Vehicle Simulation Market Size, Share & Trends by Deployment (On-premises & Cloud), Component (Software & Services), End Market (OEMs, Automotive Component Manufacturers, & Regulatory Bodies), and Region (Asia Pacific, Europe, North America, & RoW) - Global Forecast to 2032

The vehicle simulation market size was valued at USD 3.5 billion in 2024 and is expected to reach USD 5 billion by 2032 at a CAGR of 10.75% during the forecast period 2024-2032.

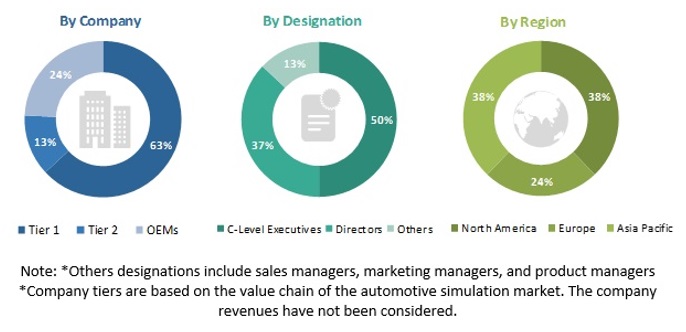

The study involves four main activities to estimate the current size of the vehicle simulation market. Exhaustive secondary research was done to collect information on the market such as the use of simulation software in various applications and by various end users. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. A top-down approach was employed to estimate the complete market size of different segments considered in this study.

Market Dynamics

Drivers: Growing Demand for Advanced Driver Assistance Systems (ADAS)

The growing demand for Advanced Driver Assistance Systems (ADAS) is a significant driver for the vehicle simulation market. As safety regulations become stricter and consumer expectations for vehicle safety rise, automakers are increasingly investing in ADAS technologies. Simulation tools allow manufacturers to design, test, and refine these systems in a virtual environment, enabling them to evaluate performance under various conditions without the costs and risks associated with physical testing. This demand for effective simulation solutions not only accelerates the development of ADAS features but also supports the overall advancement of vehicle automation, positioning the automotive industry for a safer and more technologically advanced future.

Restraints: Data Privacy and Security Concerns

Concerns about data security and privacy pose serious obstacles to the vehicle simulation market. The potential of data breaches and cyberattacks increases as simulation systems depend more and more on enormous volumes of data, including private user data and vehicle performance indicators. Because of these worries about possible liabilities and regulatory ramifications, manufacturers and other stakeholders may be discouraged from fully implementing simulation technologies. Furthermore, strict data protection laws would necessitate large security measure investments, which would make the deployment of cutting-edge simulation technologies even more challenging. In the automotive industry, this cautious atmosphere may impede the acceptance of novel solutions and slow market expansion.

Opportunities: Increased Adoption of Electric and Autonomous Vehicles

There are a lot of potential for the vehicle simulation market due to the growing trend towards electric and driverless vehicles. The necessity for sophisticated simulation tools to design, test, and validate their technology becomes crucial as manufacturers make significant investments in the development of autonomous vehicles. Without having to pay for expensive physical prototypes, automotive simulation allows businesses to simulate intricate situations and maximise vehicle performance, safety, and efficiency. In addition to improving product development timelines, this growing reliance on simulation technologies helps businesses comply with strict regulatory standards and puts them in a position to profit from the quickly changing automotive market.

Challenges: Integration with Legacy Systems

Integrating new simulation technologies with old systems is a major difficulty in the vehicle simulation market. Numerous automakers depend on well-established procedures and frameworks that could be difficult to adapt to sophisticated simulation technologies. Because businesses must spend time and money bridging the gap between old and new technology, this compatibility issue may lead to higher implementation costs and longer deadlines. Furthermore, organisational resistance to change can make integration even more difficult, resulting in inefficiencies and a delayed acceptance of creative solutions. To get the most out of automotive simulation and stay up to date with developments in the field, several obstacles must be overcome.

The following are the major objectives of the study.

- To define, segment, and forecast the vehicle simulation market from 2018 to 2025, in terms of volume and value

- To provide a detailed analysis of various factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To segment and forecast the size of the market based on application, deployment, end market, component, and region

- To forecast the size of the market for 4 regions, namely, Asia Pacific, Europe, North America, and the Rest of the World (RoW)

- To segment and forecast the size of the market, in terms of value, based on end market (OEMs, automotive component manufacturers, and regulatory bodies)

- To segment and forecast the size of the market, in terms of value, based on application (Prototyping and Testing)

- To segment and forecast the size of the market, in terms of value, based on deployment (On-premises and Cloud)

- To segment and forecast the size of the market, in terms of value, based on component (Software and Services)

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by the key players in the market.

Key Players

The vehicle simulation market is dominated by globally established players such as Ansys (US), Altair (US), Siemens PLM (US), PTC (US), and Dassault Systèmes (France). Also, Design Simulation Technologies (DST) (US), SimScale (Germany), and AnyLogic (US) provide automotive simulation solutions.

