Vehicle Intercom System Market by Application (Military Vehicles, Commercial vehicles, Airport Ground Support Vehicles, Emergency Vehicles), Component, Type (Wired, Wireless), Technology (Analog, Digital), and Region - Global Forecast to 2023

[136 Pages] The vehicle intercom system market was valued at USD 804.3 million in 2017 and is projected to reach USD 1,180.5 million by 2023, at a CAGR of 6.89 % during the forecast period. The objectives of this study are to analyze the vehicle intercom system market, along with the provision of its statistics. It also aims to define, describe, and forecast the vehicle intercom system market on the basis of the application, component, type, technology and region. 2017 has been considered the base year for this study, whereas 2018 to 2023 is considered as the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

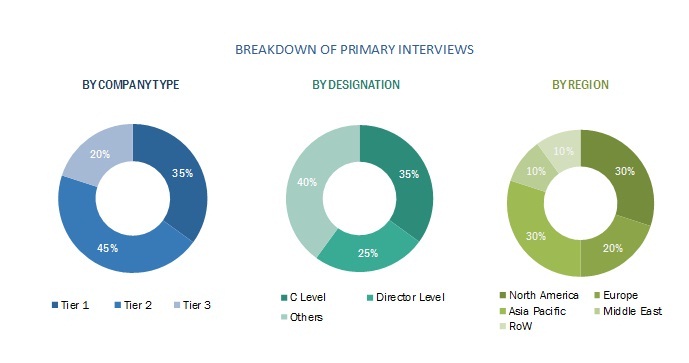

The research methodology that was used to estimate and forecast the vehicle intercom system market begins with capturing data on the revenues of the key vehicle intercom system players through secondary sources, such as Department of Defense (DoD), Ministry of defense and paid databases. The vehicle intercom system offerings are also taken into consideration to determine the market segmentation. The bottom-up approach was employed to arrive at the overall size of the vehicle intercom system market from the revenue of key players in the market. After arriving at the overall market size, the total market was split into several segments and sub segments, which were verified through primary research by conducting extensive interviews with key experts such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives of the leading companies operating in the vehicle intercom system market. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of profiles of primaries has been depicted in the figure below:

Note: Others include sales managers, marketing managers, and product managers from the vehicle intercom system industry.

Tier 1: Company revenue greater than USD 1 billion, Tier 2: Company revenue between USD 100 million and USD 1 billion, and Tier 3: Company revenue lesser than USD 100 million.

Cobham Plc. (UK), Harris Corporation (US), David Clark (US), Elbit Systems (Israel), Thales group (France), EID (Portugal), Sytech Corporation (US), Teldat (Poland), Communications-Applied Technology (US), Wolf Elec (UK), Aselsan A.S. (Turkey), Vitavox (UK), Gentex Corporation (US), Leonardo DRS (US), and MER Group (Israel) are some of the players operating in the vehicle intercom system market.

Target Audience for this Report:

- Vehicle Intercom System Manufactures

- Providers or Suppliers of Vehicle Intercom System Parts

- Manufacturers of Sub-components of Vehicle Intercom System

- Retailers, Distributors, and Wholesalers of Vehicle Intercom System parts & Structures

- Manufacturers of Defense Components

- Manufacturers of Commercial Vehicle Components

- System Integrators

- Vehicle Intercom System Association & Government Bodies

This study on the vehicle intercom system market answers several questions for stakeholders, primarily which market segments they need to focus upon during the next two to five years to prioritize their efforts and investments.

