Ultrasound Needle Guides Market by Type (Reusable, Disposable), Application (Tissue Biopsy, Fluid Aspiration, Nerve Block, Regional Anesthesia, Vascular Access), End User (Hospitals, Clinics, ASC, Diagnostic Imaging Centers) & Region - Global Forecasts to 2027

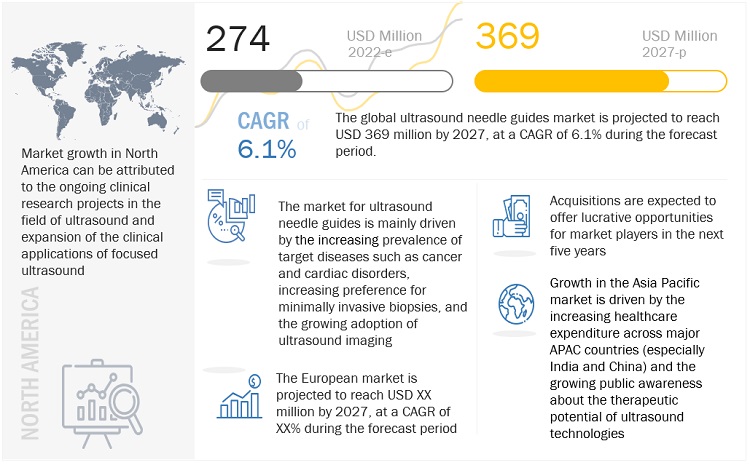

The global ultrasound needle guides market, stood at US$274 million in 2022 and is projected to advance at a resilient CAGR of 6.1% from 2022 to 2028, culminating in a forecasted valuation of US$369 billion by the end of the period.

Needle guides were developed to allow passage of the needle via a predetermined track, and it has been hypothesized that decreased path deviation translates to improved outcomes. Employment of a needle guide represents a one-time procurement cost of the bracket and regular disinfection of the needle guide to maintain sterility. A needle guide allows for fewer attempts to reach a lesion. As a result, it is less traumatic for the patient and can reduce the bleeding usually occurring in the aftermath of a biopsy. Using a needle guide for biopsies also helps fight infections. Needle guides make interventional procedures easily reproducible by making them simple and straightforward. Once the probe is aligned with the target, introducing the needle becomes effortless. These advantages will drive the growth of the global market during the forecast period.

Global Ultrasound Needle Guides Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Ultrasound Needle Guides Market Dynamics

Drivers: Increasing prevalence of target diseases

Ultrasound needle guides have applications in the diagnosis and treatment of diseases such as cancer and CVD. The prevalence of these target diseases is increasing across the globe due to factors such as the rising geriatric population and the increasing adoption of sedentary lifestyles.

In 2020, nearly 9.3% (727 million) of the global population was aged 65 years and above; this figure is projected to reach nearly 16% (1.5 billion) by 2050. The median age of the world's population is increasing due to a decline in mortality and a 20-year increase in the average lifespan during the second half of the 20th century. According to the CDC, by 2050, the average lifespan is expected to increase by 10 years globally. Owing to this trend, there is growing pressure on public health systems and an increasing need for the effective diagnosis and treatment of diseases.

Restraints: Risk of infections associated with use of aspiration and biopsy needles

Biopsy needle procedures, such as core-needle and fine-needle procedures, assist radiologists and surgeons in examining abnormalities at a particular site. However, patients can contract infections during these procedures as they involve cuts and incisions for removing tissue samples. Also, in several cases, aspiration and biopsy needles are reused, which further increases the risk of infection during these procedures. Even though the reuse of some needles is not recommended by healthcare authorities as well as product manufacturers, this practice is still prevalent, especially in developing countries.

