UAV (Drone) Propulsion Market Size, Share & Growth, 2025 To 2030

UAV (Drone) Propulsion Market by Technology (Electric, Thermal, Hybrid), Component (IC Engine (Turbofan, Turboprop, Wankel), Motor, Battery, Fuel Cell, Solar Panel, Propeller, Electronic Speed Controller), Platform, MTOW, Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The overall UAV (Drone) Propulsion Market is estimated to be valued at USD 7.01 billion in 2025 and is projected to reach USD 11.27 billion by 2030, growing at a CAGR of 10.0% from 2025 to 2030. The UAV (Drone) propulsion volume is expected to rise from 596.94 thousand units in 2025 to 869.76 thousand units by 2030. The growth of the market is driven by the increasing adoption of UAVs for commercial, defense, and logistics applications, coupled with technological advancements in electric and hybrid propulsion systems that enhance flight endurance and payload efficiency. The rising demand for lightweight, fuel-efficient propulsion units and the expanding use of drones in surveillance, agriculture, and delivery operations are further accelerating market expansion globally.

KEY TAKEAWAYS

- North America is expected to account for a 38.4% share of the UAV (drone) propulsion market in 2025.

- By platform, the military segment is expected to dominate the market from 2025 to 2030.

- By technology, the hybrid segment is projected to grow at the fastest rate of 15.5% from 2025 to 2030.

- By component, the power source segment is projected to grow at the fastest rate from 2025 to 2030.

- DJI, Honeywell International Inc., and Rolls-Royce plc were identified as some of the star players in the UAV (drone) propulsion market, given their strong market share and product footprint.

- Sky Power GmbH, Orbital UAV, and KDE Direct have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The future growth of the UAV (Drone) Propulsion Industry is expected to be driven by advances in hybrid-electric systems, hydrogen fuel cells, and high-density batteries that enable longer endurance and lower emissions. AI-powered energy management and miniaturized propulsion will enhance efficiency and mission flexibility. Rising defense demand, commercial adoption in logistics, agriculture, and urban air mobility, along with supportive policies, position the market as a key enabler of future military and commercial innovation.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ business is increasingly shaped by disruptive technologies, regulatory changes, and new use cases. Propulsion system manufacturers are prioritizing AI-driven and hybrid-electric systems, supported by startups, investments, and strategic partnerships. Expanding adoption by government agencies, research organizations, delivery operators, law enforcement, and commercial users is driving new revenue opportunities in the UAV (Drone) propulsion market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing procurement of military UAVs

-

Growing demand for long-endurance UAVs

Level

-

Limited energy density in batteries

-

High development and manufacturing costs

Level

-

Integration with artificial intelligence for smart propulsion

-

Increasing deployment of UAV swarm and micro-drone in defense and rescue operations

Level

-

Miniaturization without performance loss

-

Lack of propulsion testing infrastructure in emerging economies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing procurement of military UAVs

Growing defense investments and the transition to multi-role UAVs are fueling demand for propulsion systems with greater endurance, efficiency, and payload capacity. This is driving OEMs to develop advanced hybrid engines, electric modules, and microturbines tailored to military requirements.

Restraint: High development and manufacturing costs

Developing UAV propulsion systems involves high R&D spending, advanced materials, and precision engineering, resulting in significant costs. Limited production volumes and lack of economies of scale further challenge smaller players and slow broader adoption.

Opportunity: Integration with artificial intelligence for smart propulsion

AI-enabled propulsion systems optimize power output, improve efficiency, and enable predictive maintenance. This reduces downtime, enhances reliability, and supports greater mission flexibility, creating strong opportunities across both defense and commercial UAV markets.

Challenge: Miniaturization without performance loss

The need for compact UAVs is constrained by difficulties in scaling down propulsion systems without compromising thrust, endurance, or reliability. Performance trade-offs, cooling issues, and higher costs make miniaturization a critical industry challenge.

