Global Vehicle Robotic Market Size, Share & Trends by Application (Welding, Painting, Cutting, Material Handling), Type (Articulated, Cartesian, SCARA, Cylindrical), Component (Controller, Robotic Arm, End Effector, Sensors, Drive) and Region - Global Forecast to 2032

The global vehicle robotic market size was valued at USD 10 billion in 2024 and is expected to reach USD 27 billion by 2032 at a CAGR of 13.22 % during the forecast period 2024-2032.

The increasing reliance on articulated robots to ensure efficiency in the production process, is expected to be the prime factor enhancing the growth of the automotive robotics industry. The intelligent manufacturing industry of the future has a special focus on process automation and industrial robotics. Robotics technology is becoming essential in assembly lines as automakers look to increase accuracy and lower manufacturing costs. Furthermore, robots can now do complicated jobs with increased accuracy and flexibility thanks to developments in AI and machine learning. In addition to increasing efficiency, this automation trend puts the automotive industry in a position to satisfy changing customer needs and industry norms.

Market Dynamics

Drivers: Rising Vehicle Production

Globally rising car production is a primary driver of expansion in the automotive sector, including complex technologies, automotive robotics, and components. Manufacturers are raising output to meet rising consumer demand for autos. This production surge encourages investments in automation and sophisticated manufacturing techniques, thereby increasing productivity, lowering costs, and improving quality. A better automotive market is eventually the outcome of increasing car output, which supports the expansion of adjacent industries such as automotive electronics, safety systems, and sustainable vehicle technologies as global economies recover and urbanization accelerates.

Restraints: High penetration in automotive industry

Although automation and robotics are widely used in the automobile sector, there are several limitations despite their positive effects on productivity and efficiency. In certain areas, the vehicle robotic market is saturated because of the widespread use of sophisticated robotic systems and automation technology by automakers. This saturation might make it more difficult for new competitors and cutting-edge technology to establish themselves, especially in mature industries where businesses might be hesitant to make further automation investments. Furthermore, smaller enterprises may be discouraged by the high costs of deploying and maintaining advanced robotics, which would further limit expansion. Because of this, the widespread use of these technologies makes it difficult for the industry to grow, particularly in highly automated industries.

Opportunities: Productivity Optimization

Because businesses want to maximise output while minimising expenses, productivity optimisation offers the automobile industry a significant potential. Automobile manufacturers may attain more precision, quicker production cycles, and less downtime with the help of developments in automation, data analytics, and industrial IoT. Businesses may proactively solve problems with the help of technologies like real-time monitoring and predictive maintenance, which guarantees more seamless operations and reduces interruptions. Furthermore, increasing productivity using robotics and AI-powered procedures enables more economical resource use, which lowers waste and energy usage. Productivity optimisation becomes a crucial factor in gaining a competitive edge and fostering long-term growth as the automotive sector adopts these cutting-edge solutions.

Challenges: Significant initial investment

The high upfront costs associated with implementing cutting-edge technology like automation, robots, and AI-driven systems present a major obstacle for the automobile sector. Although the initial expenditures of these technologies can be prohibitive, especially for smaller or mid-sized enterprises, they offer long-term benefits in terms of productivity and efficiency. Adoption may be delayed, and budgets strained by the costs of equipment acquisition, system integration, and employee training. The financial strain is further increased by the high cost of updates and maintenance. A barrier to entry for businesses aiming to modernise their manufacturing processes can emerge from the requirement for a sizable initial capital investment, which can also delay the rate of technology adoption.

The following are the major objectives of the study.

- To define, describe, and forecast the vehicle robotic market on the basis of Application, component, application, product type and region, in terms of volume (thousand/million units) and value (USD million/billion)

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, industry-specific challenges, and burning issues)

- To analyze opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To strategically analyze subsegments (product type and component) with respect to individual growth trends, future prospects, and contribution to the total market

- To forecast the size of market segments with respect to four main regions (along with key countries)— namely, Asia-Pacific, North America, Europe, and the Rest of the World (RoW)

- To strategically profile key players and comprehensively analyze their strategies and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product development, and research and development (R&D) in the market.

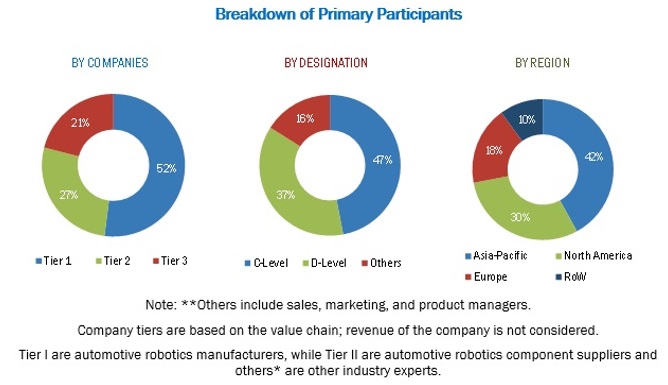

Major companies that are active in the automotive robots market across different regions have been discovered throughout this research study, and in-depth talks have been used to examine their product offerings, regional presence, and distribution methods. Both top-down and bottom-up methods have been applied to estimate the size of the market overall. The percentage splits acquired from primary respondents as well as secondary sources like Factiva, Bloomberg BusinessWeek, and Hoovers were used to estimate the sizes of the other distinct markets.

