Vacuum Interrupter Market by Application (Circuit Breaker, Contactor, Recloser, Load Break Switch, & Tap Changer), End User (Oil & Gas, Mining, Utilities & Transportation), Rated Voltage and Region - Global Forecast to 2025

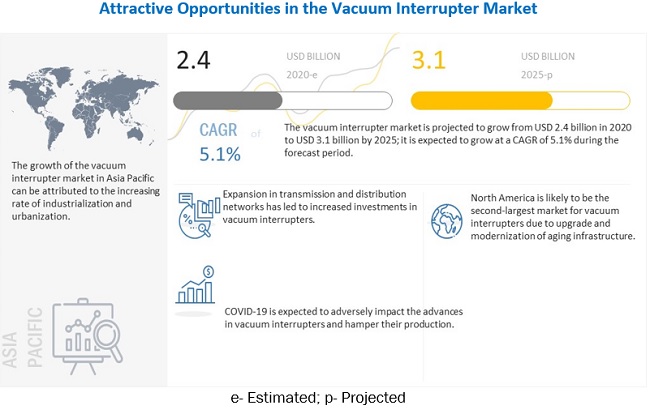

[212 Pages Report] The global vacuum interrupter market size was valued at $2.4 billion in 2020 and to reach $3.1 billion by 2025, growing at a compound annual growth rate (CAGR) of 5.1% from 2020 to 2025. This growth can be attributed to factors such as upgradation and modernization of aging infrastructure for safe and secure electrical distribution systems, expansion of transmission & distribution networks, and increasing rate of industrialization and urbanization.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Vacuum Interrupter Market

The COVID-19 pandemic has slowed the growth of the power industry. This is primarily due to nationwide lockdowns that have been imposed to prevent further spike in the spread of the disease. The renewable energy industry, which until recently was growing at a rapid pace, has been witnessing slow growth over the past few months. This slowdown is mainly due to economic contractions, which have resulted in the reduction of power demand from various end-user industries. With decrease in power demand, it is estimated that there would be very negligible investments from utilities for replacing aging grid infrastructure and new renewable installations.

For instance, in India, about 40% of the electricity demand is generated from industrial and commercial establishments who account for a higher percentage of sales revenue of utilities. However, during the period of lockdown, India’s demand for electricity has dropped down by about 20–25%, which has adversely impacted the revenue of distribution utilities in the short term. The revenue deficit of distribution companies is estimated to be about USD 1.7 billion per month in the country.

Vacuum Interrupter Market Dynamics

Driver: Expansion of transmission & distribution networks

Electrification in transportation and other related sectors is expected to experience a humongous boost in the upcoming years. This would lead to a gigantic increase in the demand for electricity demand and, consequently, its generation, which will ultimately require an investment of billions of dollars in transmission over the next decade. The investment in the electricity transmission & distribution sector could grow to more than USD 600 billion. Much of this investment is expected to be in the electric vehicle segment. In addition to this investment, there exists the need to maintain the existing transmission system and to integrate it into the electricity generated from renewable sources to meet the existing electricity requirement. The level of investment, on an average, is expected to be equivalent to USD 3–7 billion per year by 2030, which is equivalent to a 20–50% increase compared to that of the past decade, as per a report by Brattle, a trade association advocating for transmission investment. All this is primarily expected to be headed by 2 major driving factors, that is, connecting new renewables to the grid and keeping the system reliable while the peak load increases.

Restraint: Lack of existing government policies specific to vacuum interrupters

As per the Kyoto protocol, SF6 is among the most potent greenhouse gases with a global warming potential of 23,000 and has been listed as an extremely harmful greenhouse gas by the Intergovernmental Panel on Climate Change. Simultaneously, SF6 is enlisted as a greenhouse gas, on which green taxes are to be levied. Accordingly, the Kyoto Protocol stipulates the reduction of emissions. Other gases such as dry air, nitrogen, and CO2, or their mixtures lower global warming potential, but have very limited dielectric strength compared to SF6.

However, there is a need to formulate certain norms and government policies on the use of vacuum interrupters. It is noted that industries that are prohibiting the use of these enlisted greenhouse gases are switching to air type equipment or other gas equipment. In doing so, the usage of vacuum type interruption devices is not diminishing. Thus, the lack of policies, norms, and reforms specific to vacuum interrupters is acting as a major restraint in this case.

