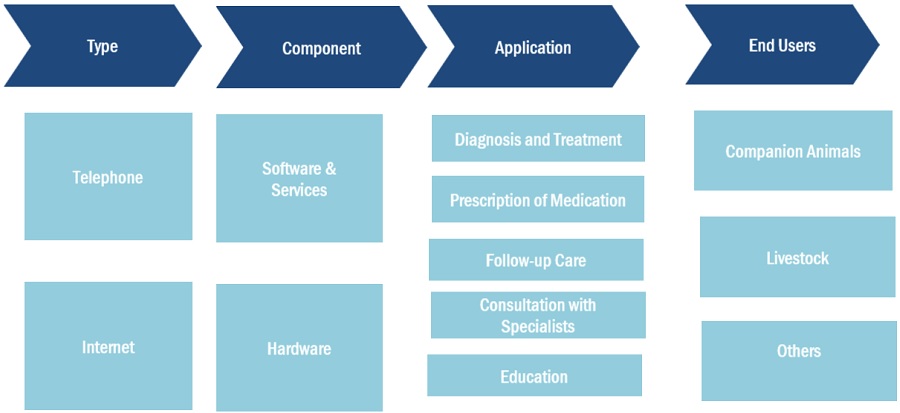

Veterinary Telemedicine Market by Type (Telephone, Internet), Component (Software & Services, Hardware), Application (Diagnosis & Treatment, Prescription, Follow-up, Consultation, Education), Animal Type (Companion, Livestock) & Region - Global Forecast to 2028

Market Growth Outlook Summary

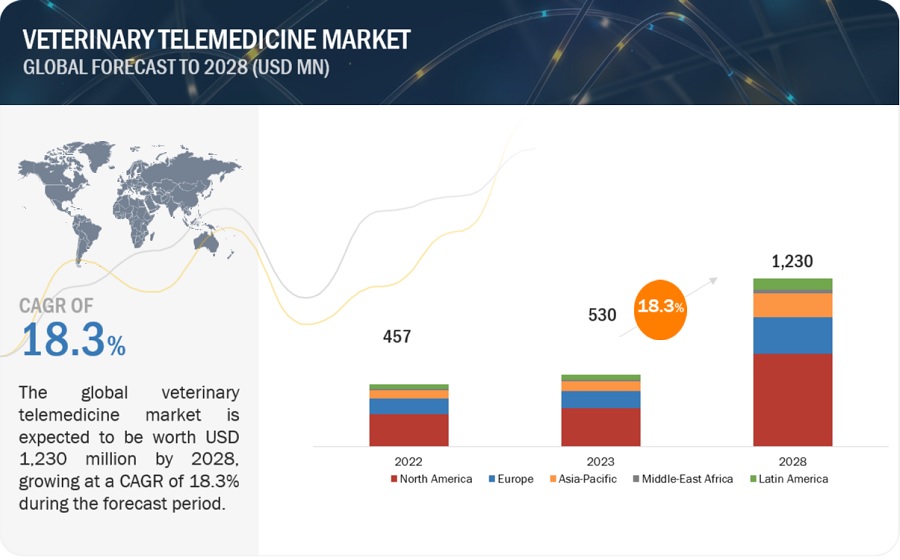

The global veterinary telemedicine market, valued at US$457 million in 2022, stood at US$530 million in 2023 and is projected to advance at a resilient CAGR of 18.3% from 2023 to 2028, culminating in a forecasted valuation of US$1,230 million by the end of the period. Growth in this market is largely driven by the increasing adoption of Internet of Things (IoT) and Artificial Intelligence (AI) technologies both pet owners and the veterinary industry has significantly influenced the development and effectiveness of veterinary telemedicine. IoT devices, such as wearables and smart sensors, enable remote monitoring of pets' vital signs and health parameters, with real-time data transmitted to veterinarians for analysis. AI algorithms can analyze this data to identify patterns and trends, aiding in accurate assessments and timely interventions. Additionally, AI-powered telemedicine platforms facilitate virtual consultations, where AI algorithms assist in diagnosis and treatment decisions by analyzing medical records and diagnostic images. Predictive analytics and AI-driven chatbots/virtual assistants provide proactive recommendations, triage support, and personalized care guidance. Furthermore, electronic health record systems for pets, enabled by IoT and AI, enhance data management and drive evidence-based decision making, resulting in improved remote monitoring, diagnostic accuracy, preventive care, and overall efficiency in veterinary healthcare delivery.

