Ultrasound Probe Covers Market by Type (Disposable, Reusable), Material (Latex, Latex-free), Application (Endocavitary), End User (Hospitals, Diagnostic Imaging Centers, Maternity Centers, Ambulatory Surgical Centers) & Region - Global Forecast to 2027

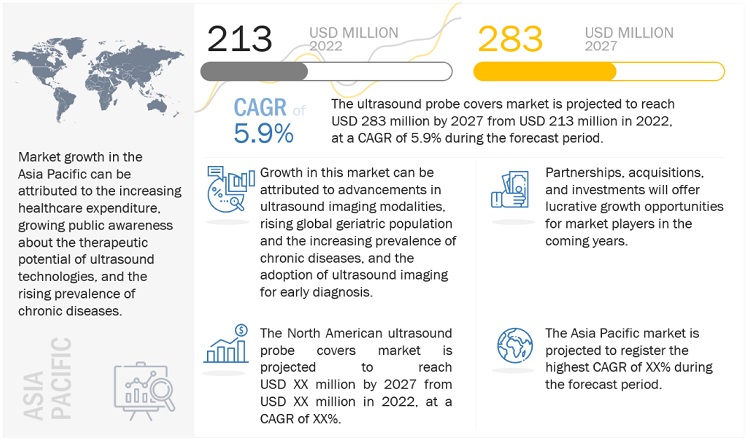

The global ultrasound probe covers market in terms of revenue was estimated to be worth $213 million in 2022 and is poised to reach $283 million in 2027, growing at a CAGR of 5.9% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The incidence of hospital-acquired infections due to improper probe reprocessing has been drastically increasing in the recent past. This has led to an emerging awareness about infection control, especially with regards to ultrasound probes, which is one of the major drivers of the global market. Simultaneously, the rising prevalence of chronic diseases also leads to more ultrasound imaging procedures being performed, which in turn increases the market for ultrasound probe covers.

Ultrasound Probe Covers Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Ultrasound Probe Covers Market Dynamics

Driver: Advancements in ultrasound imaging modalities

The availability of instant diagnostic data has helped reduce overall healthcare costs by replacing more expensive diagnostic exams. This has led to a wide range of ultrasound imaging procedures, most of which require ultrasound probe covers for infection prevention. In the past decade, the medical devices sector has witnessed significant transformations and technological advancements in ultrasound imaging, including the emergence of portable, handheld, and smartphone-based ultrasound imaging devices and the evolution of ultrasound probes and transducers. The advancing technologies in ultrasound imaging and probes, and subsequently the growing application of ultrasound imaging in various modalities, will also lead to an increased use of ultrasound probe covers for the control of potential infections through ultrasound probes.

Restraint: Lack of awareness about probe reprocessing and infection control

According to the Joint Commission's survey, hospital-acquired infections caused by blood-borne pathogens or bacterial agents in patients are increasing due to a lack of knowledge among healthcare providers about probe reprocessing and infection control. Non-compliance with evidence-based guidelines and manufacturers' instructions for use (IFU) has resulted in an increased risk of infections and outbreaks. This lack of awareness and knowledge about infection control is one of the major factors restraining market growth in the forecast period.

