Veterinary Pharmaceuticals Market by Product (Drugs, Vaccines, Medicatives feed additives), Animal Type (Production, Companion), Route of Administration (Oral, Parenteral), Distribution Channel (Veterinary Hospitals, Clinics), Indication (Infectious, Dermatology, Pain) and Region - Global Forecast to 2027

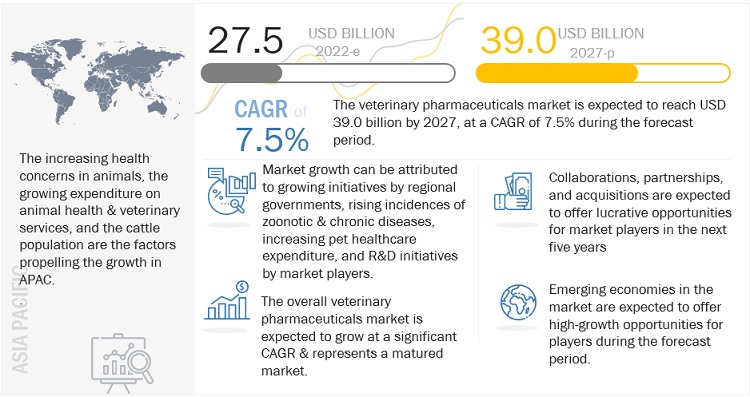

The global veterinary pharmaceuticals market size is projected to reach USD 39.0 billion by 2027 from USD 27.5 billion in 2022, at a CAGR of 7.5% during the forecast period. Market is driven by factors such as growing livestock population, rise in pet ownership, rising meat & diary consumption, incrementing number of infectious diseases among animals, mandatory animal vaccinations. On the other hand, rising threat of antibiotic resistance, poor veterinary healthcare infrastructure is expected to limit market growth to a certain extent in the coming years.

The rise in pet ownership is one of the factors driving the market growth during the forecast period. According to Household, Income and Labour Dynamics in Australia (HILDA) Survey, published in 2020, two-thirds of the Australians, which accounted for 62% of surveyed people have at least one pet. The reports also indicates that around 72% of Australian pet owners have at least one dog and 37% have a least one cat. Increasing penetration of pet ownership will increase a greater number of pets and therefore the demand for more veterinary pharmaceuticals in the market.

Veterinary Pharmaceutical Market

To know about the assumptions considered for the study, Request for Free Sample Report

“The production animal segment accounted for the largest market share in the veterinary pharmaceuticals market, by animal type, during the forecast period”

The Veterinary pharmaceuticals market is segmented into production animals & companion animals, by animal type. In 2021, production animal segment accounted for a sizable market share in the veterinary pharmaceuticals market, by animal type. The increasing spending on animal health, rising demands for protein, are attributed to the market growth.

“The topical segment is projected to grow at highest CAGR during the forecast period”

Based on route of administration, the veterinary pharmaceuticals market is segmented into oral, parenteral, and topical route. The topical segment accounted for the significant growth rate throughout the forecast period. This can be attributed to its high adoption for the treatment of skin infections in animals.

“APAC region accounted for the highest CAGR”

The global veterinary pharmaceuticals market is divided into five regions: North America, Asia-Pacific, Europe, Latin America, and the Middle East and Africa. According to the regional analysis, the Asia-Pacific region is likely to retain a considerable growth rate throughout the forecast period. The Asia-Pacific Veterinary pharmaceuticals market is being propelled by the factors, such as higher adoption of companion animals and increasing health concerns in animals, have promoted the market growth in this region. In addition, the growing expenditure on animal health & veterinary services, and the cattle population are expected to drive the market in the Asia Pacific region.

To know about the assumptions considered for the study, download the pdf brochure

Competitive Landscape

Key Industry Developments:

The key market players are involved in strategic collaborations, regional expansions, and new product launches to sustain the competition. Established organizations and large enterprises are investing in acquisitions of other market players to gain a competitive edge. For instance, in October 2021, Zoetis invested in new manufacturing and development facility in Ireland, to increase its Monoclonal Antibodies (mAbs) production capabilities. This is anticipated to enhance its veterinary therapeutic biopharmaceuticals portfolio. In August 2020, Merck acquired IdentiGEN, a company dealing in DNA-based animal traceability solutions for aquaculture & livestock from Ireland-based MML Growth Capital Partners. This helped the company expand its product portfolio. Initiatives like these are further contributing to market growth.

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, D-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, Latin America – 6% , and the Middle East & Africa – 4%

Lits of Companies Profiled in the Report:

- Archer Daniels Midland

- Boehringer Ingelheim International GmbH

- Ceva Sante Animale

- Dechra Pharmaceuticals Plc

- Elanco Animal Health Inc.

- Evonik Industries AG (rag stiftung)

- Merck & Co., Inc.

- Soparfin SCA

- Virbac SA

- Zoetis Inc.