Attractive Opportunities in Veterinary Telemedicine Market

To know about the assumptions considered for the study, Request for Free Sample Report

Veterinary Telemedicine Market Dynamics

Driver: Increasing prevalence of chronic diseases in animals

Globally, the prevalence of several chronic conditions has increased in animals over the last decade. According to the American Veterinary Medical Association (AVMA), diabetes mellitus is a common chronic disease in both cats and dogs. It is estimated that approximately 1 in 200 cats and 1 in 300 dogs develop diabetes in their lifetime. Also, according to the International Renal Interest Society (IRIS), chronic kidney disease (CKD) is prevalent in aging cats and dogs. It is estimated that up to 30% of cats and 10% of dogs over the age of 10 suffer from CKD. Similarly, Cancer is a group of diseases that can affect any part of the body. It is the second leading cause of death in dogs and the third leading cause of death in cats. (Source: National Cancer Institute).

Restraint: High costs associated with the services

The high cost of veterinary telemedicine can factor that may limit its widespread adoption and act as a restraint for the market. While telemedicine offers numerous benefits in terms of convenience, accessibility, and reduced stress for both pets and their owners, the cost associated with providing telemedicine services can be a restraint for the growth of the market. Several factors contribute to the cost of veterinary telemedicine services. Such as, implementing a telemedicine platform requires initial investment in technology infrastructure, software development, and staff training. Additionally, maintaining secure communication channels, complying with data privacy regulations, and ensuring reliable internet connectivity all add to the expenses. Furthermore, veterinarians offering telemedicine services charge consultation fees that are comparable to or slightly lower than in-person visits. However, depending on the nature of the medical condition, certain cases may require additional diagnostic tests or in-person examinations, leading to additional costs. These costs can accumulate, particularly for ongoing treatment or complex medical conditions.

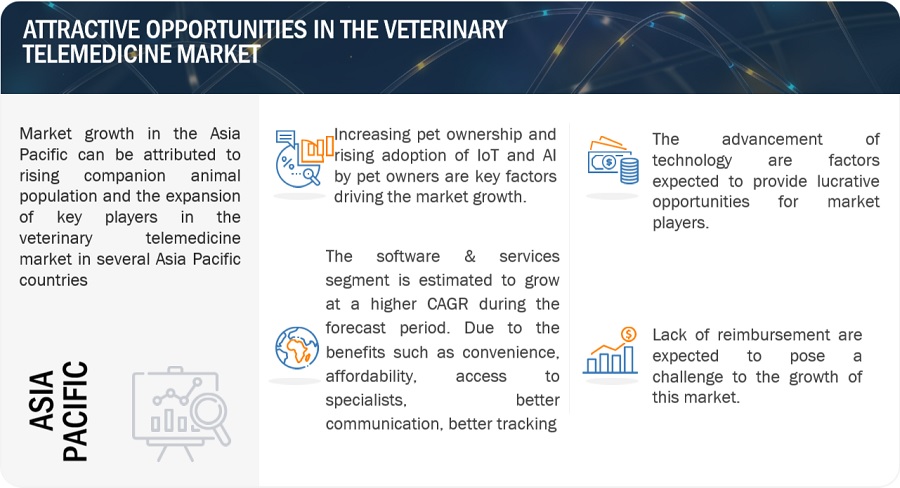

Opportunity: The advancement of technology

Advancements in technology play a crucial role in the growth and development of veterinary telemedicine. These advancements have improved the quality of care, expanded the range of services, and increased accessibility for both veterinarians and pet owners. The development of specialized telemedicine platforms and mobile applications has revolutionized veterinary care. These platforms allow veterinarians to conduct virtual consultations, share medical records and images, and communicate with pet owners remotely. Examples of popular telemedicine platforms include Firstvet, Vetster, TeleVet, and AirVet.