Opportunity: High growth opportunities in emerging countries

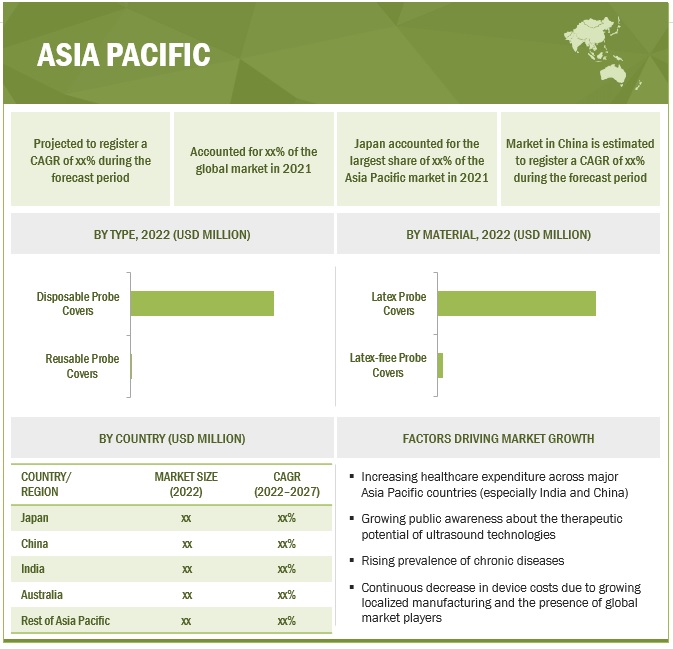

Diversified healthcare markets in the APAC region, rising infectious and chronic disease incidence, and increased R&D initiatives to raise awareness about safe practises in medicine and healthcare are just a few of the reasons why China, India, and other emerging economies offer significant growth opportunities for ultrasound probe covers companies.

In addition, infrastructural developments in healthcare facilities, increasing healthcare expenditure, and the low-cost manufacturing advantage offered by emerging countries in the Asia Pacific are expected to encourage market players to invest in this region in the coming years.

Challenge: Lack of trained professionals

There are a number of inherent risks arising from sonographers' practice, including misdiagnosis and misuse of ultrasound equipment, as well as the risks associated with carrying out intimate examinations. Worldwide, there is a stark shortage of skilled healthcare workers, including sonographers. This has a direct impact on the usage of ultrasound machines and probes, which includes following their proper disinfection protocol. This will hamper the adoption of ultrasound probe covers.

Among end users, maternity centers occupied the second-largest share of the ultrasound probe covers industry.

After hospitals and diagnostic imaging centers, maternity centers occupied the largest share of the ultrasound probe covers market. The continuous rise in prenatal testing across major markets and the increasing number of awareness programs to sensitise healthcare professionals about the infections transmitted through endocavitary probes to the mother and foetus are expected to drive the market for ultrasound probe covers.

The United States had the world's largest region for the ultrasound probe covers industry.

In 2021, the US occupied the largest share in North America and globally, in the global ultrasound probe covers market. This can mainly be attributed to the growing availability of medical reimbursements for ultrasound procedures, and the growing number of diagnostic centers and hospitals in the country. Along with this, increasing awareness of infection control and ultrasound disinfection is also expected to support market growth during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Among the key emerging players in the ultrasound probe covers market are CIVCO Medical Solutions (US), Ecolab, Inc. (US), GE Healthcare (US), CS Medical LLC (US), Parker Laboratories, Inc. (US), Sheathing Technologies, Inc. (US), Becton, Dickinson and Company (US), B. Braun Melsungen AG (Germany), Advance Medical Designs, Inc. (US), Nanosonics Ltd. (Australia), and Aspen Surgical (US).

These companies adopted strategies such as partnerships, acquisitions, and investments to strengthen their presence, globally.

Scope of the Ultrasound Probe Covers Industry:

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$213 million |

|

Estimated Value by 2027 |

$283 million |

|

Revenue Rate |

Poised to grow at a CAGR of 5.9% |

|

Market Driver |

Advancements in ultrasound imaging modalities |

|

Market Opportunity |

High growth opportunities in emerging countries |

The research report categorizes the ultrasound probe covers market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Disposable probe covers

- Reusable probe covers

By Material

- Latex Probe Covers

- Latex-free probe covers

By Application

- Endocavitary probe covers

- External cavitary probe covers

By End User

- Hospitals and Diagnostic Imaging Centers

- Maternity Centers

- Ambulatory Care Centers

- Research and Academic Institutes

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- France

- Germany

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

Recent Developments of Ultrasound Probe Covers Industry

- In April 2022, Audax Private Equity (US) invested in Aspen Surgical (US), which will allow Audax to continue to support Aspen as it pursues imminent organic growth and larger-scale acquisition opportunities to expand globally.

- In December 2021, GE Healthcare (US) acquired BK Medical (US) to add the field of real-time surgical visualization to its pre- and post-operative ultrasound capabilities

- In March 2021, Aspen Surgical (US) acquired BlueMed Medical Supplies (Canada) to strengthen its broad portfolio of surgical disposables and patient and staff safety products

- In February 2021, CS Medical LLC (US) renewed its partnership with Association for Professionals in Infection Control and Epidemiology (APIC, US) for the prevention of healthcare-associated infections (HAIs).

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global ultrasound probe covers market?