Opportunities: Growth opportunities in emerging economies

An increase in the per capita income and healthcare expenses in developing markets across APAC and Latin America has increased patient access to advanced healthcare treatments. However, some countries in the APAC and Latin America rely heavily on purchasing medical devices (including ultrasound devices and accessories) from developed countries such as the US, Japan, Germany, and Ireland. This represents significant growth opportunities for players operating in the ultrasound needle guides market. According to the World Bank, Asia accounts for more than half of the world’s population. Authorities in various developing countries in this region are planning to establish new healthcare delivery models, such as day-care centers, single-specialty hospitals, and long-term care centers, to serve larger population sections. Many private enterprises are also taking steps to cater to the needs of modern and well-equipped state-run healthcare facilities in these countries. In China, the private hospital sector is expected to maintain double-digit growth over the coming years owing to regulatory changes, market demand, and capital investments. In the private hospitals segment, specialty hospitals are witnessing high growth.

Challenges: Limited number of skilled medical professionals

Ultrasound procedures require skilled professionals. However, globally, there is a shortage of these physicians and surgeons. According to the Fourth Global Forum on Human Resources for Health, conducted by the WHO in 2017, the global shortage of healthcare workers is expected to rise to 40 million by 2030. The most acute shortage is expected to be in the Southeast Asian and African regions.

Estimates from the Association of American Medical Colleges (AAMC) in 2017 indicate a projected shortfall of nearly 105,000 physicians by 2030 in the US. The projected shortage of physicians has increased across all specialties. For primary care, a shortage of between 7,300 and 43,100 physicians is expected. Non-primary care specialties—including medical, surgical, and other specialties—are expected to experience a shortfall of between 33,500 to 61,800 physicians.

Based on type, the disposable needle guides segment of ultrasound needle guides market, will grow at the highest CAGR during the forecast period

Based on type, the market is segmented into reusable needle guides and disposable needle guides. The demand for disposable needle guides is expected to grow due to their benefits over reusable needle guides. A disposable needle guide is made of a single piece of medical-grade plastic. However, the high cost of treatment and diagnosis, as well as the lack of awareness, are hindering the growth of the disposable needle guides market .

Based on application, the tissue biopsy segment of ultrasound needle guides market, will grow at the highest CAGR during the forecast period

Based on application, the market is segmented into tissue biopsy, fluid aspiration, vascular access procedures, nerve block and regional anesthesia, and other applications. the tissue biopsy segment will grow at the highest CAGR during the forecast period as biopsies are majorly used to diagnose cancer, but they can help identify other conditions, such as infections and inflammatory and autoimmune disorders.

Based on end user, the hospitals and clinics segment of ultrasound needle guides market, will grow at the highest CAGR during the forecast period

Based on end user, the market is segmented into hospitals and clinics, ambulatory surgical centers, diagnostic imaging centers, and other end users. In 2021, the hospitals segment will grow at the highest CAGR during the forecast period. The growth of hospitals and clinics segment can be attributed to the growing number of hospitals across major markets and the rising adoption of minimally invasive diagnostic and surgical procedures (such as biopsies, endoscopic procedures, and hysteroscopy) in these facilities

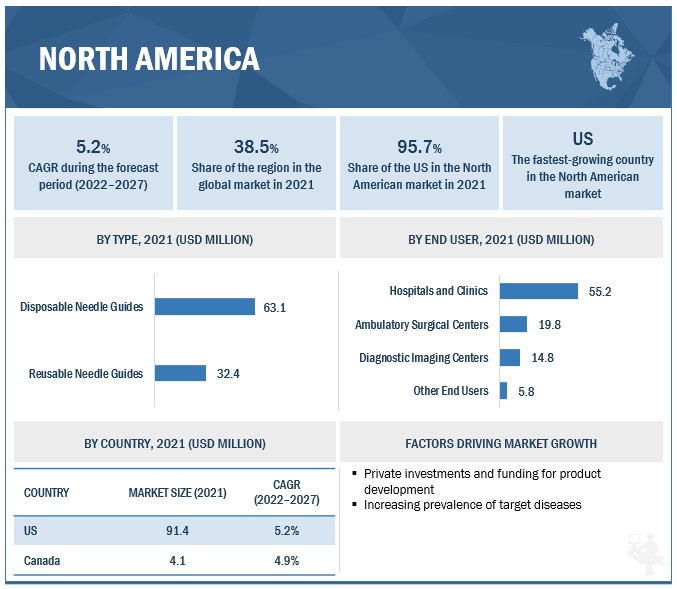

North America is expected to account for the largest share of the ultrasound needle guides market in 2021