UAV (Drone) Propulsion Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Honeywell Aerospace and HAL are jointly manufacturing high-power turbogenerators in India to power hybrid-electric UAVs, unmanned helicopters, and next-generation eVTOLs. | This initiative enables longer endurance, improved payload capacity, reduced foreign dependence, and greater operational flexibility. |

|

GE Aerospace and Kratos are co-developing small, low-cost turbojet and turbofan engines optimized for tactical UAVs used in ISR, electronic warfare, and combat support. | The program delivers affordable jet-powered UAVs, scalable mass production, and high-speed quick-launch mission capability. |

|

Pratt & Whitney’s F100 turbofan engine, originally designed for the F-15/F-16, is being used in a hypersonic UAV prototype by Hermeus, integrated into a turbine-based combined cycle (TBCC) propulsion system. | The solution provides high thrust, temperature tolerance, and sub- to hypersonic flight, enabling reusable hypersonic UAVs. |

|

Ascendance Flight Technologies is developing Atea, a 5-seater hybrid-electric VTOL aircraft powered by its proprietary Sterna propulsion system and supported by Dassault’s 3DEXPERIENCE platform. | The aircraft offers a 400 km range, 200 km/h cruise speed, up to 80% fewer emissions, four times quieter operation than helicopters, and scalability to hydrogen power. |

|

Intelligent Energy is deploying its IE-SOAR hydrogen fuel cell systems for UAV applications in parcel delivery, inspection, cinematography, agriculture, surveillance, and LiDAR/mapping. | These systems deliver three times longer endurance compared to batteries, fast refueling, lower total cost of ownership, near-silent operation, and improved efficiency. |

|

Elroy Air has conducted the flight of its Chaparral C1 hVTOL cargo drone powered by a turbogenerator-hybrid electric propulsion system, capable of autonomous cargo handling and long-range flights. | The drone achieves a range of over 300 miles, carries a payload of 300 lbs, operates runway-independently, serves both defense resupply and cargo logistics. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The UAV (drone) propulsion market ecosystem consists of manufacturers developing advanced electric, hybrid, and turbine systems, supported by private enterprises specializing in niche propulsion solutions. End users in defense, commercial, and logistics sectors are increasing demand for high-endurance, efficient, and mission-specific propulsion, making integration of innovative technologies and cost-effective solutions central to market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

UAV (Drone) Propulsion Market By Technology

Electric propulsion leads this segment as it enables quiet operations, low emissions, and cost efficiency, making it highly suitable for commercial, consumer, and government applications. The rapid growth of e-commerce, infrastructure inspection, and urban mobility further drives adoption of electric systems due to their reliability and ease of maintenance.

UAV (Drone) Propulsion Market By Platform

Military UAVs represent the largest platform segment, driven by rising defense budgets and the demand for ISR, combat, and tactical missions. Propulsion systems in this segment are prioritized for endurance, higher payload capacity, and adaptability to diverse mission environments, ensuring continued dominance.

UAV (Drone) Propulsion Market By Component

Internal combustion (IC) engines remain the leading component segment as they provide high thrust and long endurance for larger UAVs. Their reliability, scalability, and proven performance in both defense and heavy commercial operations make them critical for missions where electric power alone is insufficient.

UAV (Drone) Propulsion Market By MTOW

The 2–25 kg weight class is the largest MTOW segment, supported by widespread use in commercial, consumer, and government UAVs for mapping, agriculture, and surveillance. This category balances portability with meaningful payload capacity, making it the most versatile and widely adopted UAV class.

REGION

Asia Pacific to be fastest-growing region in global UAV (Drone) propulsion market during forecast period

The UAV (Drone) propulsion market in the Asia Pacific is expanding rapidly, supported by higher defense expenditures, increasing surveillance needs, and growing commercial applications. Accelerated adoption of advanced propulsion technologies is being driven by strategic investments and favorable policies across China, Japan, India, South Korea, and Australia.

