Ultrapure Water Market by Equipment, Material, and Service (Filtration, Consumables/Aftermarket), Application (Washing Fluid, Process Feed), End-Use Industry (Semiconductor, Power, Pharmaceutical), and Region - Global Forecast to 2027

Ultrapure Water Market

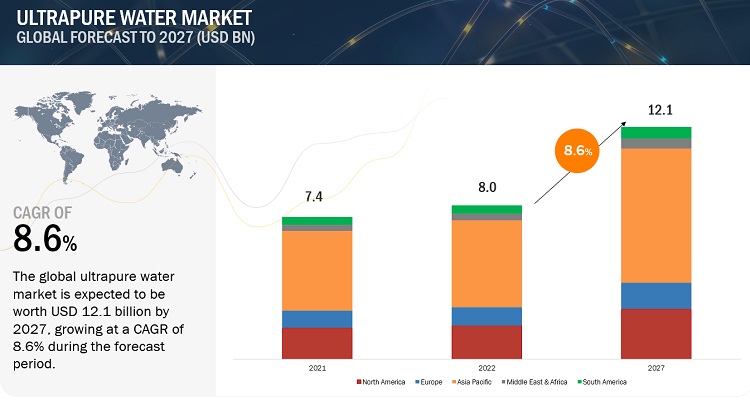

The global ultrapure water market was valued at USD 8.0 billion in 2022 and is projected to reach USD 12.1 billion by 2027, growing at 8.6% cagr during the forecast period. The demand for ultrapure water industry is being driven by the increasing use of electronic devices such as smartphones, laptops, and tablets. To assure the quality and performance of the finished product, the electronics manufacturing process demands a high level of precision and cleanliness. Even minute amounts of pollutants in the water used for manufacturing can result in defects in the semiconductor or microchip, which can lead to product failures or malfunctions. Hence, the production of high-quality electronic devices requires ultrapure water, which has a relatively low impurity concentration.

Global Ultrapure Water Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Ultrapure Water Market Dynamics

Driver: Increasing adoption of desalination technologies

Desalination is the process of removing salts and minerals from seawater or brackish water to make it suitable for human consumption or industrial use. The global water crisis has led to an increased focus on water recycling and reuse. Desalination has become an increasingly popular solution for meeting the world's growing demand for freshwater, and the demand for ultrapure water is also increasing. Ultrapure water is used in desalination as it is required to clean and maintain the various components of the desalination system, such as membranes and filters. Before the desalination process, seawater or brackish water is pretreated with ultrapure water.

Restraint: Limited availability of water resources

The limited availability of water resources can make it difficult to obtain the large volumes of water needed for ultrapure water production. Water scarcity can be a major problem in some places, and the sources of water that are available might be polluted with impurities like heavy metals and chemicals, which makes it difficult to produce high-quality ultrapure water.

Opportunity: Increasing installation of supercritical and ultra-supercritical coal power plants

Coal-fired power plants are the second-largest end user of ultrapure water. These power generation plants are being upgraded to supercritical and ultra-supercritical technologies across the globe. These advanced technologies require high-purity ultrapure water. This has opened a significant opportunity for the players in the ultrapure water market.

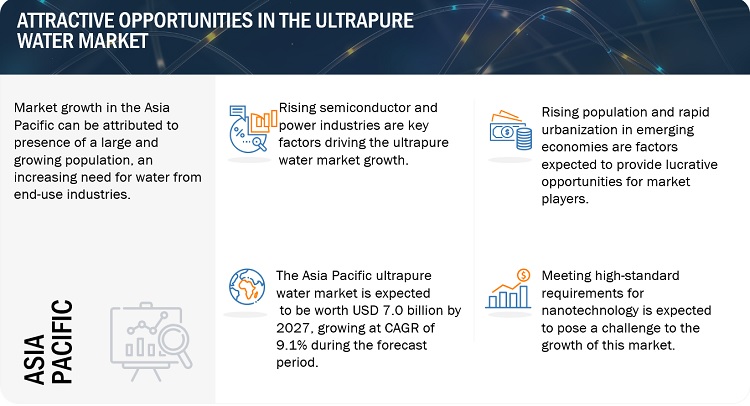

Challenges: Meeting high-standard requirements for nanotechnology

Nanotechnology is a relatively new technology that is now used on a large scale in the semiconductor and electronics industries. With nanotechnology chips becoming smaller in size, wafers washing is becoming a challenge. As wafers sizes become smaller, purity requirements are getting higher, which are difficult to keep. Thus, the biggest challenge for ultrapure water system developers is to cope with the requirements of advancing nanotechnology.

