Tunable Filter Market by Type (Liquid Crystal, Acousto-Optic, Linear-Variable), System Type (Software-Defined Radios, Handheld Radios, Radar Systems, Spectrometers, Communication Systems), Application, and Geography - Global Forecast to 2023

Updated date -

The tunable filter market was valued at USD 108.5 Million in 2016 and is expected to reach USD 203.1 Million by 2023, at a CAGR of 8.86% during the forecast period. The adoption of acousto-optic tunable filters (AOTFs) for various medical and commercial applications and implementation of liquid crystal tunable filters for highly demanding machine vision applications are the major factors that drive the demand for tunable filters. For this study, the base year considered is 2016, and the tunable filter market forecast is provided for 2017–2023.

Selected Market Dynamics in Tunable Filter Market

Implementation of liquid crystal tunable filters for highly demanding machine vision applications

Machine vision is one of the most prime application areas of liquid crystal tunable filters (LCTFs). LCTFs primarily help in reducing specular reflections to improve the performance of the imaging algorithm, which, in turn, is increasing its use in machine vision systems. Liquid crystal tunable filters, with dynamic range and large output, are used to improve the performance of optical imaging systems for biomedical applications. Liquid crystal tunable filters with high throughput as well as a high dynamic range are primarily designed for spectral domain optical coherence tomography, along with hyperspectral imaging. Thus, rising technological advancements demand LCFTs for a wide array of applications across different systems, which, in turn, is increasing the growth of the liquid crystal tunable filter market across different regions in the world.

Poor spectral performance of tunable filters

Poor spectral performance (edge steepness) of tunable filters is due to the variation of spectral properties across a non-zero width optical beam. The limited spectral performance is usually optimized for a particular system by trading off lower transmission or spatial resolution from a smaller beam against the higher spectral resolution. However, the tradeoff is very high for most systems. It is estimated that new wavelength filtering technologies are expected to address this issue.

This report provides a detailed analysis of the tunable filter market segmented on the basis of type, application, system type, and geography (North America, Europe, APAC, and RoW). The report provides detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market. The report also profiles key players and comprehensively analyzes their market ranking and core competencies, along with details of the competitive landscape of the market leaders.

To estimate the size of the tunable filter market, top-down and bottom-up approaches have been used. This research study involves an extensive use of secondary sources, directories, and paid databases—such as Factiva and OneSource—to identify and collect information useful to study the technical, market-oriented, and commercial aspects of the tunable filter market. The research methodology is explained below.

The tunable filter market is estimated to grow from USD 122.0 Million in 2017 to USD 203.1 Million by 2023, at a CAGR of 8.86% between 2017 and 2023. Factors such as the adoption of acousto-optic tunable filters (AOTFs) for various medical and commercial applications and implementation of liquid crystal tunable filters for highly demanding machine vision applications are driving the growth of the tunable filter market.

The tunable filter market has been segmented on the basis of types into liquid crystal tunable filters (LCTFs), acousto-optic tunable filters (AOTFs), linear-variable tunable filters (LVTFs), and other tunable filters, which include thin-film, bulk Sagnac, Mach-Zehnder, Michelson type interferometers, Fabry-Perot interferometers, angle-tuned thin-film filters, and notch filters. Liquid crystal tunable filters held the largest share of the tunable filter market in 2016, and this trend is expected to continue in the next few years. LCFTs are having a wide array of applications across different systems, which, in turn, is increasing the growth of the liquid crystal market. Also, these filters provide better imaging of specular objects; therefore, LCFTs are being highly adopted to be used in the machine vision systems.

In 2016, the military application accounted for the largest share of the tunable filter market. Tunable filter are provided for all key military communications and surveillance platforms that are used throughout the world. Tunable filters have been used for performing high-quality communications based on requirements during harsh environmental conditions and critical places. These factors have contributed to the increased adoption of tunable filter for military applications.

