Transparent Conductive Films Market by Application (Smartphones, Tablets, Notebooks, LCDs, Wearable Devices), Material (ITO on Glass, ITO on PET, Metal Mesh, Silver Nanowires, Carbon Nanotubes), and Region - Global Forecast to 2026

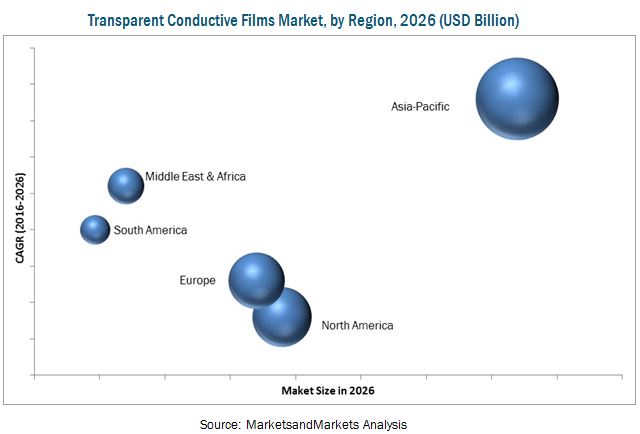

[152 Pages Report] The Transparent Conductive Films Market is projected to reach USD 8.46 Billion by 2026, at a CAGR of 9.4% from 2016 to 2026. Based on application, the smartphone segment is expected to lead the Global market. The Asia-Pacific is the largest market for transparent conductive films. The demand for transparent conductive films is expected to grow in the coming years due to its increasing consumption in LCDs, wearable devices, smartphones, tablets, notebooks, and other applications.

The objectives of this study are:

- To define and segment the transparent conductive films market on the basis of material, application, and region

- To identify market dynamics such as drivers, restraints, opportunities, and challenges that are influencing the growth of the Global market

- To analyze and forecast the demand for transparent conductive films, in terms of value

- To estimate, analyze, and forecast the market with respect to key countries

- To analyze and forecast the demand for transparent conductive films in different applications such as smartphones, tablets, displays, wearable devices, notebooks, and others

- To analyze recent developments such as facility & capacity expansions, partnerships & collaborations, and new product developments in the market

- To identify various industry trends prevailing in the market, namely, bargaining power of buyers, bargaining power of suppliers, threats of substitutes, threats of new entrants, and intensity of rivalry through Porter’s Five Forces analysis

- To strategically identify and profile key players in the market

- Market share analysis of leading market players that are operating in the Global market

Years considered for the study are:

- Base Year – 2015

- Estimated Year – 2016

- Projected Year – 2026

- Forecast Period – 2016 to 2026

For company profiles, 2015 has been considered as the base year. In cases wherein information was not available for the base year, the years prior to it have been considered.

Research Methodology

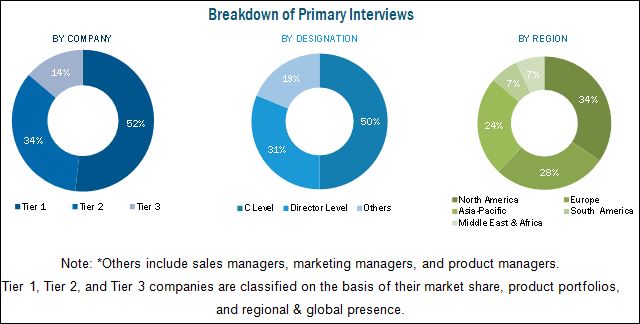

This study aims to estimate the global transparent conductive films market size for 2016 and projects its demand till 2026. It also provides a detailed qualitative and quantitative analysis of themarket. Various secondary sources that include directories, industry journals, and magazines such as Printed Electronics World, Solid State Technology, Journal of Display Technology, and various associations such as the Society for Information Display (SID), and Shenzhen FPD & Touch Association have been referred to identify and collect information useful for this extensive commercial study of the transparent conductive films market. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess future prospects of the market. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The value chain of the transparent conductive films market includes raw material suppliers and manufacturers. Leading players operating in the Global market are Teijin Ltd (Japan), Toyobo Co., Ltd (Japan), Nitto Denko Corporation (Japan), TDK Corporation (Japan), Canatu Oy (Finland), Cambrios Technologies Corporation (U.S.), C3Nano (U.S.), Gunze (Japan), Dontech Inc. (U.S.), and Blue Nano Inc. (U.S.).

