Veterinary X-ray Market by Technology (Direct, Computed, Film), Type (Digital, Analog), Mobility (Fixed, Portable), Animal (Companion, Large Animal), Application (Trauma, Oncology, Dental), End User (Clinic, Hospital) - Forecasts to 2023

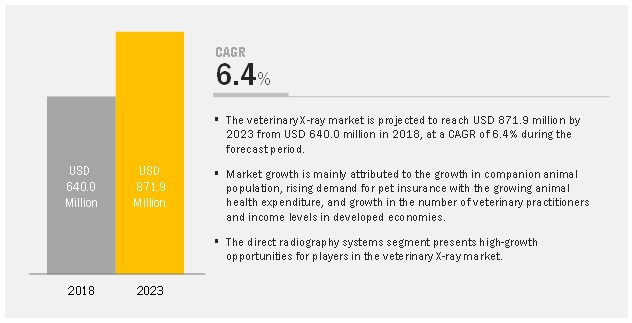

The veterinary X-ray market is projected to reach USD 872 million by 2023, at a CAGR of 6.4%.

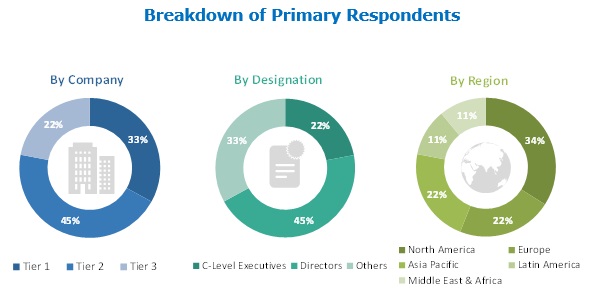

The study involved four major activities to estimate the current market size for veterinary X-ray products. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, trade directories, and databases such as D&B Hoovers and Bloomberg Businessweek were referred to identify and collect information for this study.

Primary Research

The veterinary X-ray market comprises several stakeholders such as veterinary X-ray system manufacturers and distributors. Primary sources from the supply side include CEOs, vice presidents, marketing and sales directors, business development managers, and innovation directors of veterinary X-ray systems manufacturing companies. Demand-side primary sources include industry experts such as directors of veterinary hospitals and clinics, veterinary hospital & clinic managers, diagnostic centers veterinarians, professors, research scientists, and related key opinion leaders.

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the global veterinary X-ray industry. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the veterinary X-ray market on the basis of technology, type, mobility, animal type, application, end user, and region

- To provide detailed information about factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players

- To forecast the size of the market segments in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, and major countries in these regions

- To strategically profile the key players and comprehensively analyze their market shares and core competencies in the veterinary X-ray market

- To track and analyze competitive developments such as partnerships, agreements, collaborations, alliances, mergers & acquisitions, product launches, expansions, and R&D activities in the veterinary X-ray market

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Technology, mobility, type, application, animals, end users, and regions |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Companies covered |

IDEXX (US), Fujifilm (Japan), Onex Corporation (Canada), Sedecal (Spain), Agfa-Gevaert (Belgium) and Sound Technologies (US), Fujifilm Holdings Corporation (Japan), Canon, Inc. (Japan), Examion (Germany), Konica Minolta (US), DRE Veterinary (US), and Heska Corporation (US) |

Scope of the Report:

The research report categorizes the market into the following segments and subsegments:

Veterinary X-ray Market, by Technology

- Direct (Capture) Radiography Systems

- Computed Radiography Systems

- Film-based Radiography Systems

Veterinary X-ray Market, by Type

- Digital X-ray

- Analog X-ray

Veterinary X-ray Market, by Mobility

- Stationary

- Portable

Veterinary X-ray Market, by Animal Type

- Small Companion Animals

- Large Animals

Veterinary X-ray Market, by Application

- Orthopedics and Trauma

- Oncology

- Dental Applications

- Other Applications (Neurology, Cardiology, Urology, and Diseases Involving the Respiratory System)

Veterinary X-ray Market, by End User

- Veterinary Hospitals and Academic Institutes

- Veterinary Clinics

Veterinary X-ray Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe veterinary X-ray market into Belgium, the Netherlands, and Denmark

- Further breakdown of the Latin American veterinary X-ray market into Brazil, Argentina, and the Rest of Latin America

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Rising animal health expenditure and growing demand for pet insurance, increasing number of veterinary practitioners in developed regions, and growth in the companion animals market are the primary drivers for the veterinary X-ray market during the forecast period.

