Tunnel Automation Market by Component (HVAC, Lighting & Power Supply, Signalization), Offering (Hardware, Software, and Services), Tunnel Type (Railway Tunnels and Highway and Roadway Tunnels), and Geography - Global Forecast to 2035

The Tunnel Automation Market Overview From 2025 To 2035

The tunnel automation market is entering a transformative phase with technology playing a pivotal role in redefining how tunnels are operated maintained and experienced. From railway tunnels to roadway infrastructure the integration of automation across HVAC lighting signalization and power systems is unlocking new levels of efficiency safety and sustainability. As cities grow and transportation demands rise tunnel automation will be indispensable to building resilient infrastructure for the future. With strong growth projected from 2025 to 2035 stakeholders in this market including technology providers infrastructure developers and public agencies have a tremendous opportunity to shape the future of global mobility..

Tunnel Automation Market, By Offering:

- Hardware

- Software

- Services

Tunnel Automation Market, By Tunnel Type

- Railways

- Highway and Roadway Tunnels

Tunnel Automation Market, By Component

- HVAC

- Lighting & Power Supply

- Signalization

- Others

Tunnel Automation Market, By Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Switzerland

- Rest of Europe (Italy, the Netherlands, Denmark, Slovenia, Sweden, Finland, Norway, Romania, Bulgaria, and Poland)

-

Asia Pacific (APAC)

- China

- Japan

- Australia

- Rest of APAC (India, Singapore, Malaysia, and Thailand)

-

Rest of the World (RoW)

- Middle East and Africa

- South America

Key questions addressed by the report:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industrial trends for market?

- How inorganic growth strategies implemented by key players will impact the growth rate of the market, and who will have the undue advantage?

- What are the current investment trends in the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary and Primary Research

2.1.1.1 Key Industry Insights

2.1.2 Secondary Data

2.1.2.1 List of Major Secondary Sources

2.1.2.2 Secondary Sources

2.1.3 Primary Data

2.1.3.1 Primary Interviews With Experts

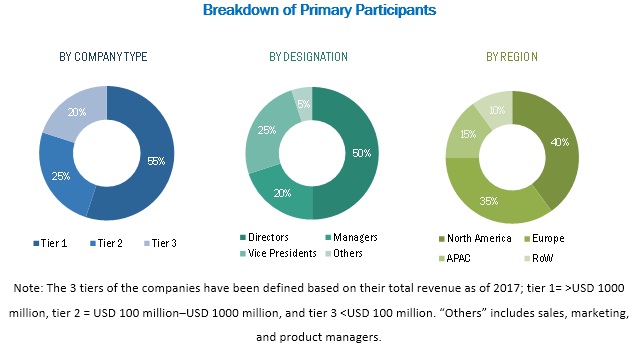

2.1.3.2 Breakdown of Primaries

2.1.3.3 Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in Market

4.2 Market in Europe, By Country and Component

4.3 Market, By Offering

4.4 Market, By Tunnel Type

4.5 Market, By Component

4.6 Market, By Country

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Incidents of Road Accidents Leading to Increasing Demand for Enhanced Security

