Translucent Concrete Market by Raw Material Type (Concrete, Optical Elements), Application (Facade & Wall Cladding, Flooring), End-use Industry (Construction & Infrastructure), and Region (NA, EU, APAC, MEA, LA) - Global Forecast to 2024

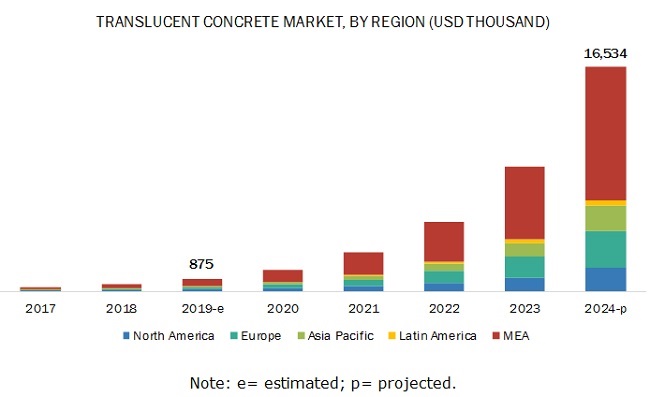

The translucent concrete market is projected to reach USD 16,534 thousand by 2024, at a CAGR of 80%. The translucent concrete industry is growing due to the rising awareness towards the use of environmentally friendly construction materials and need for aesthetical products for construction.

The translucent concrete, when used as a building material, allows easy transmission of sunlight light through it and thus helps in conservation of electric energy in the daytime. It also has excellent aesthetical properties and can also be used in interior applications of commercial and residential buildings.

The concrete in the raw material segment is expected to account for a major share of the translucent concrete market, in terms of volume, during the forecast period

The translucent concrete is made of two main types of raw materials, namely-concrete, and optical elements. The concrete material, when used offers strength to the final product. The optical element, however, is the key raw material used in the manufacturing of translucent concretes without which the main characteristic of transparency is not achieved. Also, the optical elements are costlier raw materials required in the construction of translucent concrete products.

However, even when used in smaller quantity, these elements have a high ability to efficiently transmitting the light from one end to another. The volume consumption of concrete is dominant in the translucent concrete market, and optical elements are required in a smaller volume. The high volume of concrete is needed to attain high strength of translucent concrete products.

The façade and wall cladding application is expected to account for a major share of the translucent concrete market, in terms of value and volume, during the forecast period.

The major applications of translucent concrete are facades & wall cladding and flooring, among others. The largest application of translucent concrete is façade & wall cladding. The translucent concrete, when used in façade & wall cladding, offers natural light transmission and saves electrical energy. It is also weather weather-insensitive and hence, offers durability. It also provides high strength due to the presence of concrete as raw material.

Construction & infrastructure industry is expected to be the fastest-growing end-use industry for the translucent concrete market.

The translucent concrete finds major applications in end-use industries, namely construction & infrastructure, furniture, and ornament. The translucent concrete is used mainly in construction & infrastructure industry. The growing urbanization has led to increased demand for construction activities.

The translucent concrete has the ability to pass light through it. It consists of optical elements such as optical fibers, glass rods, and resins that offer the light-transmitting property to the translucent concretes. The growing urbanization, the increasing spending power, demand for aesthetical and decorative buildings, and need for energy conservation has increased the market for translucent concretes.

MEA to hold the largest market share in the translucent concrete market.

The MEA is the promising region for translucent concrete. Translucent concrete has been used to enhance aesthetical looks of mosque and wall of a bank in this region. The construction sector in the MEA region is going through a phenomenal growth phase, with strong government support and massive ongoing projects. This positive growth in the construction & infrastructure industry would drive the demand for translucent concrete in the region.

Saudi Arabia is a key market in MEA. The focus of the government is continuously shifting toward new avenues, such as residential and commercial construction, to reduce the country’s dependence on the oil & gas sector. This is expected to boost the market for translucent concrete in Saudi Arabia.