The global ultrasound probe covers market boasts a total revenue value of $283 million in 2027.

What is the estimated growth rate (CAGR) of the global ultrasound probe covers market?

The global ultrasound probe covers market has an estimated compound annual growth rate (CAGR) of 5.9% and a revenue size in the region of $213 million in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Advancements in ultrasound imaging modalities- Rising global geriatric population and increasing prevalence of chronic diseases- Adoption of ultrasound imaging for early diagnosis- Rising incidence of hospital-acquired infections due to improper reprocessing of ultrasound probes- Increasing birth rate/number of pregnanciesRESTRAINTS- Lack of awareness about probe reprocessing and infection controlOPPORTUNITIES- High growth opportunities in emerging countriesCHALLENGES- Lack of trained professionals- Adoption of remote ultrasound technologies

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 TARIFF AND REGULATORY LANDSCAPEREGULATORY ANALYSIS- North America- Europe- Asia PacificREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.5 KEY CONFERENCES AND EVENTS IN 2023

-

5.6 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR ULTRASOUND PROBE COVERSINSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.8 VALUE CHAIN ANALYSIS

- 5.9 SUPPLY CHAIN ANALYSIS

-

5.10 ECOSYSTEM MARKET MAP

-

5.11 PRICING ANALYSISAVERAGE SELLING PRICE OF ULTRASOUND PROBE COVERS, BY KEY PLAYERAVERAGE SELLING PRICE TREND

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.13 ADJACENT MARKETS FOR ULTRASOUND PROBE COVERS

-

5.14 INDUSTRY TRENDSUPTAKE OF NEW TECHNOLOGIES IN ULTRASOUND IMAGINGDISINFECTION METHODS WITH MOBILE/ PORTABLE ULTRASOUND HARDWARE

- 6.1 INTRODUCTION

-

6.2 DISPOSABLE PROBE COVERSLOW RISK OF INFECTION AND EASE OF USE TO DRIVE MARKET

-

6.3 REUSABLE PROBE COVERSMOST PLAYERS DO NOT MANUFACTURE THIS CATEGORY OF PROBES

- 7.1 INTRODUCTION

-

7.2 LATEX PROBE COVERSECONOMICAL PRICING AND EASE OF USE TO SUPPORT ADOPTION

-

7.3 LATEX-FREE PROBE COVERSEXCELLENT SCANNING QUALITY AND STRETCHABILITY TO SUPPORT MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 ENDOCAVITARY PROBE COVERSGROWING INCIDENCE OF CARDIOVASCULAR AND GYNECOLOGICAL DISORDERS TO DRIVE MARKET

-

8.3 EXTERNAL CAVITARY PROBE COVERSRISING INCIDENCE OF PRETERM BIRTHS, ESPECIALLY IN DEVELOPING COUNTRIES, TO DRIVE GROWTH

- 9.1 INTRODUCTION

-

9.2 HOSPITALS AND DIAGNOSTIC IMAGING CENTERSLARGEST END USERS OF ULTRASOUND TRANSDUCERS/PROBES

-

9.3 MATERNITY CENTERSRISE IN PRENATAL TESTING TO SUPPORT MARKET GROWTH

-

9.4 AMBULATORY CARE CENTERSRISING DEMAND FOR PORTABLE AND COMPACT ULTRASOUND DEVICES TO DRIVE MARKET

-

9.5 RESEARCH AND ACADEMIC INSTITUTESGROWING USE OF ULTRASOUND IMAGING IN CLINICAL RESEARCH APPLICATIONS TO SUPPORT MARKET GROWTH

- 9.6 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAIMPACT OF RECESSION ON ULTRASOUND PROBE COVERS MARKET IN NORTH AMERICAUS- Largest market for ultrasound probe covers in North AmericaCANADA- Growing awareness about early disease diagnosis to drive market

-

10.3 EUROPEIMPACT OF RECESSION ON ULTRASOUND PROBE COVERS MARKET IN EUROPEGERMANY- Most advanced healthcare system in EuropeFRANCE- Modernization of healthcare infrastructure to support market growthUK- Rising geriatric population to drive marketITALY- Rising incidence of cancer and increasing healthcare expenditure to support market growthSPAIN- Developing healthcare facilities and infrastructure to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICIMPACT OF RECESSION ON ULTRASOUND PROBE COVERS MARKET IN ASIA PACIFICJAPAN- Rising geriatric population to drive marketCHINA- Increasing patient pool to drive marketINDIA- Significant burden of targeted diseases and availability of affordable devices to drive marketAUSTRALIA- Growing awareness campaigns to drive marketREST OF ASIA PACIFIC