5.2.1.2 Government Regulations Favoring Adoption of Tunnel Automation Solutions

5.2.1.3 Growing Integration of IoT and Cloud With Tunnel Automation Solutions

5.2.2 Restraints

5.2.2.1 High Deployment Costs of Tunnel Automation Solutions

5.2.3 Opportunities

5.2.3.1 Increasing Number of Tunnel Construction Projects

5.2.3.2 Integration of Analytics in Tunnel Management

5.2.4 Challenges

5.2.4.1 Lack of Technically Skilled Labors to Install and Monitor Tunnel Automation Solutions

5.3 Value Chain Analysis

6 Tunnel Automation Market, By Offering (Page No. - 45)

6.1 Introduction

6.2 Hardware

6.3 Software

6.4 Services

7 Market, By Tunnel Type (Page No. - 51)

7.1 Introduction

7.2 Railways

7.2.1 Subway Stations and Tunnels

7.2.2 Railway Stations and Tunnels

7.3 Highway and Roadway Tunnels

8 Tunnel Automation Market, By Component (Page No. - 58)

8.1 Introduction

8.2 HVAC

8.3 Lighting & Power Supply

8.3.1 Tunnel Lighting

8.3.2 Power Supply

8.4 Signalization

8.4.1 Traffic Control Systems

8.4.2 Public Announcement and Alarm Systems

8.5 Others

8.5.1 Fire Detection Systems

8.5.2 Traffic Management Systems

8.5.3 Central Control and Monitoring Systems

8.5.4 Video Surveillance Systems

8.5.5 Incident Detection Systems

8.5.6 Communication Systems

8.5.7 Gas Detection Systems

9 Geographic Analysis (Page No. - 82)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 UK

9.3.2 Germany

9.3.3 France

9.3.4 Switzerland

9.3.5 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 Japan

9.4.3 Australia

9.4.4 Rest of Asia Pacific (RoAPAC)

9.5 Rest of the World (RoW)

9.5.1 Middle East and Africa (MEA)

9.5.2 South America

10 Competitive Landscape (Page No. - 112)

10.1 Introduction

10.2 Ranking Analysis of Market Players

10.3 Competitive Scenario

10.3.1 Expansions

10.3.2 Product Launches and Developments

10.3.3 Acquisitions

10.3.4 Partnerships, Collaborations, Contracts, and Joint Ventures

11 Company Profiles (Page No. - 121)

11.1 Key Players

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)*

11.1.1 Siemens

11.1.2 Johnson Controls

11.1.3 ABB Group

11.1.4 Sick Ag

11.1.5 Honeywell

11.1.6 Philips Lighting

11.1.7 Trane

11.1.8 Swarco

11.1.9 Eaton

11.1.10 Kapsch

*Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

11.2 Other Companies

11.2.1 Psi Incontrol

11.2.2 Agidens

11.2.3 Sice

11.2.4 Indra

11.2.5 Osram

11.2.6 Advantech

11.2.7 Codel International

11.2.8 General Electric

11.2.9 Phoenix Contact

11.2.10 Delta Electronics

12 Appendix (Page No. - 158)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (64 Tables)

Table 1 Tunnel Automation Market, By Offering, 2015–2023 (USD Million)

Table 2 Market for Hardware, By Component, 2015–2023 (USD Million)

Table 3 Market for Software, By Component, 2015–2023 (USD Million)

Table 4 Market for Services, By Component, 2015–2023 (USD Million)

Table 5 Market, By Tunnel Type, 2015–2023 (USD Million)

Table 6 Market for Railway Tunnels, By Type, 2015–2023 (USD Million)

Table 7 Market for Railway Tunnels, By Component, 2015–2023 (USD Million)

Table 8 Market for Subway Stations and Tunnels, By Component, 2015–2023 (USD Million)

Table 9 Market for Railway Stations and Tunnels, By Component, 2015–2023 (USD Million)

Table 10 Market for Highway and Roadway Tunnels, By Component, 2015–2023 (USD Million)

Table 11 Market, By Component, 2015–2023 (USD Million)

Table 12 Tunnel Automation Market for HVAC, By Offering, 2015–2023 (USD Million)

Table 13 Market for HVAC for Railway Tunnels, By Component Type, 2015–2023 (Million Units)

Table 14 Market for HVAC, By Region, 2015–2023 (USD Million)

Table 15 Market for HVAC in Europe, By Country, 2015–2023 (USD Million)

Table 16 Market for HVAC in North America, By Country, 2015–2023 (USD Million)

Table 17 Market for HVAC in APAC, By Country, 2015–2023 (USD Million)

Table 18 Market for HVAC in RoW, By Region, 2015–2023 (USD Million)

Table 19 Market for HVAC, By Tunnel Type, 2015–2023 (USD Million)

Table 20 Market for Lighting & Power Supply, By Offering, 2015–2023 (USD Million)

Table 21 Tunnel Automation Market for Lighting & Power Supply, By Region, 2015–2023 (USD Million)

Table 22 Market for Lighting & Power Supply in Europe, By Country, 2015–2023 (USD Million)

Table 23 Market for Lighting & Power Supply in North America, By Country, 2015–2023 (USD Million)

Table 24 Market for Lighting & Power Supply in APAC, By Country, 2015–2023 (USD Million)

Table 25 Market for Lighting & Power Supply in RoW, By Region, 2015–2023 (USD Million)

Table 26 Market for Lighting & Power Supply, By Tunnel Type, 2015–2023 (USD Million)

