Two Wheeler Fuel Injection Systems Market by Technology (Carbureted Fuel Injection System, Electronic Fuel Injection System), by Engine Size, by Component and by Geography - Global Forecast and Analysis to 2019

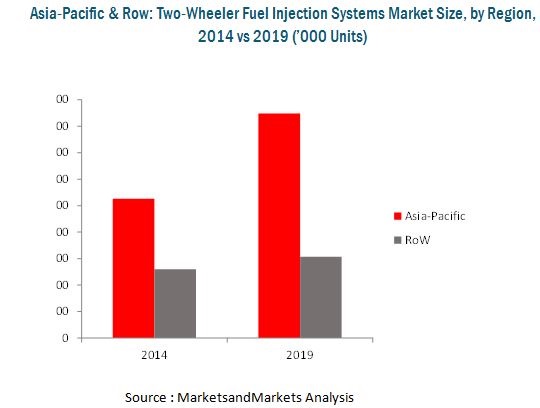

[165 Pages Report] Global two-wheeler fuel injection systems market includes a wide range of components such as Fuel injection (FI) system, which includes Fuel injectors, Electronic control unit (ECU) & Fuel pump/rail, and carburetors, which include off-idle circuit, open throttle circuit, choke, power valve, and accelerator pump. In the future, the demand for two-wheeler fuel injection systems is anticipated to increase specifically in the Asia-Pacific region. With one-third of the world population in China and India, there is tremendous scope for investment in this region. Moreover, there is abundant scope for sales of two-wheeler in this region, as countries such as India and China has a favorable demographic distribution of buyers.

Increase in the level of income and standard of living is another factor that is expected to drive demand for the two-wheeler fuel injection systems market. Increasing penetration of electric vehicles and lower safety features of two wheelers are acting as restraining factors for the growth of the market. The European economy is recovering from an economic crisis, but with increasing government initiatives, the market is expected to grow in the future.

This report classifies and defines the global market in terms of volume and value. This report provides comprehensive analysis and insights on the global market (both - qualitative and quantitative). The report highlights potential growth opportunities in the coming years; it also covers review of the market drivers, restraints, growth indicators, challenges, legislation trends, market dynamics, competitive landscape, and other key aspects with respect to global market. Some of the key players in the global market include Robert Bosch GmbH (Germany), Magneti Marelli S.p.A. (Italy), Ucal Fuel systems Ltd. (India), Delphi Automotive PLC (U.K.), Keihien Corporation (Japan), and Mikuni Corporation (Japan).

Scope of the Report

The report covers the global two-wheeler fuel injection systems market in terms of volume and value. Market size in terms of volume is provided from 2012 to 2019 in units, whereas the value of the market is provided in $millions. The global market is broadly classified by geography (Asia-Pacific, Europe, North America, and RoW), focusing on key countries in each region by technology (Carbureted Fuel Injection System, Electronic Fuel injection System) by engine size (Less Than 100cc, 101cc-150cc, 151cc-250cc, 251cc-500cc, 501cc & Above).

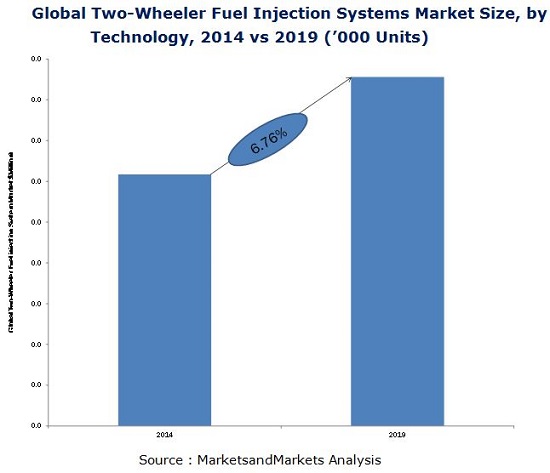

Global two-wheeler fuel injection systems market: The market value of two-wheeler fuel injection systems is projected to grow at a CAGR of 6.76% to reach $ 8.6 Billion by 2019

Growth in infrastructure and initiatives taken by government to curb exhaust emission across the globe is boosting the market for global two-wheeler fuel injection systems, which is anticipated to grow with a promising CAGR of ~7% during the period under study. Robust economic growth, rising population, and rapid urbanization in the Asia-Pacific region is a major driver that aids the demand in this region. Additionally, with technological advancements, fuel injection systems are also set to become more fuel-efficient with low emissions, reliable, and affordable. Increasing funding from banks for purchase of two-wheeler has also helped the industry grow much faster. Many companies have started adopting strategies such as of joint venture, mergers and acquisitions, and collaborations; the focus is clearly set on developing markets such as China, India, Brazil, and Russia.

