Unattended Ground Sensors (UGS) Market by Sensor Type (Seismic, Acoustic, Magnetic, and Infrared), Deployment (Hand-Emplaced, and Air-Delivered), End-User (Security, and Critical Infrastructure), and Region - Global Forecast to 2022

The unattended ground sensors market was valued at USD 352.5 Million in 2016 and is expected to reach USD 457.9 Million by 2022 at a CAGR of 4.71% during the forecast period.

The years considered for the study are as follows:

- Base Year – 2016

- Estimated Year – 2017

- Projected Year – 2022

- Forecast Period – 2017 to 2022

2016 has been considered as the base year for company profiles. Whenever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To define, estimate, segment, and forecast the unattended ground sensor market on the basis of sensor type, deployment, and end-user

- To forecast the market size of segments with respect to various regions such as North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To identify, analyze, describe, and evaluate key drivers, restraints, opportunities, and challenges impacting the growth of the unattended ground sensor market

- To identify industry trends, market trends, and technology trends currently prevailing in the unattended ground sensor market

- To anticipate the degree of competition in the market by identifying key market players

- To provide company profiles of key companies in the unattended ground sensor market based on their product portfolios, financial positions, and key growth strategies

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market

- To track and analyze competitive developments such as contracts, agreements, acquisitions, collaborations, partnerships & joint ventures, and new product launches by key players in the unattended ground sensor market

The unattended ground sensors market is projected to grow at a CAGR of 4.71% from 2017 to 2022, to reach a market size of USD 457.9 Million by 2022 from USD 363.8 Million in 2017. This growth can be attributed to the changing nature of warfare and rise in the terrorism, geopolitical issues, and insurgencies across countries in the world.

Based on sensor type, the unattended ground sensors market is segmented into seismic, acoustic, magnetic, and infrared. Seismic sensors is expected to be the largest segment of the unattended ground sensor market. These sensors provide direction of intruder’s movement, foot-borne, and vehicles based on seismic signature they produce. Also, recent technological advancements in the seismic sensor made it more efficient and less prone to false alarms.

Security is the largest segment of the unattended ground sensors market, by end-user. Unattended ground sensors systems enable the military and public security forces to deter intruders from entering or crossing borders. Thus, the increasing applicability of UGS in the military and public security sectors is projected to drive the growth of the unattended ground sensors market.

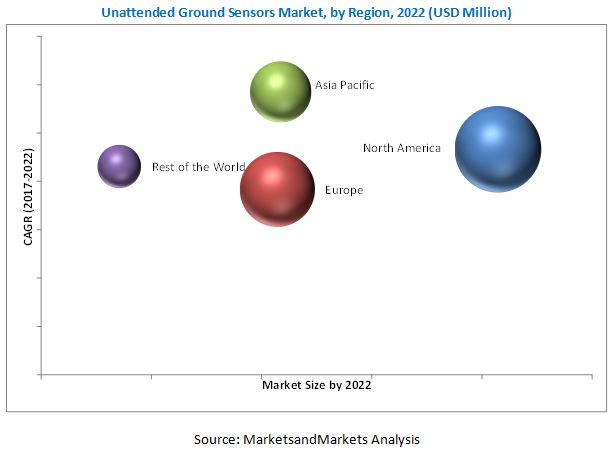

In this report, the unattended ground sensor market has been analyzed with respect to regions, namely, North America, Europe, Asia Pacific, and Rest of the World. North America is expected to lead the global unattended ground sensor market during the forecast period, owing to the increasing use of UGS in overseas combat operations carried out by the US Army in countries, such as Afghanistan and Iraq.

Asia Pacific is estimated to be the fastest-growing market for unattended ground sensors from 2017 to 2022. The increasing demand for network-centric warfare systems from military forces of various countries in the Asia Pacific region is projected to drive the growth of the unattended ground sensor market in this region. China, India, and Japan are the key markets for unattended ground sensors in this region. China is the largest market in Asia Pacific. The People's Liberation Army (PLA) in China has undertaken various reforms to elevate Integrated Network Electronic Warfare (INEW) to a strategic level of combat. In India, the development of tactical command, communication, and intelligence systems by the Indian Army is a major step towards enhancing UGS capabilities, which is fueling the demand for advanced unattended ground sensors in the country.