Ultrapure Water Market Ecosystem

By end-use industry, power is estimated to be the second-largest industry during the forecast period in the ultrapure water industry

Ultrapure water is an important component in power generation. The use of ultrapure water is critical in a number of applications, including steam generation, cooling water, and high-pressure boiler feed water. Ultrapure water is used as the primary feedwater source for the boiler in a power plant. Ultrapure water is further treated through a series of processes to remove any remaining impurities before it is fed into the boiler. In cooling tower systems, ultrapure water is frequently utilized as makeup water to make up for water lost to evaporation or drift.

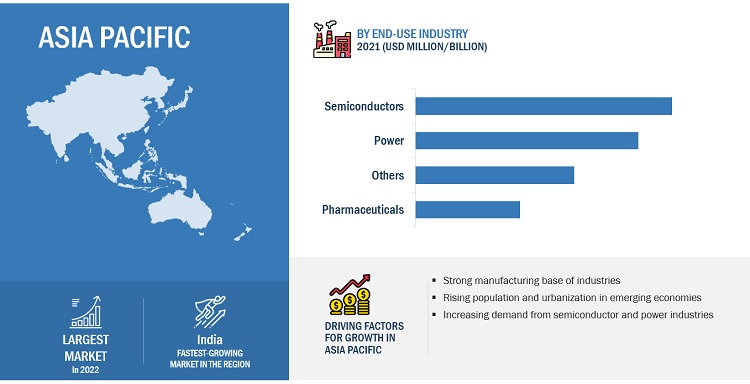

Asia Pacific is projected to be fastest growing amongst other regions in the ultrapure water industry, in terms of value.

Asia Pacific is projected to be the fastest growing market for ultrapure water due to rapid industrialization in recent years, particularly in countries like China, India, and South Korea. This has led to an increase in demand for ultrapure water, which is used in various industrial processes such as semiconductor, pharmaceutical, and electronic manufacturing. Industries are increasingly using ultrapure water for high-precision manufacturing processes, research & development, and quality control.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Ultrapure Water Market Players

The key players in the ultrapure water market include Veolia (France), Asahi Kasei (Japan), Ecolab (US), DuPont (US), Evoqua Water Technologies (France), Ovivo Inc. (Canada), Organo Corporation (Japan), Hydranautics (US), Danaher Corporation (US), MANN+HUMMEL (Germany), Pentair (US), and Kurita Water Industries (Japan), among others. The ultrapure water industry report analyzes the key growth strategies, such as partnerships and acquisitions adopted by the leading market players between 2019 and 2022.

Ultrapure Water Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 8.0 billion |

|

Revenue Forecast in 2027 |

USD 12.1 billion |

|

CAGR |

8.6% |

|

Years considered for the study |

2018-2027 |

|

Base Year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Million/Billion) |

|

Segments |

Equipment, Material, and Service, Application, End-use Industry, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Veolia (France), Asahi Kasei (Japan), Ecolab (US), DuPont (US), Evoqua Water Technologies (France), Ovivo Inc. (Canada), Organo Corporation (Japan), Hydranautics (US), Danaher Corporation (US), MANN+HUMMEL (Germany), Pentair (US), and Kurita Water Industries (Japan) are the key players in the market. |

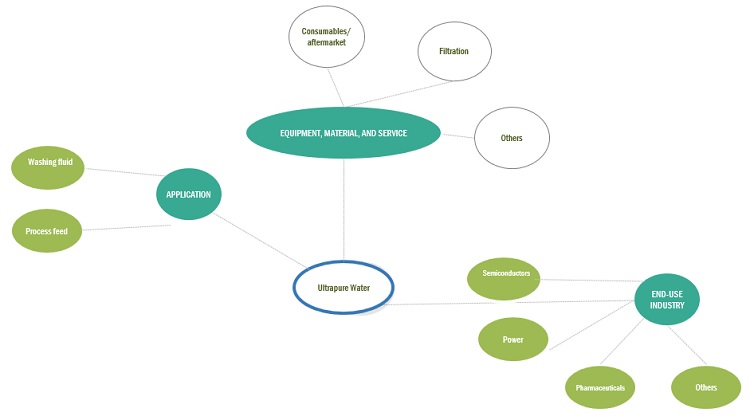

This report categorizes the global ultrapure water market based on equipment, material, and service, application, end-use industry, and region.

On the basis of equipment, material, and service, the ultrapure water market has been segmented as follows:

- Filtration

- Consumables/Aftermarket

- Others

On the basis of application, the ultrapure water market has been segmented as follows:

- Washing Fluid

- Process Feed

On the basis of end-use industry, the ultrapure water market has been segmented as follows:

- Semiconductor

- Power

- Pharmaceutical

- Others

On the basis of region, the ultrapure water market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In January 2023, Xylem announced the acquisition of Evoqua Water Technologies in an all-stock transaction valuing approximately USD 7.5 billion.

