Veterinary Electrosurgery Market by Product (Bipolar, Monopolar, Consumables), Application (General, Gynecology, Dental, Orthopedic, Ophthalmic), Animals, End User (Vet. Hospital, Clinic), Key Stakeholder & Buying Criteria, Unmet Need - Forecast to 2028

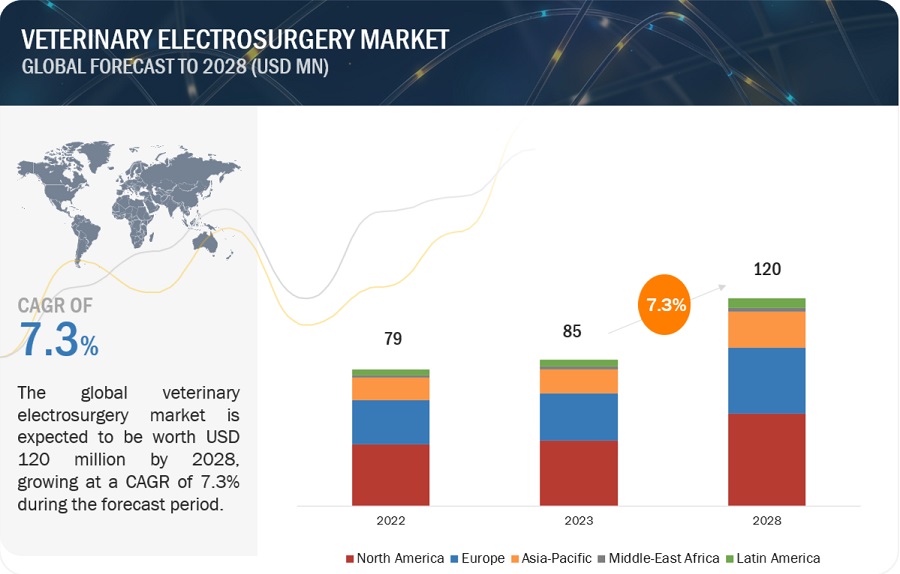

The global veterinary electrosurgery market in terms of revenue was estimated to be worth $85 million in 2023 and is poised to reach $120 million by 2028, growing at a CAGR of 7.3% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The market is driven by the demand for precise, minimally invasive surgeries in animals. Advancements in electrosurgical technology, including AI integration and improved safety features, contribute to its growth. The pet population growth and specialized veterinary care also boost market expansion.

Attractive Opportunities in the Veterinary Electrosurgery Market

To know about the assumptions considered for the study, Request for Free Sample Report

Veterinary Electrosurgery Market Dynamics

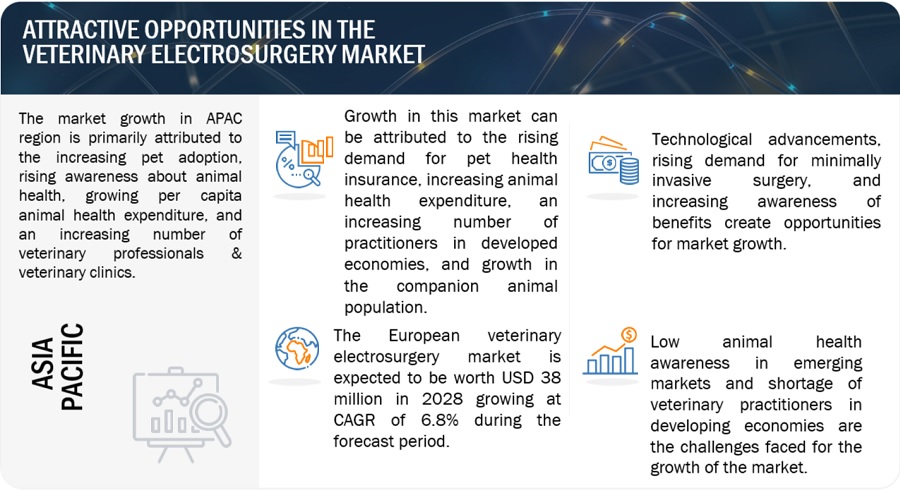

Driver: Rising number of veterinary practitioners in developed economies

The rising number of veterinarians, particularly in developed economies, is one of the major drivers of the growth of the veterinary electrosurgery instruments market. According to the American Veterinary Medical Association (AVMA), the number of veterinary professionals in the US increased from 113,394 in 2018 to 118,624 in 2020. Similarly, according to the Royal College of Veterinary Surgeons (RCVS), the number of veterinary practices in the UK increased from 22,009 in 2016 to 28,900 in 2020. The number of veterinarians in the US, Australia, and New Zealand grows at more than 3–4% per year. Owing to this trend, the market for veterinary electrosurgery in these countries is also predictable to grow in the forecast period.