Challenge: Lack of reimbursement

In many regions, insurance coverage for veterinary telemedicine services is limited or non-existent. This means that pet owners typically have to pay out-of-pocket for virtual consultations, which may deter some individuals from utilizing telemedicine options. The absence of insurance reimbursement can create financial barriers and limit the adoption of telemedicine services. Without reimbursement, veterinary clinics may find it challenging to set competitive pricing for telemedicine services. They must strike a balance between covering their costs and making services affordable for pet owners. The lack of reimbursement can impact the financial viability and sustainability of veterinary telemedicine practices.

Veterinary Telemedicine Market Ecosystem

Leading players in this market include well-established and financially stable service providers of veterinary telemedicine services. These companies have been operating in the market for several years and possess a diversified product/service portfolio, advanced technologies, and strong global presence. Prominent companies in this market include Vettriage (US), JustAnswer(US), Airvet (US), PetDesk (US), Pawsquad (UK).

The internet segment of veterinary telemedicine industry is expected to register the highest CAGR during the forecast period.

Based on type, the veterinary telemedicine market is segmented into telephone and internet. The internet segment is expected to register the highest CAGR during the forecast period. The internet segment also allows for the use of live chat and video conferencing, which can provide a more interactive and personal experience for pet owners. Internet-based veterinary telemedicine is a valuable tool for pet owners and veterinarians. It is a more comprehensive and interactive way to provide veterinary care, and it is becoming increasingly popular.

The software & services segment of veterinary telemedicine industry is estimated to grow at a higher CAGR during the forecast period.

Based on component, the veterinary telemedicine market is segmented into software & services and hardware. The software & services segment is estimated to grow at a higher CAGR during the forecast period.

Growth in this segment can be attributed to the benefits such as convenience, affordability, access to specialists, better communication, better tracking.

The diagnosis and treatment segment of veterinary telemedicine industry is expected to grow at the highest CAGR during the forecast period.

Based on application, the veterinary telemedicine market is segmented into diagnosis and treatment, prescription of medication, follow-up care, consultation with specialists and education. The diagnosis and treatment segment in the market is expected to continue to grow in the coming years. As the technology continues to improve and more veterinarians become comfortable using telemedicine, it is likely that this segment will become even more popular.

APAC is estimated to be the fastest-growing regional market for veterinary telemedicine industry.

The global veterinary telemedicine market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2022, APAC is estimated to be the fastest-growing regional market for veterinary telemedicine. The high growth in this market can majorly be attributed to the growing disposable income levels in APAC countries, due to which the willingness to spend on animal healthcare and well-being is rising. The growing trend of pet ownership in APAC countries has resulted in increased pet healthcare expenditures.

To know about the assumptions considered for the study, download the pdf brochure

The veterinary telemedicine market is dominated by a few globally established players such as Vettriage (US), JustAnswer (US), Airvet (US), PetDesk (US), Pawsquad (UK).

Scope of the Veterinary Telemedicine Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$530 million |

|

Projected Revenue by 2028 |

$1,230 million |

|

Revenue Rate |

Poised to Grow at a CAGR of 18.3% |

|

Market Driver |

Increasing prevalence of chronic diseases in animals |

|

Market Opportunity |

The advancement of technology |

The study categorizes the veterinary telemedicine market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Telephone

- Internet

By Component

- Software & Services

- Hardware

By Application

- Diagnosis and treatment

- Prescription of medication

- Follow-up care

- Consultation with specialists

- Education

By Animal Type

- Companion Animals

- Livestock

- Others

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global veterinary telemedicine market between 2023 and 2028?

The global veterinary telemedicine market is projected to grow from USD 530 million in 2023 to USD 1,230 million by 2028, demonstrating a robust CAGR of 18.3%.

What are the key factors driving the veterinary telemedicine market?

The major drivers of the veterinary telemedicine market include the increasing prevalence of chronic diseases in animals, advancements in technology such as AI and IoT, and the growing trend of pet ownership globally.

What challenges does the veterinary telemedicine market face?

Key challenges in the veterinary telemedicine market include the high costs associated with telemedicine services and the lack of reimbursement from insurance providers for virtual consultations.

Which segment is expected to register the highest growth in the veterinary telemedicine market?

The internet segment is expected to register the highest CAGR during the forecast period, driven by the increasing use of video conferencing and live chat tools for more comprehensive and interactive veterinary care.