North America is expected to account for the largest share of the global market in 2021. Its dominance in the global market is mainly attributed to the large share of North America in the global market is attributed to the early commercialization of these devices in the region, and the significant healthcare expenditure in the US, include private investments and funding for product development and the increasing prevalence of target diseases such as breast cancer, CVD, kidney stones, and arthritis.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the ultrasound needle guides market are Roper Technologies (CIVCO Medical Solutions) (US), Aspen Surgical (US), FUJIFILM Holdings Corporation (Japan), Siemens Healthineers AG (Germany), Becton, Dickinson and Company (US), Argon Medical Devices (US), Hologic, Inc. (US), Remington Medical Inc. (US), Geotek Medical (Turkey), InnoFine (China), KOELIS (France), Rocket Medical (China), BIRR (Netherlands), IZI Medical (US), Sheathing Technologies, Inc. (US), weLLgo Medical Products GmbH (Germany), and Advance Medical Designs, Inc. (US).

Ultrasound Needle Guides Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD million) |

|

Segments covered |

By type, application, end-user |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

|

Companies covered |

Roper Technologies (CIVCO Medical Solutions) (US), Aspen Surgical (US), FUJIFILM Holdings Corporation (Japan), Siemens Healthineers AG (Germany), Becton, Dickinson and Company (US), Argon Medical Devices (US), Hologic, Inc. (US), Remington Medical Inc. (US), Geotek Medical (Turkey), InnoFine (China), KOELIS (France), Rocket Medical (China), BIRR (Netherlands), IZI Medical (US), Sheathing Technologies, Inc. (US), weLLgo Medical Products GmbH (Germany), and Advance Medical Designs, Inc. (US) |

The study categorizes the ultrasound needle guides market into following segments and sub-segments:

By Type

- Disposable Needle Guides

- Reusable Needle Guides

By Application

- Tissue Biopsy

- Fluid Aspiration

- Vascular Access Procedures,

- Nerve Block and Regional Anesthesia

- Other Applications

By End User

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Diagnostic Imagig Centers

- Other End Users

By region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

Recent Developments

- In April 2022, Audax Private Equity has invested in Aspen Surgical. This investment has helped Audax to support Aspen as it pursues imminent organic growth and larger-scale acquisition opportunities to expand globally as a leading provider of single-use surgical products to acute care and surgical settings.

- In March 2021, Aspen Surgical has acquired Bluemed Medical Supplies. The acquisition of BlueMed has strengthened Aspen’s broad portfolio of surgical disposables and patient and staff safety products sold in the acute care market.

- In November 2020, Aspen Surgical has acquired Protek Medical Products. The acquisition of Protek has strengthened Aspen’s broad portfolio of medical and patient & staff safety products sold in the hospitals and surgery centers markets.

Frequently Asked Questions (FAQs):

What is the projected market value of the global ultrasound needle guides market?

The global market of ultrasound needle guides is projected to reach USD 369 million.

What is the estimated growth rate (CAGR) of the global ultrasound needle guides market for the next five years?

The global ultrasound needle guides market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% from 2022 to 2027.

What are the major revenue pockets in the ultrasound needle guides market currently?