Key Players in Translucent Concrete Market

The translucent concrete market comprises major solution providers, such Litracon Ltd (Hungary), LUCEM GmbH (Germany), Dupont Lightstone (Denmark), CRE Panel GmbH (Austria), LCT GesmbH (Austria), Italcementi SpA (Italy), Pan-United Corporation Ltd (Singapore), Beton Broz (Czech Republic), Glass block technology limited (UK), and Florack Bauunternehmung GmBH (Germany). The study includes an in-depth competitive analysis of these key players in the translucent concrete market, with their company profiles, recent developments, and key market strategies.

LUCEM GmbH (Germany), is one of the prime manufacturers of translucent concrete in the Europe region. LUCEM GmbH is a leading manufacturer of translucent concrete products. The products manufactured by the company have sustainability and aesthetic properties. The company provides a variety of translucent concrete products for various applications. It is involved in implementing business strategies such as new product development and agreement to increase its market share around the globe. For instance, in September 2019, LUCEM GmbH has developed translucent concrete panels with properties such as weather- and UV-resistant, resistant to abrasion and non-flammability.

Translucent Concrete Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019–2024 |

|

Base year |

2018 |

|

Forecast period |

2019–2024 |

|

Units considered |

Value (USD Thousand), Volume (ton) |

|

Segments |

Raw material type, application, end-use industry and region |

|

Regions |

Europe, North America, APAC, MEA, and Latin America |

|

Companies |

Litracon Ltd (Hungary), LUCEM GmbH (Germany), Dupont Lightstone (Denmark), CRE Panel GmbH (Austria), LCT GesmbH (Austria), Italcementi SpA (Italy), Pan-United Corporation Ltd (Singapore), Beton Broz (Czech Republic), Glass block technology limited (UK), and Florack Bauunternehmung GmBH (Germany) |

This research report categorizes the translucent concrete market based on raw material type, application, end-use industry, and region.

By Raw Material Type:

- Concrete

- Optical Elements

By Application:

- Façade & Wall Cladding

- Flooring

- Other (Digital signage, benches, reception desks, lamps, jewelry, and bar-tops)

By End-Use Industry:

- Construction & Infrastructure

- Other (Ornament and Furniture)

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Key Questions Addressed By The Report

- Which are the major end-use industries of translucent concrete?

- Which industry is the major consumer of translucent concrete?

- Which region is the largest and fastest-growing market for translucent concrete?

- What are the major raw material types of translucent concrete?

- What are the major applications of translucent concrete?

- What are the major strategies adopted by leading market players?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 SUPPLY SIDE ANALYSIS

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 27)