Opportunity: Increasing investments in smart grid & power distribution in developing region

The global power sector is witnessing a rise in the investments in smart grid infrastructure by utility providers. The European region is also likely to invest about USD 133 billion by 2027 for smart grid infrastructure. For instance, Tavrida Electric signed a series of contracts with PKP Energetyka (Warsaw, Poland) for the supply of 25 reclosers. The sale was preceded by a 2-year period of presentations and tests of the units that were supplied. As a result, at the end of 2017, the latter was supplied with over 50 reclosers.

Challenge: Availability of cheap & inferior quality products

The largest market for vacuum interrupters is the Asia Pacific market, where many developing nations will install a large number of vacuum interrupters in the coming time. In these developing nations, the preference is given to price over quality. Major countries such as Bangladesh, Bhutan, Sri Lanka, and India lay special focus on the pricing of electrical products. The superior quality vacuum interrupters are expected to have a life span of about 30 years. However, with a fall in the pricing, the quality of the product also drops significantly. Local manufacturers in this region pose similar challenges to global manufacturers. These gray market players have advantages over big players in terms of price competitiveness and local supply network, which is difficult for leading players to achieve. The gray market, thus, acts as a challenge for the vacuum interrupter market.

To know about the assumptions considered for the study, download the pdf brochure

By application, circuit breaker segment is expected to be the fastest growing market from 2020 to 2025

The circuit breaker segment, by application, is estimated to be the largest market, at a CAGR of 5.4% during the forecast period. The recloser segment is expected to be the fastest growing segment during the forecast period, at a CAGR of 5.7% during the forecast period. Positive economic outlook and growing manufacturing industries in developing countries, infrastructure development, and urbanization are the major factors driving the growth of the circuit breaker segment. Consecutively, effective transmission & distribution channels and refurbishment of the existing distribution networks with modernized protective devices demand the use of reclosers to protect the distribution networks. Consequently, with the increase in the installation of reclosers and such equipment, the vacuum interrupter market is expected to be boosted in the forecast period.

By end user, utilities segment, is expected to be the largest market from 2020 to 2025

The utilities segment is expected to hold the largest market share and be the fastest growing segment during the forecast period. It primarily covers industries oriented toward power generation and transmission & distribution process. The advent of new electrical gadgets and the endless need for electricity and utility services are driving this segment in the forecast period.

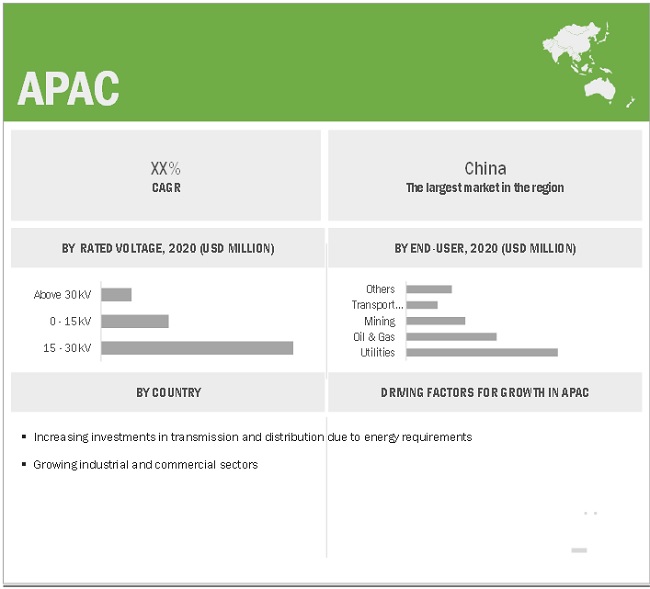

Asia Pacific: The leading vacuum interrupter market

The Asia Pacific region is projected to be the largest vacuum interrupter market by 2025. Countries such as China, India, Japan, and South Korea are among the major countries considered as the main manufacturing hub for vacuum interrupters. Over the past few years, this region has witnessed rapid economic development.