North America is expected to account for the largest share of the global market in 2021. Its dominance in the global market is mainly attributed to the large share of North America in the global market is attributed to the early commercialization of these devices in the region, and the significant healthcare expenditure in the US, include private investments and funding for product development and the increasing prevalence of target diseases such as breast cancer, CVD, kidney stones, and arthritis.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing prevalence of target diseases- Increasing preference for minimally invasive biopsies- Increasing adoption of ultrasound imaging- Advantages offered by needle guidesRESTRAINTS- Risk of infections associated with use of aspiration and biopsy needles- Limited reimbursement in developing countriesOPPORTUNITIES- Growth opportunities in emerging economiesCHALLENGES- Limited number of skilled medical professionals

-

5.3 INDUSTRY TRENDSNEEDLE TIP TRACKING TECHNOLOGY

-

5.4 TARIFF AND REGULATORY LANDSCAPEREGULATORY ANALYSIS- North America- Europe- Asia PacificREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 ECOSYSTEM MARKET MAP

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR ULTRASOUND NEEDLE GUIDESINSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

-

5.10 TECHNOLOGY ANALYSISROBOTIC ASSISTANCEIMAGE-BASED NEEDLE TRACKING

-

5.11 INDICATIVE PRICING MODEL ANALYSISAVERAGE SELLING PRICE TRENDS

- 5.12 KEY CONFERENCES AND EVENTS IN 2022–2023

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 DISPOSABLE NEEDLE GUIDESINCREASING HEALTHCARE AWARENESS TO DRIVE GROWTH

-

6.3 REUSABLE NEEDLE GUIDESHIGHER PREFERENCE FOR DISPOSABLE NEEDLE GUIDES DUE TO LOWER RISK OF INFECTION TO RESTRAIN MARKET GROWTH

- 7.1 INTRODUCTION

-

7.2 TISSUE BIOPSYNEEDLE GUIDES ENSURE BETTER SAFETY OF PATIENTS DURING BIOPSY PROCEDURES

-

7.3 FLUID ASPIRATIONINCREASING NUMBER OF SURGERIES TO DRIVE GROWTH

-

7.4 VASCULAR ACCESS PROCEDURESNEEDLE GUIDES IMPROVE NEEDLE PLACEMENT DURING VASCULAR ACCESS PROCEDURES

-

7.5 NERVE BLOCK AND REGIONAL ANESTHESIANEEDLE GUIDES ENSURE PLACEMENT OF NEEDLE TIP WITHIN SCAN PLANE DURING NERVE BLOCK AND REGIONAL ANESTHESIA PROCEDURES

- 7.6 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 HOSPITALS AND CLINICSHOSPITALS PERFORM LARGE NUMBER OF ULTRASOUND-BASED MEDICAL PROCEDURES

-

8.3 AMBULATORY SURGICAL CENTERSINCREASING NUMBER OF OUTPATIENT VISITS TO DRIVE GROWTH

-

8.4 DIAGNOSTIC IMAGING CENTERSINCREASED DEMAND FOR EARLY DIAGNOSIS TO DRIVE MARKET

- 8.5 OTHER END USERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAIMPACT OF RECESSION ON ULTRASOUND NEEDLE GUIDES MARKET IN NORTH AMERICAUS- US to dominate North American ultrasound needle guides market during forecast periodCANADA- Growing awareness about early disease diagnosis to drive market growth

-

9.3 EUROPEIMPACT OF RECESSION ON ULTRASOUND NEEDLE GUIDES MARKET IN EUROPEGERMANY- Germany held largest share of European ultrasound needle guides market in 2021FRANCE- Modernization of healthcare infrastructure fueling market growthUK- Rising geriatric population to drive market growthITALY- Improved reimbursement scenario to support overall market growthSPAIN- Developing healthcare facilities and infrastructure to drive growthREST OF EUROPE

-

9.4 ASIA PACIFICIMPACT OF RECESSION ON ULTRASOUND NEEDLE GUIDES MARKET IN ASIA PACIFICCHINA- Increasing patient pool to drive market growthJAPAN- Rising geriatric population to drive market growthINDIA- Significant burden of target diseases and availability of affordable devices to drive market growthAUSTRALIA- Growing awareness campaigns to drive market growthREST OF ASIA PACIFIC