Scope of the Report:

|

Report Metric |

Details |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Veterinary pharmaceuticals – Product type, animal type, route of administration, end user, and region |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

|

Companies covered |

|

The research report categorizes the veterinary pharmaceuticals market into the following segments and subsegments:

Product Type

-

Drugs

- Anti-infective

- Anti-inflammatory

- Parasiticide

-

Vaccines

- Inactivated Vaccines

- Attenuated Vaccines

- Recombinant Vaccines

- Others

-

Medicated Feed Additives

- Amino Acids

- Antibiotics and Antimicrobials

Indication

- Infectious Diseases

- Dermatologic Diseases

- Pain

- Orthopedic Diseases

- Behavioral Diseases

- Other Indications

Animal Type

-

Production Animals/Livestock

- Poultry

- Swine

- Cattle

- Sheep & Goats

- Others

-

Companion Animals

- Dogs

- Cats

- Horses

- Others

- Route of Administration

- Oral Route

- Parenteral Route

- Topical Route

- Distribution Channels

- Veterinary Hospitals

- Veterinary Clinics

- Retail Pharmacies

Region

-

North America

- US

- Canada

-

Europe

- France

- Germany

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH APPROACH

2.1.1 SECONDARY SOURCES

2.1.1.1 KEY DATA FROM SECONDARY SOURCES

2.1.2 PRIMARY SOURCES

2.1.2.1 KEY DATA FROM PRIMARY SOURCES

2.1.2.2 BREAKDOWN OF PRIMARIES

2.2 MARKET SIZE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 INDUSTRY TRENDS

5.4 REGULATORY ANALYSIS

5.5 ECOSYSTEM ANALYSIS

5.6 TECHNOLOGY ANALYSIS

5.7 TRADE ANALYSIS

5.8 VALUE CHAIN ANALYSIS

5.9 PORTER’S FIVE FORCES ANALYSIS

5.10 PATENT ANALYSIS

5.11 SUPPLY CHAIN ANALYSIS

5.12 PRICING ANALYSIS

5.13 TRENDS & DISRUPTIONS AFFECTING CUSTOMERS BUSINESS

5.14 KEY CONFERENCES AND EVENTS (2022-2023)

5.15 KEY STAKEHOLDERS & BUYING CRITERIA

6 VETERINARY PHARMACEUTICALS MARKET, BY PRODUCT TYPE, 2020-2027 (USD MILLION)

6.1 INTRODUCTION

6.2 DRUGS

6.2.1 ANTI-INFECTIVE

6.2.2 ANTI-INFLAMMATORY

6.2.3 PARASITICIDE

6.3 VACCINES

6.3.1 INACTIVATED VACCINES

6.3.2 ATTENUATED VACCINES

6.3.3 RECOMBINANT VACCINES

6.3.4 OTHERS

6.4 MEDICATED FEED ADDITIVES

6.4.1 AMINO ACIDS

6.4.2 ANTIBIOTICS

7 VETERINARY PHARMACEUTICALS MARKET, BY ANIMAL TYPE, 2020-2027 (USD MILLION)

7.1 INTRODUCTION

7.2 PRODUCTION ANIMALS/LIVESTOCK

7.2.1 POULTRY

7.2.2 SWINE

7.2.3 CATTLE

7.2.4 SHEEP & GOATS

7.2.5 OTHERS

7.3 COMPANION ANIMALS

7.3.1 DOGS

7.3.2 CATS

7.3.3 HORSES

7.3.4 OTHERS

8 VETERINARY PHARMACEUTICALS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2027 (USD MILLION)

8.1 INTRODUCTION

8.2 ORAL ROUTE

8.3 PARENTERAL ROUTE

8.4 TOPICAL ROUTE

9 VETERINARY PHARMACEUTICALS MARKET, BY DISTRIBUTION CHANNEL, 2020-2027 (USD MILLION)

9.1 INTRODUCTION

9.2 VETERINARY HOSPITALS

9.3 VETERINARY CLINICS

9.4 RETAIL PHARMACIES

10 VETERINARY PHARMACEUTICALS MARKET, BY INDICATION, 2020-2027 (USD MILLION)

10.1 INTRODUCTION

10.2 INFECTIOUS DISEASES

10.3 DERMATOLOGIC DISEASES

10.4 PAIN

10.5 ORTHOPEDIC DISEASES

10.6 BEHAVIORAL DISEASES

10.7 OTHER INDICATIONS

11 VETERINARY PHARMACEUTICALS MARKET, BY COUNTRY/REGION, 2020-2027 (USD MILLION)

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.2.1 US

11.2.2 CANADA

11.3 EUROPE

11.3.1 UK

11.3.2 GERMANY

11.3.3 FRANCE

11.3.4 ITALY

11.3.5 SPAIN

11.3.6 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 JAPAN

11.4.2 CHINA

11.4.3 INDIA

11.4.4 REST OF ASIA PACIFIC

11.5 LATIN AMERICA

11.6 MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

12.1 OVERVIEW

12.2 REVENUE SHARE ANALYSIS OF KEY PLAYERS (2021)

12.3 COMPETITIVE BENCHMARKING

12.4 MARKET SHARE/RANKING ANALYSIS, BY KEY PLAYERS (2021)

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

12.6 STARTUPS/SMES EVALUATION QUADRANT (2021)

12.6.1 PROGRESSIVE COMPANIES

12.6.2 STARTING BLOCKS

12.6.3 RESPONSIVE COMPANIES

12.6.4 DYNAMIC COMPANIES

12.7 COMPANY PRODUCT FOOTPRINT

12.8 COMPANY INDICATION FOOTPRINT

12.9 COMPANY ANIMAL TYPE FOOTPRINT

12.10 COMPANY ROUTE OF ADMINISTRATION FOOTPRINT

12.11 COMPANY DISTRIBUTION CHANNEL FOOTPRINT

12.12 COMPANY END USER FOOTPRINT

12.13 COMPETITIVE SITUATIONS & TRENDS

13 COMPANY PROFILES

(Business Overview, Financials, Recent Developments, MnM View)

