Veterinary Care Market Size by Treatment Type (No medicalization, Basic Medicalization, and Under Long Term Veterinary Care), Animal Type (Dogs, Cats, Cattle, Horses, Pigs, and Poultry), and Region - Global Forecast to 2025

Market Growth Outlook Summary

The global veterinary care market growth is primed to transition from USD 5.2 billion in 2018 to USD 23 billion by 2025, showcasing a strong CAGR of 5.7%. Key factors driving growth include increasing regulatory initiatives and rising demand for animal health products, particularly in regions like Asia and Latin America. Livestock animals such as cattle and poultry are expected to see higher medicalization rates, especially in emerging economies like the Philippines and Vietnam. Major players such as Zoetis, Merck, Boehringer Ingelheim, and others are expanding through strategic acquisitions, new product launches, and geographical expansions. Latin America, especially Brazil and Argentina, is emerging as a key region for growth, driven by a growing demand for veterinary products and services.

To know about the assumptions considered for the study, Request for Free Sample Report

Livestock animals such as cattle and poultry are expected to receive maximum medicalization in the coming years

The animal type segment of the veterinary care market is bifurcated further into dogs, cats, pigs, poultry, cattle, and horses. Livestock animals such as cattle and poultry are expected to experience higher medicalization rates during the forecast years. In emerging economies such as the Philippines and Vietnam, earlier, poultry health was neglected, and owners used to discard the chickens in bulk during a virus outbreak. Similar was the condition of a few cattle farms. Unorganized farms were often neglected, and that hampered the overall meat production in such countries. However, the current laws have been framed to scrutinize the situation in farms and ensure maximum animal protection.

The decline in non-medicalized animals has positively impacted the veterinary care industry.

Based on the type of treatment, the veterinary care market is segmented into no medicalization, basic medicalization, and under veterinary care. The percentage of non-medicalized animals is going to experience a decline over the next few years. The major reason behind this sharp decrease in no medicalization in animals is rising awareness amongst the farm as well as the pet owners. Moreover, government initiatives to promote animal welfare has also raised the medicalization rate in animals; thus, proving beneficial for the overall market.

Latin America veterinary care industry will experience considerable growth during the forecast years, by region

Latin America is one of the regions that has experienced significant growth in animal health space for the past few years. Countries such as Brazil and Argentina have shown potential demand for veterinary products and services. Several major players in the veterinary space have considered expansion Latin America due to the enormous growth opportunities it offers in the animal health industry.

The leading players in the animal treatment market include Zoetis (US), Merck (US), Boehringer Ingelheim (Germany), Elanco (US), Ceva (France), Phibro Animal Health Corporation (US), Virbac SA (France), IDEXX Laboratories, Inc., Neogen Corporation (US), Heska Corporation. (US) and others. These players undertake several strategic initiatives such as mergers, acquisitions, new product launches, and geographical expansions that helps them in sustaining market competition.

Scope of the Veterinary Care Industry:

|

Report Metric |

Details |

|

Forecast Period |

2018-2025 |

|

Projected Revenue Size by 2025 |

$23 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 5.7% |

|

Market Driver |

Forthcoming trends |

|

Market Opportunity |

Emerging economies |

The research report categorizes the Veterinary Care market to forecast revenue and analyze trends in each of the following submarkets:

By Animal Type

- Dogs

- Cats

- Cattle

- Pigs

- Horses

- Poultry

By Medicalization Type

- No medicalization

- Basic Medicalization

- Veterinary Care

By Region

-

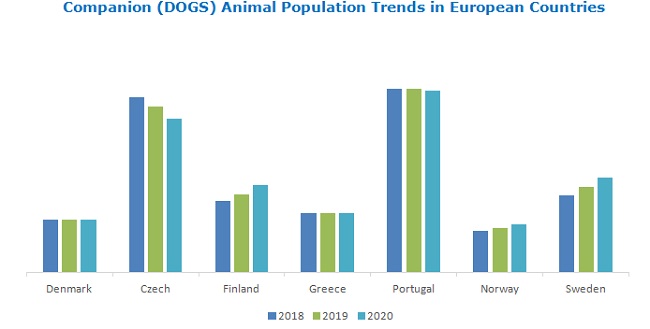

Europe

- Denmark

- Finland

- Greece

- Norway

- Portugal

- Belgium

- Czech Republic

- Sweden

-

Asia Pacific

- Singapore

- New Zealand

- Vietnam

- Philippines

- Malaysia

- Indonesia

-

Latin America

- Brazil

- Argentina

- Colombia

- Mexico

- Chile

-

Africa

- South Africa

Recent Developments of Veterinary Care industry

- In February 2020, Zoetis acquired Ethos Diagnostic Science. This acquisition will not only expand company’s product portfolio but will also help the company to grow exponentially in the veterinary space.