According to a 2017 report by the World Economic and Financial Surveys, the growth momentum in the largest economies in Asia Pacific is expected to remain quite strong, reflecting the policy stimulus in China and Japan, which, in turn, is benefiting other economies in Asia. The rapid increase in economic growth would lead to an increase in the demand for power. This would necessitate greater investments in the power generation infrastructure. Additionally, the rise in investments in smart grid technologies, which include distribution grid automation, smart meters, and demand response systems in countries such as Japan, South Korea, and Australia, would create growth opportunities for the market in the forecast period.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

End user, application, rated voltage, and region |

|

Geographies covered |

Asia Pacific, North America, Europe, the Middle East, Africa, and South America |

|

Companies covered |

ABB (Switzerland), Eaton (US), Siemens AG (Germany), Crompton Greaves Limited (India), LS Industrial System (South Korea), Shaanxi Baoguang Vacuum Electric Device Company Limited (China), Meidensha Corporation (Japan), Mitsubishi Electric Corporation (Japan), Toshiba Corporation (Japan), ACTOM (South Africa), Wuhan Feite Electric Company Limited (China), Chengdu Zuguang Electronics Company Limited (China), and Shaanxi Joyelectric International Company Limited (China) |

This research report categorizes the vacuum interrupter market based on end-user, application, rated voltage, and region.

On the basis of end-user, the market has been segmented as follows:

- Utilities

- Oil & Gas

- Mining

- Transportation

- Others (Others includes commercial establishments such as social & educational institutions, hospitals, storage facilities, hotels, and shopping complexes)

On the basis of application, the market has been segmented as follows:

- Circuit Breaker

- Contactor

- Recloser

- Load Break Switch

- Tap Changer

- Others (Others include vacuum interrupters used in DC applications and traction in the transportation systems)

On the basis of rated voltage, the market has been segmented as follows:

- 0–15 kV

- 15–30 kV

- Above 30 kV

On the basis of region, the market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East

- South America

- Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of the region or country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Recent Developments

- In March 2019, Eaton partnered with Electric Power Research Institute to provide new energy management, smart, and secure circuit breakers for generation energy grid.

- In September 2018, ABB supplied High-Voltage Direct Current (HVDC) converter stations in Tajikistan and Pakistan. The project was a part of a World Bank supported order to be executed as a consortium project with Spanish Engineering, Procurement, Construction (EPC) company, Cobra. Cobra was responsible for the construction and installation of the associated substations.

- In September 2018, Siemens AG started its manufacturing unit in Queensland, Australia to cater to the growing global demand for Fusesaver. Fusesaver is a product that helps in eliminating up to 80% of the sustained electricity outages in rural power networks.

- In February 2018, Mitsubishi Corporation completed the construction of an integrated automation factory with the e-F@ctory concept. The factory produced products such as vacuum interrupters and circuit breakers by deploying the integrated automation, which is based on IoT technologies for achieving high efficiency, productivity, and minimizing cost.

- In January 2018, under the 'Make in India' initiative, ABB opened a factory in Nashik (India) for manufacturing power distribution products. The products exported by the factory are outdoor products for substations such as tank circuit breaker, auto reclosers, and gas-insulated switchgear.

Frequently Asked Questions (FAQ):

What is the current size of the vacuum interrupter market ?

The current market size of global vacuum interrupter market is 2.4 billion in 2020.

What is the major drivers for vacuum interrupter market?

The continuous shale development activities and the development of gas terminals are the key factors driving the growth of the vacuum interrupter market.

Which is the fastest growing region during the forecasted period in vacuum interrupter market?

Asia Pacific is the fastest growing region during the forecasted period owing to increasing investments for development of electric infrastructure

Which is the fastest growing segment, by type during the forecasted period in vacuum interrupter market?

The utilities segment, by end user type is the fastest growing segment during the forecasted period owing increasing offshore oil & gas activities. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.3.1 VACUUM INTERRUPTER MARKET, BY RATED VOLTAGE: INCLUSIONS & EXCLUSIONS

1.3.2 MARKET, BY END USER: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONAL SCOPE

1.5 YEARS CONSIDERED

1.6 CURRENCY

1.7 LIMITATION

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 MARKET SIZE ESTIMATION

2.1.1 DEMAND-SIDE ANALYSIS

TABLE 1 INSTALLED CAPACITY OF KEY END USER INDUSTRIES AND TRANSMISSION & DISTRIBUTION INVESTMENTS ARE THE DETERMINING FACTORS FOR THE GLOBAL MARKET