The report analyzes the veterinary X-ray market by technology, type, animal type, application, mobility, end user, and region.

Computed radiography systems accounted for the largest share of the veterinary X-ray market, by technology, in 2017

On the basis of technology, the computed radiography systems segment accounted for the largest market share in 2017. The rising need for increased flexibility, increasing demand for affordable Digital X-Ray equipment, and the benefits offered by CR systems over traditional X-ray systems are some of the major factors driving market growth.

Digital X-rays held the largest share of the veterinary X-ray market in 2017

Based on type, the veterinary X-ray market is categorized into digital X-rays and analog X-rays. The digital X-rays segment accounted for the largest market share in 2017. The large share of this segment can be attributed to the number of benefits offered by digital X-ray systems over analog systems, including cost savings, improved efficiency and productivity, and patient-centric, value-based imaging.

Veterinary hospitals & academic institutes accounted for the largest share of the veterinary X-ray market, by end user, in 2017

The veterinary X-ray market, by end user, is segmented into veterinary hospitals & academic institutes and veterinary clinics. The veterinary hospitals & academic institutes segment accounted for the largest market share in 2017. The large share of this segment can be attributed to the widespread adoption of X-ray equipment in large universities for educational & research purposes and the growing demand for modern, state-of-the-art large veterinary facilities.

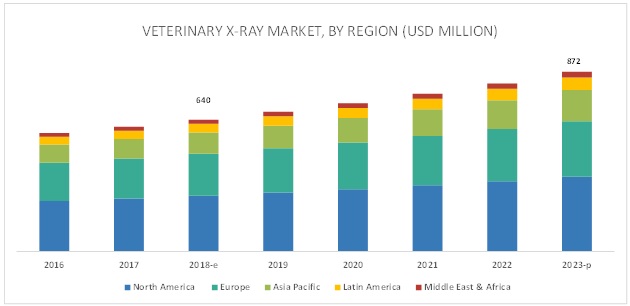

North America dominated the veterinary X-ray market in 2017; this trend is expected to continue during the forecast period

Geographically, the veterinary X-ray market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of this market in 2017. Rising number of veterinary practices, increasing number of companion animals, and rising companion animal healthcare expenditure are some of the key factors driving the growth of the veterinary X-ray market in North America.

The prominent players in the veterinary X-ray market are IDEXX (US), Fujifilm (Japan), Onex Corporation (Canada), Sedecal (Spain), Agfa-Gevaert (Belgium), Sound Technologies (US), Fujifilm Holdings Corporation (Japan), Canon, Inc. (Japan), Examion (Germany), Konica Minolta (US), DRE Veterinary (US), and Heska Corporation (US).

Recent Developments

- In 2018, Heska Corporation (US) formed a partnership with Pathway Vet Alliance (US). Under the terms of this agreement, Pathway plans to align its internal diagnostic portfolio with Heska, which can provide in-house operational services like point-of-care blood diagnostics, digital imaging, and allergy testing.

- In 2018, Carestream Health signed a service partnership agreement with Med Imaging Healthcare, a Diagnostic Imaging equipment maintenance company. The partnership was aimed at providing wider maintenance coverage and support for Carestream customers across Scotland.

- In 2016, Heska acquired Cuattro Veterinary (US), a company offering flat-panel digital radiography systems. This international expansion provides Heska with a strong and established platform for launching Heska's blood diagnostics platforms and programs to international markets.

Key Questions Addressed in the Report

- Who are the top 10 players operating in the veterinary X-ray market?

- What are the driving factors, restraints, opportunities, and challenges in the veterinary X-ray market?

- What are the industry trends and current scenario of the veterinary X-ray market?

- What are the growth trends in the veterinary X-ray market at segmental and overall market levels?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Market Share Estimation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 36)

