Turf Care Equipment Market by Type (Sprayer, Roller, Topdresser, Aerator, Bunker Rake), Category (Walk- & Tow-Behind, Bed-Mounted, Ride-On, Attachment), Application (Golf Course, Baseball, Football), Powertrain, Customer & Region - Global Forecast to 2027

The turf care equipment is used to assist in the maintenance operations of the golf courses. Some major turf care equipment are sprayers, rollers, top dressers, aerators, and bunker rake machines. The turf care equipment is widely used in maintaining the large golf course sites with less efforts and reduce the time required for completing the operations.

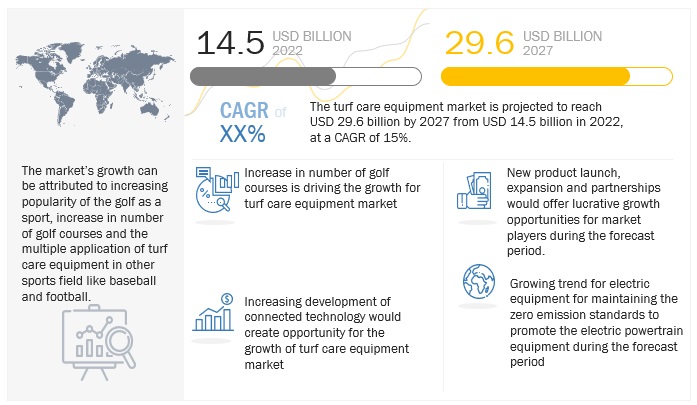

The global turf care equipment market size is expected to grow from USD 14.5 billion in 2022 to USD 29.6 billion in 2027, at a CAGR of 15%. The increasing popularity of golf as a sport globally is among the major factor influencing the turf care equipment market. Also, the increased application of these equipment in other sports fields like baseball fields, football fields and cricket fields are also boosting the growth of the market.

Drivers: Increase in the number of golf courses to drive the demand for turf care equipment

There is growth in the number of golf courses across the globe as per the survey conducted by National Golf Foundation (NGF), in 2021, which showed 206 countries play golf out of 251 countries and dependent territories. As per the records of NGF, there is a nearly 44% increase in the numbers from 2006 to 2019. Also, as per the ASIAN Golf, nearly 5,000 golf courses were developed in Asia by March 2020, of which 196 were officially registered in India. Therefore, the growing popularity among people for golf and rising enthusiasm toward this sport will drive the turf care equipment market during the forecast period.

Growth of the hospitality sector

The hospitality sector includes hotels and resorts with large turf areas and luxurious amenities like small golf courses. With the shifting preference toward luxury tourism, there has been an increase in the number of luxurious hotels and resorts globally. The turf care equipment finds wide application in the maintenance of the turfs at these hotels and resorts. Thus, the rising number of such luxury hotels and resorts would drive the demand for turf care equipment during the forecast period.

Challenges: Cost reduction and improved energy density of EV batteries

The increasing trend for electric powered equipment by the golf course owners for maintaining the zero-emission policy within the green zero has created demand for electric turf care equipment. The major challenge faced by the manufacturers is development of lithium-ion batteries that are compact and highly efficient, keeping the cost structure into consideration. Another challenge faced is the energy density of EV batteries. The challenge is to produce high energy density batteries for compact turf care equipment with longer running efficiencies

Key Players in the Market

The Toro Company (US), Deere & Company (US), Salsco, Inc. (US), Turfco. (US), Tru-Turf Pty LTD (Australia), Smithco (US), Redexim World (Netherlands), Baroness (US), Turftime Equipment (US), and Team Sprayers Ltd (UK) are few players in the Turf care equipment Market globally.

Recent Developments

- In September 2022, The Toro Company and True Value Company (US) entered an expanded partnership agreement. As per the agreement, The Toro Company will provide True Value Company’s independently owned retailers access to the complete line of Toro’s battery-powered Flex-Force 60V outdoor power equipment.

- In August 2022, Deere & Company introduced the GPS sprayer. The HD200 GPS precision sprayer has revolutionised the way to apply herbicides, fungicides and fertilisers over the golf lawns. It is attached to the Deere & Company’s ProGator heavy-duty utility vehicle chassis. It is packed full of technology such as AutoTrac, which guides the machine for the operator to turn on and shut off individual nozzles. This means spraying the turf becomes far more accurate as there is no overlap or non-target areas sprayed with expensive chemicals.

- In August 2022, The Toro Company introduced IntelliDash Irrigation and Fleet Management Platform, which would help golf course owners to monitor, manage, track and maintain their operations all in one place. IntelliDash provides a platform that the golf course superintendents can easily access on any computer or mobile device, so equipment, labor, and agronomic data can be viewed from anywhere at any time.