4 PREMIUM INSIGHTS (Page No. - 31)

4.1 ATTRACTIVE OPPORTUNITIES IN THE TRANSLUCENT CONCRETE MARKET

4.2 TRANSLUCENT CONCRETE MARKET, BY APPLICATION AND REGION, 2018

4.3 TRANSLUCENT CONCRETE MARKET, BY RAW MATERIAL

4.4 TRANSLUCENT CONCRETE MARKET, BY END-USE INDUSTRY

4.5 TRANSLUCENT CONCRETE MARKET, BY KEY COUNTRIES

5 MACROECONOMIC INDICATORS (Page No. - 34)

5.1 INTRODUCTION

5.1.1 RISING POPULATION

5.1.2 INCREASE IN MIDDLE-CLASS POPULATION, 2009–2030

5.2 TRENDS AND FORECAST OF GDP

5.3 CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO THE GDP, BY COUNTRY

6 MARKET OVERVIEW (Page No. - 38)

6.1 INTRODUCTION

6.2 MARKET DYNAMICS

6.2.1 DRIVERS

6.2.1.1 Increasing need for energy conservation

6.2.1.2 Reduced initial maintenance and enhanced aesthetical properties

6.2.2 RESTRAINTS

6.2.2.1 High cost of optical fibers

6.2.2.2 Requirement of skilled labor

6.2.3 OPPORTUNITIES

6.2.3.1 Road safety and security

6.2.3.2 Good potential in cold regions

6.2.4 CHALLENGES

6.2.4.1 Reduction in cost of production

6.3 PORTER’S FIVE FORCES ANALYSIS

6.3.1 BARGAINING POWER OF SUPPLIERS

6.3.2 BARGAINING POWER OF BUYERS

6.3.3 THREAT OF SUBSTITUTES

6.3.4 THREAT OF NEW ENTRANTS

6.3.5 INTENSITY OF COMPETITIVE RIVALRY

7 TRANSLUCENT CONCRETE MARKET, BY RAW MATERIAL (Page No. - 42)

7.1 INTRODUCTION

7.2 CONCRETE

7.2.1 CONCRETE OFFERS A HOARD OF ADVANTAGES, INCLUDING HIGH DURABILITY WHEN USED AS A RAW MATERIAL

7.3 OPTICAL ELEMENTS

7.3.1 OPTICAL ELEMENTS HELP IN ENERGY CONSERVATION OF AN INFRASTRUCTURE

8 TRANSLUCENT CONCRETE MARKET, BY APPLICATION (Page No. - 47)

8.1 INTRODUCTION

8.2 FACADES & WALL CLADDING

8.2.1 TRANSLUCENT CONCRETE ALLOWS NATURAL LIGHT TO PASS THROUGH IT WHEN USED IN THIS APPLICATION

8.3 FLOORING

8.3.1 TRANSLUCENT CONCRETE HELPS IN RENDERING AESTHETIC APPEAL

8.4 OTHERS

9 TRANSLUCENT CONCRETE MARKET, BY END-USE INDUSTRY (Page No. - 53)

9.1 INTRODUCTION

9.2 CONSTRUCTION & INFRASTRUCTURE

9.2.1 TRANSLUCENT CONCRETE IS EXPERIENCING HIGH DEMAND IN THIS SEGMENT DUE TO PROPERTIES SUCH AS DURABILITY, HIGH MECHANICAL STRENGTH, AND ENERGY SAVING

9.3 OTHERS

9.3.1 FURNITURE

9.3.2 ORNAMENTS

10 TRANSLUCENT CONCRETE MARKET, BY REGION (Page No. - 59)

10.1 INTRODUCTION

10.2 MEA

10.2.1 BY RAW MATERIAL

10.2.2 BY APPLICATION

10.2.3 BY END-USE INDUSTRY

10.2.4 BY COUNTRY

10.2.5 UAE

10.2.5.1 The construction & infrastructure industry is expected to impact the market in the future

10.2.5.2 By application

10.2.6 SAUDI ARABIA

10.2.6.1 Government’s focus on non-oil sectors and a significant number of construction projects are helpful for the market growth

10.2.6.2 By application

10.2.7 REST OF MEA

10.2.7.1 By application

10.3 EUROPE

10.3.1 BY RAW MATERIAL

10.3.2 BY APPLICATION

10.3.3 BY END-USE INDUSTRY

10.3.4 BY COUNTRY

10.3.5 HUNGARY

10.3.5.1 Hungary is the most important market for translucent concrete

in Europe 73

10.3.5.2 By application

10.3.6 GERMANY

10.3.6.1 Germany has the presence of a few key market players, which makes the country a promising market

10.3.6.2 By application

10.3.7 FRANCE

10.3.7.1 France is a developed economy with a prominent construction output

10.3.7.2 By application

10.3.8 UK

10.3.8.1 The country has one of the established construction & infrastructure industries in the region

10.3.8.2 By application

10.3.9 ITALY

10.3.9.1 The presence of a diversified construction & infrastructure industry is boosting the market

10.3.9.2 By application

10.3.10 RUSSIA

10.3.10.1 Urbanization is driving the construction activities significantly in the country

10.3.10.2 By application

10.3.11 SPAIN

10.3.11.1 As construction is one of the key industrial sectors of the country, there are growth opportunities for the market

10.3.11.2 By application

10.3.12 SWITZERLAND

10.3.12.1 The market is likely to grow at a decent rate in the country

10.3.13 AUSTRIA

10.3.13.1 The recovery of the economy and investments in the infrastructural sector is favorable for the market growth in the country

