Veterinary Pain Management Market by Product (Drug (NSAIDs, Opioids), Route of Administration (Oral, Parenteral), Device (Laser)), Application (Joint Pain, Cancer), Animal (Companion and Livestock), End User (Hospital, Pharmacy) - Global Forecast to 2027

Veterinary Pain Management Market Overview and Growth Projections

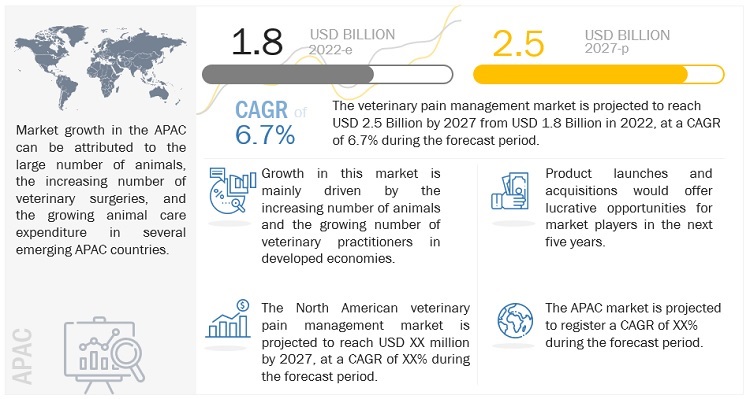

Veterinary pain management market growth forecasted to transform from $1.8 billion in 2022 to $2.5 billion by 2027, driven by a CAGR of 6.7%. Pain is the physiological term to describe the chemical processes that are at work in the body that receive a stimulus, modify it, and transfer it to the brain for interpretation and reaction. The stimulus can be physical, temperature, chemical, or inflammatory damage to tissues. In veterinary practices, pain management is achieved through analgesic drugs and devices.

Factors such as growth in companion animal adoption, the increasing number of veterinary practitioners and their rising income levels in developed economies, increasing consumption of meat & milk, the growing prevalence of animal disease causing pain and inflammation, and rising adoption of pet insurance with growing animal health expenditure are expected to drive the growth of this market. However, increasing pet care costs may restrain market growth to a certain extent.

In this report, the veterinary pain management market has been segmented by product, application, animal type, end user, and region.

Global Veterinary Pain Management Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Veterinary Pain Management Market Dynamics

DRIVERS: Increasing number of veterinary practitioners in developed economies

The growing veterinary practitioner base across developed countries is one of the major factors responsible for the growing number of private clinical practices and hospitals. According to the American Veterinary Medical Association, the number of veterinary professionals in the US increased from 117,735 in 2017 to 13,539 in 2019 and 118,624 in 2020. The number of veterinarians in the US, Australia, and New Zealand is growing by more than 3–4% per year. Owing to this trend, the market for veterinary pain management products in these countries is also expected to grow in the forecast period.

RESTRAINTS: Increasing pet care costs

In European countries such as Germany, the veterinary cost is approximately ~USD 162.9 (EUR 140) per dog and USD 75.61 (EUR 65) per cat annually. In the last ten years, pet care costs have increased significantly. According to the APPA 2021 report, veterinary care is the second-highest source of spending in the pet care community. The US, for example, spent over USD 31.4 billion in 2020 and 34.3 billion in 2021 on veterinary care and related product sales.

Advancedment in pain management devices play a significant role in pain management; however, materials and equipment used in these procedures is costly.

OPPORTUNITIES Increasing popularity of non-conventional and non-pharmaceutical treatment techniques

The increasing popularity of non-pharmaceutical pain management techniques is a major trend in the market, creating immense prospects for future market growth. Approaches such as pain management using laser therapy and electromagnetic therapy are increasingly being adopted as they offer advantages over conventional pharmaceutical treatment options for pain management. Laser therapy cures inflammation and pain by exposing the affected area to light energy of the desired wavelength, frequency, and power, whereas electromagnetic therapy makes use of a magnetic field, radiowaves, and other forms of electromagnetic energy of desired intensity. These therapies cure the cause of pain, ruling out the need for painful invasive surgeries and further use of pain relief drugs. These therapies also help reduce the healing time for patients.

Companies such as K-Laser USA and Assisi are major players offering devices used in laser and electromagnetic therapy, respectively. Assisi claims to bring about 58% faster wound healing using its targeted Pulsed Electromagnetic Field (tPEMF) therapy, which is an FDA-approved NPAID (non-pharmaceutical anti-inflammatory device). These companies are coming up with several other innovative devices for pain management. For instance, K-Laser USA manufactures Platinum 4, the world’s first smart laser that not only has the right mix of power, wavelength, pulsing, and expert protocol but also has a performance tracking app displaying the number of treatments, by species and condition. The app can also calculate the revenue generated and assist in effectively viewing detailed patient profiles.

CHALLENGES Stringent regulatory process

Regulatory bodies ensure that veterinary pain management products do not exhibit negative effects on animal health, and ensure their quality and efficacy, various authorities have set stringent regulations for their approval. The Veterinary International Committee for Harmonization (VICH) also plays a significant role in bringing together regulatory authorities in the US, Europe, and Japan. Apart from that the US FDA; Canadian Food Agency; European Medical Agency; Ministry of Agriculture, Forestry, and Fisheries (MAFF); and Australian Pesticides and Veterinary Medicines Authority (APVMA) are some of the major regulatory bodies that approve medicines for veterinary purposes.

“Laser therapy device segment is expected to grow at highest CAGR in the veterinary pain management market by device type during forecast period”

The veterinary pain management market is segmented into laser therapy and electromagnetic field therapy devices on the basis of types of veterinary pain management devices. The laser therapy devices segment expected to grow at highest gowth rate during forecast period. Laser therapy is effective in curing a wide range of acute and chronic pain conditions; it targets and cures the cause of pain, ruling out the need for painful invasive surgeries and further use of pain relief drugs.