Scope of the Report

This research report categorizes the vehicle intercom system market into the following segments:

Vehicle Intercom System market, By Application

- Military Vehicles

- Main Battle Tanks

- Armored Fighting Vehicles

- Light Protected Vehicles

- Amphibious Armored Vehicles

- Commercial Vehicles

- SUVs

- Sedans

- Limousines

- Buses/Vans

- Taxi/Passenger Cars

- Heavy Trucks

Airport Ground Support Vehicles

- Emergency Vehicles

- Police Vehicles

- Fire Vehicles

Vehicle Intercom System Market, By Component

- Central Unit

- Crew Control Unit

- Radio Interface Unit

- Intercom User Unit

- Wireless Intercom Unit

- Headset Dismounted Interface

- Loudspeaker Unit

- Adapter

- Wire/Cable

- Tactical Ethernet Switch

Vehicle Intercom System Market, By Type

- Wired

- Wireless

Vehicle Intercom System Market, By Technology

- Analog

- Digital

Vehicle Intercom System Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report on the vehicle intercom system market:

Global and regional level data can be provided for Airport Ground Support Vehicles such as:

- Deicing/anti-icing trucks

- Forklift trucks

- Passenger buses

- GPUs

- Cargo Loader

- Fuel trucks

- Hydrant trucks

- Cabin service vehicles

Country level data of

- Country level data for Rest of the world for vehicle Intercom System Market could be provided.

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

The vehicle intercom system market is projected to grow from an estimated USD 845.9 million in 2018 to USD 1,180.5 million by 2023, at a CAGR of 6.89% from 2018 to 2023. Factors such as the increasing complexity of military operations and the need for smooth communication in emergency vehicles are expected to drive the growth of the market.

The vehicle intercom system market is segmented based on component, application, technology, type, and region. Based on application, the vehicle intercom system market has been segmented into military vehicles, commercial vehicles, airport ground support vehicles, and emergency vehicles. The military vehicles segment is estimated to lead the vehicle intercom system market in 2018. Military modernization programs around the world and increasing research and development activities carried out by companies and governments to increase the efficiency and functioning of military vehicles are some of the factors expected to drive this segment.

Based on component, the vehicle intercom system market has been segmented into central unit, crew control unit, radio interface unit, intercom user unit, wireless intercom unit, headset dismounted interface, loudspeaker unit, adapter, wire/cable, and tactical Ethernet switch. The central unit segment is expected to lead the vehicle intercom system market. Several companies are working to upgrade the central unit of vehicle intercom systems technologically, as the unit plays an important role in the customization of the complete functionality of the intercom system.

Based on technology, the vehicle intercom system market is segmented into digital and analog. The digital segment is expected to lead the vehicle intercom system market during the forecast period. The demand for digital vehicle intercom systems is increasing across the globe due to effective and clear communication enabled by these systems.

Based on type, the vehicle intercom system market is segmented into wired and wireless. The wireless segment is expected to grow at the highest CAGR during the forecast period. Wireless networks allow crew members to move with ease without being tethered to a fixed position. This, in turn, increases the demand for wireless networks.

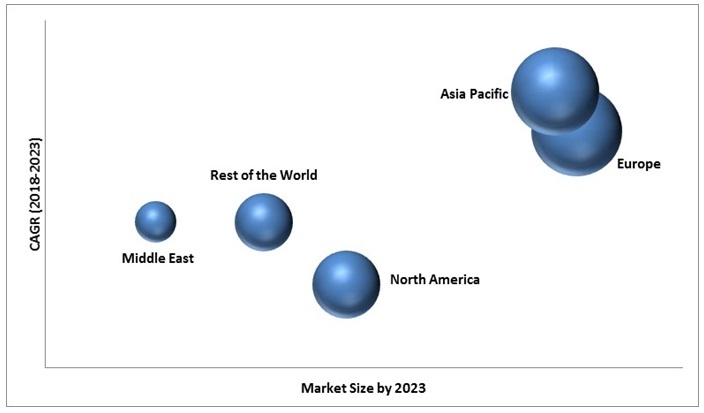

VEHICLE INTERCOM SYSTEM MARKET, BY REGION, 2023 (USD MILLION)

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

Based on region, the vehicle intercom systems market is segmented into North America, Europe, Asia Pacific, the Middle East, and Rest of the World (RoW). The European region is expected to lead the vehicle intercom systems market in 2018 and is projected to lead the vehicle intercom systems market during the forecast period. Military upgrades by Russia, the UK, France and Germany and the high usage of intercoms in commercial and emergency vehicles in these countries are expected to drive the vehicle intercom market in this region.