10.4 NORTH AMERICA

10.4.1 BY RAW MATERIAL

10.4.2 BY APPLICATION

10.4.3 BY END-USE INDUSTRY

10.4.4 BY COUNTRY

10.4.5 US

10.4.5.1 The yearly spending in the construction industry in the country is huge, which is propelling the market

10.4.5.2 By application

10.4.6 CANADA

10.4.6.1 Heat insulation and light-transmitting properties of translucent concrete are driving the market in the country

10.4.6.2 By application

10.5 APAC

10.5.1 BY RAW MATERIAL

10.5.2 BY APPLICATION

10.5.3 BY END-USE INDUSTRY

10.5.4 BY COUNTRY

10.5.5 CHINA

10.5.5.1 Government’s focus on using eco-friendly construction products is fueling the market

10.5.5.2 By application

10.5.6 JAPAN

10.5.6.1 The demand for advanced construction solutions is likely to grow in the country, thereby driving the market

10.5.6.2 By application

10.5.7 AUSTRALIA

10.5.7.1 Focus on the construction of energy-efficient buildings is favorable for the translucent concrete market

10.5.7.2 By application

10.5.8 SOUTH KOREA

10.5.8.1 Restructuring of the construction industry is expected to drive the market in the country

10.5.8.2 By application

10.5.9 SINGAPORE

10.5.9.1 There is a demand for high-quality construction with a focus on aesthetics in Singapore

10.5.9.2 By application

10.5.10 THAILAND

10.5.10.1 As one of the popular travel destinations, the country focuses on the development of attractive infrastructure

10.5.10.2 By application

10.6 LATIN AMERICA

10.6.1 BY RAW MATERIAL

10.6.2 BY APPLICATION

10.6.3 BY END-USE INDUSTRY

10.6.4 BY COUNTRY

10.6.5 BRAZIL

10.6.5.1 The country is the leading market for translucent concrete in

the region 97

10.6.5.2 By application

10.6.6 MEXICO

10.6.6.1 The infrastructure and developmental programs of the Federal Government is helping in the market growth

10.6.6.2 By application

11 COMPETITIVE LANDSCAPE (Page No. - 100)

11.1 INTRODUCTION

11.2 MARKET RANKING

11.3 COMPETITIVE SCENARIO

11.3.1 NEW PRODUCT DEVELOPMENT

11.3.2 AGREEMENT

11.3.3 ACQUISITION

12 COMPANY PROFILES (Page No. - 103)

(Business Overview, Products Offered, Recent Developments, Projects undertaken, SWOT Analysis, MnM View)*

12.1 LITRACON LTD

12.2 LUCEM GMBH

12.3 DUPONT LIGHTSTONE

12.4 CRE PANEL GMBH

12.5 ITALCEMENTI SPA

12.6 PAN-UNITED CORPORATION LTD

12.7 BETON BROZ

12.8 GLASS BLOCK TECHNOLOGY LIMITED

12.9 FLORACK BAUUNTERNEHMUNG GMBH

12.10 ILLUMINART

12.11 OTHER PLAYERS

12.11.1 SUBIN TRANSLUCENT CONCRETE

12.11.2 ROCALITE

12.11.3 VAN DELFT WESTERHOF

12.11.4 AKRITI ENGINEERS

12.11.5 FAPINEX

12.11.6 SOCRATES ARCHITECT

*Details on Business Overview, Products Offered, Recent Developments, Projects undertaken, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 123)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

LIST OF TABLES (111 Tables)

TABLE 1 GDP (CURRENT PRICES), BY COUNTRY, 2017–2024 (USD BILLION)

TABLE 2 NORTH AMERICA: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP, BY COUNTRY, 2014–2021 (USD BILLION)

TABLE 3 EUROPE: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP, BY COUNTRY, 2014–2021 (USD BILLION)

TABLE 4 APAC: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP, BY COUNTRY, 2014–2021 (USD BILLION)

TABLE 5 MEA: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP, BY COUNTRY, 2014–2021 (USD BILLION)

TABLE 6 LATIN AMERICA: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP, BY COUNTRY, 2014–2021 (USD BILLION)

TABLE 7 TRANSLUCENT CONCRETE MARKET SIZE, BY RAW MATERIAL, 2017–2024 (USD THOUSAND)

TABLE 8 TRANSLUCENT CONCRETE MARKET SIZE, BY RAW MATERIAL, 2017–2024 (TON)