Table 27 Tunnel Automation Market for Signalization, By Offering, 2015–2023 (USD Million)

Table 28 Market for Signalization, By Region, 2015–2023 (USD Million)

Table 29 Market for Signalization in Europe, By Country, 2015–2023 (USD Million)

Table 30 Market for Signalization in North America, By Country, 2015–2023 (USD Million)

Table 31 Market for Signalization in APAC, By Country, 2015–2023 (USD Million)

Table 32 Market for Signalization in RoW, By Region, 2015–2023 (USD Million)

Table 33 Market for Signalization, By Tunnel Type, 2015–2023 (USD Million)

Table 34 Market for Others, By Offering, 2015–2023 (USD Million)

Table 35 Tunnel Automation Market for Others, By Region, 2015–2023 (USD Million)

Table 36 Market for Others in Europe, By Country, 2015–2023 (USD Million)

Table 37 Market for Others in North America, By Country, 2015–2023 (USD Million)

Table 38 Market for Others in APAC, By Country, 2015–2023 (USD Million)

Table 39 Market for Others in RoW, By Region, 2015–2023 (USD Million)

Table 40 Market in North America, By Country, 2015–2023 (USD Million)

Table 43 Market in North America, By Component, 2015–2023 (USD Million)

Table 44 Market in Us, By Component, 2015–2023 (USD Million)

Table 45 Tunnel Automation Marketin Canada, By Component, 2015–2023 (USD Million)

Table 46 Market in Mexico, By Component, 2015–2023 (USD Million)

Table 47 Market in Europe, By Country, 2015–2023 (USD Million)

Table 48 Market in Europe, By Component, 2015–2023 (USD Million)

Table 49 Market in Uk, By Component, 2015–2023 (USD Million)

Table 50 Market in Germany, By Component, 2015–2023 (USD Million)

Table 51 Market in France, By Component, 2015–2023 (USD Million)

Table 52 Market in Switzerland, By Component, 2015–2023 (USD Million)

Table 53 Market in RoE, By Component, 2015–2023 (USD Million)

Table 54 Market in APAC, By Country, 2015–2023 (USD Million)

Table 55 Market in APAC, By Component, 2015–2023 (USD Million)

Table 56 Tunnel Automation Market in China, By Component, 2015–2023 (USD Million)

Table 57 Market in Japan, By Component, 2015–2023 (USD Million)

Table 58 Market in Australia, By Component, 2015–2023 (USD Million)

Table 59 Market in RoAPAC, By Component, 2015–2023 (USD Million)

Table 60 Market in RoW, By Region, 2015–2023 (USD Million)

Table 61 Market in RoW, By Component, 2015–2023 (USD Million)

Table 62 Market in Mea, By Component, 2015–2023 (USD Million)

Table 63 Tunnel Automation Market in South America, By Component, 2015–2023 (USD Million)

Table 64 Top Market Players in 2017

List of Figures (58 Figures)

Figure 1 Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Assumptions for the Research Study

Figure 5 Global Market, 2016–2023 (USD Million)

Figure 6 Others to Hold Largest Share of Market, By Component, in 2023

Figure 7 Hardware to Hold Largest Size of Market, By Offering, During Forecast Period

Figure 8 Railway Tunnels Held Larger Size of Market, By Tunnel Type, in 2017

Figure 9 Market, By Region, 2017

Figure 10 Increasing Incidents of Roadway and Highway Tunnel Accidents Fueling Growth of Market

Figure 11 UK Held Largest Share of Market in Europe in 2017

Figure 12 Hardware Held Largest Size of Market in 2017

Figure 13 Railway Tunnels Held Larger Size of Market in 2017

Figure 14 Others Held Largest Share of Market in 2017

Figure 15 US Held Largest Share of Market in 2017

Figure 16 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Top 5 Countries in North America and Europe in Terms of Road Accidents (In Thousands)

Figure 18 Costs Involved in Deployment of Tunnel Automation Solutions

Figure 19 Value Chain Analysis: Major Value Added During Research, Conceptualization, and Design, and Software Design and Development Phases

Figure 20 Market for Services to Grow at Highest CAGR During Forecast Period

Figure 21 Market for HVAC for Hardware to Grow at Highest CAGR During Forecast Period