The rising income levels of veterinarians also support this market's growth. For instance, according to the US Bureau of Labor Statistics, the income of veterinarians in the US increased to USD 100,370 per annum in 2021 from USD 93,830 per annum in 2018. Similarly, according to the Office of National Statistics (UK), the income of veterinarians in the country increased to USD 54,023.40 (GBP 40,000) per annum in 2020 from USD 52,917 (GBP 32,970) per annum in 2011. Income growth is a major indicator of the rising buying potential of veterinarians, which is expected to increase the acceptance of veterinary surgical and electrosurgery instruments in the coming years.

Restraint: High cost of veterinary electrosurgery equipment

Veterinary electrosurgery instruments are highly priced products. In developed countries, such as the US, Germany, the UK, and Japan, manual electrosurgery unit costs from ~USD 1000 to USD 3000. Depending on the type of generator and special cutting modes, the price of these systems could be around USD 5000. The high cost is associated with the purchase, maintenance, and servicing costs; therefore, it is a major market restraint.

The lack of reimbursements for veterinary procedures is another limiting the uptake of veterinary electrosurgery instruments among veterinary practitioners. Veterinarians spend USD 10,000 on dental equipment and USD 4,000-5,000 on an electrosurgical generator without accessories, which costs an additional USD 1,000. Veterinary endoscopies cost between USD 800 and USD 2,000 depending on the treatment site. Thus, the high cost of veterinary electrosurgical products and procedures directly affect the number of visits by pet owners to veterinary facilities. Hence, the high cost of veterinary electrosurgery equipment is limiting the market growth.

Opportunity: Untapped emerging markets

The untapped emerging markets present a compelling opportunity for the market. As developing economies continue to witness substantial growth in their pet ownership and livestock farming sectors, the demand for advanced veterinary surgical procedures is on the rise. However, this growth potential is particularly promising in emerging markets, where access to modern veterinary surgical equipment remains limited.

For instance, in countries like India and Brazil, there has been a noticeable shift towards companion animal ownership, leading to a surge in pet healthcare expenditures. As these markets urbanize and incomes rise, more pet owners are seeking high-quality surgical care for their animals. Similarly, in the agriculture sector, emerging markets like China and South Africa are experiencing a transformation in livestock production, with a focus on improving yield and quality. Veterinary electrosurgery devices can play a pivotal role in ensuring efficient and precise surgical interventions in both companion and livestock animals.

Moreover, the cost-effectiveness of electrosurgery equipment compared to traditional surgical techniques makes it an attractive option for emerging markets with budget constraints in their healthcare and agricultural sectors. The potential for growth in these regions is underscored by the fact that many veterinary clinics and farms are currently under-equipped and lack access to the latest surgical technologies.

Challenge: Low awareness of animal health in emerging markets

The low awareness of animal health in emerging markets poses a significant challenge for the market. In these regions, limited awareness about the importance of veterinary care and surgical interventions for animals hinders the adoption of advanced technologies like electrosurgery. According to data from the Food and Agriculture Organization (FAO), many emerging economies lack comprehensive animal health infrastructure, which includes both healthcare facilities and public awareness campaigns. For instance, in sub-Saharan Africa, where livestock farming is a vital source of livelihood, the lack of awareness regarding animal health issues results in delayed or inadequate treatment, leading to significant economic losses. Similarly, in parts of Asia and Latin America, where pet ownership is growing, pet owners may not fully understand the benefits of electrosurgery in providing precise and minimally invasive procedures for their animals.

This low awareness extends to veterinarians and livestock farmers, who may not be well-informed about the advantages of electrosurgery over traditional surgical methods. In these markets, veterinary education and training often focus on basic healthcare, leaving gaps in knowledge about cutting-edge technologies. As a result, there is a reluctance to invest in costly electrosurgery equipment, despite its potential to improve surgical outcomes and reduce post-operative complications.

In conclusion, the low awareness of animal health and the benefits of electrosurgery in emerging markets impedes market growth and adoption of this advanced technology. However, with strategic efforts to raise awareness, educate veterinarians and farmers, and offer affordable solutions, the market can overcome this challenge and tap into the vast potential of these untapped markets. This not only benefits the industry but also contributes to improving animal welfare and increasing productivity in agriculture, aligning with global efforts to ensure sustainable and healthy food systems.

Veterinary Electrosurgery Market Ecosystem

Prominent companies in this market include Medtronic (Ireland), B. Braun (Germany), Integra LifeSciences (US), Olympus Corporation (Japan), Covetrus, Inc. (US), Symmetry Surgical, Inc. (US), Avante Animal Health (DRE Veterinary) (US), Summit Hill Laboratories (US), Burtons Medical Equipment Limited (UK), Eickemeyer (Germany), KLS Martin (Germany), Macan Manufacturing (US), XcelLance Medical Technologies Pvt. Ltd. (India), Alsa Apparecchi Medicali SRL (Italy), and Kentamed Ltd. (Europe).

The bipolar electrosurgical instruments segment of the veterinary electrosurgery industry accounted for the largest share.