-

10.5 LATIN AMERICAIMPACT OF RECESSION ON ULTRASOUND PROBE COVERS MARKET IN LATIN AMERICABRAZIL- Universal healthcare system to support market growthMEXICO- Modernization of healthcare infrastructure to support market growthREST OF LATIN AMERICA

-

10.6 MIDDLE EAST AND AFRICAIMPACT OF RECESSION ON ULTRASOUND PROBE COVERS MARKET IN MIDDLE EAST AND AFRICA

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY PLAYERS IN ULTRASOUND PROBE COVERS MARKET

- 11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 11.4 ULTRASOUND PROBE COVERS MARKET SHARE (2021)

- 11.5 MARKET SHARE ANALYSIS

-

11.6 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.7 COMPETITIVE BENCHMARKING

- 11.8 REGIONAL FOOTPRINT ANALYSIS OF COMPANIES

- 11.9 ULTRASOUND PROBE COVERS MARKET: R&D EXPENDITURE

- 11.10 COMPETITIVE SCENARIO

-

12.1 KEY PLAYERSCIVCO MEDICAL SOLUTIONS (SUBSIDIARY OF ROPER TECHNOLOGIES)- Business overview- Products offered- MnM viewECOLAB, INC.- Business overview- Products offered- MnM viewGE HEALTHCARE- Business overview- Products offered- Recent developments- MnM viewCS MEDICAL LLC- Business overview- Products offered- Recent developmentsPARKER LABORATORIES, INC.- Business overview- Products offeredSHEATHING TECHNOLOGIES, INC.- Business overview- Products offeredBECTON, DICKINSON AND COMPANY- Business overview- Products offeredB. BRAUN MELSUNGEN AG- Business overview- Products offeredADVANCE MEDICAL DESIGNS, INC.- Business overview- Products offeredNANOSONICS LTD.- Business overview- Products offeredASPEN SURGICAL- Business overview- Products offered- Recent developmentsMCKESSON CORPORATION- Business overview- Products offered

-

12.2 OTHER PLAYERSMEDLINE INDUSTRIES- Business overview- Products offeredFUJI LATEX CO., LTD.- Business overview- Products offeredKAREX BERHAD- Business overview- Products offeredFAIRMONT MEDICAL PRODUCTS LTD.- Business overview- Products offeredDYNAREX CORPORATION- Business overview- Products offeredPALMEDIC B.V.- Business overview- Products offeredPROMECON GMBH- Business overview- Products offeredSURGITOOLS MEDICAL INSTRUMENTS CO., LTD.PAJUNK MEDICAL PRODUKTE GMBHPREMIUM HEALTHCARE DISPOSABLES PRIVATE LIMITEDEDM MEDICAL SOLUTIONSESI, INC.CARDINAL HEALTH, INC.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 STANDARD CURRENCY CONVERSION RATES (UNIT OF USD)

- TABLE 2 RISK ASSESSMENT: ULTRASOUND PROBE COVERS MARKET

- TABLE 3 CERVICAL CANCER DATA, BY REGION, 2020–2050 (THOUSAND)

- TABLE 4 DRIVERS: IMPACT ANALYSIS

- TABLE 5 RESTRAINTS: IMPACT ANALYSIS

- TABLE 6 RISING INCOME LEVELS IN EMERGING COUNTRIES

- TABLE 7 OPPORTUNITIES: IMPACT ANALYSIS

- TABLE 8 CHALLENGES: IMPACT ANALYSIS

- TABLE 9 JAPAN: CLASSIFICATION OF MEDICAL DEVICES AND REVIEWING BODY

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 16 ULTRASOUND PROBE COVERS: LIST OF MAJOR PATENTS

- TABLE 17 SPAULDING CLASSIFICATION OF MEDICAL DEVICES BASED ON LEVEL OF PATIENT CONTACT

- TABLE 18 AVERAGE SELLING PRICE OF ULTRASOUND PROBE COVERS (2022)