What role do software and services play in the veterinary telemedicine market?

The software and services segment is expected to grow at a higher CAGR due to the convenience and affordability it offers, along with better communication and access to specialists, which is transforming veterinary healthcare delivery.

How does the increasing prevalence of chronic diseases in animals affect the veterinary telemedicine market?

The rising prevalence of chronic diseases like diabetes, chronic kidney disease (CKD), and cancer in pets is driving demand for veterinary telemedicine services, enabling pet owners to manage these conditions more effectively.

What technological advancements are contributing to the growth of veterinary telemedicine?

Advancements such as IoT devices for remote monitoring, AI-powered telemedicine platforms, and predictive analytics are significantly improving diagnostic accuracy and the overall efficiency of veterinary care, contributing to market growth.

Which regions are expected to show the highest growth in the veterinary telemedicine market?

The Asia-Pacific (APAC) region is expected to experience the fastest growth, driven by rising disposable incomes, increased pet ownership, and growing healthcare expenditure in countries like China, India, and Japan.

How are pet owners contributing to the growth of the veterinary telemedicine market?

The growing trend of pet ownership, particularly in developed and emerging economies, is increasing demand for veterinary telemedicine services as pet owners seek convenient, accessible, and personalized care for their pets.

What is the role of leading companies in the veterinary telemedicine market?

Leading companies such as Vettriage, JustAnswer, Airvet, and PetDesk are at the forefront of developing specialized telemedicine platforms, expanding access to virtual care, and leveraging AI to enhance diagnostic and treatment capabilities in the veterinary telemedicine market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing pet ownership- Increasing prevalence of chronic diseases in animals- Rising adoption of IoT and AI by pet owners- Increase in pet healthcare spendingRESTRAINTS- High cost associated with veterinary telemedicine services- Lack of awareness and accessibility to servicesOPPORTUNITIES- Advancements in technology- Increased access to specialistsCHALLENGES- Lack of reimbursement

-

5.3 INDUSTRY TRENDSDEVELOPMENT OF NEW AND INNOVATIVE SERVICESGROWTH OF SUBSCRIPTION MODEL

-

5.4 REGULATORY ANALYSISNORTH AMERICA- US- CanadaEUROPEASIA PACIFICLATIN AMERICA

- 5.5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6 VALUE CHAIN ANALYSIS

-

5.7 ECOSYSTEM MARKET MAP

-

5.8 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR VETERINARY TELEMEDICINEVETERINARY TELEMEDICINE MARKET: TOP APPLICANTSJURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR PATENTS

- 5.10 TECHNOLOGY ANALYSIS

- 5.11 PRICING MODEL ANALYSIS

-

5.12 KEY CONFERENCES AND EVENTSLIST OF KEY CONFERENCES AND EVENTS (2023–2025)

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 INTERNETFASTEST-GROWING SEGMENT OF MARKET

-

6.3 TELEPHONEOLDEST AND MOST ESTABLISHED SEGMENT

- 7.1 INTRODUCTION

-

7.2 SOFTWARE & SERVICESGROWING ADOPTION OF MOBILE DEVICES TO DRIVE MARKET

-

7.3 HARDWAREESSENTIAL COMPONENT OF VETERINARY TELEMEDICINE

- 8.1 INTRODUCTION

-

8.2 DIAGNOSIS AND TREATMENTINCREASING DEMAND FOR CONVENIENT AND ACCESSIBLE VETERINARY CARE TO DRIVE MARKET

-

8.3 PRESCRIPTION OF MEDICATIONCONVENIENT OPTION FOR PET OWNERS TO SEEK VETERINARY CARE REMOTELY

-

8.4 FOLLOW-UP CAREESSENTIAL COMPONENT OF VETERINARY TELEMEDICINE

-

8.5 CONSULTATION WITH SPECIALISTSRESULTS IN FASTER ACCESS TO SPECIALIZED OPINIONS

-

8.6 EDUCATIONEXPANDS ACCESS TO QUALITY EDUCATIONAL RESOURCES FOR VETERINARY PROFESSIONALS

- 9.1 INTRODUCTION

-

9.2 COMPANION ANIMALSRISING PET ADOPTION TO DRIVE MARKET

-

9.3 LIVESTOCKGROWING FOCUS ON REGULAR CHECKUPS TO SUPPORT MARKET GROWTH

- 9.4 OTHER ANIMALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Large population of companion animals to drive marketCANADA- Rising pet and livestock population to support market growth

