Turbine Oil Market by Base Oil (Mineral Oil, Synthetic Oil, Bio-based Oil), Turbine Type (Steam, Turbine, Gas Turbine, Hydraulic Systems), End-Use Industry (Transportation, Industrial) and Region (North America, Europe, Asia Pacific, South America, Middle East & Africa) - Global Forecast to 2030

The turbine oil market is projected to reach USD 1.91 billion by 2030, at a CAGR of 3.9% from USD 1.40 billion in 2022. Because of improved economies and rising energy consumption in both emerging and developed parts of the world, the turbine oil industry is expanding rapidly. The turbine lubricating oils include high quality and superior water separation capabilities. Traditional turbine oils are the most widely used mineral-based lubricants because they assist to reduce external contamination and oxidation products. With the recent adoption of bio-based turbine oils, it is expected that their use would increase more quickly overall, particularly in North America and Europe.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Rising energy consumption across the globe

The necessity for installing additional gas, steam, and hydroelectric power turbines has increased due to the rise in global energy consumption. The market for turbine oils is also influenced by factors including an increase in wind energy investment and supportive government initiatives and legislation. Global demand for renewable energy is now rising as a result of policy interventions by several nations, such as Nationally Determined Contributions (NDCs) and Sustainable Development Goals (SDGs).

Restraints: Growing demand for hybrid and e-vehicles

Hybrid vehicles contain both a small internal combustion engine (ICE) and an electric motor for optimum power utilization and reducing emissions from vehicles. The growing number of hybrid vehicles will reduce the demand for lubricants per vehicle almost by half, as per industry experts. This factor, coupled with increasing battery parity, will reduce the volume of the global turbine oil market.

Opportunities: Rising initiatives towards renewable energy sources

The number of wind turbines is increasing along with the size of the turbines. These turbines are being installed in remote and offshore locations. Thus, performance is paramount and any gearbox and bearing failure may lead to a huge problem. With the growing number of wind turbines and improved gearbox and bearing technology, the use of advanced lubrication is increasing. Similarly, hydroelectric power generation and tidal power generation also involves huge turbines. Thus, the growth of the renewable energy industry is expected to positively impact the turbine oil industry and offer lucrative opportunities to turbine oil manufacturers.

Challenges: Stringent environmental norms and continuous reforms by governments

Regulatory and policy restrictions on fossil-fuel fired power plants can however, restrain the growth of the steam turbines market. Growing concerns about the negative impact of carbon emissions on climate and consequent measures by regional and country level policies such as capping the amount of emissions acceptable from these plants have led to retirements of existing plants as well as shelving of future construction in favor of other options, even if they are more costly.

“Mineral Oil was the largest base oil for turbine oil market in 2021, in terms of value”

The mineral oil segment is leading the overall turbine oil market, in terms of value, in 2021. This is owed to the growing demand for mineral oil in the automotive sector in the developing countries of Asia Pacific, the Middle East & Africa, and South America. There is growing demand for Group II base oils, mainly in the developing regions of the world. They are produced via petroleum refineries in large quantities because of its high usage in different sectors such as transportation, industrial machinery, and equipment.

“Steam turbines was the largest turbine type for turbine oil market in 2021, in terms of value”

The growth is attributed to the continuing investments in electricity generation infrastructure, particularly in the large economies of Asia Pacific region. Coal fired power generation continues to remain one of the most affordable option for developing economies in the world, particularly in Asia-Pacific. Moreover, there is sufficient supply of coal for usage as fuel, while other options such as natural gas require creation of new infrastructure for its import and use. Although, the world as a whole is slowly moving away from coal-based power generation in view of growing environmental concerns, the transition is expected to be slow and would need syndicated efforts across different economies to take place.

