Utility Locator Market by Technique (Electromagnetic Field, GPR), Offering (Equipment and Services), Target (Metallic Utilities and Non-Metallic Utilities), Vertical (Oil & Gas, Electricity, Transportation) and Region - Global Forecast to 2027

Updated on : October 23, 2024

Utility Locator Market Size & Growth

The utility locator market size is projected to grow from USD 833 million in 2022 to USD 1,109 million by 2027; growing at a Compound Annual Growth Rate (CAGR) of 5.9% from 2022 to 2027.

The utility locator market growth is driven by factors including, Introduction of standards and ease in regulations pertaining to utility locators; and benefits of utility locator systems over traditional technologies/methods. Additionally, rising demand for real-time utility locating for underground utilities, concrete structures, roads, railway lines, etc., is expected to create growth opportunities during the forecast period. However, high cost of ownership and maintenance of utility locator and lack of expertise and skillset are challenging challenging the utility locator market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Utility Locator Market Trends and Dynamics

Introduction of standards and ease in regulations pertaining to utility locators to drive market growth

The update in standards for the utility locators is helping to maintain the accuracy in underground utility surveys. For instance, the PAS 128 standards update of 2022 named as PAS 128:2022 which is the British standards institute (BSI) specification for underground utility location. The update of the standard enables the users to plan more effectively and provide safer execution of street works, civil works, and ground works. The publicly available specification (PAS) 256 standard is endorsed by the institute of civil engineers (ICE), British standard institute (BSI), and infrastructure UK in HM treasury. The update and launch of new utility standards in turn drives the utility locator adoption. For instance, China’s government is planning to invest heavily in different infrastructural development projects, such as transportation and railway infrastructure development projects.According to a news published in January 2022 in China Macro Economy newsletter, the cabinet of China has started work to quicken the pace of 102 major projects outlined in its 2021–2025 development plan. The country is prone to frequent natural disasters such as earthquakes and landslides, which increases the need to monitor and inspect the structures in real time.

Rising demand for real-time utility locating for underground utilities to create growth opportunities for the utility locator market

The increasing need for real-time analysis of underground utilities, concrete structures, roads, railway lines, etc., is one of the emerging concepts and new trends in the utility locator market. Different techniques are used such as electromagnetic field, ground penetrating radar and other for locating. Advanced methods enable respective utility owners to perform real-time analyses of their underground utilities. Utility locating equipment and service providers have started using fleet telemetry systems, GPS devices, GIS data devices, and GPR devices comprising multiple GPR antennas, called ‘GPR Arrays’, allow surveying the areas more quickly by collecting several GPR profiles simultaneously and offer 3D images of the objects and a more refined data capture ability feature and other sensors to collect location-based data on underground utilities.

High cost of ownership and maintenance of utility locator restrain the market growth

Price is the major factor in restraining the growth of the utility locator market since utility locating equipment are more expensive than manual digging. The cost of ownership of these locating equipment starts from around USD 1,000 and goes to USD 5,800, depending on the type and capabilities and features of the equipment. The average selling price of GPR equipment ranges from USD 20,000–USD 25,000, depending on the type, capabilities, and features.Apart from the cost of purchase, the total cost of utility locating equipment include the maintenance cost, communication equipment, cost of business (including the repair & maintenance, wages), training of staff and their quality assurance, etc. For operating the utility locators there is a need high skilled manpower to operate the utility locating equipment.

Lack of expertise and skill set is a challenge market experience

The field inspector should have knowledge of construction and operation of the underground utility distribution and collection systems, policies, and procedures. The field inspector should also be an expert in computer and software-related operations to gather the exact physical characteristics and location of the utility. The lack of knowledge related to electronic or manual utility locator equipment, field survey, and lack of understanding related to utility maps and construction drawings make the job of utility locating less attractive for the field officer.

Utility locators using electromagnetic field technique contribute largest market share throught the forecast period

Electromagnetic field locator is the most common equipment for locating utilities buried underground. Electromagnetic field utility locating equipment, such as pipe and cable locators, electronic marker systems (EMS), e-line locators, terrain conductivity equipment, and metal detector, often consist of a transmitter and a receiver. The use of electromagnetic radiation to locate underground utilities in places where human reach is not possible will have positive impact on the growth of the utility locator industry.

Services of utility locator market to grow at a highest CAGR between 2022 and 2027

Various services pertaining to utility locating equipment include rental, training, inspection, calibration, and maintenance and repair services. The high ownership cost of a utility locator, accessories and the constant requirement for innovative utility locating solutions for different applications facilitate end users to adopt utility locating equipment on rent. For instance, for domestic purpose one will not buy whole utility locator for single time use only, instead will call for service. And Training services help the user to operate the equipment effectively and efficiently and to maintain the safety while detecting utilities.