Driving factors in the bipolar veterinary-electrosurgery market and technology include the demand for precise and minimally invasive animal surgeries. Technological advancements, including AI integration and enhanced safety features, fuel market growth. Additionally, the expansion of pet ownership and livestock farming in emerging markets has driven the need for advanced surgical tools that provide superior hemostasis and tissue sealing capabilities. As a result, the market is witnessing a shift towards bipolar instruments, reflecting their efficiency and effectiveness in addressing the evolving needs of the industry.

The veterinary clinics segment accounted for the largest share in the veterinary electrosurgery industry.

Veterinary clinics are witnessing a surge in demand for electrosurgery due to several key trends and drivers. The growing awareness about the benefits of minimally invasive procedures in animal healthcare has fueled the adoption of electrosurgery devices in veterinary clinics. These devices offer precise incisions, reduced blood loss, and faster recovery times, aligning with the increasing emphasis on animal welfare. Moreover, advancements in technology have led to the development of user-friendly and versatile electrosurgery equipment, making them accessible and easy to use for veterinarians. Additionally, the rising prevalence of various animal health disorders and the need for efficient surgical solutions further propel the dominance of electrosurgery in the veterinary market.

Small animals segment accounted for the largest share and are expected to grow at the highest rate in the veterinary electrosurgery industry.

The veterinary electrosurgery market is experiencing a growing dominance in the realm of small animals due to several key trends and drivers. First, the increasing pet ownership rates worldwide have led to a higher demand for advanced surgical procedures, pushing the need for precise and minimally invasive techniques offered by electrosurgery. Additionally, advancements in technology have made electrosurgery more accessible and user-friendly, further fueling its adoption among veterinarians specializing in small animal care. Moreover, the rising awareness of the importance of pet healthcare and the willingness of pet owners to invest in their pets' well-being are driving the growth of the small animal segment in the market.

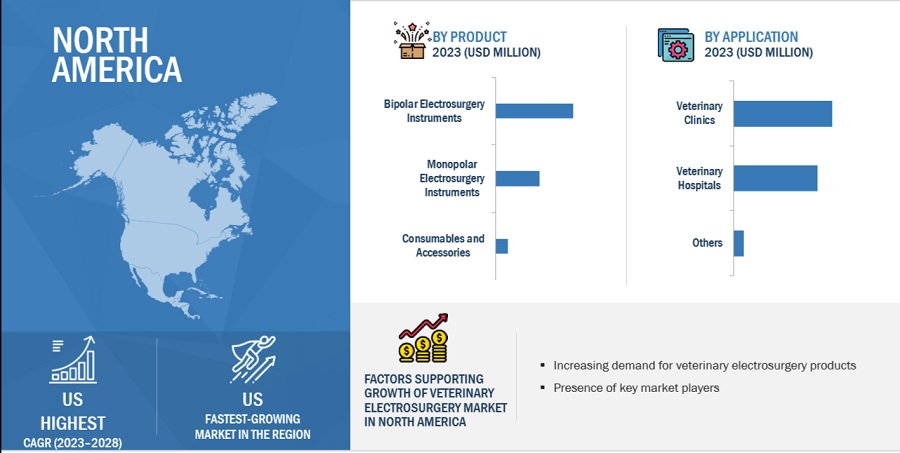

North America is expected to account for the largest share of the veterinary electrosurgery industry.

The veterinary electrosurgery market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & and Africa. In 2022, the North American region accounted for the largest share of the market. Government initiative to boost the adoption of advanced technology like veterinary electrosurgery, increased healthcare expenditure, and rise in animal healthcare research, is expected to boost the market in this region. Additionally, North America's strong research and development capabilities foster innovation in the sector.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the veterinary electrosurgery market are Medtronic (Ireland), B. Braun (Germany), Integra LifeSciences (US), Olympus Corporation (Japan), Covetrus, Inc. (US), Symmetry Surgical, Inc. (US), Avante Animal Health (DRE Veterinary) (US), Summit Hill Laboratories (US), Burtons Medical Equipment Limited (UK), Eickemeyer (Germany), KLS Martin (Germany), Macan Manufacturing (US), XcelLance Medical Technologies Pvt. Ltd. (India), Alsa Apparecchi Medicali SRL (Italy), and Kentamed Ltd. (Europe). These players include high shares in the market due to strategic mergers, acquisitions, partnerships, and large distribution channels adopted by them. This also leads to an increase in their geographic reach.