4.1 Veterinary X-Ray: Market Overview

4.2 Veterinary X-Ray Market: Geographic Growth Opportunities

4.3 North America: Veterinary X-Ray Market, By Technology (2017)

4.4 Regional Mix: Veterinary X-Ray Market (2018–2023)

4.5 Veterinary X-Ray Market: Developed vs Developing Markets, 2018 vs 2023

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Key Market Drivers

5.2.1.1 Growth in Companion Animal Population

5.2.1.2 Rising Demand for Pet Insurance With Growing Animal Health Expenditure

5.2.1.3 Growth in the Number of Veterinary Practitioners and Income Levels in Developed Economies

5.2.2 Key Market Restraints

5.2.2.1 Increasing Pet Care Costs

5.2.2.2 High Cost of Instruments and Procedures

5.2.3 Key Market Opportunities

5.2.3.1 Untapped Emerging Markets

5.2.4 Key Challenges

5.2.4.1 Lack of Animal Healthcare Awareness in Emerging Markets

5.2.4.2 Shortage of Veterinarians in Emerging Markets

6 Veterinary X-Ray Market, By Technology (Page No. - 46)

6.1 Introduction

6.2 Computed Radiography Systems

6.2.1 Computed Radiography Systems Form the Largest Veterinary X-Ray Segment

6.3 Direct Radiography Systems

6.3.1 Direct Radiography Systems are the Fastest-Growing Technology Segment

6.4 Film-Based Radiography Systems

6.4.1 Demand for Film-Based Radiography Systems is High in Emerging Markets Due to Its Overall Cost-Effectiveness

7 Veterinary X-Ray Market, By Type (Page No. - 54)

7.1 Introduction

7.2 Digital X-Ray Systems

7.2.1 Improved Efficiency and Productivity and Value-Based Imaging are the Key Benefits of Digital X-Ray Systems

7.3 Analog X-Ray Systems

7.3.1 Lower-Quality Images and Longer Exposure to Radiation are Important Factors Restricting Market Growth

8 Veterinary X-Ray Market, By Mobility (Page No. - 59)

8.1 Introduction

8.2 Stationary X-Ray Systems

8.2.1 Stationary X-Rays are Most Suitable for Small-Animal Radiographic Examinations

8.3 Portable X-Ray Systems

8.3.1 Portable X-Rays are Best Suited for Outdoor Imaging

9 Veterinary X-Ray Market, By Animal Type (Page No. - 64)

9.1 Introduction

9.2 Small Companion Animals

9.2.1 Rising Companion Animal Population, A Major Factor for the Large Share of This Segment

9.3 Large Animals

9.3.1 Growing Awareness of Animal Health in the Livestock Industry to Drive Market Growth

10 Veterinary X-Ray Market, By Application (Page No. - 71)

10.1 Introduction

10.2 Orthopedics & Trauma

10.2.1 Orthopedics & Trauma Applications Account for the Largest Share of the Market

10.3 Dental Applications

10.3.1 Dental Radiology is the Core Diagnostic Modality for Veterinary Dental Care

10.4 Oncology

10.4.1 Oncology Segment to Register Highest Growth Rate in the Coming Years

10.5 Other Applications

11 Veterinary X-Ray Market, By End User (Page No. - 79)

11.1 Introduction

11.2 Veterinary Hospitals & Academic Institutes

11.2.1 Growing Demand for Modern, State-Of-The-Art Large Veterinary Facilities has Resulted in High Adoption in Hospitals

11.3 Veterinary Clinics

11.3.1 Growing Number of Private Veterinary Clinical Practices are Responsible for Market Growth in This Segment

12 Veterinary X-Ray Market, By Region (Page No. - 85)

12.1 Introduction

12.2 North America

12.2.1 Us

12.2.1.1 US Accounted for the Largest Share of the North American Veterinary X-Ray Market

12.2.2 Canada

12.2.2.1 Canada is Poised to Register the Highest CAGR in the North American Veterinary X-Ray Market

12.3 Europe

12.3.1 Germany

12.3.1.1 Germany Accounted for the Largest Share of the Europe Veterinary X-Ray Market

12.3.2 Uk

12.3.2.1 High Cancer Prevalence in Pets and Rising Injury are Major Factors for Market Growth in the Country

12.3.3 France

12.3.3.1 Increasing Domestic Demand for Livestock and Poultry Products is Driving Market Growth

12.3.4 Italy

12.3.4.1 Increasing Population of Cats, Sheep, Goats, and Swine to Positively Impact the Adoption of Veterinary X-Rays in the Country