- In November 2019, Zoetis acquired ZNLabs a reference laboratory company that is operational across the U.S. This has helped the company to enhance its offerings and improve its business performance

- In June 2020, Merck completed the acquisition of a Quantified Ag leading data analytics company that monitors cattle temperature and helps in the early detection of any disease. This acquisition will diversify Merck’s veterinary product offerings and will positively impact the company’s profitability.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global veterinary care market?

The global veterinary care market boasts a total revenue value of $23 billion in 2025.

What is the estimated growth rate (CAGR) of the global veterinary care market?

The global veterinary care market has an estimated compound annual growth rate (CAGR) of 5.7%.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

TABLE 1 COUNTRIES COVERED

FIGURE 1 VETERINARY CARE ANALYSIS

FIGURE 2 YEARS CONSIDERED FOR THE STUDY

1.2 MARKET DEFINITION

TABLE 2 MARKET DEFINITIONS

2 RESEARCH METHODOLOGY

2.1 SECONDARY RESEARCH

2.2 PRIMARY RESEARCH

2.3 ANALYSIS + OUTPUT

3 VETERINARY CARE MARKET – KEY INSIGHTS

3.1 ASIA PACIFIC VETERINARY CARE MARKET

FIGURE 5 ASIA PACIFIC VETERINARY CARE MARKET

FIGURE 6 COMPETITIVE LEADERSHIP MAPPING

3.2 LATIN AMERICA ANIMAL HEALTH MARKET

FIGURE 7 LATIN AMERICA ANIMAL HEALTHCARE

FIGURE 8 COMPETITIVE LEADERSHIP MAPPING

4 VETERINARY CARE MARKET BY MEDICALIZATION TYPE

4.1 NO MEDICALIZATION

4.2 BASIC MEDICALIZATION

4.3 UNDER LONG TERM VETERINARY CARE

5 VETERINARY CARE MARKET BY ANIMAL TYPE

5.1 DOGS

5.2 CATS

5.3 HORSES

5.4 CATTLE

5.5 PIGS

5.6 POULTRY

6 VETERINARY CARE MARKET, BY COUNTRY

6.1 EUROPE

FIGURE 9 CANNE POPULATION- EUROPEAN COUNTRIES

FIGURE 10 FELINE POPULATION- EUROPEAN COUNTRIES

6.1.1 DENMARK

TABLE 3 DENMARK: VETERINARY CARE MARKET - PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 4 DENMARK: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 5 DENMARK: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

FIGURE 11 DENMARK-BOVINE POPULATION

FIGURE 12 DENMARK-PORCINE POPULATION

6.1.2 CZECH REPUBLIC

TABLE 6 CZECH REPUBLIC: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 7 CZECH REPUBLIC: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 8 CZECH REPUBLIC: VETERINARY CARE INDUSTRY - PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

FIGURE 13 CZECH REPUBLIC--POULTRY POPULATION

FIGURE 14 CZECH REPUBLIC--PORCINE POPULATION

6.1.3 FINLAND

TABLE 9 FINLAND: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 10 FINLAND: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 11 FINLAND: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

FIGURE 15 FINLAND- POULTRY POPULATION

FIGURE 16 FINLAND PORCINE POPULATION

6.1.4 BELGIUM

TABLE 12 BELGIUM: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 13 BELGIUM: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 14 BELGIUM: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

FIGURE 17 BELGIUM- BOVINE POPULATION

FIGURE 18 BELGIUM- POULTRY POPULATION

6.1.4 GREECE

TABLE 15 GREECE: VETERINARY CARE MARKET - PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 16 GREECE: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 17 GREECE: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

FIGURE 19 GREECE- EQUINE POPULATION

FIGURE 20 GREECE-PORCINE POPULATION

6.1.6 SWEDEN

TABLE 18 SWEDEN: VETERINARY CARE INDUSTRY - PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 19 SWEDEN: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 20 SWEDEN: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

FIGURE 21 SWEDEN EQUINE POPULATION

FIGURE 22 SWEDEN POULTRY POPULATION

6.1.7 PORTUGAL

TABLE 21 PORTUGAL: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 22 PORTUGAL: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 23 POTUGAL: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

FIGURE 23 PORTUGAL BOVINE POPULATION

FIGURE 24 PORTUGAL POULTRY POPULATION

6.1.8 NORWAY

TABLE 24 NORWAY: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 25 NORWAY: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 26 NORWAY: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 25 NORWAY: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 26 NORWAY: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

6.2 ASIA PACIFIC

6.2.1 INDONESIA

TABLE 42 INDONESIA: VETERINARY CARE MARKET - PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 43 INDONESIA: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 44 INDONESIA: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

FIGURE 37 INDONESIA BOVINE POPULATION

FIGURE 38 INDONESIA POULTRY POPULATION

6.2.2 MALAYSIA

TABLE 45 MALAYSIA: VETERINARY CARE INDUSTRY - PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 46 MALAYSIA: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 47 MALAYSIA: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