Telecommunication vertical to record for largest utility locator market share throught the forecaste period

Telecommunications and electricity were among the first verticals for which utility locators were rapidly adopted in the past. Telecommunications infrastructure has been established worldwide, Telecommunications comprises telephone lines, TV lines, cable TVs, fiber optic cables, and others. Telecommunication lines are the communication facilities that can be made up of paired, insulated copper conductors, i.e., TIP (A) and RING (B). The utility locator assures uninterrupted operations of communication cables. However, the emergence of 5G technology is expected to increase the demand for utility locators in telecommunications vertical in the near future.

Utility Locator Industry Regional Analysis

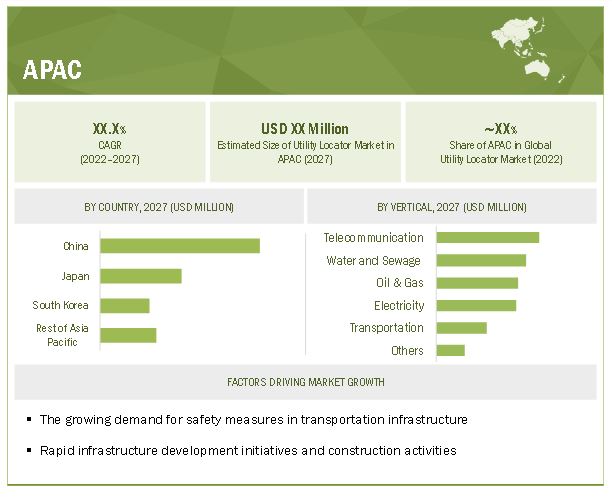

Utility Locator Market in APAC to grow significantly during the forecast period

APAC is expected to be the fastest-growing market for utility locators as the region is characterized by rapid infrastructure development initiatives and huge investments by the public and private sectors in residential, industrial, and commercial establishments. The utility locator market in this region has been segmented into China, India, Japan, and Rest of APAC that mainly includes Australia, Russia, South Korea, and countries in Southeast Asia. Specifically, in china the government is planning to invest heavily in different infrastructural development projects, such as transportation and railway infrastructure development projects.

To know about the assumptions considered for the study, download the pdf brochure

Top Utility Locator Companies - Key Market Players

Key players in utility locator companies are

- Radiodetection Ltd.(UK),

- Guideline Geo (Sweden),

- Rigid Tool Company (US),

- Ditch Witch (The Charles Machine Works) (US),

- Leica Geosystems AG (US),

- Vivax-Metrotech Corporation (US),

- 3M (US),

- USIC LLC (US),

- multiVIEW Locates Inc. (Canada),

- Ground Penetrating Radar (US).

Utility Locator Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 833 million |

| Projected Market Size | USD 1,109 million |

| Growth Rate | CAGR of 5.9% |

|

Market size available for years |

2018—2027 |

|

Base year |

2021 |

|

Forecast period |

2022—2027 |

|

Units |

Value (USD Million), Volume (Million Units) |

|

Segments covered |

Utility locator technique, Offering, Geography, Vertical. |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Radiodetection Ltd.(UK), Guideline Geo (Sweden), Rigid Tool Company (US), Ditch Witch (The Charles Machine Works) (US), Leica Geosystems AG (US), Vivax-Metrotech Corporation (US), 3M (US), USIC LLC (US), multiVIEW Locates Inc. (Canada), and Ground Penetrating Radar (US) are the major players in the market. |

This report categorizes the utility locator market share based on utility locator technique, Offering, Geography, Vertical.

Utility locator Market, by Technique:

- Electromagnetic field

- Ground penetrating radar

- Other

Utility locator Market, by offering:

- Equipment

- Services

Utility locator Market, by Vertical:

- Oil & gas

- Electricity

- Transportation

- Water and sewage

- Telecommunication

- Others

Utility locator Market, by region:

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

RoW

- South America

- Middle East & Africa

Recent Developments in Utility Locator Industry

- In April 2022, Radiodetection Ltd. Launched the 120CXB Metallic Cable analyzer TDR, the new high precision time domain reflectometer(TDR) which is used to find cable faults quickly and easily.

- In September 2021, Guideline Geo launched MALA Easy Locator core, which is a most efficient utility locating GPR solution. The product offers to interpret data in real time by indicating and marking object beneath the surface while measuring.

- In Feb 2021, Rigid tool company launched the RIGID Seek Tech ST-305R, poweful and flexible multi-frequency transmitter which iscompatable with any RIGID SeekTech or NaviTrack receiver to find buried conductors.

- In august 2022, Ditch Witch announced acquisition of specific assets from River city Manufacturing Inc. including hydrawheel design of rock saws.