The market in APAC is expected to grow at the highest CAGR during 2017–2023. The rapid adoption of wireless communication technologies by emerging countries such as China and India are driving the growth of the tunable filter market in APAC.

The key factors restraining the growth of the tunable filter market are the high initial cost and R&D expenses. The key players in the ecosystem of the market profiled in this report include Santec Corporation (Japan), Semrock (US), EXFO (Canada), Dover Corporation (US), Gooch & Housego (UK), Brimrose Corporation of America (US), Kent Optronics (US), Micron Optics (US), Thorlabs (US), DiCon Fiberoptics (US), AA Opto Electronic (France), Netcom, Inc. (US), Coleman Microwave (US), Delta Optical Thin Film (Denmark), and Smiths Interconnect (UK and US).

Santec (Japan) is one of the leading manufacturers of tunable lasers, optical instruments, OCT products, and fiber-optic components. The company offers a variety of tunable filter including optical bandpass filters, thin-film filters, and liquid crystal filters. The company serves its customers in more than 30 countries; these include most of the world’s major telecommunications companies, telecommunication system manufacturers, and medical equipment companies.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Geographic Scope

1.3.2 Years Considered for Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

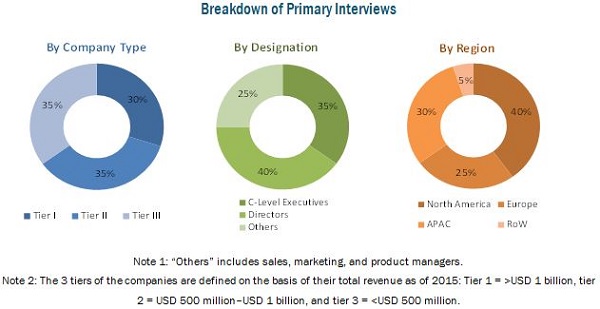

2.1.2.4 Breakdown of Primaries

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Share By Bottom-Up Analysis (Demand-Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share By Top-Down Analysis (Supply-Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Growth Opportunities in the Tunable Filter Market

4.2 Market, By Type

4.3 Market, By Application

4.4 Market, By Geography

5 Market Overview (Page No. - 34)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Adoption of Acousto-Optic Tunable Filters (AOTFS) for A Wide Range of Applications