Figure 22 Others to Hold Largest Size of Market for Services Throughout Forecast Period

Figure 23 Market for Railway Tunnels to Grow at Higher CAGR During Forecast Period

Figure 24 Market for HVAC for Railway Tunnels to Grow at Highest CAGR From 2018 to 2023

Figure 25 Market for HVAC for Highway and Roadway Tunnels to Grow at Highest CAGR During Forecast Period

Figure 26 Market for HVAC to Grow at Highest CAGR During Forecast Period

Figure 27 Market for HVAC for Services to Grow at Highest CAGR During Forecast Period

Figure 28 Tunnel Automation Market for HVAC in Canada to Grow at Highest CAGR During Forecast Period

Figure 29 Hardware to Hold Largest Size of Market for Lighting & Power Supply Throughout Forecast Period

Figure 30 US to Hold Largest Size of Market for Lighting & Power Supply in North America Throughout Forecast Period

Figure 31 Market for Signalization for Services to Grow at Highest CAGR During Forecast Period

Figure 32 US to Hold Largest Size of Market for Signalization in North America Throughout Forecast Period

Figure 33 Hardware to Hold Largest Size of Market for Others Throughout Forecast Period

Figure 34 Market for Others in Canada to Grow at Highest CAGR During Forecast Period

Figure 35 Geographic Snapshot: Market in China to Grow at Highest CAGR During Forecast Period

Figure 36 Tunnel Automation Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 37 Snapshot of Market in North America

Figure 38 Market in Canada to Grow at Highest CAGR During Forecast Period

Figure 39 Tunnel Automation Market for HVAC in US to Grow at Highest CAGR During Forecast Period

Figure 40 Snapshot of Market in Europe

Figure 41 Market in Switzerland to Grow at Highest CAGR During Forecast Period

Figure 42 Market for HVAC in UK to Grow at Highest CAGR During Forecast Period

Figure 43 Market for HVAC in Switzerland to Grow at Highest CAGR During Forecast Period

Figure 44 Snapshot of Market in APAC

Figure 45 Market China to Grow at Highest CAGR During Forecast Period

Figure 46 Other Components to Hold Largest Size of Market in China Throughout Forecast Period

Figure 47 Tunnel Automation Market for HVAC in RoAPAC to Grow at Highest CAGR During Forecast Period

Figure 48 Market in Middle East and Africa to Grow at Higher CAGR During Forecast Period

Figure 49 Partnerships and Contracts Emerged as Key Growth Strategies Adopted By Major Players in Market Between 2016 and 2018

Figure 50 Market Evolution Framework: Partnerships and Contracts, Followed By Expansions, Fuelled Growth of Market During 2016–2018

Figure 51 Siemens: Company Snapshot

Figure 52 Johnson Controls: Company Snapshot

Figure 53 ABB Group: Company Snapshot

Figure 54 Sick AG: Company Snapshot

Figure 55 Honeywell: Company Snapshot

Figure 56 Philips Lighting: Company Snapshot

Figure 57 Eaton: Company Snapshot

Figure 58 Kapsch: Company Snapshot

The study involved four major activities in estimating the current size of the tunnel automation market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the market begins with capturing data on revenue of key vendors in the market through secondary research. This study incorporates the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the market. Vendor offerings have also been considered to determine the market segmentation. This entire research methodology includes the study of annual and financial reports of top players, presentations, press releases, journals, paid databases, trade directories, regulatory bodies, and safety standard organizations.

Primary Research

The tunnel automation market comprises several stakeholders, such as suppliers of raw material and manufacturing equipment; standard components, original equipment manufacturers (OEMs); original device manufacturers (ODMs) of tunnel automation; solutions providers; vendors of assembly, testing, and packaging solutions; and system integrators in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major application areas and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Research Objective

- To define, describe, and forecast the overall market, in terms of value, by offering, tunnel type, component, and region

- To describe and forecast the market, in terms of value, by region–Asia Pacific (APAC), Europe, North America, and Rest of the World (RoW) along with their respective countries

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of tunnel automation solutions

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the tunnel automation ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches and development; acquisitions; contracts, agreements, collaboration, and partnerships; and expansion in the tunnel automation market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 15)

Growth opportunities and latent adjacency in Tunnel Automation Market

As our university builds an underground construction research center this report can be relevant and helpful for us.