Scope of the Veterinary Electrosurgery Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$85 million |

|

Estimated Value by 2028 |

$120 million |

|

Revenue Rate |

Poised to grow at a CAGR of 7.3% |

|

Market Driver |

Rising number of veterinary practitioners in developed economies |

|

Market Opportunity |

Untapped emerging markets |

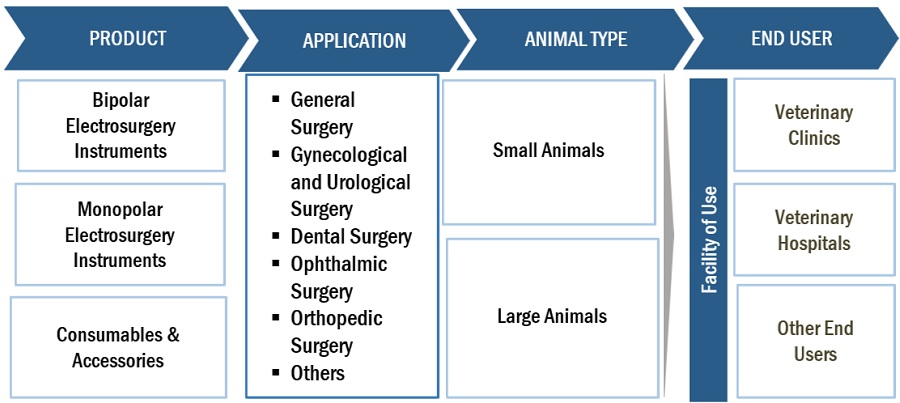

The research report categorizes the Veterinary Electrosurgery Market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Bipolar Electrosurgical Instruments

- Monopolar Electrosurgical Instruments

- Consumables & Accessories

By Application

- General Surgery

- Gynaecological & Urological Surgery

- Dental Surgery

- Ophthalmic Surgery

- Orthopedic Surgery

- Other Applications

By Animal Type

- Small Animals

- Large Animals

By End User

- Veterinary Hospital

- Veterinary Clinics

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of APAC

- Latin America

- Middle East and Africa

Recent Developments of Veterinary Electrosurgery Industry

- In April 2021, DRE Veterinary (US) partnered with Avante Health Solutions (US). This partnership rebranded DRE Veterinary to Avante Animal Health.

- In December 2020, Covetrus, Inc. (US) constructed a new DACH headquarters in Dusseldorf, Germany. The new headquarters focuses on the asset of Germany, Austria, and Switzerland-based teams and the firm’s Central European sites.

- In January 2020, Symmetry Surgical, Inc. (US) acquired O.R. Company (US). The acquisition complements Symmetry’s existing instrumentation portfolio and expands its minimally invasive surgical instrument offering.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global veterinary electrosurgery market?

The global veterinary electrosurgery market boasts a total revenue value of $120 million by 2028.

What is the estimated growth rate (CAGR) of the global veterinary electrosurgery market?

The global veterinary electrosurgery market has an estimated compound annual growth rate (CAGR) of 7.3% and a revenue size in the region of $85 million in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing animal healthcare expenditure and rising demand for pet health insurance- Rising number of veterinary practitioners across mature markets- Growth in companion animal populationRESTRAINTS- Rising pet care costs- High cost of veterinary electrosurgery equipmentOPPORTUNITIES- Growth potential of emerging economiesCHALLENGES- Low awareness of animal health in emerging markets- Shortage of veterinary practitioners

-

5.3 INDUSTRY TRENDSTECHNOLOGICAL ADVANCEMENTS IN ELECTROSURGERY UNITSEXPANSION OF VETERINARY BUSINESSES

-

5.4 TECHNOLOGY ANALYSISADVANCED BIPOLAR VESSEL SEALING SYSTEMSADOPTION OF BIG DATA AND ANIMAL WEARABLE DEVICESUSE OF AI IN VETERINARY ELECTROSURGERY

- 5.5 PRICING ANALYSIS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

-

5.8 ECOSYSTEM/MARKET MAP

-

5.9 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR VETERINARY ELECTROSURGERY MARKETINSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS

- 5.12 TRADE ANALYSIS: HS CODES

- 5.13 VETERINARY ELECTROSURGERY MARKET: UNMET NEEDS

- 5.14 END-USER EXPECTATIONS FOR VETERINARY ELECTROSURGERY MARKET

-

5.15 REGULATORY ANALYSISUSEUROPE

- 5.16 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.17 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA FOR PRODUCTS

- 5.18 CASE STUDY ANALYSIS

- 6.1 INTRODUCTION

-

6.2 BIPOLAR INSTRUMENTSABILITY TO RESTRICT DAMAGE TO SURROUNDING TISSUES TO PROPEL MARKET

-

6.3 MONOPOLAR INSTRUMENTSHIGH PRECISION AND IMPROVED SAFETY FEATURES TO DRIVE MARKET

-

6.4 CONSUMABLES & ACCESSORIESGROWING ADOPTION OF ELECTROSURGICAL INSTRUMENTS TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 GENERAL SURGERYRISING NUMBER OF SOFT TISSUE SURGERIES TO DRIVE MARKET

-

7.3 GYNECOLOGICAL & UROLOGICAL SURGERYGROWING PREFERENCE FOR MIS TECHNIQUES TO DRIVE MARKET

-

7.4 DENTAL SURGERYRISING FOCUS ON ORAL HYGIENE TO SUPPORT MARKET GROWTH

-

7.5 OPHTHALMIC SURGERYCATARACTS AND CORNEAL INFECTIONS IN COMPANION ANIMALS TO PROPEL MARKET

-

7.6 ORTHOPEDIC SURGERYRISING INCIDENCE OF OSTEOARTHRITIS TO SUPPORT MARKET GROWTH

- 7.7 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 SMALL ANIMALSGROWTH IN COMPANION ANIMAL POPULATION TO DRIVE MARKET