12.3.5 Spain

12.3.5.1 Increasing Animal Healthcare Expenditure is A Major Factor Responsible for Market Growth

12.3.6 Rest of Europe

12.4 Asia Pacific

12.4.1 China

12.4.1.1 China Accounted for the Largest Share of the Veterinary X-Ray Market in Asia Pacific

12.4.2 Japan

12.4.2.1 Increasing Adoption of Dogs and Cats in Japanese Households is Boosting Market Growth

12.4.3 India

12.4.3.1 Government Initiatives for Animal Health, A Major Cause of Market Growth

12.4.4 Rest of APAC

12.5 Latin America

12.5.1 Growing Veterinary Practices & Veterinary Healthcare Expenditure to Drive Growth in Latin America

12.6 Middle East & Africa

12.6.1 Rising Demand for Regular Animal Health Check-Ups to Propel Market Growth in Middle East & Africa

13 Competitive Landscape (Page No. - 147)

13.1 Overview

13.2 Market Share Analysis

13.3 Competitive Scenario

13.3.1 Acquisitions

13.3.2 Partnerships

13.3.3 Product Launches

14 Company Profiles (Page No. - 152)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

14.1 Onex Corporation

14.2 IDEXX Laboratories

14.3 Agfa-Gevaert Group

14.4 Fujifilm

14.5 Sedecal

14.6 Sound Technologies

14.7 Canon

14.8 Examion

14.9 Heska Corporation

14.10 DRE Veterinary

14.11 Clearvet

14.12 Allpro Imaging

14.13 Pixxgen

14.14 Konica Minolta

14.15 Vetel Diagnostics

14.16 Control-X Medical

14.17 Fovea

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 183)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (186 Tables)

Table 1 Standard Currency Conversion Rates

Table 2 Market Dynamics: Market Impact

Table 3 Pet Population, By Country, 2012–2016 (Million)

Table 4 Developed Economies: Number of Veterinary Professionals (2012–2016)

Table 5 Companion Animal Population, By Country, 2016 (Million)

Table 6 Key Differences Between Film-Based, Cr, and Dr Technologies

Table 7 Veterinary X-Ray Market, By Technology, 2016–2023 (USD Million)

Table 8 Veterinary Computed Radiography Products Available in the Market

Table 9 Computed Radiography Systems Market, By Country, 2016–2023 (USD Million)

Table 10 Computed Radiography Systems Market, By Region, 2016–2023 (Thousand Units)

Table 11 Veterinary Direct Radiography Products Available in the Market

Table 12 Direct Radiography Systems Market, By Country, 2016–2023 (USD Million)

Table 13 Direct Radiography Systems Market, By Region, 2016–2023 (Thousand Units)

Table 14 Veterinary Film-Based Radiography Products Available in the Market

Table 15 Film-Based Radiography Systems Market, By Country, 2016–2023 (USD Million)

Table 16 Film-Based Radiography Systems Market, By Region, 2016–2023 (Thousand Units)

Table 17 Veterinary X-Ray Market, By Type, 2016–2023 (USD Million)

Table 18 Digital X-Ray Systems Market, By Country, 2016–2023 (USD Million)

Table 19 Digital X-Ray Radiography Systems Market, By Region, 2016–2023 (Thousand Units)

Table 20 Analog X-Ray Systems Market, By Country, 2016–2023 (USD Million)

Table 21 Analog X-Ray Radiography Systems Market, By Region, 2016–2023 (Thousand Units)

Table 22 Veterinary X-Ray Market, By Mobility, 2016–2023 (USD Million)

Table 23 Key Products in the Stationary X-Ray Systems Market

Table 24 Stationary Veterinary X-Ray Systems Market, By Country, 2016–2023 (USD Million)

Table 25 Key Portable X-Ray Products Table

Table 26 Portable Veterinary X-Ray Systems Market, By Country, 2016–2023 (USD Million)

Table 27 Veterinary X-Ray Market, By Animal Type, 2016–2023 (USD Million)

Table 28 European Companion Animal Population, By Country (2017)

Table 29 Healthcare Expenditure on Companion Animals, 2016

Table 30 Veterinary X-Ray Systems Available in the Market for Small Companion Animals

Table 31 Veterinary X-Ray Market for Small Companion Animals, By Country, 2016–2023 (USD Million)

Table 32 Global Population of Farm Animals, 2010–2016 (Million)

Table 33 Veterinary X-Ray Systems Available in the Market for Large Animals

Table 34 Veterinary X-Ray Market for Large Animals, By Country, 2016–2023 (USD Million)

Table 35 Veterinary X-Ray Market, By Application, 2016–2023 (USD Million)

Table 36 Veterinary X-Ray Market for Orthopedics & Trauma, By Country, 2016–2023 (USD Million)

Table 37 Key Veterinary Dental X-Ray Products Available in the Market

Table 38 Veterinary X-Ray Market for Dental Applications, By Country, 2016–2023 (USD Million)