5.1.1.2 Implementation of Liquid Crystal Tunable Filters for Highly Demanding Machine Vision Applications

5.1.2 Restraints

5.1.2.1 Poor Spectral Performance of Tunable Filter

5.1.2.2 High Initial Costs and R&D Expenses

5.1.3 Opportunities

5.1.3.1 Use of Fluorescence Imaging and Spectroscopy as Tools for Nondestructive Analysis of Works of Art

5.1.4 Challenges

5.1.4.1 Improving Product Quality

5.2 Value Chain Analysis

5.3 Key Industry Trends

6 Patent Analysis of Tunable Filters (Page No. - 39)

6.1 Introduction

6.2 Various Patents Related to the Tunable Filters Market

6.2.1 EP 1723721 A1: Integrated Tunable Filter for Broadband Tuner:

6.2.2 US 5132826 A: Ferroelectric Liquid Crystal Tunable Filter and Color Generation:

6.2.3 US 4945539 A: Acousto-Optic Tunable Filter:

6.2.4 US 9800278 B2: Tunable Filter, Cancellers, and Duplexers Based on Passive Mixers:

6.2.5 US 7728701 B2: Waveguide-Based Mems Tunable Filter and Phase Shifters:

6.2.6 US 9761921 B2: Tunable Bandpass Filter:

6.2.7 US 9236846 B2: Tunable Bandpass Filter Device and Method:

6.2.8 US 9473091 B2: Amplifier With Common-Mode Filter:

6.2.9 US 9300272 B2: Tunable Filter Structures and Design Structures:

6.2.10 EP 1253687 B1: Self-Adjustable Tunable Filter:

7 Market, By Type (Page No. - 43)

7.1 Introduction

7.2 Liquid Crystal Tunable Filter (LCTF)

7.2.1 Advantages

7.2.2 Disadvantages

7.3 Acousto-Optic Tunable Filter (AOTF)

7.3.1 Advantages

7.3.2 Disadvantages

7.4 Linear-Variable Tunable Filter (LVTF)

7.4.1 Advantages

7.4.2 Disadvantages

7.5 Other Tunable Filter

8 Market, By System Type (Page No. - 48)

8.1 Introduction

8.2 Military

8.2.1 Military Handheld Radios

8.2.2 Software-Defined Radios

8.2.3 Radar Systems

8.2.4 Testing and Measurement Systems

8.2.5 RF Amplifiers

8.3 Commercial

8.3.1 Spectrophotometers

8.3.2 Avionics Communications Systems

8.3.3 Surveillance Systems

8.3.4 Others

9 Market, By Application (Page No. - 54)

9.1 Introduction

9.2 Military

9.2.1 Satellite Communications (SATCOM)

9.2.2 Optical Channel Performance Monitoring

9.2.3 Optical Signal Noise Suppression

9.2.4 Missile Tracking

9.3 Commercial

9.3.1 Light Detection and Ranging (LiDAR)

9.3.2 Hyperspectral Imaging

9.3.3 Wavelength Switching

9.3.4 Signal Equalization

10 Market, By Geography (Page No. - 61)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 UK

10.3.2 Germany

10.3.3 France

10.3.4 Rest of Europe

10.4 APAC

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 South Korea

10.4.5 Rest of APAC

10.5 RoW

10.5.1 Middle East and Africa

10.5.2 South America

11 Competitive Landscape (Page No. - 81)

11.1 Introduction

11.2 Ranking Analysis of Top Players

11.3 Competitive Situations and Trends

11.3.1 Product Launches and Developments

11.3.2 Mergers & Acquisitions

11.3.3 Contracts/Partnerships/Collaborations

12 Company Profiles (Page No. - 85)

12.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.2 Santec Corporation

12.3 Semrock

12.4 EXFO

12.5 Dover Corporation

12.6 Gooch & Housego

12.7 Brimrose Corporation of America

12.8 Kent Optronics

12.9 Micron Optics

12.10 Thorlabs

12.11 Dicon Fiberoptics

12.12 AA Opto Electronic

12.13 Netcom, Inc.

12.14 Coleman Microwave

12.15 Delta Optical Thin Film A/S

12.16 Smiths Interconnect

12.17 Key Innovators

12.17.1 Precisive, LLC

12.17.2 II-VI Incorporated

12.17.3 Agiltron, Inc.

12.17.4 Photon Etc.

12.17.5 Api Technologies Corp.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 120)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (34 Tables)

Table 1 List of Published Patents Related to Tunable Filters

Table 2 Comparison of Properties of Different Types of Tunable Filter

Table 3 Tunable Filter Market, By Type, 2014–2023 (USD Million)

Table 4 Market for Military Application, By System Type, 2014–2023 (USD Million)

Table 5 Market for Commercial Application, By System Type, 2014–2023 (USD Million)

Table 6 Market, By Application, 2014–2023 (USD Million)

Table 7 Market , By Military Application, 2014–2023 (USD Million)

Table 8 Market for Military Application, By Region, 2014–2023 (USD Million)

Table 9 Market , By Commercial Application, 2014–2023 (USD Million)

Table 10 Market for Commercial Application, By Region, 2014–2023 (USD Million)

Table 11 Market, By Region, 2014–2023 (USD Million)

Table 12 Market in North America, By Application, 2014–2023 (USD Million)

Table 13 Market in North America, By Country, 2014–2023 (USD Million)

Table 14 Market in US, By Application, 2014–2023 (USD Million)

Table 15 Market in Canada, By Application, 2014–2023 (USD Million)