-

8.3 LARGE ANIMALSRISING FOCUS ON ANIMAL HEALTH & WELL-BEING TO SUPPORT MARKET

- 9.1 INTRODUCTION

-

9.2 VETERINARY HOSPITALSRISING DEMAND FOR ADVANCED INSTRUMENTS IN EMERGENCY CARE TO DRIVE MARKET

-

9.3 VETERINARY CLINICSRISING PET OWNERSHIP RATES TO PROPEL MARKET

- 9.4 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Rising expenditure on animal health to drive marketCANADA- Growing demand for pet care services to propel marketNORTH AMERICA: RECESSION IMPACT

-

10.3 EUROPEGERMANY- Rising demand for animal-derived food products to drive marketUK- Rising incidence of chronic diseases in companion animals to boost demandFRANCE- Increasing awareness about animal health to support market growthITALY- Growing establishment of veterinary practices to boost demandSPAIN- Rising awareness of animal health to support market growthREST OF EUROPEEUROPE: RECESSION IMPACT

-

10.4 ASIA PACIFICCHINA- High incidence of zoonotic diseases to drive marketJAPAN- Growth in veterinary care expenditure to propel marketINDIA- Growing pet ownership rates and rising establishment of veterinary clinics to drive marketAUSTRALIA- Rising trend of specialized veterinary clinics to support market growthSOUTH KOREA- Increasing demand for technologically advanced electrosurgery instruments to fuel uptakeREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

10.5 LATIN AMERICAINCREASING NUMBER OF VETERINARY PRACTITIONERS TO SUPPORT MARKET GROWTHLATIN AMERICA: RECESSION IMPACT

-

10.6 MIDDLE EAST & AFRICAAVAILABILITY OF FUNDS FOR ANIMAL HEALTHCARE TO SUPPORT MARKET GROWTHMIDDLE EAST & AFRICA: RECESSION IMPACT

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES

- 11.3 REVENUE SHARE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINTREGIONAL FOOTPRINT ANALYSIS

-

11.6 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING FOR START-UPS/SMES

-

11.7 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSMEDTRONIC PLC- Business overview- Products offered- MnM viewB. BRAUN MELSUNGEN AG- Business overview- Products offered- MnM viewINTEGRA LIFESCIENCES- Business overview- Products offered- MnM viewOLYMPUS CORPORATION- Business overview- Products offered- Recent developmentsCOVETRUS, INC.- Business overview- Products offered- Recent developments- MnM viewSYMMETRY SURGICAL, INC.- Business overview- Products offered- Recent developments- MnM viewAVANTE ANIMAL HEALTH- Business overview- Products offered- Recent developmentsSUMMIT HILL LABORATORIES- Business overview- Products offeredBURTONS MEDICAL EQUIPMENT LTD.- Business overview- Products offeredEICKEMEYER- Business overview- Products offeredKLS MARTIN GROUP- Business overview- Products offeredMACAN MANUFACTURING- Business overview- Products offeredXCELLANCE MEDICAL TECHNOLOGIES PVT. LTD.- Business overview- Products offeredALSA APPARECCHI MEDICALI SRL- Business overview- Products offeredKENTAMED LTD.- Business overview- Products offeredPROMISE TECHNOLOGY CO., LTD.- Business overview- Products offeredSHANGHAI HUIFENG MEDICAL INSTRUMENT CO., LTD.- Business overview- Products offeredKWANZA VETERINARY- Business overview- Products offeredKEEBOVET VETERINARY ULTRASOUND EQUIPMENT- Business overview- Products offeredLED SPA- Business overview- Products offered

-

12.2 OTHER PLAYERSKARL STORZHEAL FORCESPECIAL MEDICAL TECHNOLOGY, CO. LTD.BEIJING TAKTVOLL TECHNOLOGY CO., LTD.NANJING SHOULIANG-MED TECHNOLOGY CO., LTD.ALAN ELECTRONIC SYSTEMS PVT. LTD.DELTRONIX MEDICAL DEVICES

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 RISK ASSESSMENT ANALYSIS

- TABLE 3 VETERINARY ELECTROSURGERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- TABLE 4 BREAKDOWN OF PET INDUSTRY EXPENDITURE IN US (2020–2021) (USD BILLION)

- TABLE 5 PET POPULATION, BY ANIMAL TYPE, 2014-2020 (MILLION)

- TABLE 6 EUROPE: PET POPULATION, BY COUNTRY, 2014–2022 (MILLION)

- TABLE 7 AI INTEGRATION IN VETERINARY ELECTROSURGERY

- TABLE 8 REGIONAL PRICING ANALYSIS OF VETERINARY ELECTROSURGERY PRODUCTS, 2022 (USD THOUSAND)

