Vertiports Market by Type (Vertihubs, Vertibases, Vertipads), Solution (Landing Pads, Terminal Gates, Ground Support Equipment, Charging Stations, Ground Control Stations), Landscape, Location, Topology, and Region - Global Forecast to 2030

Update: 10/22/2024

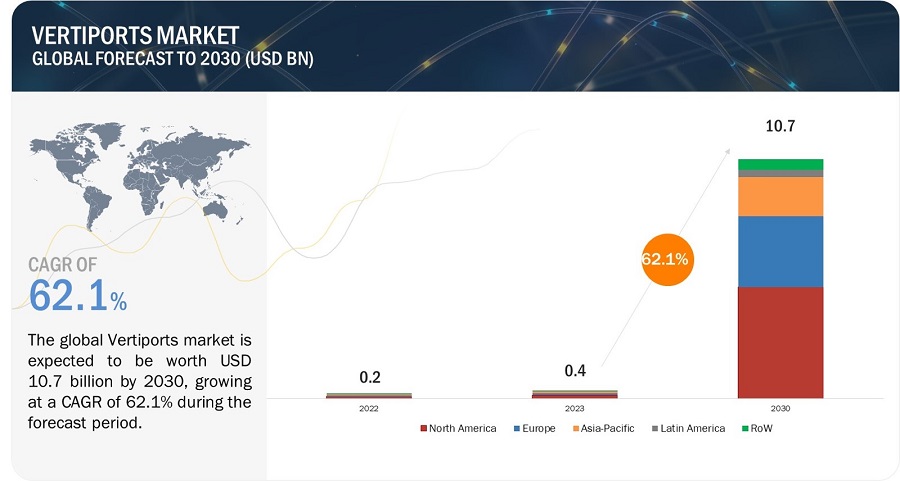

The Vertiports Market size was estimated at USD 0.2 million in 2022 and is predicted to increase from USD 0.4 Billion in 2023 to approximately USD 10.7 Billion by 2030, expanding at a CAGR of 62.1% from 2023 to 2030.

Vertiports Market Key Takeaways

-

By Market Size & Growth, Vertiports Market is projected to reach USD 10.7 Billion by 2030, growing from USD 0.4 Billion in 2023 at a CAGR of 62.1% during the forecast period.

-

By aligning with the rising demand for sustainable urban transport, vertiports are becoming a cornerstone in reducing road congestion and enabling greener mobility in major metropolitan regions.

-

By focusing on Ground-Based Vertiport types, the market is witnessing the fastest growth in this segment due to their ease of integration with current city infrastructure, such as rooftops and parking garages.

-

By prioritizing passenger transportation, this application segment dominates the market, driven by the increasing need for efficient short-distance urban travel, especially in traffic-prone cities.

-

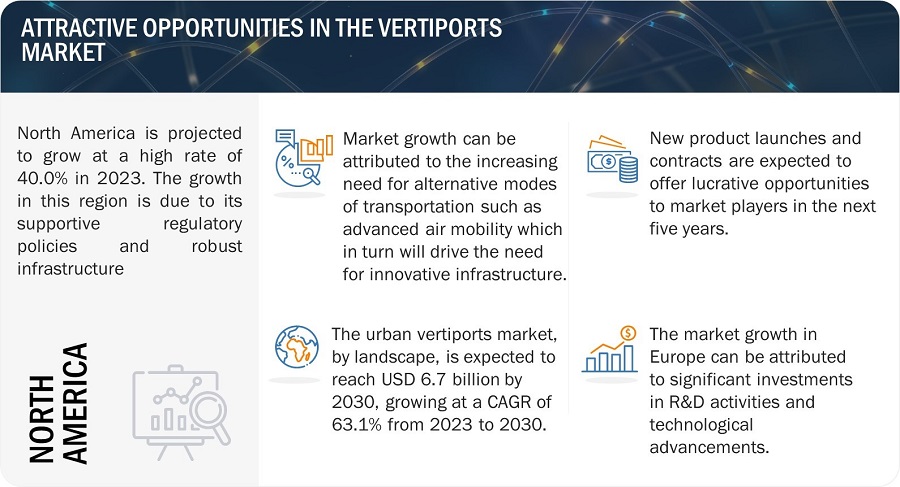

By seeing strong momentum in the Americas, particularly in the U.S., the region is expected to lead due to supportive regulatory frameworks, early adoption of advanced air mobility solutions, and strong investments in eVTOL infrastructure.

-

By leveraging the growing role of vertiport operation and maintenance services, the service segment is growing as operators prepare for long-term usage and continuous functionality of urban air mobility hubs.

-

By integrating energy and charging stations, vertiports are evolving beyond landing zones to become complete mobility ecosystems supporting electric aircraft with efficient turnaround times.

-

By collaborating with urban planners and aviation authorities, the market is shaped by strategic partnerships aimed at seamlessly embedding vertiports into cityscapes while ensuring safety, noise control, and accessibility.

