US Anticoagulation Therapy Market by Product ((Anticoagulants Drugs (NOACs, Warfarin)), PT/INR Devices (In-Office, Home Testing)), Service Type (Testing & Consulting), Type of Clinic (Hospital Associated, Independent & Pharmacy-based) - Global Forecast to 2022

[86 Pages Report] The US anticoagulation therapy market is projected to reach USD 27.83 Billion by 2022 from USD 17.25 Billion in 2016, at a CAGR of 8.5%. The market is segmented into products (anticoagulation drugs and PT/INR testing devices) and anticoagulation clinics. The growth in the anticoagulation drugs market is primarily driven by the rising incidence of venous thromboembolism, atrial fibrillation, and stroke; long-term administration and high volume of recurring sales of anticoagulation drugs; and increasing demand for novel oral anticoagulants (NOACs). On the other hand, the high cost of NOACs and requirement of significant investments in the development of anticoagulation drugs are the major factors restraining the growth of this market. In addition, the growth in the anticoagulation clinics market is primarily driven by the increasing prevalence of cardiovascular diseases & blood disorders, high level of medication adherence associated with clinics, and rising aging population.

Years considered for this report

- 2016 – Base Year

- 2017 – Estimated Year

- 2022 – Projected Year

Objectives of the Study

- To define, describe, and forecast the market on the basis of anticoagulation drugs, PT/INR testing devices, and anticoagulation clinics

- To provide detailed information regarding the major factors influencing growth of the market (drivers, restraints, and industry-specific opportunities)

- To analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall US anticoagulation therapy industry

- To forecast the size of the US anticoagulation therapy market

- To profile key market players in the US anticoagulation market

- To track and analyze competitive developments such as product launches and approvals in the market

Research Methodology

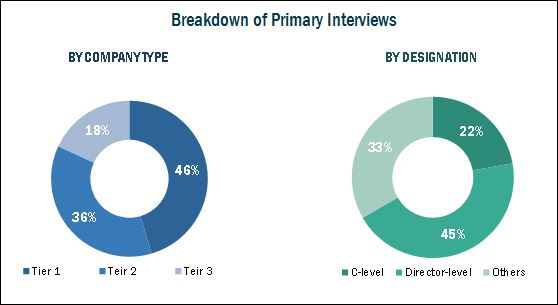

Top-down and bottom-up approaches were used to validate the size of the US anticoagulation therapy market and estimate the size of various other dependent submarkets. Major players in the market were identified through secondary sources; directories; databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, journals and their market revenues were determined through primary and secondary research. Secondary research included in the study are the annual and financial reports of top market players, whereas primary research included extensive interviews with the key opinion leaders such as CEOs, directors, and marketing executives. The percentage splits, shares, and breakdowns of the product and clinic markets were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The US anticoagulation therapy market is consolidated in nature. C. H. Boehringer Sohn (Germany), Bristol-Myers Squibb (US), Johnson & Johnson (US), Pfizer (US), Daiichi Sankyo (Japan), and Portola Pharmaceuticals (US) are the major market players in the global market for drugs while Roche (Switzerland), Abbott (US), Siemens (Germany), Alere (US), and CoaguSense (US) are the major market players in the US anticoagulation therapy market for PT/INR home testing devices.

Target Audience:

- Healthcare service providers

- Healthcare service payers/insurance payers

- Pharmaceutical companies

- Medical device companies

- Venture capitalists

- Government bodies

- Business research and consulting firms

Scope of the Report

The research report categorizes the US anticoagulation therapy market into the following segments and subsegments:

-

US Anticoagulation Therapy (Products) Market

- Us Anticoagulation Therapy (Products) Market For Drugs

- Novel Oral Anticoagulants (NOACs)

- Warfarin (VKA)

- Other Drugs

-

US Anticoagulation Therapy (Products) Market For PT/INR Testing Devices

- In-Office Testing Devices

- Analyzers

- Reagents and Kits

- Home Testing Devices

-

US Anticoagulation Therapy Market For Clinics

-

US Anticoagulation Therapy Market For Clinics, By Type Of Service

- Testing Services

- Consulting Services

-

Us Anticoagulant Therapy Market For Clinics, By Type Of Clinic

- Hospital Associated Clinic

- Independent Clinics

- Pharmacy-based Clinics

-

US Anticoagulation Therapy Market For Clinics, By Type Of Service

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of top companies

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The US anticoagulation therapy market is projected to reach USD 27.83 Billion by 2022 from an estimated USD 18.49 Billion in 2017, at a CAGR of 8.5%. Market growth is primarily driven by the rising incidence of venous thromboembolism, atrial fibrillation, and stroke; long-term administration and high volume of recurring sales of anticoagulation drugs; and increasing demand for novel oral anticoagulants (NOACs).