- In July 2022, Ovivo acquired Wastech Controls and Engineering, Inc., an automation solution provider in water and wastewater treatment. It will enhance the cross-selling opportunities for both companies.

- In December 2021, Ovivo and AquaAction renewed and strengthened their partnership to create an impact in the technology and innovation sector.

Frequently Asked Questions (FAQ):

What is the current size of the global ultrapure water market?

Global ultrapure water market size is estimated to reach USD 12.1 billion by 2027 from USD 8.0 billion in 2022, at a CAGR of 8.6% during the forecast period.

Who are the winners in the global ultrapure water market?

Companies such as Veolia (France), Asahi Kasei (Japan), Ecolab (US), DuPont (US), Evoqua Water Technologies (France), Ovivo Inc. (Canada), Organo Corporation (Japan), Hydranautics (US), Danaher Corporation (US), MANN+HUMMEL (Germany), Pentair (US), and Kurita Water Industries (Japan).

What are some of the drivers in the market?

Growing demand in electronics and semiconductor industries drives the market.

Which segment on the basis of application is expected to garner the highest traction within the ultrapure water market?

Based on application, washing fluid segment held the largest share of the ultrapure water market in 2021.

What are some of the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use partnerships and acquisitions as important growth tactics.

How is ultrapure water produced?

Ultrapure water is produced using processes like reverse osmosis, deionization, distillation, and electro-deionization to remove contaminants and impurities to an extremely low level.

What are the main methods for producing ultrapure water?

The most common methods are reverse osmosis (RO), deionization (DI), and ultrafiltration, often used in combination to achieve the desired purity levels.

What factors are driving the growth of the ultrapure water market?

Key drivers include increasing demand from high-tech industries, stringent quality standards, government initiatives for infrastructure development, and advancements in purification technologies.

Is ultrapure water safe to drink?

No, ultrapure water is not safe for human consumption as it lacks essential minerals and can disrupt electrolyte balance in the body.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 RECESSION IMPACT

-

5.3 MARKET DYNAMICSDRIVERS- Growing demand in electronics and semiconductor industries- Increasing adoption of desalination technologiesRESTRAINTS- Limited availability of water resourcesOPPORTUNITIES- Increasing investment for wafer washing in emerging economies- Increasing installation of supercritical and ultra-supercritical coal power plantsCHALLENGES- Meeting high-standard requirements for nanotechnology

-

5.4 VALUE CHAIN ANALYSISPURIFICATION PROCESSMANUFACTURERSDISTRIBUTORSEND-USE INDUSTRIES

-

5.5 PURIFICATION PROCESS ANALYSISPRE-TREATMENTPRIMARY STAGEPOLISHING STAGE

-

5.6 PORTER’S FIVE FORCE ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF RIVALRY

-

5.7 MACROECONOMIC INDICATORSGLOBAL GDP TRENDS

-

5.8 TARIFF AND REGULATORY LANDSCAPEREGULATIONS- North America- Europe- Asia PacificSTANDARDS- ISO 14644-1:2015 Cleanroom Classification- ISO 3696:1987- ASTM D1193-06(2018)- United States Pharmacopeia (USP)- European Pharmacopoeia (EP)REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.9 PRICING ANALYSISAVERAGE SELLING PRICE TREND, BY REGIONAVERAGE SELLING PRICE TREND OF ULTRAPURE WATER PURIFICATION SYSTEM

-

5.10 TECHNOLOGY ANALYSISNEW TECHNOLOGIES – ULTRAPURE WATER

-

5.11 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEPUBLICATION TRENDS (2012-2022)INSIGHTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

-

5.12 TRADE ANALYSISIMPORT TRADE ANALYSISEXPORT TRADE ANALYSIS

-

5.13 ECOSYSTEM / MARKET MAP

-

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.15 KEY CONFERENCES & EVENTS (2023–2024)

-

5.16 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN THE BUYING PROCESSBUYING CRITERIA- Quality- Service

-

5.17 CASE STUDYPRODUCTION OF ULTRAPURE WATER USING ELECTRODEIONIZATION (EDI) TECHNOLOGY BY GE WATER & PROCESS TECHNOLOGIESPRODUCTION OF ULTRAPURE WATER BY SUEZ WATER TECHNOLOGIES & SOLUTIONS

- 6.1 INTRODUCTION

- 6.2 FILTRATION

- 6.3 CONSUMABLES/AFTERMARKET

- 6.4 OTHERS

- 7.1 INTRODUCTION

-

7.2 WASHING FLUIDSEMICONDUCTORPHARMACEUTICAL

-

7.3 PROCESS FEEDSEMICONDUCTOR WAFER FABRICATIONFLAT SCREEN DISPLAY

- 8.1 INTRODUCTION

- 8.2 REVERSE OSMOSIS (RO)