Key Target Audience

- Manufacturers of transparent conductive films

- Traders, distributors, and suppliers of transparent conductive films

- Application industries operating in the transparent conductive films supply chain

- Government and consulting organizations

- Film regulators and other regulatory institutions

- Investment banks and private equity firms

Scope of the Report: This research report categorizes the transparent conductive films market on the basis of material, application, and region. The report forecasts revenues as well as analyzes trends in each of these submarkets.

On the basis of Application:

- Smartphones

- Tablets

- Notebooks

- LCDs

- Wearable Devices

- Others

On the basis of Material:

- ITO on Glass

- ITO on PET

- Silver Nanowires

- Metal Mesh

- Carbon Nanotubes

- Others

On the basis of Region:

- Asia-Pacific

- North America

- Europe

- Middle East & Africa

- South America

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Application Analysis

- Further breakdown of material and application segments into subsegments

The transparent conductive films market is projected to reach USD 8.46 Billion by 2026, at a CAGR of 9.4% from 2016 to 2026. Factors driving the growth of the global market is the rising demand for high conductivity, low resistance, and high transparency of touch screens. Strong demand and advancement of communication technology will lead to higher consumption of smartphones and other communication devices, thereby increasing the demand for transparent conductive films.

Major applications areas of transparent conductive films are smartphones, tablets, LCDs, notebooks, and wearable devices, among others. Transparent conductive films are majorly used in smartphones. The growing demand for LCD display units and preference for luxury products are driving the growth of the LCD application segment. Transparent conductive films are thin films, which are widely used in touch screens and flexible screens. Transparent conductive films due to their mechanical properties, excellent electrical conductivity, and optical transparency are widely used in organic photovoltaic cells and other applications.

The transparent conductive films market in the Asia-Pacific region is anticipated to grow at the highest CAGR between 2016 and 2026. Japan and China have witnessed stable economic growth, and the growth of the transparent conductive films market is expected to grow in these two countries in the future. Moreover, rising demand from electronic components, smartphones, LCDs, and other applications will drive the demand for transparent conductive films in the Asia-Pacific region.

The demand for transparent conductive films is expected to be hampered in the coming years due to certain challenges such as decreasing supply of Indium Tin Oxide (ITO) due to rise in prices. Silver nanowires, metal mesh, and carbon nanotubes, among others, are some of the prominent alternatives to ITO. However, it is difficult for transparent conductive film manufacturers to provide unmatched properties of ITO through its alternatives.

Key companies operating in the transparent conductive films market are Teijin Ltd (Japan), Toyobo Co., Ltd (Japan), Nitto Denko Corporation (Japan), TDK Corporation (Japan ), Canatu Oy (Finland), Cambrios Technologies Corporation (U.S.), C3Nano (U.S.), Gunze (Japan), Dontech Inc. (U.S.), and Blue Nano Inc. (U.S.). These players are engaged in manufacturing and supply of transparent conductive films and have a strong regional presence. Companies in Asia-Pacific and Europe are focusing on additional capacities and new product developments to meet the increasing use of transparent conductive films in various applications.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Transparent Conductive Films Market

4.2 Market, By Material

4.3 Market

4.4 Market Growth

4.5 Market: Emerging vs Developed Nations

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Demand for Smartphones, Tablets and Other Similar Flexible Devices