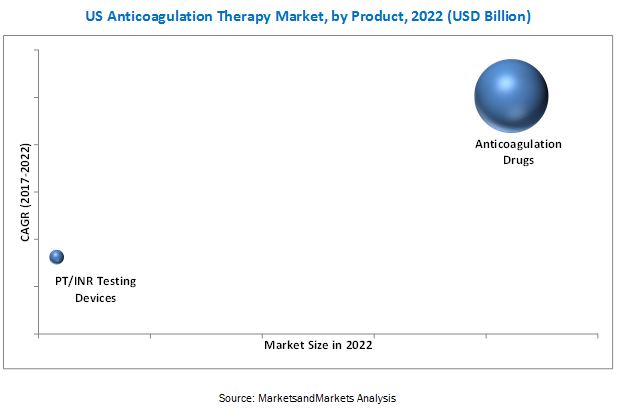

In this report, the US anticoagulation therapy market is segmented on the basis of products and clinics. On the basis of products, the market is segmented into anticoagulation drugs and PT/INR testing devices.

Based on drug type, the anticoagulation therapy market for drugs is segmented into NOACs, warfarin (VKA), and other drugs. In 2016, the NOACs segment dominated the US anticoagulation therapy market for drugs. Due to the better safety and efficacy of NOACs as compared to traditional therapies, the adoption of NOACs is higher as compared to traditional drugs. In addition, key market players such as Portola Pharmaceuticals (received FDA approval for its NOAC Betrixaban in July 2017) are focusing on the development of NOACs in order to capitalize on the growth opportunities presented by this shift in market dynamics. Consequently, many other companies are also expected to focus on developing more safe and efficient NOACs in the coming years; this will ensure the continued growth of this segment.

The anticoagulation therapy market for PT/INR testing devices is segmented into in-office testing devices and home testing devices. The in-office devices segment dominated the US anticoagulation therapy market for PT/INR testing devices. The large share of this segment is mainly attributed to the large number of patients opting for in-office testing services. However, the home testing devices segment is expected to grow at the highest CAGR due to its advantages such as convenience, time & cost savings, and quick result generation. Additionally, the cost of test devices and the tests themselves are often reimbursable.

The anticoagulation therapy market for clinics is segmented on the basis of type of services and clinics. The types of clinics include hospital associated clinics, independent clinics, and pharmacy-based clinics while the types of services include testing services and consulting services. The pharmacy-based clinics segment is expected to register the highest CAGR during the forecast period. In the US, the number of pharmacy-based anticoagulation clinics has increased significantly in the last few years. This is due to the fact that better results are achieved when therapy is managed by expert pharmacists rather than care provided by family physicians. Moreover, the cost of therapy provided by pharmacy-based anticoagulation clinics is comparatively lesser than independent and hospital associated anticoagulation clinics which is expected to drive the market for pharmacy-based anticoagulation clinics.

C. H. Boehringer Sohn (Germany), Bristol-Myers Squibb (US), Johnson & Johnson (US), Pfizer (US), Daiichi Sankyo (Japan), and Portola Pharmaceuticals (US) are the major market players in the global market for drugs while Roche (Switzerland), Abbott (US), Siemens (Germany), Alere (US), and CoaguSense (US) are the major market players in the US anticoagulation therapy market for PT/INR home testing devices.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 13)

2.1 Research Approach

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary Interviews

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Market Sizing Methodology for Anticoagulation Drugs and PT/INR Testing Devices