-

10.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Increasing awareness about pet healthcare to drive marketFRANCE- Rising pet ownership to support market growthUK- Growing pet adoption to drive demand for veterinary telemedicineITALY- Rising demand for poultry and pork meat to support market growthSPAIN- Increasing number of veterinary practices to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTJAPAN- Increasing expenditure on pet healthcare to drive marketCHINA- Fastest-growing veterinary telemedicine market in Asia PacificINDIA- Rising demand for meat and dairy products to support market growthREST OF ASIA PACIFIC

-

10.5 LATIN AMERICAGROWING VETERINARY HEALTHCARE EXPENDITURE TO DRIVE MARKETLATIN AMERICA: RECESSION IMPACT

-

10.6 MIDDLE EAST & AFRICAGROWING PREVALENCE OF ANIMAL DISEASES TO PROPEL MARKETMIDDLE EAST & AFRICA: RECESSION IMPACT

- 11.1 INTRODUCTION

- 11.2 MARKET SHARE ANALYSIS

-

11.3 COMPANY FOOTPRINT ANALYSISCOMPANY FOOTPRINT, BY TYPECOMPANY FOOTPRINT, BY REGION

-

11.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.5 COMPETITIVE BENCHMARKING

-

12.1 KEY PLAYERSVETTRIAGE- Business overview- Services offered- MnM viewJUSTANSWER- Business overview- Services offered- MnM viewAIRVET- Business overview- Services offered- MnM viewFIRSTVET- Business overview- Services offeredVETSTER- Business overview- Services offeredTELEVET- Business overview- Services offeredANIPANION- Business overview- Services offeredVITUSVET- Business overview- Services offeredWHISKERS WORLDWIDE- Business overview- Services offeredWELLHAVEN PET HEALTH- Business overview- Services offeredASKVET- Business overview- Services offeredPETRIAGE- Business overview- Services offeredPETDESK- Business overview- Services offeredPAWSQUAD- Business overview- Services offeredBI X GMBH- Business overview- Services offeredGUARDIANVETS- Business overview- Services offeredTELETAILS- Business overview- Services offeredACTIV4PETS- Business overview- Services offeredBABELBARK- Business overview- Services offeredLINKYVET- Business overview- Services offeredVETCHAT- Business overview- Services offeredVETCT- Business overview- Services offeredVETOCLOCK- Business overview- Services offeredVETNOW- Business overview- Services offeredVETSOURCE- Business overview- Services offered

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 RISK ASSESSMENT: VETERINARY TELEMEDICINE MARKET

- TABLE 2 EUROPE: PET POPULATION, BY COUNTRY, 2014–2022 (MILLION)

- TABLE 3 US: BREAKDOWN OF PET INDUSTRY EXPENDITURE, 2020 VS. 2021 (USD BILLION)

- TABLE 4 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 AVERAGE SELLING PRICE OF VETERINARY TELEMEDICINE DEVICES AND SERVICES OFFERED BY LEADING PLAYERS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VETERINARY TELEMEDICINE DEVICES AND SERVICES

- TABLE 8 KEY BUYING CRITERIA FOR VETERINARY TELEMEDICINE DEVICES AND SERVICES

- TABLE 9 VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 10 INTERNET-BASED VETERINARY TELEMEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 11 TELEPHONE-BASED VETERINARY TELEMEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 12 VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 13 VETERINARY TELEMEDICINE SOFTWARE & SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 14 VETERINARY TELEMEDICINE HARDWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 15 VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 16 VETERINARY TELEMEDICINE MARKET FOR DIAGNOSIS AND TREATMENT, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 VETERINARY TELEMEDICINE MARKET FOR PRESCRIPTION OF MEDICATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 18 VETERINARY TELEMEDICINE MARKET FOR FOLLOW-UP CARE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 VETERINARY TELEMEDICINE MARKET FOR CONSULTATION WITH SPECIALISTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 VETERINARY TELEMEDICINE MARKET FOR EDUCATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 22 POPULATION OF SMALL COMPANION ANIMALS, BY COUNTRY, 2012–2020 (MILLION)