Table 39 Veterinary X-Ray Market for Oncology, By Country, 2016–2023 (USD Million)

Table 40 Veterinary X-Ray Market for Other Applications, By Country, 2016–2023 (USD Million)

Table 41 Veterinary X-Ray Market, By End User, 2016–2023 (USD Million)

Table 42 US: Number of Imaging Scans in Veterinary Teaching Hospitals (2014)

Table 43 Key Veterinary X-Ray Brands in Universities

Table 44 Veterinary X-Ray Market for Veterinary Hospitals & Academic Institutes, By Country, 2016–2023 (USD Million)

Table 45 Number of Private Clinical Practices, By Country (2012 vs 2016)

Table 46 Veterinary X-Ray Market for Veterinary Clinics, By Country, 2016–2023 (USD Million)

Table 47 Companion Animal and Food-Producing Animal Population, By Country, 2016 (Million Heads)

Table 48 Veterinary X-Ray Market, By Region, 2016-2023 (USD Million)

Table 49 Prevalence of Bone Fractures in Dogs & Cats, By Anatomic Location (2014)

Table 50 North America: Veterinary X-Ray Market, By Country/Region, 2016–2023 (USD Million)

Table 51 North America: Veterinary X-Ray Market, By Technology, 2016–2023 (USD Million)

Table 52 North America: Veterinary X-Ray Market, By Type, 2016–2023 (USD Million)

Table 53 North America: Veterinary X-Ray Market, By Mobility, 2016–2023 (USD Million)

Table 54 North America: Veterinary X-Ray Market, By Animal Type, 2016–2023 (USD Million)

Table 55 North America: Veterinary X-Ray Market, By Application, 2016–2023 (USD Million)

Table 56 North America: Veterinary X-Ray Market, By End User, 2016–2023 (USD Million)

Table 57 Companion Animal Population, 2014 vs 2016 (Million)

Table 58 US: Veterinary X-Ray Market, By Technology, 2016–2023 (USD Million)

Table 59 US: Veterinary X-Ray Market, By Type, 2016–2023 (USD Million)

Table 60 US: Veterinary X-Ray Market, By Mobility, 2016–2023 (USD Million)

Table 61 US: Veterinary X-Ray Market, By Animal Type, 2016–2023 (USD Million)

Table 62 US: Veterinary X-Ray Market, By Application, 2016–2023 (USD Million)

Table 63 US: Veterinary X-Ray Market, By End User, 2016–2023 (USD Million)

Table 64 Canada: Food-Producing Animal Population (2010–2016) (Million)

Table 65 Canada: Veterinary Practices, By Animal Type (2014 vs 2015)

Table 66 Canada: Veterinary X-Ray Market, By Technology, 2016–2023 (USD Million)

Table 67 Canada: Veterinary X-Ray Market, By Type, 2016–2023 (USD Million)

Table 68 Canada: Veterinary X-Ray Market, By Mobility, 2016–2023 (USD Million)

Table 69 Canada: Veterinary X-Ray Market, By Animal Type, 2016–2023 (USD Million)

Table 70 Canada: Veterinary X-Ray Market, By Application, 2016–2023 (USD Million)

Table 71 Canada: Veterinary X-Ray Market, By End User, 2016–2023 (USD Million)

Table 72 Europe: Number of Veterinarians and Veterinary Para-Professionals, 2012–2017

Table 73 Europe: Veterinary X-Ray Market, By Country/Region, 2016–2023 (USD Million)

Table 74 Europe: Veterinary X-Ray Market, By Technology, 2016–2023 (USD Million)

Table 75 Europe: Veterinary X-Ray Market, By Type, 2016–2023 (USD Million)

Table 76 Europe: Veterinary X-Ray Market, By Mobility, 2016–2023 (USD Million)

Table 77 Europe: Veterinary X-Ray Market, By Animal Type, 2016–2023 (USD Million)

Table 78 Europe: Veterinary X-Ray Market, By Application, 2016–2023 (USD Million)

Table 79 Europe: Veterinary X-Ray Market, By End User, 2016–2023 (USD Million)

Table 80 Germany: Companion Animal Population, (2010–2016) (Million)

Table 81 Germany: Number of Veterinarians, By Type of Practice, 2015 vs 2017

Table 82 Germany: Veterinary X-Ray Market, By Technology, 2016–2023 (USD Million)

Table 83 Germany: Veterinary X-Ray Market, By Type, 2016–2023 (USD Million)