2.2.2 Market Sizing Methodology for Anticoagulation Therapy for Clinics

2.2.3 Market Breakdown and Data Triangulation

2.2.4 Market Share Estimation

2.2.5 Assumptions for the Study

3 Market Overview (Page No. - 23)

3.1 Market Dynamics: Anticoagulation Drugs

3.1.1 Drivers

3.1.1.1 Rising Incidence of Venous Thromboembolism, Atrial Fibrillation, and Stroke

3.1.1.2 Increasing Demand for Noacs as Alternatives to Warfarin

3.1.1.3 Growing Number of Patients Requiring Lifelong Anticoagulation Therapy

3.1.2 Market Restraints

3.1.2.1 High Price of Noacs

3.1.2.2 High Development Expenditure, Stringent Regulations

3.1.3 Market Opportunities

3.1.3.1 Increase in Outpatient Management of Anticoagulation Therapy

3.1.3.2 Development of Noac Reversal Agents

3.2 Market Dynamics: Anticoagulation Clinics

3.2.1 Key Market Drivers

3.2.1.1 Increasing Prevalence of Cvd and Blood Disorders

3.2.1.2 High Level of Medication Adherence

3.2.1.3 Growth in the Geriatric Population

3.2.2 Market Restraints

3.2.2.1 Rising Adoption of Noacs

3.2.2.2 Demand for Alternative Treatments

3.2.2.3 Home PT/INR Testing

3.2.3 Market Opportunities

3.2.3.1 Development of Alternative Approaches

4 Market Insights (Page No. - 33)

4.1 Introduction

4.2 Number of Anticoagulation Clinics

4.3 Business Models of Anticoagulation Clinics

4.3.1 Revenue Structure

4.3.2 Infrastructure Requirements for Sustaining in the Market

4.3.2.1 Role of Teleconsultation and Telemonitoring

4.3.2.2 Role of Electronic Health Record in Anticoagulation Clinics

4.4 Reimbursement Scenario (CMS & Private Payers)

4.4.1 Reimbursement Rate (2016–2017)

4.4.1.1 Reimbursement for PT/INR Testing

4.4.1.2 Reimbursement for Evaluation and Management Service Associated With Anticoagulation Therapy

4.4.2 Reimbursement Trends for Anticoagulation Therapy

4.5 Impact of New Oral Anticoagulants (Noacs) on Anticoagulation Clinics

5 US Anticoagulation Therapy (Products) Market (Page No. - 51)

5.1 US Anticoagulation Therapy (Products) Market for Drugs

5.1.1 Introduction

5.1.2 Novel Oral Anticoagulants

5.1.3 Warfarin (Vitamin K Antagonist)

5.1.4 Other Drugs

5.2 US Anticoagulation Therapy (Products) Market for PT/INR Testing Devices

5.2.1 Introduction

5.2.2 In-Office Testing Devices

5.2.3 Home Testing Devices

6 US Anticoagulation Therapy Market for Clinics (Page No. - 59)

6.1 Introduction

6.2 US Anticoagulation Therapy Market for Clinics, By Type of Service

6.2.1 Introduction

6.2.2 Testing Services

6.2.3 Consulting Services

6.3 US Anticoagulant Therapy Market for Clinics, By Type of Clinic

6.3.1 Introduction

6.3.2 Hospital Associated Clinics

6.3.3 Independent Clinics

6.3.4 Pharmacy-Based Clinics

7 Company Profiles (Page No. - 67)

(Business Overview, Products Offered, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments.)*

7.1 Introduction

7.2 Home Testing Devices Manufacturers

7.2.2 Abbott Laboratories

7.2.3 Siemens AG

7.2.4 Coagusense, Inc.

7.2.5 Alere Inc.

7.3 Drug Manufacturers

7.3.1 C. H. Boehringer Sohn AG & Co. Kg

7.3.2 Bristol-Myers Squibb Company

7.3.3 Johnson & Johnson

7.3.4 Pfizer, Inc.

7.3.5 Daiichi Sankyo Company, Limited

7.3.6 Portola Pharmaceuticals, Inc.

*Details on Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, Key Relationships Might Not Be Captured in Case of Unlisted Companies.