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ULTRASOUND PROBE COVERS

- TABLE 20 KEY BUYING CRITERIA FOR ULTRASOUND PROBE COVERS

- TABLE 21 ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 22 DISPOSABLE ULTRASOUND PROBE COVERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 23 REUSABLE ULTRASOUND PROBE COVERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 24 ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 25 LATEX ULTRASOUND PROBE COVERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 26 LATEX-FREE ULTRASOUND PROBE COVERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 27 ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 28 ENDOCAVITARY ULTRASOUND PROBE COVERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 29 EXTERNAL CAVITARY ULTRASOUND PROBE COVERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 30 ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 31 ULTRASOUND PROBE COVERS MARKET FOR HOSPITALS AND DIAGNOSTIC IMAGING CENTERS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 32 ULTRASOUND PROBE COVERS MARKET FOR MATERNITY CENTERS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 33 ULTRASOUND PROBE COVERS MARKET FOR AMBULATORY CARE CENTERS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 34 ULTRASOUND PROBE COVERS MARKET FOR RESEARCH AND ACADEMIC INSTITUTES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 35 ULTRASOUND PROBE COVERS MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 36 ULTRASOUND PROBE COVERS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 37 NORTH AMERICA: ULTRASOUND PROBE COVERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 38 NORTH AMERICA: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 39 NORTH AMERICA: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 40 NORTH AMERICA: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 41 NORTH AMERICA: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 42 US: KEY MACROINDICATORS

- TABLE 43 US: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 44 US: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 45 US: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 46 US: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 47 CANADA: KEY MACROINDICATORS

- TABLE 48 CANADA: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 49 CANADA: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 50 CANADA: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 51 CANADA: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 52 EUROPE: ULTRASOUND PROBE COVERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 53 EUROPE: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 54 EUROPE: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 55 EUROPE: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 56 EUROPE: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 57 GERMANY: KEY MACROINDICATORS

- TABLE 58 GERMANY: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 59 GERMANY: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 60 GERMANY: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 61 GERMANY: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 62 FRANCE: KEY MACROINDICATORS

- TABLE 63 FRANCE: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 64 FRANCE: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 65 FRANCE: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 66 FRANCE: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 67 UK: KEY MACROINDICATORS

- TABLE 68 UK: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 69 UK: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 70 UK: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 71 UK: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 72 ITALY: KEY MACROINDICATORS

- TABLE 73 ITALY: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 74 ITALY: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 75 ITALY: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 76 ITALY: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 77 SPAIN: KEY MACROINDICATORS

- TABLE 78 SPAIN: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 79 SPAIN: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 80 SPAIN: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 81 SPAIN: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 82 REST OF EUROPE: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 83 REST OF EUROPE: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 84 REST OF EUROPE: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 85 REST OF EUROPE: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 86 ASIA PACIFIC: ULTRASOUND PROBE COVERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 87 ASIA PACIFIC: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 88 ASIA PACIFIC: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 89 ASIA PACIFIC: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 90 ASIA PACIFIC: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 91 JAPAN: KEY MACROINDICATORS

- TABLE 92 JAPAN: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 93 JAPAN: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 94 JAPAN: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 95 JAPAN: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 96 CHINA: KEY MACROINDICATORS

- TABLE 97 CHINA: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 98 CHINA: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 99 CHINA: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 100 CHINA: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 101 INDIA: KEY MACROINDICATORS

- TABLE 102 INDIA: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 103 INDIA: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 104 INDIA: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 105 INDIA: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 106 AUSTRALIA: KEY MACROINDICATORS

- TABLE 107 AUSTRALIA: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 108 AUSTRALIA: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 109 AUSTRALIA: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 110 AUSTRALIA: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 111 REST OF ASIA PACIFIC: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 112 REST OF ASIA PACIFIC: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 113 REST OF ASIA PACIFIC: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 114 REST OF ASIA PACIFIC: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 115 LATIN AMERICA: ULTRASOUND PROBE COVERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 116 LATIN AMERICA: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 117 LATIN AMERICA: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 118 LATIN AMERICA: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 119 LATIN AMERICA: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 120 BRAZIL: KEY MACROINDICATORS

- TABLE 121 BRAZIL: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 122 BRAZIL: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 123 BRAZIL: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 124 BRAZIL: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 125 MEXICO: KEY MACROINDICATORS