Unattended ground sensors are primarily used in the military sector; these sensors also monitor critical infrastructures, such as utilities and commercial & industrial facilities. The changing nature of warfare is one of the most significant factors projected to drive the growth of the unattended ground sensor market. The increase in transnational conflicts has led to a rise in the defense expenditure of various emerging countries worldwide. Territorial disputes and terror attacks in Asia Pacific, the Middle East, and Africa have led to increased investments by the government of countries in these regions to develop advanced electronic systems, such as UGS. However, the operational issues associated with UGS is restraining the market growth, and susceptibility of sensor networks to cyber attacks pose a challenge in the use of unattended ground sensors. But, growing need for enhanced situational awareness will positively impact the market growth.

Leading players in the unattended ground sensor market include Northrop Grumman (US), Textron (US), Elbit Systems (Israel), L3 Communications (US), DTC (US), and others. Contracts & agreements was the strategy most commonly adopted by the top players, constituting more than one-third of the total developments from 2012 to 2017.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Supply-Side & Demand-Side Indicators

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 Increase in Defense Spending

2.2.3 Supply-Side Indicators

2.2.3.1 Technological Advancements in Sensors

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Unattended Ground Sensor Market

4.2 Asia Pacific Unattended Ground Sensor Market, By Sensor Type and Country

4.3 Unattended Ground Sensors Market, By Deployment

4.4 Unattended Ground Sensors Market, By Region

4.5 Unattended Ground Sensors Market, By End User

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Changing Nature of Warfare

5.2.1.2 Terrorism, Geopolitical Issues, and Rising Insurgencies in Nations

5.2.2 Restraints

5.2.2.1 Operational Issues Associated With UGS

5.2.3 Opportunities

5.2.3.1 Growing Need for Enhanced Situational Awareness

5.2.3.2 Rising Incidences of Border Trespassing

5.2.4 Challenges

5.2.4.1 Susceptibility of Sensor Networks to Cyberattacks

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 UGS & Future Combat Systems

6.2.1 Tactical-Unattended Ground Sensors (T-UGS)

6.2.2 Urban-Unattended Ground Sensors (U-UGS)

6.2.3 Dissolution of Fcs

6.3 Relevant Technology Trends

6.3.1 UGS Design With High-Density Fpga

6.3.2 Convergence of Cyber Operations and Electronic Warfare on the Battlefield

6.3.3 Plug-and-Play UGS

6.3.4 UGS Algorithm

6.4 Porter’s Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.1.1 Requirement of Huge Investment

6.4.1.2 Policy, Regulatory, and Legal Obstacles

6.4.1.3 Information Shared With Suppliers and Manufacturers is Highly Sensitive

6.4.2 Threat of Substitutes

6.4.2.1 Unavailability of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.3.1 High Switching Cost

6.4.3.2 Requirement of Customized Components and Parts

6.4.4 Bargaining Power of Buyers

6.4.4.1 High Level of Product Differentiation

6.4.4.2 High Switching Cost

6.4.4.3 Difficulty in Switching Suppliers

6.4.5 Intensity of Competitive Rivalry

6.4.5.1 Limited Number of Firms

6.5 Innovations & Patent Registrations

7 Unattended Ground Sensors Market, By Sensor Type (Page No. - 50)

7.1 Introduction

7.2 Seismic

7.3 Acoustic

7.4 Magnetic

7.5 Infrared

8 Unattended Ground Sensors Market, By Deployment (Page No. - 57)

8.1 Introduction

8.2 Air-Delivered

8.3 Hand-Emplaced

9 Unattended Ground Sensors Market, By End User (Page No. - 60)

9.1 Introduction

9.2 Security

9.2.1 Military

9.2.2 Public Security

9.3 Critical Infrastructure

9.3.1 Utilities

9.3.2 Industrial & Commercial Facilities

10 Unattended Ground Sensors Market, By Region (Page No. - 68)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Russia

10.3.2 UK

10.3.3 France

10.3.4 Germany

10.3.5 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 Rest of Asia Pacific