“Postoperative segment holds the second largest share of by application type of veterinary pain management market”

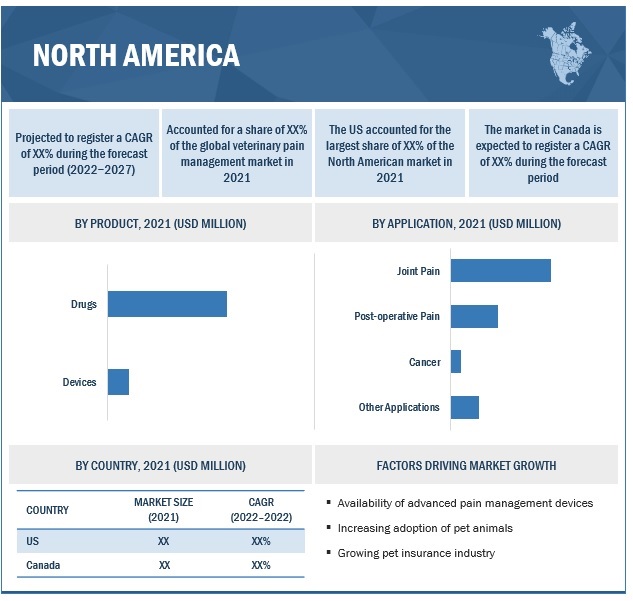

The veterinary pain management market is segmented into joint pain, post-operative pain, cancer, and other applications on the basis of application. The postoperative segment accounted for the second largest share of the veterinary pain management market in 2021. The large share of this segment can be attributed to increasing veterinary surgeries in both developed and developing market.

“The cat holds the largest share of companion animal veterinary pain management market in 2021”

Based on animal type, the veterinary pain management market is segmented into companion animals and livestock animals. The cat segment of companion animal accounted for the largest share of the veterinary pain management market in 2021. The large share of this segment can be attributed to the increasing cat ownership, and rising pet healthcare expenditure.

“Veterinary Hospitals accounted for the largest share of the veterinary pain management market in 2021”

Based on end users, the veterinary pain management market is segmented into veterinary hospitals, veterinary clinics, and pharmacies & drug stores. The veterinary hospitals segment accounted for the largest share of the veterinary pain management market in 2021. The large share of this segment can be attributed to the large pool of veterinarians, the increasing number of veterinarians establishing private hospitals, increasing vet visits by animal owners, and increasing adoption of pet healthcare insurance.

Geographic Snapshot: Veterinary Pain Management Market

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the veterinary pain management market are Boehringer Ingelheim International GmbH (Germany), Zoetis Inc. (US), Elanco Animal Health Incorporated (US), Merck & Co., Inc. (US), Dechra Pharmaceuticals (UK), Vetoquinol (France), SeQuent Scientific Limited (India), Norbrook Laboratories Limited (Ireland), Ceva Santé Animale (France), Chanelle Pharma (Ireland), and K-Laser USA (US). New product launches and acquisitions were the major strategies adopted by these payers to maintain their positions in the veterinary pain management market.

Veterinary Pain Management Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$1.8 billion |

|

Estimated Value by 2027 |

$2.5 billion |

|

Growth Rate |

poised to grow at a CAGR of 6.7% |

|

Largest Share Segments |

Post-operative, Animal Type - CAT, Veterinary Hospitals |

|

Market Report Segmentation |

By Product, Application Type, Animal Type, End User & Region |

|

Growth Drivers |

|

|

Growth Opportunities |

|

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

The research report veterinary pain management market into the following segments and sub-segments:

By Product

-

Drug Market

-

By Type

- NSAIDS

- Opioids

- Local anaesthetics

- Alpha-2 agonists

- Disease-modifying osteoarthritis agents

- Others

-

By Route of Administration

- Oral

- Parenteral

- Topical

-

By Type

-

Device

- Laser Therapy Device

- Electromagnetic Device

By Application

-

Joint Pain

- Osteoarthritis

- Musculoskeletal

- Cancer Pain

- Postoperative Pain

- Others

By Animal Type

-

Companion Animal

- Dog

- Cat

- Horse

- Others

-

Livestock Animal

- Cattle

- Swine

- Others

By End User

- Veterinary Hospitals

- Veterinary Clinics

- Pharmacies and Drug Store

By Country

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- India

- China

- Rest of APAC

- Latin America

- Middle East & Africa

Recent Developments:

- In June 2022, Boehringer collaborated with Carthronix to identify new molecules to target cancers in dogs.

- In April 2021, Zoetis acquired Jurox to strengthen its portfolio of anesthetics for companion animals.

Frequently Asked Questions (FAQ):

Which are the top industry players in the veterinary pain management market?

The major players in this market are Boehringer Ingelheim International GmbH (Germany), Zoetis Inc. (US), Elanco Animal Health Incorporated (US), Merck & Co., Inc. (US), Dechra Pharmaceuticals (UK), Vetoquinol (France)

Which region is dominating in the veterinary pain management market?

In 2021, North America accounted for the largest share of the veterinary pain management market in 2021. The growing ownership od animal; increasing animal surgeries, technological advancements in veterinary pain management devices.

What are emerging trends in veterinary pain management market?

The regenerative medicine or stem cell therapy is used as a treatment for the long term pain management in animals

Which is the leading end user in the veterinary pain management market?

The large share of veterinary hospitals, can be attributed to the large number of surgical procedures performed in hospitals .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 40)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 VETERINARY PAIN MANAGEMENT MARKET SEGMENTATION

1.3.2 REGIONAL MARKETS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 STANDARD CURRENCY CONVERSION RATES

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 46)

2.1 RESEARCH APPROACH

2.2 RESEARCH METHODOLOGY DESIGN

FIGURE 2 VETERINARY PAIN MANAGEMENT MARKET: RESEARCH DESIGN

2.2.1 SECONDARY RESEARCH

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.2.2.1 Key data from primary sources

2.2.2.2 Insights from primary experts

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 8 SUPPLY-SIDE MARKET SIZE ESTIMATION: VETERINARY PAIN MANAGEMENT MARKET (2021)

FIGURE 9 TOP-DOWN APPROACH

FIGURE 10 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 12 DATA TRIANGULATION METHODOLOGY

2.5 MARKET SHARE ESTIMATION

2.6 ASSUMPTIONS

2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 60)

FIGURE 13 VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 14 VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 15 VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022 VS. 2027 (USD MILLION)

FIGURE 16 VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 17 VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 18 VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 19 VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 20 GEOGRAPHICAL SNAPSHOT OF VETERINARY PAIN MANAGEMENT MARKET