Products offered by various companies operating in the vehicle intercom systems market have been listed in the report. The recent developments section of the report provides information on the strategies adopted by various companies between November 2013 and October 2018 to strengthen their positions in the vehicle intercom systems market.

Major players in the vehicle intercom systems market include Cobham Plc. (UK),Harris Corporation (US), David Clark (US), Elbit Systems (Israel), Thales Group (France), EID (Portugal), Sytech Corporation (US), Teldat (Poland), Communications-Applied Technology (US), Wolf Elec (UK), Aselsan A.S. (Turkey), Vitavox (UK), Gentex Corporation (US), Leonardo DRS (US), and MER Group (Israel). These companies have the significant geographic reach and distribution channels.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table Of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered For the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities In Vehicle Intercom System Market

4.2 Vehicle Intercom System In Military Vehicles, By Type

4.3 Vehicle Intercom System In Commercial Vehicles, By Type

4.4 Vehicle Intercom System In Emergency Vehicles, By Type

4.5 Vehicle Intercom System, By Technology

4.6 Asia Pacific Vehicle Intercom System

4.7 Vehicle Intercom System, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Complexities of Military Operations

5.2.1.2 Need for Smooth And Uninterrupted Communication In Emergency Vehicles

5.2.1.3 Rapid Technological Innovations in the Communications Industry

5.2.2 Opportunities

5.2.2.1 Ongoing Military Modernization Programs In Various Countries Across The Globe

5.2.3 Challenges

5.2.3.1 Increasing Threats of Cyber Warfare

5.2.3.2 Ensuring Interoperability of Disparate Communication Technologies

6 Industry Trends (Page No. - 39)

6.1 Introduction

6.2 Emerging Trends In The Vehicle Intercom Systems Market

6.2.1 Vehicle Electronics System (Vetronics)

6.2.2 Wireless Intercom

6.2.3 Development of Next-Generation IP

6.3 Innovation & Patent Registrations

7 Vehicle Intercom System Market, By Application (Page No. - 42)

7.1 Introduction

7.2 Military Vehicles

7.2.1 Main Battle Tanks

7.2.2 Armored Fighting Vehicles

7.2.3 Light Protected Vehicles

7.2.4 Amphibious Armored Vehicles

7.3 Commercial Vehicles

7.3.1 SUVS

7.3.2 SEDANS

7.3.3 Limousines

7.3.4 Buses/Vans

7.3.5 Taxis/Passenger Cars

7.3.6 Heavy Trucks

7.4 Airport Ground Support Vehicles

7.4.1 Deicing/Anti-Icing Trucks

7.4.2 Forklift Trucks

7.4.3 Passenger Buses

7.4.4 Ground Power Units

7.4.5 Fuel Trucks

7.4.6 Hydrant Trucks

7.4.7 Cabin Service Vehicles

7.4.8 Cargo Loaders

7.5 Emergency Vehicles

7.5.1 Police Vehicles

7.5.2 Fire Engine

8 Vehicle Intercom System Market, By Component (Page No. - 52)

8.1 Introduction

8.2 Central Unit

8.3 Crew Control Unit

8.4 Radio Interface Unit

8.5 Intercom User Unit (IUU)

8.6 Wireless Intercom Unit

8.7 Headset Dismounted Interface

8.8 Loudspeaker Unit

8.9 Adapter

8.10 Wire/Cable

8.11 Tactical Ethernet Switch

9 Vehicle Intercom System Market, By Technology (Page No. - 56)

9.1 Introduction

9.2 Analog

9.3 Digital

10 Vehicle Intercom System Market, By Type (Page No. - 60)

10.1 Introduction

10.2 Wired Intercom System

10.3 Wireless Intercom System

11 Vehicle Intercom System Market, By Region (Page No. - 63)

11.1 Introduction

11.2 North America

11.2.1 Us

11.2.2 Canada

11.3 Europe