10.5 Rest of the World (RoW)

11 Company Profiles (Page No. - 94)

(Overview, Products and Services, Financials, Strategy & Development)*

11.1 Market Rank Analysis, 2016

11.2 Textron

11.3 Northrop Grumman

11.4 Thales

11.5 Lockheed Martin

11.6 Raytheon

11.7 Elbit Systems

11.8 Leonardo

11.9 Applied Research Associates (ARA)

11.10 Harris Corporation

11.11 L3 Technologies

11.12 Domo Tactical Communications (DTC)

11.13 MCQ

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 121)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (62 Tables)

Table 1 List of Ongoing Geopolitical Issues and Conflicts

Table 2 Innovations & Patent Registrations

Table 3 Unattended Ground Sensors Market Size, By Sensor Type, 2015-2022 (USD Million)

Table 4 Seismic: Market Size, By Region, 2015−2022 (USD Million)

Table 5 Seismic: Market Size, By End User, 2015−2022 (USD Million)

Table 6 Acoustic: Market Size, By Region, 2015−2022 (USD Million)

Table 7 Acoustic: Market Size, By End User, 2015−2022 (USD Million)

Table 8 Magnetic: Market Size, By Region, 2015−2022 (USD Million)

Table 9 Magnetic: Market Size, By End User, 2015−2022 (USD Million)

Table 10 Infrared: Market Size, By Region, 2015−2022 (USD Million)

Table 11 Infrared: Unattended Ground Sensors Market Size, By End User, 2015−2022 (USD Million)

Table 12 Unattended Ground Sensors Market Size, By Deployment, 2015-2022 (USD Million)

Table 13 Air Delivered: Unattended Ground Sensors Market Size, By Region, 2015−2022 (USD Million)

Table 14 Hand Emplaced: Unattended Ground Sensors Market Size, By Region, 2015−2022 (USD Million)

Table 15 Unattended Ground Sensors Market Size, By End User, 2015-2022 (USD Million)

Table 16 Security: Unattended Ground Sensors Market Size, By Region, 2015−2022 (USD Million)

Table 17 Security: Market Size, By Sensor Type, 2015−2022 (USD Million)

Table 18 Security: Market Size, By Application, 2015−2022 (USD Million)

Table 19 Military: Market Size, By Region, 2015−2022 (USD Million)

Table 20 Public Security: Unattended Ground Sensors Market Size, By Region, 2015−2022 (USD Million)

Table 21 Critical Infrastructure: Market Size, By Region, 2015−2022 (USD Million)

Table 22 Critical Infrastructure: Market Size, By Sensor Type, 2015−2022 (USD Million)

Table 23 Critical Infrastructure: Market Size, By Application, 2015−2022 (USD Million)

Table 24 Utilities: Unattended Ground Sensors Market Size, By Region, 2015−2022 (USD Million)

Table 25 Industrial & Commercial Facilities: Unattended Ground Sensors Market Size, By Region, 2015−2022 (USD Million)

Table 26 Unattended Ground Sensors Market Size, By Region, 2015-2022 (USD Million)

Table 27 North America: Market Size, By Sensor Type, 2015-2022 (USD Million)

Table 28 North America: Market Size, By Deployment, 2015−2022 (USD Million)

Table 29 North America: Unattended Ground Sensors Market Size, By End User, 2015−2022 (USD Million)

Table 30 North America: Unattended Ground Sensors Market Size, By Security Application, 2015−2022 (USD Million)

Table 31 North America: Unattended Ground Sensors Market Size, By Critical Infrastructure Application, 2015−2022 (USD Million)

Table 32 North America Unattended Ground Sensors Market Size, By Country, 2015-2022 (USD Million)

Table 33 US: Unattended Ground Sensors Market Size, By Sensor Type, 2015-2022 (USD Million)

Table 34 Canada: Unattended Ground Sensors Market Size, By Sensor Type, 2015-2022 (USD Million)

Table 35 Mexico: Market Size, By Sensor Type, 2015−2022 (USD Million)

Table 36 Europe: Market Size, By Sensor Type, 2015−2022 (USD Million)

Table 37 Europe: Market Size, By Deployment, 2015−2022 (USD Million)

Table 38 Europe: Unattended Ground Sensors Market Size, By End User, 2015−2022 (USD Million)

Table 39 Europe: Unattended Ground Sensors Market Size, By Security Application, 2015−2022 (USD Million)