13.1 KEY PLAYERS

13.1.1 ARCHER DANIELS MIDLAND

13.1.2 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

13.1.3 CEVA SANTE ANIMALE

13.1.4 DECHRA PHARMACEUTICALS PLC

13.1.5 ELANCO ANIMAL HEALTH INC.

13.1.6 EVONIK INDUSTRIES AG (RAG STIFTUNG)

13.1.7 MERCK & CO., INC.

13.1.8 SOPARFIN SCA

13.1.9 VIRBAC SA

13.1.10 ZOETIS INC.

13.2 OTHER PLAYERS

13.2.1 BAYER AG

13.2.2 VETOQUINOL

13.2.3 CARGILL, INCORPORATED

13.2.4 NUTRECO

13.2.5 KINDRED BIOSCIENCES, INC.

13.2.6 BIOGÉNESIS BAGÓ

13.2.7 NEOGEN CORPORATION

13.2.8 HESTER BIOSCIENCES LIMITED

13.2.9 NORBROOK

13.2.10 PHIBRO ANIMAL HEALTH CORPORATION

13.2.11 CHINA ANIMAL HUSBANDRY CO. LTD

13.2.12 CADILA PHARMACEUTICALS LTD

13.2.13 APTIMMUNE BIOLOGICS

13.2.14 KYORITSU SEIYAKU

13.2.15 CHANELLE PHARMA

14 APPENDIX

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

*The segmentation of the study can be updated during the course of the study based on primary insights and secondary research

*The list of companies mentioned above is indicative only and might change during the course of the study.

*Details on key financials might not be captured in case of unlisted companies.

The veterinary pharmaceuticals market is mainly driven by factors such as rise in number of zoonotic & chronic diseases, rise in livestock population, increasing pet ownership rates, increase in demand for meat and animal-based products, increasing number of veterinary practitioners in developed eceonomies. However, high costs associated with animal healthcare, lack of awareness about animal health in the emerging nations, and increased prevalence of counterfeit drugs, are expected to restrain the growth of this market to a certain extent in the coming years.

The veterinary pharmaceutical market is segmented by product type, animal type, route of administration, end user, and region. The key players operating in the market include Archer-Daniels-Midland Company (US), Boehringer Ingelheim International GmbH (Germany), Ceva Santé Animale (France), Dechra Pharmaceuticals PLC (UK), Elanco Animal Health Inc. (US), Evonik Industries AG (Germany), Merck & Co., Inc. (US), Soparfin SCA (France), Virbac SA (France), Zoetis Inc. (US), Cargill, Inc. (US), Nutreco (Netherlands), Kindred Biosciences, Inc. (US), and Biogenesis Bago (Argentina).

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the veterinary pharmaceuticals market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the veterinary pharmaceuticals market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

A breakdown of the primary respondents for the veterinary pharmaceuticals market is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the veterinary pharmaceuticals market was arrived at after data triangulation from the following approaches:

Approach to calculate the revenue of different players in the veterinary pharmaceuticals market

The size of the global veterinary pharmaceuticals market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global veterinary pharmaceuticals market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the veterinary pharmaceuticals market by product type, animal type, route of administration, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of the veterinary pharmaceuticals market with respect to five major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle east & Africa

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile key players in the veterinary pharmaceuticals market as well as comprehensively analyze their core competencies

- To track and analyze competitive developments such as product launches; acquisitions; expansions; as well as collaborations, agreements, and partnerships of the leading players in the veterinary pharmaceuticals market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific veterinary pharmaceuticals market into Singapore, Australia, South Korea, New Zealand, and other countries

- Further breakdown of the Rest of Europe veterinary pharmaceuticals market into Belgium, Russia, the Netherlands, Switzerland, and other countries

- Further breakdown of the Rest of Latin America veterinary pharmaceuticals market into the Brazil, Mexico, and other countries.

Growth opportunities and latent adjacency in Veterinary Pharmaceuticals Market