11.3.1 Russia

11.3.2 Germany

11.3.3 France

11.3.4 UK

11.3.5 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.2 India

11.4.3 Australia

11.4.4 Japan

11.4.5 Rest of Asia Pacific

11.5 Middle East

11.5.1 Israel

11.5.2 UAE

11.5.3 Saudi Arabia

11.5.4 Rest Of The Middle East

11.6 Rest Of The World

11.6.1 Africa

11.6.2 Latin America

12 Competitive Landscape (Page No. - 99)

12.1 Introduction

12.2 Rank Analysis

12.3 Competitive Situations And Trends

12.3.1 Contracts

12.3.2 New Product Launches

12.3.3 Agreements

13 Company Profiles (Page No. - 103)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MNM View)*

13.1 COBHAM PLC

13.2 Harris Corporation

13.3 David Clark Company

13.4 ELBIT Systems Ltd.

13.5 Thales Group

13.6 EID, S.A.

13.7 Systems Engineering Technologies Corporation (Sytech)

13.8 TELDAT

13.9 Communications-Applied Technology (C-AT)

13.10 Wolf Elec Intercoms

13.11 ASELSAN A.S.

13.12 VITAVOX

13.13 GENTEX Corporation

13.14 Leonardo DRS

13.15 MER Group

*Details On Business Overview, Products Offered, Recent Developments, SWOT Analysis, MNM View Might Not Be Captured In Case Of Unlisted Companies.

14 Appendix (Page No. - 130)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List Of Tables (99 Tables)

Table 1 Important Innovation & Patent Registrations, 2012-2016

Table 2 Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 3 Vehicle Intercom System In Military Vehicles, By Type, 20162023 (USD Million)

Table 4 Vehicle Intercom System In Military Vehicles, By Region, 20162023 (USD Million)

Table 5 Vehicle Intercom System In Commercial Vehicles, By Type, 20162023 (USD Million)

Table 6 Vehicle Intercom System In Commercial Vehicles, By Region, 20162023 (USD Million)

Table 7 Vehicle Intercom System In Airport Ground Support Vehicles, By Region, 20162023 (USD Million)

Table 8 Vehicle Intercom System In Emergency Vehicles, By Type, 20162023 (USD Million) 51

Table 9 Vehicle Intercom System In Emergency Vehicles, By Region, 20162023 (USD Million)

Table 10 Vehicle Intercom System Size, By Component, 20162023 (USD Million)

Table 11 Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 12 Analog Vehicle Intercom System Size, By Region, 20162023 (USD Million)

Table 13 Digital Vehicle Intercom System Size, By Region, 20162023 (USD Million)

Table 14 Vehicle Intercom System Size, By Type, 20162023 (USD Million)

Table 15 Wired Vehicle Intercom System Size, By Region, 20162023 (USD Million)

Table 16 Wireless Vehicle Intercom System Size, By Region, 20162023 (USD Million)

Table 17 Vehicle Intercom System Size, By Region, 20162023 (USD Million)

Table 18 North America Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 19 North America Vehicle Intercom System Size, By Component, 20162023 (USD Million)

Table 20 North America Vehicle Intercom System Size, By Type, 20162023 (USD Million)

Table 21 North America Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 22 North America Vehicle Intercom System Size, By Country, 20162023 (USD Million)

Table 23 Us Vehicle Intercom System Market, By Application, 20162023 (USD Million)

Table 24 Us Vehicle Intercom System Market, By Type, 20162023 (USD Million)

Table 25 Us Vehicle Intercom System Market, By Technology, 20162023 (USD Million)

Table 26 Canada Vehicle Intercom System, By Application, 20162023 (USD Million)

Table 27 Canada Vehicle Intercom System Size, By Type, 20162023 (USD Million)