Key Questions Addressed in the Report

Which are the major companies in the utility locator market share? What are their major strategies to strengthen their market presence?

Radiodetection Ltd.(UK), Guideline Geo (Sweden), Rigid Tool Company (US), Ditch Witch (The Charles Machine Works) (US), Leica Geosystems AG (US), and Vivax-Metrotech Corporation (US). These companies have adopted organic as well as inorganic growth strategies such as product launches, and partnerships to gain competitive advantage in the market.

Which is the potential for utility locator market in terms of the region?

APAC is the region with high growth opportunities owing to the presence of countries such as China and South Korea, India, Australia. Rising adoption innovative technologies in industries in China, South Korea, and Japan also facilitate growth to the market.

What are the opportunities for new utility locator market entrants?

Rising demad for real-time analysis of underground utilities, concrete structures, roads, railway lines, etc., is one of the emerging concepts and new trends in the utility locator market.

Which verticals are expected to drive the growth of the utility locator market size in the next six years?

Telecommunication, Water and sewage, oil & gas, are verticals with the highest opportunities for utility locator adaption. Utility locator with Ground penetrating(GPR) techniques can detect underground metallic as well as non-metallic objects; vertical water and sewage is expected to contribute more in the utility locator market using GPR technique.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 UTILITY LOCATOR MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

FIGURE 2 MARKET: REGIONAL SEGMENTATION

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 3 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of key secondary sources

2.1.2.2 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 List of key primary interview participants

2.1.3.3 Breakdown of primary interviews

2.1.3.4 Key data from primary sources

2.1.3.5 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market share by bottom-up analysis (demand side)

FIGURE 4 UTILITY LOCATOR MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

FIGURE 5 MARKET: TOP-DOWN APPROACH

FIGURE 6 MARKET: SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 8 MARKET, 2018–2027 (USD MILLION)

FIGURE 9 ELECTROMAGNETIC FIELD TECHNIQUE TO HAVE LARGEST MARKET SHARE

FIGURE 10 UTILITY LOCATOR SERVICES TO GROW AT HIGHER CAGR

FIGURE 11 TELECOMMUNICATIONS VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE

FIGURE 12 ASIA PACIFIC EXPECTED TO BE FASTEST-GROWING MARKET

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN UTILITY LOCATOR MARKET

FIGURE 13 AGING INFRASTRUCTURE MAINTENANCE NEEDS TO DRIVE MARKET

4.2 UTILITY LOCATOR MARKET, BY OFFERING

FIGURE 14 UTILITY LOCATOR EQUIPMENT TO HAVE LARGER MARKET SIZE IN 2027

4.3 UTILITY LOCATOR MARKET, BY TECHNIQUE

FIGURE 15 GPR TECHNIQUE TO GROW AT HIGHEST CAGR

4.4 UTILITY LOCATOR MARKET IN NORTH AMERICA, BY VERTICAL AND COUNTRY

FIGURE 16 TELECOMMUNICATIONS VERTICAL AND US TO ACCOUNT FOR LARGEST UTILITY LOCATOR MARKET SHARES IN NORTH AMERICA

4.5 UTILITY LOCATOR MARKET, BY COUNTRY

FIGURE 17 US TO HAVE LARGEST SIZE OF MARKET

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MARKET

5.2.1 DRIVERS

5.2.1.1 Concern for safety and protection of underground utilities

5.2.1.2 Benefits of utility locator systems over traditional technologies/methods

5.2.1.3 Introduction of standards and ease in regulations pertaining to utility locators

FIGURE 19 MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 High cost of ownership and maintenance of utility locators

FIGURE 20 MARKET: IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for real-time utility locating

5.2.3.2 Growing infrastructure requires maintenance operations by utility locator system

FIGURE 21 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Lack of expertise and skillset

5.2.4.2 Differed weather and soil conditions in addition to technological limitations

FIGURE 22 MARKET: IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 UTILITY LOCATOR MARKET: VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM ANALYSIS

FIGURE 24 MARKET: ECOSYSTEM ANALYSIS

TABLE 1 MARKET: ECOSYSTEM

5.5 PRICING ANALYSIS

TABLE 2 AVERAGE SELLING PRICE OF UTILITY LOCATOR SYSTEMS OFFERED BY TOP COMPANIES, 2021

TABLE 3 INDICATIVE PRICE OF UTILITY LOCATOR SYSTEMS

5.5.1 AVERAGE SELLING PRICE OF COMPONENTS OFFERED BY KEY PLAYERS

FIGURE 25 AVERAGE SELLING PRICE OF COMPONENTS OFFERED BY KEY PLAYERS

TABLE 4 AVERAGE SELLING PRICE OF COMPONENTS OFFERED BY KEY PLAYERS (USD)