- 8.3 ULTRAFILTRATION (UF)

- 8.4 NANOFILTRATION

- 8.5 ION EXCHANGE RESIN

- 8.6 TANK VENT FILTRATION

- 8.7 RESIN TRAP FILTRATION

- 8.8 DEGASIFICATION

- 8.9 ELECTRODEIONIZATION (EDI)

- 8.10 OTHERS

- 9.1 INTRODUCTION

-

9.2 SEMICONDUCTORWAFERSFLAT PANEL DISPLAYSELECTRONIC COMPONENTS

-

9.3 POWERGAS TURBINE POWERCOAL-FIRED POWER

-

9.4 PHARMACEUTICALREAGENTSCELL CULTURECLINICAL ANALYZERS

- 9.5 OTHERS

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICCHINA- Growing industrial activities fueling demand for ultrapure waterJAPAN- Presence of major electronics companies and investments in semiconductor technologies to drive marketINDIA- Government initiatives to boost local manufacturing of semiconductor to drive demand for ultrapure waterSOUTH KOREA- Leads semiconductor production in Asia PacificREST OF ASIA PACIFIC

-

10.3 NORTH AMERICAUS- US to be dominant manufacturer and consumer of ultrapure waterCANADA- Rapidly growing semiconductor and pharmaceutical industries to drive demandMEXICO- Significant growth opportunities for market players in Mexico

-

10.4 EUROPEGERMANY- Semiconductor industry to be major consumer of ultrapure waterUK- Strong electronics industry to fuel demand for ultrapure waterFRANCE- High potential for ultrapure water market growth in electronics sectorITALY- Semiconductor segment to be dominant end user of ultrapure waterSPAIN- Growth of semiconductor industry to boost ultrapure water marketREST OF EUROPE

-

10.5 SOUTH AMERICABRAZIL- Expanding economy stimulated by increasing investments and improved government policies to drive demandARGENTINA- Lucrative consumer electronics market to drive demand for ultrapure waterREST OF SOUTH AMERICA

-

10.6 MIDDLE EAST & AFRICASAUDI ARABIA- Power generation sector to support market growthSOUTH AFRICA- Growing disposable income and consumer awareness driving demand for ultrapure waterREST OF MIDDLE EAST & AFRICA

- 11.1 OVERVIEW

- 11.2 KEY PLAYERS STRATEGIES / RIGHT TO WIN

- 11.3 MARKET EVALUATION FRAMEWORK

- 11.4 REVENUE ANALYSIS

- 11.5 RANKING OF KEY PLAYERS

- 11.6 MARKET SHARE ANALYSIS

-

11.7 COMPANY EVALUATION MATRIX (TIER 1)STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTSCOMPANY FOOTPRINT- Company Technology Footprint- Company Equipment, Material, And Service Footprint- Company End-Use Industry Footprint- Company Region Footprint- Company Overall Footprint

- 11.8 STRENGTH OF PRODUCT PORTFOLIO FOR TIER 1 COMPANIES, 2022

- 11.9 BUSINESS STRATEGY EXCELLENCE FOR TIER 1 COMPANIES, 2022

-

11.10 COMPANY EVALUATION MATRIX (START-UPS AND SMES)PROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING

- 11.11 STRENGTH OF PRODUCT PORTFOLIO (START-UPS AND SMES)

- 11.12 BUSINESS STRATEGY EXCELLENCE (START-UPS AND SMES)

-

11.13 COMPETITIVE SITUATION AND TRENDSDEALSOTHERSNEW PRODUCT LAUNCH

-

12.1 KEY PLAYERSVEOLIA- Business overview- Products offered- Recent developments- MnM view3M- Business overview- Products offered- Recent developments- MnM viewMERCK- Business overview- Products offered- Recent developments- MnM viewASAHI KASEI- Business overview- Products offered- Recent developments- MnM viewDUPONT- Business overview- Products offered- Recent developments- MnM viewDANAHER CORPORATION- Business overview- Products offered- Recent developments- MnM viewECOLAB- Business overview- Products offered- Recent developments- MnM viewMANN+HUMMEL- Business overview- Products offered- MnM viewKURITA WATER INDUSTRIES- Business overview- Products offered- Recent developments- MnM viewEVOQUA WATER TECHNOLOGIES (NOW XYLEM INC.)- Business overview- Products offered- Recent developments- MnM view

-

12.2 OTHER PLAYERSPENTAIRORGANO CORPORATIONOVIVOHYDRANAUTICSKOCH SEPARATION SOLUTIONSAPPLIED MEMBRANES INC.KOMAL WATER INDUSTRIESRODI SYSTEMS CORPORATIONNGK INSULATORSAQUA-CHEM, INC.CULLIGANMEMSTAR USAOSMOFLOSYNDER FILTRATION INC.NX FILTRATION BVARIES CHEMICAL, INC.AQUATECH INTERNATIONAL LLCION EXCHANGE INDIA LTD.MEMBRANE GROUPWIGEN WATER TECHNOLOGIESWATERPROFESSIONALS