Table 84 Germany: Veterinary X-Ray Market, By Mobility, 2016–2023 (USD Million)

Table 85 Germany: Veterinary X-Ray Market, By Animal Type, 2016–2023 (USD Million)

Table 86 Germany: Veterinary X-Ray Market, By Application, 2016–2023 (USD Million)

Table 87 Germany: Veterinary X-Ray Market, By End User, 2016–2023 (USD Million)

Table 88 UK: Companion Animal Population, Thousand Units (2016 vs 2017)

Table 89 Veterinary Practice Premises Under the Royal College of Veterinary Surgeons (Rcvs) Practice Standards Scheme, By Type

Table 90 UK: Veterinary X-Ray Market, By Technology, 2016–2023 (USD Million)

Table 91 UK: Veterinary X-Ray Market, By Type, 2016–2023 (USD Million)

Table 92 UK: Veterinary X-Ray Market, By Mobility, 2016–2023 (USD Million)

Table 93 UK: Veterinary X-Ray Market, By Animal Type, 2016–2023 (USD Million)

Table 94 UK: Veterinary X-Ray Market, By Application, 2016–2023 (USD Million)

Table 95 UK: Veterinary X-Ray Market, By End User, 2016–2023 (USD Million)

Table 96 France: Companion Animal Population, 2010–2016 (Million)

Table 97 France: Number of Veterinarians, 2015 vs 2017

Table 98 France: Veterinary X-Ray Market, By Technology, 2016–2023 (USD Million)

Table 99 France: Veterinary X-Ray Market, By Type, 2016–2023 (USD Million)

Table 100 France: Veterinary X-Ray Market, By Mobility, 2016–2023 (USD Million)

Table 101 France: Veterinary X-Ray Market, By Animal Type, 2016–2023 (USD Million)

Table 102 France: Veterinary X-Ray Market, By Application, 2016–2023 (USD Million)

Table 103 France: Veterinary X-Ray Market, By End User, 2016–2023 (USD Million)

Table 104 Italy: Companion Animal Population, Thousand Units (2017 vs 2016)

Table 105 Italy: Number of Veterinarians, 2012 vs 2017

Table 106 Italy: Veterinary X-Ray Market, By Technology, 2016–2023 (USD Million)

Table 107 Italy: Veterinary X-Ray Market, By Type, 2016–2023 (USD Million)

Table 108 Italy: Veterinary X-Ray Market, By Mobility, 2016–2023 (USD Million)

Table 109 Italy: Veterinary X-Ray Market, By Animal Type, 2016–2023 (USD Million)

Table 110 Italy: Veterinary X-Ray Market, By Application, 2016–2023 (USD Million)

Table 111 Italy: Veterinary X-Ray Market, By End User, 2016–2023 (USD Million)

Table 112 Spain: Companion Animal Population, Thousand Units (2017 vs 2016)

Table 113 Spain: Food-Producing Animal Population, 2010-2016 (Million)

Table 114 Spain: Veterinary X-Ray Market, By Technology, 2016–2023 (USD Million)

Table 115 Spain: Veterinary X-Ray Market, By Type, 2016–2023 (USD Million)

Table 116 Spain: Veterinary X-Ray Market, By Mobility, 2016–2023 (USD Million)

Table 117 Spain: Veterinary X-Ray Market, By Animal Type, 2016–2023 (USD Million)

Table 118 Spain: Veterinary X-Ray Market, By Application, 2016–2023 (USD Million)

Table 119 Spain: Veterinary X-Ray Market, By End User, 2016–2023 (USD Million)

Table 120 Companion Animal Ownership in the Rest of Europe, 2016 (Million)

Table 121 RoE: Total Number of Veterinarians and Para-Veterinarians (2010 vs 2016)

Table 122 RoE: Veterinary X-Ray Market, By Technology, 2016–2023 (USD Million)

Table 123 RoE: Veterinary X-Ray Market, By Type, 2016–2023 (USD Million)

Table 124 RoE: Veterinary X-Ray Market, By Mobility, 2016–2023 (USD Million)

Table 125 RoE: Veterinary X-Ray Market, By Animal Type, 2016–2023 (USD Million)

Table 126 RoE: Veterinary X-Ray Market, By Application, 2016–2023 (USD Million)

Table 127 RoE: Veterinary X-Ray Market, By End User, 2016–2023 (USD Million)

