Vehicle Recycling Market by Material (Iron, Al, Steel, Rubber, Copper, Glass, Plastic), ICE & EV Component (Engine-Transmission, Battery, Motor, Door, Windshield, Tire, BIW), Vehicle (Electric & ICE passenger & commercial vehicles) & Region - Global Forecast to 2027

Vehicle recycling comprises reusing the vehicles' refurbished, shredded, and recycled parts. These include the materials such as plastics, aluminum, and steel. Vehicles that have reached their ‘end-of-life’ are dismantled in recycling plants to remove components and shredded to recover materials.

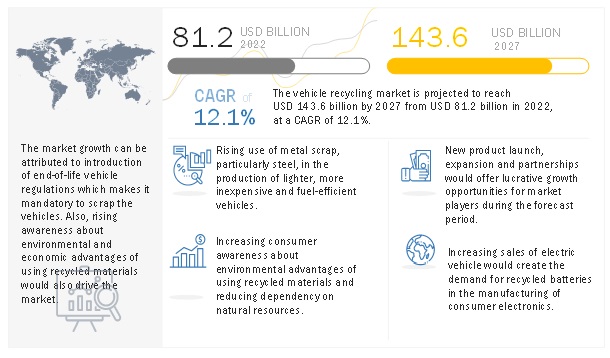

The vehicle recycling market size is expected to grow from USD 81.2 billion in 2022 to USD 143.6 billion in 2027, at a CAGR of 12.1%. The rising awareness among consumers, the need for energy savings, fast industrialization and urbanization happening around the world are the major factors for the vehicle recycling market. Another growth-promoting aspect is the extensive use of scrap metal, particularly steel, in producing lighter, more inexpensive, and fuel-efficient vehicles. The market is also being driven by increasing consumer awareness of the environmental advantages of using recycled materials to reduce reliance on natural resources.

Drivers: Rising Consumer Awareness about the Environmental Benefits of Recycled Products to drive the Vehicle Recycling Market

Growing consumer awareness regarding the environmental benefits of recycled products and reducing reliance on natural resources is driving the market's growth. Rising vehicle parc around the globe has led to end-of-life vehicles. According to markets & market analysis, around 544 million unit vehicles are on the road across the globe. Of these vehicles, approximately in the US, more than 12 million cars are recycled each year.

Growing scrap policies around the world have propelled the vehicle recycling market. For instance, in 2021, India introduced a vehicle scrapping policy to scrap out the vehicles that are not fit for taking on the roads. This new scrapping policy will help to reduce the pollution due to old vehicles. Also, it will help increase the sale of new vehicles and create job opportunities in the vehicle recycling industry. Further, the benefits of recycled products include reducing the environmental risks associated with the disposal of batteries, rubber, oils, and other materials. Also, the recycling of vehicles will help conserve natural resources and reduce greenhouse emissions, and recycling creates business opportunities and potential employment. Thus, considering the above factors, vehicle recycling is expected to grow faster during the forecast period.

Drivers: Rising Industrialization and Urbanization across the globe to drive the Vehicle Recycling Industry

Rapid urbanization and Industrialization around the globe, particularly in developing countries, and various initiatives taken by governments of different countries towards sustainable development are creating a positive prospect for the growth of the global vehicle recycling market. The countries such as the US, Germany, China, and Japan are the leading nations in vehicle recycling. For instance, 27 million vehicles are recycled yearly at the global level. Out of these vehicles, 12 million vehicles are recycled in the US. Increasing end-of-life vehicles around the globe is among the major driving factor for the vehicle recycling market. For instance, it is projected that India will have around 22.5 million end-of-life vehicles by 2025

Further, the rising sale of electric vehicles has increased EV parc around the globe. In 2022, the global sale of electric vehicles will be around 8,151 thousand units and is expected to grow at a CAGR of 21.7% from 2022-2030. The batteries and motors of electric vehicles must be recycled because batteries cost around 50-60% of vehicle cost. Lithium-ion battery material is very expensive and rarely available, and China has major control over its supply chain. Considering the above factors, most EV OEMs will focus on recycling these components for further use in new vehicles.

Challenges: Difficulty in obtaining Feedstock for the Recycling Centers.