Market Size & Forecast Report

-

2023 Market Size: SD 0.4 Billion

-

2030 Projected Market Size: 10.7 Billion

-

CAGR (2023-2030): 62.1%

-

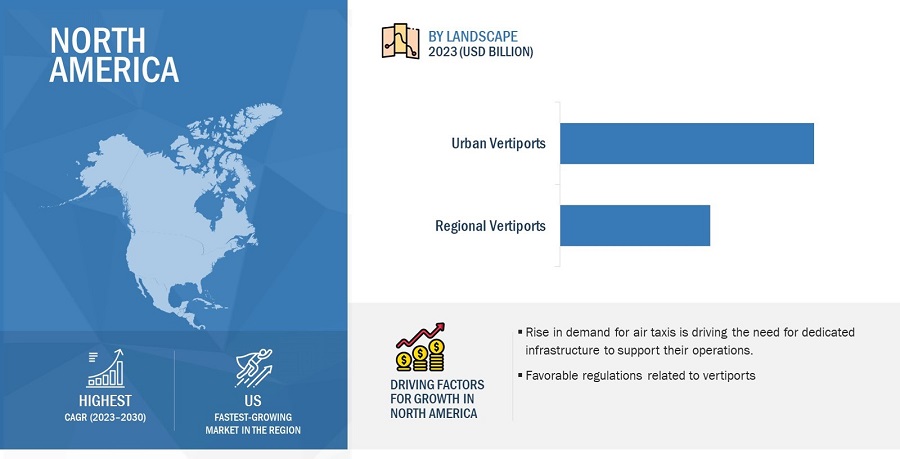

North America :Highest CAGR

The Vertiports Industry is driven by factors such as increasing opportunities for software and data solution providers, increasing demand for AAM, and growing technological advancements in vertiports.

Vertiports Market Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

Vertiports Market Dynamics:

Driver: Growing technological advancements to develop vertiports

Technological advancements are at the forefront of driving the growth and development of the vertiports market. As the demand for advanced air mobility aircraft continues to rise, innovative technologies are reshaping vertiports into efficient and futuristic hubs for air transportation. One of the major drivers in the vertiports market is the advent of automation and robotics. These advanced technologies have revolutionized ground operations, making them more streamlined and efficient. Automated systems enable seamless passenger management, resource allocation, and ground movement safety monitoring. Vertiports can significantly enhance operational efficiency and optimize passenger flow by automating processes such as check-in, baggage handling, and security checks. Robotics also play a key role by assisting with tasks that require precision and efficiency, such as luggage handling and maintenance operations. This reduces human error and contributes to faster turnaround times and improved overall performance of the vertiport.

Another critical technological advancement is developing charging infrastructure specifically designed for electric VTOL aircraft. With the growing emphasis on sustainability and environmental consciousness, electric VTOLs have emerged as a promising solution for advanced air mobility. Vertiports are taking the lead by integrating charging stations and infrastructure to support these aircraft. This charging infrastructure allows efficient and rapid recharging of the aircraft's batteries, enabling quick turnaround times between flights. Moreover, advancements in wireless charging technology are being explored, offering the potential for even more seamless and convenient recharging experiences for electric VTOLs. This technological development is crucial for the widespread adoption and success of electric VTOLs in the vertiports market, as it addresses the need for efficient and sustainable operations.

Restraint: High initial investment

High initial investment acts as a significant restraint in the vertiports industry. One major cost factor is land acquisition, as suitable land in urban areas or near populated regions comes at a high price. Identifying land that meets necessary criteria, such as airspace considerations and proximity to transportation networks, adds complexity and increases costs. The construction and infrastructure development phase also requires substantial investment. Vertiports must have specialized facilities, including landing areas, charging stations, maintenance facilities, and passenger amenities, all of which come with significant construction costs. The installation of advanced technologies, such as air traffic management systems and charging infrastructure, further adds to the financial burden.

Another aspect of the high initial investment is the technological requirements of vertiports. The integration of advanced systems and technologies is essential for the efficient operation of these facilities. This includes air traffic management systems, communication systems, radar systems, airspace management software, and charging infrastructure for eVTOL aircraft. Implementing these technologies requires significant investment, and ensuring the seamless integration of these systems and meeting the regulatory standards further adds to the cost. Operational costs and maintenance expenses are ongoing financial commitments for vertiports. These include staff salaries, security measures, utilities, equipment maintenance, and compliance with regulatory requirements. These operational costs can be substantial, particularly during the early stages of a vertiport's operation when the demand for AAM services may not have reached its full potential.

Opportunity: Growing opportunities for infrastructure providers

In the vertiport market, the design and development of vertiport present crucial opportunities for infrastructure providers. A multidisciplinary strategy integrating knowledge in architecture, urban planning, and aviation infrastructure is necessary for vertiport design. Developers with experience in constructing airports or transportation hubs can use their expertise to develop effective and cutting-edge vertiport designs. When designing a vertiport, it is important to consider things like the best layout, passenger flow, connection with current transportation networks, and the capacity to accommodate VTOL vehicle operations. Developers may stand out in the vertiport industry and draw customers by offering distinctive and useful design solutions. The rising need for vertiport infrastructure can be advantageous for construction businesses. As the sector grows, there will be a demand for specialized infrastructure providers that can develop vertiports that adhere to exacting operating and safety standards. These businesses ought to have expertise in building intricate infrastructure projects, including runways, passenger terminals, infrastructure for electrical charging, and other relevant services. These businesses can win contracts for developing vertiports and contribute to the growth of the advanced air mobility ecosystem by utilizing their construction knowledge. It is essential to adhere to industry standards and regulations to guarantee that the vertiport infrastructure is developed to the greatest safety standards. In order to reduce project costs and deadlines, infrastructure businesses might also explore cutting-edge construction methods and materials, such as using modular construction techniques.