Table 16 Market in Mexico, By Application, 2014–2023 (USD Million)

Table 17 Market in Europe, By Application, 2014–2023 (USD Million)

Table 18 Market in Europe, By Country, 2014–2023 (USD Million)

Table 19 Market in UK, By Application, 2014–2023 (USD Million)

Table 20 Market in Germany, By Application, 2014–2023 (USD Million)

Table 21 Market in France, By Application, 2014–2023 (USD Million)

Table 22 Market in Rest of Europe, By Application, 2014–2023 (USD Million)

Table 23 Market in APAC, By Application, 2014–2023 (USD Million)

Table 24 Market in APAC, By Country, 2014–2023 (USD Million)

Table 25 Market in China, By Application, 2014–2023 (USD Million)

Table 26 Market in Japan, By Application, 2014–2023 (USD Million)

Table 27 Market in India, By Application, 2014–2023 (USD Million)

Table 28 Market in South Korea, By Application, 2014–2023 (USD Thousand)

Table 29 Market in Rest of APAC, By Application, 2014–2023 (USD Thousand)

Table 30 Market in RoW, By Application, 2014–2023 (USD Million)

Table 31 Market in RoW, By Region, 2014–2023 (USD Million)

Table 32 Market in Middle East and Africa, By Application, 2014–2023 (USD Million)

Table 33 Market in South America, By Application, 2014–2023 (USD Million)

Table 34 Ranking of Top 10 Players in the Overall Market

List of Figures (37 Figures)

Figure 1 Tunable Filter Market Segmentation

Figure 2 Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market, 2014–2023 (USD Million)

Figure 6 Market Share, By Type (2017 vs 2023)

Figure 7 Market, By Military and Commercial System Type and Application, 2017 vs 2023

Figure 8 Market for Commercial Wavelength Switching Application Expected to Grow at the Highest CAGR Between 2017 and 2023

Figure 9 North America Estimated to Account for the Largest Share of the Market in 2017

Figure 10 The Demand for Tunable Filter for Communications Systems Anticipated to Drive the Market Growth

Figure 11 Market for Other Tunable Filters Expected to Grow at the Highest CAGR Between 2017 and 2023

Figure 12 Commercial Application to Account for A Larger Size of the Market By 2023

Figure 13 Satellite Communication to Hold the Largest Share of the Market for Military Application By 2023

Figure 14 Market in China to Grow at the Highest CAGR Between 2017 and 2023

Figure 15 Use of Fluorescence Imaging and Spectroscopy as Tools for Nondestructive Analysis of Works of Art Would Provide Lucrative Opportunity to Tunable Filter Providers

Figure 16 Value Chain Analysis (2016): Major Value Added By Component Manufactures

Figure 17 Product Innovations—Key Trend in the Market

Figure 18 Market for Other Tunable Filters Expected to Grow at the Highest CAGR Between 2017 and 2023

Figure 19 Market for Software-Defined Radios Expected to Grow at the Highest CAGR During the Forecast Period

Figure 20 Other Commercial Systems to Dominate the Market During the Forecast Period

Figure 21 Market for Commercial Application Expected to Grow at A Higher CAGR During the Forecast Period

Figure 22 Geographic Snapshot: Market in APAC Expected to Witness the Highest Growth Between 2017 and 2023

Figure 23 Market in China Estimated to Grow at the Highest CAGR Between 2017 and 2023

Figure 24 North America: Market Snapshot

Figure 25 Europe: Market Snapshot

Figure 26 APAC: Market Snapshot

Figure 27 Geographic Revenue Mix of Leading Players

Figure 28 Santec Corporation: Company Snapshot

Figure 29 Santec Corporation: SWOT Analysis

Figure 30 Semrock: SWOT Analysis

Figure 31 EXFO: Company Snapshot

Figure 32 EXFO: SWOT Analysis

Figure 33 Dover Corporation: Company Snapshot

Figure 34 Dover Corporation: SWOT Analysis

Figure 35 Gooch & Housego: Company Snapshot

Figure 36 Gooch & Housego: SWOT Analysis

Figure 37 Smiths Interconnect: Company Snapshot

The entire research methodology includes the study of annual and financial reports of top players, presentations, press releases, journals, paid databases, and interviews with industry experts.