-

9.5 LATIN AMERICAIMPACT OF RECESSION ON ULTRASOUND NEEDLE GUIDES MARKET IN LATIN AMERICABRAZIL- Universal healthcare system to drive market growthMEXICO- Modernization of healthcare infrastructure to support market growthREST OF LATIN AMERICA

-

9.6 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON ULTRASOUND NEEDLE GUIDES MARKET IN MIDDLE EAST & AFRICA

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE ANALYSIS OF KEY MARKET PLAYERS

- 10.4 MARKET SHARE ANALYSIS

-

10.5 COMPANY FOOTPRINT ANALYSISFOOTPRINT OF COMPANIES, BY TYPEFOOTPRINT OF COMPANIES, BY APPLICATIONFOOTPRINT OF COMPANIES, BY REGION

-

10.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.7 COMPETITIVE BENCHMARKING

-

10.8 COMPETITIVE SCENARIODEALS

-

11.1 KEY PLAYERSCIVCO MEDICAL SOLUTIONS (A ROPER COMPANY)- Business overview- Products offered- MnM viewBECTON, DICKINSON AND COMPANY- Business overview- Products offered- MnM viewASPEN SURGICAL- Business overview- Products offered- Recent developments- MnM viewARGON MEDICAL DEVICES- Business overview- Products offered- MnM viewFUJIFILM SONOSITE, INC. (A PART OF FUJIFILM HOLDINGS CORPORATION)- Business overview- Products offered- MnM viewROCKET MEDICAL- Business overview- Products offeredSIEMENS HEALTHINEERS AG- Business overview- Products offeredHOLOGIC, INC.- Business overview- Products offeredREMINGTON MEDICAL INC.- Business overview- Products offeredGEOTEK MEDICAL- Business overview- Products offered

-

11.2 OTHER PLAYERSINNOFINE- Business overview- Products offeredKOELIS- Business overview- Products offeredBIRR- Business overview- Products offeredIZI MEDICAL- Business overview- Products offeredSHEATHING TECHNOLOGIES, INC.- Business overview- Products offeredWELLGO MEDICAL PRODUCTS GMBH- Business overview- Products offeredADVANCE MEDICAL DESIGNS, INC.- Business overview- Products offered

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 RISK ASSESSMENT: ULTRASOUND NEEDLE GUIDES MARKET

- TABLE 3 GLOBAL CANCER INCIDENCE FOR GERIATRIC POPULATION (65–85+), 2020 VS. 2040

- TABLE 4 RISING INCOME LEVELS IN EMERGING COUNTRIES

- TABLE 5 US FDA: THREE MAIN CLASSIFICATIONS OF MEDICAL DEVICES

- TABLE 6 JAPAN: CLASSIFICATION OF MEDICAL DEVICES AND THE REVIEWING BODY

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ULTRASOUND NEEDLE GUIDES: LIST OF MAJOR PATENTS

- TABLE 13 AVERAGE SELLING PRICE OF ULTRASOUND NEEDLE GUIDES (2022)

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ULTRASOUND NEEDLE GUIDES

- TABLE 15 KEY BUYING CRITERIA FOR ULTRASOUND NEEDLE GUIDES

- TABLE 16 ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 17 DISPOSABLE ULTRASOUND NEEDLE GUIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 18 REUSABLE ULTRASOUND NEEDLE GUIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 19 ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 20 ULTRASOUND NEEDLE GUIDES MARKET FOR TISSUE BIOPSY, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 21 ULTRASOUND NEEDLE GUIDES MARKET FOR FLUID ASPIRATION, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 22 ULTRASOUND NEEDLE GUIDES MARKET FOR VASCULAR ACCESS PROCEDURES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 23 ULTRASOUND NEEDLE GUIDES MARKET FOR NERVE BLOCK AND REGIONAL ANESTHESIA, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 24 ULTRASOUND NEEDLE GUIDES MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 25 ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 26 ULTRASOUND NEEDLE GUIDES MARKET FOR HOSPITALS AND CLINICS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 27 ULTRASOUND NEEDLE GUIDES MARKET FOR AMBULATORY SURGICAL CENTERS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 28 ULTRASOUND NEEDLE GUIDES MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 29 ULTRASOUND NEEDLE GUIDES MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 30 ULTRASOUND NEEDLE GUIDES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 31 NORTH AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 32 NORTH AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 33 NORTH AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 34 NORTH AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 35 US: KEY MACROINDICATORS