- TABLE 126 MEXICO: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 127 MEXICO: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 128 MEXICO: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 129 MEXICO: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 130 REST OF LATIN AMERICA: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 131 REST OF LATIN AMERICA: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 132 REST OF LATIN AMERICA: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 133 REST OF LATIN AMERICA: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: ULTRASOUND PROBE COVERS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 138 ULTRASOUND PROBE COVERS MARKET: DEGREE OF COMPETITION

- TABLE 139 DEALS, JANUARY 2019–JANUARY 2023

- TABLE 140 OTHER DEVELOPMENTS, JANUARY 2019–JANUARY 2023

- TABLE 141 CIVCO MEDICAL SOLUTIONS: BUSINESS OVERVIEW

- TABLE 142 ECOLAB, INC.: BUSINESS OVERVIEW

- TABLE 143 GE HEALTHCARE: BUSINESS OVERVIEW

- TABLE 144 CS MEDICAL LLC: BUSINESS OVERVIEW

- TABLE 145 PARKER LABORATORIES, INC.: BUSINESS OVERVIEW

- TABLE 146 SHEATHING TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 147 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

- TABLE 148 B. BRAUN MELSUNGEN AG: BUSINESS OVERVIEW

- TABLE 149 ADVANCE MEDICAL DESIGNS, INC.: BUSINESS OVERVIEW

- TABLE 150 NANOSONICS LTD.: BUSINESS OVERVIEW

- TABLE 151 ASPEN SURGICAL: BUSINESS OVERVIEW

- TABLE 152 MCKESSON CORPORATION: COMPANY OVERVIEW

- TABLE 153 MEDLINE INDUSTRIES: BUSINESS OVERVIEW

- TABLE 154 FUJI LATEX CO., LTD.: BUSINESS OVERVIEW

- TABLE 155 KAREX BERHAD: BUSINESS OVERVIEW

- TABLE 156 FAIRMONT MEDICAL PRODUCTS LTD.: BUSINESS OVERVIEW

- TABLE 157 DYNAREX CORPORATION: BUSINESS OVERVIEW

- TABLE 158 PALMEDIC B.V.: BUSINESS OVERVIEW

- TABLE 159 PROMECON GMBH: BUSINESS OVERVIEW

- FIGURE 1 ULTRASOUND PROBE COVERS MARKET SEGMENTATION

- FIGURE 2 REGIONAL SEGMENTATION

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 PRIMARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 8 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 9 REVENUE SHARE ANALYSIS ILLUSTRATION: CIVCO MEDICAL SOLUTIONS

- FIGURE 10 SUPPLY-SIDE MARKET SIZE ESTIMATION: ULTRASOUND PROBE COVERS MARKET (2021)

- FIGURE 11 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2022–2027)

- FIGURE 12 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 13 TOP-DOWN APPROACH

- FIGURE 14 DATA TRIANGULATION METHODOLOGY

- FIGURE 15 ULTRASOUND PROBE COVERS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 16 ULTRASOUND PROBE COVERS MARKET, BY MATERIAL, 2022 VS. 2027 (USD MILLION)

- FIGURE 17 ULTRASOUND PROBE COVERS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 18 ULTRASOUND PROBE COVERS MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 19 GEOGRAPHICAL SNAPSHOT OF ULTRASOUND PROBE COVERS MARKET

- FIGURE 20 ADVANCEMENTS IN ULTRASOUND IMAGING MODALITIES TO DRIVE MARKET

- FIGURE 21 DISPOSABLE PROBE COVERS TO DOMINATE NORTH AMERICAN ULTRASOUND PROBE COVERS MARKET IN 2021

- FIGURE 22 ASIA PACIFIC COUNTRIES TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 23 NORTH AMERICA WILL CONTINUE TO DOMINATE MARKET IN 2027

- FIGURE 24 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 25 MARKET DYNAMICS: ULTRASOUND PROBE COVERS MARKET

- FIGURE 26 US: NUMBER OF PRETERM BIRTHS, 2010–2019

- FIGURE 27 GDP GROWTH FORECAST: COMPARISON AMONG INDIA, CHINA, US, AND GERMANY, 2020 VS. 2040 (USD MILLION)