- In March 2022, Deere & Company launched JDLink Technology which synchronizes the cloud technology and the electrified machines at the golf courses. The new technology allows users to synchronize selected machines working anywhere on the course, which supports managing the activity remotely.

- In June 2021, Turfco. Released the T5000 Spreader/Sprayer built with a 60-gallon sprayer and 325-lb spreader capacity. The spreader/sprayer is coupled with a 22-hp engine delivering speeds up to 7 mph. The new product offers a steering wheel drive system, a two-nozzle boomless spray system, and an optional 3-in-1 tank.

Frequently Asked Questions (FAQ):

What is the current size of the global turf care equipment market?

The turf care equipment market is projected to grow from USD 14.5 billion in 2022 to USD 29.6 billion by 2027, at a CAGR of 15%.

Which are the major equipment types currently used in golf course maintenance?

Sprayers, rollers, top-dressers, aerators, and bunker rake machines are used in golf course maintenance.

Many companies are operating in the turf care equipment market space across the globe. Do you know who are the front leaders and what strategies have been adopted by them?

The Toro Company (US), Deere & Company (US), Salsco, Inc. (US), Turfco. (US), Tru-Turf Pty LTD (Australia) are the top player in the market. New product development, mergers and acquisitions and expansions are the highly adopted strategies by the key market players.

How is the demand for turf care equipment varies by region?

North America is estimated to be the largest market for turf care equipment during the forecast period. The growth of the turf care equipment market in North America is mainly attributed to the higher demand from the US.

What are the growth opportunities for the turf care equipment market?

The growing trend for electric equipment to follow the zero-emission standards in the vicinity would create growth opportunities for the electric propelled turf care equipment during the forecast period. .

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources to build the base numbers

2.1.1.2 Secondary sources to estimate market sizing

2.1.1.3 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Sampling techniques & data collection methods

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

2.4 FACTOR ANALYSIS

2.5 ASSUMPTIONS

2.5.1 RESEARCH ASSUMPTIONS

2.5.2 LIMITATIONS/RISK FACTORS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 PORTERS FIVE FORCES ANALYSIS

5.3.1 PORTER’S FIVE FORCES ANALYSIS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 BARGAINING POWER OF SUPPLIERS

5.3.6 INTENSITY OF COMPETITIVE RIVALRY

5.4 PATENT ANALYSIS

5.5 AVERAGE SELLING PRICE ANALYSIS

5.6 GOLF COURSE EQUIPEMENT ECOSYSTEM

5.7 SUPPLY CHAIN ANALYSIS

5.8 CASE STUDY ANALYSIS

5.9 TRADE ANALYSIS

5.10 KEY CONFERENCES & EVENTS

5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

6 RECOMMENDATIONS BY MARKETSANDMARKETS

7 TURF CARE EQUIPMENT OE MARKET, BY EQUIPMENT

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS/LIMITATIONS

7.1.3 INDUSTRY INSIGHTS

7.2 SPRAYER

7.3 ROLLER

7.4 TOPDRESSER

7.5 AERATOR

7.6 BUNKER RAKE MACHINE

(Note - The Chapter represents the OE market only in terms of value and would further be Segmented at Regional Level - Asia Pacific, Europe, North America, Latin America and Middle East & Africa)

8 SPRAYER OE MARKET, BY PRODUCT CATEGORY

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS/LIMITATIONS

8.1.3 INDUSTRY INSIGHTS

8.2 WALK-BEHIND

8.3 RIDE-ON

8.4 ATTACHMENT

The Chapter represent the OE market only in terms of value and would further be Segmented at Regional Level - Asia Pacific, Europe, North America, Latin America and Middle East & Africa)

9 ROLLER OE MARKET, BY PRODUCT CATEGORY

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS/LIMITATIONS

9.1.3 INDUSTRY INSIGHTS

9.2 WALK-BEHIND

9.3 TOW-BEHIND

9.4 RIDE-ON

9.5 FRONT-ATTACHMENT

The Chapter represent the OE market only in terms of value and would further be Segmented at Regional Level - Asia Pacific, Europe, North America, Latin America and Middle East & Africa)

10 TOPDRESSER OE MARKET, BY PRODUCT CATEGORY

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS/LIMITATIONS

10.1.3 INDUSTRY INSIGHTS

10.2 WALK-BEHIND

10.3 BED-MOUNTED

10.4 RIDE-ON

10.5 ATTACHMENT

The Chapter represent the OE market only in terms of value and would further be Segmented at Regional Level - Asia Pacific, Europe, North America, Latin America and Middle East & Africa)

11 AERATOR OE MARKET, BY PRODUCT CATEGORY

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS/LIMITATIONS

11.1.3 INDUSTRY INSIGHTS

11.2 WALK-BEHIND

11.3 RIDE-ON

11.4 ATTACHMENT

The Chapter represent the OE market only in terms of value and would further be Segmented at Regional Level - Asia Pacific, Europe, North America, Latin America and Middle East & Africa)