- TABLE 23 VETERINARY TELEMEDICINE MARKET FOR COMPANION ANIMALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 VETERINARY TELEMEDICINE MARKET FOR LIVESTOCK, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 VETERINARY TELEMEDICINE MARKET FOR OTHER ANIMALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 VETERINARY TELEMEDICINE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 NORTH AMERICA: VETERINARY TELEMEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 NORTH AMERICA: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 29 NORTH AMERICA: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 32 US: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 33 US: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 34 US: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 35 US: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 36 CANADA: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 37 CANADA: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 38 CANADA: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 39 CANADA: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 40 EUROPE: VETERINARY TELEMEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 EUROPE: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 42 EUROPE: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 43 EUROPE: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 44 EUROPE: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 45 GERMANY: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 46 GERMANY: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 47 GERMANY: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 48 GERMANY: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 49 FRANCE: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 50 FRANCE: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 51 FRANCE: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 52 FRANCE: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 53 UK: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 54 UK: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 55 UK: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 56 UK: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 57 ITALY: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 58 ITALY: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 59 ITALY: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 60 ITALY: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 61 SPAIN: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 62 SPAIN: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 63 SPAIN: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 64 SPAIN: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 65 REST OF EUROPE: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 66 REST OF EUROPE: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 67 REST OF EUROPE: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 68 REST OF EUROPE: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 69 ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 72 ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 74 JAPAN: PRODUCTION AND CONSUMPTION OF ANIMAL-DERIVED FOOD PRODUCTS, 2000 VS. 2030 (THOUSAND METRIC TONS)

- TABLE 75 JAPAN: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 76 JAPAN: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 77 JAPAN: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 78 JAPAN: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 79 CHINA: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 80 CHINA: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 81 CHINA: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 82 CHINA: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 83 INDIA: PRODUCTION AND CONSUMPTION OF ANIMAL-DERIVED FOOD PRODUCTS, 2000 VS. 2030 (THOUSAND METRIC TONS)

- TABLE 84 INDIA: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 85 INDIA: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 86 INDIA: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 87 INDIA: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 88 REST OF ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 89 REST OF ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 90 REST OF ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 92 LATIN AMERICA: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 LATIN AMERICA: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 94 LATIN AMERICA: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 95 LATIN AMERICA: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 96 MIDDLE EAST & AFRICA: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 98 MIDDLE EAST & AFRICA: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 100 VETERINARY TELEMEDICINE MARKET: KEY STARTUPS/SMES