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 26 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN MARKET

5.7 TECHNOLOGY ANALYSIS

5.7.1 ARTIFICIAL INTELLIGENCE

5.7.2 INTERNET OF THINGS

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9 KEY STAKEHOLDERS & BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 27 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP-3 VERTICALS

TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP-3 VERTICALS (%)

5.9.2 BUYING CRITERIA

FIGURE 28 KEY BUYING CRITERIA FOR TOP-3 VERTICALS

TABLE 7 KEY BUYING CRITERIA FOR TOP-3 VERTICALS

5.10 CASE STUDIES

TABLE 8 MULTIVIEW USED GPR SYSTEM TO INVESTIGATE ROAD STRUCTURE OVER SEVERAL KILOMETERS IN ONTARIO

TABLE 9 GUIDELINE GEO USED GPR IMAGING OF WESTERN WALL, JERUSALEM, ISRAEL

TABLE 10 GPR SLICE SOFTWARE HELPED ANALYZE DATA FROM GPR

TABLE 11 WHEEL-MOUNTED SEEKER SPR ALLOWED ANALYSIS OF SUBSURFACE ROCK ON TRENCH LINES

TABLE 12 C-THRUE GPR USED TO IDENTIFY METAL ELEMENTS IN STRUCTURAL ELEMENTS

5.11 TRADE ANALYSIS

FIGURE 29 IMPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

FIGURE 30 EXPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

5.12 PATENT ANALYSIS

FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS FROM 2012 TO 2022

TABLE 13 TOP 20 PATENT OWNERS FROM 2021 TO 2022

FIGURE 32 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

TABLE 14 LIST OF A FEW PATENTS IN UTILITY LOCATOR MARKET, 2020–2021

5.13 KEY CONFERENCES & EVENTS, 2022–2023

TABLE 15 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.1 STANDARDS

TABLE 20 STANDARDS FOR MARKET

6 UTILITY LOCATOR MARKET, BY TECHNIQUE (Page No. - 72)

6.1 INTRODUCTION

FIGURE 33 ELECTROMAGNETIC FIELD-BASED UTILITY LOCATOR TO HAVE LARGEST MARKET SHARE

TABLE 21 UTILITY LOCATOR MARKET, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 22 UTILITY LOCATOR MARKET, BY TECHNIQUE, 2022–2027 (USD MILLION)

6.2 ELECTROMAGNETIC FIELD

6.2.1 INCREASED USE OF ELECTROMAGNETIC RADIATION TO LOCATE UNDERGROUND UTILITIES

TABLE 23 UTILITY LOCATOR MARKET FOR ELECTROMAGNETIC FIELD, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 24 MARKET FOR ELECTROMAGNETIC FIELD TECHNIQUE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 25 MARKET FOR ELECTROMAGNETIC FIELD, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 26 UTILITY LOCATOR MARKET FOR ELECTROMAGNETIC FIELD TECHNIQUE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 27 MARKET FOR ELECTROMAGNETIC FIELD TECHNIQUE, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 UTILITY LOCATOR MARKET FOR ELECTROMAGNETIC FIELD TECHNIQUE, BY REGION, 2022–2027(USD MILLION)

6.3 GROUND PENETRATING RADAR (GPR)

6.3.1 RISE IN USE OF GPR IN UTILITY LOCATOR TO LOCATE BURIED PIPES, CABLES, AND OTHER RELATED BURIED OBJECTS

TABLE 29 UTILITY LOCATOR MARKET FOR GPR TECHNIQUE, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 30 MARKET FOR GPR TECHNIQUE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 31 MARKET FOR GPR TECHNIQUE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 32 MARKET FOR GPR TECHNIQUE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 33 MARKET FOR GPR TECHNIQUE, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 UTILITY LOCATOR MARKET FOR GPR TECHNIQUE, BY REGION, 2022–2027 (USD MILLION)

6.4 OTHERS

TABLE 35 UTILITY LOCATOR MARKET FOR OTHER TECHNIQUES, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 36 MARKET FOR OTHER TECHNIQUES, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 37 UTILITY LOCATOR MARKET FOR OTHER TECHNIQUES, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 38 MARKET FOR OTHER TECHNIQUES, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 39 MARKET FOR OTHER TECHNIQUES, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 UTILITY LOCATOR MARKET FOR OTHER TECHNIQUES, BY REGION, 2022–2027 (USD MILLION)

7 UTILITY LOCATOR MARKET, BY OFFERING (Page No. - 83)

7.1 INTRODUCTION

FIGURE 34 MARKET FOR UTILITY LOCATING SERVICES TO GROW AT HIGHER CAGR

TABLE 41 UTILITY LOCATOR MARKET, BY OFFERING 2018–2021 (USD MILLION)