4 PREMIUM INSIGHTS (Page No. - 66)

4.1 VETERINARY PAIN MANAGEMENT MARKET OVERVIEW

FIGURE 21 GROWTH IN COMPANION ANIMAL ADOPTION AND INCREASING PREVALENCE OF ANIMAL DISEASES TO DRIVE MARKET GROWTH

4.2 VETERINARY PAIN MANAGEMENT MARKET: REGIONAL MIX

FIGURE 22 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 ASIA PACIFIC: VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT AND COUNTRY (2021)

FIGURE 23 VETERINARY PAIN MANAGEMENT DRUGS SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2021

4.4 VETERINARY PAIN MANAGEMENT MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 24 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

4.5 VETERINARY PAIN MANAGEMENT MARKET: DEVELOPED VS. DEVELOPING MARKETS

FIGURE 25 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 71)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 26 VETERINARY PAIN MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 MARKET DRIVERS

5.2.1.1 Growth in companion animal population

TABLE 2 PET POPULATION, BY ANIMAL, 2014–2020 (MILLION)

5.2.1.2 Increasing consumption of meat & milk

TABLE 3 PAST AND PROJECTED TRENDS IN CONSUMPTION OF MEAT AND MILK IN DEVELOPED AND DEVELOPING COUNTRIES

TABLE 4 ASIA: COUNTRY-LEVEL CONSUMPTION OF ANIMAL-DERIVED FOOD PRODUCTS, 2020 VS. 2030 (THOUSAND METRIC TONS)

5.2.1.3 Growing prevalence of diseases

5.2.1.4 Increasing number of veterinary practitioners in developed economies

TABLE 5 NUMBER OF VETERINARIANS AND PARAVETERINARIANS IN DEVELOPED COUNTRIES, 2012–2020

5.2.2 MARKET RESTRAINTS

5.2.2.1 Rising pet care costs

FIGURE 27 US: BASIC ANNUAL EXPENSES FOR DOGS AND CATS, 2021

5.2.3 MARKET OPPORTUNITIES

5.2.3.1 Increasing popularity of non-conventional and non-pharmaceutical treatment techniques

5.2.3.2 Untapped emerging markets

5.2.4 MARKET CHALLENGES

5.2.4.1 Stringent regulatory process

5.3 TECHNOLOGY ANALYSIS

5.3.1 KEY TECHNOLOGIES

5.3.1.1 Development of low-level light therapy/laser therapy/photobiomodulation

TABLE 6 SOME COMMERCIALLY AVAILABLE LASER THERAPY INSTRUMENTS

5.4 ECOSYSTEM ANALYSIS

TABLE 7 VETERINARY PAIN MANAGEMENT MARKET: ECOSYSTEM MAPPING

FIGURE 28 VETERINARY PAIN MANAGEMENT MARKET: ECOSYSTEM MARKET MAP

5.5 AVERAGE SELLING PRICE TRENDS

5.5.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION

TABLE 8 PRICING ANALYSIS OF PAIN MANAGEMENT PRODUCTS OFFERED BY LEADING PLAYERS (USD)

5.6 PATENT ANALYSIS

5.6.1 PATENT PUBLICATION TRENDS FOR VETERINARY PAIN MANAGEMENT PRODUCTS

FIGURE 29 PATENT PUBLICATION TRENDS (JANUARY 2012–AUGUST 2022)

5.6.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 30 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTIONS) FOR VETERINARY PAIN MANAGEMENT (JANUARY 2012–JULY 2022)

FIGURE 31 TOP APPLICANT COUNTRIES/REGIONS FOR VETERINARY PAIN MANAGEMENT PATENTS (JANUARY 2012–JULY 2022)

5.7 VALUE CHAIN ANALYSIS

FIGURE 32 VETERINARY PAIN MANAGEMENT MARKET: VALUE CHAIN ANALYSIS

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 33 VETERINARY PAIN MANAGEMENT MARKET: SUPPLY CHAIN ANALYSIS

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 34 VETERINARY PAIN MANAGEMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 9 VETERINARY PAIN MANAGEMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT FROM NEW ENTRANTS

5.9.2 THREAT FROM SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.10 KEY CONFERENCES & EVENTS DURING 2022–2023

TABLE 10 VETERINARY PAIN MANAGEMENT MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.11 KEY STAKEHOLDERS & BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 35 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 11 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

5.11.2 BUYING CRITERIA

FIGURE 36 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 12 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.12 TRENDS AND DISRUPTIONS AFFECTING CUSTOMERS’ BUSINESSES

FIGURE 37 VETERINARY PAIN MANAGEMENT MARKET: TRENDS AND DISRUPTIONS AFFECTING CUSTOMERS’ BUSINESSES

5.13 TRADE ANALYSIS

5.14 INDUSTRY TRENDS

5.14.1 ADOPTION OF REGENERATIVE MEDICINE

5.15 REGULATORY ANALYSIS

5.15.1 REGULATORY LANDSCAPE

FIGURE 38 DEVELOPMENT AND APPROVAL PROCESS FOR ANIMAL PHARMACEUTICAL PRODUCTS

5.15.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.15.2.1 US

TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.15.2.2 Europe

TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.15.2.3 Rest of the world

TABLE 15 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT (Page No. - 99)

6.1 INTRODUCTION

TABLE 16 VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

6.2 DRUGS

6.2.1 DRUGS MARKET, BY TYPE

TABLE 17 VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 18 VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.1.1 NSAIDs

6.2.1.1.1 Extensive use of NSAIDS to control pain and inflammation in animals to drive market

TABLE 19 VETERINARY PAIN MANAGEMENT DRUGS MARKET FOR NSAIDS, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.1.2 Opioids

6.2.1.2.1 Advantages of opioids such as remarkable safety profile, high efficacy, and reversibility to promote adoption

TABLE 20 VETERINARY PAIN MANAGEMENT DRUGS MARKET FOR OPIOIDS, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.1.3 Local anesthetics

6.2.1.3.1 Ability of local anesthetics to minimize post-operative pain in animals to support demand

TABLE 21 VETERINARY PAIN MANAGEMENT DRUGS MARKET FOR LOCAL ANESTHETICS, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.1.4 Alpha-2 agonists

