1.12 Creaform

12.1.13 Zygo

12.1.14 Vision Engineering

12.2 Key Innovators

12.2.1 Carmar

12.2.2 Dongguan Yihui Optoelectronics Technology

12.2.3 Sipcon Instrument Industries

12.2.4 Accu-Tech Measurement System

12.2.5 Octum

*Details on Business Overview, Products and Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 148)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (66 Tables)

Table 1 Secondary Sources

Table 2 Primary Interviews With Experts

Table 3 Market, By Offering, 2015–2023 (USD Million)

Table 4 Market for Hardware, By Type, 2015–2023 (USD Million)

Table 5 Market for Hardware, By Product Type, 2015–2023 (USD Million)

Table 6 Market for Hardware, By Application, 2015–2023 (USD Million)

Table 7 Market for Hardware, By Region, 2015–2023 (USD Million)

Table 8 Market for Software, By Product Type, 2015–2023 (USD Million)

Table 9 Market for Software, By Application, 2015–2023 (USD Million)

Table 10 Market for Software, By Region, 2015–2023 (USD Million)

Table 11 Market for Services, By Type, 2015–2023 (USD Million)

Table 12 Market for Services, By Product Type, 2015–2023 (USD Million)

Table 13 Market for Services, By Application, 2015–2023 (USD Million)

Table 14 Market for Services, By Region, 2015–2023 (USD Million)

Table 15 Market, By Product Type, 2015–2023 (USD Million)

Table 16 Market, By Product Type, 2015–2023 (Units)

Table 17 Manual Market, By Offering, 2015–2023 (USD Million)

Table 18 Manual Market, By Application, 2015–2023 (USD Million)

Table 19 Manual Market, By Region, 2015–2023 (USD Million)

Table 20 Semi Automated Market, By Offering, 2015–2023 (USD Million)

Table 21 Semi Automated Market, By Application, 2015–2023 (USD Million)

Table 22 Semi Automated Market, By Region, 2015–2023 (USD Million)

Table 23 Automated Video Measuring System Market, By Offering, 2015–2023 (USD Million)

Table 24 Automated Market, By Application, 2015–2023 (USD Million)

Table 25 Automated Market, By Region, 2015–2023 (USD Million)

Table 26 Market, By Application, 2015–2023 (USD Million)

Table 27 Market for Automotive, By Offering, 2015–2023 (USD Million)

Table 28 Market for Automotive, By Product Type, 2015–2023 (USD Million)

Table 29 Market for Automotive, By Region, 2015–2023 (USD Million)

Table 30 Market for Aerospace & Defence, By Offering, 2015–2023 (USD Million)

Table 31 Market for Aerospace & Defence, By Product Type, 2015–2023 (USD Million)

Table 32 Market for Aerospace & Defence, By Region, 2015–2023 (USD Million)

Table 33 Market for Heavy Machinery Industry, By Offering, 2015–2023 (USD Million)

Table 34 Market for Heavy Machinery Industry, By Product Type, 2015–2023 (USD Million)

Table 35 Market for Heavy Machinery Industry, By Region, 2015–2023 (USD Million)

Table 36 Market for Energy & Power, By Offering, 2015–2023 (USD Million)

Table 37 Market for Energy & Power, By Product Type, 2015–2023 (USD Million)

Table 38 Market for Energy & Power, By Region, 2015–2023 (USD Million)

Table 39 Market for Electronics Application, By Offering, 2015–2023 (USD Million)

Table 40 Market for Electronics Application, By Product Type, 2015–2023 (USD Million)

Table 41 Market for Electronics Application, By Region, 2015–2023 (USD Million)

Table 42 Market for Medical Application, By Offering, 2015–2023 (USD Million)

Table 43 Market for Medical Application, By Product Type, 2015–2023 (USD Million)

Table 44 Market for Medical Application, By Region, 2015–2023 (USD Million)

Table 45 Market for Other Application, By Offering, 2015–2023 (USD Million)

Table 46 Market for Other Application, By Product Type, 2015–2023 (USD Million)

Table 47 Market for Other Application, By Region, 2015–2023 (USD Million)

Table 48 Market, By Region, 2015–2023 (USD Million)

Table 49 Market in North America, By Offering, 2015–2023 (USD Million)

Table 50 Market in North America, By Product Type, 2015–2023 (USD Million)

Table 51 Market in North America, By Application, 2015–2023 (USD Million)

Table 52 Market in North America, By Country, 2015–2023 (USD Million)

Table 53 Market in Europe, By Offering, 2015–2023 (USD Million)

Table 54 Market in Europe, By Product Type, 2015–2023 (USD Million)

Table 55 Market in Europe, By Application, 2015–2023 (USD Million)