Global market is steadily captivating in the regions of North America and Europe. However, Asia-Pacific and RoW countries are witnessing huge investments in infrastructure such as roads, bridges, highways, and expressways to increase transport facilities between countries. Hence, the market for fuel injection system is projected to grow. In the developed nations of Europe and North America, upcoming infrastructure projects are fewer in number; however with rising employment rates and increased R&D activity, steady growth is expected in this region as well. For this report, the global market has been primarily divided by technologies including Carbureted Fuel Injection System (CFI), and Electronic Fuel Injection (EFI) system, which is further segmented into Multi-Pont Fuel Injection System (MPFI).

The global two-wheeler fuel injection systems market is dominated by various players including Robert Bosch GmbH (Germany), Magneti Marelli S.p.A. (Italy), Ucal Fuel systems Ltd. (India), Delphi Automotive PLC (U.K.), Keihien Corporation (Japan), and Mikuni Corporation (Japan).

Table of Contents

1 Introduction (Page No. - 15)

1.1 Study Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.1.1 Global Two-Wheeler Fuel Injection Systems Market, By Technology

1.3.1.2 Global Market, By Region

1.3.1.3 Global Market, By Engine Size

1.3.2 Years Considered in the Report

1.4 Currency & Pricing

1.5 Limitation

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Two-Wheeler Fuel Injection Systems Market

2.2 Market Size Estimation

2.3 Market Crackdown & Data Triangulation

2.4 Market Share Estimation

2.4.1 Key Data From Secondary Sources

2.4.2 Key Data From Primary Sources

2.4.2.1 Key Industry Insights

2.5 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Two-Wheeler Fuel Injection System Market

4.2 Life-Cycle Analysis, By Region

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increase in Standard of Living in Developing Nations

5.4.1.2 Favorable Demographics in Asia-Pacific Region

5.4.1.3 Improving Economic Condition in Developed Nations

5.4.2 Restraints

5.4.2.1 Two-Wheelers Are Comparatively Less Safe

5.4.2.2 Increase in Adoption of Electric Vehicles

5.4.3 Opportunities

5.4.3.1 Increasing Demand for High-End Bikes

5.4.3.2 Gaining Prominence of Certain Products and Customer Segment

5.4.4 Challenges

5.4.4.1 Maintaining the Balance Between Fuel Efficiency, Cost, and Emissions

5.4.4.2 Manufacturing Low-Cost Electronic Fuel Injection Systems

5.4.5 Burning Issue

5.4.5.1 Introduction of Low-Priced Cars

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Two-Wheeler Fuel Injection System, By Technology (Page No. - 48)