5.3.1.2 Growing Preference for Touch Enabled LCD Panels

5.3.2 Restraints

5.3.2.1 High Volatility in Prices of Indium Tin Oxide

5.3.2.2 Lower Acceptance of Graphene Material

5.3.3 Opportunities

5.3.3.1 Continuous Development of Application Products

5.3.3.2 Strong Growth of ITO Alternatives

5.3.4 Challenges

5.3.4.1 Growing Need for Films With Higher Conductivity

5.3.4.2 Difficulty to Achieve the Properties Offered By ITO Using Alternative Materials

5.4 Cost Structure Analysis

6 Transparent Conductive Films Market, By Application (Page No. - 45)

6.1 Introduction

6.2 Smartphones

6.3 Tablets

6.4 Notebooks

6.5 LCD

6.6 Wearable Devices

6.7 Others

7 Transparent Conductive Films Market, By Material (Page No. - 56)

7.1 Introduction

7.2 Indium Tin Oxide on Glass

7.3 Indium Tin Oxide on PET

7.4 Silver Nanowire

7.5 Metal Mesh

7.6 Carbon Nanotubes

7.7 Others

8 Regional Analysis (Page No. - 66)

8.1 Introduction

8.2 Asia-Pacific

8.2.1 Japan

8.2.2 China

8.2.3 Taiwan

8.2.4 South Korea

8.2.5 India

8.3 North America

8.3.1 U.S.

8.3.2 Canada

8.3.3 Mexico

8.4 Europe

8.4.1 Germany

8.4.2 France

8.4.3 U.K.

8.4.4 Sweden

8.4.5 Italy

8.4.6 Rest of Europe

8.5 Middle East & Africa

8.5.1 South Africa

8.5.2 UAE

8.5.3 Saudi Arabia

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

8.6.3 Colombia

9 Competitive Landscape (Page No. - 114)

9.1 Overview

9.2 Transparent Conductive Films Market: Company Share Analysis

9.3 New Product Development

9.4 Maximum Developments in 2014 and 2015

9.5 Competitive Situation & Trends

9.5.1 New Product Development

9.5.2 Partnership

9.5.3 Contracts

9.5.4 Expansion

10 Company Profiles (Page No. - 122)

(Overview, Financial*, Products & Services, Strategy, and Developments)

10.1 Nitto Denko Corporation

10.2 Teijin Ltd.

10.3 TDK Corporation

10.4 Toyobo Co., Ltd

10.5 Gunze

10.6 Canatu OY

10.7 Cambrios Technologies Corporation

10.8 C3nano

10.9 Dontech Inc.

10.10 Blue Nano Inc.

*Details Might Not Be Captured in Case of Unlisted Companies

11 Appendix (Page No. - 144)

11.1 Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.5 Introducing RT: Real Time Market Intelligence

11.6 Available Customizations

11.7 Related Reports

11.8 Author Details

List of Tables (79 Tables)

Table 1 Global Transparent Conductive Films Market Snapshot

Table 2 Market, By Application

Table 3 Market, By Material

Table 4 Market, By Region

Table 5 Transparent Conductive Films: Cost Structure Analysis

Table 6 Market, By Application, 2014-2026 (USD Million)

Table 7 Transparent Conductive Films Market for Smartphones, By Region, 2014-2026 (USD Million)

Table 8 Market for Tablets, By Region, 2014-2026 (USD Million)

Table 9 Market for Notebooks, By Region, 2014-2026 (USD Million)

Table 10 Market for LCD, By Region, 2014-2026 (USD Million)

Table 11 Market for Wearable Devices, By Region, 2014-2026 (USD Million)

Table 12 Market for Others, By Region, 2014-2026 (USD Million)

Table 13 Market, By Material, 2014-2026 (USD Million)

Table 14 ITO on Glass Market, By Region, 2014-2026 (USD Million)

Table 15 ITO on PET Market, By Region, 2014-2026 (USD Million)

Table 16 Silver Nanowire Market, By Region, 2014-2026 (USD Million)

Table 17 Metal Mesh Market, By Region, 2014-2026 (USD Million)

Table 18 Carbon Nanotubes Market, By Region, 2014-2026 (USD Million)

Table 19 Other Market, By Region, 2014-2026 (USD Million)

Table 20 Market, By Region, 2014-2026 (USD Million)

Table 21 Asia-Pacific: Market, By Country, 2014-2026 (USD Million)

Table 22 Asia-Pacific: Market, By Application, 2014-2026 (USD Million)

Table 23 Asia-Pacific: Market, By Material, 2014-2026 (USD Million)

Table 24 Japan: Market, By Application, 2014-2026 (USD Million)

Table 25 Japan: Market, By Material, 2014-2026 (USD Million)

Table 26 China: Market, By Application, 2014-2026 (USD Million)

Table 27 China: Market, By Material, 2014-2026 (USD Million)

Table 28 Taiwan: Transparent Conductive Films Market, By Application, 2014-2026 (USD Million)

Table 29 Taiwan: Market, By Material, 2014-2026 (USD Million)

Table 30 South Korea: Market, By Application, 2014-2026 (USD Million)

Table 31 South Korea: Market, By Material, 2014-2026 (USD Million)

Table 32 India: Market, By Application, 2014-2026 (USD Million)