TABLE 42 UTILITY LOCATOR MARKET, BY OFFERING, 2022–2027 (USD MILLION)

7.2 EQUIPMENT

7.2.1 ADVANCEMENTS IN UTILITY LOCATING EQUIPMENT TO LOCATE UNDERGROUND UTILITIES

TABLE 43 UTILITY LOCATOR MARKET FOR EQUIPMENT, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 44 MARKET FOR EQUIPMENT, BY TECHNIQUE, 2022–2027 (USD MILLION)

7.3 SERVICES

7.3.1 CONCERN FOR SAFETY AND PROTECTION OF UNDERGROUND UTILITIES DRIVE DEMAND FOR UTILITY SERVICES

TABLE 45 UTILITY LOCATOR MARKET FOR SERVICE, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 46 MARKET FOR SERVICE, BY TECHNIQUE, 2022–2027 (USD MILLION)

8 UTILITY LOCATOR MARKET, BY TARGET (Page No. - 88)

8.1 INTRODUCTION

FIGURE 35 MARKET FOR METALLIC UTILITIES TO HAVE LARGER SHARE

TABLE 47 UTILITY LOCATOR MARKET, BY TARGET, 2018–2021 (USD MILLION)

TABLE 48 UTILITY LOCATOR MARKET, BY TARGET, 2022–2027 (USD MILLION)

8.2 METALLIC UTILITIES

8.2.1 ELECTROMAGNETIC UTILITY SOLUTIONS ENABLE EFFECTIVE TRACING AND MARKING OF UNDERGROUND BURIED METALLIC UTILITIES

8.3 NON-METALLIC UTILITIES

8.3.1 GPR OFFERS TRACING AND IDENTIFICATION OF BURIED NON-METALLIC UTILITIES

9 UTILITY LOCATOR MARKET, BY VERTICAL (Page No. - 91)

9.1 INTRODUCTION

FIGURE 36 TELECOMMUNICATIONS VERTICAL OF MARKET TO HAVE LARGEST SHARE CAGR

TABLE 49 UTILITY LOCATOR MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 50 UTILITY LOCATOR MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 OIL & GAS

9.2.1 UTILITY LOCATORS TRACE PIPELINES TRANSMISSION AND PINPOINT PROBLEM AREAS IN OIL & GAS INDUSTRY

TABLE 51 UTILITY LOCATOR MARKET FOR OIL & GAS, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 52 MARKET FOR OIL & GAS, BY TECHNIQUE, 2022–2027 (USD MILLION)

TABLE 53 MARKET FOR OIL & GAS, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 MARKET FOR OIL & GAS, BY REGION, 2022–2027 (USD MILLION)

9.3 ELECTRICITY

9.3.1 GROWING POWER DISTRIBUTION NETWORK IN DEVELOPING COUNTRIES TO CREATE GROWTH OPPORTUNITIES

TABLE 55 UTILITY LOCATOR MARKET FOR ELECTRICITY, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 56 MARKET FOR ELECTRICITY, BY TECHNIQUE, 2022–2027 (USD MILLION)

TABLE 57 MARKET FOR ELECTRICITY, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 MARKET FOR ELECTRICITY, BY REGION, 2022–2027 (USD MILLION)

9.4 TRANSPORTATION

9.4.1 RAPID URBANIZATION DRIVES DEMAND FOR UTILITY LOCATORS

TABLE 59 UTILITY LOCATOR MARKET FOR TRANSPORTATION, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 60 FOR TRANSPORTATION, BY TECHNIQUE, 2022–2027 (USD MILLION)

TABLE 61 MARKET FOR TRANSPORTATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 UTILITY LOCATOR MARKET FOR TRANSPORTATION, BY REGION, 2022–2027 (USD MILLION)

9.5 WATER & SEWAGE

9.5.1 UTILITY LOCATOR ENABLES TRACING OF RIGHT DAMAGE SPOTS

TABLE 63 UTILITY LOCATOR MARKET FOR WATER & SEWAGE, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 64 MARKET FOR WATER & SEWAGE, BY TECHNIQUE, 2022–2027 (USD MILLION)

TABLE 65 MARKET FOR WATER & SEWAGE, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 UTILITY LOCATOR MARKET FOR WATER & SEWAGE, BY REGION, 2022–2027 (USD MILLION)

9.6 TELECOMMUNICATIONS

9.6.1 UTILITY LOCATORS ASSURE UNINTERRUPTED OPERATION OF COMMUNICATION CABLES

TABLE 67 UTILITY LOCATOR MARKET FOR TELECOMMUNICATIONS, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 68 UTILITY LOCATOR MARKET FOR TELECOMMUNICATIONS, BY TECHNIQUE, 2022–2027 (USD MILLION)