2.1.1.1 Assumptions

2.1.2 SUPPLY-SIDE ANALYSIS

2.1.2.1 Assumptions

2.1.2.2 Calculation

2.1.3 FORECAST

2.2 SOME OF THE INSIGHTS OF INDUSTRY EXPERTS

3 EXECUTIVE SUMMARY (Page No. - 38)

3.1 PRE- AND POST-COVID-19 SCENARIO ANALYSIS

FIGURE 1 PRE- AND POST-COVID-19 SCENARIO ANALYSIS

TABLE 2 GLOBAL MARKET SNAPSHOT, BY SIZE AND SHARE, 2020 VS. 2025

FIGURE 2 ASIA PACIFIC DOMINATED THE MARKET IN 2019

FIGURE 3 CIRCUIT BREAKER SEGMENT IS EXPECTED TO GROW AT THE HIGHEST CAGR IN APPLICATION SEGMENT DURING THE FORECAST PERIOD

FIGURE 4 UTILITIES SEGMENT IS EXPECTED TO LEAD THE MARKET IN END USER SEGMENT DURING THE FORECAST PERIOD

FIGURE 5 15–30 KV RATED VOLTAGE SEGMENT IS EXPECTED TO LEAD THE MARKET DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 6 UPGRADE & MODERNIZATION OF AGING INFRASTRUCTURE IS EXPECTED TO DRIVE THE MARKET

4.2 MARKET, BY REGION

FIGURE 7 ASIA PACIFIC IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 MARKET, BY RATED VOLTAGE

FIGURE 8 15–30 KV RATED VOLTAGE SEGMENT DOMINATED THE MARKET IN 2019

4.4 MARKET, BY APPLICATION

FIGURE 9 CIRCUIT BREAKER SEGMENT IS EXPECTED TO DOMINATE THE MARKET IN 2019

4.5 MARKET, BY END USER

FIGURE 10 UTILITIES SEGMENT DOMINATED THE MARKET, BY END USER, IN 2019

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 11 COVID-19 GLOBAL PROPAGATION

FIGURE 12 COVID-19 PROPAGATION IN SELECT COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 13 RECOVERY ROAD FOR 2020 & 2021

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 14 REVISED GDP FORECAST FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 15 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, & CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Upgrade & modernization of aging infrastructure for safe & secure electrical distribution systems

FIGURE 16 YEAR-ON-YEAR (Y-O-Y) GLOBAL NUMBER OF POWER OUTAGES

5.5.1.2 Expansion of transmission & distribution networks

FIGURE 17 ANNUAL INVESTMENT IN TRANSMISSION (IN BILLION USD/YEAR)

5.5.1.3 Increasing rate of industrialization & urbanization

5.5.2 RESTRAINTS

5.5.2.1 Risks associated with device malfunction

5.5.2.2 Lack of existing government policies specific to vacuum interrupters

5.5.3 OPPORTUNITIES

5.5.3.1 Increasing investments in smart grid & power distribution in developing regions

FIGURE 18 INVESTMENTS IN SMART DISTRIBUTION NETWORKS, BY COUNTRY (IN BILLION USD)

5.5.3.2 Demand for uninterrupted power supply from utilities

5.5.3.3 Increase in the use of renewable energy

FIGURE 19 PROJECTED SHARE OF RENEWABLES IN ELECTRICITY, HEAT, AND TRANSPORT, 2017–2023 (%)

5.5.4 CHALLENGES

5.5.4.1 Availability of cheap & inferior quality products

5.5.4.2 Availability of various alternative technologies in the segment

5.5.4.3 Impact of COVID-19 on renewable energy sector

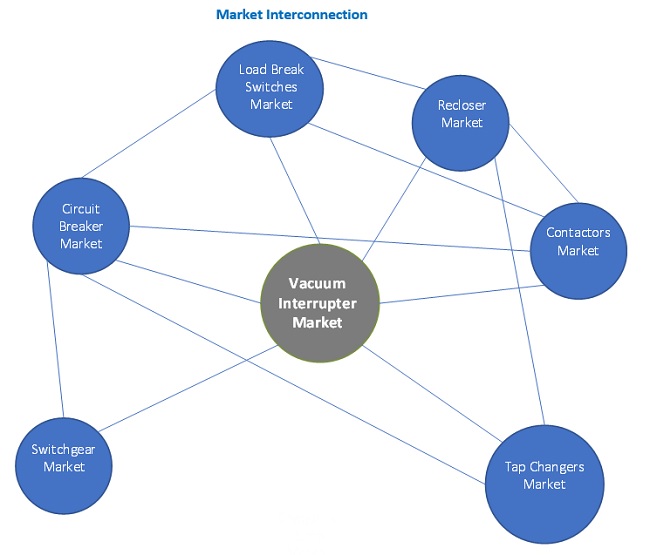

5.6 ADJACENT AND INTERCONNECTED MARKETS

TABLE 3 ADJACENT AND INTERCONNECTED MARKETS (USD BILLION)