- TABLE 36 US: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 37 US: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 38 US: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 39 CANADA: KEY MACROINDICATORS

- TABLE 40 CANADA: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 41 CANADA: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 42 CANADA: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 43 EUROPE: ULTRASOUND NEEDLE GUIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 44 EUROPE: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 45 EUROPE: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 46 EUROPE: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 47 GERMANY: KEY MACROINDICATORS

- TABLE 48 GERMANY: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 49 GERMANY: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 50 GERMANY: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 51 FRANCE: KEY MACROINDICATORS

- TABLE 52 FRANCE: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 53 FRANCE: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 54 FRANCE: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 55 UK: KEY MACROINDICATORS

- TABLE 56 UK: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 57 UK: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 58 UK: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 59 ITALY: KEY MACROINDICATORS

- TABLE 60 ITALY: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 61 ITALY: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 62 ITALY: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 63 SPAIN: KEY MACROINDICATORS

- TABLE 64 SPAIN: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 65 SPAIN: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 66 SPAIN: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 67 REST OF EUROPE: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 68 REST OF EUROPE: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 69 REST OF EUROPE: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 70 ASIA PACIFIC: ULTRASOUND NEEDLE GUIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 71 ASIA PACIFIC: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 72 ASIA PACIFIC: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 73 ASIA PACIFIC: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 74 CHINA: KEY MACROINDICATORS

- TABLE 75 CHINA: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 76 CHINA: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 77 CHINA: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 78 JAPAN: KEY MACROINDICATORS

- TABLE 79 JAPAN: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 80 JAPAN: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 81 JAPAN: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 82 INDIA: KEY MACROINDICATORS

- TABLE 83 INDIA: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 84 INDIA: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 85 INDIA: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 86 AUSTRALIA: KEY MACROINDICATORS

- TABLE 87 AUSTRALIA: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 88 AUSTRALIA: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 89 AUSTRALIA: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 90 REST OF ASIA PACIFIC: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 93 LATIN AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 94 LATIN AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 95 LATIN AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 96 LATIN AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 97 BRAZIL: KEY MACROINDICATORS

- TABLE 98 BRAZIL: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 99 BRAZIL: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 100 BRAZIL: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 101 MEXICO: KEY MACROINDICATORS

- TABLE 102 MEXICO: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 103 MEXICO: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 104 MEXICO: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 105 REST OF LATIN AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 106 REST OF LATIN AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 107 REST OF LATIN AMERICA: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 111 ULTRASOUND NEEDLE GUIDES MARKET: KEY START-UPS/SMES

- TABLE 112 ULTRASOUND NEEDLE GUIDES MARKET: DEALS (JANUARY 2019–JANUARY 2023)