TABLE 9 CONCRETE: TRANSLUCENT CONCRETE MARKET SIZE, BY REGION, 2017–2024 (USD THOUSAND)

TABLE 10 CONCRETE: TRANSLUCENT CONCRETE MARKET SIZE, BY REGION, 2017–2024 (TON)

TABLE 11 OPTICAL ELEMENTS: TRANSLUCENT CONCRETE MARKET SIZE, BY REGION, 2017–2024 (USD THOUSAND)

TABLE 12 OPTICAL ELEMENTS: TRANSLUCENT CONCRETE MARKET SIZE, BY REGION, 2017–2024 (TON)

TABLE 13 TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 14 TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 15 FACADES & WALL CLADDING: TRANSLUCENT CONCRETE MARKET SIZE, BY REGION, 2017–2024 (USD THOUSAND)

TABLE 16 FACADES & WALL CLADDING: TRANSLUCENT CONCRETE MARKET SIZE, BY REGION, 2017–2024 (TON)

TABLE 17 FLOORING: TRANSLUCENT CONCRETE MARKET SIZE, BY REGION, 2017–2024 (USD THOUSAND)

TABLE 18 FLOORING: TRANSLUCENT CONCRETE MARKET SIZE, BY REGION, 2017–2024 (TON)

TABLE 19 OTHER APPLICATIONS: TRANSLUCENT CONCRETE MARKET SIZE, BY REGION, 2017–2024 (USD THOUSAND)

TABLE 20 OTHER APPLICATIONS: TRANSLUCENT CONCRETE MARKET SIZE, BY REGION, 2017–2024 (TON)

TABLE 21 TRANSLUCENT CONCRETE MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

TABLE 22 TRANSLUCENT CONCRETE MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 23 CONSTRUCTION & INFRASTRUCTURE: TRANSLUCENT CONCRETE MARKET SIZE, BY REGION, 2017–2024 (USD THOUSAND)

TABLE 24 CONSTRUCTION & INFRASTRUCTURE: TRANSLUCENT CONCRETE MARKET SIZE, BY REGION, 2017–2024 (TON)

TABLE 25 OTHER END-USE INDUSTRIES: TRANSLUCENT CONCRETE MARKET SIZE, BY REGION, 2017–2024 (USD THOUSAND)

TABLE 26 OTHER END-USE INDUSTRIES: TRANSLUCENT CONCRETE MARKET SIZE, BY REGION, 2017–2024 (TON)

TABLE 27 TRANSLUCENT CONCRETE MARKET SIZE, BY REGION, 2017–2024 (USD THOUSAND)

TABLE 28 TRANSLUCENT CONCRETE MARKET SIZE, BY REGION, 2017–2024 (TON)

TABLE 29 MEA: TRANSLUCENT CONCRETE MARKET SIZE, BY RAW MATERIAL, 2017–2024 (USD THOUSAND)

TABLE 30 MEA: TRANSLUCENT CONCRETE MARKET SIZE, BY RAW MATERIAL, 2017–2024 (TON)

TABLE 31 MEA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 32 MEA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 33 MEA: TRANSLUCENT CONCRETE MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

TABLE 34 MEA: TRANSLUCENT CONCRETE MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 35 MEA: TRANSLUCENT CONCRETE MARKET SIZE, BY COUNTRY, 2017–2024 (USD THOUSAND)

TABLE 36 MEA: TRANSLUCENT CONCRETE MARKET SIZE, BY COUNTRY, 2017–2024 (TON)

TABLE 37 UAE: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 38 UAE: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 39 SAUDI ARABIA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 40 SAUDI ARABIA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 41 REST OF MEA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 42 REST OF MEA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 43 EUROPE: TRANSLUCENT CONCRETE MARKET SIZE, BY RAW MATERIAL, 2017–2024 (USD THOUSAND)

TABLE 44 EUROPE: TRANSLUCENT CONCRETE MARKET SIZE, BY RAW MATERIAL, 2017–2024 (TON)

TABLE 45 EUROPE: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 46 EUROPE: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 47 EUROPE: TRANSLUCENT CONCRETE MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