Table 33 India: Market, By Material, 2014-2026 (USD Million)

Table 34 North America: Market, By Country, 2014-2026 (USD Million)

Table 35 North America: Market, By Application, 2014-2026 (USD Million)

Table 36 North America: Market, By Material, 2014-2026 (USD Million)

Table 37 U.S.: Market, By Application, 2014-2026 (USD Million)

Table 38 U.S.: Market, By Material, 2014-2026 (USD Million)

Table 39 Canada: Market, By Application, 2014-2026 (USD Million)

Table 40 Canada: Market, By Material, 2014-2026 (USD Million)

Table 41 Mexico: Market, By Application, 2014-2026 (USD Million)

Table 42 Mexico: Market, By Material, 2014-2026 (USD Million)

Table 43 Europe: Market, By Country, 2014-2026 (USD Million)

Table 44 Europe: Market, By Application, 2014-2026 (USD Million)

Table 45 Europe: Market, By Material, 2014-2026 (USD Million)

Table 46 Germany: Market, By Application, 2014-2026 (USD Million)

Table 47 Germany: Market, By Material, 2014-2026 (USD Million)

Table 48 France: Market, By Application, 2014-2026 (USD Million)

Table 49 France: Market, By Material, 2014-2026 (USD Million)

Table 50 U.K.: Transparent Conductive Films Market, By Application, 2014-2026 (USD Million)

Table 51 U.K.: Market, By Material, 2014-2026 (USD Million)

Table 52 Sweden: Market, By Application, 2014-2026 (USD Million)

Table 53 Sweden: Market, By Material, 2014-2026 (USD Million)

Table 54 Italy: Market, By Application, 2014-2026 (USD Million)

Table 55 Italy: Market, By Material, 2014-2026 (USD Million)

Table 56 Rest of Europe: Market, By Application, 2014-2026 (USD Million)

Table 57 Rest of Europe: Market, By Material, 2014-2026 (USD Million)

Table 58 Middle East & Africa: Market, By Country, 2014-2026 (USD Million)

Table 59 Middle East & Africa: Market, By Application, 2014-2026 (USD Million)

Table 60 Middle East & Africa: Market, By Material, 2014-2026 (USD Million)

Table 61 South Africa: Transparent Conductive Films Market, By Application, 2014-2026 (USD Million)

Table 62 South Africa: Market, By Material, 2014-2026 (USD Million)

Table 63 UAE: Market, By Application, 2014-2026 (USD Million)

Table 64 UAE: Market, By Material, 2014-2026 (USD Million)

Table 65 Saudi Arabia: Market, By Application, 2014-2026 (USD Million)

Table 66 Saudi Arabia: Market, By Material, 2014-2026 (USD Million)

Table 67 South America: Transparent Conductive Films Market, By Country, 2014-2026 (USD Million)

Table 68 South America: Market, By Application, 2014-2026 (USD Million)

Table 69 South America: Market, By Material, 2014-2026 (USD Million)

Table 70 Brazil: Market, By Application, 2014-2026 (USD Million)

Table 71 Brazil: Market, By Material, 2014-2026 (USD Million)

Table 72 Argentina: Market, By Application, 2014-2026 (USD Million)

Table 73 Argentina: Market, By Material, 2014-2026 (USD Million)

Table 74 Colombia: Market, By Application, 2014-2026 (USD Million)

Table 75 Colombia: Market, By Material, 2014-2026 (USD Million)

Table 76 New Product Development, 2014-2015

Table 77 Partnership, 2012-2015

Table 78 Contracts, 2012-2013

Table 79 Expansion, 2012-2014

List of Figures (68 Figures)

Figure 1 Global Transparent Conductive Films Market: Market Segmentation

Figure 2 Market: Research Design

Figure 3 Breakdown of Primary Interviews, By Company Type, Designation, and Region

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Global Market: Data Triangulation

Figure 7 The ITO on Glass Material Segment is Projected to Dominate the Global Market During the Forecast Period

Figure 8 Asia-Pacific Region is Estimated to Be the Largest Market for Transparent Conductive Films in 2016

Figure 9 Market Share, By Region, 2016

Figure 10 Asia-Pacific is Projected to Be the Fastest-Growing Transparent Conductive Films Market, 2016-2021

Figure 11 The Global Market is Projected to Witness Substantial Growth During the Forecast Period