TABLE 69 MARKET FOR TELECOMMUNICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 UTILITY LOCATORMARKET FOR TELECOMMUNICATIONS, BY REGION, 2022–2027 (USD MILLION)

9.7 OTHERS

TABLE 71 UTILITY LOCATOR MARKET FOR OTHER VERTICALS, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 72 MARKET FOR OTHER VERTICALS, BY TECHNIQUE, 2022–2027 (USD MILLION)

TABLE 73 MARKET FOR OTHER VERTICALS, BY REGION, 2018–2021 (USD MILLION)

TABLE 74 UTILITY LOCATOR MARKET FOR OTHER VERTICALS, BY REGION, 2022–2027 (USD MILLION)

10 UTILITY LOCATOR MARKET, BY REGION (Page No. - 105)

10.1 INTRODUCTION

FIGURE 37 UTILITY MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST CAGR

TABLE 75 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 38 NORTH AMERICA: UTILITY LOCATOR MARKET SNAPSHOT

TABLE 77 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY TECHNIQUE, 2022–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Rising government investments in transportation & infrastructure

10.2.2 CANADA

10.2.2.1 Growing demand for electricity distribution lines

10.2.3 MEXICO

10.2.3.1 Growing infrastructure sector to fuel utility locator market

10.3 EUROPE

FIGURE 39 EUROPE: MARKET SNAPSHOT

TABLE 83 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY TECHNIQUE, 2022–2027 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 Improvement in transportation infrastructure

10.3.2 GERMANY

10.3.2.1 Infrastructure redevelopment projects to create market growth opportunities

10.3.3 FRANCE

10.3.3.1 High demand for utility locator solutions in infrastructure projects

10.3.4 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 40 ASIA PACIFIC: UTILITY LOCATOR MARKET SNAPSHOT

TABLE 89 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET, BY TECHNIQUE, 2022–2027 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 94 ASIA PACIFIC: UTILITY LOCATOR MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Increasing investments in infrastructure development to boost market

10.4.2 JAPAN

10.4.2.1 Demand for safety measures in transportation infrastructure

10.4.3 SOUTH KOREA

10.4.3.1 Growing demand for inspection systems in bridges, buildings, and tunnels

10.4.4 REST OF ASIA PACIFIC

10.5 REST OF THE WORLD (ROW)

TABLE 95 ROW: UTILITY LOCATOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 96 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 97 ROW: MARKET, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 98 ROW: MARKET, BY TECHNIQUE, 2022–2027 (USD MILLION)

TABLE 99 ROW: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 100 ROW: UTILITY LOCATOR MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.5.1 MIDDLE EAST & AFRICA

10.5.2 SOUTH AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 125)

11.1 OVERVIEW

11.2 TOP-FIVE COMPANY REVENUE ANALYSIS

FIGURE 41 MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2017–2021

11.3 MARKET SHARE ANALYSIS, 2021

TABLE 101 UTILITY LOCATOR MARKET SHARE ANALYSIS (2021)

11.4 COMPETITIVE LEADERSHIP MAPPING, 2021

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 42 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

11.5 MARKET: COMPANY FOOTPRINT

TABLE 102 COMPANY FOOTPRINT

TABLE 103 OFFERING FOOTPRINT OF COMPANIES

TABLE 104 VERTICAL FOOTPRINT OF COMPANIES

TABLE 105 REGIONAL FOOTPRINT OF COMPANIES

11.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2021

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 DYNAMIC COMPANIES

11.6.4 STARTING BLOCKS

FIGURE 43 UTILITY LOCATOR, SMES EVALUATION QUADRANT, 2021

11.7 STARTUP EVALUATION MATRIX

TABLE 106 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 107 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