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 ULTRAPURE WATER MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 ULTRAPURE WATER: VALUE CHAIN STAKEHOLDERS

- TABLE 3 ULTRAPURE WATER: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 TRENDS OF PER CAPITA GDP, 2020–2022 (USD)

- TABLE 5 GDP GROWTH ESTIMATE AND PROJECTION OF KEY COUNTRIES, 2023–2027

- TABLE 6 CURRENT HEALTH EXPENDITURE (% OF GDP) OF KEY COUNTRIES, 2018–2019

- TABLE 7 CLEAN ROOM AND CLEAN AIR DEVICE CLASSIFICATION

- TABLE 8 STANDARD SPECIFICATION FOR REAGENT WATER

- TABLE 9 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 AVERAGE SELLING PRICE TREND, BY REGION (USD/LITER)

- TABLE 11 AVERAGE SELLING PRICE ULTRAPURE WATER PURIFICATION SYSTEM (USD)

- TABLE 12 LIST OF PATENTS BY KURITA WATER INDUSTRIES LTD.

- TABLE 13 LIST OF PATENTS BY ORGANO CORPORATION

- TABLE 14 LIST OF PATENTS BY VWS UK LTD.

- TABLE 15 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 16 REGION-WISE IMPORT TRADE (USD THOUSAND)

- TABLE 17 REGION-WISE EXPORT TRADE (USD THOUSAND)

- TABLE 18 ULTRAPURE WATER MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 20 ULTRAPURE WATER MARKET SIZE, BY EQUIPMENT, MATERIAL, AND SERVICE, 2018–2021 (USD MILLION)

- TABLE 21 ULTRAPURE WATER MARKET SIZE, BY EQUIPMENT, MATERIAL, AND SERVICE, 2022–2027 (USD MILLION)

- TABLE 22 ULTRAPURE WATER MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 23 ULTRAPURE WATER MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 24 ULTRAPURE WATER MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 25 ULTRAPURE WATER MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 26 ASIA PACIFIC: ULTRAPURE WATER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 27 ASIA PACIFIC: ULTRAPURE WATER MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 28 ASIA PACIFIC: ULTRAPURE WATER MARKET, BY EQUIPMENT, MATERIAL, AND SERVICE, 2018–2021 (USD MILLION)

- TABLE 29 ASIA PACIFIC: ULTRAPURE WATER MARKET, BY EQUIPMENT, MATERIAL, AND SERVICE, 2022–2027 (USD MILLION)

- TABLE 30 ASIA PACIFIC: ULTRAPURE WATER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 31 ASIA PACIFIC: ULTRAPURE WATER MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 32 ASIA PACIFIC: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 33 ASIA PACIFIC: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 34 CHINA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 35 CHINA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 36 JAPAN: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 37 JAPAN: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 38 INDIA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 39 INDIA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 40 SOUTH KOREA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 41 SOUTH KOREA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 42 REST OF ASIA PACIFIC: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 43 REST OF ASIA PACIFIC: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 44 NORTH AMERICA: ULTRAPURE WATER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 45 NORTH AMERICA: ULTRAPURE WATER MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 46 NORTH AMERICA: ULTRAPURE WATER MARKET, BY EQUIPMENT, MATERIAL, AND SERVICE, 2018–2021 (USD MILLION)

- TABLE 47 NORTH AMERICA: ULTRAPURE WATER MARKET, BY EQUIPMENT, MATERIAL, AND SERVICE, 2022–2027 (USD MILLION)

- TABLE 48 NORTH AMERICA: ULTRAPURE WATER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 49 NORTH AMERICA: ULTRAPURE WATER MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 50 NORTH AMERICA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 51 NORTH AMERICA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 52 US: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 53 US: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 54 CANADA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 55 CANADA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 56 MEXICO: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 57 MEXICO: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 58 EUROPE: ULTRAPURE WATER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 59 EUROPE: ULTRAPURE WATER MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 60 EUROPE: ULTRAPURE WATER MARKET, BY EQUIPMENT, MATERIAL, AND SERVICE, 2018–2021 (USD MILLION)

- TABLE 61 EUROPE: ULTRAPURE WATER MARKET, BY EQUIPMENT, MATERIAL, AND SERVICE, 2022–2027 (USD MILLION)