Table 28 Canada Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 29 Europe Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 30 Europe Vehicle Intercom System Size, By Component, 20162023 (USD Million)

Table 31 Europe Vehicle Intercom System Size, By Type,20162023 (USD Million)

Table 32 Europe Vehicle Intercom System Size, By Technology,20162023 (USD Million)

Table 33 Europe Vehicle Intercom System Size, By Country,20162023 (USD Million)

Table 34 Russia Vehicle Intercom System Size, By Application,20162023 (USD Million)

Table 35 Russia Vehicle Intercom System Size, By Type,20162023 (USD Million)

Table 36 Russia Vehicle Intercom System Size, By Technology,20162023 (USD Million)

Table 37 Germany Vehicle Intercom System Size, By Application,20162023 (USD Million)

Table 38 Germany Vehicle Intercom System Size, By Type,20162023 (USD Million)

Table 39 Germany Vehicle Intercom System Size, By Technology,20162023 (USD Million)

Table 40 France Vehicle Intercom System Size, By Application,20162023 (USD Million)

Table 41 France Vehicle Intercom System Size, By Type,20162023 (USD Million)

Table 42 France Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 43 Uk Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 44 Uk Vehicle Intercom System Size, By Type, 20162023 (USD Million)

Table 45 Uk Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 46 Rest Of Europe Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 47 Rest Of Europe Vehicle Intercom System Size, By Type, 20162023 (USD Million)

Table 48 Rest Of Europe Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 49 Asia Pacific Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 50 Asia Pacific Vehicle Intercom System Size, By Component, 20162023 (USD Million)

Table 51 Asia Pacific Vehicle Intercom System Size, By Type, 20162023 (USD Million)

Table 52 Asia Pacific Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 53 Asia Pacific Vehicle Intercom System Market Size, By Country, 20162023 (USD Million)

Table 54 China Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 55 China Vehicle Intercom System Size, By Type, 20162023 (USD Million)

Table 56 China Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 57 India Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 58 India Vehicle Intercom System Size, By Type, 20162023 (USD Million)

Table 59 India Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 60 Australia Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 61 Australia Vehicle Intercom System Size, By Type, 20162023 (USD Million)

Table 62 Australia Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 63 Japan Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 64 Japan Vehicle Intercom System Size, By Type, 20162023 (USD Million)

Table 65 Japan Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 66 Rest Of Asia Pacific Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 67 Rest Of Asia Pacific Vehicle Intercom System Size, By Type, 20162023 (USD Million)

Table 68 Rest Of Asia Pacific Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 69 Middle East Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 70 Middle East Vehicle Intercom System Size, By Component, 20162023 (USD Million)

Table 71 Middle East Vehicle Intercom System Market Size, By Type, 20162023 (USD Million)

Table 72 Middle East Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 73 Middle East Vehicle Intercom System Size, By Country, 20162023 (USD Million)

Table 74 Israel Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 75 Israel Vehicle Intercom System Size, By Type, 20162023 (USD Million)

Table 76 Israel Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 77 Uae Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 78 Uae Vehicle Intercom System Size, By Type, 20162023 (USD Million)

Table 79 Uae Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 80 Saudi Arabia Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 81 Saudi Arabia Vehicle Intercom System Size, By Type, 20162023 (USD Million)

Table 82 Saudi Arabia Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 83 Rest Of The Middle East Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 84 Rest Of The Middle East Vehicle Intercom System Size, By Type, 20162023 (USD Million)

Table 85 Rest Of The Middle East Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 86 Rest Of The World Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 87 Rest Of The World Vehicle Intercom System Size, By Component, 20162023 (USD Million)

Table 88 Rest Of The World Vehicle Intercom System Market Size, By Type, 20162023 (USD Million)

Table 89 Rest Of The World Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 90 Rest Of The World Vehicle Intercom System Size, By Region, 20162023 (USD Million)

Table 91 Africa Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 92 Africa Vehicle Intercom System Size, By Type, 20162023 (USD Million)