FIGURE 39 MALAYSIA BOVINE POPULATION

FIGURE 40 MALAYSIA POULTRY POPULATION

6.2.3 NEW ZEALAND

TABLE 48 NEW ZEALAND: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 49 NEW ZEALAND: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 50 NEW ZEALAND: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

FIGURE 41 NEW ZEALAND BOVINE POPULATION

FIGURE 42 NEW ZEALAND POULTRY POPULATION

6.2.4 SINGAPORE

TABLE 51 SINGAPORE: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 52 SINGAPORE: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 53 SNGAPORE: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

FIGURE 43 SINGAPORE PORCINE POPULATION

FIGURE 44 SINGAPORE POULTRY POPULATION

6.2.5 VIETNAM

TABLE 54 VIETNAM: VETERINARY CARE MARKET - PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 55 VIETNAM: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 56 VIETNAM: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

FIGURE 45 VIETNAM BOVINE POPULATION

FIGURE 46 VIETNAM POULTRY POPULATION

6.2.6 PHILIPPINES

TABLE 57 PHILIPINNES: VETERINARY CARE INDUSTRY - PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 58 PHILIPPINES: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 59 PHILIPPINES: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

FIGURE 47 PHILIPPINES BOVINE POPULATION

FIGURE 48 PHILIPPINES: POULTRY POPULATION

6.3 LATIN AMERICA

6.3.1 ARGENTINA

TABLE 27 ARGENTINA: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 28 ARGENTINA: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 29 ARGENTINA: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

FIGURE 27 AREGNTINA: EQUINE POPULATION

FIGURE 28 ARGENTINA POULTRY POPULATION

6.3.2 BRAZIL

TABLE 30 BRAZIL: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 31 BRAZIL: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 32 BRAZIL: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 31 BRAZIL: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 32 BRAZIL: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

6.3.3 MEXICOL

TABLE 33 MEXICO: VETERINARY CARE MARKET - PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 34 MEXICO: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 35 MEXCIO: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

FIGURE 31 MEXCIO BOVINE POPULATION

FIGURE 32 MEXICO POULTRY POPULATION

6.3.4 COLOMBIA

TABLE 36 COLOMBIA: VETERINARY CARE INDUSTRY - PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 37 COLOMBIA: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 38 COLOMBIA: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

FIGURE 33 COLOMBIA BOVINE POPULATION

FIGURE 34 COLOMBIA POULTRY POPULATION

6.3.5 CHILE

TABLE 39 CHILE: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 40 CHILE: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 41 CHILE: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

FIGURE 35 CHILE BOVINE POPULATION

FIGURE 36 CHILE POULTRY POPULATION

6.4 SOUTH AFRICA

TABLE 60 SOUTH AFRICA: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 61 SOUTH AFRCIA: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 62 SOUTH AFRICA: VETERINARY CARE INDUSTRY - PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

FIGURE 49 SOUTH AFRICA: BOVINE POPULATION)

FIGURE 50 SOUTH AFRICA: POULTRY POPULATION

7 APPENDIX

7.1 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

7.2 AUTHOR DETAIL

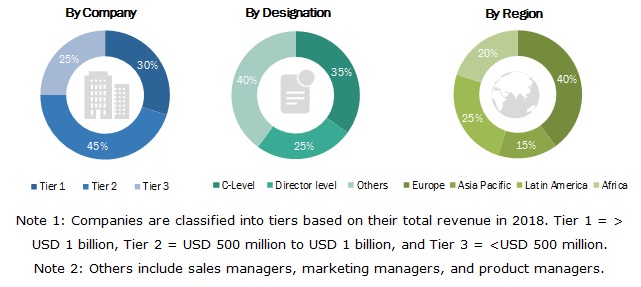

This study involved the extensive use of both primary and secondary sources. The research process included a study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the veterinary care market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, industry experts from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Industry experts from the supply side include CEOs, presidents, vice presidents, marketing managers, product managers, sales executives, business development executives, and technology & innovation directors of companies providing veterinary care products. A breakdown of primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Analysis

The robust methodology was utilized while analyzing the animal treatment rate wherein, data was gathered through secondary sources and then was further validated through primary interviews. Animal population data, disease prevalence data, and diagnosis trends were studied through government publications and articles released from associations such as OIE. Further, the diagnosis rate and disease prevalence rate in animals was verified by conducting several primary interviews.

Data Triangulation

To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To analyze the medicalization rate in species such as dogs, cats, horses, pigs, cattle, and poultry.

- To provide detailed information about the key factors influencing animal treatment rate (such as regulatory scenario, animal welfare initiatives and entry barriers country-wise)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall animal treatment market

- To analyze market opportunities for stakeholders and provide detailed animal healthcare scenarios for various countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Veterinary Care Market