- FIGURE 28 US PREMARKET NOTIFICATION: 510(K) APPROVAL PROCESS FOR MEDICAL DEVICES

- FIGURE 29 CANADA: APPROVAL PROCESS FOR CLASS II MEDICAL DEVICES

- FIGURE 30 EUROPE: CE MARK APPROVAL PROCESS FOR ULTRASOUND PROBE COVERS

- FIGURE 31 PATENT PUBLICATION TRENDS (JANUARY 2012–DECEMBER 2022)

- FIGURE 32 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR ULTRASOUND PROBE COVER PATENTS (JANUARY 2012–JANUARY 2023)

- FIGURE 33 TOP 10 APPLICANT COUNTRIES/REGIONS FOR ULTRASOUND PROBE COVER PATENTS (JANUARY 2012–JANUARY 2023)

- FIGURE 34 ULTRASOUND PROBE COVERS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 35 ULTRASOUND PROBE COVERS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 36 ULTRASOUND PROBE COVERS MARKET: ECOSYSTEM MARKET MAP

- FIGURE 37 AVERAGE SELLING PRICE OF ULTRASOUND PROBE COVERS, BY KEY PLAYER

- FIGURE 38 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR ULTRASOUND PROBE COVERS

- FIGURE 39 KEY BUYING CRITERIA FOR ULTRASOUND PROBE COVERS

- FIGURE 40 ADJACENT MARKETS FOR ULTRASOUND PROBE COVERS

- FIGURE 41 ULTRASOUND PROBE COVERS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 42 NORTH AMERICA: ULTRASOUND PROBE COVERS MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: ULTRASOUND PROBE COVERS MARKET SNAPSHOT

- FIGURE 44 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 45 ULTRASOUND PROBE COVERS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2021

- FIGURE 46 ULTRASOUND PROBE COVERS MARKET: COMPANY EVALUATION QUADRANT (2021)

- FIGURE 47 R&D EXPENDITURE OF KEY PLAYERS IN ULTRASOUND PROBE COVERS MARKET (2020 VS. 2021)

- FIGURE 48 ROPER TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2021)

- FIGURE 49 ECOLAB, INC.: COMPANY SNAPSHOT (2021)

- FIGURE 50 GE HEALTHCARE: COMPANY SNAPSHOT (2021)

- FIGURE 51 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2021)

- FIGURE 52 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2021)

- FIGURE 53 NANOSONICS LTD.: COMPANY SNAPSHOT (2021)

- FIGURE 54 MCKESSON CORPORATION: COMPANY SNAPSHOT (2022)

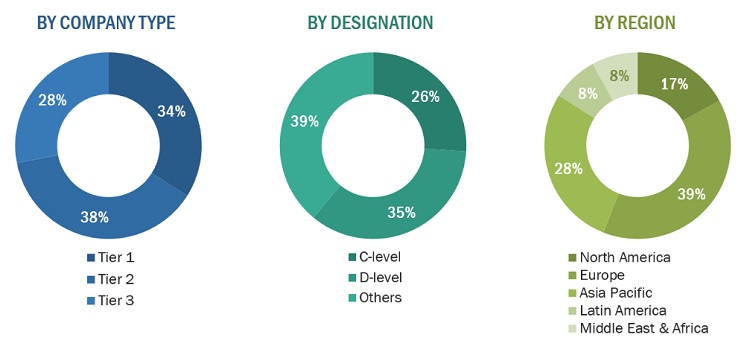

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the ultrasound probe covers market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the global market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

A breakdown of the primary respondents for the ultrasound probe covers market is provided below:

Tiers are defined based on a company’s total revenue. As of 2021: Tier 1= >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3= <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the ultrasound probe covers market was arrived at after data triangulation as mentioned below.

Approach to calculating the revenue of different players in the global market

The size of the global ultrasound probe covers market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the ultrasound probe covers market by application, type, end user, material, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of the global market with respect to five major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile key players in the global market as well as comprehensively analyze their core competencies

- To track and analyze competitive developments such as investments, partnerships, and acquisitions of the leading players in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific market into New Zealand, South Korea, Malaysia, Singapore, Indonesia, and other countries

- Further breakdown of the Rest of Europe market into Belgium, Russia, the Netherlands, Switzerland, and other countries

- Further breakdown of the Rest of Latin America market into Argentina, Peru, and other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ultrasound Probe Covers Market