6.2.1.4.1 Excessive sedation caused and loss of muscle coordination may limit use of alpha-2 agonists

TABLE 22 VETERINARY PAIN MANAGEMENT DRUGS MARKET FOR ALPHA-2 AGONISTS, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.1.5 Disease-modifying osteoarthritis drugs

6.2.1.5.1 Ability of DMOADs to stabilize joint membranes, help with joint cartilage repair, and improve joint lubrication to increase adoption

TABLE 23 VETERINARY PAIN MANAGEMENT DRUGS MARKET FOR DISEASE-MODIFYING OSTEOARTHRITIS DRUGS, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.1.6 Other drugs

TABLE 24 OTHER VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2 DRUGS MARKET, BY ROUTE OF ADMINISTRATION

TABLE 25 ROUTES OF ADMINISTRATION OF MAJOR VETERINARY PAIN MANAGEMENT DRUGS

TABLE 26 VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

6.2.2.1 Oral

6.2.2.1.1 Affordability and ability to treat wide range of diseases to drive demand for oral drugs

TABLE 27 ORAL VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2.2 Parenteral

6.2.2.2.1 Advantages such as injecting drugs at affected sites and no direct interaction with gastrointestinal tract make parenteral drugs popular

TABLE 28 PARENTERAL VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2.3 Topical

6.2.2.3.1 Temporary effects of topical drugs compared with oral and parenteral drugs to hinder market growth

TABLE 29 TOPICAL VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3 DEVICES

TABLE 30 VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 31 VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.1 LASER THERAPY DEVICES

6.3.1.1 Effectiveness of laser therapy devices in curing wide range of acute and chronic pain conditions in animals to drive growth

TABLE 32 VETERINARY PAIN MANAGEMENT LASER THERAPY DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.2 ELECTROMAGNETIC THERAPY DEVICES

6.3.2.1 Adoption of electromagnetic therapy devices to grow in coming years due to their effectiveness and ease of handling

TABLE 33 VETERINARY PAIN MANAGEMENT ELECTROMAGNETIC THERAPY DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7 VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION (Page No. - 116)

7.1 INTRODUCTION

TABLE 34 VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 JOINT PAIN

TABLE 35 VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY TYPE, 2020–2027 (USD MILLION)

TABLE 36 VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.1 OSTEOARTHRITIS

7.2.1.1 Growing prevalence of osteoarthritis in companion animals to drive market growth

TABLE 37 VETERINARY PAIN MANAGEMENT MARKET FOR OSTEOARTHRITIS, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.2 MUSCULOSKELETAL DISORDERS

7.2.2.1 Rising number of veterinary visits to drive adoption of pain management drugs for musculoskeletal disorders

TABLE 38 VETERINARY PAIN MANAGEMENT MARKET FOR MUSCULOSKELETAL DISORDERS, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 POST-OPERATIVE PAIN

7.3.1 INCREASING NUMBER OF ANIMALS UNDERGOING SURGERY TO DRIVE GROWTH IN THIS MARKET SEGMENT

TABLE 39 VETERINARY PAIN MANAGEMENT MARKET FOR POST-OPERATIVE PAIN, BY COUNTRY, 2020–2027 (USD MILLION)

7.4 CANCER

7.4.1 NEED FOR PAIN MANAGEMENT AT ALL STAGES OF CANCER TREATMENT TO SUPPORT GROWTH

TABLE 40 VETERINARY PAIN MANAGEMENT MARKET FOR CANCER, BY COUNTRY, 2020–2027 (USD MILLION)

7.5 OTHER APPLICATIONS

TABLE 41 VETERINARY PAIN MANAGEMENT MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8 VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE (Page No. - 125)

8.1 INTRODUCTION

TABLE 42 VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 43 VETERINARY PAIN MANAGEMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.2 COMPANION ANIMALS

TABLE 44 VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 45 VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY COUNTRY, 2020–2027 (USD MILLION)

8.2.1 DOGS

8.2.1.1 Higher adoption rate of dogs than other companion animals to drive market growth

TABLE 46 DOG POPULATION, BY COUNTRY, 2012–2020 (MILLION)

TABLE 47 VETERINARY PAIN MANAGEMENT MARKET FOR DOGS, BY COUNTRY, 2020–2027 (USD MILLION)

8.2.2 CATS

8.2.2.1 Growing pet cat population to support growth

TABLE 48 CAT POPULATION, BY COUNTRY, 2012–2020 (MILLION)

TABLE 49 VETERINARY PAIN MANAGEMENT MARKET FOR CATS, BY COUNTRY, 2020–2027 (USD MILLION)

8.2.3 HORSES

8.2.3.1 Growing equine health awareness to drive growth

TABLE 50 EQUINE POPULATION, BY COUNTRY, 2012–2019 (THOUSAND)

TABLE 51 VETERINARY PAIN MANAGEMENT MARKET FOR HORSES, BY COUNTRY, 2020–2027 (USD MILLION)

8.2.4 OTHER COMPANION ANIMALS

TABLE 52 VETERINARY PAIN MANAGEMENT MARKET FOR OTHER COMPANION ANIMALS, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 LIVESTOCK ANIMALS

TABLE 53 VETERINARY PAIN MANAGEMENT FOR LIVESTOCK ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 54 VETERINARY PAIN MANAGEMENT MARKET FOR LIVESTOCK ANIMALS, BY COUNTRY, 2020–2027 (USD MILLION)

8.3.1 CATTLE

8.3.1.1 Growing consumption of meat to support market growth

TABLE 55 CATTLE POPULATION, BY COUNTRY, 2012–2019 (MILLION)

TABLE 56 VETERINARY PAIN MANAGEMENT MARKET FOR CATTLE, BY COUNTRY, 2020–2027 (USD MILLION)

8.3.2 SWINE

8.3.2.1 Growing incidence of infectious diseases to drive market growth

TABLE 57 SWINE POPULATION, BY COUNTRY, 2012–2019 (MILLION)

TABLE 58 VETERINARY PAIN MANAGEMENT MARKET FOR SWINE, BY COUNTRY, 2020–2027 (USD MILLION)