Key Players

The report analyses all major players in the vehicle robotic market, including ABB (Switzerland), FANUC Corporation (Japan), Yaskawa Electric Corporation (Japan), KUKA AG (Germany), and Kawasaki Heavy Industries (Japan).

Report Details:

|

Report Metrics |

Details |

|

Base year for estimation |

2023 |

|

Forecast period |

2024 – 2032 |

|

Market Growth forecast |

USD 27 billion by 2032 at a CAGR of 13.22 % |

|

Top Players |

ABB (Switzerland), FANUC Corporation (Japan), Yaskawa Electric Corporation (Japan), KUKA AG (Germany), and Kawasaki Heavy Industries (Japan). |

|

Largest Market |

Asia Pacific |

|

Segments covered |

|

|

By Type |

Articulated, Cartesian, SCARA, Cylindrical |

|

Component |

Controller, Robotic Arm, End Effector, Sensors, Drive |

|

Application |

Welding, Painting, Cutting, Material Handling |

|

Geographies covered |

North America, Asia Pacific, Europe, and Rest of the World. |

|

Additional Customization to be offered |

Detailed analysis and profiles of additional market players. |

The following are the major objectives of the study.

- To define, describe, and forecast the vehicle robotic market on the basis of product type, component, application, and region, in terms of volume (thousand/million units) and value (USD million/billion)

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, industry-specific challenges, and burning issues)

- To analyze opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To strategically analyze subsegments (product type and component) with respect to individual growth trends, future prospects, and contribution to the total market

- To forecast the size of market segments with respect to four main regions (along with key countries)— namely, Asia-Pacific, North America, Europe, and the Rest of the World (RoW)

- To strategically profile key players and comprehensively analyze their strategies and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product development, and research and development (R&D) in the market

Major Market Developments

- In 2021, Fanuc and Denso Corporation broadened its partnership with Denso to improve robotics solutions for automotive production, emphasizing automation and AI technologies.

- In 2022, Siemens acquired Mendix in order to improve its digital services by fusing low-code development capabilities with robotics and automation products.

- In 2023, KUKA continued to acquire smaller software businesses to enhance its expertise in smart manufacturing solutions and artificial intelligence integration in robotics.

Target Audience

- Manufacturers of automotive robotics

- Integrators of automotive robotics

- Industry associations

- Automotive OEM’s

- Tier 1 and Tier 2 Suppliers

- Private equity firms

Report Scope:

Vehicle Robotics Market, By Application

- Welding

- Painting

- Cutting

- Material Handling

Market, by Type

- Articulated

- Cartesian

- SCARA

- Cylindrical

Market, by Component

- Controller

- Robotic Arm

- End Effector

- Sensors

- Drive

Market, by region

- Asia Pacific

- Europe

- North America

- Rest of the World

Automotive robotics applications namely, primary process and secondary process to drive the growth of vehicle robotic market

Primary Process

The primary application type includes welding, painting, and cutting applications. The welding application market is estimated to account for the largest share, in terms of value, of the global market.

Secondary Process

The secondary application type includes material handling, palletizing and packaging assembly/disassembly applications.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications of automotive robotics?

High penetration rate of industrial robotics in the global automotive industry would result in relatively lower growth rates compare to other industries. Electrical/electronic and metal and machinery industry posted a higher growth rates than automotive industry in terms of volume during 2024. As of 2024, around 40% of total installed base of industrial robots are in the automotive industry. Such high concentration of robotics in automotive industry would limit growth potential for robot manufacturers serving primarily to automotive industry.

Frequently Asked Questions (FAQ):

What are automotive robots used for?

The main applications of automotive robots are in manufacturing operations like material handling, welding, painting, and assembly. They enhance the manufacturing process's accuracy, safety, and efficiency.

What is the current size of the vehicle robotic market?

The current size of the vehicle robotic market is estimated at USD 10 billion in 2024

Which region will have the largest market in the vehicle robotic market?

The Asia Pacific region will have the largest vehicle robotic market due to booming automotive manufacturing industry in China, India and Japan, and rising investment in automotive infrastructure.

Who are the winners in the vehicle robotic market?

Major players in the vehicle robotic market, including ABB (Switzerland), FANUC Corporation (Japan), Yaskawa Electric Corporation (Japan), KUKA AG (Germany), and Kawasaki Heavy Industries (Japan).

How is AI impacting automotive robotics?

AI is being integrated into robotics to improve decision-making, machine learning, and predictive maintenance, enabling robots to adapt to changing environments and workloads. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Global Vehicle Robotic Market