- TABLE 101 VETTRIAGE: BUSINESS OVERVIEW

- TABLE 102 JUSTANSWER: BUSINESS OVERVIEW

- TABLE 103 AIRVET: BUSINESS OVERVIEW

- TABLE 104 FIRSTVET: BUSINESS OVERVIEW

- TABLE 105 VETSTER: BUSINESS OVERVIEW

- TABLE 106 TELEVET: BUSINESS OVERVIEW

- TABLE 107 ANIPANION: BUSINESS OVERVIEW

- TABLE 108 VITUSVET: BUSINESS OVERVIEW

- TABLE 109 WHISKERS WORLDWIDE: BUSINESS OVERVIEW

- TABLE 110 WELLHAVEN PET HEALTH: BUSINESS OVERVIEW

- TABLE 111 ASKVET: BUSINESS OVERVIEW

- TABLE 112 PETRIAGE: BUSINESS OVERVIEW

- TABLE 113 PETDESK: BUSINESS OVERVIEW

- TABLE 114 PAWSQUAD: BUSINESS OVERVIEW

- TABLE 115 BI X GMBH: BUSINESS OVERVIEW

- TABLE 116 GUARDIANVETS: BUSINESS OVERVIEW

- TABLE 117 TELETAILS: BUSINESS OVERVIEW

- TABLE 118 ACTIV4PETS: BUSINESS OVERVIEW

- TABLE 119 BABELBARK: BUSINESS OVERVIEW

- TABLE 120 LINKYVET: BUSINESS OVERVIEW

- TABLE 121 VETCHAT: BUSINESS OVERVIEW

- TABLE 122 VETCT: BUSINESS OVERVIEW

- TABLE 123 VETOCLOCK: BUSINESS OVERVIEW

- TABLE 124 VETNOW: BUSINESS OVERVIEW

- TABLE 125 VETSOURCE: BUSINESS OVERVIEW

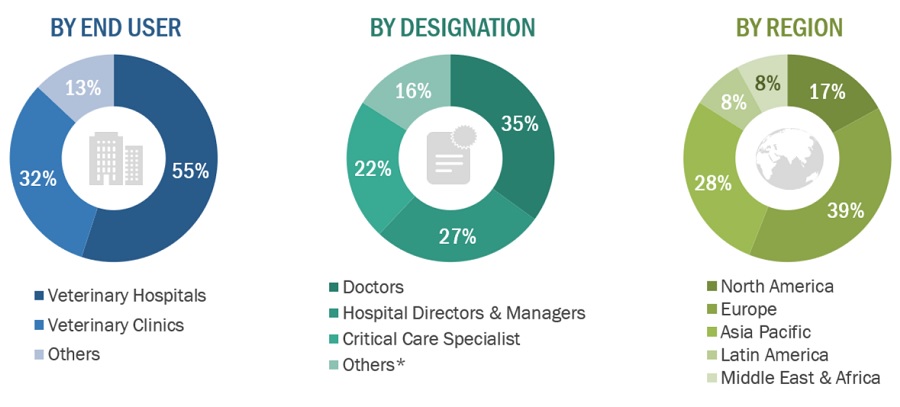

- FIGURE 1 VETERINARY TELEMEDICINE MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: VETTRIAGE

- FIGURE 9 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR VETERINARY TELEMEDICINE MARKET (2023–2028)

- FIGURE 10 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

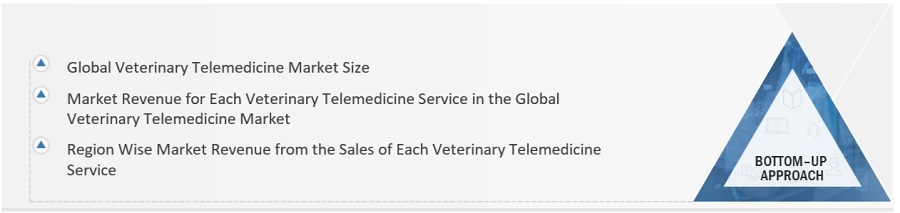

- FIGURE 11 TOP-DOWN APPROACH

- FIGURE 12 BOTTOM-UP APPROACH

- FIGURE 13 DATA TRIANGULATION METHODOLOGY

- FIGURE 14 VETERINARY TELEMEDICINE MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 GEOGRAPHICAL SNAPSHOT OF VETERINARY TELEMEDICINE MARKET

- FIGURE 19 INCREASING PET OWNERSHIP TO DRIVE MARKET

- FIGURE 20 INTERNET SEGMENT HELD LARGEST SHARE OF ASIA PACIFIC MARKET IN 2022

- FIGURE 21 ASIA PACIFIC COUNTRIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 22 NORTH AMERICA WILL CONTINUE TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 23 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 24 VETERINARY TELEMEDICINE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 US: PET INDUSTRY EXPENDITURE, 2010–2021 (USD BILLION)

- FIGURE 26 VETERINARY TELEMEDICINE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 VETERINARY TELEMEDICINE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 VETERINARY TELEMEDICINE MARKET: GLOBAL PATENT PUBLICATION TRENDS (2015–2023)

- FIGURE 29 TOP APPLICANTS FOR VETERINARY TELEMEDICINE PATENTS (2015–2023)

- FIGURE 30 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR VETERINARY TELEMEDICINE (2015–2023)

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VETERINARY TELEMEDICINE DEVICES AND SERVICES

- FIGURE 32 KEY BUYING CRITERIA FOR VETERINARY TELEMEDICINE DEVICES AND SERVICES

- FIGURE 33 NORTH AMERICA: VETERINARY TELEMEDICINE MARKET SNAPSHOT

- FIGURE 34 US: POPULATION OF DOGS, 2012–2023 (MILLION)