8.3.3 OTHER LIVESTOCK ANIMALS

TABLE 59 VETERINARY PAIN MANAGEMENT MARKET FOR OTHER LIVESTOCK ANIMALS, BY COUNTRY, 2020–2027 (USD MILLION)

9 VETERINARY PAIN MANAGEMENT MARKET, BY END USER (Page No. - 141)

9.1 INTRODUCTION

TABLE 60 VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2 VETERINARY HOSPITALS

9.2.1 GROWING INVESTMENTS IN EXPANDING VETERINARY HOSPITALS TO DRIVE MARKET GROWTH

TABLE 61 VETERINARY PAIN MANAGEMENT MARKET FOR HOSPITALS, BY COUNTRY, 2020–2027 (USD MILLION)

9.3 VETERINARY CLINICS

9.3.1 GROWING NUMBER OF PATIENT VISITS TO PROMOTE GROWTH IN THIS MARKET SEGMENT

TABLE 62 VETERINARY PAIN MANAGEMENT MARKET FOR CLINICS, BY COUNTRY, 2020–2027 (USD MILLION)

9.4 PHARMACIES & DRUG STORES

9.4.1 CONVENIENCE AND EASY ACCESS TO VETERINARY DRUGS TO MAKE PHARMACIES POPULAR ALTERNATIVES

TABLE 63 VETERINARY PAIN MANAGEMENT MARKET FOR PHARMACIES & DRUG STORES, BY COUNTRY, 2020–2027 (USD MILLION)

10 VETERINARY PAIN MANAGEMENT MARKET, BY REGION (Page No. - 146)

10.1 INTRODUCTION

FIGURE 39 VETERINARY PAIN MANAGEMENT MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

TABLE 64 VETERINARY PAIN MANAGEMENT MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 40 NORTH AMERICA: VETERINARY PAIN MANAGEMENT MARKET SNAPSHOT

TABLE 65 NORTH AMERICA: VETERINARY PAIN MANAGEMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 66 NORTH AMERICA: VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 67 NORTH AMERICA: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

TABLE 69 NORTH AMERICA: VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 71 NORTH AMERICA: VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY TYPE, 2020–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: VETERINARY PAIN MANAGEMENT MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Growing pet ownership to drive market growth

FIGURE 41 US: POPULATION OF DOGS, 2012–2020 (MILLION)

TABLE 76 HEALTHCARE EXPENDITURE ON COMPANION ANIMALS, 2018 VS. 2020

FIGURE 42 NUMBER OF VETERINARIANS IN US, 2016–2020

TABLE 77 US: FOOD-PRODUCING ANIMAL POPULATION, 2001–2019 (MILLION)

TABLE 78 US: NUMBER OF VETERINARIANS IN PRIVATE CLINICAL PRACTICES, 2014–2020

TABLE 79 US: VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 80 US: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 81 US: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

TABLE 82 US: VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 83 US: VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 84 US: VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY TYPE, 2020–2027 (USD MILLION)

TABLE 85 US: VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 86 US: VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 US: VETERINARY PAIN MANAGEMENT MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 US: VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Growing pool of skilled veterinarians to support market growth

FIGURE 43 CANADA: COMPANION ANIMAL POPULATION, 2016–2020 (MILLION)

TABLE 89 CANADA: LARGE ANIMAL POPULATION, 2001–2019 (MILLION)

TABLE 90 CANADA: VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 91 CANADA: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 92 CANADA: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

TABLE 93 CANADA: VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 94 CANADA: VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 95 CANADA: VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 CANADA: VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 97 CANADA: VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 98 CANADA: VETERINARY PAIN MANAGEMENT MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 99 CANADA: VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3 EUROPE

TABLE 100 EUROPE: COMPANION POPULATION, 2019 (MILLION)

TABLE 101 EUROPE: LIVESTOCK POPULATION, 2019 (MILLION)

TABLE 102 EUROPE: NUMBER OF VETERINARIANS, 2012–2019

TABLE 103 EUROPE: VETERINARY PAIN MANAGEMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 104 EUROPE: VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 105 EUROPE: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 106 EUROPE: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

TABLE 107 EUROPE: VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 108 EUROPE: VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 109 EUROPE: VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY TYPE, 2020–2027 (USD MILLION)

TABLE 110 EUROPE: VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 111 EUROPE: VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 112 EUROPE: VETERINARY PAIN MANAGEMENT MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 113 EUROPE: VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Rising awareness about pet healthcare in Germany to promote market growth

TABLE 114 GERMANY: LIVESTOCK ANIMAL POPULATION, 2016–2019 (MILLION)

TABLE 115 GERMANY: COMPANION ANIMAL POPULATION, 2016–2019 (MILLION)

TABLE 116 GERMANY: VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 117 GERMANY: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 118 GERMANY: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

TABLE 119 GERMANY: VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 120 GERMANY: VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 121 GERMANY: VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY TYPE, 2020–2027 (USD MILLION)

TABLE 122 GERMANY: VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 123 GERMANY: VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 124 GERMANY: VETERINARY PAIN MANAGEMENT MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 125 GERMANY: VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 Favorable government policies promoting export of livestock products to support growth

TABLE 126 FRANCE: PET POPULATION, 2017–2020 (MILLION)

TABLE 127 FRANCE: LIVESTOCK ANIMAL POPULATION, 2016–2019 (MILLION)

TABLE 128 FRANCE: VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 129 FRANCE: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 130 FRANCE: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

TABLE 131 FRANCE: VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 132 FRANCE: VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 133 FRANCE: VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY TYPE, 2020–2027 (USD MILLION)

TABLE 134 FRANCE: VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 135 FRANCE: VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 136 FRANCE: VETERINARY PAIN MANAGEMENT MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 137 FRANCE: VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.3 UK

10.3.3.1 Increasing availability of animal health insurance to aid growth

TABLE 138 UK: PET POPULATION, 2017–2020 (MILLION)

TABLE 139 UK: LIVESTOCK ANIMAL POPULATION, 2016–2019 (MILLION)

TABLE 140 UK: VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 141 UK: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 142 UK: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

TABLE 143 UK: VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 144 UK: VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 145 UK: VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY TYPE, 2020–2027 (USD MILLION)

TABLE 146 UK: VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 147 UK: VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 148 UK: VETERINARY PAIN MANAGEMENT MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 149 UK: VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Growing demand for pork to propel market growth in Italy