11.8 COMPETITIVE SITUATIONS AND TRENDS

TABLE 108 MARKET: PRODUCT LAUNCHES, 2019–2022

TABLE 109 MARKET: DEALS, 2019–2022

12 COMPANY PROFILES (Page No. - 139)

12.1 UTILITY LOCATOR MARKET KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

12.1.1 RADIODETECTION LTD.

TABLE 110 RADIODETECTION LTD.: BUSINESS OVERVIEW

FIGURE 44 RADIODETECTION LTD.: COMPANY SNAPSHOT

TABLE 111 RADIODETECTION LTD.: PRODUCT OFFERING

TABLE 112 RADIODETECTION LTD.: PRODUCT LAUNCHES AND DEVELOPMENTS

12.1.2 GUIDELINE GEO

TABLE 113 GUIDELINE GEO: BUSINESS OVERVIEW

FIGURE 45 GUIDELINE GEO: COMPANY SNAPSHOT

TABLE 114 GUIDELINE GEO: PRODUCT OFFERING

TABLE 115 GUIDELINE GEO: PRODUCT LAUNCHES AND DEVELOPMENTS

12.1.3 RIDGE TOOL COMPANY

TABLE 116 RIDGE TOOL COMPANY: BUSINESS OVERVIEW

FIGURE 46 RIDGE TOOL COMPANY: COMPANY SNAPSHOT

TABLE 117 RIDGE TOOL COMPANY: PRODUCT OFFERING

12.1.4 DITCH WITCH (THE CHARLES MACHINE WORKS)

TABLE 118 DITCH WITCH: BUSINESS OVERVIEW

FIGURE 47 DITCH WITCH: COMPANY SNAPSHOT

TABLE 119 DITCH WITCH: PRODUCT OFFERING

12.1.5 LEICA GEOSYSTEMS AG

TABLE 120 LEICA GEOSYSTEMS AG: BUSINESS OVERVIEW

FIGURE 48 LEICA GEOSYSTEMS AG: COMPANY SNAPSHOT

TABLE 121 LEICA GEOSYSTEMS AG: PRODUCT OFFERING

12.1.6 VIVAX-METROTECH CORPORATION

TABLE 122 VIVAX-METROTECH CORPORATION: BUSINESS OVERVIEW

TABLE 123 VIVAX-METROTECH CORPORATION: PRODUCT OFFERING

TABLE 124 VIVAX-METROTECH CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

12.1.7 3M

TABLE 125 3M: BUSINESS OVERVIEW

FIGURE 49 3M: COMPANY SNAPSHOT

TABLE 126 3M: PRODUCT OFFERING

12.1.8 USIC, LLC

TABLE 127 USIC, LLC: BUSINESS OVERVIEW

TABLE 128 USIC, LLC: SERVICE OFFERING

12.1.9 MULTIVIEW LOCATES INC.

TABLE 129 MULTIVIEW LOCATES INC.: BUSINESS OVERVIEW

TABLE 130 MULTIVIEW LOCATES INC.: SERVICE OFFERING

12.1.10 GROUND PENETRATING RADAR SYSTEMS, LLC

TABLE 131 GROUND PENETRATING RADAR SYSTEMS, LLC: BUSINESS OVERVIEW

TABLE 132 GROUND PENETRATING RADAR SYSTEMS, LLC: SERVICE OFFERING

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 GSSI GEOPHYSICAL SURVEY SYSTEMS, INC.

TABLE 133 GSSI GEOPHYSICAL SURVEY SYSTEMS, INC.: BUSINESS OVERVIEW

12.2.2 MCLAUGHLIN GROUP, INC. (A VERMEER COMPANY)

TABLE 134 MCLAUGHLIN GROUP, INC.: BUSINESS OVERVIEW

12.2.3 MAVERICK INSPECTION LTD

TABLE 135 MAVERICK INSPECTION LTD: BUSINESS OVERVIEW

12.2.4 RHD SERVICES

TABLE 136 RHD SERVICES: BUSINESS OVERVIEW

12.2.5 ONE VISION UTILITY SERVICES

TABLE 137 ONE VISION UTILITY SERVICES: BUSINESS OVERVIEW

12.2.6 UTILITIES PLUS

TABLE 138 UTILITIES PLUS: BUSINESS OVERVIEW

12.2.7 US RADAR INC.

TABLE 139 US RADAR, INC.: BUSINESS OVERVIEW

12.2.8 TECHNICS GROUP

TABLE 140 TECHNICS GROUP: BUSINESS OVERVIEW

12.2.9 GEOTEC SURVEYS LTD.

TABLE 141 GEOTEC SURVEYS LTD.: BUSINESS OVERVIEW

12.2.10 LANDSCOPE ENGINEERING LTD

TABLE 142 LANDSCOPE ENGINEERING LTD: BUSINESS OVERVIEW

12.2.11 PLOWMAN CRAVEN LIMITED

TABLE 143 PLOWMAN CRAVEN LIMITED: BUSINESS OVERVIEW

12.2.12 ASIAN CONTEC LIMITED

TABLE 144 ASIAN CONTEC LIMITED: BUSINESS OVERVIEW

12.2.13 UTIL LOCATE

TABLE 145 UTIL LOCATE: BUSINESS OVERVIEW

12.2.14 PENHALL COMPANY

TABLE 146 PENHALL COMPANY: BUSINESS OVERVIEW

12.2.15 CHAITANYA INSTRUMENTS PVT LTD

TABLE 147 CHAITANYA INSTRUMENTS PVT LTD: BUSINESS OVERVIEW

12.2.16 DETECTION SERVICES

TABLE 148 DETECTION SERVICES: BUSINESS OVERVIEW

13 ADJACENT & RELATED MARKET (Page No. - 185)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 GPR MARKET, BY TYPE

TABLE 149 GPR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 150 GPR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.4 HANDHELD SYSTEMS