Table 40 Europe: Unattended Ground Sensors Market Size, By Critical Infrastructure Application, 2015−2022 (USD Million)

Table 41 Europe: Unattended Ground Sensors Market Size, By Country, 2015-2022 (USD Million)

Table 42 Russia: Unattended Ground Sensors Market Size, By Sensor Type, 2015-2022 (USD Million)

Table 43 UK: Unattended Ground Sensors Market Size, By Sensor Type, 2015-2022 (USD Million)

Table 44 France: Unattended Ground Sensors Market Size, By Sensor Type, 2015-2022 (USD Million)

Table 45 Germany: Unattended Ground Sensors Market Size, By Sensor Type, 2015-2022 (USD Million)

Table 46 Rest of Europe: Unattended Ground Sensor Market Size, By Sensor Type, 2015-2022 (USD Million)

Table 47 Asia Pacific: Unattended Ground Sensors Market Size, By Sensor Type, 2015-2022 (USD Million)

Table 48 Asia Pacific: Unattended Ground Sensors Market Size, By Deployment, 2015-2022 (USD Million)

Table 49 Asia Pacific: Unattended Ground Sensors Market Size, By End User, 2015-2022 (USD Million)

Table 50 Asia Pacific: Unattended Ground Sensors Market Size, By Security Application, 2015-2022 (USD Million)

Table 51 Asia Pacific: Market Size, By Critical Infrastructure Application, 2015-2022 (USD Million)

Table 52 Asia Pacific: Unattended Ground Sensors Market Size, By Country, 2015-2022 (USD Million)

Table 53 China: Unattended Ground Sensor Market Size, By Sensor Type, 2015-2022 (USD Million)

Table 54 India: Unattended Ground Sensor Market Size, By Sensor Type, 2015-2022 (USD Million)

Table 55 Japan: Unattended Ground Sensor Market Size, By Sensor Type, 2015-2022 (USD Million)

Table 56 Rest of Asia Pacific: Unattended Ground Sensor Market Size, By Sensor Type, 2015-2022 (USD Million)

Table 57 Rest of the World: Market Size, By Sensor Type, 2015-2022 (USD Million)

Table 58 Rest of the World: Market Size, By Deployment, 2015-2022 (USD Million)

Table 59 Rest of the World: Market Size, By End User, 2015-2022 (USD Million)

Table 60 Rest of the World: Unattended Ground Sensor Market Size, By Security Application, 2015-2022 (USD Million)

Table 61 Rest of the World: Market Size, By Critical Infrastructure Application, 2015-2022 (USD Million)

Table 62 Rest of the World: Unattended Ground Sensor Market Size, By Region, 2015-2022 (USD Million)

List of Figures (49 Figures)

Figure 1 Unattended Ground Sensors Market Segmentation

Figure 2 Regional Scope

Figure 3 Research Process Flow

Figure 4 Research Design

Figure 5 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 6 Global Distribution of Military Expenditure, 2016

Figure 7 Military Expenditure in Asia & Oceania, 2006-2016 (USD Billion)

Figure 8 Bottom-Up Approach

Figure 9 Top-Down Approach

Figure 10 Data Triangulation

Figure 11 Unattended Ground Sensors Market, By Sensor Type, 2017 & 2022 (USD Million)

Figure 12 Unattended Ground Sensor Market, By End User, 2017 & 2022 (USD Million)

Figure 13 Unattended Ground Sensor Market, By Deployment, 2017 & 2022 (USD Million)

Figure 14 Unattended Ground Sensor Market, By Region

Figure 15 The Changing Nature of Warfare is Expected to Drive the Growth of the Unattended Ground Sensors Market From 2017 to 2022

Figure 16 The Seismic Sensor Type Segment is Estimated to Account for the Largest Share of the Asia Pacific Unattended Ground Sensors Market in 2017

Figure 17 The Hand-Emplaced Deployment Segment is Projected to Grow at A Higher CAGR as Compared to Air-Delivered Deployment Segment From 2017 to 2022

Figure 18 The Unattended Ground Sensor Market in China is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 19 The Security End User Segment is Projected to Lead the Unattended Ground Sensor Market From 2017 to 2022