The challenges in the vehicle recycling market include ensuring adequate feedstock of end-of-life vehicles for recycling centers spread across the globe. Most of the players involved in vehicle recycling are informal and less organized. Hence, it is difficult for these players to outsource end-of-life vehicles as they don’t have any intermediaries or channel partners for sourcing the feedstock. Further, the lack of a proper supply chain in the recycling industry lacks scrapping centers and recycling facilities. Even though if the vehicle's components are recycled, there is a lack of demand-supply chain in many countries. In addition to this, to make cars lighter and more fuel-efficient, plastic and plastic composites, such as carbon fibre reinforced polymers (CFRP), are being used more frequently. Despite being advantageous to the industry, it lowers the recovery value in terms of recycling.

Key Players in the Market

ASM Auto Recycling LTD (UK), Copart Inc. (US), Eco-Bat Technologies (US), Scholz Recycling GmbH (Germany), Schnitzer Steel Industries, Inc. (US), LKQ Corporation (US), Hensel Recycling Group (Germany), Indra Automobile Recycling (France), Keiaisha Co. Ltd (Japan), Sims Metal Management Limited (US), European Metal Recycling (UK), Tianqi Automation Engineering Co., Ltd (China), Toyota Motor Corporation (Japan), Volkswagen AG (Germany)

Recent Developments

- In May 2022, Schnitzer Steel Industries, Inc. acquired the operating assets of Encore Recycling LLC (Encore) in the greater Atlanta Metro area. This acquisition includes full-service recycling facilities, a metal shredding operation, and a recycled auto-parts center.

- In March 2022, Schnitzer Steel Industries, Inc., a manufacturer and exporter of recycled metal products announced the launch of GRN SteelTM, a net-zero carbon product line from its Cascade Steel manufacturing operations in McMinnville, Oregon.

- In August 2021, Schnitzer Steel Industries, Inc. announced the successful production restart at its Cascade Steel Rolling Mills in McMinnville, OR. The company also entered an agreement to purchase the assets of Columbus Recycling in the Southeast region of the United States.

- In March 2021, The LQK corporation acquired mobility diagnostic company Greenlight Automotive. Elitek Vehicle Services branding will formally replace Greenlight. The Lincoln and Omaha markets are now included in Elitek's national coverage through Greenlight, with further expansion to come.

- In December 2021, Sims metal management company acquired Maryland-based Atlantic Recycling Group (ARG), including the firm’s auto shredding plant in Baltimore.

- In January 2019, Indra Automobile Recycling and PSA Group signed strategic partnership agreement to increase the use of Re-used spare parts. The objective of these partnership is to make easier to Group PSA 4,000 authorized repairers in France to order and sell used components from all manufacturers.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources to build the base numbers

2.1.1.2 Secondary sources to estimate market sizing

2.1.1.3 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Sampling techniques & data collection methods

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

2.4 FACTOR ANALYSIS

2.5 ASSUMPTIONS

2.5.1 RESEARCH ASSUMPTIONS

2.5.2 LIMITATIONS/RISK FACTORS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 PORTERS FIVE FORCES ANALYSIS

5.3.1 PORTER’S FIVE FORCES ANALYSIS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 BARGAINING POWER OF SUPPLIERS

5.3.6 INTENSITY OF COMPETITIVE RIVALRY

5.4 AVERAGE SELLING PRICE ANALYSIS

5.5 VEHICLE RECYCLING ECOSYSTEM

5.6 SUPPLY CHAIN ANALYSIS

5.7 CASE STUDY ANALYSIS

5.8 TRADE ANALYSIS

5.9 KEY CONFERENCES & EVENTS

5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.11 REGULATORY ANALYSIS

6 RECOMMENDATIONS BY MARKETSANDMARKETS

7 VEHICLE RECYCLING OE MARKET (ICE), BY MATERIAL TYPE

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS/LIMITATIONS

7.1.3 INDUSTRY INSIGHTS

7.2 IRON

7.3 ALUMINIUM

7.4 STEEL

7.5 RUBBER

7.6 COPPER

7.7 GLASS

7.8 PLASTIC

7.9 OTHERS

Note: The chapter represents OE market for On-highway (ICE) Vehicles (Passenger Cars, Commercial Vehicles). The chapter would be provided at regional level (Asia Pacific, Europe, North America, and Rest of World)

8 VEHICLE RECYCLING OE MARKET (ICE), BY VEHICLE TYPE

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS/LIMITATIONS

8.1.3 INDUSTRY INSIGHTS

8.2 PASSENGER CAR RECYCLING

8.3 COMMERCIAL VEHICLE RECYCLING

Note: The chapter represents OE market for On-highway (ICE) Vehicles (Passenger Cars, Commercial Vehicles). The chapter would be provided at regional level (Asia Pacific, Europe, North America, and Rest of World)