Table 128 Asia Pacific: Food-Producing Animal Population, (2010–2016) (Million)

Table 129 APAC: Veterinary X-Ray Market, By Country/Region, 2016–2023 (USD Million)

Table 130 APAC: Veterinary X-Ray Market, By Technology, 2016–2023 (USD Million)

Table 131 APAC: Veterinary X-Ray Market, By Type, 2016–2023 (USD Million)

Table 132 APAC: Veterinary X-Ray Market, By Mobility, 2016–2023 (USD Million)

Table 133 APAC: Veterinary X-Ray Market, By Animal Type, 2016–2023 (USD Million)

Table 134 APAC: Veterinary X-Ray Market, By Application, 2016–2023 (USD Million)

Table 135 APAC: Veterinary X-Ray Market, By End User, 2016–2023 (USD Million)

Table 136 China: Livestock Population (Million)

Table 137 China: Veterinary X-Ray Market, By Technology, 2016–2023 (USD Million)

Table 138 China: Veterinary X-Ray Market, By Type, 2016–2023 (USD Million)

Table 139 China: Veterinary X-Ray Market, By Mobility, 2016–2023 (USD Million)

Table 140 China: Veterinary X-Ray Market, By Animal Type, 2016–2023 (USD Million)

Table 141 China: Veterinary X-Ray Market, By Application, 2016–2023 (USD Million)

Table 142 China: Veterinary X-Ray Market, By End User, 2016–2023 (USD Million)

Table 143 Japan: Food-Producing Animal Population, (2010-2016) (Million)

Table 144 Japan: Number of Veterinarians, 2010 vs 2016

Table 145 Japan: Veterinary X-Ray Market, By Technology, 2016–2023 (USD Million)

Table 146 Japan: Veterinary X-Ray Market, By Type, 2016–2023 (USD Million)

Table 147 Japan: Veterinary X-Ray Market, By Mobility, 2016–2023 (USD Million)

Table 148 Japan: Veterinary X-Ray Market, By Animal Type, 2016–2023 (USD Million)

Table 149 Japan: Veterinary X-Ray Market, By Application, 2016–2023 (USD Million)

Table 150 Japan: Veterinary X-Ray Market, By End User, 2016–2023 (USD Million)

Table 151 India: Food-Producing Animal Population (2010–2016) (Million)

Table 152 India: Veterinary X-Ray Market, By Technology, 2016–2023 (USD Million)

Table 153 India: Veterinary X-Ray Market, By Type, 2016–2023 (USD Million)

Table 154 India: Veterinary X-Ray Market, By Mobility, 2016–2023 (USD Million)

Table 155 India: Veterinary X-Ray Market, By Animal Type, 2016–2023 (USD Million)

Table 156 India: Veterinary X-Ray Market, By Application, 2016–2023 (USD Million)

Table 157 India: Veterinary X-Ray Market, By End User, 2016–2023 (USD Million)

Table 158 RoAPAC: Food Producing Animal Population (2010–2016) (Million)

Table 159 RoAPAC: Number of Veterinarians

Table 160 RoAPAC: Veterinary X-Ray Market, By Technology, 2016–2023 (USD Million)

Table 161 RoAPAC: Veterinary X-Ray Market, By Type, 2016–2023 (USD Million)

Table 162 RoAPAC: Veterinary X-Ray Market, By Mobility, 2016–2023 (USD Million)

Table 163 RoAPAC: Veterinary X-Ray Market, By Animal Type, 2016–2023 (USD Million)

Table 164 RoAPAC: Veterinary X-Ray Market, By Application, 2016–2023 (USD Million)

Table 165 RoAPAC: Veterinary X-Ray Market, By End User, 2016–2023 (USD Million)

Table 166 Number of Veterinarians and Veterinary Para-Professionals in Latin American Countries, 2010 vs 2016

Table 167 Latin America: Veterinary X-Ray Market, By Technology, 2016–2023 (USD Million)

Table 168 Latin America: Veterinary X-Ray Market, By Type, 2016–2023 (USD Million)

Table 169 Latin America: Veterinary X-Ray Market, By Mobility, 2016–2023 (USD Million)

Table 170 Latin America: Veterinary X-Ray Market, By Animal Type, 2016–2023 (USD Million)

Table 171 Latin America: Veterinary X-Ray Market, By Application, 2016–2023 (USD Million)

Table 172 Latin America: Veterinary X-Ray Market, By End User, 2016–2023 (USD Million)