Challenges: Limited regulatory framework

The regulatory framework surrounding vertiports presents a significant challenge to the market's development and expansion. The establishment of comprehensive and clear regulations is crucial to ensure the safe and efficient operation of vertiports, manage airspace, address noise pollution concerns, and define operational standards. However, the regulatory landscape for advanced air mobility and vertiports is still nascent, which leads to uncertainties and challenges. The absence of well-defined and standardized regulations specific to vertiports can hinder the progress of infrastructure projects. Vertiports need to adhere to various regulations, including zoning, land use, building codes, and aviation regulations. Existing regulations may not fully consider the unique characteristics and requirements of vertiport operations, resulting in delays, complexities, and increased costs for developers and operators. Collaboration between industry players, regulatory agencies, local governments, and aviation authorities is required to develop and implement suitable legislation for vertiports. The procedure entails assessing safety regulations, implementing noise reduction plans, creating airspace management systems, and integrating vertiports with the current traffic network. However, the development and growth of vertiports may be hampered by this laborious and complicated process. Vertiport operators may face difficulties due to different rules in various countries, which could impede the growth of a seamless network. Vertiports may span several cities, states, or even nations, requiring navigating a confusing web of laws. Regulatory agencies must collaborate and harmonize their regulations to ensure uniform standards and promote the market's effective expansion.

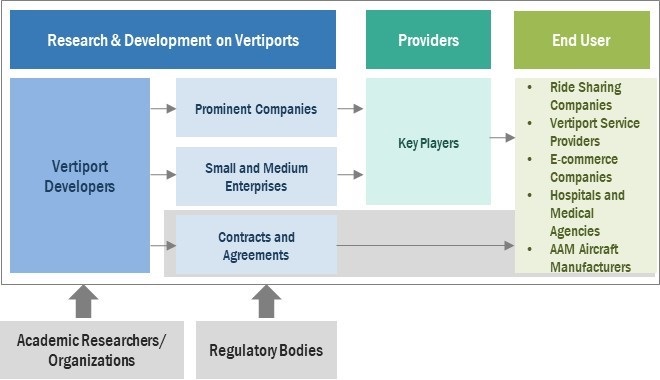

Vertiports Market Ecosystem:

Based on type, the vertihubs segment is projected to have the second highest share in 2023

Based on type, the vertiports market has been segmented into vertihubs, vertibases, and vertipads. Vertihubs are situated at one or two significant airports, in addition to two or three metropolitan areas near the busiest commuter routes. They are planned as standalone structures with ten active takeoff and landing areas and an additional 20 spaces for parking or maintenance that will be built in central, high-traffic zones. Vertihubs might possibly offer some sort of shopping or other passenger services. The need for flight planning, monitoring, and coordination as regulatory frameworks for VTOL operations, along with the overall safety of the aerial mobility system, is driving the demand for the vertihubs segment.

Based on Landscape, the urban vertiports segment of the market is projected to grow at the highest CAGR from 2023 to 2030.

Based on the landscape, the vertiports market has been segmented into urban vertiports and regional vertiports. Urban vertiports are being driven by the escalating congestion in urban areas. These vertiports serve as departure and arrival points for air taxis, delivery drones, and other urban air mobility vehicles. They are strategically located in urban centers or designated areas to provide convenient access to commuters and facilitate efficient transportation. Urban vertiports feature charging and maintenance facilities, passenger terminals, cargo handling areas, and airspace management systems to ensure safe and seamless operations. Thus, the increasing demand for on-demand air mobility services, including air taxis and delivery drones in urban areas, creates a lucrative market for urban vertiports.

Based on Location, the rooftop/elevated segment of the market is projected to grow at the highest CAGR from 2023 to 2030.

Based on Location, the vertiports market has been segmented into ground-based, rooftop/elevated, and floating. The rooftop/elevated segment is estimated to lead during the forecast period owing to their effective utilization of limited urban space, such as rooftops, by optimizing land usage in densely populated areas. The increasing demand for advanced air mobility and the potential integration of autonomous vehicles further bolster the outlook for rooftop/elevated vertiports.

North America is expected to account for the highest CAGR in the forecasted period.

North America is estimated to account for the highest CAGR in the forecasted period. The market growth in this region is anticipated to be fueled by the rising demand for advanced air mobility solutions, which is motivated by traffic congestion and the need for faster transportation options. The development of vertiport infrastructure has been aided by improvements in electric vertical takeoff and landing (eVTOL) technology, which has made it more commercially and environmentally sustainable. The development of vertiports in North America is also benefitted by supportive regulatory frameworks and investments from the public and private sectors.

Vertiport Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Vertiports Companies: Top Key Market Players

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size

|

USD 0.4 Billion in 2023

|

|

Projected Market Size

|

USD 10.7 Billion by 2030

|

|

Growth Rate

|

CAGR of 62.1%

|

|

Market size available for years |

2020-2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2030 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

By Solution, By Type, By Location, By Landscape, By Topology |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Rest of the World |

|

Companies covered |

Ferrovial (Spain), Vports(Canada), Volocopter GmbH (Germany), Skyports Infrastructure Limited (UK), Skyscape Inc. (Japan), and Skyportz (Australia), among others |

Vertiports Market Highlights

This research report categorizes the vertiports Market based on solution, type, location, landscape, topology, and region.

|

Segment |

Subsegment |

|

By Type |

|

|

By Solution |

|

|

By Location |

|

|

By Landscape |

|

|

By Topology |

|

|

By Region |

|

Recent Developments

- In June 2023, Groupe ADP signed a Memorandum of Understanding (MoU) with AutoFlight to test Prosperity 1 eVTOL flights at Pontoise Airport during the Paris Olympic Games 2024. With five new vertiports, Groupe ADP is leading the development of eVTOL infrastructure in the Paris Region.