Table 56 Market in Europe, By Country, 2015–2023 (USD Million)

Table 57 Market in Asia Pacific, By Offering, 2015–2023 (USD Million)

Table 58 Market in Asia Pacific, By Product Type, 2015–2023 (USD Million)

Table 59 Market in Asia Pacific, By Application, 2015–2023 (USD Million)

Table 60 Market in Asia Pacific, By Country, 2015–2023 (USD Million)

Table 61 Market in RoW, By Offering, 2015–2023 (USD Million)

Table 62 Market in RoW, By Product Type, 2015–2023 (USD Million)

Table 63 Market in RoW, By Application, 2015–2023 (USD Million)

Table 64 Market in RoW, By Region, 2015–2023 (USD Million)

Table 65 Ranking Analysis of the Top Players in the Market, 2017

Table 66 Market Evaluation Framework—Product Launches and Partnerships & Agreements Emerged as Major Growth Strategies Between 2014 and 2017

List of Figures (48 Figures)

Figure 1 Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Breakdown and Data Triangulation

Figure 5 Market, 2015–2023 (USD Million)

Figure 6 Hardware Segment Expected to Hold the Largest Size of the Market During the Forecast Period

Figure 7 Video Measuring System for Medical Application Expected to Grow at the Highest CAGR During the Forecast Period

Figure 8 Automated/CNC Video Measuring System Expected to Grow at the Highest CAGR During the Forecast Period

Figure 9 Asia Pacific Expected to Grow at the Highest CAGR in Video Measuring Market During the Forecast Period

Figure 10 Increasing Adoption of Non-Contact Measurement Techniques is Expected to Propel the Growth of Market

Figure 11 China Held the Largest Share of the Market in Asia Pacific in 2017

Figure 12 Hardware Segment Held the Largest Market Share in 2017

Figure 13 Manual Video Measuring System Held the Largest Market Size in 2017

Figure 14 US Held the Largest Share of the Market in 2017

Figure 15 Market: Market Dynamics

Figure 16 Average Yearly Wages in the Manufacturing Sector in China

Figure 17 Value Chain Analysis of the Market

Figure 18 Adoption of High Computational Cameras is A Leading Trend in the Market

Figure 19 Market for Software Expected to Grow at the Highest CAGR Between 2018 and 2023

Figure 20 Cameras, Among All Hardware Components Expected to Hold the Largest Market Size of the Video Measuring System Market in 2018

Figure 21 North America to Hold the Largest Market Size for Hardware Component in 2018

Figure 22 Asia Pacific Expected to Grow at the Highest CAGR in Software Market During the Forecast Period

Figure 23 North America Held the Largest Size of the Video Measuring System Services Market in 2018

Figure 24 Automated/CNC Market Expected to Grow at the Highest CAGR Between 2018 and 2023

Figure 25 Hardware to Hold Largest Size for the Manual Video Measuring System Market in 2018

Figure 26 Hardware to Hold the Largest Size for the Semi-Automated Video Measuring System Market in 2018

Figure 27 Software Market Expected to Grow at the Highest CAGR During the Forecast Period

Figure 28 Market for Medical Application Expected to Grow at the Highest CAGR Between 2018 and 2023

Figure 29 North America to Hold the Largest Size for Automotive Application in 2018

Figure 30 North America to Hold the Largest Size for Aerospace & Defence Application in 2018

Figure 31 Asia Pacific Expected to Grow at the Highest CAGR in the Market for Heavy Industry Application During the Forecast Period

Figure 32 Asia Pacific Expected to Grow at the Highest CAGR in the Market for Energy & Power Application During the Forecast Period

Figure 33 North America Expected to Hold the Largest Size in the Market for Electronics Application During the Forecast Period

Figure 34 North America to Hold the Largest Size for Medical Application in 2018

Figure 35 Asia Pacific Expected to Grow at the Highest CAGR in Market for Other Application Between 2018 and 2023

Figure 36 India Expected to Grow at the Highest CAGR in Market During the Forecast Period

Figure 37 North America: Market Snapshot

Figure 38 Europe: Market Snapshot

Figure 39 Asia Pacific: Market Snapshot

Figure 40 Companies Adopted Product Launches as the Key Growth Strategy From 2014 to 2017

Figure 41 Hexagon: Company Snapshot

Figure 42 Carl Zeiss: Company Snapshot

Figure 43 Faro Technologies: Company Snapshot

Figure 44 Nikon: Company Snapshot

Figure 45 Perceptron: Company Snapshot

Figure 46 Renishaw: Company Snapshot

Figure 47 Keyence: Company Snapshot

Figure 48 Advantest: Company Snapshot

Growth opportunities and latent adjacency in Video Measuring System Market