12 TURF CARE EQUIPMENT OE MARKET, BY APPLICATION

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS/LIMITATIONS

12.1.3 INDUSTRY INSIGHTS

12.2 GOLF COURSES

12.3 BASEBALL INFIELDS

12.4 FOOTBALL PITCHES

12.5 OTHER SPORTS FIELD

(Note - The Chapter represent the OE market only in terms of value and would further be Segmented at Regional Level - Asia Pacific, Europe, North America, Latin America and Middle East & Africa. The chapter would not include any further bifurcation in terms of equipment or product category, and it would be an overall split of all equipment types into mentioned applications)

13 TURF CARE EQUIPMENT OE MARKET, BY POWERTRAIN

13.1 INTRODUCTION

13.1.1 RESEARCH METHODOLOGY

13.1.2 ASSUMPTIONS/LIMITATIONS

13.1.3 INDUSTRY INSIGHTS

13.2 GASOLINE

13.3 DIESEL

13.4 ELECTRIC & HYBRID

(Note - The Chapter represent the OE market only in terms of value and would further be Segmented at Regional Level - Asia Pacific, Europe, North America, Latin America and Middle East & Africa. The chapter would not include any further bifurcation in terms of equipment or product category, and it would be an overall split of all equipment types into mentioned powertrains)

14 TURF CARE EQUIPMENT OE MARKET, BY CUSTOMER

14.1 INTRODUCTION

14.1.1 RESEARCH METHODOLOGY

14.1.2 ASSUMPTIONS/LIMITATIONS

14.1.3 INDUSTRY INSIGHTS

14.2 COMMERCIAL

14.3 RESIDENTIAL

(Note - The Chapter represent the OE market only in terms of value and would further be Segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America, Latin America and Middle East & Africa. The chapter would not include any further bifurcation in terms of equipment or product category, and it would be an overall split of all equipment types into mentioned customers)

15 TURF CARE EQUIPMENT OE MARKET, BY REGION

15.1 INTRODUCTION

15.1.1 RESEARCH METHODOLOGY

15.1.2 ASSUMPTIONS/LIMITATIONS

15.1.3 INDUSTRY INSIGHTS

15.2 ASIA PACIFIC

15.3 EUROPE

15.4 NORTH AMERICA

15.5 LATIN AMERICA

15.6 MIDDLE EAST & AFRICA

The Chapter represent the OE market only in terms of value and would further be Segmented at country level.

16 COMPETITIVE LANDSCAPE

16.1 OVERVIEW

16.2 TURF CARE EQUIPMENT: MARKET RANKING ANALYSIS, 2021

16.3 COMPETITIVE EVALUATION QUADRANT

16.3.1 STAR

16.3.2 EMERGING LEADERS

16.3.3 PERVASIVE

16.3.4 PARTICIPANTS

16.4 COMPETITIVE SCENARIO

16.4.1 SUPPLY CONTRACT/PARTNERSHIPS/JOINT VENTURES/ COLLABORATIONS

16.4.2 MERGERS & ACQUISITIONS

16.4.3 EXPANSIONS

16.5 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019-2022

16.6 COMPETITIVE BENCHMARKING

17 COMPANY PROFILES

17.1 TORO

17.2 JOHN DEERE

17.3 SALSCO INC.

17.4 TURFCO.

17.5 TRU-TURF

17.6 SMITHCO

17.7 REDEXIM

17.8 BARONESS

17.9 TURFTIME EQUIPMENT

17.10 TEAM SPRAYERS

17.11 ADDITONAL PLAYERS

17.11.1 CUSHMAN

17.11.2 AGRIMETAL

17.11.3 WIEDENMANN

17.11.4 VENTRAC

17.11.5 TRUE-SURFACE

17.11.6 GREENMAN

17.11.7 RYAN TURF

17.11.8 EARTH & TURF

17.11.9 Z TURF EQUIPMENT

17.11.10 LELY TURF

17.11.11 AIRTECH SPRAYERS

17.11.12 WOODBAY TURF TECHOLOGIES

*Indicative list of companies and can be updated post study commence

(The company profile would include Business Overview, Financial Information (company’s total and segmental revenues, business segment and regional mix as provided by the company), Products Offered, Recent Developments)

Short Profiles would be provided for ‘Additional Players’ which would include information such as Headquarter, Founded Year, Latest Revenue, Business Overview, Products Offered, etc.

Details on aforementioned factors, especially Financial Information, would be captured for Listed companies only. Other financial details such as Revenue including/excluding aftermarket, and Gross Margin including/excluding aftermarket would be covered if provided by the company)

18 APPENDIX

Growth opportunities and latent adjacency in Turf Care Equipment Market