- In June 2023, UrbanV S.p.A and Lilium partnered for the advancement of infrastructure for Advanced Air Mobility (AAM). The firms' partnership to construct vertiport infrastructure would allow eVTOL networks for Lilium aircraft and clients, with an initial focus on Italy and the French Riviera, where UrbanV will begin operations, with the possibility for further markets.

- In June 2023, Lilium and UrbanV S.p.A has partnered for the advancement of infrastructure for Advanced Air Mobility (AAM). The firms' partnership to construct vertiport infrastructure would allow eVTOL networks for Lilium aircraft and clients, with an initial focus on Italy and the French Riviera, where UrbanV will begin operations, with the possibility for further markets.

- In March 2023, Ferrovial and Eve Air Mobility partnered to provide safe and dependable operation of vertiports and eVTOLs. It includes Eve Air Mobility's software that will help vertiports and eVTOLs communicate with one another.

- In February 2023, Skyports Infrastructure and Dubai’s Road and Transport Authority (RTA) partnered to create a vertiport network in Dubai for a 2026 launch, including a proposal for future vertiport infrastructure. The partnership includes four vertiports at Dubai International Airport, Palm Jumeirah, Dubai Downtown, and Dubai Marina.

Frequently Asked Questions (FAQ):

What is the current size of the vertiports market?

The global vertiports market size is estimated to grow from USD 0.4 Billion in 2023 to USD 10.7 Billion by 2030, at a CAGR of 62.1% in the forecasted period.

Who are the winners in the vertiports market?

Skyports Infrastructure Limited (UK), Urban-Air Port Ltd (UK), Skyscape Inc. (Japan), Groupe ADP (France), and Ferrovial (Spain) are some of the winners in the market.

What are some of the opportunities of the vertiports market?

Intermodal Integration for efficient travel and increasing opportunities for infrastructure providers are a few opportunities for the vertiports market.

What are some of the technological advancements in the vertiports market?

Vertiport Management Systems, Automated Ground Handling, and Remote maintenance and monitoring systems are some of the technological advancements in the vertiports market.

What are the factors driving the growth of the vertiports market?

Growing demand for advanced air mobility and increasing technological advancements are a few growth prospects of the vertiports market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for Advanced Air Mobility- Growing technological advancements to develop vertiports- Smart city initiativesRESTRAINTS- High initial investment- Limited availability of suitable sitesOPPORTUNITIES- Growing opportunities for infrastructure providers- Leveraging intermodal connectivity potential to create sustainable vertiports- Opportunity for software and data solution providersCHALLENGES- Lack of skilled labor- Limited regulatory framework

- 5.3 RECESSION IMPACT ANALYSIS

-

5.4 VALUE CHAIN ANALYSISRAW MATERIALSR&DSOLUTION PROVIDERSVERTIPORT DEVELOPERSEND USERS

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR VERTIPORTS MARKET

-

5.6 VERTIPORTS MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING ANALYSIS

- 5.9 VOLUME DATA BY TYPE

-

5.10 TARIFF AND REGULATORY LANDSCAPENORTH AMERICAEUROPEASIA PACIFIC

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.12 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.13 TECHNOLOGY ANALYSISROBOTICSDATA ANALYTICS AND MANAGEMENT

-

5.14 USE CASE ANALYSISVERTIPORT AUTOMATION SYSTEM FOR GROUND OPERATIONSSUSTAINABLE VERTIPORTS

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSVERTIPORT MANAGEMENT SYSTEMSAUTOMATED GROUND HANDLINGREMOTE MAINTENANCE AND MONITORING SYSTEMSINTEGRATION OF ADVANCED DIGITAL INFRASTRUCTURE AND SMART TECHNOLOGIESBLOCKCHAIN TECHNOLOGY

-

6.3 IMPACT OF MEGATRENDSAIR TRAFFIC MANAGEMENTVEHICLE-TO-VERTIPORT COMMUNICATIONARTIFICIAL INTELLIGENCE

-

6.4 INNOVATION AND PATENT ANALYSIS

- 6.5 ROADMAP FOR VERTIPORTS

- 7.1 INTRODUCTION

-

7.2 LANDING PADSGROWTH IN ADVANCED AIR MOBILITY TO DRIVE SEGMENT

-

7.3 TERMINAL GATESNEED FOR EFFICIENT PASSENGER MANAGEMENT TO BOOST MARKET

-

7.4 GROUND SUPPORT EQUIPMENTNEED TO SUPPORT VERTIPORT OPERATIONS ON GROUND TO FUEL MARKET

-

7.5 CHARGING STATIONSNEED FOR QUICK AND EFFICIENT CHARGING TO DRIVE MARKET

-

7.6 GROUND CONTROL STATIONSNEED TO MANAGE AND MONITOR AIRCRAFT FOR SAFE AND RELIABLE FLIGHT TO DRIVE MARKET

-

7.7 OTHER SOLUTIONSEFFICIENT MAINTENANCE, SAFETY, AND SECURITY OF VERTIPORTS TO DRIVE SEGMENT

- 8.1 INTRODUCTION

-

8.2 URBAN VERTIPORTSINCREASED URBAN CONGESTION AND TRAFFIC CHALLENGES TO DRIVE MARKET

-

8.3 REGIONAL VERTIPORTSREDUCED LEAD TIME TO REMOTE AREAS TO BOOST MARKET

- 9.1 INTRODUCTION

-

9.2 VERTIHUBSINCREASED POSSIBILITY FOR EFFICIENT AND SUSTAINABLE TRANSPORTATION TO FUEL GROWTH

-

9.3 VERTIPADSINCREASED ADOPTION DUE TO COST EFFECTIVENESS TO DRIVE MARKET

-

9.4 VERTIBASESENHANCED LANDING PAD DESIGNS TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 GROUND-BASEDDEMAND TO IMPROVE PRODUCTIVITY AND CONNECTIVITY BETWEEN HUBS TO BOOST MARKET