6 VACUUM INTERRUPTER MARKET, BY END USER (Page No. - 56)

6.1 INTRODUCTION

FIGURE 20 VACUUM INTERRUPTER MARKET SIZE, BY END USER, 2019 (USD MILLION)

TABLE 4 MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 5 PRE-COVID-19: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 6 POST-COVID-19: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

6.2 UTILITIES

TABLE 7 UTILITIES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 8 POST-COVID-19: UTILITIES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.3 OIL & GAS SECTOR

TABLE 9 OIL & GAS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 10 POST-COVID-19: OIL & GAS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.4 MINING SECTOR

TABLE 11 MINING: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 12 POST-COVID-19: MINING: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.5 TRANSPORTATION SECTOR

TABLE 13 TRANSPORTATION: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 14 POST-COVID-19: TRANSPORTATION: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.6 OTHERS

TABLE 15 OTHERS SECTOR : MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 POST-COVID-19: OTHERS SECTOR : MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7 MARKET, BY APPLICATION (Page No. - 64)

7.1 INTRODUCTION

FIGURE 21 MARKET SHARE, BY APPLICATION, 2019 (USD MILLION)

TABLE 17 MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 18 PRE-COVID-19: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 19 POST-COVID-19: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

7.2 CIRCUIT BREAKER

TABLE 20 CATEGORICAL INVESTMENT IN ENERGY, BY REGION, 2017—1/2 (USD MILLION)

TABLE 21 CATEGORICAL INVESTMENT IN ENERGY, BY REGION, 2017—2/2 (USD MILLION)

TABLE 22 CIRCUIT BREAKER: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 POST-COVID-19: CIRCUIT BREAKER: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.3 LOAD BREAK SWITCH

TABLE 24 LOAD BREAK SWITCH: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 POST-COVID-19: LOAD BREAK SWITCH: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.4 RECLOSER

TABLE 26 RECLOSER: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 POST-COVID-19: RECLOSER: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.5 CONTACTOR

TABLE 28 CONTACTOR: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 POST-COVID-19: CONTACTOR: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.6 TAP CHANGER

TABLE 30 TAP CHANGER: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 POST-COVID-19: TAP CHANGER: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.7 OTHERS

TABLE 32 OTHERS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 POST-COVID-19: OTHERS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8 VACUUM INTERRUPTER MARKET, BY RATED VOLTAGE (Page No. - 75)

8.1 INTRODUCTION

FIGURE 22 GLOBAL MARKET, BY RATED VOLTAGE, 2019

TABLE 34 MARKET SIZE, BY RATED VOLTAGE, 2016–2019 (USD MILLION)

TABLE 35 PRE-COVID-19: MARKET SIZE, BY RATED VOLTAGE, 2020–2025 (USD MILLION)

TABLE 36 POST-COVID-19: MARKET SIZE, BY RATED VOLTAGE, 2020–2025 (USD MILLION)

8.2 0–15 KV

TABLE 37 0–15 KV: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 38 POST-COVID-19: 0–15 KV: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.3 15–30 KV

TABLE 39 15–30 KV: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 POST-COVID-19: 15–30 KV: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.4 ABOVE 30 KV

TABLE 41 ABOVE 30 KV: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 POST-COVID-19: ABOVE 30 KV: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9 VACUUM INTERRUPTER MARKET, BY REGION (Page No. - 81)

9.1 INTRODUCTION

FIGURE 23 REGIONAL SNAPSHOT: ASIA PACIFIC MARKET IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 24 MARKET SHARE (VALUE), BY REGION, 2019

TABLE 43 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 44 PRE-COVID-19: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 45 POST-COVID-19: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 25 ASIA PACIFIC: REGIONAL SNAPSHOT

TABLE 46 ASIA PACIFIC: MARKET SIZE, BY RATED VOLTAGE, 2016–2019 (USD MILLION)

TABLE 47 POST-COVID-19 ASIA PACIFIC: MARKET SIZE, BY RATED VOLTAGE, 2020–2025 (USD MILLION)

TABLE 48 ASIA PACIFIC: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 49 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 50 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 51 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 52 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 53 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.2.1 CHINA

TABLE 54 CHINA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 55 POST-COVID-19: CHINA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 56 CHINA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 57 POST-COVID-19: CHINA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.2.2 INDIA