- TABLE 9 VETERINARY ELECTROSURGERY MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 10 LIST OF PATENTS/PATENT APPLICATIONS IN VETERINARY ELECTROSURGERY MARKET, 2020–2023

- TABLE 11 KEY CONFERENCES AND EVENTS (2023−2024)

- TABLE 12 HS CODES FOR VETERINARY ELECTROSURGERY INSTRUMENTS & CONSUMABLES

- TABLE 13 UNMET NEEDS ANALYSIS

- TABLE 14 END-USER EXPECTATION ANALYSIS

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VETERINARY ELECTROSURGERY PRODUCTS

- TABLE 19 KEY BUYING CRITERIA FOR PRODUCTS, BY RANKING ANALYSIS

- TABLE 20 CASE STUDY 1: ESTIMATING MARKET SIZE OF VETERINARY DIAGNOSTICS PRODUCTS AND MARKET SHARE ANALYSIS FOR KEY PRODUCTS (COUNTRY-LEVEL)

- TABLE 21 CASE STUDY 2: ESTIMATING MARKET SIZE OF VETERINARY SURGICAL INSTRUMENTS AND MARKET SHARE ANALYSIS FOR KEY PRODUCTS (COUNTRY-LEVEL)

- TABLE 22 VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 23 VETERINARY ELECTROSURGERY MARKET FOR BIPOLAR INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 VETERINARY ELECTROSURGERY MARKET FOR MONOPOLAR INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 VETERINARY ELECTROSURGERY MARKET FOR CONSUMABLES & ACCESSORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 27 VETERINARY ELECTROSURGERY MARKET FOR GENERAL SURGERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 GYNECOLOGICAL SURGERIES PERFORMED, BY ANIMAL TYPE

- TABLE 29 VETERINARY ELECTROSURGERY MARKET FOR GYNECOLOGICAL & UROLOGICAL SURGERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 VETERINARY ELECTROSURGERY MARKET FOR DENTAL SURGERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 VETERINARY ELECTROSURGERY MARKET FOR OPHTHALMIC SURGERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 VETERINARY ELECTROSURGERY MARKET FOR ORTHOPEDIC SURGERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 VETERINARY ELECTROSURGERY MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 35 VETERINARY ELECTROSURGERY MARKET FOR SMALL ANIMALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 VETERINARY ELECTROSURGERY MARKET FOR LARGE ANIMALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 38 VETERINARY ELECTROSURGERY MARKET FOR VETERINARY HOSPITALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 VETERINARY ELECTROSURGERY MARKET FOR VETERINARY CLINICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 VETERINARY ELECTROSURGERY MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 VETERINARY ELECTROSURGERY MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: VETERINARY ELECTROSURGERY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 47 US: KEY MACROINDICATORS

- TABLE 48 US: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 49 US: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 50 US: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 51 US: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 52 CANADA: KEY MACROINDICATORS

- TABLE 53 CANADA: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 54 CANADA: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 55 CANADA: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 56 CANADA: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 57 EUROPE: VETERINARY ELECTROSURGERY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 EUROPE: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 59 EUROPE: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 60 EUROPE: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 61 EUROPE: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 62 GERMANY: KEY MACROINDICATORS

- TABLE 63 GERMANY: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 64 GERMANY: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 65 GERMANY: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 66 GERMANY: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 67 UK: KEY MACROINDICATORS

- TABLE 68 UK: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 69 UK: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 70 UK: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 71 UK: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 72 FRANCE: KEY MACROINDICATORS

- TABLE 73 FRANCE: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 74 FRANCE: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 75 FRANCE: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 76 FRANCE: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 77 ITALY: KEY MACROINDICATORS

- TABLE 78 ITALY: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 79 ITALY: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 80 ITALY: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 81 ITALY: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 82 SPAIN: KEY MACROINDICATORS

- TABLE 83 SPAIN: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 84 SPAIN: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 85 SPAIN: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 86 SPAIN: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 87 REST OF EUROPE: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 88 REST OF EUROPE: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 89 REST OF EUROPE: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 90 REST OF EUROPE: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 96 CHINA: KEY MACROINDICATORS

- TABLE 97 CHINA: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 98 CHINA: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 99 CHINA: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 100 CHINA: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 101 JAPAN: KEY MACROINDICATORS

- TABLE 102 JAPAN: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 103 JAPAN: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 104 JAPAN: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 105 JAPAN: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 106 INDIA: KEY MACROINDICATORS

- TABLE 107 INDIA: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 108 INDIA: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 109 INDIA: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 110 INDIA: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 111 AUSTRALIA: KEY MACROINDICATORS

- TABLE 112 AUSTRALIA: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 113 AUSTRALIA: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 114 AUSTRALIA: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 115 AUSTRALIA: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 116 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 117 SOUTH KOREA: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 118 SOUTH KOREA: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 119 SOUTH KOREA: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 120 SOUTH KOREA: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 124 REST OF ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 125 LATIN AMERICA: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 126 LATIN AMERICA: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 127 LATIN AMERICA: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 128 LATIN AMERICA: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021–2028 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 133 KEY DEVELOPMENTS IN VETERINARY ELECTROSURGERY MARKET