TABLE 150 ITALY: PET POPULATION, 2017–2020 (MILLION)

TABLE 151 ITALY: LIVESTOCK ANIMAL POPULATION, 2016–2019 (MILLION)

TABLE 152 ITALY: VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 153 ITALY: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 154 ITALY: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

TABLE 155 ITALY: VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 156 ITALY: VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 157 ITALY: VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY TYPE, 2020–2027 (USD MILLION)

TABLE 158 ITALY: VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 159 ITALY: VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 160 ITALY: VETERINARY PAIN MANAGEMENT MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 161 ITALY: VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Rising livestock population to make Spain a relatively large market

TABLE 162 SPAIN: PET POPULATION, 2017–2020 (MILLION)

TABLE 163 SPAIN: LIVESTOCK ANIMAL POPULATION, 2016–2019 (MILLION)

TABLE 164 SPAIN: VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 165 SPAIN: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 166 SPAIN: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

TABLE 167 SPAIN: VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 168 SPAIN: VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 169 SPAIN: VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY TYPE, 2020–2027 (USD MILLION)

TABLE 170 SPAIN: VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 171 SPAIN: VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 172 SPAIN: VETERINARY PAIN MANAGEMENT MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 173 SPAIN: VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.6 REST OF EUROPE (ROE)

TABLE 174 REST OF EUROPE: COMPANION ANIMAL OWNERSHIP, BY COUNTRY, 2019 (MILLION)

TABLE 175 REST OF EUROPE: LIVESTOCK POPULATION, BY COUNTRY, 2019 (MILLION)

TABLE 176 REST OF EUROPE: VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 177 REST OF EUROPE: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 178 REST OF EUROPE: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

TABLE 179 REST OF EUROPE: VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 180 REST OF EUROPE: VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 181 REST OF EUROPE: VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY TYPE, 2020–2027 (USD MILLION)

TABLE 182 REST OF EUROPE: VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 183 REST OF EUROPE: VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 184 REST OF EUROPE: VETERINARY PAIN MANAGEMENT MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 185 REST OF EUROPE: VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 44 ASIA PACIFIC: VETERINARY PAIN MANAGEMENT MARKET SNAPSHOT

TABLE 186 ASIA PACIFIC: VETERINARY PAIN MANAGEMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 187 ASIA PACIFIC: VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 188 ASIA PACIFIC: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 189 ASIA PACIFIC: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

TABLE 190 ASIA PACIFIC: VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 191 ASIA PACIFIC: VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 192 ASIA PACIFIC: VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY TYPE, 2020–2027 (USD MILLION)

TABLE 193 ASIA PACIFIC: VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 194 ASIA PACIFIC: VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 195 ASIA PACIFIC: VETERINARY PAIN MANAGEMENT MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 196 ASIA PACIFIC: VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Growing pet insurance industry in Japan to support growth

TABLE 197 NUMBER OF DOMESTICATED DOGS AND CATS IN JAPAN, 2012–2020 (THOUSAND)

TABLE 198 JAPAN: VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 199 JAPAN: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 200 JAPAN: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

TABLE 201 JAPAN: VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 202 JAPAN: VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 203 JAPAN: VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY TYPE, 2020–2027 (USD MILLION)

TABLE 204 JAPAN: VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 205 JAPAN: VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 206 JAPAN: VETERINARY PAIN MANAGEMENT MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 207 JAPAN: VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Growing willingness to spend on pet health products to support growth

TABLE 208 CHINA: LIVESTOCK POPULATION, 2010–2019 (MILLION)

TABLE 209 CHINA: VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 210 CHINA: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 211 CHINA: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

TABLE 212 CHINA: VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 213 CHINA: VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 214 CHINA: VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY TYPE, 2020–2027 (USD MILLION)

TABLE 215 CHINA: VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 216 CHINA: VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 217 CHINA: VETERINARY PAIN MANAGEMENT MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 218 CHINA: VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Economic growth and changing lifestyles to lead to significant growth in Indian animal health industry

TABLE 219 INDIA: LIVESTOCK POPULATION, 2007 VS. 2012 VS. 2019 (MILLION)

TABLE 220 INDIA: VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 221 INDIA: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 222 INDIA: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

TABLE 223 INDIA: VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 224 INDIA: VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 225 INDIA: VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY TYPE, 2020–2027 (USD MILLION)

TABLE 226 INDIA: VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 227 INDIA: VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 228 INDIA: VETERINARY PAIN MANAGEMENT MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 229 INDIA: VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 230 REST OF ASIA PACIFIC: VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 231 REST OF ASIA PACIFIC: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 232 REST OF ASIA PACIFIC: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

TABLE 233 REST OF ASIA PACIFIC: VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 234 REST OF ASIA PACIFIC: VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 235 REST OF ASIA PACIFIC: VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY TYPE, 2020–2027 (USD MILLION)

TABLE 236 REST OF ASIA PACIFIC: VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 237 REST OF ASIA PACIFIC: VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 238 REST OF ASIA PACIFIC: VETERINARY PAIN MANAGEMENT MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 239 REST OF ASIA PACIFIC: VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 GROWING NUMBER OF PARAVETERINARY PROFESSIONALS IN LATIN AMERICA TO DRIVE GROWTH

TABLE 240 LATIN AMERICA: LIVESTOCK POPULATION, BY COUNTRY, 2010–2019 (MILLION)

TABLE 241 LATIN AMERICA: VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 242 LATIN AMERICA: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 243 LATIN AMERICA: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

TABLE 244 LATIN AMERICA: VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 245 LATIN AMERICA: VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 246 LATIN AMERICA: VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY TYPE, 2020–2027 (USD MILLION)

TABLE 247 LATIN AMERICA: VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 248 LATIN AMERICA: VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 249 LATIN AMERICA: VETERINARY PAIN MANAGEMENT MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 250 LATIN AMERICA: VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 AVAILABILITY OF FUNDING TO PROMOTE ANIMAL HEALTHCARE TO SUPPORT MARKET GROWTH

TABLE 251 MIDDLE EAST: LIVESTOCK POPULATION, 2010 VS. 2019 (MILLION)