UAV (Drone) Propulsion Market: COMPANY EVALUATION MATRIX

The company evaluation matrix for the UAV (Drone) propulsion market evaluates players based on product footprint and market share. It highlights their competitive positioning and ranks them according to market strength and growth strategies. DJI (star) is positioned as a leading player with a strong focus on advanced battery technologies, while General Atomics is recognized as an emerging leader in this market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

List of Top UAV (Drone) Propulsion Market Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.67 Billion |

| Market Forecast in 2030 (value) | USD 11.27 Billion |

| Growth Rate | CAGR of 10.0% from 2025 to 2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East, and Rest of the World |

WHAT IS IN IT FOR YOU: UAV (Drone) Propulsion Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segments covered at regional/global level to gain an understanding on market potential by each country |

| Emerging leader | Additional company profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional market leader | Additional country market estimates | Additional country-level deep dive for a more targeted understanding on the total addressable market |

RECENT DEVELOPMENTS

- April 2025 : General Atomics partnered strategically with South Korea’s Hanwha Systems and Hanwha Aerospace to advance airborne defense solutions.

- February 2025 : Rolls-Royce signed a strategic partnership to strengthen India’s defense manufacturing ecosystem by deepening local partnerships, particularly with Hindustan Aeronautics Limited (HAL) and other Indian defense stakeholders.

- September 2024 : Shenzhen Grepow Battery Co., Ltd. introduced the Tattu 3.5 and 4.0 battery series for industrial drones. The drones offer a 30Ah capacity, a 4C-5C charging point, and a Battery Management System (BMS) for real-time monitoring. The Tattu 3.5 requires an Anti-Spark Modular, while the Tattu 4.0 includes a built-in MOSFET for easier installation and safety.

- July 2024 : GE Aerospace (US) and Kratos Turbine Technologies, a division of Kratos Defense & Security Solutions, Inc.(US), signed a Memorandum of Understanding to partner on the development and production of small, affordable engines that could potentially power unmanned aerial systems (UAS), collaborative combat aircraft, and similar applications. The partnership was built on an existing joint development agreement, including full-scale engine production.

- June 2024 : General Electric Company (GE Aerospace) (US) and Hindustan Aeronautics Limited (HAL) (India) partnered to design, develop, and manufacture unmanned aerial vehicles (UAVs) in India. This partnership aligned with India’s “Make in India” and “Aatmanirbhar Bharat” initiatives, aiming to localize advanced aerospace technologies and reduce reliance on imports.

Table of Contents

Methodology

This research study involves the use of extensive secondary sources, directories, and databases (e.g., Hoovers, Bloomberg Business, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial study on the UAV (drone) propulsion market. Primary sources include several industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, IP vendors, standards, and organizations related to all the segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to, for identifying and collecting information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals and certified publications, and articles from recognized authors; and websites, directories, and databases. Secondary research has mainly been used to obtain key information about the industry’s supply chain, the market’s value chain, major players, market classification, and segmentation according to the industry trends to the bottommost level, geographic markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research has been conducted after obtaining information about the current scenario of the UAV (Drone) propulsion market through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across North America, Europe, Asia Pacific, the Middle East, and the Rest of the World. This primary data was collected through questionnaires, emails, and telephonic interviews.

Notes: The tiers of companies are based on their revenue as of 2024.

Tier 1: company revenue greater than USD 1 billion; tier 2: company revenue between USD 100 million and USD 1 billion; and tier 3: company revenue less than USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