- TABLE 62 EUROPE: ULTRAPURE WATER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 63 EUROPE: ULTRAPURE WATER MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 64 EUROPE: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 65 EUROPE: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 66 GERMANY: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 67 GERMANY: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 68 UK: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 69 UK: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 70 FRANCE: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 71 FRANCE: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 72 ITALY: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 73 ITALY: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 74 SPAIN: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 75 SPAIN: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 76 REST OF EUROPE: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 77 REST OF EUROPE: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 78 SOUTH AMERICA: ULTRAPURE WATER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 79 SOUTH AMERICA: ULTRAPURE WATER MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 80 SOUTH AMERICA: ULTRAPURE WATER MARKET, BY EQUIPMENT, MATERIAL, AND SERVICE, 2018–2021 (USD MILLION)

- TABLE 81 SOUTH AMERICA: ULTRAPURE WATER MARKET, BY EQUIPMENT, MATERIAL, AND SERVICE, 2022–2027 (USD MILLION)

- TABLE 82 SOUTH AMERICA: ULTRAPURE WATER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 83 SOUTH AMERICA: ULTRAPURE WATER MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 84 SOUTH AMERICA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 85 SOUTH AMERICA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 86 BRAZIL: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 87 BRAZIL: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 88 ARGENTINA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 89 ARGENTINA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 90 REST OF SOUTH AMERICA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 91 REST OF SOUTH AMERICA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 92 MIDDLE EAST & AFRICA: ULTRAPURE WATER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 93 MIDDLE EAST & AFRICA: ULTRAPURE WATER MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 94 MIDDLE EAST & AFRICA: ULTRAPURE WATER MARKET, BY EQUIPMENT, MATERIAL, AND SERVICE, 2018–2021 (USD MILLION)

- TABLE 95 MIDDLE EAST & AFRICA: ULTRAPURE WATER MARKET, BY EQUIPMENT, MATERIAL, AND SERVICE, 2022–2027 (USD MILLION)

- TABLE 96 MIDDLE EAST & AFRICA: ULTRAPURE WATER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: ULTRAPURE WATER MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 98 MIDDLE EAST & AFRICA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 100 SAUDI ARABIA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 101 SAUDI ARABIA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 102 SOUTH AFRICA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 103 SOUTH AFRICA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 104 REST OF MIDDLE EAST & AFRICA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 105 REST OF MIDDLE EAST & AFRICA: ULTRAPURE WATER MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 106 MARKET EVALUATION FRAMEWORK

- TABLE 107 REVENUE ANALYSIS OF KEY COMPANIES (2019–2021)