TABLE 252 AFRICA: FOOD-PRODUCING ANIMAL POPULATION, 2012 VS. 2014 VS. 2019 (MILLION)

TABLE 253 MIDDLE EAST & AFRICA: VETERINARY PAIN MANAGEMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 254 MIDDLE EAST & AFRICA: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 255 MIDDLE EAST & AFRICA: VETERINARY PAIN MANAGEMENT DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD MILLION)

TABLE 256 MIDDLE EAST & AFRICA: VETERINARY PAIN MANAGEMENT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 257 MIDDLE EAST & AFRICA: VETERINARY PAIN MANAGEMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 258 MIDDLE EAST & AFRICA: VETERINARY PAIN MANAGEMENT MARKET FOR JOINT PAIN, BY TYPE, 2020–2027 (USD MILLION)

TABLE 259 MIDDLE EAST & AFRICA: VETERINARY PAIN MANAGEMENT MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 260 MIDDLE EAST & AFRICA: VETERINARY PAIN MANAGEMENT MARKET FOR COMPANION ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 261 MIDDLE EAST & AFRICA: VETERINARY PAIN MANAGEMENT MARKET FOR LIVESTOCK ANIMALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 262 MIDDLE EAST & AFRICA: VETERINARY PAIN MANAGEMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 229)

11.1 MARKET OVERVIEW

11.2 KEY PLAYER STRATEGIES

FIGURE 45 VETERINARY PAIN MANAGEMENT MARKET: KEY PLAYER STRATEGIES

11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 46 REVENUE ANALYSIS OF TOP PLAYERS IN VETERINARY PAIN MANAGEMENT MARKET

11.4 MARKET SHARE ANALYSIS (2021)

FIGURE 47 VETERINARY PAIN MANAGEMENT MARKET SHARE ANALYSIS, BY KEY PLAYER, 2021

TABLE 263 VETERINARY PAIN MANAGEMENT MARKET: DEGREE OF COMPETITION

11.5 COMPANY EVALUATION QUADRANT (2021)

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 48 VETERINARY PAIN MANAGEMENT MARKET: COMPANY EVALUATION QUADRANT (2021)

11.6 START-UP/SME EVALUATION QUADRANT (2021)

11.6.1 PROGRESSIVE COMPANIES

11.6.2 DYNAMIC COMPANIES

11.6.3 STARTING BLOCKS

11.6.4 RESPONSIVE COMPANIES

FIGURE 49 VETERINARY PAIN MANAGEMENT MARKET: START-UP/SME EVALUATION QUADRANT (2021)

11.7 COMPETITIVE BENCHMARKING

TABLE 264 VETERINARY PAIN MANAGEMENT MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 265 VETERINARY PAIN MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (START-UPS/SMES)

11.8 COMPANY FOOTPRINT

TABLE 266 VETERINARY PAIN MANAGEMENT MARKET: OVERALL COMPANY FOOTPRINT

TABLE 267 VETERINARY PAIN MANAGEMENT MARKET: COMPANY PRODUCT FOOTPRINT

TABLE 268 VETERINARY PAIN MANAGEMENT MARKET: COMPANY APPLICATION FOOTPRINT

TABLE 269 VETERINARY PAIN MANAGEMENT MARKET: COMPANY ANIMAL TYPE FOOTPRINT

TABLE 270 VETERINARY PAIN MANAGEMENT MARKET: COMPANY END-USER FOOTPRINT

TABLE 271 VETERINARY PAIN MANAGEMENT MARKET: COMPANY REGIONAL FOOTPRINT

11.9 COMPETITIVE SCENARIO

TABLE 272 KEY DEALS, JANUARY 2019–AUGUST 2022

TABLE 273 PRODUCT LAUNCHES & APPROVALS, JANUARY 2019–AUGUST 2022

TABLE 274 OTHER DEVELOPMENTS, JANUARY 2019–AUGUST 2022

12 COMPANY PROFILES (Page No. - 245)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

TABLE 275 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: BUSINESS OVERVIEW

FIGURE 50 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: COMPANY SNAPSHOT (2021)

12.1.2 ZOETIS INC.

TABLE 276 ZOETIS INC.: BUSINESS OVERVIEW

FIGURE 51 ZOETIS INC.: COMPANY SNAPSHOT (2021)

12.1.3 ELANCO ANIMAL HEALTH INCORPORATED

TABLE 277 ELANCO ANIMAL HEALTH INCORPORATED: BUSINESS OVERVIEW

FIGURE 52 ELANCO ANIMAL HEALTH INCORPORATED: COMPANY SNAPSHOT (2021)

12.1.4 MERCK & CO., INC.

TABLE 278 MERCK & CO., INC.: BUSINESS OVERVIEW

FIGURE 53 MERCK & CO., INC.: COMPANY SNAPSHOT (2021)

12.1.5 DECHRA PHARMACEUTICALS

TABLE 279 DECHRA PHARMACEUTICALS: BUSINESS OVERVIEW

FIGURE 54 DECHRA PHARMACEUTICALS: COMPANY SNAPSHOT (2021)

12.1.6 VETOQUINOL

TABLE 280 VETOQUINOL: BUSINESS OVERVIEW

FIGURE 55 VETOQUINOL: COMPANY SNAPSHOT (2021)

12.1.7 SEQUENT SCIENTIFIC LIMITED

TABLE 281 SEQUENT SCIENTIFIC LIMITED: BUSINESS OVERVIEW

FIGURE 56 SEQUENT SCIENTIFIC LIMITED: COMPANY SNAPSHOT (2021)