-

10.3 ROOFTOP/ELEVATEDEFFORTLESS TRANSITION BETWEEN DIFFERENT MODES OF TRANSPORTATION TO DRIVE GROWTH

-

10.4 FLOATINGDEMAND FOR INCREASED ACCESSIBILITY AND CONNECTIVITY TO URBAN CENTERS TO DRIVE MARKET

- 11.1 INTRODUCTION

-

11.2 SINGLEABILITY TO IMPROVE EMERGENCY RESPONSE AND MEDICAL SERVICES TO DRIVE MARKET

-

11.3 LINEARSEAMLESS INTEGRATION WITH EXISTING TRANSPORTATION NETWORKS TO FUEL MARKET

-

11.4 SATELLITENEED FOR SPACE OPTIMIZATION TO DRIVE MARKET

-

11.5 PIERINCREASING URBAN CONGESTION AND AIR TRAFFIC TO FUEL MARKET

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: REGIONAL RECESSION IMPACT ANALYSISNORTH AMERICA: PESTLE ANALYSISUS- Presence of top market leaders to drive marketCANADA- GOVERNMENT SUPPORT TO DRIVE MARKET

-

12.3 EUROPEEUROPE: REGIONAL RECESSION IMPACT ANALYSISEUROPE: PESTLE ANALYSISUK- Technological advancements in AAM to drive marketFRANCE- Development of comprehensive vertiport network to fuel marketGERMANY- Increasing investments in R&D to drive marketITALY- Increased adoption of UAVs to drive marketSWITZERLAND- Innovation and sustainability to boost marketREST OF EUROPE- Growing focus on smart city initiatives to fuel market

-

12.4 ASIA PACIFICASIA PACIFIC: REGIONAL RECESSION IMPACT ANALYSISASIA PACIFIC: PESTLE ANALYSISCHINA- Regulatory policies and standards to fuel marketMALAYSIA- Development of air taxi infrastructure to drive marketJAPAN- Development of unmanned ecosystem to boost marketAUSTRALIA- Increasing demand for cargo air vehicles to boost marketSOUTH KOREA- Growing partnerships to drive marketREST OF ASIA PACIFIC- Increased investments to drive market

-

12.5 LATIN AMERICALATIN AMERICA: REGIONAL IMPACT ANALYSISLATIN AMERICA: PESTLE ANALYSISBRAZIL- Rapid urban transportation to drive marketMEXICO- Increasing demand for sustainable urban mobility to drive marketREST OF LATIN AMERICA- Focused partnerships to deploy and develop AAM infrastructure to propel growth

-

12.6 REST OF THE WORLD (ROW)REST OF THE WORLD: REGIONAL RECESSION IMPACT ANALYSISMIDDLE EAST- Strategic initiatives by infrastructure developers to boost growthAFRICA- R&D investments in AAM technology to drive market

- 13.1 INTRODUCTION

- 13.2 RANKING ANALYSIS, 2022

-

13.3 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.4 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

13.5 COMPETITIVE SCENARIO AND TRENDSDEALS

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSSKYPORTS INFRASTRUCTURE LIMITED- Business overview- Products/services/solutions offered- Recent developments- MnM viewGROUPE ADP- Business overview- Products/services/solutions offered- Recent developments- MnM viewURBANV SPA- Business overview- Products/services/solutions offered- Recent developments- MnM viewFERROVIAL- Business overview- Products/services/solutions offered- Recent developments- MnM viewURBAN-AIR PORT LTD.- Business overview- Products/services/solutions offered- Recent developments- MnM viewEHANG- Business overview- Products/services/solutions offered- Recent developmentsLILIUM AVIATION GMBH- Business overview- Products/services/solutions offered- Recent developmentsSKYSCAPE INC.- Business overview- Products/services/solutions offered- Recent developmentsVOLOCOPTER GMBH- Business overview- Products/services/solutions offered- Recent developmentsVARON VEHICLES CORPORATION- Business overview- Products/services/solutions offered- Recent developmentsBAYARDS VERTIPORT SOLUTIONS- Business overview- Products/services/solutions offeredVPORTS- Business overview- Products/services/solutions offered- Recent developmentsSKYPORTZ- Business overview- Products/services/solutions offered- Recent developmentsSKYWAY- Business overview- Products/services/solutions offered- Recent developmentsVOLATUS INFRASTRUCTURE LLC- Business overview- Products/services/solutions offered- Recent developments

-

14.3 OTHER PLAYERSVERTIKO MOBILITY INC.EVERTISKYAIRSIGHTBLUENESTTAVISTOCK DEVELOPMENT COMPANYALTAPORT INC.AEROAUTO LLCKOOKIEJARAIRNOVAEVERTIPORTS INTERNATIONAL CORPORATION

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 VERTIPORTS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 VERTIPORTS MARKET ECOSYSTEM

- TABLE 4 VERTIPORTS: PORTER’S FIVE FORCE ANALYSIS

- TABLE 5 AVERAGE PRICE ANALYSIS OF VERTIPORTS, BY TYPE

- TABLE 6 VERTIPORTS MARKET, BY TYPE (UNITS)

- TABLE 7 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES IN NORTH AMERICA

- TABLE 8 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES IN EUROPE

- TABLE 9 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES IN ASIA PACIFIC

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING VERTIPORTS, BY SOLUTION (%)