- TABLE 108 ULTRAPURE WATER MARKET: DEGREE OF COMPETITION

- TABLE 109 OVERALL TECHNOLOGY FOOTPRINT

- TABLE 110 OVERALL EQUIPMENT, MATERIAL, AND SERVICE FOOTPRINT

- TABLE 111 OVERALL END-USE INDUSTRY FOOTPRINT

- TABLE 112 OVERALL REGION FOOTPRINT

- TABLE 113 OVERALL COMPANY FOOTPRINT

- TABLE 114 ULTRAPURE WATER MARKET: DETAILED LIST OF COMPANIES

- TABLE 115 ULTRAPURE WATER: DEALS, 2018–MAY 2023

- TABLE 116 ULTRAPURE WATER: OTHERS, 2018–MAY 2023

- TABLE 117 ULTRAPURE WATER: NEW PRODUCT LAUNCH, 2018–MAY 2023

- TABLE 118 VEOLIA: COMPANY OVERVIEW

- TABLE 119 VEOLIA: PRODUCT OFFERINGS

- TABLE 120 VEOLIA: DEALS

- TABLE 121 VEOLIA: OTHER DEVELOPMENTS

- TABLE 122 3M: COMPANY OVERVIEW

- TABLE 123 3M: PRODUCT OFFERINGS

- TABLE 124 3M: DEALS

- TABLE 125 3M: OTHER DEVELOPMENTS

- TABLE 126 MERCK: COMPANY OVERVIEW

- TABLE 127 MERCK: PRODUCT OFFERINGS

- TABLE 128 MERCK: DEALS

- TABLE 129 MERCK: OTHER DEVELOPMENTS

- TABLE 130 ASAHI KASEI: COMPANY OVERVIEW

- TABLE 131 ASAHI KASEI: PRODUCT OFFERINGS

- TABLE 132 ASAHI KASEI: DEALS

- TABLE 133 ASAHI KASEI: OTHER DEVELOPMENTS

- TABLE 134 DUPONT: COMPANY OVERVIEW

- TABLE 135 DUPONT: PRODUCT OFFERINGS

- TABLE 136 DUPONT: DEALS

- TABLE 137 DANAHER CORPORATION: COMPANY OVERVIEW

- TABLE 138 DANAHER: PRODUCT OFFERINGS

- TABLE 139 DANAHER CORPORATION: DEALS

- TABLE 140 ECOLAB: COMPANY OVERVIEW

- TABLE 141 ECOLAB: PRODUCT OFFERINGS

- TABLE 142 ECOLAB: DEALS

- TABLE 143 MANN+HUMMEL: COMPANY OVERVIEW

- TABLE 144 MANN+HUMMEL: PRODUCT OFFERINGS

- TABLE 145 KURITA WATER INDUSTRIES: COMPANY OVERVIEW

- TABLE 146 KURITA WATER INDUSTRIES: PRODUCT OFFERINGS

- TABLE 147 KURITA WATER INDUSTRIES: DEALS

- TABLE 148 EVOQUA WATER TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 149 EVOQUA WATER TECHNOLOGIES: PRODUCT OFFERINGS

- TABLE 150 EVOQUA WATER TECHNOLOGIES: DEALS

- TABLE 151 PENTAIR: COMPANY OVERVIEW

- TABLE 152 ORGANO CORPORATION: COMPANY OVERVIEW

- TABLE 153 OVIVO: COMPANY OVERVIEW

- TABLE 154 HYDRANAUTICS: COMPANY OVERVIEW

- TABLE 155 KOCH SEPARATION SOLUTIONS: COMPANY OVERVIEW

- TABLE 156 APPLIED MEMBRANES INC.: COMPANY OVERVIEW

- TABLE 157 KOMAL WATER INDUSTRIES: COMPANY OVERVIEW

- TABLE 158 RODI SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 159 NGK INSULATORS: COMPANY OVERVIEW

- TABLE 160 AQUA-CHEM, INC.: COMPANY OVERVIEW

- TABLE 161 CULLIGAN: COMPANY OVERVIEW

- TABLE 162 MEMSTAR USA: COMPANY OVERVIEW

- TABLE 163 OSMOFLO: COMPANY OVERVIEW

- TABLE 164 SYNDER FILTRATION INC.: COMPANY OVERVIEW

- TABLE 165 NX FILTRATION BV: COMPANY OVERVIEW

- TABLE 166 ARIES CHEMICAL, INC.: COMPANY OVERVIEW

- TABLE 167 AQUATECH INTERNATIONAL LLC: COMPANY OVERVIEW

- TABLE 168 ION EXCHANGE INDIA LTD.: COMPANY OVERVIEW

- TABLE 169 MEMBRANE GROUP: COMPANY OVERVIEW

- TABLE 170 WIGEN WATER TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 171 WATERPROFESSIONALS: COMPANY OVERVIEW

- FIGURE 1 ULTRAPURE WATER MARKET SEGMENTATION

- FIGURE 2 ULTRAPURE WATER MARKET: RESEARCH DESIGN

- FIGURE 3 ULTRAPURE WATER MARKET: BOTTOM-UP APPROACH

- FIGURE 4 ULTRAPURE WATER MARKET: TOP-DOWN APPROACH

- FIGURE 5 ULTRAPURE WATER MARKET: DATA TRIANGULATION

- FIGURE 6 FILTRATION TO WITNESS FASTEST-GROWTH IN EQUIPMENT, MATERIAL, AND SERVICE SEGMENT

- FIGURE 7 WASHING FLUID TO LEAD OVERALL MARKET DURING FORECAST PERIOD

- FIGURE 8 SEMICONDUCTOR ACCOUNTED FOR LARGEST SHARE OF ULTRAPURE WATER MARKET

- FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO OFFER ATTRACTIVE OPPORTUNITIES IN ULTRAPURE WATER MARKET DURING FORECAST PERIOD

- FIGURE 11 FILTRATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 WASHING FLUID TO LEAD OVERALL MARKET BY 2027

- FIGURE 13 SEMICONDUCTOR TO LEAD OVERALL MARKET DURING FORECAST PERIOD

- FIGURE 14 INDIA TO REGISTER HIGHEST CAGR IN ULTRAPURE WATER MARKET

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ULTRAPURE WATER MARKET

- FIGURE 16 OVERVIEW OF VALUE CHAIN OF ULTRAPURE WATER MARKET

- FIGURE 17 ULTRAPURE WATER TREATMENT PROCESS

- FIGURE 18 PORTER’S FIVE FORCES ANALYSIS: ULTRAPURE WATER MARKET

- FIGURE 19 PATENTS REGISTERED (2012 TO 2022)

- FIGURE 20 NUMBER OF PATENTS REGISTERED IN LAST 10 YEARS

- FIGURE 21 TOP JURISDICTIONS

- FIGURE 22 KURITA WATER INDUSTRIES REGISTERED MAXIMUM NUMBER OF PATENTS

- FIGURE 23 REGION-WISE IMPORT TRADE (USD THOUSAND)

- FIGURE 24 REGION-WISE EXPORT TRADE (USD THOUSAND)