- TABLE 113 CIVCO MEDICAL SOLUTIONS: BUSINESS OVERVIEW

- TABLE 114 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

- TABLE 115 ASPEN SURGICAL: BUSINESS OVERVIEW

- TABLE 116 ARGON MEDICAL DEVICES: BUSINESS OVERVIEW

- TABLE 117 FUJIFILM HOLDINGS CORPORATION: BUSINESS OVERVIEW

- TABLE 118 ROCKET MEDICAL: BUSINESS OVERVIEW

- TABLE 119 SIEMENS HEALTHINEERS: BUSINESS OVERVIEW

- TABLE 120 HOLOGIC, INC.: BUSINESS OVERVIEW

- TABLE 121 REMINGTON MEDICAL INC.: BUSINESS OVERVIEW

- TABLE 122 GEOTEK MEDICAL: BUSINESS OVERVIEW

- TABLE 123 INNOFINE: BUSINESS OVERVIEW

- TABLE 124 KOELIS: BUSINESS OVERVIEW

- TABLE 125 BIRR: BUSINESS OVERVIEW

- TABLE 126 IZI MEDICAL: BUSINESS OVERVIEW

- TABLE 127 SHEATHING TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 128 WELLGO MEDICAL PRODUCTS GMBH: BUSINESS OVERVIEW

- TABLE 129 ADVANCE MEDICAL DESIGNS, INC: BUSINESS OVERVIEW

- FIGURE 1 ULTRASOUND NEEDLE GUIDES MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

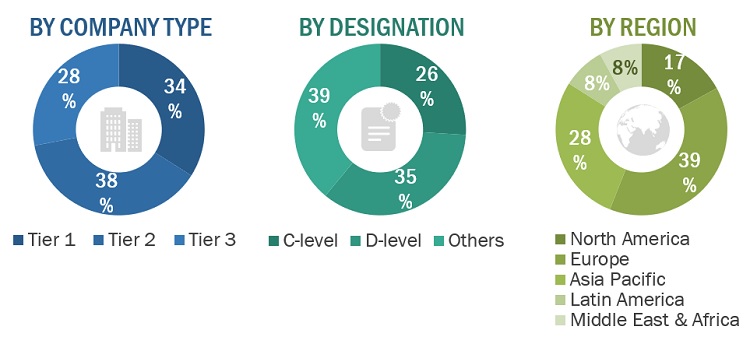

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: ROPER TECHNOLOGIES (CIVCO MEDICAL SOLUTIONS)

- FIGURE 9 SUPPLY-SIDE MARKET SIZE ESTIMATION: ULTRASOUND NEEDLE GUIDES MARKET (2021)

- FIGURE 10 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2022–2027)

- FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 12 TOP-DOWN APPROACH

- FIGURE 13 DATA TRIANGULATION METHODOLOGY

- FIGURE 14 ULTRASOUND NEEDLE GUIDES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 15 ULTRASOUND NEEDLE GUIDES MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 16 ULTRASOUND NEEDLE GUIDES MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 17 GEOGRAPHIC SNAPSHOT OF ULTRASOUND NEEDLE GUIDES MARKET

- FIGURE 18 INCREASING DEMAND FOR ULTRASOUND PROCEDURES TO DRIVE MARKET GROWTH

- FIGURE 19 DISPOSABLE NEEDLE GUIDES SEGMENT HELD LARGEST SHARE OF ASIA PACIFIC MARKET IN 2021

- FIGURE 20 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 NORTH AMERICA WOULD BE LARGEST MARKET FOR ULTRASOUND NEEDLE GUIDES THROUGHOUT FORECAST PERIOD

- FIGURE 22 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 23 ULTRASOUND NEEDLE GUIDES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 GDP GROWTH FORECAST: COMPARISON AMONG INDIA, CHINA, US, AND GERMANY, 2020 VS. 2040 (FORECAST)

- FIGURE 25 US PREMARKET NOTIFICATION: 510(K) APPROVAL PROCESS FOR MEDICAL DEVICES

- FIGURE 26 CANADA: APPROVAL PROCESS FOR CLASS II MEDICAL DEVICES

- FIGURE 27 EUROPE: CE MARK APPROVAL PROCESS FOR ULTRASOUND NEEDLE GUIDES

- FIGURE 28 ULTRASOUND NEEDLE GUIDES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 ULTRASOUND NEEDLE GUIDES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 30 ULTRASOUND NEEDLE GUIDES MARKET: ECOSYSTEM MARKET MAP

- FIGURE 31 PATENT PUBLICATION TRENDS (JANUARY 2012–JANUARY 2023)