- TABLE 11 KEY BUYING CRITERIA FOR VERTIPORTS, BY SOLUTION

- TABLE 12 VERTIPORTS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 13 LIST OF MAJOR PATENTS FOR VERTIPORTS

- TABLE 14 VERTIPORTS MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 15 VERTIPORTS MARKET, BY SOLUTION, 2023–2030 (USD MILLION)

- TABLE 16 VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 17 VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 18 VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 19 VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 20 VERTIPORTS MARKET, BY LOCATION, 2020–2022 (USD MILLION)

- TABLE 21 VERTIPORTS MARKET, BY LOCATION, 2023–2030 (USD MILLION)

- TABLE 22 VERTIPORTS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 23 VERTIPORTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 24 NORTH AMERICA: VERTIPORTS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 25 NORTH AMERICA: VERTIPORTS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 26 NORTH AMERICA: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 27 NORTH AMERICA: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 28 NORTH AMERICA: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 29 NORTH AMERICA: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 30 US: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 31 US: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 32 US: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 33 US: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 34 CANADA: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 35 CANADA: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 36 CANADA: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 37 CANADA: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 38 EUROPE: VERTIPORTS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 39 EUROPE: VERTIPORTS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 40 EUROPE: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 41 EUROPE: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 42 EUROPE: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 43 EUROPE: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 44 UK: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 45 UK: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 46 UK: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 47 UK: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 48 FRANCE: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 49 FRANCE: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 50 FRANCE: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 51 FRANCE: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 52 GERMANY: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 53 GERMANY: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 54 GERMANY: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 55 GERMANY: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 56 ITALY: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 57 ITALY: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 58 ITALY: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 59 ITALY: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 60 SWITZERLAND: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 61 SWITZERLAND: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 62 SWITZERLAND: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 63 SWITZERLAND: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 64 REST OF EUROPE: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 65 REST OF EUROPE: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 66 REST OF EUROPE: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 67 REST OF EUROPE: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 68 ASIA PACIFIC: VERTIPORTS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 69 ASIA PACIFIC: VERTIPORTS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 70 ASIA PACIFIC: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 71 ASIA PACIFIC: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 72 ASIA PACIFIC: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 73 ASIA PACIFIC: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 74 CHINA: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 75 CHINA: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 76 CHINA: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 77 CHINA: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 78 MALAYSIA: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 79 MALAYSIA: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 80 MALAYSIA: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 81 MALAYSIA: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 82 JAPAN: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 83 JAPAN: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 84 JAPAN: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 85 JAPAN: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 86 AUSTRALIA: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 87 AUSTRALIA: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 88 AUSTRALIA: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 89 AUSTRALIA: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 90 SOUTH KOREA: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 91 SOUTH KOREA: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 92 SOUTH KOREA: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 93 SOUTH KOREA: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 95 REST OF ASIA PACIFIC: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 97 REST OF ASIA PACIFIC: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 98 LATIN AMERICA: VERTIPORTS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 99 LATIN AMERICA: VERTIPORTS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 100 LATIN AMERICA: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 101 LATIN AMERICA: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 102 LATIN AMERICA: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 103 LATIN AMERICA: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 104 BRAZIL: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 105 BRAZIL: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 106 BRAZIL: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 107 BRAZIL: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 108 MEXICO: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 109 MEXICO: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 110 MEXICO: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 111 MEXICO: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 112 REST OF LATIN AMERICA: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 113 REST OF LATIN AMERICA: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 114 REST OF LATIN AMERICA: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 115 REST OF LATIN AMERICA: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 116 REST OF THE WORLD: VERTIPORTS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 117 REST OF THE WORLD: VERTIPORTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 118 REST OF THE WORLD: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 119 REST OF THE WORLD: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 120 REST OF THE WORLD: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 121 REST OF THE WORLD: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 122 MIDDLE EAST: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 123 MIDDLE EAST: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 124 MIDDLE EAST: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 125 MIDDLE EAST: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 126 AFRICA: VERTIPORTS MARKET, BY LANDSCAPE, 2020–2022 (USD MILLION)

- TABLE 127 AFRICA: VERTIPORTS MARKET, BY LANDSCAPE, 2023–2030 (USD MILLION)

- TABLE 128 AFRICA: VERTIPORTS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 129 AFRICA: VERTIPORTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 130 KEY DEVELOPMENTS BY LEADING PLAYERS IN VERTIPORTS MARKET, 2022–2023

- TABLE 131 VERTIPORTS MARKET: KEY STARTUPS/SMES

- TABLE 132 VERTIPORTS MARKET: DEALS, 2020–2023

- TABLE 133 SKYPORTS INFRASTRUCTURE LIMITED: BUSINESS OVERVIEW

- TABLE 134 SKYPORTS INFRASTRUCTURE LIMITED: PRODUCT/SERVICES/ SOLUTIONS OFFERED

- TABLE 135 SKYPORTS INFRASTRUCTURE LIMITED: DEALS

- TABLE 136 GROUPE ADP: BUSINESS OVERVIEW

- TABLE 137 GROUPE ADP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 138 GROUPE ADP: DEALS

- TABLE 139 URBANV SPA: BUSINESS OVERVIEW

- TABLE 140 URBANV SPA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 141 URBANV SPA: DEALS

- TABLE 142 FERROVIAL: BUSINESS OVERVIEW

- TABLE 143 FERROVIAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 144 FERROVIAL: DEALS

- TABLE 145 URBAN-AIR PORT LTD.: BUSINESS OVERVIEW

- TABLE 146 URBAN-AIR PORT LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 147 URBAN-AIR PORT LTD.: DEALS

- TABLE 148 EHANG: BUSINESS OVERVIEW

- TABLE 149 EHANG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 150 EHANG: DEALS