Table 173 Africa: Food-Producing Animal Population (Million)

Table 174 Africa: Number of Veterinarians and Para-Veterinarians (2010 vs 2016)

Table 175 Middle East: Number of Veterinarians and Para Veterinarians (2010 vs 2016)

Table 176 Middle East & Africa: Veterinary X-Ray Market, By Technology, 2016–2023 (USD Million)

Table 177 Middle East & Africa: Veterinary X-Ray Market, By Type, 2016–2023 (USD Million)

Table 178 Middle East & Africa: Veterinary X-Ray Market, By Mobility, 2016–2023 (USD Million)

Table 179 Middle East & Africa: Veterinary X-Ray Market, By Animal Type, 2016–2023 (USD Million)

Table 180 Middle East & Africa: Veterinary X-Ray Market, By Application, 2016–2023 (USD Million)

Table 181 Middle East & Africa: Veterinary X-Ray Market, By End User, 2016–2023 (USD Million)

Table 182 Growth Strategy Matrix (2015–2018)

Table 183 Product Portfolio Analysis: Veterinary X-Ray Market

Table 184 Acquisitions, 2015–2018

Table 185 Partnerships, 2015–2018

Table 186 Product Launches, 2015–2018

List of Figures (40 Figures)

Figure 1 Veterinary X-Ray Market Segmentation

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews (Supply Side): By Company Type, Designation, and Region

Figure 4 Breakdown of Primary Interviews (Demand Side): By End User, Designation, and Region

Figure 5 Bottom-Up Approach

Figure 6 Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Veterinary X-Ray Market, By Technology, 2018 vs 2023 (USD Million)

Figure 9 Veterinary X-Ray Market, By Animal Type, 2018 vs 2023 (USD Million)

Figure 10 Veterinary X-Ray Market, By End User, 2018 vs 2023 (USD Million)

Figure 11 Geographic Snapshot of Veterinary X-Ray Market

Figure 12 Growth in Companion Animal Population & Rising Demand for Pet Insurance to Drive Market Growth

Figure 13 China to Witness the Highest Growth During the Forecast Period

Figure 14 Computed Radiography Systems Accounted for the Largest Share of the North American Veterinary X-Ray Market in 2017

Figure 15 APAC to Register the Highest Growth Rate During the Forecast Period (2018–2023)

Figure 16 Developing Markets to Register A Higher Growth Rate Between 2018 & 2023

Figure 17 North America: Pet Health Insurance Market, 2012–2016 (USD Million)

Figure 18 Computed Radiography Systems to Dominate the Veterinary X-Ray Market, By Technology, During the Forecast Period

Figure 19 Digital X-Ray Systems Will Continue to Dominate the Veterinary X-Ray Market During the Forecast Period

Figure 20 Stationary X-Ray Systems Will Continue to Dominate the Market During the Forecast Period

Figure 21 Small Companion Animals Will Continue to Dominate the Veterinary X-Ray Market During the Forecast Period

Figure 22 Oncology Segment to Register the Highest Growth in the Veterinary X-Ray Market During the Forecast Period

Figure 23 Veterinary Hospitals & Academic Institutes to Continue to Dominate the Veterinary X-Ray Market in 2023

Figure 24 Rise in the Number of Veterinarians in the US (2012–2016)

Figure 25 North America to Dominate the Market During the Forecast Period

Figure 26 Veterinary X-Ray Market: Geographical Growth Opportunities

Figure 27 North America: Veterinary X-Ray Market Snapshot

Figure 28 Rise in the Number of Companion Animal Veterinarians in the Us

Figure 29 Rise in Companion Animal Health Insurance in the US (2008 to 2016)

Figure 30 Rise in Number of Practising Veterinarians, UK (2013–2016)

Figure 31 APAC: Veterinary X-Ray Market Snapshot

Figure 32 Geographic Reach of Key Market Players (2017)

Figure 33 Veterinary X-Ray Market Share Analysis, By Key Player, 2017

Figure 34 Onex Corporation: Company Snapshot (2017)

Figure 35 IDEXX Laboratories, Inc.: Company Snapshot (2017)

Figure 36 Agfa-Gevaert Group: Company Snapshot (2017)

Figure 37 Fujifilm: Company Snapshot (2017)

Figure 38 Canon: Company Snapshot (2017)

Figure 39 Heska Corporation: Company Snapshot (2017)

Figure 40 Konika Minolta: Company Snapshot (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Veterinary X-ray Market