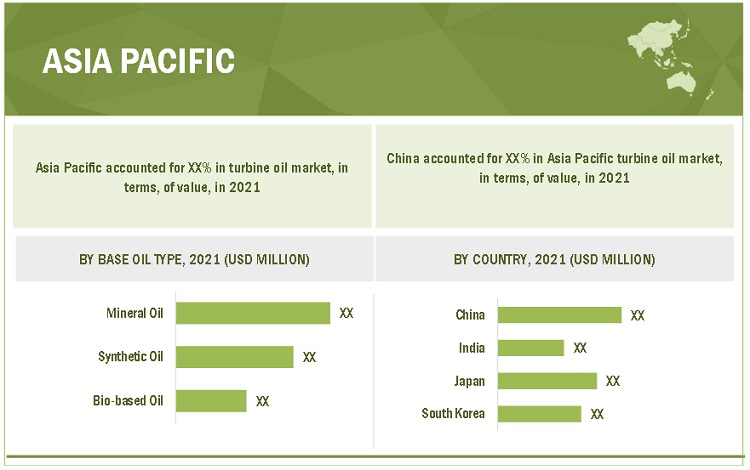

“Asia Pacific was the largest market for turbine oil in 2021, in terms of value.”

The Asia Pacific region led the worldwide market for turbine oils in 2021 and is estimated to grow at highest CAGR over the next five years. The installation of wind turbines and steam turbines will ultimately increase due to the high need for power generation in China, Japan, India, and Southeast Asia.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market Royal Dutch Shell (Netherlands), ExxonMobil Corporation (US), BP plc (UK), TotalEnergies SE. (France) Chevron Corporation (US) and Idemitsu Kosan Co. Ltd. (Japan). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of turbine oil market have opted for new product launches to sustain their market position.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2017-2030 |

|

Base Year |

2021 |

|

Forecast period |

2022–2030 |

|

Units considered |

Volume (Kiloton), Value (USD Million) |

|

Segments |

Base Oil, Turbine Type, End-Use Industry and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

The key players in this market are Royal Dutch Shell (Netherlands), ExxonMobil Corporation (US), BP plc (UK), TotalEnergies SE (France) Chevron Corporation (US) and Idemitsu Kosan Co. Ltd. (Japan)

|

This report categorizes the global turbine oil market based on application, end-use industry and region.

On the basis of base oil, the turbine oil market has been segmented as follows:

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

On the basis of turbine type, the turbine oil market has been segmented as follows:

- Gas Turbines

- Steam Turbines

- Wind Turbines

- Hydraulic Systems

- Air Compressors & Vacuum Pumps

- Others

On the basis of end-use industry, the turbine oil market has been segmented as follows:

- Transportation

- Aviation

- Marine

- Railway

- Automotive

- Construction

- Metal & Mining

- Cement Production

- Power Generation

- Automotive Production

- Chemical

- Oil & Gas

- Textile

- Food Processing

- Others

On the basis of region, the turbine oil market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Frequently Asked Questions (FAQ):

What is the expected growth rate of turbine oil market?

The forecast period for Turbine oil market in this study is 2022-2030. The Turbine oil market is projected to grow at CAGR of 3.9%, in terms of value, during the forecast period.

Who are the major key players in turbine oil market?

Royal Dutch Shell (Netherlands), ExxonMobil Corporation (US), BP plc (UK), TotalEnergies SE. (France) Chevron Corporation (US) and Idemitsu Kosan Co. Ltd. (Japan).

What is the average selling price trend for turbine oil market?

Prices are low in Asian countries (primarily China and India) compared to those in Europe and North America due to the low prices of raw materials and the availability of low-cost workforces in Asia Pacific. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of content