- FIGURE 25 ULTRAPURE WATER MARKET ECOSYSTEM

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 27 SUPPLIER SELECTION CRITERION

- FIGURE 28 FILTRATION SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

- FIGURE 29 WASHING FLUID TO BE LARGER SEGMENT DURING FORECAST PERIOD

- FIGURE 30 SEMICONDUCTOR INDUSTRY TO BE LARGEST END USER OF ULTRAPURE WATER

- FIGURE 31 INDIA TO BE FASTEST-GROWING ULTRAPURE WATER MARKET BETWEEN 2022 AND 2027

- FIGURE 32 ASIA PACIFIC: ULTRAPURE WATER MARKET SNAPSHOT

- FIGURE 33 NORTH AMERICA: ULTRAPURE WATER MARKET SNAPSHOT

- FIGURE 34 EUROPE: ULTRAPURE WATER MARKET SNAPSHOT

- FIGURE 35 COMPANIES ADOPTED ACQUISITION AS KEY GROWTH STRATEGIES BETWEEN 2018 AND MAY 2023

- FIGURE 36 RANKING OF TOP 5 PLAYERS IN ULTRAPURE WATER MARKET

- FIGURE 37 ULTRAPURE WATER MARKET SHARE, BY COMPANY (2022)

- FIGURE 38 ULTRAPURE WATER MARKET: COMPANY EVALUATION MATRIX FOR TIER 1 COMPANIES, 2022

- FIGURE 39 ULTRAPURE WATER MARKET: COMPANY EVALUATION MATRIX FOR START- UPS AND SMES, 2022

- FIGURE 40 VEOLIA: COMPANY SNAPSHOT

- FIGURE 41 3M: COMPANY SNAPSHOT

- FIGURE 42 MERCK: COMPANY SNAPSHOT

- FIGURE 43 ASAHI KASEI: COMPANY SNAPSHOT

- FIGURE 44 DUPONT: COMPANY SNAPSHOT

- FIGURE 45 DANAHER CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 ECOLAB: COMPANY SNAPSHOT

- FIGURE 47 MANN+HUMMEL: COMPANY SNAPSHOT

- FIGURE 48 KURITA WATER INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 49 EVOQUA WATER TECHNOLOGIES: COMPANY SNAPSHOT

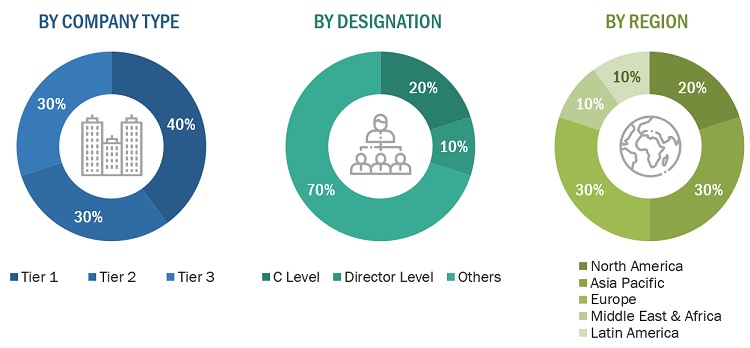

The study involved four major activities in estimating the market size of the ultrapure water market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The ultrapure water market comprises several stakeholders in the value chain, which include purification process, manufacturers, distributors, and end users/consumers. Various primary sources from the supply and demand sides of the ultrapure water industry have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the ultrapure water industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to equipment, material, and service, application, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of ultrapure water and future outlook of their business which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Veolia |

Sales Director |

|

Ecolab |

Sales Manager |

|

Evoqua |

Director |

|

Asahi Kasei |

Marketing Manager |

|

Hydranautics |

R&D Manager |

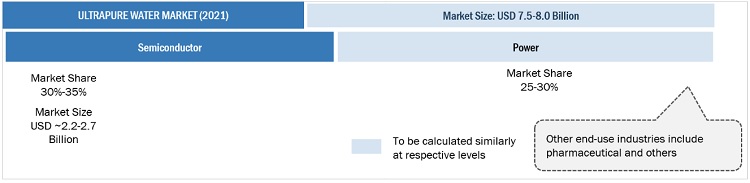

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the ultrapure water market.

- The key players in the industry have been identified through extensive secondary research.

- The purification process of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Ultrapure Water Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Ultrapure Water Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Ultrapure water (UPW) is a type of water that has undergone extensive purification processes to significantly reduce pollutants and contaminants, making it appropriate for use in sensitive industrial and scientific applications. Due to the removal of the majority or all of its mineral ions, it is also occasionally referred to as deionized water.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the size of the ultrapure water market, in terms of value

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on equipment, material, and service, application, end-use industry, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as partnerships, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ultrapure Water Market