- TABLE 134 VETERINARY ELECTROSURGERY MARKET: COMPANY FOOTPRINT ANALYSIS, BY PRODUCT

- TABLE 135 COMPANY FOOTPRINT ANALYSIS, BY APPLICATION

- TABLE 136 COMPANY FOOTPRINT ANALYSIS, BY ANIMAL TYPE

- TABLE 137 COMPANY FOOTPRINT ANALYSIS, BY END USER

- TABLE 138 REGIONAL FOOTPRINT ANALYSIS

- TABLE 139 COMPANY OVERALL FOOTPRINT

- TABLE 140 VETERINARY ELECTROSURGERY MARKET: KEY START-UP/SME COMPANIES

- TABLE 141 VETERINARY ELECTROSURGERY MARKET: PRODUCT LAUNCHES (JUNE 2023)

- TABLE 142 VETERINARY ELECTROSURGERY MARKET: DEALS (JANUARY 2020−APRIL 2021)

- TABLE 143 VETERINARY ELECTROSURGERY MARKET: OTHER DEVELOPMENTS (DECEMBER 2020)

- TABLE 144 MEDTRONIC PLC: BUSINESS OVERVIEW

- TABLE 145 B. BRAUN MELSUNGEN AG: BUSINESS OVERVIEW

- TABLE 146 INTEGRA LIFESCIENCES: BUSINESS OVERVIEW

- TABLE 147 OLYMPUS CORPORATION: BUSINESS OVERVIEW

- TABLE 148 COVETRUS, INC.: BUSINESS OVERVIEW

- TABLE 149 SYMMETRY SURGICAL INC.: BUSINESS OVERVIEW

- TABLE 150 AVANTE ANIMAL HEALTH: BUSINESS OVERVIEW

- TABLE 151 SUMMIT HILL LABORATORIES: BUSINESS OVERVIEW

- TABLE 152 BURTONS MEDICAL EQUIPMENT LTD.: BUSINESS OVERVIEW

- TABLE 153 EICKEMEYER: BUSINESS OVERVIEW

- TABLE 154 KLS MARTIN GROUP: BUSINESS OVERVIEW

- TABLE 155 MACAN MANUFACTURING: BUSINESS OVERVIEW

- TABLE 156 XCELLANCE MEDICAL TECHNOLOGIES PVT. LTD.: BUSINESS OVERVIEW

- TABLE 157 ALSA APPRECCHI MEDICALI SRL: BUSINESS OVERVIEW

- TABLE 158 KENTAMED LTD.: BUSINESS OVERVIEW

- TABLE 159 PROMISE TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

- TABLE 160 SHANGHAI HUIFENG MEDICAL INSTRUMENT CO., LTD.: BUSINESS OVERVIEW

- TABLE 161 KWANZA VETERINARY: BUSINESS OVERVIEW

- TABLE 162 KEEBOVET VETERINARY ULTRASOUND EQUIPMENT: BUSINESS OVERVIEW

- TABLE 163 LED SPA: BUSINESS OVERVIEW

- FIGURE 1 MARKETS COVERED

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 6 MARKET SIZE APPROACH: REVENUE SHARE ANALYSIS

- FIGURE 7 VETERINARY ELECTROSURGERY MARKET: REVENUE SHARE ANALYSIS ILLUSTRATION OF MEDTRONIC

- FIGURE 8 TOP-DOWN APPROACH

- FIGURE 9 DEMAND-SIDE MARKET ESTIMATION: BIPOLAR AND MONOPOLAR ELECTROSURGICAL INSTRUMENTS

- FIGURE 10 DEMAND-SIDE MARKET ESTIMATION: VETERINARY ELECTROSURGERY CONSUMABLES AND ACCESSORIES

- FIGURE 11 VETERINARY ELECTROSURGERY MARKET: IMPACT ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 12 VETERINARY ELECTROSURGERY MARKET: CAGR PROJECTIONS

- FIGURE 13 DATA TRIANGULATION METHODOLOGY

- FIGURE 14 VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 VETERINARY ELECTROSURGERY MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 GEOGRAPHICAL SNAPSHOT: VETERINARY ELECTROSURGERY MARKET

- FIGURE 19 GROWTH IN COMPANION ANIMAL POPULATION AND RISING PET HEALTH EXPENDITURE TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 20 BIPOLAR INSTRUMENTS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 21 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 22 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 23 US: PET INDUSTRY EXPENDITURE (2010–2021)

- FIGURE 24 BASIC ANNUAL EXPENSES FOR DOGS AND CATS IN US, 2021

- FIGURE 25 VETERINARY ELECTROSURGERY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 VETERINARY ELECTROSURGERY MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 VETERINARY ELECTROSURGERY MARKET: ECOSYSTEM/MARKET MAP

- FIGURE 28 PATENT PUBLICATION TRENDS (JANUARY 2013−OCTOBER 2023)