Table 93 Africa Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 94 Latin America Vehicle Intercom System Size, By Application, 20162023 (USD Million)

Table 95 Latin America Vehicle Intercom System Size, By Type, 20162023 (USD Million)

Table 96 Latin America Vehicle Intercom System Size, By Technology, 20162023 (USD Million)

Table 97 Contracts, January 2013 and May 2018

Table 98 New Product Launches, January 2013 and May 2018

Table 99 Agreements, January 2013 and May 2018

List Of Figures (41 Figures)

Figure 1 Vehicle Intercom System Segmentation

Figure 2 Research Flow

Figure 3 Vehicle Intercom System: Research Design

Figure 4 Breakdown Of Primary Interviews: By Company Type, Designation & Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Assumptions Of The Research Study

Figure 9 Military Vehicles Segment Projected To Grow At Highest CAGR during Forecast Period

Figure 10 Central Unit Segment Projected To Lead Vehicle Intercom System during Forecast Period

Figure 11 Wireless Segment Projected To Grow At a Faster CAGR during Forecast Period

Figure 12 Europe Estimated To Lead Vehicle Intercom System In 2018

Figure 13 Increased Investment In Military Modernization Programs Across The Globe Is Expected To Drive The Market For Vehicle Intercom System

Figure 14 Armored Fighting Vehicles Segment Expected To Lead Vehicle Intercom System In Military Vehicles From 2018 To 2023

Figure 15 Heavy Trucks Segment Expected To Lead Vehicle Intercom System In Commercial Vehicles During Forecast Period

Figure 16 Police Vehicles Segment Estimated To Account for Larger Share Of Vehicle Intercom System In Emergency Vehicles In 2018

Figure 17 Digital Segment of the Vehicle Intercom System Projected To Grow At A Higher CAGR From 2018 To 2023

Figure 18 China Estimated To Account For Largest Share Of Asia Pacific Vehicle Intercom System In 2018

Figure 19 Vehicle Intercom System In Asia Pacific Projected To Grow At Highest CAGR During Forecast Period

Figure 20 Drivers, Restraints, Opportunities, and Challenges For The Vehicle Intercom System

Figure 21 Emerging Trends In The Vehicle Intercom System

Figure 22 Military Vehicles Segment of Vehicle Intercom System Projected To Grow At The Highest CAGR From 2018 To 2023

Figure 23 Central Unit Segment to Lead Vehicle Intercom System From 2018 To 2023

Figure 24 Digital Segment Projected To Lead Vehicle Intercom System from 2018 To 2023

Figure 25 Europe Estimated To Account for the Largest Share of Vehicle Intercom System In 2018

Figure 26 North America Vehicle Intercom System Snapshot

Figure 27 Europe Vehicle Intercom System Snapshot

Figure 28 Asia Pacific Vehicle Intercom System Snapshot

Figure 29 Companies Adopted Contracts As The Key Growth Strategy From January 2013 To May 2018

Figure 30 Revenue And Product-Based Rank Analysis Of Top Players In Vehicle Intercom System

Figure 31 COBHAM PLC: Company Snapshot

Figure 32 COBHAM: SWOT Analysis

Figure 33 Harris Corporation: Company Snapshot

Figure 34 Harris Corporation: SWOT Analysis

Figure 35 David Clark Company: SWOT Analysis

Figure 36 ELBIT Systems: Company Snapshot

Figure 37 ELBIT Systems: SWOT Analysis

Figure 38 Thales Group: Company Snapshot

Figure 39 Thales Group: SWOT Analysis

Figure 40 ASELSAN A.S.: Company Snapshot

Figure 41 GENTEX Corporation: Company Snapshot

Growth opportunities and latent adjacency in Vehicle Intercom System Market

We currently sell to the UK Defense forces and are looking to target international markets for our Intercom Radio Combiner Systems and boost our exposure as a Defense Contractor outside the UK.

I am trying to understand the size and requirements of the significant segments of the full duplex intercom market.