- TABLE 151 LILIUM AVIATION GMBH: BUSINESS OVERVIEW

- TABLE 152 LILIUM AVIATION GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 153 LILIUM AVIATION GMBH: DEALS

- TABLE 154 SKYSCAPE INC.: BUSINESS OVERVIEW

- TABLE 155 SKYSCAPE INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 156 SKYSCAPE INC.: DEALS

- TABLE 157 VOLOCOPTER GMBH: BUSINESS OVERVIEW

- TABLE 158 VOLOCOPTER GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 159 VOLOCOPTER GMBH: DEALS

- TABLE 160 VARON VEHICLES CORPORATION: BUSINESS OVERVIEW

- TABLE 161 VARON VEHICLES CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 162 VARON VEHICLES CORPORATION: DEALS

- TABLE 163 BAYARD VERTIPORT SOLUTIONS: BUSINESS OVERVIEW

- TABLE 164 BAYARD VERTIPORT SOLUTIONS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 165 BAYARD VERTIPORT SOLUTIONS: DEALS

- TABLE 166 VPORTS: BUSINESS OVERVIEW

- TABLE 167 VPORTS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 168 VPORTS: DEALS

- TABLE 169 SKYPORTZ: BUSINESS OVERVIEW

- TABLE 170 SKYPORTZ: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 171 SKYPORTZ: DEALS

- TABLE 172 SKYWAY: BUSINESS OVERVIEW

- TABLE 173 SKYWAY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 174 SKYWAY: DEALS

- TABLE 175 VOLATUS INFRASTRUCTURE LLC: BUSINESS OVERVIEW

- TABLE 176 VOLATUS INFRASTRUCTURE LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 177 VOLATUS INFRASTRUCTURE LLC: DEALS

- TABLE 178 VERTIKO MOBILITY INC.: COMPANY OVERVIEW

- TABLE 179 EVERTISKY: COMPANY OVERVIEW

- TABLE 180 AIRSIGHT: COMPANY OVERVIEW

- TABLE 181 BLUENEST: COMPANY OVERVIEW

- TABLE 182 TAVISTOCK DEVELOPMENT COMPANY: COMPANY OVERVIEW

- TABLE 183 ALTAPORT INC.: COMPANY OVERVIEW

- TABLE 184 AEROAUTO LLC: COMPANY OVERVIEW

- TABLE 185 KOOKIEJAR: COMPANY OVERVIEW

- TABLE 186 AIRNOVA: COMPANY OVERVIEW

- TABLE 187 EVETIPORTS INTERNATIONAL CORPORATION: COMPANY OVERVIEW

- FIGURE 1 VERTIPORTS MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARIES

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 RESEARCH ASSUMPTIONS

- FIGURE 9 ROOFTOP/ELEVATED SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 10 URBAN VERTIPORTS SEGMENT TO HAVE LARGER MARKET SHARE IN 2023

- FIGURE 11 LANDING PADS TO REGISTER HIGHEST MARKET SHARE IN 2023

- FIGURE 12 VERTIPORTS MARKET IN NORTH AMERICA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 INCREASED DEMAND FOR ADVANCED AIR MOBILITY (AAM) TO DRIVE MARKET GROWTH

- FIGURE 14 LANDING PADS PROJECTED TO DOMINATE MARKET IN 2023

- FIGURE 15 VERTIPADS SEGMENT TO RECORD HIGHEST GROWTH FROM 2020 TO 2030

- FIGURE 16 UK MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 VERTIPORTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 VALUE CHAIN ANALYSIS

- FIGURE 19 VERTIPORTS MARKET: REVENUE SHIFT CURVE

- FIGURE 20 VERTIPORTS MARKET: MARKET ECOSYSTEM MAP

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING VERTIPORTS, BY SOLUTION

- FIGURE 22 KEY BUYING CRITERIA FOR VERTIPORTS, BY SOLUTION

- FIGURE 23 DEVELOPMENT POTENTIAL OF VERTIPORTS SINCE 2010

- FIGURE 24 CHARGING STATIONS SEGMENT PROJECTED TO GROW AT HIGHER CAGR FROM 2023 TO 2030

- FIGURE 25 URBAN VERTIPORTS SEGMENT PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 26 VERTIPADS TO BE DOMINANT SEGMENT DURING FORECAST PERIOD

- FIGURE 27 ROOFTOP/ELEVATED SEGMENT PROJECTED TO GROW AT HIGHER CAGR FROM 2023 TO 2030

- FIGURE 28 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF VERTIPORTS MARKET IN 2023

- FIGURE 29 NORTH AMERICA: VERTIPORTS MARKET SNAPSHOT

- FIGURE 30 EUROPE: VERTIPORTS MARKET SNAPSHOT

- FIGURE 31 ASIA PACIFIC: VERTIPORTS MARKET SNAPSHOT

- FIGURE 32 LATIN AMERICA: VERTIPORTS MARKET SNAPSHOT

- FIGURE 33 MARKET RANKING OF TOP FIVE PLAYERS, 2022

- FIGURE 34 MARKET COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 35 STARTUP/SME COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 36 GROUPE ADP: COMPANY SNAPSHOT