TABLE 58 INDIA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 59 POST-COVID-19: INDIA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 60 INDIA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 61 POST-COVID-19: INDIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.2.3 JAPAN

TABLE 62 JAPAN: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 63 POST-COVID-19: JAPAN: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 64 JAPAN: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 65 POST-COVID-19: JAPAN: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.2.4 SOUTH KOREA

TABLE 66 SOUTH KOREA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 67 POST-COVID-19: SOUTH KOREA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 68 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 69 POST-COVID-19: SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.2.5 REST OF ASIA PACIFIC

TABLE 70 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 71 POST-COVID-19: REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 72 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 73 POST-COVID-19: REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3 NORTH AMERICA

FIGURE 26 NORTH AMERICA: REGIONAL SNAPSHOT

TABLE 74 NORTH AMERICA: MARKET SIZE, BY RATED VOLTAGE, 2016–2019 (USD MILLION)

TABLE 75 POST-COVID-19 NORTH AMERICA: VACUUM INTERRUPTER MARKET SIZE, BY RATED VOLTAGE, 2020–2025 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 77 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 79 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 81 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.3.1 US

TABLE 82 US: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 83 POST-COVID-19: US: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 84 US: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 85 POST-COVID-19: US: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.2 CANADA

TABLE 86 CANADA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 87 POST-COVID-19: CANADA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 88 CANADA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 89 POST-COVID-19: CANADA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.3 MEXICO

TABLE 90 MEXICO: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 91 POST-COVID-19: MEXICO: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 92 MEXICO: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 93 POST-COVID-19: MEXICO: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4 EUROPE

TABLE 94 EUROPE: MARKET SIZE, BY RATED VOLTAGE, 2016–2019 (USD MILLION)

TABLE 95 POST-COVID-19 EUROPE: MARKET SIZE, BY RATED VOLTAGE, 2020–2025 (USD MILLION)

TABLE 96 EUROPE: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 97 POST-COVID-19: EUROPE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 99 POST-COVID-19: EUROPE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 101 POST-COVID-19: EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.4.1 GERMANY

TABLE 102 GERMANY: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 103 POST-COVID-19: GERMANY: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 104 GERMANY: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 105 POST-COVID-19: GERMANY: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.2 ITALY

TABLE 106 ITALY: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 107 POST-COVID-19: ITALY: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 108 ITALY: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 109 POST-COVID-19: ITALY: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.3 RUSSIA

TABLE 110 RUSSIA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 111 POST-COVID-19: RUSSIA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 112 RUSSIA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 113 POST-COVID-19: RUSSIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.4 UK

TABLE 114 UK: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 115 POST-COVID-19: UK: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 116 UK: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 117 POST-COVID-19: UK: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.5 FRANCE

TABLE 118 FRANCE: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 119 POST-COVID-19: FRANCE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 120 FRANCE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 121 POST-COVID-19: FRANCE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.6 REST OF EUROPE

TABLE 122 REST OF EUROPE: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 123 POST-COVID-19: REST OF EUROPE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 124 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 125 POST-COVID-19: REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5 SOUTH AMERICA

TABLE 126 SOUTH AMERICA: MARKET SIZE, BY RATED VOLTAGE, 2016–2019 (USD MILLION)

TABLE 127 POST-COVID-19 SOUTH AMERICA: MARKET SIZE, BY RATED VOLTAGE, 2020–2025 (USD MILLION)

TABLE 128 SOUTH AMERICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 129 POST-COVID-19: SOUTH AMERICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 130 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 131 POST-COVID-19: SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 132 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 133 POST-COVID-19: SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.5.1 BRAZIL

TABLE 134 BRAZIL: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 135 POST-COVID-19: BRAZIL: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 136 BRAZIL: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 137 POST-COVID-19: BRAZIL: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5.2 ARGENTINA

TABLE 138 ARGENTINA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 139 POST-COVID-19: ARGENTINA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 140 ARGENTINA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 141 POST-COVID-19: ARGENTINA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5.3 CHILE

TABLE 142 CHILE: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 143 POST-COVID-19: CHILE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 144 CHILE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 145 POST-COVID-19: CHILE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5.4 REST OF SOUTH AMERICA

TABLE 146 REST OF SOUTH AMERICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 147 POST-COVID-19: REST OF SOUTH AMERICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 148 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 149 POST-COVID-19: REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.6 MIDDLE EAST