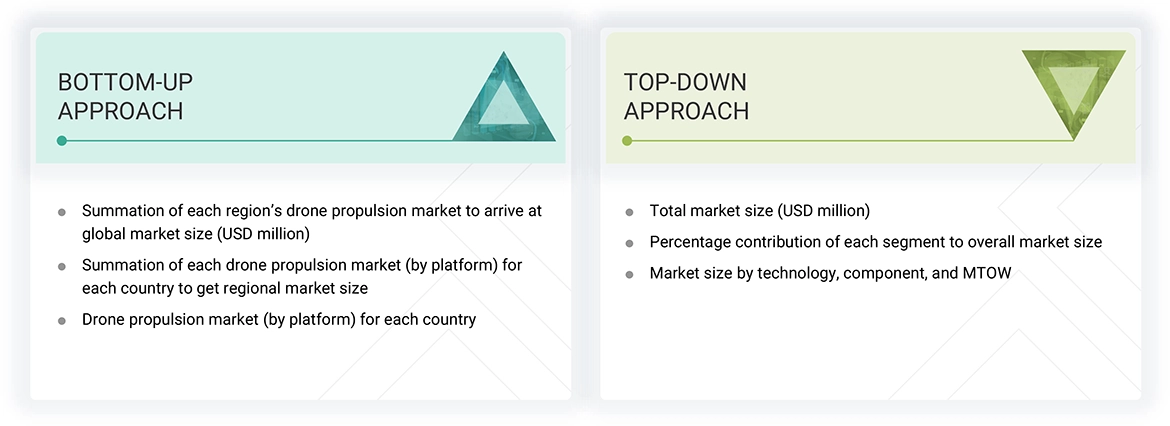

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the UAV (drone) propulsion market.

The research methodology used to estimate the market size includes the following details:

- Key players in the market have been identified through secondary research, and their market ranking has been determined through primary and secondary research. This includes a study of annual and financial reports of the top market players and extensive interviews with industry experts knowledgeable about UAV (drone) propulsion systems.

- The top-down and bottom-up approaches were used to estimate and validate the size of the global market and the dependent submarkets in the overall market.

UAV (Drone) Propulsion Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the UAV (drone) propulsion market from the estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures described below were implemented to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The UAV (drone) propulsion market size was also validated using the top-down and bottom-up approaches.

Market Definition

The UAV (drone) propulsion market comprises the power-generation and thrust-producing systems that keep unmanned aerial vehicles (UAVs) airborne across the military, commercial, government, law enforcement, and consumer segments. It covers electric drivetrains built around brushless DC motors, electronic speed controllers, lithium-ion and fuel-cell power packs; hybrid-electric propulsion that pairs batteries with piston or rotary engines; and conventional internal-combustion and micro-turbine solutions for long-range or heavy-lift missions. These technologies aim to extend endurance, improve thrust-to-weight ratios, lower acoustic signatures, and enhance platform modularity and reliability, enabling diverse applications from last-mile delivery and aerial mapping to ISR (intelligence, surveillance, reconnaissance) and precision-strike missions.

In addition to their applications in various industries, 3D cameras have become increasingly popular in recent years in the consumer market. They are used by hobbyists, enthusiasts, and professionals alike to capture 3D photos and videos of landscapes, people, animals, and more.

Key Stakeholders

- UAV (drone) propulsion manufacturers >

- Raw material suppliers

- Government agencies

- Technology support providers

- Military organizations

- Commercial organizations

- Government agencies

- Research institutions

- Emergency response and law enforcement agencies

Report Objectives

- To define, describe, segment, and forecast the size of the UAV (drone) propulsion market by component, technology, MTOW, platform, and region

- To forecast the size of various segments with respect to five major regions: North America, Europe, Asia Pacific, Middle East, and the Rest of World

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market across the globe

- To identify industry trends, market trends, and technology trends that are currently prevailing in the market

- To provide an overview of the regulatory landscape with respect to UAV (drone) propulsion regulations across regions

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, product launches, contracts, and partnerships, adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market ranking analysis, market share analysis, and revenue analysis of key players

Customization Options

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

What is the estimated size of the UAV (drone) propulsion market in 2025?

The UAV (drone) propulsion market is estimated at USD 7.01 billion in 2025.

Who are the winners in the UAV (drone) propulsion market?

The winners in the UAV (drone) propulsion market are DJI (China), RTX (US), Honeywell International Inc. (US), Rolls-Royce plc (UK), and General Electric Company (US).

What are some of the technological advancements in the market?

Here’s the list of technologies adopted in the UAV (drone) propulsion market: Hybrid-electric Propulsion Systems Advanced Battery Technologies Turboelectric & Micro Gas Turbine Propulsion AI-optimized Power Management Systems

What factors are driving growth in the UAV (drone) propulsion market?

The following factors are driving growth in the market: Increasing procurement of UAVs by military Growing demand for long-endurance UAVs Increasing application of commercial drones Technological advancements in electric propulsion systems

Which region is estimated to account for the largest share of the UAV (drone) propulsion market in 2025?

North America is estimated to account for the largest share (38.5%) of the global UAV (drone) propulsion market in 2025.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the UAV (Drone) Propulsion Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in UAV (Drone) Propulsion Market