13.4.1 CONCRETE INVESTIGATION TO DRIVE DEMAND FOR HANDHELD GPR SYSTEMS

13.5 CART-BASED SYSTEMS

13.5.1 CART-BASED SYSTEMS ARE CONSIDERED HIGHEST-QUALITY GROUND INSPECTION DATA PROVIDERS

13.6 VEHICLE-MOUNTED SYSTEMS

13.6.1 TRANSPORTATION INFRASTRUCTURE TO DRIVE DEMAND FOR VEHICLE-MOUNTED SYSTEMS

14 APPENDIX (Page No. - 188)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

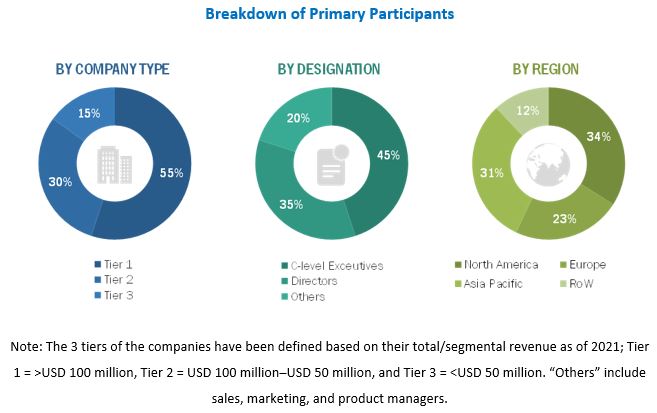

The study involved four major activities in estimating the size for utility locator market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up and top-down both approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements, press release); trade, business, and professional associations; white papers, utility locator-related journals, and certified publications; articles by recognized authors; gold and silver standard websites; and directories.

Secondary research was mainly conducted to obtain key information about the market value chain, the industry supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the utility locator market through secondary research. Several primary telephonic interviews have been conducted with key opinion leaders from the demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW). Moreover, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report for the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate, forecast and validate the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out to list the key information/insights pertaining to utility locator market.

Major players in the utility locator market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. The entire research methodology included the study of annual and financial reports of top players and interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative). All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Utility locator Market: Bottom-Up Approach

- Identifying industries that are either using or will use utility locator solutions

- Tracking leading companies and system integrators operating across various industries

- Deriving the size of the utility locator market through the data sanity method; analyzing revenues of more than 20 key providers through their annual reports and press releases and summing them up to estimate the overall market size

- Conducting multiple discussions with key opinion leaders to understand the demand for utility locator and analyzing the breakup of the scope of work carried out by each major company

- Carrying out the market trend analysis to obtain the CAGR of the utility locator market by understanding the product penetration rate in each industry and analyzing the demand and supply of utility locator in different vertical

- Assigning a percentage to the overall revenue or, in a few cases, to segmental revenues of each company to derive their revenues from the sales of utility locator systems and services. This percentage for each company was assigned based on their product portfolios

- Verifying and crosschecking estimates at every level through discussions with key opinion leaders, including CXOs, directors, and operation managers, and with domain experts at MarketsandMarkets

- Studying various paid and unpaid information sources such as annual reports, press releases, white papers, and databases

Utility locator Market: Top-Down Approach

- MarketsandMarkets focuses on the top-line expenditures and investments made throughout the utility locator ecosystem to manufacture new equipment/systems and retrofit the existing ones.

- The information related to revenues generated by key manufacturers and service providers of utility locator was studied and analyzed.

- Multiple on-field discussions were carried out with key opinion leaders of leading companies involved in manufacturing and services of utility locator.

- The geographical split was estimated using secondary sources based on various factors, such as the number of players in a specific country or region and the utility equipment and services provided by these players.

Data Triangulation

After arriving at the overall size of the utility locator market from the estimation process explained above, the total market was split into several segments and subsegments. The market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the utility locator market size, in terms of value, by technique, offering, target, and vertical

-

To describe and forecast the market size, in terms of value, by region—North America, Europe,

Asia Pacific, and the Rest of the World (RoW) - To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing market growth

- To provide a detailed overview of the process flow of the utility locator market

- To analyze opportunities for stakeholders in the utility locator market by identifying its high-growth segments

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2 along with detailing the competitive leadership and analyzing growth strategies such as product launches and developments, expansions, acquisitions, agreements, mergers, joint ventures, and partnerships of leading players

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Utility Locator Market

Does the market size include tracer wires (also known as locator wires or lead wires)? That is the portion we are really interested in. If so, would you please send over a copy of the sample report?

Looking for size of the US Utility Locator Market by State and by player with growth projections.