9 VEHICLE RECYCLING MARKET (ICE), BY COMPONENT TYPE

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS/LIMITATIONS

9.1.3 INDUSTRY INSIGHTS

9.2 ENGINE & TRANSMISSION

9.3 BATTERY

9.4 DOORS

9.5 WINDSHIELD

9.6 TIRES

9.6 BIW

9.7 OTHERS

Note: The chapter represents OE market for On-highway (ICE) Vehicles (Passenger Cars, Commercial Vehicles). The chapter would be provided at regional level (Asia Pacific, Europe, North America, and Rest of World)

10 ELECTRIC & HYBRID VEHICLE RECYCLING MARKET, BY VEHICLE TYPE

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS/LIMITATIONS

10.1.3 INDUSTRY INSIGHTS

10.2 ELECTRIC PASSENGER CARS

10.3 ELECTRIC COMMERCIAL VEHICLES

Note: The chapter represents OE market for On-highway (Electric & Hybrid) Vehicles (Passenger Cars, Commercial Vehicles). The chapter would be provided at regional level (Asia Pacific, Europe, and North America)

11 ELECTRIC & HYBRID VEHICLE RECYCLING MARKET, BY COMPONENT TYPE

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS/LIMITATIONS

11.1.3 INDUSTRY INSIGHTS

11.2 BATTERY

11.3 MOTOR

11.4 ENGINE & TRANSMISSION

11.5 BIW

11.6 DOORS

11.7 WINDSHEILD

11.8 TIRES

11.9 OTHERS

Note: The chapter represents OE market for On-highway (Electric & Hybrid) Vehicles (Passenger Cars, Commercial Vehicles). The chapter would be provided at regional level (Asia Pacific, Europe, and North America)

12 VEHICLE RECYCLING MARKET (ICE), BY REGION

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS/LIMITATIONS

12.1.3 INDUSTRY INSIGHTS

12.2 ASIA PACIFIC RESEARCH METHODOLOGY

12.2.1 CHINA

12.2.2 JAPAN

12.2.3 INDIA

12.2.4 SOUTH KOREA

12.3 EUROPE

12.3.1 GERMANY

12.3.2 FRANCE

12.3.3 SPAIN

12.3.4 RUSSIA

12.3.5 UK

12.3.6 TURKEY

12.4 AMERICAS

12.4.1 US

12.4.2 CANADA

12.4.3 MEXICO

12.4.4 BRAZIL

The Chapter represent the ICE market only and would further be Segmented at country level and vehicle type.

13 COMPETITIVE LANDSCAPE

13.1 OVERVIEW

13.2 VEHICLE RECYCLING: MARKET SHARE ANALYSIS, 2021

13.3 COMPETITIVE EVALUATION QUADRANT

13.3.1 STAR

13.3.2 EMERGING LEADERS

13.3.3 PERVASIVE

13.3.4 PARTICIPANTS

13.4 COMPETITIVE SCENARIO

13.4.1 SUPPLY CONTRACT/PARTNERSHIPS/JOINT VENTURES/ COLLABORATIONS

13.4.2 MERGERS & ACQUISITIONS

13.4.3 EXPANSIONS

13.5 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019-2022

13.6 COMPETITIVE BENCHMARKING

14 COMPANY PROFILES

14.1 ASM AUTO RECYCLING LTD.

14.2 COPART INC.

14.3 ECO-BAT TECHNOLOGIES

14.4 SCHOLZ RECYCLING GMBH

14.5 SCHNITZER STEEL INDUSTRIES, INC.

14.6 LKQ CORPORATION

14.7 HENSEL RECYCLING GROUP

14.8 INDRA AUTOMOBILE RECYCLING

14.9 KEIAISHA CO., LTD.

14.10 SIMS METAL MANAGEMENT LIMITED

14.11 EUROPEAN METAL RECYCLING (EMR)

14.12 TIANQI AUTOMATION ENGINEERING CO., LTD. (MIRACLE AUTOMATION)

14.13 ASM AUTO RECYCLING LTD

14.14 TOYOTA MOTOR CORPORATION

14.15 VOLKSWAGEN AG

*Indicative list of companies and can be updated post study commence

(The company profile would include Business Overview, Financial Information (company’s total and segmental revenues, business segment and regional mix as provided by the company), Products Offered, Recent Developments)

Details on aforementioned factors, especially Financial Information, would be captured for Listed companies only. Other financial details such as Revenue including/excluding aftermarket, and Gross Margin including/excluding aftermarket would be covered if provided by the company)

15 APPENDIX

Growth opportunities and latent adjacency in Vehicle Recycling Market