- FIGURE 35 US: PET INDUSTRY EXPENDITURE, 2018–2022 (USD BILLION)

- FIGURE 36 ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET SNAPSHOT

- FIGURE 37 VETERINARY TELEMEDICINE MARKET SHARE, BY KEY PLAYER (2022)

- FIGURE 38 VETERINARY TELEMEDICINE MARKET: COMPANY EVALUATION MATRIX

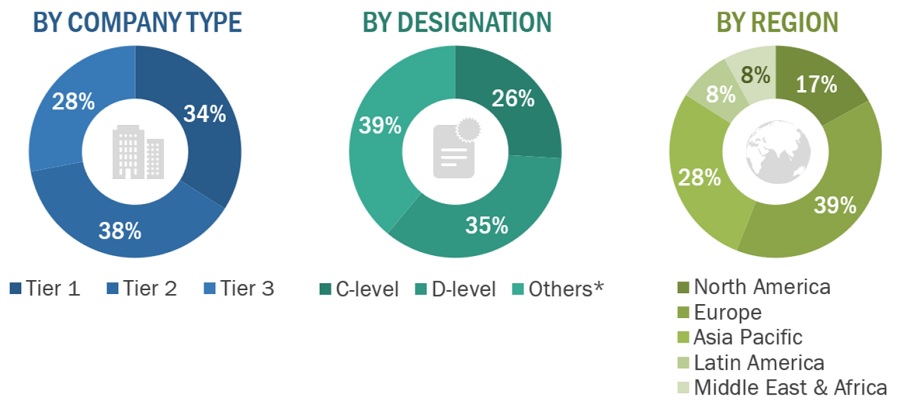

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the veterinary telemedicine market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Extensive primary research was conducted after obtaining information regarding the veterinary telemedicine market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from veterinary telemedicine service providers; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. The primary sources from the supply side and demand side are detailed below.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Interviews: Supply-Side Participants, By Company Type, Designation, And Region

Supply side:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Breakdown of Primary Interviews: Demand-Side Participants, By End User, Designation, And Region

Demand Side:

Note: Others include department heads, research scientists, and professors.

Market Size Estimation

The total size of the veterinary telemedicine market was arrived at after data triangulation from two different approaches, as mentioned below. After each approach, the weighted average of all approaches was taken based on the level of assumptions used in each approach.

Global Veterinary Telemedicine Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Veterinary Telemedicine Market Size: Top-Down Approach

Data Triangulation

After arriving at the market size, the total market was divided into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were employed, wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in this report’s market engineering process.

Market Definition

Veterinary telemedicine is the use of telecommunications technologies to provide veterinary medical services remotely. This can include things such as video consultations between veterinarians and pet owners, remote monitoring of sick or injured animals, transmission of medical images and laboratory results, provision of educational resources to pet owners. Veterinary telemedicine is a promising tool that has the potential to improve access to care and improve patient outcomes.

Key Stakeholders

- Manufacturers of veterinary telemedicine and related devices

- Suppliers and distributors of veterinary telemedicine

- Veterinary hospitals, clinics, and veterinary colleges

- Teaching hospitals and academic medical centers

- Government bodies/municipal corporations

- Business research and consulting service providers

- Venture capitalists

- US Food and Drug Administration (US FDA)

- European Union (EU)

Objectives of the Study

- To describe, analyze, and forecast the veterinary telemedicine market, by type, component, application, animal type, and region.

- To describe and forecast the veterinary telemedicine market for key regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the veterinary telemedicine market

- To strategically analyze the ecosystem, regulations, patenting trend, value chain, Porter’s five forces, and prices pertaining to the market under study

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players.

- To profile key players and comprehensively analyze their market shares and core competencies in the veterinary telemedicine market.

Available customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the RoE veterinary telemedicine market into Austria, Finland, and others

- Further breakdown of the RoLATAM veterinary telemedicine market into Brazil, Mexico, Argentina, Colombia, Chile, and others

Competitive Landscape Assessment

- Market share analysis for the North America and Europe region, which provides market shares of the top 3–5 key players in the veterinary telemedicine market.

- Competitive leadership mapping for established players in the US

Growth opportunities and latent adjacency in Veterinary Telemedicine Market