1 Introduction

1.1 Objective of the study

1.2 Market definition

1.3 Market Scope

1.3.1 Years considered for the study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.2 Secondary Data

2.2.1 Key data from secondary sources

2.3 Primary Data

2.3.1 Key data from primary sources

2.3.2 Breakdown of Primary Interviews

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Data Triangulation

2.6 Assumptions

2.7 Limitations

3 Executive Summary

4 Premium Insights

4.1 Opportunities in Turbine Oil Market

4.2 Turbine Oil Market, By Base Oil

4.3 Turbine Oil Market, By Turbine Type

4.4 Turbine Oil Market, By Region

5 Market Overview and Industry Trends

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

5.3 Supply Chain Analysis

5.3.1 Raw Material Manufacturing

5.3.2 Manufacturers

5.3.3 Distribution

5.3.4 End-Use Industry

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Buyers

5.4.4 Bargaining Power of Suppliers

5.4.5 Intensity of Competitive Rivalry

5.5 Average Selling Price

5.6 Regulatory Landscape

5.7 Industry Outlook

6 Turbine Oil Market, By Base Oil

6.1 Introduction

6.2 Mineral Oil

6.3 Synthetic Oil

6.4 Bio-based Oil

7 Turbine Oil Market, By Turbine Type

7.1 Introduction

7.2 Gas Turbines

7.3 Steam Turbines

7.4 Wind Turbines

7.5 Hydraulic Systems

7.6 Air Compressors & Vacuum Pumps

7.7 Others

8 Turbine Oil Market, By End-Use Industry

8.1 Introduction

8.2 Transportation

8.2.1 Aviation

8.2.2 Marine

8.2.3 Railway

8.2.4 Automotive

8.3 Industrial

8.3.1 Construction

8.3.2 Metal & Mining

8.3.3 Cement Production

8.3.4 Power Generation

8.3.5 Automotive Production

8.3.6 Chemical

8.3.7 Oil & Gas

8.3.8 Textile

8.3.9 Food Processing

8.3.10 Others

9 Turbine Oil Market, By Region

9.1 Introduction

9.2 Asia Pacific

9.2.1 China

9.2.2 India

9.2.3 Japan

9.2.4 South Korea

9.2.5 Rest of Asia Pacific

9.3 North America

9.3.1 U.S.

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Germany

9.4.2 France

9.4.3 Italy

9.4.4 U.K.

9.4.5 Rest of Europe

9.5 Middle East & Africa

9.5.1 Egypt

9.5.2 Saudi Arabia

9.5.3 South Africa

9.5.4 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of South America

10 Competitive Landscape

10.1 Introduction

10.2 Market Share Analysis

10.3 Company Evaluation Quadrant

10.4 Competitive Situation & Trends

10.4.1 New Product Launches

10.4.2 Contracts & Agreements

10.4.3 Partnerships & Collaborations

10.4.4 Joint Ventures

10.4.5 Expansions

11 Company Profile

11.1 Royal Dutch Shell

11.1.1 Business Overview

11.1.2 Products Offered

11.1.3 Recent Development

11.1.4 MnM View

11.1.4.1 Key Strengths

11.1.4.2 Strategic choices made

11.1.4.3 Threat from competition

11.2 Exxonmobil Corporation

11.3 BP PLC

11.4 Cheveron Corporation

11.5 TotalEnergies SE

11.6 Petrochina Company Limited

11.7 Idemitsu Kosan Ltd.

11.8 Sinopec Limited

11.9 Fuchs Petrolub AG

11.10 Valvoline

11.11 List of other key market players

12 Appendix

12.1 Insights from Industry Experts

12.2 Discussion Guide

12.3 Related Reports

The study involved four major activities to estimate the size of turbine oil market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The turbine oil market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, distributors, and end users. Various primary sources from the supply and demand sides of the turbine oil market have been interviewed to obtain qualitative and quantitative information.

The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the turbine oil industry.

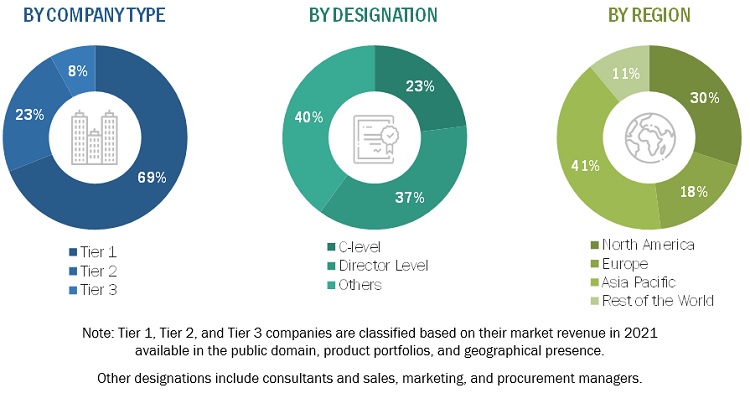

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the turbine oil market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Turbine Oil Market: Bottom-Up Approach 1

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Report Objectives

- To define, describe, and forecast the size of the turbine oil market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on base oil, turbine type, end-use industry and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, and Middle East & Africa, and South America along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies2

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Regional Analysis

Further breakdown of a region with respect to a particular country or additional application

- Company Information

Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Turbine Oil Market