- FIGURE 37 FERROVIAL: COMPANY SNAPSHOT

- FIGURE 38 EHANG: COMPANY SNAPSHOT

- FIGURE 39 LILIUM AVIATION GMBH: COMPANY SNAPSHOT

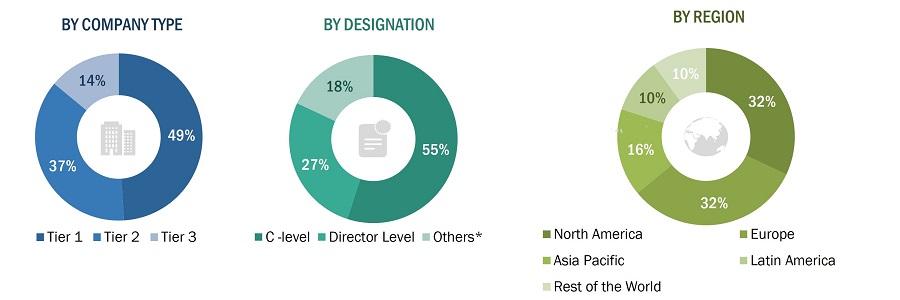

This research study used secondary sources, directories, and databases like D&B Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the vertiports market. Primary sources included industry experts from the core and related industries, preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all the segments of this industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information and assess prospects for the market's growth during the forecast period.

Secondary Research:

The share of companies in the vertiports market was determined using secondary data made available through paid and unpaid sources and by analyzing their product portfolios. The companies were rated based on the performance and quality of their products. These data points were further validated by primary sources. Secondary sources that were referred to for this research study on the vertiports market included financial statements of companies offering, and developing solutions, and information from various trade, business, and professional associations, among others. Secondary data was collected and analyzed to arrive at the overall size of the vertiports market, which was further validated by primary respondents.

Primary Research:

Extensive primary research was conducted after obtaining information about the current scenario of the vertiports market through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across North America, Europe, Asia Pacific, Latin America, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as vice presidents, directors, regional managers, technology providers, product development teams, distributors, and end users.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products & services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the trends related to technology, application, platform, and region. Stakeholders from the demand side, such as CXOs, production managers, engineers, and installation teams of end users, were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage and future outlook of their business, which could affect the vertiports market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

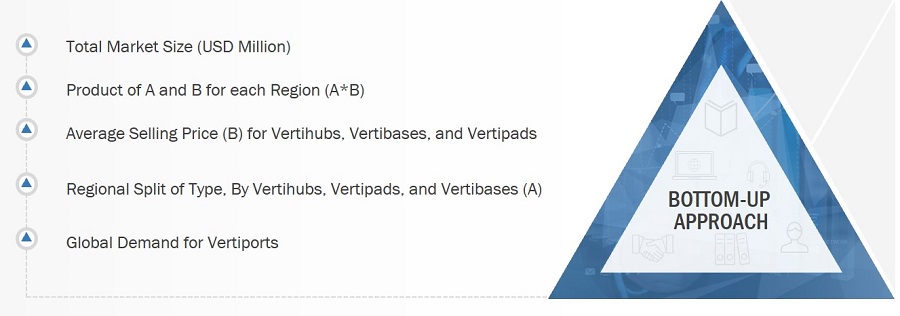

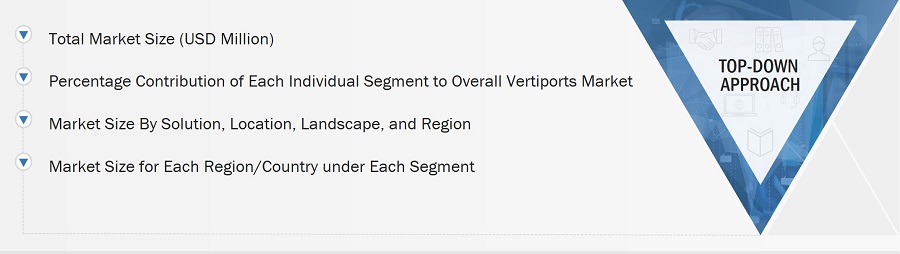

Both top-down and bottom-up approaches were used to estimate and validate the size of the vertiports market. The research methodology used to estimate the market size also includes the following details:

Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up Approach

Market size estimation methodology:Top-Down Approach

Market Definition

Vertiports are landing and takeoff facilities designed for advanced air mobility (AAM) aircraft, such as air taxis and flying cars. They serve as designated locations where these futuristic vehicles can safely land and take off. Vertiports provide infrastructure to support the operations of AAM, including landing pads, charging stations, and maintenance areas. They aim to facilitate the integration of air taxis into urban environments, offering convenient aerial mobility options for people traveling within cities. Cities can enable efficient passenger movement and help alleviate ground traffic congestion by establishing a network of vertiports.

Key Stakeholders

- Vertiport Solution Providers

- Technology Support Providers

- Logistics And Transport Solution Providers

- Regulatory Authorities

- Vertiport Developers

- Advanced Air Mobility Service Providers

- Advanced Air Mobility Operators

Objectives of the Study

- To define, describe, segment, and forecast the size of the vertiports market based on solution, location, topology, landscape, type, and region

- To understand the structure of the vertiports market by identifying its various segments and subsegments

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the market.

- To provide an overview of the tariff and regulatory landscape for the adoption of vertiports across regions

- To forecast the size of market segments across North America, Europe, Asia Pacific, Latin America, and Rest of the World, along with major countries in each region

- To identify transportation industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micromarkets1 with respect to individual technological trends and their contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies2

- To provide a detailed competitive landscape of the market, along with an analysis of business and strategies such as mergers & acquisitions, partnerships, agreements, and product developments in the vertiports market

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the vertiports market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the vertiports market.

Growth opportunities and latent adjacency in Vertiports Market