7.1 Introduction

7.2 Electronic Fuel Injection System

7.3 Carburetor Injection System

8 Two-Wheeler Fuel Injection System Market, By Region (Page No. - 54)

8.1 Introduction

8.2 Pest Analysis

8.2.1 Political Factors

8.2.2 Economic Factors

8.2.3 Social Factors

8.2.4 Technological Factors

8.3 Asia-Pacific

8.3.1 By Technology

8.3.2 By Engine Size

8.3.3 China

8.3.3.1 By Technology

8.3.3.2 By Engine Size

8.3.4 Japan

8.3.4.1 By Technology

8.3.4.2 By Engine Size

8.3.5 India

8.3.5.1 By Technology

8.3.5.2 By Engine Size

8.3.6 Indonesia

8.3.6.1 By Technology

8.3.6.2 By Engine Size

8.3.7 Thailand

8.3.7.1 By Technology

8.3.7.2 By Engine Size

8.4 Europe

8.4.1 By Technology

8.4.2 By Engine Size

8.4.3 Germany

8.4.3.1 By Technology

8.4.3.2 By Engine Size

8.4.4 Italy

8.4.4.1 By Technology

8.4.4.2 By Engine Size

8.4.5 France

8.4.5.1 By Technology

8.4.5.2 By Engine Size

8.5 North America

8.5.1 By Technology

8.5.2 By Engine Size

8.5.3 U.S.

8.5.3.1 By Technology

8.5.3.2 By Engine Size

8.5.4 Mexico

8.5.4.1 By Technology

8.5.4.2 By Engine Size

8.5.5 Canada

8.5.5.1 By Technology

8.5.5.2 By Engine Size

8.6 RoW

8.6.1 By Technology

8.6.2 By Engine Size

8.6.3 Brazil

8.6.3.1 By Technology

8.6.3.2 By Engine Size

8.6.4 Russia

8.6.4.1 By Technology

8.6.4.2 By Engine Size

9 Two-Wheeler Fuel Injection System Market, By Components (Page No. - 118)

9.1 Introduction

9.2 Fuel Injection (FI) System

9.2.1 Fuel Injectors

9.2.2 Electronic Control Unit (ECU)

9.2.3 Fuel Pump/Rail

9.3 Carburetors

9.3.1 Off-Idle Circuit

9.3.2 Open-Throttle Circuit

9.3.3 Power Valve

9.3.4 Choke

9.3.5 Accelerator Pump

10 Two-Wheeler Fuel Injection Systems Market, By Engine Size (Page No. - 122)

10.1 Introduction

10.2 Less Than 100cc

10.3 101cc 150cc

10.4 151cc 250cc

10.5 251cc 500cc

10.6 501cc & Above

11 Competitive Landscape (Page No. - 129)

11.1 Overview

11.2 Market Share Analysis

11.3 Competitive Situation and Trends

11.3.1 New Product Launches

11.3.2 Agreements, Partnerships, Collaborations, Supply Contracts & Joint Ventures

11.3.3 Expansions

11.3.4 New Application Launch

12 Company Profile (Page No. - 135)

(Company at a Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 Delphi Automotive PLC

12.3 Robert Bosch GmbH (Bosch)

12.4 Continental AG

12.5 Denso Corporation

12.6 Magneti Marelli

12.7 Keihin Corporation

12.8 Ucal Fuel Systems Ltd

12.9 Mikuni Corporation

12.10 Walbro Corporation

12.11 Edelbrock LLC

*Details on Company at a Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 159)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Introducing RT: Real Time Market Intelligence

14 Additional customizations

14.1 Geography

14.1.1 South Africa

14.1.2 Middle East

14.2 Market by transmission type

14.2.1 Manual

14.2.2 Automatic

14.3 Market by vehicle type

14.3.1 Rolling stock

14.3.2 Marine

List of Tables (86 Tables)

Table 1 Gross National Income (GNI) Per Capita (Current International)

Table 2 GDP (Gross Domestic Product) Per Capita (Current Us$)

Table 3 India is Going to be Best Prospect in Terms of Investment, as the Young Target Group (20-39) is Consistently Growing Over the Period 2011 to 2014 38

Table 4 Global Two Wheeler Fuel Injection System Market, By Technology, 2012-2019 (000 Units)

Table 5 Market, By Technology, 2012-2019 ($Million)

Table 6 Two Wheeler Electronic Fuel Injection System Market, By Region, 2012-2019 (00o Units)

Table 7 Two Wheeler Electronic Fuel Injection System Market, By Region, 2012-2019 ($Million)

Table 8 Global Two Wheeler Carburetor Injection System Market, By Region, 2012-2019 (00o Units)

Table 9 Global Two Wheeler Carburetor Injection System Market, By Region, 2012-2019 ($Million)

Table 10 Global Two Wheeler Fuel Injection Systems Market Size, By Region, 2012-2019 ('000 Units)

Table 11 Two Wheeler Fuel Injection Systems Market Size, By Region, 2012-2019 ($Million)

Table 12 Asia-Pacific: Two Wheeler Fuel Injection Systems Market Size, By Country 2012-2019 ('000 Units)

Table 13 Asia-Pacific: Market Size, By Country 2012-2019 ($Million)

Table 14 Asia-Pacific: Two Wheeler Fuel Injection System Market Size, By Engine Size, 2012-2019 (000 Units)

Table 15 Asia-Pacific: Market Size, By Engine Size, 2012-2019 ($Million)

Table 16 China: Two Wheeler Fuel Injection Systems Market Size, By Technology, 2012-2019 ('000 Units)

Table 17 China: Market Size, By Technology, 2012-2019 ($Million)