TABLE 150 MIDDLE EAST: MARKET SIZE, BY RATED VOLTAGE, 2016–2019 (USD MILLION)

TABLE 151 POST-COVID-19: MIDDLE EAST: MARKET SIZE, BY RATED VOLTAGE, 2020–2025 (USD MILLION)

TABLE 152 MIDDLE EAST: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 153 POST-COVID-19: MIDDLE EAST: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 154 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 155 POST-COVID-19: MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 156 MIDDLE EAST: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 157 POST-COVID-19: MIDDLE EAST: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.6.1 UNITED ARAB EMIRATES (UAE)

TABLE 158 UAE: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 159 POST-COVID-19: UAE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 160 UAE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 161 POST-COVID-19: UAE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.6.2 SAUDI ARABIA

TABLE 162 SAUDI ARABIA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 163 POST-COVID-19: SAUDI ARABIA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 164 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 165 POST-COVID-19: SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.6.3 KUWAIT

TABLE 166 KUWAIT: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 167 POST-COVID-19: KUWAIT: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 168 KUWAIT: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 169 POST-COVID-19: KUWAIT: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.6.4 REST OF MIDDLE EAST

TABLE 170 REST OF MIDDLE EAST: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 171 POST-COVID-19: REST OF MIDDLE EAST: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 172 REST OF MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 173 POST-COVID-19: REST OF MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.7 AFRICA

TABLE 174 AFRICA: MARKET SIZE, BY RATED VOLTAGE, 2016–2019 (USD MILLION)

TABLE 175 POST-COVID-19: AFRICA: MARKET SIZE, BY RATED VOLTAGE, 2020–2025 (USD MILLION)

TABLE 176 AFRICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 177 POST-COVID-19: AFRICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 178 AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 179 POST-COVID-19: AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 180 AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 181 POST-COVID-19: AFRICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.7.1 SOUTH AFRICA

TABLE 182 SOUTH AFRICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 183 POST-COVID-19: SOUTH AFRICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 184 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 185 POST-COVID-19: SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.7.2 ALGERIA

TABLE 186 ALGERIA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 187 POST-COVID-19: ALGERIA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 188 ALGERIA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 189 POST-COVID-19: ALGERIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.7.3 NIGERIA

TABLE 190 NIGERIA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 191 POST-COVID-19: NIGERIA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 192 NIGERIA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 193 POST-COVID-19: NIGERIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.7.4 REST OF AFRICA

TABLE 194 REST OF AFRICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 195 POST-COVID-19: REST OF AFRICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 196 REST OF AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 197 POST-COVID-19: REST OF AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 152)

10.1 OVERVIEW

FIGURE 27 KEY DEVELOPMENTS IN THE MARKET, JANUARY 2016–OCTOBER 2020

10.2 RANKING OF PLAYERS

FIGURE 28 RANKING OF KEY PLAYERS & INDUSTRY CONCENTRATION, 2019

10.3 COMPETITIVE SCENARIO

TABLE 198 DEVELOPMENTS OF KEY PLAYERS IN THE MARKET, JANUARY 2016–OCTOBER 2020

10.3.1 NEW PRODUCT DEVELOPMENTS

10.3.2 EXPANSIONS & INVESTMENTS

10.3.3 CONTRACTS & AGREEMENTS, PARTNERSHIPS, & ALLIANCES

10.3.4 MERGERS & ACQUISITIONS, PARTNERSHIPS, & COLLOBARATIONS

11 COMPANY PROFILES (Page No. - 158)

(Business Overview, Products Offered, Recent Developments, COVID-19-related Developments, MnM View)*