Figure 12 Silver Nanowire Material Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 13 Smartphone Application Segment Estimated to Account for the Largest Share of the Global Market in 2016

Figure 14 Asia-Pacific Projected to Be the Fastest-Growing Market for Transparent Conductive Films During the Forecast Period

Figure 15 Japan Projected to Be the Largest Market for Transparent Conductive Films By 2021

Figure 16 Increasing Demand for ITO Alternatives is Projected to Drive the Growth of the Transparent Conductive Films Market

Figure 17 Transparent Conductive Films: Cost Structure Analysis

Figure 18 Revenue Pocket Matrix: Global Market, By Application, 2016

Figure 19 Smartphones Segment Projected to Register the Largest Market Size in APAC By 2021

Figure 20 Tablets Segment to Grow at the Highest CAGR in the Asia-Pacific Region From 2016 to 2021

Figure 21 Notebooks Segment to Register the Largest Market Size in Asia-Pacific By 2021

Figure 22 LCD Segment to Grow at the Highest CAGR in Asia-Pacific From 2016 to 2021

Figure 23 Wearable Devices Segment to Grow at the Highest CAGR in Asia-Pacific From 2016 to 2021

Figure 24 Others Segment Projected to Grow at the Highest CAGR in Asia-Pacific From 2016 to 2021

Figure 25 Revenue Pocket Matrix: Transparent Conductive Films Market, By Material, 2016

Figure 26 ITO on Glass to Have the Largest Market Size in Asia-Pacific By 2021

Figure 27 ITO on PET Segment to Grow at the Highest CAGR in Asia-Pacific From 2016 to 2021

Figure 28 Silver Nanowire to Be the Largest Segment in Asia-Pacific By 2021

Figure 29 Metal Mesh Segment to Grow at the Highest CAGR in Asia-Pacific From 2016 to 2021

Figure 30 Carbon Nanotubes Segment to Grow at the Highest CAGR in Asia-Pacific From 2016 to 2021

Figure 31 Others Segment to Grow at the Highest CAGR in Asia-Pacific From 2016 to 2021

Figure 32 Market in South Africa to Grow at the Highest CAGR

Figure 33 Asia-Pacific Market Snapshot

Figure 34 Japan Market, 2016 & 2021

Figure 35 China Market, 2016 & 2021

Figure 36 Taiwan Transparent Conductive Films Market, 2016 & 2021

Figure 37 South Korea: Market, 2016 & 2021

Figure 38 India: Market, 2016 & 2021

Figure 39 North America Market Snapshot

Figure 40 U.S. Market, 2016 & 2021

Figure 41 Canada Market, 2016 & 2021

Figure 42 Mexico Market, 2016 & 2021

Figure 43 Europe Market Snapshot

Figure 44 Germany Transparent Conductive Films Market, 2016 & 2021

Figure 45 France Market, 2016 & 2021

Figure 46 U.K. Market, 2016 & 2021

Figure 47 Sweden Market, 2016 & 2021

Figure 48 Italy: Market, 2016 & 2021

Figure 49 Rest of Europe: Market, 2016 & 2021

Figure 50 Middle East & Africa Transparent Conductive Films Market Snapshot

Figure 51 South Africa Market, 2016 & 2021

Figure 52 UAE Market, 2016 & 2021

Figure 53 Saudi Arabia Market, 2016 & 2021

Figure 54 South America Market Snapshot

Figure 55 Brazil Market, 2016 & 2021

Figure 56 Argentina Market, 2016 & 2021

Figure 57 Colombia Market, 2016 & 2021

Figure 58 Market: Company Share Analysis, 2015 (%)

Figure 59 New Product Development is the Most Adopted Strategy in the Global Market, 2011-2016

Figure 60 Transparent Conductive Films Market: Year-Wise Share of the Total Market Developments, 2012–2016

Figure 61 Teijin Ltd: Company Snapshot

Figure 62 Toyobo Co., Ltd: Company Snapshot

Figure 63 Nitto Denko Corporation: Company Snapshot

Figure 64 TDK Corporation: Company Snapshot

Figure 65 SWOT Analysis

Figure 66 SWOT Analysis

Figure 67 SWOT Analysis

Figure 68 Gunze: Company Snapshot

Growth opportunities and latent adjacency in Transparent Conductive Films Market