TABLE 48 EUROPE: TRANSLUCENT CONCRETE MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 49 EUROPE: TRANSLUCENT CONCRETE MARKET SIZE, BY COUNTRY, 2017–2024 (USD THOUSAND)

TABLE 50 EUROPE: TRANSLUCENT CONCRETE MARKET SIZE, BY COUNTRY, 2017–2024 (TON)

TABLE 51 HUNGARY: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 52 HUNGARY: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 53 GERMANY: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 54 GERMANY: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 55 FRANCE: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 56 FRANCE: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 57 UK: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 58 UK: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 59 ITALY: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 60 ITALY: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 61 RUSSIA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 62 RUSSIA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 63 SPAIN: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 64 SPAIN: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 65 NORTH AMERICA: TRANSLUCENT CONCRETE MARKET SIZE, BY RAW MATERIAL, 2017–2024 (USD THOUSAND)

TABLE 66 NORTH AMERICA: TRANSLUCENT CONCRETE MARKET SIZE, BY RAW MATERIAL, 2017–2024 (TON)

TABLE 67 NORTH AMERICA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 68 NORTH AMERICA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 69 NORTH AMERICA: TRANSLUCENT CONCRETE MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

TABLE 70 NORTH AMERICA: TRANSLUCENT CONCRETE MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 71 NORTH AMERICA: TRANSLUCENT CONCRETE MARKET SIZE, BY COUNTRY, 2017–2024 (USD THOUSAND)

TABLE 72 NORTH AMERICA: TRANSLUCENT CONCRETE MARKET SIZE, BY COUNTRY, 2017–2024 (TON)

TABLE 73 US: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 74 US: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 75 CANADA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 76 CANADA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 77 APAC: TRANSLUCENT CONCRETE MARKET SIZE, BY RAW MATERIAL, 2017–2024 (USD THOUSAND)

TABLE 78 APAC: TRANSLUCENT CONCRETE MARKET SIZE, BY RAW MATERIAL, 2017–2024 (TON)

TABLE 79 APAC: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 80 APAC: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 81 APAC: TRANSLUCENT CONCRETE MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

TABLE 82 APAC: TRANSLUCENT CONCRETE MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 83 APAC: TRANSLUCENT CONCRETE MARKET SIZE, BY COUNTRY, 2017–2024 (USD THOUSAND)

TABLE 84 APAC: TRANSLUCENT CONCRETE MARKET SIZE, BY COUNTRY, 2017–2024 (TON)

TABLE 85 CHINA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 86 CHINA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 87 JAPAN: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 88 JAPAN: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 89 AUSTRALIA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 90 AUSTRALIA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 91 SOUTH KOREA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 92 SOUTH KOREA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 93 SINGAPORE: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 94 SINGAPORE: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 95 THAILAND: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 96 THAILAND: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 97 LATIN AMERICA: TRANSLUCENT CONCRETE MARKET SIZE, BY RAW MATERIAL, 2017–2024 (USD THOUSAND)

TABLE 98 LATIN AMERICA: TRANSLUCENT CONCRETE MARKET SIZE, BY RAW MATERIAL, 2017–2024 (TON)

TABLE 99 LATIN AMERICA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 100 LATIN AMERICA: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 101 LATIN AMERICA: TRANSLUCENT CONCRETE MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

TABLE 102 LATIN AMERICA: TRANSLUCENT CONCRETE MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 103 LATIN AMERICA: TRANSLUCENT CONCRETE MARKET SIZE, BY COUNTRY, 2017–2024 (USD THOUSAND)

TABLE 104 LATIN AMERICA: TRANSLUCENT CONCRETE MARKET SIZE, BY COUNTRY, 2017–2024 (TON)

TABLE 105 BRAZIL: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 106 BRAZIL: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 107 MEXICO: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (USD THOUSAND)

TABLE 108 MEXICO: TRANSLUCENT CONCRETE MARKET SIZE, BY APPLICATION, 2017–2024 (TON)

TABLE 109 NEW PRODUCT DEVELOPMENT, 2017–2019

TABLE 110 AGREEMENT, 2017–2019

TABLE 111 ACQUISITION, 2017–2019

LIST OF FIGURES (32 Figures)