List of Tables (29 Tables)

Table 1 Impact Analysis: Market Drivers

Table 2 Cost Difference: Noac vs Warfarin, Per Patient Per Month, in the US (2015)

Table 3 Impact Analysis: Market Restraints

Table 4 Pipeline Assessment: Anticoagulant Reversal Agents

Table 5 Impact Analysis: Market Opportunities

Table 6 Impact Analysis: Market Drivers

Table 7 Impact Analysis: Market Restraints

Table 8 Impact Analysis: Market Opportunities

Table 9 Component Cost for Different Treatment Settings of Anticoagulation Clinics

Table 10 Laboratory PT/INR Testing Reimbursement Codes & Rates

Table 11 Physician-Directed Home PT/INR Testing Hcpcs Reimbursement Codes & Rates (National)

Table 12 Physician-Directed Home PT/INR Testing Hcpcs Reimbursement Rates (State-Wise)

Table 13 Home PT/INR Testing Service Reimbursement Ambulatory Payment Classifications (Apcs) Codes & Rates Under Hospital Outpatient Prospective Payment System

Table 14 State Regulatory Bodies for PT/INR Test Reimbursement

Table 15 Reimbursement Rate for E&M Services During Anticoagulation Therapy (2015)

Table 16 Physician-Directed Home PT/INR Testing Hcpcs Reimbursement Codes & Rates, 2009 vs 2016 (National Rate)

Table 17 Laboratory PT/INR Testing Reimbursement Codes & Rates, 2009 vs 2016 (National Rate)

Table 18 Preliminary Payment Rates in 2018, 2019, and 2020 (With 10% Reduction Cap Wherever Applicable)

Table 19 Coagulation Assay Responsiveness to Noacs

Table 20 US Anticoagulation Therapy (Products) Market for Drugs, By Type, 2015–2022 (USD Million)

Table 21 List of Novel Oral Anticoagulants Available in the US Market

Table 22 Average Cost of Oral Anticoagulants Per Patient Per Month in the US (2015)

Table 23 US Anticoagulation Therapy (Products) Market for PT/INR Testing Devices, By Type, 2015–2022 (USD Million)

Table 24 US In-Office PT/INR Testing Devices Market, 2015–2022 (USD Million)

Table 25 Leading Home Testing Devices Available in the US Market

Table 26 Statistics of Thromboembolic Conditions in the Us

Table 27 US Anticoagulation Therapy Market for Clinics, By Type of Service, 2015–2022 (USD Million)

Table 28 Major Anticoagulation Clinics in the Us

Table 29 US Anticoagulant Therapy Market for Clinics, By Type of Clinic, 2015–2022 (USD Million)

List of Figures (25 Figures)

Figure 1 US Anticoagulation Therapy Market Segmentation

Figure 2 Secondary Research Approach

Figure 3 Primary Research Approach

Figure 4 Market Sizing Approach

Figure 5 Data Triangulation Methodology

Figure 6 US Anticoagulation Drugs Market: Drivers, Restraints, and Opportunities

Figure 7 US Anticoagulation Therapy Market for Clinics: Drivers, Restraints & Opportunities

Figure 8 Number of Patient Visits to Anticoagulation Clinics, By Line of Therapy (2016 vs 2022)

Figure 9 Average Number/ Percentage Share of Noac Therapy Patients Visiting Anticoagulant Clinics, 2015 vs 2020

Figure 10 Evolution of Anticoagulants

Figure 11 Percentage of Anticoagulants Prescribed for Different Indications

Figure 12 Noacs, the Largest Segment in the US Anticoagulation Therapy (Products) Market for Drugs

Figure 13 In-Office Testing Devices, the Largest Segment in the US Anticoagulation Therapy (Products) Market for PT/INR Testing Devices

Figure 14 Testing Services to Dominate the global Market for Clinics in 2017

Figure 15 Hospital-Associated Clinics Segment Will Continue to Dominate the US Anticoagulation Therapy Market for Clinics in 2022

Figure 16 F. Hoffmann-La Roche AG: Company Snapshot (2016)

Figure 17 Abbott Laboratories: Company Snapshot (2016)

Figure 18 Siemens AG: Company Snapshot (2016)

Figure 19 Alere Inc.: Company Snapshot (2016)

Figure 20 C. H. Boehringer Sohn AG & Co. Kg: Company Snapshot (2016)

Figure 21 Bristol-Myers Squibb Company: Company Snapshot (2016)

Figure 22 Johnson & Johnson: Company Snapshot (2016)

Figure 23 Pfizer, Inc.: Company Snapshot (2016)

Figure 24 Daiichi Sankyo Company, Limited: Company Snapshot (2015)

Figure 25 Portola Pharmaceuticals, Inc.: Company Snapshot (2016)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in US Anticoagulation Therapy Market