- FIGURE 32 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR ULTRASOUND NEEDLE GUIDE PATENTS, JANUARY 2012–JANUARY 2023

- FIGURE 33 TOP 10 APPLICANT COUNTRIES/REGIONS FOR ULTRASOUND NEEDLE GUIDE PATENTS (JANUARY 2012–JANUARY 2023)

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ULTRASOUND NEEDLE GUIDES

- FIGURE 35 KEY BUYING CRITERIA FOR ULTRASOUND NEEDLE GUIDES

- FIGURE 36 ULTRASOUND NEEDLE GUIDES MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 37 NORTH AMERICA: ULTRASOUND NEEDLE GUIDES MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: ULTRASOUND NEEDLE GUIDES MARKET SNAPSHOT

- FIGURE 39 REVENUE ANALYSIS OF KEY PLAYERS OPERATING IN ULTRASOUND NEEDLE GUIDES MARKET

- FIGURE 40 ULTRASOUND NEEDLE GUIDES MARKET SHARE, BY KEY PLAYER (2021)

- FIGURE 41 ULTRASOUND NEEDLE GUIDES MARKET: COMPANY EVALUATION MATRIX

- FIGURE 42 COMPANY SNAPSHOT: ROPER TECHNOLOGIES, INC. (2021)

- FIGURE 43 COMPANY SNAPSHOT: BECTON, DICKINSON AND COMPANY (2022)

- FIGURE 44 COMPANY SNAPSHOT: FUJIFILM HOLDINGS CORPORATION (2021)

- FIGURE 45 COMPANY SNAPSHOT: SIEMENS HEALTHINEERS (2021)

- FIGURE 46 COMPANY SNAPSHOT: HOLOGIC, INC. (2021)

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the ultrasound needle guides market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side and demand side are detailed below.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Interviews: Supply-Side Participants - By Company Type, Designation, and Region

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

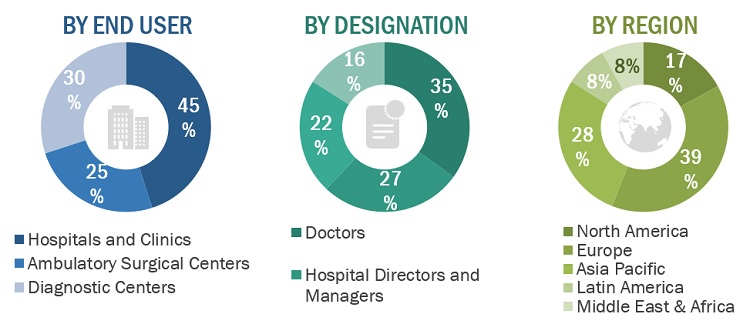

Breakdown of Primary Interviews: Demand-Side Participants by End-User, Designation, and Region

Note: Others include department heads, research scientists, and professors.

Market Size Estimation

The total size of the ultrasound needle guides market was arrived at after data triangulation from three different approaches, as mentioned below. After each approach, the weighted average of all approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were employed, wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in this report’s market engineering process.

Objectives of the Study

- To describe, analyze, and forecast the ultrasound needle guides market by type, application, end user, and region

- To describe and forecast the global market for key regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the global market

- To strategically analyze the ecosystem, regulations, patenting trend, value chain, supply chain, Porter’s five forces, technologies, key stakeholders and buying criteria, and prices pertaining to the market under study

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players

- To profile key players and comprehensively analyze their market shares and core competencies in the global market

- To analyze competitive developments such as investments, acquisitions, and R&D activities in the global market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the RoE market into Austria, Finland, and others

- Further breakdown of the Latin America market into Argentina, Colombia, Chile, and others

Competitive Landscape Assessment

- Market share analysis for the North America and Europe region, which provides market shares of the top 3–5 key players in the global market

- Competitive leadership mapping for established players in the US

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ultrasound Needle Guides Market