- The high-growth segments have been identified to analyze opportunities in the overall tunable filter market.

- Competitive developments such as contracts, agreements, mergers and acquisitions, product launches, and research and development (R&D) in the overall tunable filter market have been analyzed.

- All the percentage splits and breakdowns of the market segments have been analyzed based on secondary and primary research.

The following figure depicts the breakdown of primaries by company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

This report provides valuable insights regarding the ecosystem of the tunable filter market. This includes tunable filter manufacturers, such as Santec Corporation (Japan), Semrock (US), EXFO (Canada), Dover Corporation (US), Gooch & Housego (UK), Brimrose Corporation of America (US), Kent Optronics (US), Micron Optics (US), Thorlabs (US), DiCon Fiberoptics (US), AA Opto Electronic (France), Netcom, Inc. (US), Coleman Microwave (US), Delta Optical Thin Film (Denmark), and Smiths Interconnect (UK and US).

Target Audience:

- Optical filter device manufacturers

- Optical fiber manufacturers

- Aircraft manufacturers

- Defense researchers

- Industrial automation vendors

- Medical equipment manufacturers

- Consumer electronics vendors

- Government regulatory bodies

- Educational Institutes

- Distributors

- Investors

- Private research organizations

- Organizations, alliances, and associations related to the optical sensing industry

“The study answers several questions of the target audience with regard to the market segments to focus on in the next 2–5 years to prioritize efforts and investments.”

Scope of the Report:

Scope of the Report:

|

Report Metric |

Details |

|

Base year |

2016 |

|

Forecast period |

2017–2023 |

|

Units |

Value (USD) |

|

Segments covered |

Type, End User, Offerings, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Santec Corporation (Japan), Semrock (US), EXFO (Canada), Dover Corporation (US), Gooch & Housego (UK), Brimrose Corporation of America (US), Kent Optronics (US), Micron Optics (US), Thorlabs (US), DiCon Fiberoptics (US), AA Opto Electronic (France), Netcom, Inc. (US), Coleman Microwave (US), Delta Optical Thin Film (Denmark), and Smiths Interconnect (UK and US). |

This research report categorizes the overall tunable filter market as follows:

By Type

- Liquid Crystal Tunable Filters (LCTFs)

- Acousto-Optic Tunable Filters (AOTFs)

- Linear-Variable Tunable Filters (LVTFs)

- Other Tunable Filters (Thin-film, Bulk Sagnac, Mach-Zehnder, Michelson type interferometers, Fabry Perot interferometers, angle-tuned thin-film filters, and notch filters)

By System Type

-

Military

- Military Handheld Radios

- Radar Systems

- Testing and Measurement Systems

- RF Amplifiers

- Software-Defined Radios

-

Commercial

- Spectrophotometers

- Avionics Communications Systems

- Surveillance Systems

- Others (Spectrometers and Analyzers)

By Application

-

Military

- Satellite Communications (SATCOM)

- Optical Channel Performance Monitoring

- Optical Signal Noise Suppression

- Missile Tracking

-

Commercial

- Light Detection and Ranging (LIDAR)

- Hyperspectral Imaging

- Wavelength Switching

- Signal Equalization

By Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- France

- UK

- Rest of Europe (Greece, Spain, Italy, Russia, Finland, Denmark, Netherlands, and Sweden)

-

Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC (Australia, New Zealand, Singapore, Hong Kong, Indonesia, and Taiwan)

-

Rest of the World (RoW)

- Middle East and Africa

- South America

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Tunable Filter Market