Report Details:

|

Report Metrics |

Details |

|

Base year for estimation |

2023 |

|

Forecast period |

2024 – 2032 |

|

Forecast units |

Volume (Units) and Value (USD Million/Billion)% |

|

Geographies covered |

North America, Asia Pacific, Europe, and Rest of the World. |

|

Companies Covered |

Ansys (US), Altair (US), Siemens PLM (US), PTC (US), and Dassault Systèmes (France). Also, Design Simulation Technologies (DST) (US), SimScale (Germany), and AnyLogic (US) provide automotive simulation solutions. |

|

Additional Customization to be offered |

Detailed analysis and profiles of additional market players. |

Major Market Developments

- In 2021, Volvo Group announced a strategic partnership with NVIDIA to develop advanced AI-powered simulation software for autonomous vehicles. This collaboration aims to leverage NVIDIA's computing capabilities to enhance virtual testing and validation processes, enabling more accurate simulation of real-world driving scenarios. The focus on high-performance simulation tools supports safer and more efficient development of automated driving system.

- In 2022, Daimler Trucks launched a new simulation platform integrated with its connected truck technology. This platform utilizes telematics data and over-the-air updates to conduct real-time simulations, which enhance safety feature testing and operational efficiency. By incorporating simulation into its connectivity suite, Daimler is setting a new standard for virtual testing and predictive maintenance in the trucking industry.

- In 2023, Scania introduced a simulation-based framework as part of its connected truck lineup. The enhanced simulation capabilities focus on sustainability, allowing Scania to optimize fuel consumption and reduce emissions through advanced data analytics. By leveraging real-time monitoring and simulation, Scania aims to improve vehicle performance while contributing to its sustainability goals, showcasing the value of simulation in reducing environmental impact.

Target Audience

- Automotive Component Suppliers

- Software Developers and Engineering Service Providers

- Research and Development (R&D) Teams

- Automotive Testing and Validation Firms

- Regulatory and Standards Organizations

Report Scope:

Market, By Deployment

- On-premises

- Cloud

Market, By Component

- Software

- Services

Market, By End Market

- OEMs

- Automotive Component Manufacturers

- Regulatory Bodies

Market, By Application

- Prototyping

- Testing

Market, By Region

- North America

- Europe

- Asia Pacific

- RoW

Vehicle Simulation Market Applications, namely, Primary Process and Secondary Process, to Drive the Growth of the Vehicle Simulation Market

Primary Process

Autonomous vehicle testing, ADAS simulation, and virtual prototyping are the main uses in the vehicle simulation market. Manufacturers may create and test components online with virtual prototyping, which speeds up development and lessens the need for expensive physical prototypes. Due to the increased focus on automation and vehicle safety, ADAS simulation commands a significant portion of the market, and autonomous vehicle testing enables businesses to safely model intricate driving situations, hence advancing self-driving technology.

Secondary Process

Vehicle dynamics, crash simulation, and powertrain optimisation are the main topics of secondary applications. By analysing handling, stability, and ride quality through vehicle dynamics simulation, manufacturers may improve the overall performance of their vehicles. Physical crash tests are no longer necessary because to crash simulation, which makes safety evaluations more affordable. In order to optimise emissions and fuel efficiency and help create more environmentally friendly car designs, powertrain simulation is crucial. The market's expansion is further supported by these applications, which together enhance performance, safety, and environmental effect.

Frequently Asked Questions (FAQ):

What is automotive simulation used for?

A variety of aspects of vehicle performance, safety, and design can be digitally modelled and tested using automotive simulation. It helps manufacturers to save time and money by simulating real-world situations, optimising parts, and evaluating automotive systems like ADAS, autonomous driving, and powertrain efficiency prior to physical production.

What is the current size of the Vehicle simulation market?

The current size of the vehicle simulation market is estimated at USD 3.5 billion in 2024

Which region is expected to dominate the vehicle simulation market?

Asia Pacific is expected to be the largest region in the vehicle simulation market during the forecast period. Asia Pacific comprises emerging economies, such as China and India, along with developed nations, such as Japan, and is the largest market for automobiles.

Who are the key players in the vehicle simulation market?

Ansys (US), Altair (US), Siemens PLM (US), PTC (US), and Dassault Systèmes (France). Also, Design Simulation Technologies (DST) (US), SimScale (Germany), and AnyLogic (US).

How is AI impacting the vehicle simulation market?

AI is revolutionizing automotive simulation by enhancing modeling accuracy, enabling predictive analytics, and facilitating real-time data processing. AI-driven simulations help in designing advanced driver assistance systems (ADAS), optimizing powertrain efficiency, and improving overall vehicle safety, leading to more reliable and efficient automotive solutions. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Vehicle Simulation Market