11.1 ABB

FIGURE 29 ABB: COMPANY SNAPSHOT

11.2 EATON

FIGURE 30 EATON: COMPANY SNAPSHOT

11.3 SIEMENS AG

FIGURE 31 SIEMENS AG: COMPANY SNAPSHOT

11.4 CROMPTON GREAVES LIMITED

FIGURE 32 CROMPTON GREAVES LIMITED: COMPANY SNAPSHOT

11.5 LS INDUSTRIAL SYSTEMS

11.6 SHAANXI BAOGUANG VACUUM ELECTRIC DEVICE CO. LTD.

FIGURE 33 SHAANXI BAOGUANG VACUUM ELECTRIC DEVICE CO. LTD.: COMPANY SNAPSHOT

11.7 MEIDENSHA CORPORATION

FIGURE 34 MEIDENSHA CORPORATION: COMPANY SNAPSHOT

11.8 MITSUBISHI ELECTRIC CORPORATION

FIGURE 35 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

11.9 TOSHIBA CORPORATION

FIGURE 36 TOSHIBA CORPORATION: COMPANY SNAPSHOT

11.10 ACTOM

11.11 WUHAN FEITE ELECTRIC CO., LTD.

11.12 CHENGDU XUGUANG ELECTRONICS CO., LTD.

11.13 SHAANZI JOYELECTRIC INTERNATIONAL CO., LTD.

*Details on Business Overview, Products Offered, Recent Developments, COVID-19-related Developments, MnM View might not be captured in case of unlisted companies.

12 ADJACENT AND RELATED MARKETS (Page No. - 199)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 VACUUM INTERRUPTER INTERCONNECTED MARKETS

12.4 SWITCHGEAR MARKET

12.4.1 MARKET DEFINITION

12.4.2 MARKET OVERVIEW

12.4.3 SWITCHGEAR MARKET, BY INSULATION

12.4.3.1 GIS

TABLE 199 GIS MARKET SIZE, BY REGION, 2016–2019 (USD)

TABLE 200 GIS MARKET SIZE, BY REGION, 2020–2025 (USD)

12.4.3.2 AIS

TABLE 201 AIS MARKET SIZE, BY REGION, 2016–2019 (USD)

TABLE 202 AIS MARKET SIZE, BY REGION, 2020–2025 (USD)

12.5 SWITCHGEAR MONITORING

12.5.1 MARKET DEFINITION

12.5.2 MARKET OVERVIEW

12.5.3 SWITCHGEAR MARKET, BY VOLTAGE

12.5.3.1 High

TABLE 203 HIGH MARKET SIZE, BY REGION, 2018–2025 (USD)

12.5.3.2 Medium

TABLE 204 MEDIUM MARKET SIZE, BY REGION, 2018–2025 (USD)

13 APPENDIX (Page No. - 205)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

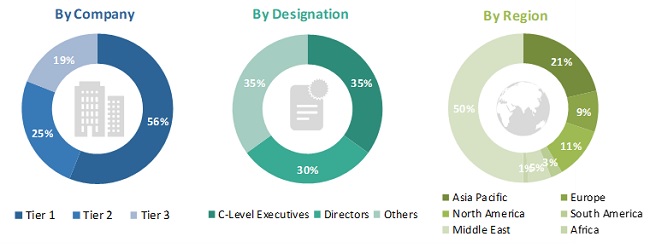

This study involved 4 major activities in estimating the current market size of the vacuum interrupter market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. Thereafter, the market breakdown and data triangulation technique was undertaken to estimate the market size of the segments and corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as T&D World, Bloomberg Business Week, Factiva, and, world oil and gas journal, to identify and collect information useful for a technical, market oriented, and commercial study of the market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The vacuum interrupter market comprises several stakeholders such as coal and oil & gas trading companies; transmission & distribution companies in the sector; electrical equipment manufacturing companies; medium and low voltage component assemblers; organizations, forums and alliances; state and national regulatory authorities; and electrical system designers, owners, and operators. The demand side of this market is characterized by its applications such as circuit breakers, contactors, reclosers, load break switches, tap changers, and others. The others segment includes vacuum interrupters used in DC applications and traction in the transportation systems. The supply side is characterized by organizations manufacturing vacuum interrupters and the equipment in which the vacuum interrupters are installed. A few of such companies are ABB, Siemens, Eaton, LS Industries, Wuhan Feite Electric Company, Meidensha Electricals, Toshiba Electrical Company. Various primary sources, from both the supply and demand sides of the market, were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global vacuum interrupter market and its dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in utilities, oil and gas, mining, transportation, and other sectors.

To know about the assumptions considered for the study, Request for Free Sample Report

Report Objectives

- To define, describe, and forecast the global vacuum interrupter market by end-user, application, rated voltage, and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution of each segment to the market

- To analyze the market opportunities for stakeholders and details of the competitive landscape for market leaders

- To forecast the growth of the market with respect to the major regions (Asia Pacific, Europe, North America, South America, Middle East, and Africa)

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze the competitive developments such as contracts & agreements, expansions, new product developments, mergers & acquisitions, and partnerships in the vacuum interrupter market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of the region or country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Vacuum Interrupter Market