12.1.8 NORBROOK LABORATORIES LIMITED

TABLE 282 NORBROOK LABORATORIES LIMITED: BUSINESS OVERVIEW

12.1.9 CEVA SANTÉ ANIMALE

TABLE 283 CEVA SANTÉ ANIMALE: BUSINESS OVERVIEW

12.1.10 CHANELLE PHARMA

TABLE 284 CHANELLE PHARMA: BUSINESS OVERVIEW

12.2 OTHER PLAYERS

12.2.1 K-LASER USA

TABLE 285 K-LASER USA: BUSINESS OVERVIEW

12.2.2 ASSISI ANIMAL HEALTH

TABLE 286 ASSISI ANIMAL HEALTH: BUSINESS OVERVIEW

12.2.3 MULTI RADIANCE MEDICAL

TABLE 287 MULTI RADIANCE MEDICAL: BUSINESS OVERVIEW

12.2.4 AVAZZIA

TABLE 288 AVAZZIA: BUSINESS OVERVIEW

12.2.5 SOUND TECHNOLOGIES

TABLE 289 SOUND TECHNOLOGIES: BUSINESS OVERVIEW

12.2.6 IRM ENTERPRISES PVT. LTD.

TABLE 290 IRM ENTERPRISES PVT. LTD.: BUSINESS OVERVIEW

12.2.7 ASHISH LIFE SCIENCE PVT. LTD.

TABLE 291 ASHISH LIFE SCIENCE PVT. LTD.: BUSINESS OVERVIEW

12.2.8 CENTURY PHARMACEUTICALS LTD.

TABLE 292 CENTURY PHARMACEUTICALS LTD.: BUSINESS OVERVIEW

12.2.9 VETINDIA PHARMACEUTICALS LTD.

TABLE 293 VETINDIA PHARMACEUTICALS LTD.: BUSINESS OVERVIEW

12.2.10 OUROFINO ANIMAL HEALTH

TABLE 294 OUROFINO ANIMAL HEALTH: BUSINESS OVERVIEW

12.2.11 LABINDIA HEALTHCARE PRIVATE LIMITED

TABLE 295 LABINDIA HEALTHCARE PRIVATE LIMITED: BUSINESS OVERVIEW

12.2.12 MORVEL LABORATORIES PVT. LTD.

TABLE 296 MORVEL LABORATORIES PVT. LTD.: BUSINESS OVERVIEW

12.2.13 RICHTER PHARMA AG

TABLE 297 RICHTER PHARMA AG: BUSINESS OVERVIEW

12.2.14 ZUCHE PHARMACEUTICALS PVT. LTD.

TABLE 298 ZUCHE PHARMACEUTICALS PVT. LTD.: BUSINESS OVERVIEW

12.2.15 FIDELIS ANIMAL HEALTH

TABLE 299 FIDELIS ANIMAL HEALTH: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 290)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The report presents a detailed assessment of the veterinary pain management market, along with qualitative inputs and insights from MarketsandMarkets. This research study involved the extensive use of both primary and secondary sources. Various factors affecting the industry were studied to identify segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics (such as drivers, restraints, opportunities, and challenges)

Secondary Research

This research study involved the use of widespread secondary sources; directories; databases such as D&B, Bloomberg Business, and Factiva; white papers; annual reports; and Companies’ House documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the veterinary pain management market. It was also used to obtain important information about the top players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the veterinary pain management market.

Market Size Estimation

The total size of the veterinary pain management market was arrived at after data triangulation from different approaches, as mentioned below. After each approach, the weighted average of the approaches was taken based on the level of assumptions used in each approach.

Bottom-up Approach: Revenues of individual companies were gathered from public sources and databases. Shares of the veterinary pain management products businesses of leading players were gathered from secondary sources to the extent available. In certain cases, the share of the business unit was ascertained after a detailed analysis of various parameters, including product portfolio, market positioning, selling price, and geographic reach and strength. Individual shares or revenue estimates were validated through expert interviews.

Country level Analysis: The size of the veterinary pain management market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products in the veterinary pain management market was obtained from secondary data and validated by primary participants to arrive at the total veterinary pain management market. Primary participants further validated the numbers.

Primary Interviews: As a part of the primary research process, individual respondent insights on the market size and growth were taken during the interview (regional and global, as applicable). All the responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Geographic market assessment (by region & country): The geographic assessment was conducted using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and the respective growth trends

Approach 2: Geographic adoption trends for individual product segments, by application, and growth prospects for each segment (assumptions and indicative estimates validated from primary interviews)

At each point, assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall electrosurgery market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and shares of the leading players in a particular region or country.

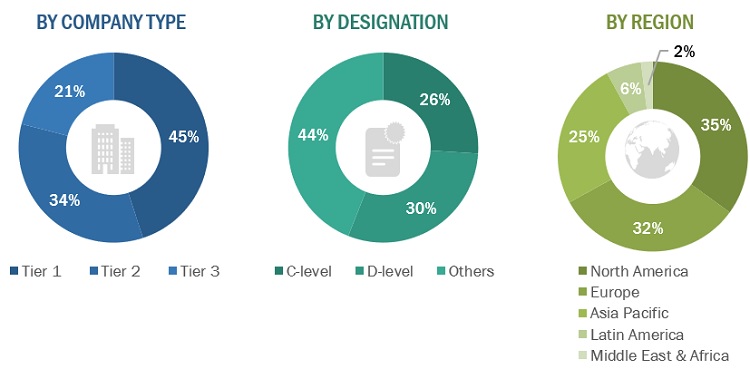

Breakdown of Primary Interviews

A breakdown of the primary respondents for veterinary pain management market (supply side) market is provided below:

Note 1: Companies are classified into tiers based on their total revenue. As of 2021, Tier 1 = >USD 500 million, Tier 2 = USD 200 million to USD 500 million, and Tier 3 =

Note 2: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 3: Other primaries include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in this report’s market engineering process.

Approach to derive the market size and estimate market growth

The market share for leading players were ascertained after a detailed assessment of their revenues from the veterinary pain management products business using secondary data available through paid and unpaid sources. Owing to data limitations, in certain cases, the revenue share was arrived at after a detailed assessment of the product portfolios of major companies and their respective sales performance. At each point, this data was validated through primary interviews with industry experts.

Objectives of the Study

- To define, describe, and forecast the veterinary pain management market by product, application, animal type, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to the individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their market shares and core competencies in the global veterinary pain management market

- To track and analyze competitive developments such as partnerships, agreements, and collaborations; mergers & acquisitions; product developments; and geographical expansions in the global veterinary pain management market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top companies

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific veterinary pain management market into South Korea, Australia, New Zealand, and others

- Further breakdown of the Rest of Europe veterinary pain management market into Belgium, Russia, the Netherlands, Switzerland, and others

- Further breakdown of the Latin America veterinary pain management market into Argentina, Colombia, Brazil, and others

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Veterinary Pain Management Market