Table 18 China: Two Wheeler Fuel Injection System Market Size, By Engine Size, 2012-2019 (000 Units)

Table 19 China: Market Size, By Engine Size, 2012-2019 ($Million)

Table 20 Japan: Two Wheeler Fuel Injection Systems Market Size, By Technology, 2012-2019 ('000 Units)

Table 21 Japan: Market Size, By Technology, 2012-2019 ($Million)

Table 22 Japan: Two Wheeler Fuel Injection System Market Size, By Engine Size, 2012-2019 (000 Units)

Table 23 Japan: Market Size, By Engine Size, 2012-2019 ($Million)

Table 24 India: Two Wheeler Fuel Injection Systems Market Size, By Technology, 2012-2019 ('000 Units)

Table 25 India: Market Size, By Technology, 2012-2019 ($Million)

Table 26 India: Two Wheeler Fuel Injection System Market Size, By Engine Size, 2012-2019 (000 Units)

Table 27 India: Market Size, By Engine Size, 2012-2019 ($Million)

Table 28 Indonesia: Two Wheeler Fuel Injection Systems Market Size, By Technology, 2012-2019 ('000 Units)

Table 29 Indonesia: Market Size, By Technology, 2012-2019 ($Million)

Table 30 Indonesia: Two Wheeler Fuel Injection System Market Size, By Engine Size, 2012-2019 (000 Units)

Table 31 Indonesia: Market Size, By Engine Size, 2012-2019 ($Million)

Table 32 Thailand: Two Wheeler Fuel Injection Systems Market Size, By Technology, 2012-2019 ('000 Units)

Table 33 Thailand: Market Size, By Technology, 2012-2019 ($Million)

Table 34 Thailand: Two Wheeler Fuel Injection System Market Size, By Engine Size, 2012-2019 (000 Units)

Table 35 Thailand: Market Size, By Engine Size, 2012-2019 ($Million)

Table 36 Europe: Two Wheeler Fuel Injection Systems Market Size, By Country 2012-2019 ('000 Units)

Table 37 Europe: Market Size, By Country 2012-2019 ($Million)

Table 38 Europe: Two Wheeler Fuel Injection System Market Size, By Engine Size, 2012-2019 (000 Units)

Table 39 Europe: Market Size, By Engine Size, 2012-2019 ($Million)

Table 40 Germany: Two Wheeler Fuel Injection Systems Market Size, By Technology, 2012-2019 ('000 Units)

Table 41 Germany: Market Size, By Technology, 2012-2019 ($Million)

Table 42 Germany: Two Wheeler Fuel Injection System Market Size, By Engine Size, 2012-2019 (000 Units)

Table 43 Germany: Market Size, By Engine Size, 2012-2019 ($Million)

Table 44 Italy: Two Wheeler Fuel Injection Systems Market Size, By Technology, 2012-2019 ('000 Units)

Table 45 Italy: Market Size, By Technology, 2012-2019 ($Million)

Table 46 Italy: Two Wheeler Fuel Injection System Market Size, By Engine Size, 2012-2019 (000 Units)

Table 47 Italy: Market Size, By Engine Size, 2012-2019 ($Million)

Table 48 France: Two Wheeler Fuel Injection Systems Market Size, By Technology, 2012-2019 ('000 Units)

Table 49 France: Market Size, By Technology, 2012-2019 ($Million)

Table 50 France: Two Wheeler Fuel Injection System Market Size, By Engine Size, 2012-2019 (000 Units)

Table 51 France: Market Size, By Engine Size, 2012-2019 ($Million)

Table 52 North America: Two Wheeler Fuel Injection Systems Market Size, By Country 2012-2019 ('000 Units)

Table 53 North America: Market Size, By Country 2012-2019 ($Million)

Table 54 North America: Two Wheeler Fuel Injection System Market Size, By Engine Size, 2012-2019 (000 Units)

Table 55 North America: Market Size, By Engine Size, 2012-2019 ($Million)

Table 56 U.S.: Two Wheeler Fuel Injection Systems Market Size, By Technology, 2012-2019 ('000 Units)

Table 57 U.S.: Market Size, By Technology, 2012-2019 ($Million)

Table 58 U.S.: Two Wheeler Fuel Injection System Market Size, By Engine Size, 2012-2019 (000 Units)