FIGURE 1 TRANSLUCENT CONCRETE MARKET: RESEARCH DESIGN

FIGURE 2 MARKET NUMBER ESTIMATION

FIGURE 3 METHODOLOGY: SUPPLY SIDE SIZING

FIGURE 4 TRANSLUCENT CONCRETE MARKET: DATA TRIANGULATION

FIGURE 5 OPTICAL ELEMENTS SEGMENT DOMINATED THE MARKET

FIGURE 6 FLOORING TO BE THE FASTEST-GROWING APPLICATION SEGMENT

FIGURE 7 CONSTRUCTION & INFRASTRUCTURE END-USE INDUSTRY DOMINATES THE MARKET

FIGURE 8 MEA ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2018

FIGURE 9 CHINA TO BE THE FASTEST-GROWING TRANSLUCENT CONCRETE MARKET

FIGURE 10 HIGH DEMAND FROM THE CONSTRUCTION & INFRASTRUCTURE INDUSTRY TO DRIVE THE MARKET

FIGURE 11 MEA AND THE FACADES & WALL CLADDING SEGMENT ACCOUNTED FOR THE LARGEST MARKET SHARES

FIGURE 12 CONCRETE SEGMENT TO DOMINATE THE MARKET

FIGURE 13 CONSTRUCTION & INFRASTRUCTURE SEGMENT TO DOMINATE THE MARKET

FIGURE 14 CHINA TO REGISTER THE HIGHEST CAGR

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE TRANSLUCENT CONCRETE MARKET

FIGURE 16 TRANSLUCENT CONCRETE MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 OPTICAL ELEMENTS SEGMENT TO REGISTER THE HIGHEST GROWTH

FIGURE 18 APAC TO REGISTER THE HIGHEST CAGR IN THE CONCRETE SEGMENT

FIGURE 19 FLOORING TO BE THE LARGEST APPLICATION OF TRANSLUCENT CONCRETE

FIGURE 20 MEA TO BE THE LARGEST MARKET IN THE FACADES & WALL CLADDING SEGMENT

FIGURE 21 CONSTRUCTION & INFRASTRUCTURE END-USE INDUSTRY TO DOMINATE THE TRANSLUCENT CONCRETE MARKET

FIGURE 22 MEA TO REGISTER THE HIGHEST CAGR IN THE CONSTRUCTION & INFRASTRUCTURE SEGMENT

FIGURE 23 CHINA TO BE THE FASTEST-GROWING MARKET, GLOBALLY

FIGURE 24 MEA: TRANSLUCENT CONCRETE MARKET SNAPSHOT

FIGURE 25 EUROPE: TRANSLUCENT CONCRETE MARKET SNAPSHOT

FIGURE 26 NORTH AMERICA: TRANSLUCENT CONCRETE MARKET SNAPSHOT

FIGURE 27 COMPANIES ADOPTED ACQUISITION, AGREEMENT, AND NEW PRODUCT DEVELOPMENT AS KEY GROWTH STRATEGIES BETWEEN 2017 AND 2019

FIGURE 28 LITRACON LTD: SWOT ANALYSIS

FIGURE 29 LUCEM GMBH: SWOT ANALYSIS

FIGURE 30 DUPONT LIGHTSTONE: SWOT ANALYSIS

FIGURE 31 CRE PANEL GMBH: SWOT ANALYSIS

FIGURE 32 ITALCEMENTI SPA: SWOT ANALYSIS

The study involved two major activities in estimating the current size for the translucent concrete market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the size of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The translucent concrete market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of mainly construction & infrastructure industry. Advancements in technology and diverse applications characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total translucent concrete market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from construction & infrastructure industry.

Report Objectives

- To define, describe, and forecast the market size of the translucent concrete market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market based on raw material type, application, and end-use industry

- To analyze and forecast the market based on five regions, namely, Europe, North America, APAC, the MEA, and Latin America

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of Europe translucent concrete market

- Further breakdown of Rest of APAC translucent concrete market

- Further breakdown of Rest of Latin American translucent concrete market

- Further breakdown of Rest of MEA translucent concrete market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Growth opportunities and latent adjacency in Translucent Concrete Market