- FIGURE 29 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR VETERINARY ELECTROSURGERY PATENTS (JANUARY 2013−OCTOBER 2023)

- FIGURE 30 TOP APPLICANT COUNTRIES FOR VETERINARY ELECTROSURGERY (JANUARY 2013−OCTOBER 2023)

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VETERINARY ELECTROSURGERY PRODUCTS

- FIGURE 32 KEY BUYING CRITERIA FOR VETERINARY ELECTROSURGERY PRODUCTS

- FIGURE 33 ANNUAL PER CAPITA MEAT CONSUMPTION PROJECTIONS, EMERGING VS. MATURE MARKETS (2020−2030)

- FIGURE 34 GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 35 NORTH AMERICA: VETERINARY ELECTROSURGERY MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET SNAPSHOT

- FIGURE 37 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN VETERINARY ELECTROSURGERY MARKET (2018−2022)

- FIGURE 38 VETERINARY ELECTROSURGERY MARKET: MARKET SHARE ANALYSIS (2022)

- FIGURE 39 VETERINARY ELECTROSURGERY MARKET: COMPANY EVALUATION MATRIX (2022)

- FIGURE 40 VETERINARY ELECTROSURGERY MARKET: START-UP/SME COMPANY EVALUATION MATRIX (2022)

- FIGURE 41 MEDTRONIC PLC: COMPANY SNAPSHOT (2022)

- FIGURE 42 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2022)

- FIGURE 43 INTEGRA LIFESCIENCES: COMPANY SNAPSHOT (2022)

- FIGURE 44 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2022)

The study involved four major activities in estimating the current size of the veterinary electrosurgery market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering veterinary electrosurgery products and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the veterinary electrosurgery market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the veterinary electrosurgery market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from veterinary electrosurgery manufacturers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side customers/end users who are using veterinary electrosurgery products were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of veterinary electrosurgery and the future outlook of their business, which will affect the overall market.

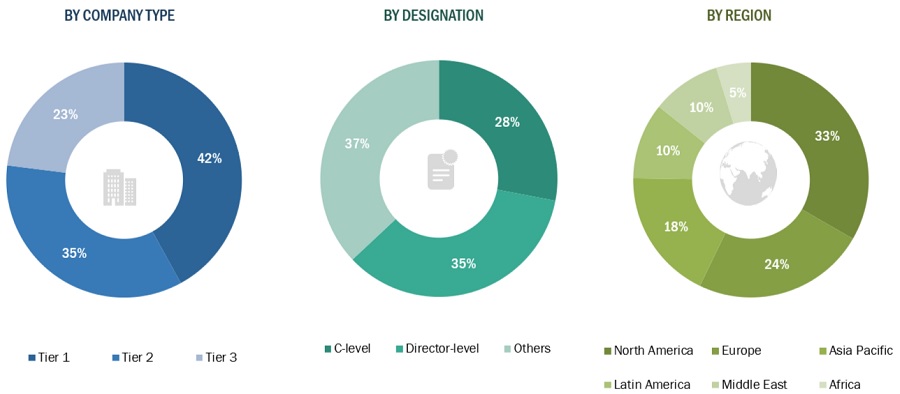

Breakdown of Primary Interviews : Supply-Side Participants, By Company Type, Designation, and Region

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2022: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3=<USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the veterinary electrosurgery market includes the following details.

The market sizing of the market was undertaken from the global side.

Country-level Analysis: The size of the veterinary electrosurgery market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products and services in the overall veterinary electrosurgery market was obtained from secondary data and validated by primary participants to arrive at the total Veterinary Electrosurgery market. Primary participants further validated the numbers.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall veterinary electrosurgery market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Veterinary Electrosurgery Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Veterinary Electrosurgery Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Electrosurgery, refers to the cutting, coagulation, desiccation (removing intra- and extra-cellular fluid), or fulguration (tissue destruction by sparking) of tissue using a high-frequency electrical current. Veterinary electrosurgical instruments are used to treat injury and deformity in animals.

Key Stakeholders

- Veterinary electrosurgical instruments manufacturers and distributors

- Veterinary hospitals and clinics

- Veterinary institutes

- Research institutes

- Government associations

- Research & consulting firms

- Market research & consulting firms

- Animal health research and development (R&D) companies

- Business Research and Consulting Service Providers

- Venture Capitalists

Report Objectives

- To define, describe, and forecast the global veterinary electrosurgery market on the basis of product, application, animal type end user and region.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micro markets with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the veterinary electrosurgery market with respect to six main regions (along with countries), namely, North America, Europe, Asia Pacific, Latin America and The Middle East and Africa

- To profile the key players in the global veterinary electrosurgery market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions, product launches, regulatory approvals, and R&D activities of the leading players in the global veterinary electrosurgery market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe veterinary electrosurgery market into the Netherlands, Austria, Belgium, and others

- Further breakdown of the Rest of Asia Pacific veterinary electrosurgery market into Singapore, Malaysia, and others

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Veterinary Electrosurgery Market