Table 59 U.S.: Market Size, By Engine Size, 2012-2019 ($Million)

Table 60 Mexico: Two Wheeler Fuel Injection Systems Market Size, By Technology, 2012-2019 ('000 Units)

Table 61 Mexico: Market Size, By Technology, 2012-2019 ($Million)

Table 62 Mexico: Two Wheeler Fuel Injection System Market Size, By Engine Size, 2012-2019 (000 Units)

Table 63 Mexico: Market Size, By Engine Size, 2012-2019 ($Million)

Table 64 Canada: Two Wheeler Fuel Injection Systems Market Size, By Technology, 2012-2019 ('000 Units)

Table 65 Canada: Market Size, By Technology, 2012-2019 ($Million)

Table 66 Canada: Two Wheeler Fuel Injection System Market Size, By Engine Size, 2012-2019 (000 Units)

Table 67 Canada: Market Size, By Engine Size, 2012-2019 ($Million)

Table 68 RoW: Two Wheeler Fuel Injection Systems Market Size, By Country 2012-2019 ('000 Units)

Table 69 RoW: Market Size, By Country 2012-2019 ($Million)

Table 70 RoW: Two Wheeler Fuel Injection System Market Size, By Engine Size, 2012-2019 (000 Units)

Table 71 RoW: Market, By Engine Size, 2012-2019 ($Million)

Table 72 Brazil: Two Wheeler Fuel Injection Systems Market Size, By Technology, 2012-2019 ('000 Units)

Table 73 Brazil: Market Size, By Technology, 2012-2019 ($Million)

Table 74 Brazil: Two Wheeler Fuel Injection System Market Size, By Engine Size, 2012-2019 (000 Units)

Table 75 Brazil: Market Size, By Engine Size, 2012-2019 ($Million)

Table 76 Russia: Two Wheeler Fuel Injection Systems Market Size, By Technology, 2012-2019 ('000 Units)

Table 77 Russia: Market Size, By Technology, 2012-2019 ($Million)

Table 78 Russia: Two Wheeler Fuel Injection System Market Size, By Engine Size, 2012-2019 (000 Units)

Table 79 Russia: Market Size, By Engine Size, 2012-2019 ($Million)

Table 80 Engine Size: Two Wheeler Fuel Injection System Market Size, By Volume, 2012-2019 (000 Units)

Table 81 Engine Size: Market Size, By Value 2012-2019 ($Million)

Table 82 Less Than 100cc Two-Wheeler Fuel Injection Systems Market Size, By Region 2012-2019 ($Million)

Table 83 101cc-150cc Two Wheeler Fuel Injection Systems Market Size, By Region 2012-2019 ($Million)

Table 84 151cc-250cc Two Wheeler Fuel Injection Systems Market Size, By Region 2012-2019 ($Million)

Table 85 251cc-500cc Two Wheeler Fuel Injection Systems Market Size, By Region 2012-2019 ($Million)

Table 86 500cc & Above Two Wheeler Fuel Injection Systems Market Size, By Region 2012-2019 ($Million)

List of Figures (64 Figures)

Figure 1 Global Two Wheeler Fuel Injection Systems Market

Figure 2 Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Break Down of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Two Wheeler Fuel Injection Systems Market Snapshot (2014 vs. 2019)

Figure 6 Market Size, By Technology, 2014 ($Million & CAGR%)

Figure 7 Asia-Pacific: Largest Two-Wheeler Market in the World

Figure 8 Future Growth for Two- Wheeler Fuel Injection System Market

Figure 9 151cc-250cc Segment to Grow at the Fastest Rate Among All Engine Size Segments

Figure 10 Asia-Pacific: The Largest Market for Two Wheelers

Figure 11 Two Wheeler Fuel Injection System Market, By Countries

Figure 12 Mid-Sized Engines (101cc-250cc) to Account for Over Three-Fifth of the Global Two-Wheeler Fuel Injection Market By 2019

Figure 13 The Two Wheeler Market in Europe Has Now Entered the Maturity Phase

Figure 14 Technology Roadmap

Figure 15 Global Two Wheeler Fuel Injection Systems Market Segmentation

Figure 16 Favorable Demographics in Asia-Pacific & Improving Economic Conditions in Developed Nations to Spur Demand for Two Wheeler Fuel Injection Systems