Figure 20 Unattended Ground Sensor Market: Drivers, Restraints, Opportunities and Challenges

Figure 21 US Department of Defense – Proposed Rdt&E Budget, 2017

Figure 22 Total Illegal Alien Apprehensions in the US (2010–2016)

Figure 23 CBP & Ice Annual Budgets (2006–2016)

Figure 24 UGS Technology Trends

Figure 25 Porter’s Five Forces Analysis

Figure 26 Unattended Ground Sensor Market, By Sensor Type, 2017 & 2022 (USD Million)

Figure 27 Unattended Ground Sensor Market, By Deployment, 2017 & 2022

Figure 28 Unattended Ground Sensor Market, By End User, 2017 & 2022 (USD Million)

Figure 29 Unattended Ground Sensor Market: Regional Snapshot (2017)

Figure 30 North America Unattended Ground Sensor Market Snapshot

Figure 31 Europe Unattended Ground Sensor Market Snapshot

Figure 32 Asia Pacific Unattended Ground Sensors Market Snapshot

Figure 33 Revenue & Product-Based Rank Analysis of Top Players in the Unattended Ground Sensor Market

Figure 34 Textron Systems Corporation: Company Snapshot

Figure 35 Textron: SWOT Analysis

Figure 36 Northrop Grumman: Company Snapshot

Figure 37 Northrop Grumman: SWOT Analysis

Figure 38 Thales: Company Snapshot

Figure 39 Thales: SWOT Analysis

Figure 40 Lockheed Martin: Company Snapshot

Figure 41 Lockheed Martin: SWOT Analysis

Figure 42 Raytheon: Company Snapshot

Figure 43 Raytheon Company: SWOT Analysis

Figure 44 Elbit Systems: Company Snapshot

Figure 45 Elbit Systems: SWOT Analysis

Figure 46 Leonardo: Company Snapshot

Figure 47 Harris Corporation: Company Snapshot

Figure 48 Harris Corporation: SWOT Analysis

Figure 49 L3 Technologies: Company Snapshot

Research Methodology

This research study involved the usage of extensive secondary sources including directories; databases of articles; journals on unattended ground sensors, company newsletters; and information portals such as D&B Hoovers, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the market. Primary sources are several industry experts from the core and related industries, OEMs, vendors, suppliers, technology developers, alliances, and organizations. These sources are related to all the segments of the value-chain of this industry.

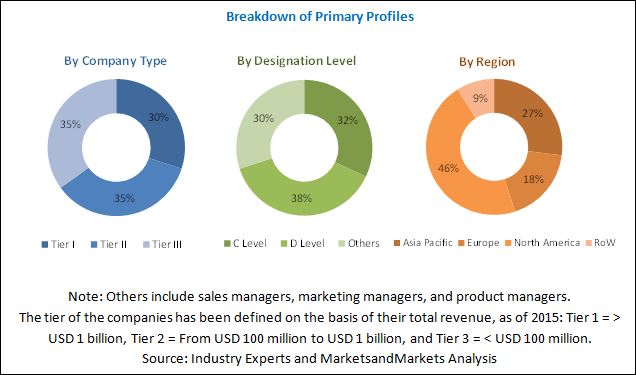

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess prospects. After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure given below illustrates the breakdown of primaries conducted during the research study on the basis of company type, designation, and region, conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

The unattended ground sensors ecosystem comprises OEMs such as Northrop Grumman (US), Textron (US), Elbit Systems (Israel), L3 Communications (US), DTC (US), and others.

Target Audience:

- Manufacturers of Unattended Ground Sensors

- Wholesalers, Retailers, and Distributors of Unattended Ground Sensors

- System Integrators

- Technology Providers

- Sensor Manufacturers

- Raw Material Suppliers

- Defense Regulatory Bodies

Scope of the Report:

-

By Sensor Type

- Seismic

- Acoustic

- Magnetic

- Infrared

-

By Deployment

- Hand-Emplaced

- Air-Delivered

-

By End-user

-

Security

- Military

- Public Security

-

Critical Infrastructure

- Utilities

- Industrial & Commercial Facilities

-

Security

-

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Company Information

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Unattended Ground Sensors (UGS) Market

I would like some details about unattended sensors; our main focus is petroleum infrastructure security and protection.