Figure 17 Proportion of Road Traffic Deaths, By Country, 2010

Figure 18 Value Chain Analysis: Two Wheeler Fuel Injection System Market

Figure 19 Porters Five Forces Analysis (2013)

Figure 20 Carbureted Versus Electronic Fuel Injection, 2014 & 2019

Figure 21 Electronic Fuel Injection System, By Region

Figure 22 Carbureted Fuel Injection System, By Region

Figure 23 Region-Wise Snapshot (2014) Emerging Markets Becoming Focus Areas for Two Wheeler Fuel Injection System Manufacturers

Figure 24 Asia-Pacific: India & China Are Major Markets

Figure 25 Asia-Pacific: Two Wheeler Fuel Injection Systems Market Size, By Country, 2014 vs 2019, ($Million)

Figure 26 Asia-Pacific: Market Size, By Country, 2014 ($Million)

Figure 27 China: Largest Two Wheeler Market in the World

Figure 28 China: Two Wheeler Fuel Injection System Market, By Engine Size, 2014 vs 2019, ($Million)

Figure 29 India: an Attractive Market for Two-Wheelers Globally

Figure 30 Europe: Two Wheeler Fuel Injection Systems Market Size, By Country, 2014 vs 2019, ($Million)

Figure 31 Europe: Market Size, By Country, 2014 ($Million)

Figure 32 Italy: the Largest Non-Asian Motorcycle Market in the World

Figure 33 Europe: Two Wheeler Fuel Injection System Market, By Engine Size, 2014 vs 2019 ($Million)

Figure 34 North America: Two Wheeler Fuel Injection Systems Market Size, By Country, 2014 vs 2019, ($Million)

Figure 35 North America: Two Wheeler Fuel Injection Technology Market Share, 2014

Figure 36 U.S.: Largest Market for Two Wheelers in North America

Figure 37 North America: Two-Wheeler Fuel Injection System Market, By Engine Size, 2014 vs 2019 ($Million)

Figure 38 RoW: Two Wheeler Fuel Injection Systems Market Size, By Country, 2014 vs. 2019

Figure 39 RoW: Market Size, By Country, 2014 ($Million)

Figure 40 Russia: Fastest Growing Two-Wheeler Market in RoW

Figure 41 RoW: Two Wheeler Fuel Injection System Market, By Engine Size, 2014 vs 2019 ($Million)

Figure 42 151cc-250cc is the Fastest Growing Engine Size Segment in the Two Wheeler Fuel Injection System Market

Figure 43 Engine Size: Two Wheeler Fuel Injection System Market Share, By Value

Figure 44 Companies Adopted Expansion & Product Innovation as Key Growth Strategy

Figure 45 Robert Bosch GmbH Grew at the Fastest Rate Between 2009-2013

Figure 46 FIS Market Share, By Key Player, 2014*

Figure 47 Battle for Market Share: Companies Adopted Expansion and New Product Launch as Their Strategy

Figure 48 Region-Wise Revenue Mix of Top 5 Market Players

Figure 49 Competitive Benchmarking of Key Market Players: Denso Corporation & Robert Bosch GmbH Emerged as Champions Owing to Their Diversified Product Portfolio

Figure 50 Delphi Automotive PLC: Business Overview

Figure 51 SWOT Analysis: Delphi Automotive PLC

Figure 52 Robert Bosch GmbH: Business Overview

Figure 53 Robert Bosch GmbH: SWOT Analysis

Figure 54 Business Overview: Continental Ag

Figure 55 Business Overview: Denso Corporation

Figure 56 Magneti Marelli: Business Overview

Figure 57 SWOT Analysis: Magneti Marelli

Figure 58 Keihin Corporation: Business Overview

Figure 59 SWOT Analysis: Keihin Corporation

Figure 60 Business Overview: Ucal Fuel Systems Ltd

Figure 61 SWOT Analysis: Ucal Fuel Systems Ltd

Figure 62 Business Overview: Mikuni Corporation

Figure 63 Business Overview: Walbro Corporation

Figure 64 Business Overview: Edelbrock LLC

Growth opportunities and latent adjacency in Two Wheeler Fuel Injection Systems Market

Hello my company is an automotive injection decorative trim supplier and we are reviewing our current business technologies. We would like to find out what the current IMD (In-Mould Decorative) market - particularly which automotive brand and model uses IMD and what is the percentage?